Overview

Navigating disability benefits can be challenging, and it's important to understand how they may impact your finances. Disability benefits can be taxable, depending on the type of assistance you receive and your total income. For instance, Social Security Disability Insurance (SSDI) payments might be taxed if your income exceeds certain thresholds. However, Supplemental Security Income (SSI) is generally not taxable.

We understand that financial obligations can feel overwhelming. That's why it's crucial to be aware of the tax implications associated with these benefits. Knowing the income limits and how premium payment methods work can help you manage your responsibilities effectively. Remember, you are not alone in this journey, and there are resources available to assist you in navigating these complexities.

Introduction

Understanding the nuances of disability benefits and their tax implications is crucial for millions of Americans who rely on this essential financial support. We recognize that as the number of individuals receiving disability assistance continues to rise, so does the complexity surrounding whether these benefits are taxable.

It's common to feel overwhelmed by various factors influencing tax obligations—such as income thresholds and the source of premium payments. Many recipients grapple with the question: do you pay taxes on disability benefits?

This article delves into the intricacies of disability benefits taxation, offering clarity and guidance for those navigating this often-overlooked financial landscape. Remember, you are not alone in this journey, and we’re here to help you find the answers you need.

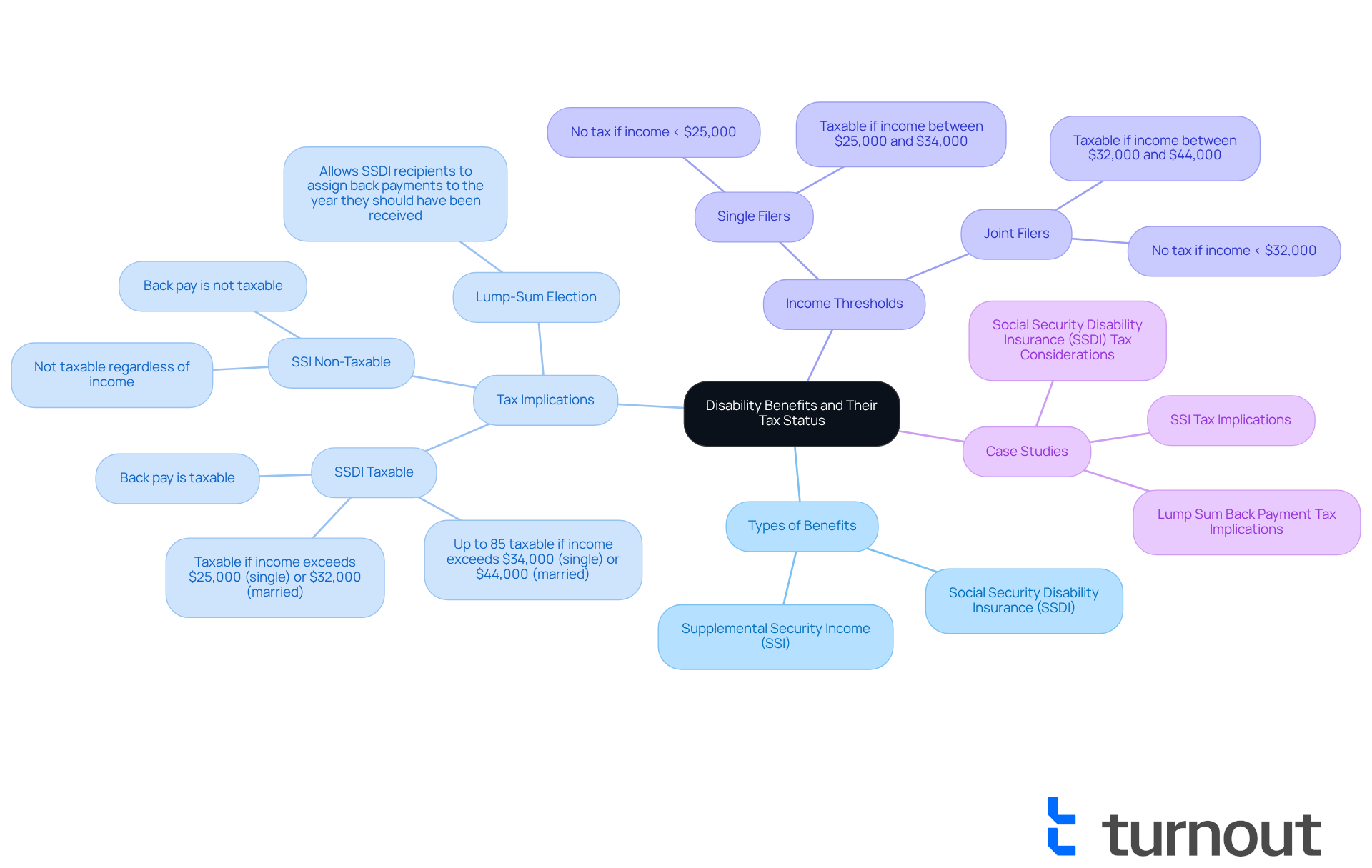

Define Disability Benefits and Their Tax Status

Disability assistance provides essential financial support to individuals who are unable to work due to medical conditions or disabilities. These benefits can come from various sources, including government programs like Insurance (SSDI) and private insurance plans. It's important to understand that when considering , the can vary significantly based on the type of assistance received and the recipient's overall income. Understanding do you pay taxes on is crucial for and complying with tax regulations.

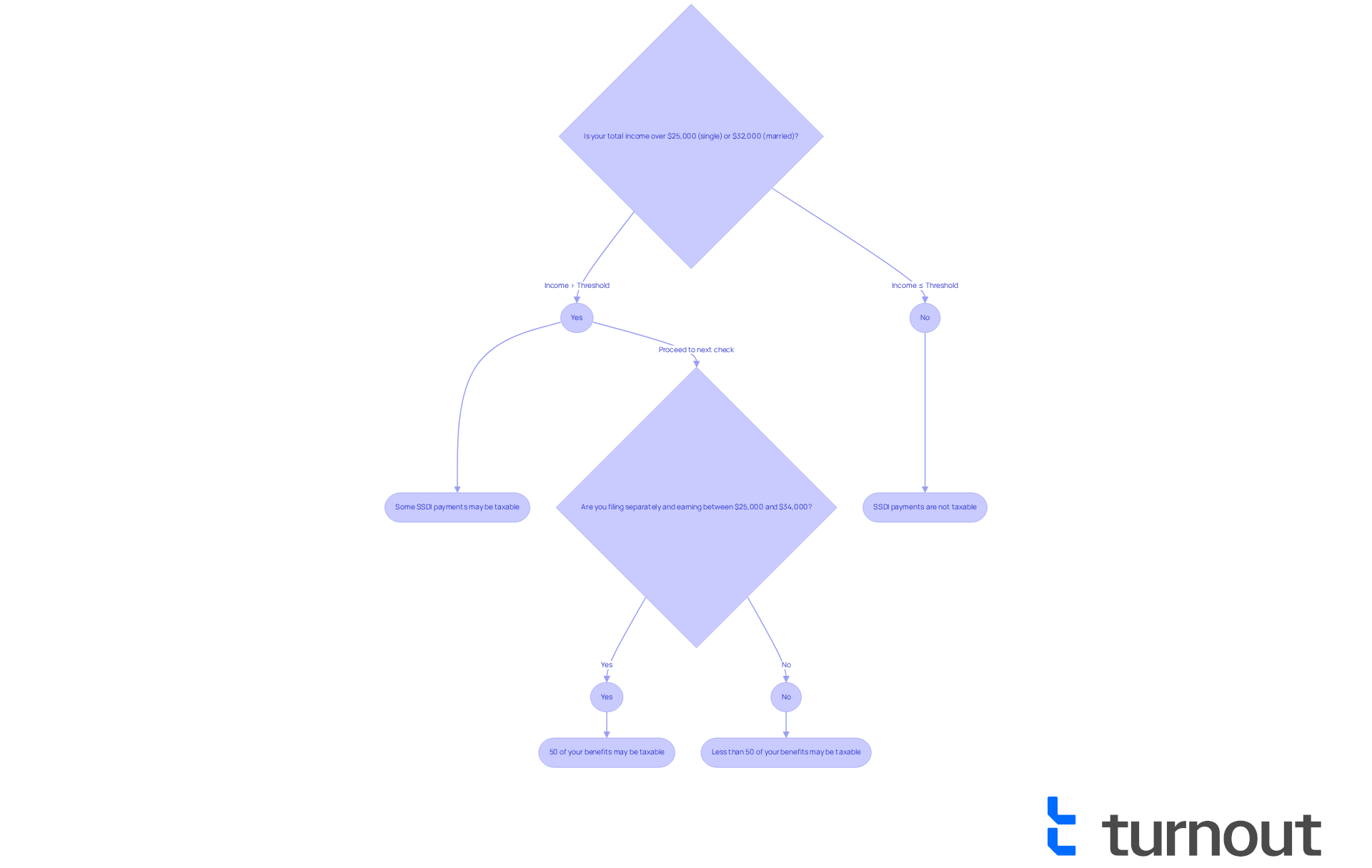

We understand that navigating . For those receiving disability benefits, the question of do you pay taxes on disability arises when total income exceeds certain thresholds. Specifically, do you pay taxes on disability payments if your total income surpasses $25,000 for individuals filing alone and $32,000 for couples filing jointly? If earnings exceed $34,000 for individual filers or $44,000 for combined filers, you might wonder, do you pay taxes on disability payments that may be up to 85% taxable? On the other hand, Supplemental Security Income (SSI) payments are not taxable, and recipients do not need to file taxes if their income is below $12,950 annually.

In 2025, nearly 5 million Americans are expected to receive disability benefits, which brings up the question: do you pay taxes on disability and emphasizes the importance of . For instance, a case study illustrates that while SSI back pay is not taxable, SSDI-related back pay is, which can lead recipients to wonder, do you pay taxes on disability? Fortunately, the IRS allows SSDI recipients to use the 'lump-sum election' method to assign back payments to the year they should have been received, potentially easing tax concerns.

It's important to note that Turnout is not a law firm and does not provide legal advice. We work with trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax relief, ensuring that beneficiaries receive qualified support without the need for legal representation. Remember, do you pay taxes on disability assistance is vital for managing your finances effectively and ensuring compliance with tax regulations. You're not alone in this journey, and we're here to help.

Identify Taxable and Non-Taxable Disability Benefits

Not all disability assistance is taxable, and we understand that navigating these complexities can be overwhelming. Supplemental Security Income (SSI) is generally exempt from federal income tax, providing some relief. However, it's important to note that if your , payments from Insurance (SSDI)?

According to IRS guidelines, if you are wondering do you pay taxes on disability, your total income—which includes half of your SSDI payments—must exceed $25,000 for single filers or $32,000 for married couples filing jointly for a portion of your SSDI payments to become taxable. For married individuals submitting separate returns and living independently, it is common to ask, do you pay taxes on disability benefits if their earnings fall between $25,000 and $34,000, as 50% of their benefits may be subject to taxation. Understanding these thresholds is crucial for , particularly when you ask, do you pay taxes on disability?

We know that financial matters can be confusing. That’s why that help you navigate these complex systems. With trained nonlawyer advocates for SSD claims, we ensure that you receive the support you need without establishing an attorney-client relationship. Remember, you are not alone in this journey. Staying informed about your can significantly enhance your .

Examine the Role of Premium Payments in Tax Liability

Understanding whether you do pay taxes on disability can feel overwhelming, but we're here to help you navigate this important topic. The largely depend on who pays the premiums and how payments are made. If a company covers the premiums for a disability insurance policy, the payments received are generally subject to taxation. However, if you pay the premiums with after-tax funds, those benefits are typically tax-free. This distinction is crucial for you to grasp, particularly in understanding whether you , as it can significantly impact your overall .

For instance, if you receive from a policy for which you personally covered the premiums, that assistance is often exempt from taxes. In fact, statistics show that benefits are 100 percent tax-free if premiums were solely paid by you on an after-tax basis. On the other hand, if your employer covered 50% of the premium cost, then 50% of the long-term disability payments would be taxable.

It's also essential to maintain your to avoid policy lapses, which could jeopardize your eligibility for assistance. We understand that these nuances can be challenging, but grasping them can empower you to make informed choices about your disability insurance and answer the question: do you pay taxes on disability? Remember, you are not alone in this journey, and taking the time to understand these details can make a significant difference in your .

. Follow the branches to see how each scenario impacts your tax situation.](https://images.tely.ai/telyai/gndqobwd-the-central-idea-represents-the-overall-topic-of-tax-implications-with-branches-showing-how-the-method-of-paying-premiums-affects-tax-obligations-follow-the-branches-to-see-how-each-scenario-impacts-your-tax-situation.webp)

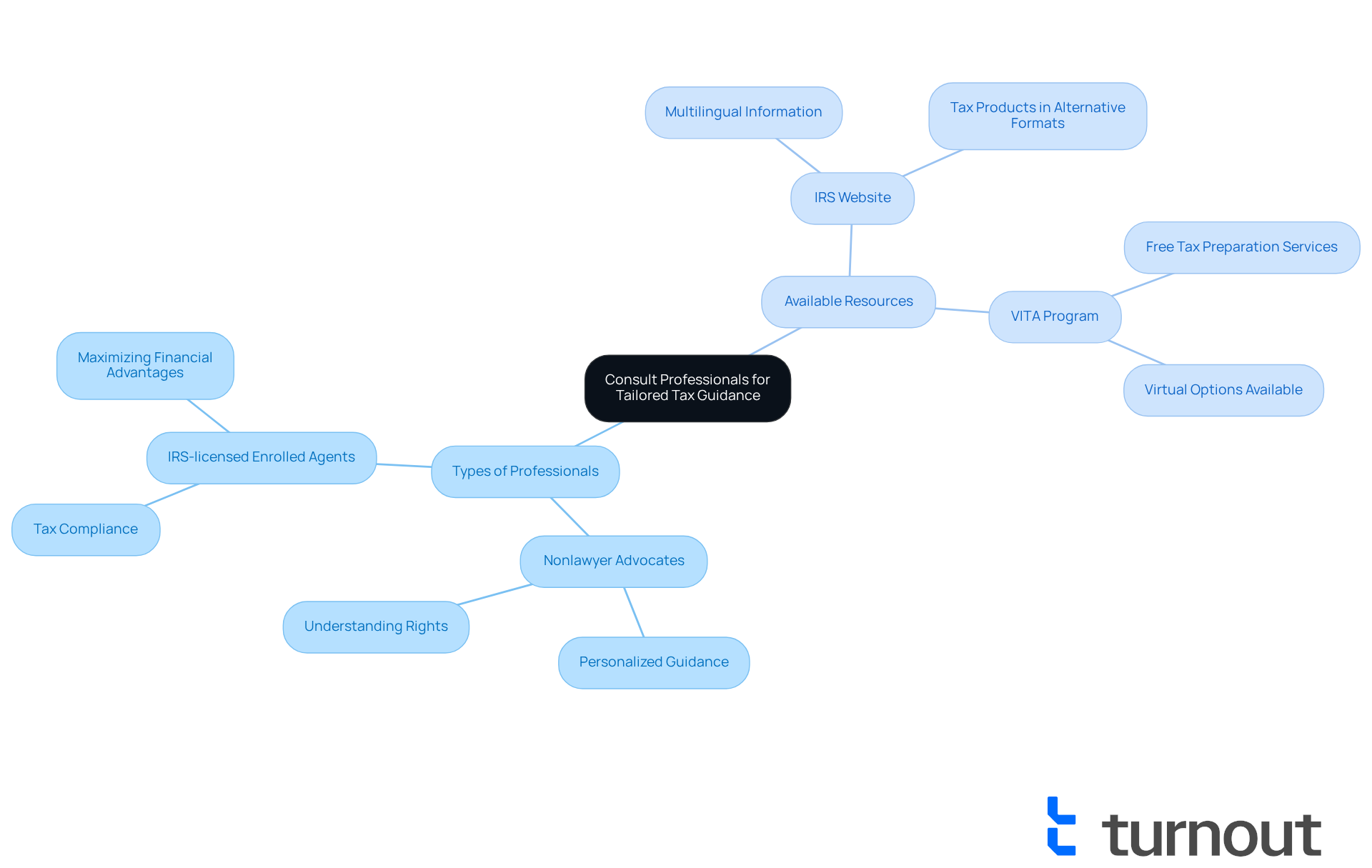

Consult Professionals for Tailored Tax Guidance

Navigating the complexities of can feel overwhelming, particularly when considering . We understand that this is a challenging journey, and it’s crucial to seek who specialize in this area. While Turnout does not provide legal counsel, it offers access to trained non-legal advocates and . These professionals deliver personalized guidance tailored to your unique circumstances, including income levels, types of benefits received, and methods of premium payment.

Nonlawyer advocates are here to help you understand your rights and navigate the application processes. Meanwhile, IRS-licensed enrolled agents focus specifically on tax-related matters. By consulting knowledgeable professionals through Turnout, you can ensure compliance with tax regulations while maximizing your financial advantages.

There are valuable resources available to support you on this journey. The IRS website offers information in various multilingual and alternative formats. Additionally, local , such as the Volunteer Income Tax Assistance (VITA) program, provide free tax preparation services, including virtual options. Many individuals have successfully managed their tax situations with , finding considerable financial relief and clarity about their obligations.

Engaging with these resources not only aids in understanding tax implications, such as do you pay taxes on disability, but also empowers you to make informed decisions about your financial future. Remember, you are not alone in this journey. It’s important to remain vigilant against scams related to tax services, as the IRS will never contact you via email, text, or social media to request personal information. We're here to help you navigate this process with confidence.

Conclusion

Understanding the tax implications of disability benefits is essential for anyone navigating financial support systems. We understand that this can be a complex and overwhelming process. It's important to know that not all disability assistance is subject to taxation, with specific exemptions for programs like Supplemental Security Income (SSI). However, for those receiving Social Security Disability Insurance (SSDI), tax obligations can arise based on income thresholds. This makes it crucial to grasp the nuances of when and how these benefits may be taxed.

Key points to consider include:

- The varying tax statuses of different types of disability benefits

- How premium payments can impact tax liability

- Consulting professionals for tailored guidance

Insights into thresholds for taxable income and the distinction between taxable and non-taxable benefits empower you to make informed financial decisions. Additionally, resources such as trained advocates and IRS-licensed agents are available to help you understand your obligations and maximize your financial advantages.

Ultimately, staying informed about the tax status of disability benefits is vital for effective financial management. As the landscape of disability assistance continues to evolve, we encourage you to seek expert advice and utilize available resources. By doing so, you can navigate the complexities of tax obligations confidently, ensuring compliance while optimizing your financial well-being. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What are disability benefits?

Disability benefits provide financial support to individuals who are unable to work due to medical conditions or disabilities. They can come from various sources, including government programs like Social Security Disability Insurance (SSDI) and private insurance plans.

Are disability benefits taxable?

The tax status of disability benefits varies based on the type of assistance received and the recipient's overall income. Some benefits may be taxable while others, like Supplemental Security Income (SSI), are not.

What income thresholds determine if disability benefits are taxable?

For individuals filing alone, disability benefits may be taxable if total income exceeds $25,000. For couples filing jointly, the threshold is $32,000. If earnings exceed $34,000 for individual filers or $44,000 for combined filers, up to 85% of disability payments may be taxable.

Are SSI payments taxable?

No, Supplemental Security Income (SSI) payments are not taxable, and recipients do not need to file taxes if their income is below $12,950 annually.

What is the 'lump-sum election' method?

The 'lump-sum election' method allows SSDI recipients to assign back payments to the year they should have been received, which can help ease tax concerns.

Is back pay from SSI taxable?

No, SSI back pay is not taxable. However, SSDI-related back pay is taxable.

How many Americans are expected to receive disability benefits in 2025?

Nearly 5 million Americans are expected to receive disability benefits in 2025.

Does the article provide legal advice regarding disability benefits and taxes?

No, the article states that Turnout is not a law firm and does not provide legal advice, but works with trained nonlawyer advocates and IRS-licensed enrolled agents for support.