Overview

This article serves as a compassionate step-by-step guide for individuals seeking to claim credits for the disabled and elderly. We recognize that navigating this process can be challenging, and we are here to help you understand the eligibility requirements and the necessary steps to complete your claim.

To ease your journey, we outline specific criteria for qualification, including age and income limits. We also provide practical advice for gathering the required documents and troubleshooting common issues that may arise along the way. Remember, you are not alone in this journey; many have faced similar challenges and found success.

By following this guide, you can take confident steps toward claiming the credit that supports your needs. We encourage you to reflect on your situation and consider how this information can assist you. Together, we can navigate this process with care and understanding.

Introduction

Navigating the complexities of tax benefits can feel overwhelming, especially for those facing the challenges of age or disability. We understand that the credit for the elderly and disabled offers essential financial relief, yet many individuals remain unaware of its existence or the steps needed to claim it. This guide aims to demystify the process, providing you with the knowledge and support necessary to access this vital resource.

What obstacles might you encounter on your journey to secure this credit? It's common to feel uncertain, but we are here to help you effectively overcome these challenges. Together, we can explore the steps you need to take to ensure you receive the benefits you deserve.

Understand the Credit for the Elderly and Disabled

The credit for disabled and elderly is a non-refundable tax benefit that provides crucial monetary support to those who qualify. The credit for disabled and elderly individuals can significantly lessen the tax burden, making it an invaluable resource for those who may be facing financial challenges due to age or disability.

We understand that navigating financial difficulties can be overwhelming. It's important to note that the credit for disabled and elderly is available to those who meet specific criteria, which we will explore in the following sections. By understanding this credit, you take the first step toward accessing the support you deserve. Remember, you are not alone in this journey, and we’re here to help you make the most of the benefits available to you.

Determine Eligibility Requirements

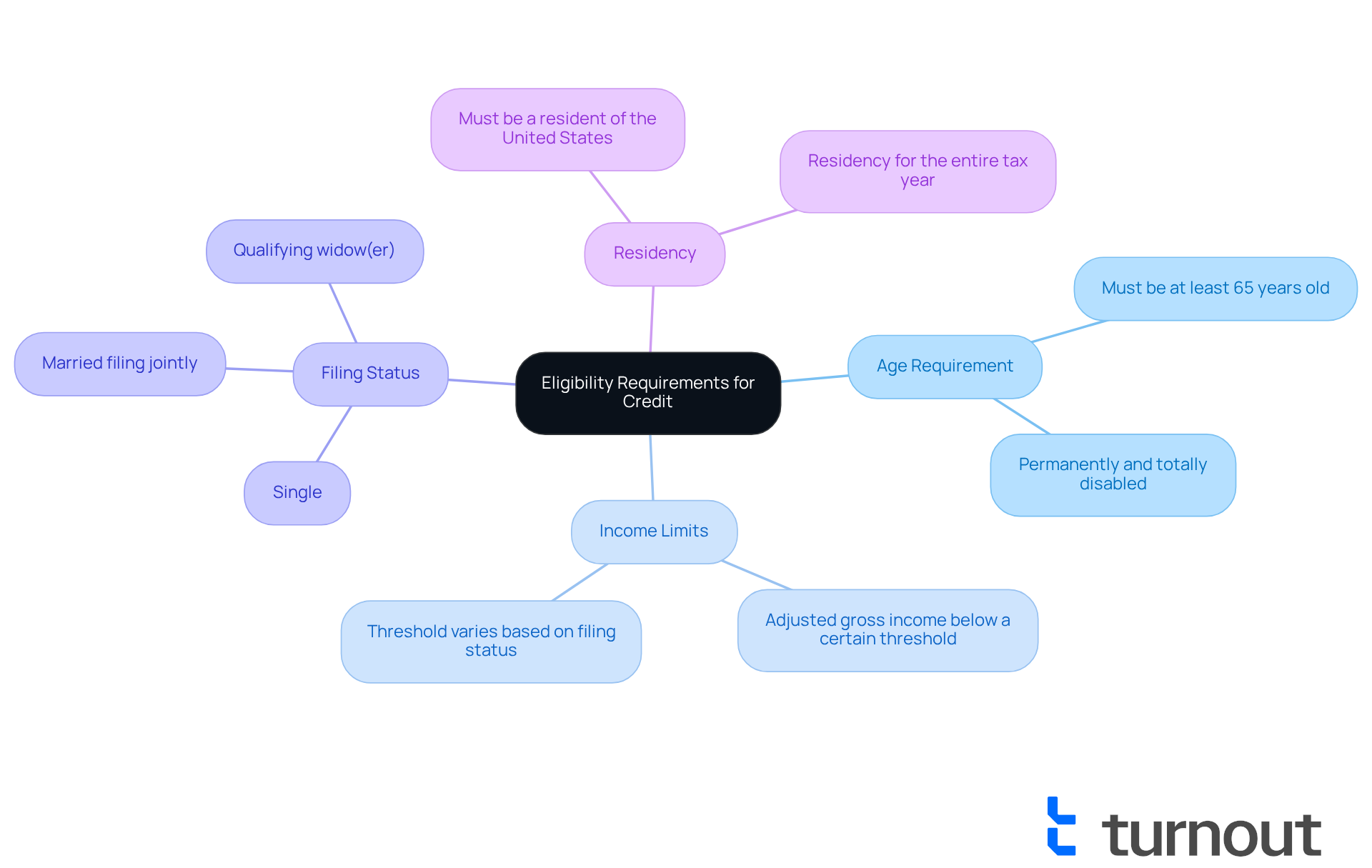

To qualify for the credit for disabled and elderly, we understand that you may have concerns about meeting specific criteria. Here’s what you need to know:

- Age Requirement: You must be at least 65 years old or permanently and totally disabled.

- Income Limits: Your adjusted gross income should be below a certain threshold, which varies based on your filing status.

- Filing Status: You need to file your tax return as either single, married filing jointly, or qualifying widow(er).

- Residency: You must be a resident of the United States for the entire tax year.

Navigating these requirements can be overwhelming, especially for those applying for Social Security Disability (SSD) claims. While we are not a legal practice and do not have connections with any legal firm or governmental body, our trained non-legal advocates are here to help you understand the process. We want you to feel supported as you fulfill the necessary criteria.

Additionally, for any tax-related concerns, we collaborate with IRS-licensed enrolled agents who can guide you through tax debt relief options. Remember, you are not alone in this journey. Review these requirements carefully with our assistance to determine if you are eligible to claim the credit for disabled and elderly.

Follow the Steps to Claim Your Credit

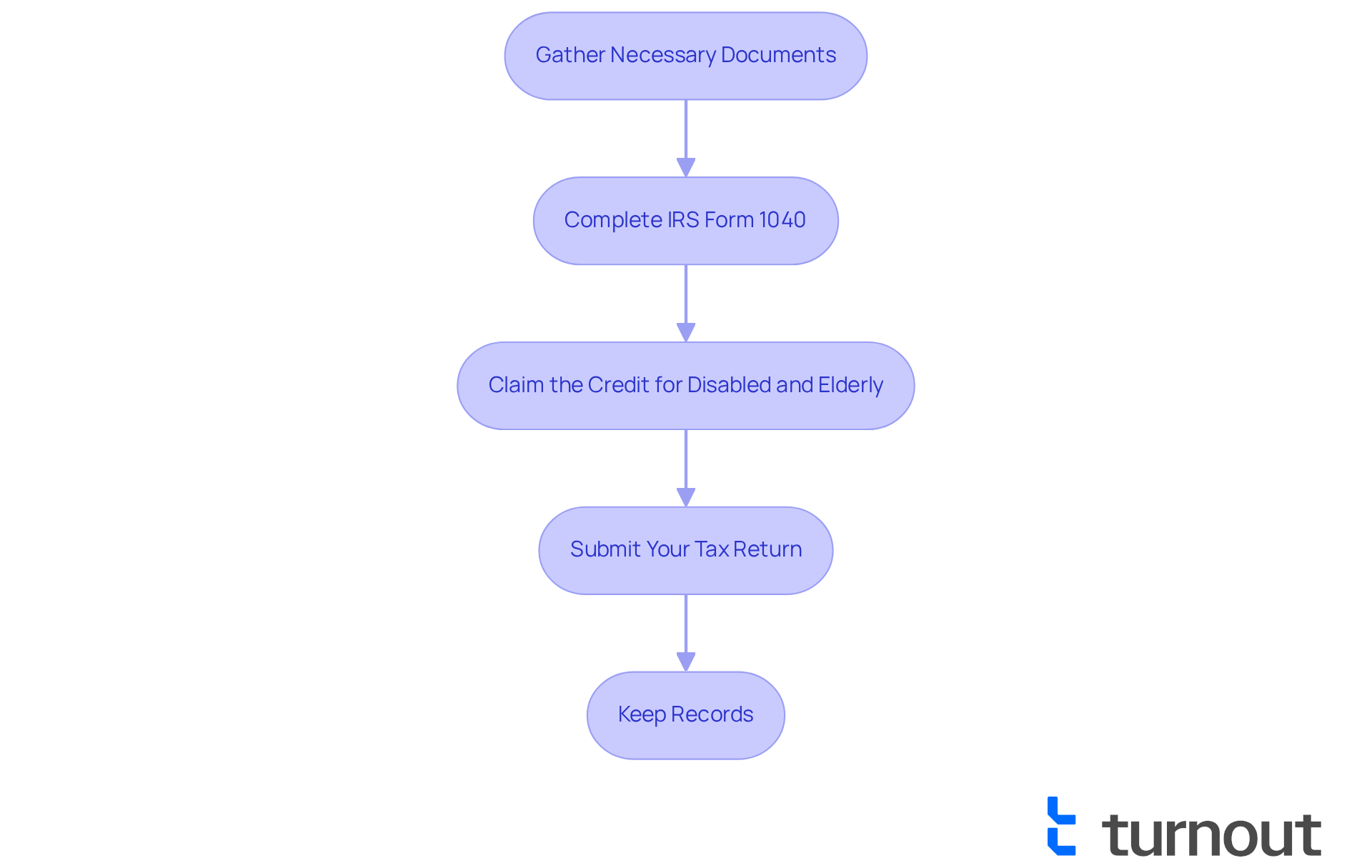

To claim your Credit for the Elderly and Disabled with the support of Turnout, we invite you to follow these simple steps:

- Gather Necessary Documents: Start by collecting your tax returns, proof of age or disability, and any other relevant financial documents. We understand that this can feel overwhelming, but taking it one step at a time can make it manageable.

- Complete IRS Form 1040: Fill out the standard tax form, ensuring you include all income sources and deductions. Remember, accuracy is key, and we're here to support you through this process.

- Claim the Credit for Disabled and Elderly: On your tax form, locate the section for the credit for disabled and elderly. Enter the appropriate amount based on your eligibility. It's important to know that you're not alone in navigating this.

- Submit Your Tax Return: File your completed tax return by the deadline, either electronically or via mail. We know that deadlines can be stressful, but you can do this!

- Keep Records: Retain copies of your submitted documents and any correspondence with the IRS for future reference. Keeping organized records can help ease your mind.

By following these steps, you can effectively claim your credit and potentially reduce your tax liability. This initiative aims to simplify the process for you, providing expert guidance and tools, including trained non-legal advocates and IRS-licensed enrolled agents. Together, we can help you navigate the complexities of government benefits and financial assistance. Remember, you are not alone in this journey; we are here to help you every step of the way.

Troubleshoot Common Issues When Claiming the Credit

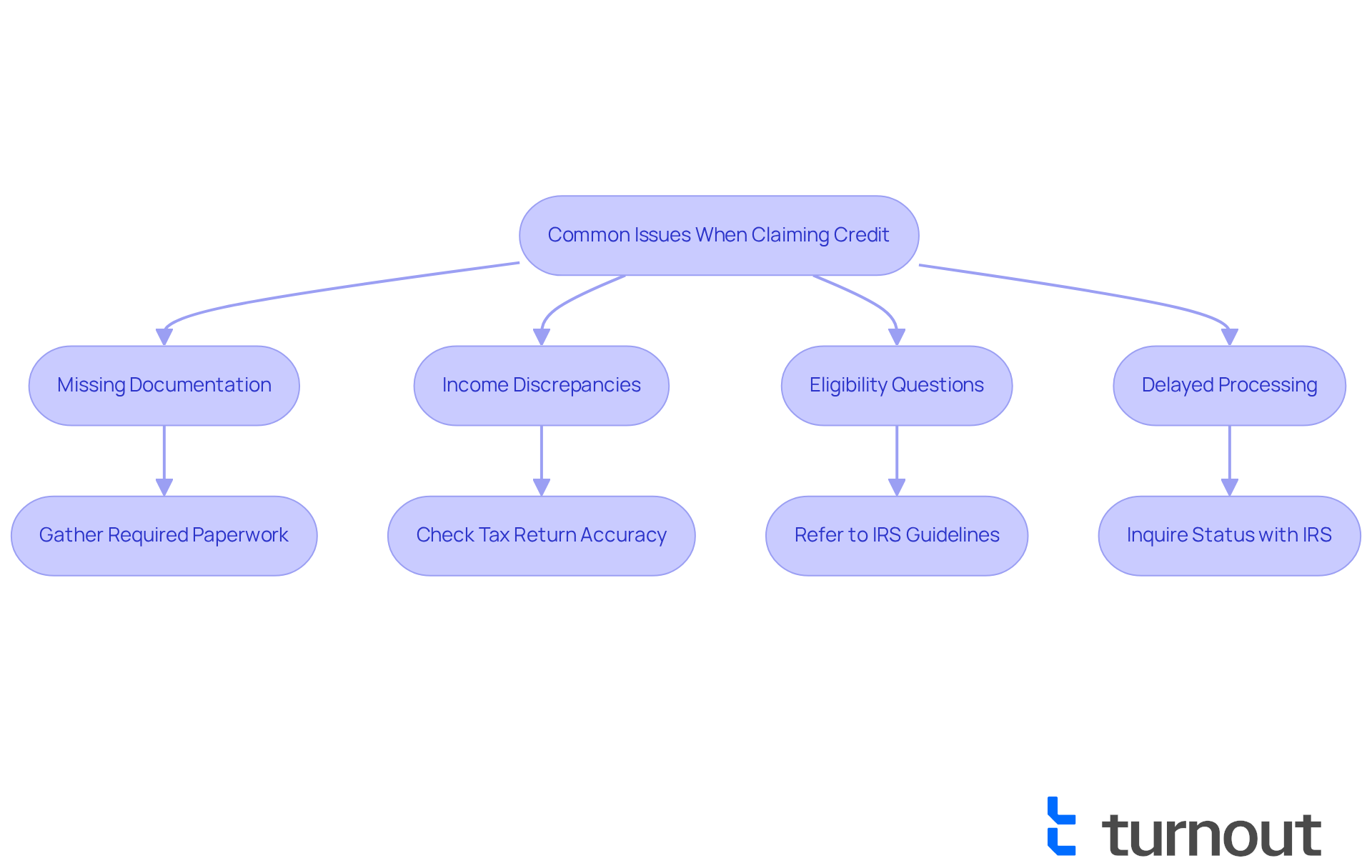

When claiming the credit for disabled and elderly, it's common to encounter some challenges. We understand that this process can feel overwhelming, but we're here to help. Here’s how to troubleshoot some of the most frequent issues you might face:

- Missing Documentation: If you receive a notice from the IRS about missing documents, it’s important to act quickly. Gather the required paperwork and respond to their request as soon as possible.

- Income Discrepancies: If your reported income does not match IRS records, take a moment to double-check your tax return for accuracy. Correcting any errors can help resolve this issue.

- Eligibility Questions: If you're uncertain about your eligibility, you’re not alone. We encourage you to refer to the IRS guidelines or seek help from trained advocates at our organization regarding credit for disabled and elderly. They can provide personalized guidance tailored to your situation.

- Delayed Processing: If your claim is taking longer than expected, don’t hesitate to reach out to the IRS. Inquire about the status of your return and ensure there are no outstanding issues.

By being proactive and addressing these common concerns, you can navigate the claiming process more effectively. Remember, you are not alone in this journey; the support of Turnout's trained nonlawyer advocates is here for you.

Conclusion

Understanding and claiming the credit for the elderly and disabled can provide vital financial relief for those who qualify. We understand that navigating this system can often feel daunting. By demystifying the eligibility requirements, the application process, and common challenges, this guide empowers individuals to take proactive steps, ensuring that deserving individuals receive the support they need.

Key insights discussed include the specific eligibility criteria based on:

- Age

- Income limits

- Residency

We also provide a straightforward step-by-step process for claiming the credit. It's common to encounter potential issues during the claiming process, but this guide offers practical solutions and support resources to help mitigate these challenges. By following the outlined steps and utilizing available assistance, you can effectively claim your benefits and alleviate some of your financial burdens.

Ultimately, this guide serves as a crucial resource for those seeking to claim their rightful credit for the elderly and disabled. It highlights the significance of being informed and organized in navigating this process. For anyone eligible, taking action now can lead to substantial benefits. Remember, support is available, and you are not alone in this journey.

Frequently Asked Questions

What is the credit for the elderly and disabled?

The credit for the elderly and disabled is a non-refundable tax benefit that provides financial support to qualifying individuals, helping to lessen their tax burden.

Who qualifies for the credit for the elderly and disabled?

Specific criteria must be met to qualify for the credit, though the article does not detail these criteria.

How can the credit for the elderly and disabled help individuals?

This credit can significantly reduce the tax burden for those facing financial challenges due to age or disability.

Is the credit for the elderly and disabled refundable?

No, it is a non-refundable tax benefit, meaning it cannot result in a refund if the credit exceeds the tax owed.

What should individuals do to access the credit for the elderly and disabled?

Understanding the credit and its eligibility criteria is the first step toward accessing the support it provides.