Overview

Navigating the world of GoFundMe donations can be overwhelming, and we understand that many of you may have questions about how these contributions are treated for tax purposes. Generally, donations received as personal gifts are not taxed for the recipients. However, it's important to note that donations made to registered charities may be tax-deductible for the donors.

Recognizing the difference between personal gifts and charitable contributions is crucial. We encourage you to maintain accurate records of your donations to ensure compliance with tax regulations. This can help alleviate some of the stress associated with tax season and provide clarity on your financial situation.

You are not alone in this journey. Many individuals face similar uncertainties, and we're here to help guide you through this process. Remember, understanding these distinctions can empower you to make informed decisions about your contributions and their potential impact. If you have further questions, don’t hesitate to reach out for support.

Introduction

Understanding the intricacies of crowdfunding platforms like GoFundMe is essential as millions seek financial support for personal and charitable causes. We recognize that while these donations can provide vital assistance, they also raise important questions about tax implications that both donors and recipients must navigate. Are GoFundMe donations taxed? This article explores the nuances of taxation related to crowdfunding.

We will look at the distinctions between personal gifts and charitable contributions, the responsibilities of both parties, and the record-keeping strategies necessary for compliance.

As the landscape of fundraising evolves, so does the need for clarity on these financial obligations. It's common to feel overwhelmed by the complexities of tax responsibilities. How can individuals ensure they are meeting their obligations while maximizing the benefits of their generosity? We're here to help you navigate this journey with understanding and support.

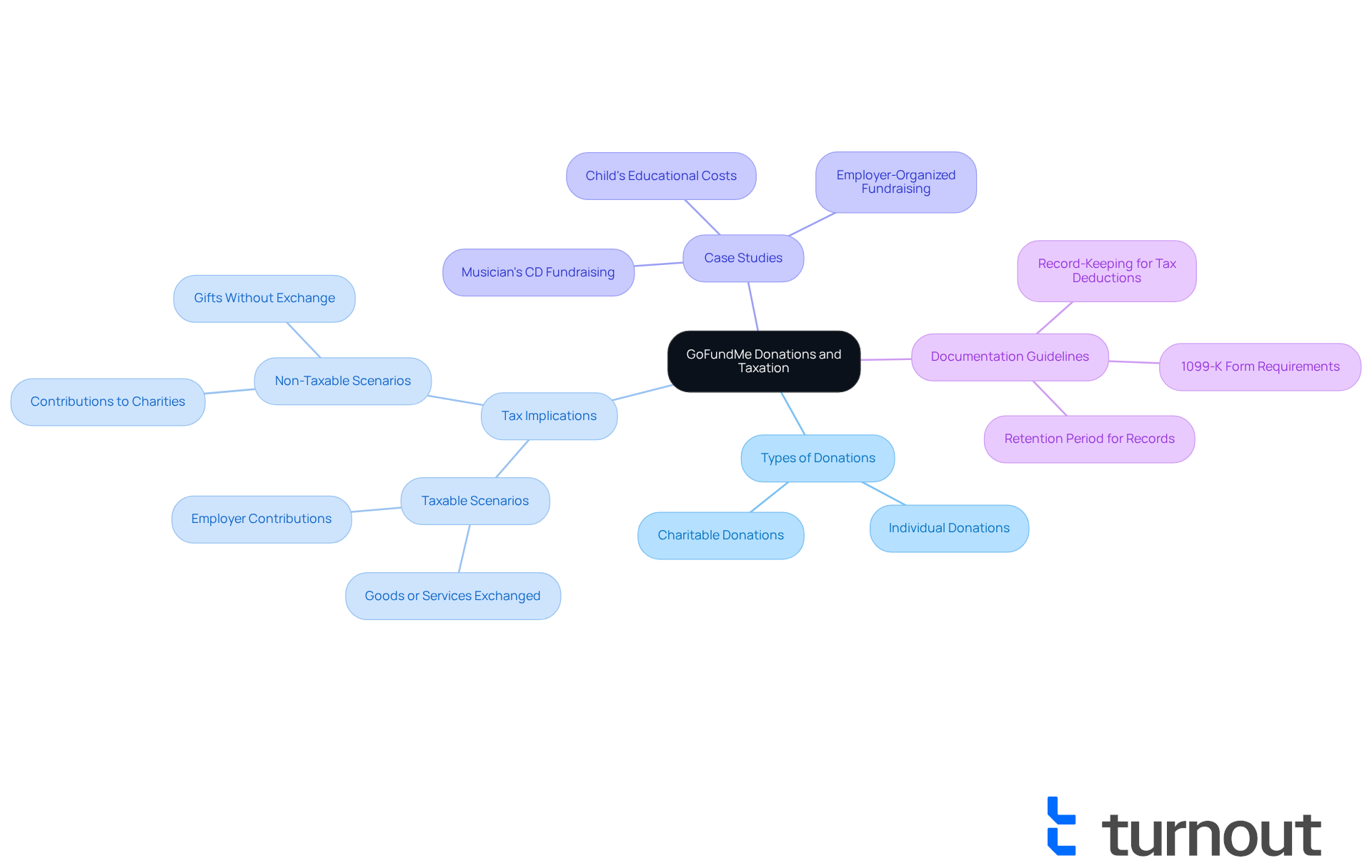

Explore the Basics of GoFundMe Donations and Taxation

GoFundMe has emerged as a leading crowdfunding platform, enabling individuals to raise funds for a wide range of personal causes, including medical expenses and charitable initiatives. In 2025, millions of Americans are anticipated to use GoFundMe for individual fundraising, emphasizing its importance in the financial landscape. It is important to consider [how are GoFundMe donations taxed](https://optimataxrelief.com/blog/gofundme-how-are-donations-taxed), as contributions made via GoFundMe can be categorized as either individual donations or charitable support, a differentiation that carries significant tax implications. Typically, individual gifts are not subject to tax for the recipient, while donations to registered charities may be eligible for tax deductions for the giver, provided they meet the required conditions.

Understanding if and how are GoFundMe donations taxed is essential for anyone participating in fundraising efforts. We understand that navigating these rules can be overwhelming. For instance, if resources are collected without any items or services provided in return, they are generally regarded as donations, leading to the inquiry of whether are GoFundMe donations taxed. Conversely, if an organizer collects money in exchange for goods or services, this raises the question of whether are GoFundMe donations taxed, as that income may be categorized as taxable business revenue. Furthermore, it is vital to recognize that the annual donation tax exclusion is $15,000 per recipient per year; exceeding this threshold may require submitting a federal donation tax return.

Case studies illustrate these points:

- One situation featured an organizer collecting donations for a musician's new CD, where supporters received a copy in exchange, leading to the contributions being categorized as taxable income.

- In another instance, money collected for a child's educational costs, with no items exchanged, was considered gifts and not taxable.

Moreover, if a crowdfunding campaign exceeds certain thresholds, such as $5,000 in total payments, the platform may issue a 1099-K form, notifying the IRS of the contributions. This form does not automatically suggest that the funds are taxable; however, it highlights the importance of accurate classification and record-keeping to determine if GoFundMe donations are taxed. Contributors should retain records for tax deductions on donations of $250 or greater and maintain thorough documentation for at least three years to ensure compliance with tax rules and clarify the source of the money collected.

By familiarizing yourself with these tax responsibilities, you can navigate the complexities of crowdfunding with greater confidence and clarity. As Sabrina Parys, an editor and content strategist at NerdWallet, emphasizes, "It's essential to keep good records and receipts." Remember, you are not alone in this journey; we’re here to help you every step of the way.

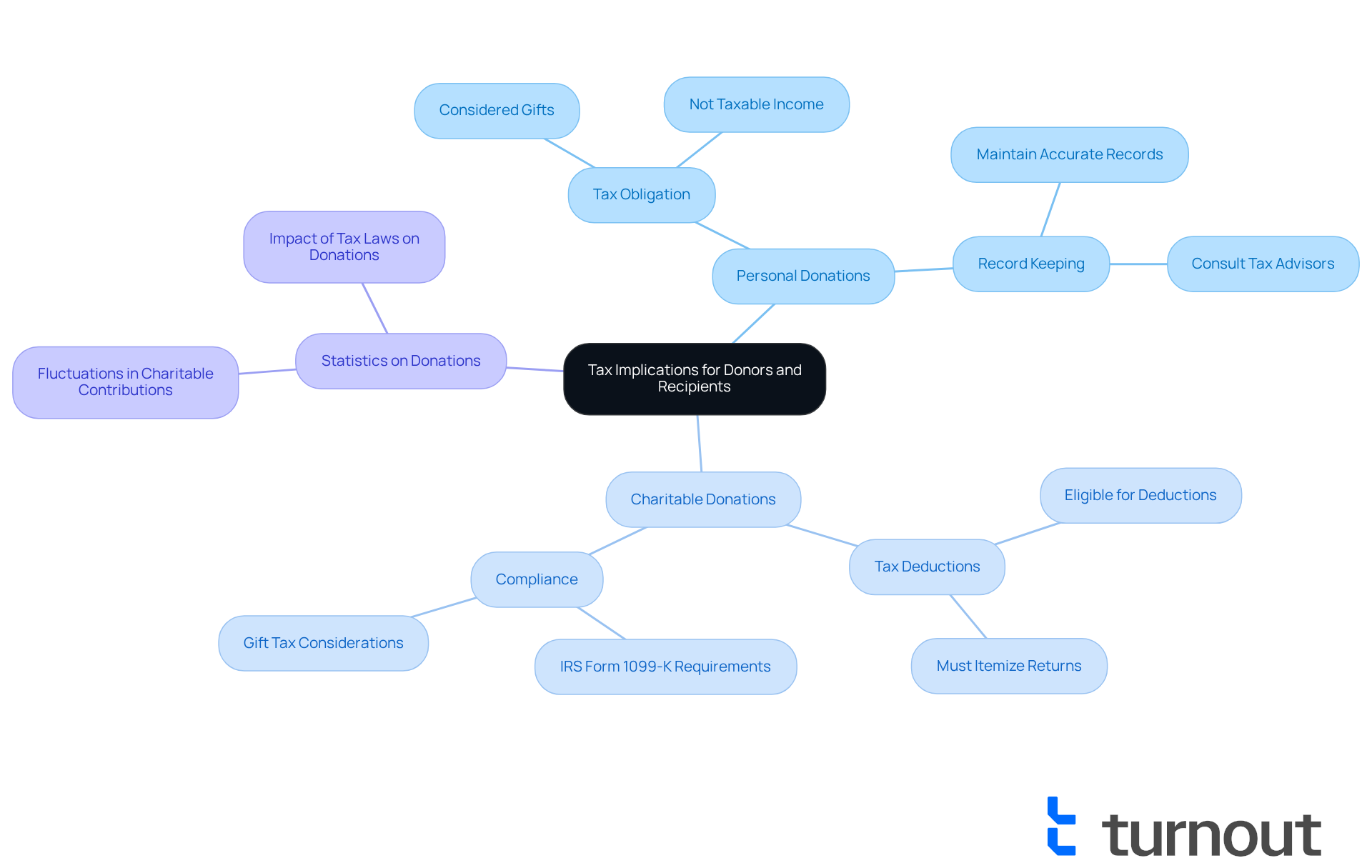

Understand Tax Implications for Donors and Recipients

We understand that navigating the world of donations can be overwhelming. Contributions to personal GoFundMe campaigns are generally viewed as personal gifts, leading many to wonder, are GoFundMe donations taxed for donors? However, if you choose to donate to a registered 501(c)(3) charity through GoFundMe, you can claim a tax deduction.

It's important to note that individuals often wonder if GoFundMe donations are taxed, but typically they do not face tax obligations on these amounts as long as they do not provide goods or services in return for the contributions. We encourage both donors and recipients to keep accurate records of all transactions. This diligence helps substantiate claims and ensures compliance with tax regulations, preventing unexpected tax issues during filing season.

It's common to feel uncertain about these matters, especially with recent statistics showing fluctuations in charitable donations claimed for tax deductions in the U.S., and questions like are GoFundMe donations taxed; understanding the nuances of tax compliance in crowdfunding scenarios is crucial. Remember, you are not alone in this journey; we’re here to help you navigate these complexities.

Clarify When GoFundMe Donations Are Tax-Deductible

When considering whether GoFundMe donations are taxed, it's important to know that they are tax-deductible only if directed to a qualified charitable organization. We understand that navigating these options can be overwhelming. To ensure your contribution qualifies, look for campaigns that clearly state they are collecting resources for a registered 501(c)(3) charity.

It's essential to note that donations to personal fundraisers, such as those on GoFundMe, lead to the question of whether GoFundMe donations are taxed, as they typically do not qualify for tax deductions and are viewed as personal gifts. To support your tax deduction claims, verify the recipient's status by checking for proper documentation, such as a receipt or acknowledgment from the charity. This step is crucial for your peace of mind.

The IRS allows taxpayers to deduct eligible charitable donations of up to 60% of their adjusted gross income (AGI). In certain cases, specific limits apply, including a temporary suspension during 2020 and 2021, which permitted individuals to donate up to 100% of their AGI to qualified charities. Remember, you are not alone in this journey. Always consult a qualified professional for personalized guidance on charitable contributions. We're here to help you maximize your benefits while adhering to tax regulations.

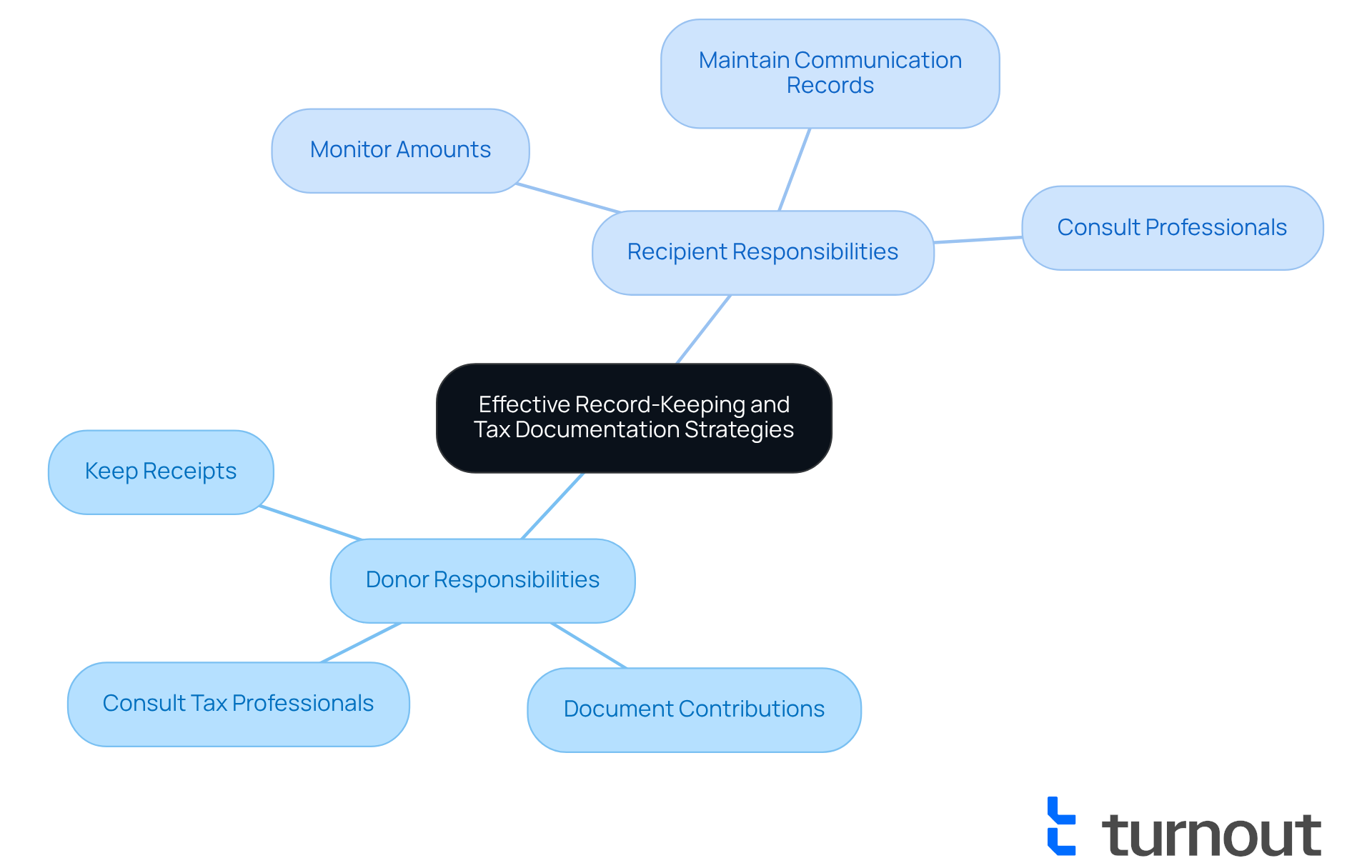

Implement Effective Record-Keeping and Tax Documentation Strategies

To maintain compliance and simplify tax filing, it’s essential for both donors and recipients to implement effective record-keeping strategies. We understand that navigating tax obligations can be overwhelming. Donors should keep receipts and documentation of their contributions, especially for those made to charitable organizations. Recipients, on the other hand, should monitor the amounts acquired, the purpose of the resources, and any communications associated with the fundraising effort. Utilizing spreadsheets or dedicated financial software can make organizing this information much easier.

Additionally, consulting with a tax professional can provide personalized guidance tailored to your specific situation, ensuring that you meet all necessary requirements. It’s crucial for recipients to maintain accurate records for at least three years to support tax reporting and compliance. The IRS mandates that crowdfunding platforms report distributions exceeding $20,000 from more than 200 transactions via Form 1099-K for 2023 and prior years. For 2024, the threshold is reduced to $5,000. This underscores the necessity for recipients to keep detailed records.

Furthermore, contributions made from detached generosity may not be taxable, while employer contributions typically are. Understanding how and if GoFundMe donations are taxed is vital for proper tax treatment. As the IRS states, 'Money received through crowdfunding, such as GoFundMe, raises the question of whether GoFundMe donations are taxed; taxpayers should understand their obligations and the benefits of good recordkeeping.' By implementing these documentation strategies, you can navigate the complexities of tax obligations associated with crowdfunding more effectively. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding the taxation of GoFundMe donations is essential for both donors and recipients. We recognize that navigating these complexities can be overwhelming. Contributions can be categorized as personal gifts or charitable donations, each carrying different tax implications. As crowdfunding platforms continue to rise in popularity, it’s crucial to grasp these distinctions.

Accurate record-keeping is vital. Personal contributions generally do not incur tax obligations, but donations made in exchange for goods or services may be considered taxable income. It’s common to feel unsure about what this means for you. The need for proper documentation becomes even more important, especially for contributions exceeding certain thresholds, to ensure compliance with IRS regulations.

Ultimately, being informed about the tax responsibilities associated with GoFundMe donations empowers individuals to engage in fundraising with confidence. We’re here to help you navigate this landscape. Staying abreast of tax guidelines and maintaining thorough records not only simplifies the process but also helps avoid unexpected tax liabilities. Embracing these practices allows both donors and recipients to focus on the impact of their contributions rather than the complexities of tax obligations. Remember, you are not alone in this journey.

Frequently Asked Questions

What is GoFundMe and why is it significant?

GoFundMe is a leading crowdfunding platform that allows individuals to raise funds for personal causes, such as medical expenses and charitable initiatives. Its significance is highlighted by the anticipated use of the platform by millions of Americans for fundraising in 2025.

How are GoFundMe donations categorized for tax purposes?

GoFundMe donations can be categorized as either individual donations or charitable support. This distinction is important because individual gifts are generally not taxable for the recipient, while donations to registered charities may qualify for tax deductions for the giver if certain conditions are met.

Are GoFundMe donations taxable?

Generally, if resources are collected without providing any items or services in return, they are regarded as donations and are not taxable. However, if money is collected in exchange for goods or services, it may be classified as taxable business revenue.

What is the annual donation tax exclusion amount?

The annual donation tax exclusion is $15,000 per recipient per year. Contributions exceeding this threshold may require the donor to submit a federal donation tax return.

Can you provide examples of how GoFundMe donations are treated for tax purposes?

Yes, one example is an organizer collecting donations for a musician's new CD where supporters received a copy in exchange; these contributions were considered taxable income. In contrast, money collected for a child's educational costs without any items exchanged was classified as gifts and not taxable.

What happens if a crowdfunding campaign exceeds certain thresholds?

If a crowdfunding campaign exceeds $5,000 in total payments, GoFundMe may issue a 1099-K form, which notifies the IRS of the contributions. This form does not automatically mean the funds are taxable, but it emphasizes the need for accurate classification and record-keeping.

What documentation should contributors maintain for tax purposes?

Contributors should retain records for tax deductions on donations of $250 or greater and maintain thorough documentation for at least three years to ensure compliance with tax rules and clarify the source of the money collected.

What is the importance of record-keeping in crowdfunding?

Keeping good records and receipts is essential for navigating the tax implications of crowdfunding. It helps individuals understand their tax responsibilities and provides necessary documentation for potential deductions or clarifications with the IRS.