Overview

Navigating the world of benefits can be overwhelming, especially when it comes to understanding how Disability Insurance and Social Security retirement benefits work together. You may be relieved to know that under certain circumstances, it is possible to receive both benefits simultaneously. This is particularly true if you qualify for Social Security Disability Insurance (SSDI) before reaching your full retirement age.

Many individuals find themselves in a situation where they can temporarily receive both types of benefits. This often happens when they apply for early retirement while their disability claim is being processed. It's common to feel uncertain about eligibility requirements, but understanding these can make a significant difference in your financial planning.

We encourage you to explore your options and consider seeking assistance. Remember, you are not alone in this journey. We're here to help you navigate these important decisions with care and compassion.

Introduction

Navigating the intricacies of Social Security benefits can feel overwhelming, especially when trying to understand how disability support relates to retirement payments. If you are facing health challenges, you might be wondering: Can I access both Social Security Disability Insurance (SSDI) and retirement benefits at the same time?

In this article, we will explore the eligibility criteria, application processes, and potential strategies to help maximize your financial support. We understand that ensuring you receive the assistance you need is crucial, and we want to help you avoid common pitfalls in the system.

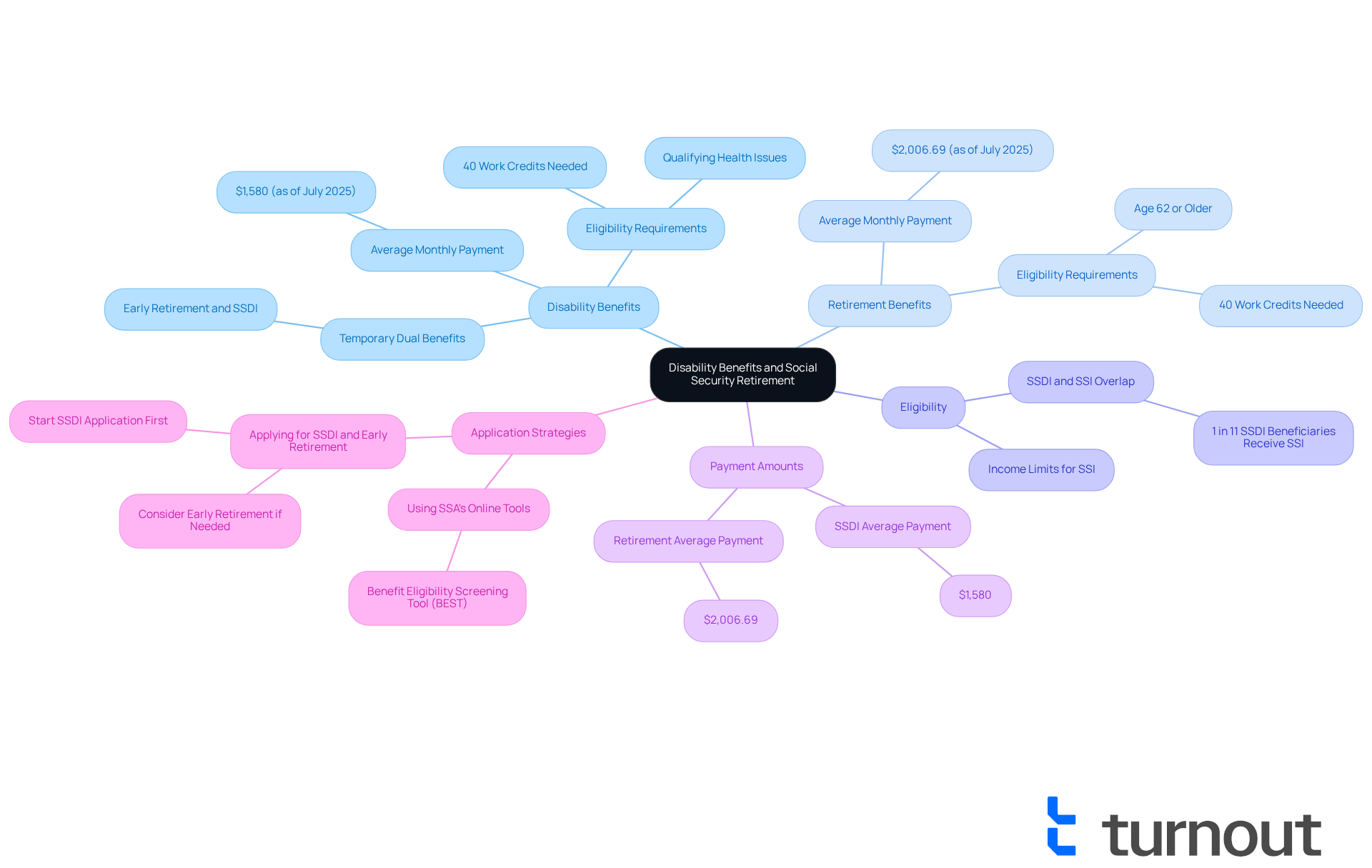

Understand Disability Benefits and Social Security Retirement

Disability support, especially Social Security Disability Assistance, is designed for individuals who are unable to work due to qualifying health issues. We understand that navigating these systems can feel overwhelming. On the other hand, Social Insurance retirement payments are available to those who have reached a specific age and have contributed to the system through their work history.

While it's common to think that one cannot receive both Social Security Disability Insurance and full retirement payments simultaneously, it raises the question: can you get disability and social security at the same time in certain situations? For instance, if someone qualifies for Social Security Disability Insurance before reaching full retirement age, they may wonder, can you get disability and social security at the same time, as they could temporarily receive both disability payments and early retirement income if their disability claim is accepted after they request early retirement.

As of July 2025, the average monthly disability payment was $1,580, while the average monthly retirement allowance was $2,006.69. It's noteworthy that one in every 11 SSDI beneficiaries also receives Supplemental Security Income (SSI), highlighting the connection between these programs. This underscores the importance of understanding the eligibility requirements and application processes for both benefits.

Turnout simplifies access to government assistance and financial support by providing tools and expert guidance to help individuals navigate these complex systems. It’s essential to remember that Turnout is not a law firm and does not offer legal representation. Instead, they utilize trained nonlawyer advocates for SSD claims and work with IRS-licensed enrolled agents for tax debt relief. Financial advisors emphasize the necessity of applying for all potential benefits to ensure financial stability. For example, if urgent funds are needed during the disability benefits request process, individuals might consider applying for early retirement, knowing that disability compensation will repay the increased amount once granted. This strategic approach can significantly ease financial strain while waiting for disability benefits approval.

We recognize that navigating the intricacies of Social Security Disability Insurance and retirement assistance can be challenging. However, utilizing resources such as TTurnout's services and the SSA's online Eligibility Screening Tool (BEST) can help evaluate eligibility and simplify the application process. Understanding these nuances is crucial for effectively managing financial resources and ensuring access to the benefits you deserve. Remember, you are not alone in this journey; we’re here to help.

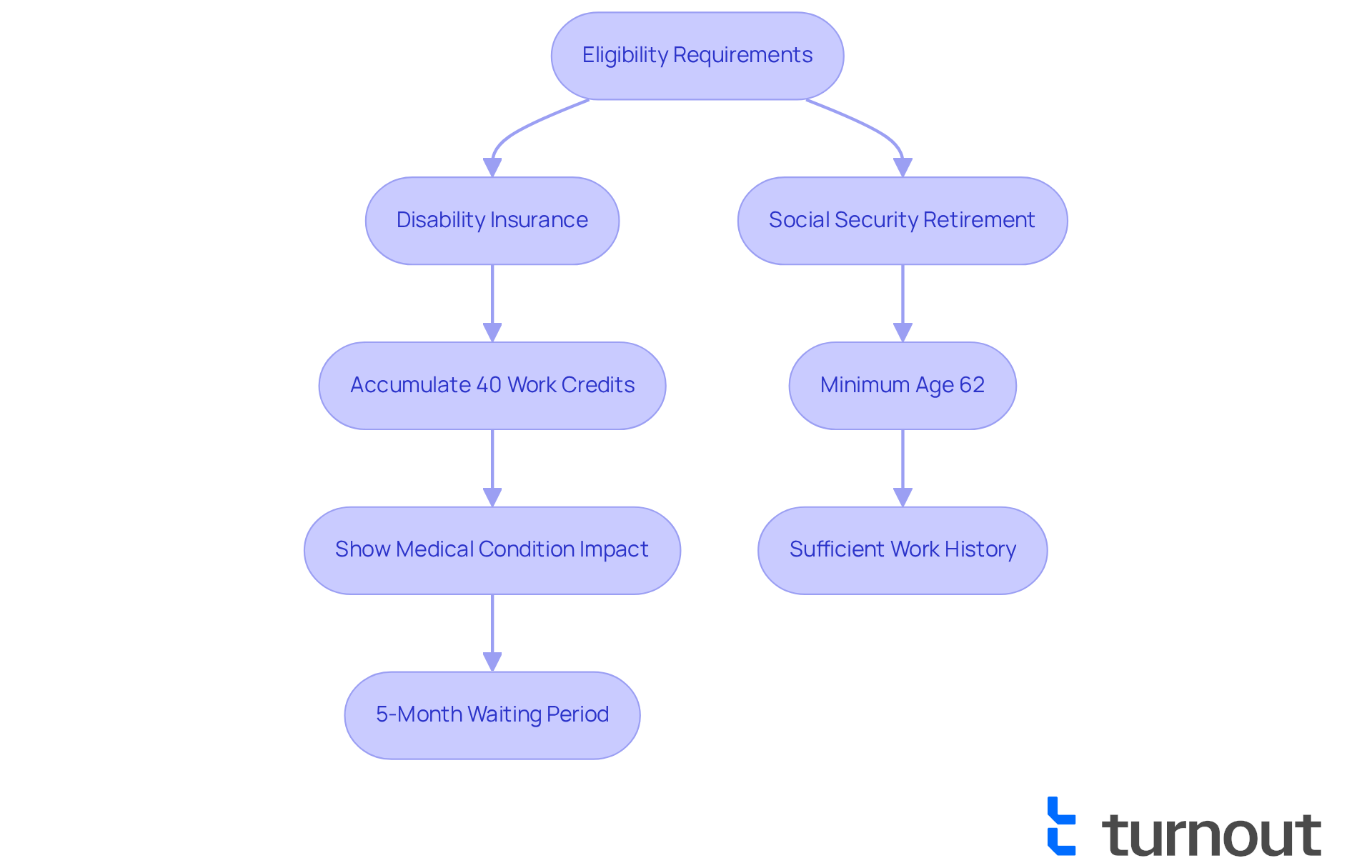

Evaluate Eligibility Requirements for Disability and Social Security

Navigating the path to Disability Insurance can be challenging, and we understand the concerns you may have. To be eligible, it's important to have a work history that meets the Administration's criteria, which includes accumulating at least 40 work credits. Additionally, you must show that your medical condition significantly affects your ability to work.

When it comes to Social Security retirement payments, individuals typically need to be at least 62 years old and have a sufficient work history. Gathering comprehensive documentation, such as medical records and employment history, is crucial to support your eligibility claims. Familiarizing yourself with the SSA's guidelines can help ensure you meet all necessary requirements for both disability support and retirement assistance.

Understanding these requirements is vital. The choices you make during the application process can have long-lasting financial implications. It's also important to note that there is a five-month waiting period for disability assistance to begin after approval.

You might be relieved to know that you can get disability and social security at the same time, making you eligible for both types of assistance and providing additional financial support.

At Turnout, we’re here to help. We offer access to trained nonlawyer advocates who can assist you in navigating these complex processes. Our goal is to ensure you have the support needed to understand and meet the eligibility requirements effectively. Please remember that Turnout is not a law firm and does not provide legal advice. We also offer services related to tax debt relief, working with IRS-licensed enrolled agents. You are not alone in this journey; we are here to support you every step of the way.

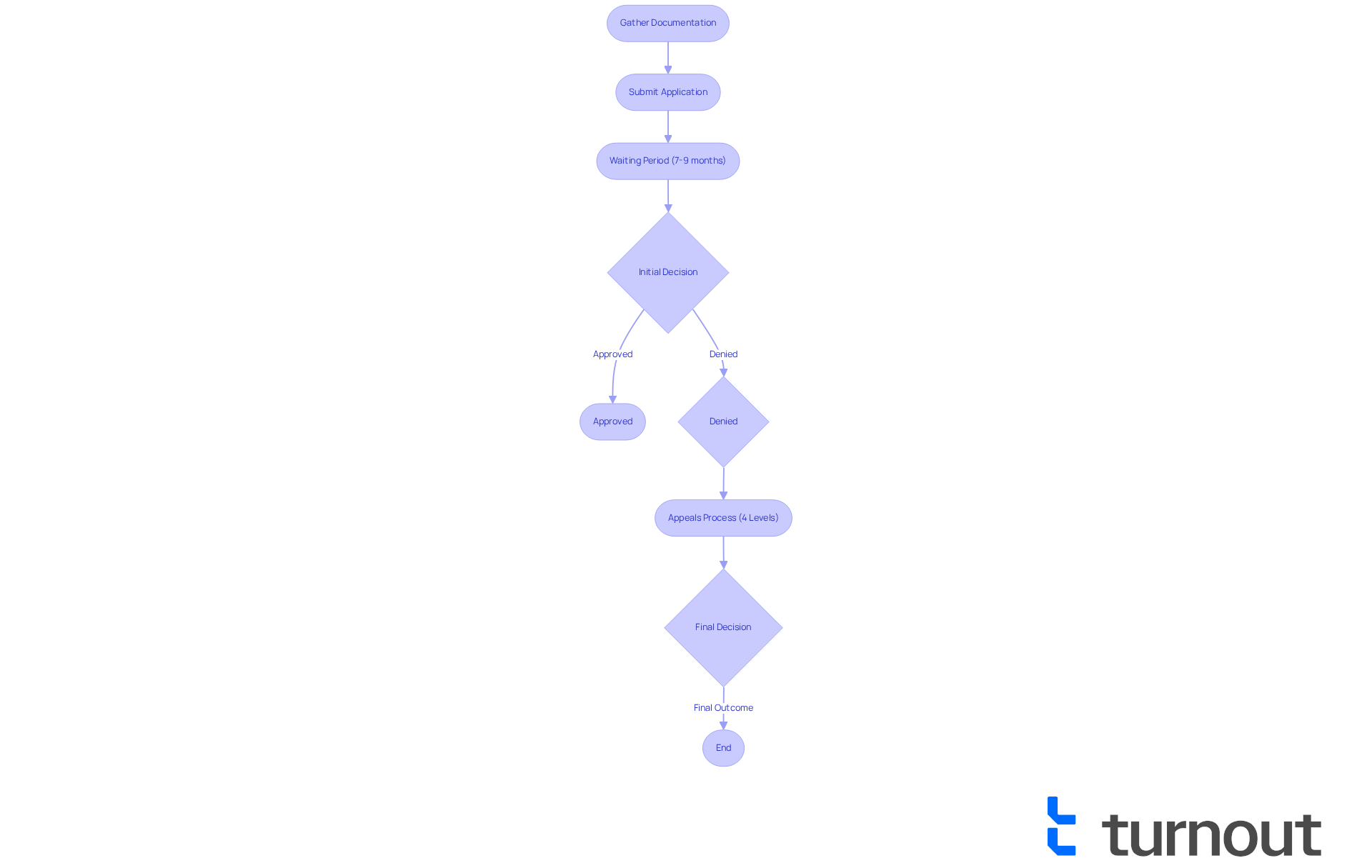

Follow the Application Process for Disability and Social Security Benefits

Starting the procedure for Social Security Disability Insurance (SSDI) and retirement benefits can feel overwhelming, but we're here to help. You can begin the process online through the SSA's site or in person at a local SSA office. First, gather essential documentation, including your Social Security number, medical records, and work history. Filling out the forms correctly is crucial; ensure that all details are up-to-date and thorough.

After submission, it's common to experience a waiting period as the SSA evaluates your request. This process generally requires around seven to nine months for initial decisions. If your request is denied, remember that you have the right to contest the decision through a structured four-level appeals process. However, this can significantly prolong the timeline—potentially taking twice as long. It's vital to keep track of deadlines and maintain open communication with the SSA throughout.

Did you know that about 70% of SSDI requests are now submitted online? This rising trend towards digital submissions can simplify the process for many. Successful instances of online platforms show that thorough preparation and precise information can lead to positive outcomes, even amidst the complexities of the system.

Turnoutis here to simplify your access to these advantages. We offer expert guidance and support through trained nonlegal advocates who can assist you in navigating the SSD claims process. Importantly, Turnout is not a law firm, and the information provided does not constitute legal advice.

The urgency of timely submissions cannot be overstated. In 2023, 30,000 individuals passed away while awaiting access to Social Services. This underscores the essential need for swift action and the assistance that Turnout provides. You are not alone in this journey; together, we can work towards ensuring you receive the support you need.

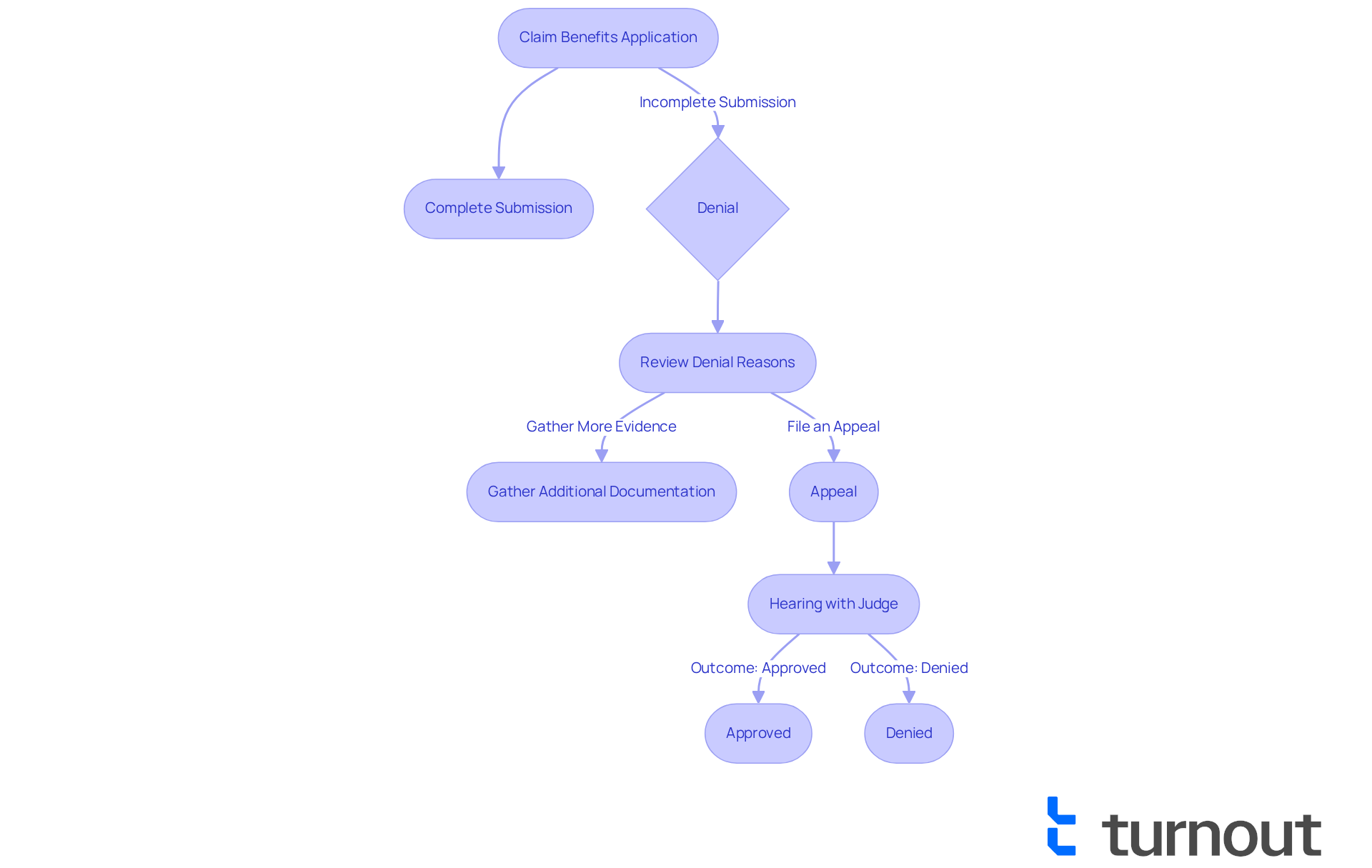

Troubleshoot Common Issues in Claiming Benefits

We understand that navigating the benefits application process can be overwhelming. Frequent problems often arise from incomplete submissions, insufficient medical documentation, and misunderstandings of eligibility criteria. To help you troubleshoot these issues, ensure that all forms are filled out completely and accurately. If your request is denied, carefully review the reasons for rejection provided by the Social Security Administration (SSA). Gathering additional documentation can strengthen your case.

It's common to feel discouraged when faced with statistics indicating that approximately 67% of initial disability benefit applications are denied, with only about 36% approved. This highlights the importance of thorough preparation. Engaging with a consumer advocacy organization like Turnout can provide valuable assistance. Their trained nonlawyer advocates are here to help you navigate the complexities of SSD claims.

Many applicants successfully appeal their denials by presenting comprehensive medical records and addressing specific issues outlined in the denial notice. In fact, about 45% of SSDI claims are approved after a hearing with an administrative law judge. This emphasizes the importance of pursuing all available options.

Staying organized and proactive, along with support from Turnout's advocates, can significantly enhance your chances of a successful claim. Remember, you are not alone in this journey; we're here to help.

Conclusion

Navigating the complexities of disability and Social Security benefits can feel overwhelming. We understand that it is crucial to know that individuals may be eligible to receive both types of support simultaneously under certain circumstances. By grasping the nuances of Social Security Disability Insurance (SSDI) and retirement benefits, you can better position yourself to secure the financial assistance you need during challenging times.

This article explores the eligibility requirements for both disability and retirement benefits, emphasizing the importance of thorough documentation and understanding the application process. It's possible to receive both benefits if you qualify for SSDI before reaching full retirement age. Addressing common issues that arise during the claims process is also essential. Resources like Turnout provide valuable support, ensuring you have the guidance needed to navigate these complex systems effectively.

Ultimately, the journey to securing disability and Social Security benefits highlights the importance of proactive engagement and informed decision-making. We encourage you to explore all potential benefits and utilize available resources to enhance your chances of a successful claim. Taking the first step toward understanding and applying for these benefits can significantly impact your financial stability. Remember, acting swiftly and seeking assistance when needed can make all the difference.

Frequently Asked Questions

What is the purpose of Social Security Disability Assistance?

Social Security Disability Assistance is designed to provide support to individuals who are unable to work due to qualifying health issues.

Who is eligible for Social Security retirement payments?

Social Security retirement payments are available to individuals who have reached a specific age and have contributed to the system through their work history.

Can you receive both Social Security Disability Insurance and retirement payments at the same time?

Yes, in certain situations, individuals may receive both Social Security Disability Insurance and early retirement payments if their disability claim is accepted after they request early retirement.

What are the average monthly payments for disability and retirement as of July 2025?

As of July 2025, the average monthly disability payment was $1,580, while the average monthly retirement allowance was $2,006.69.

What is the relationship between SSDI beneficiaries and Supplemental Security Income (SSI)?

One in every 11 SSDI beneficiaries also receives Supplemental Security Income (SSI), indicating a connection between these programs.

How can Turnout assist individuals with disability benefits and financial support?

Turnout simplifies access to government assistance by providing tools and expert guidance to help individuals navigate the complex systems of disability benefits and financial support.

Is Turnout a law firm?

No, Turnout is not a law firm and does not offer legal representation. They utilize trained nonlawyer advocates for SSD claims and work with IRS-licensed enrolled agents for tax debt relief.

What should individuals consider if they need urgent funds during the disability benefits request process?

Individuals might consider applying for early retirement to access funds, knowing that disability compensation will repay the increased amount once granted.

How can individuals evaluate their eligibility for Social Security benefits?

Individuals can utilize resources such as Turnout's services and the SSA's online Eligibility Screening Tool (BEST) to evaluate their eligibility and simplify the application process.

What is the importance of understanding the application processes for disability and retirement benefits?

Understanding the eligibility requirements and application processes is crucial for effectively managing financial resources and ensuring access to the benefits one deserves.