Overview

We understand that navigating the world of donations can be challenging, especially when it comes to understanding tax implications. GoFundMe donations made to personal fundraisers are generally not tax-deductible. These contributions are classified as personal gifts, rather than charitable donations to qualified organizations. It's important to note that only donations made to campaigns linked to registered 501(c)(3) organizations can be deducted.

This distinction emphasizes the necessity of proper documentation and understanding the criteria for tax-deductible contributions. We encourage you to keep this in mind as you consider your giving options. Remember, you are not alone in this journey, and we're here to help you make informed decisions.

Introduction

Understanding the intricacies of crowdfunding can feel overwhelming, especially when considering the tax implications of donations made through platforms like GoFundMe. We know that as these online fundraising campaigns grow in popularity, with millions of contributions made each year, many potential donors are left wondering: Are these donations tax deductible?

This article aims to guide you through the nuances of GoFundMe donations, exploring what qualifies for tax deductions and how to navigate the IRS guidelines effectively. It's common to have concerns about these details, and grasping them is essential for making informed contributions that truly make a difference.

Define GoFundMe Donations and Their Purpose

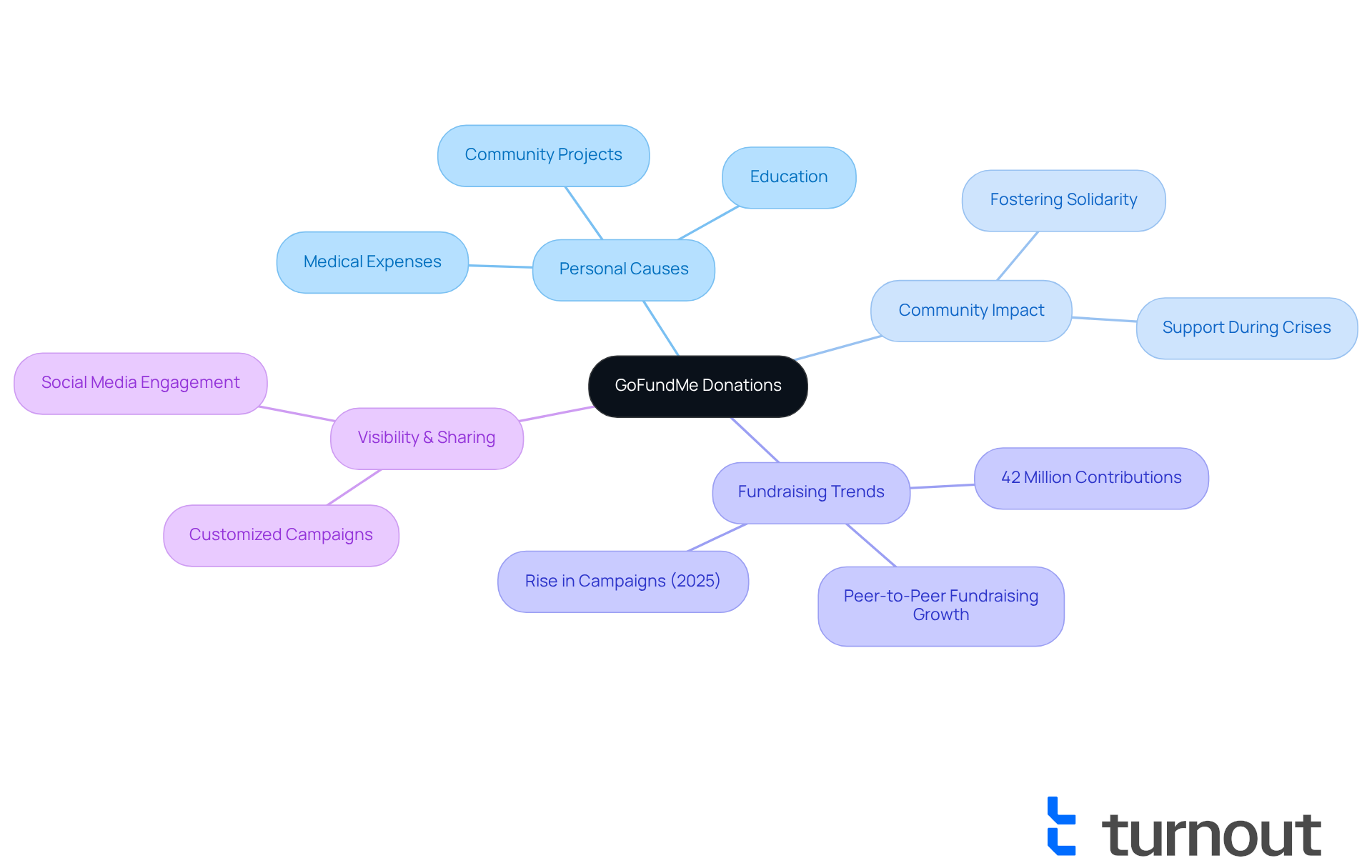

are heartfelt gifts made through a , designed to assist individuals in gathering funds for various personal causes, such as medical expenses, education, and community projects. We understand that during difficult times, these contributions aim to provide , helping individuals or groups more effectively.

Unlike traditional fundraising methods, this platform empowers individuals to create , significantly increasing their visibility to potential supporters. This democratization of fundraising has led to a , with over 42 million contributions made this year alone—averaging two contributions every second.

Fundraising specialists emphasize that the impact of crowdfunding platforms extends beyond mere financial aid; it fosters a sense of community and solidarity among contributors and beneficiaries. As Kathy Calvin beautifully stated, 'Giving is not solely about providing a contribution. It is about .' The notable increase in campaigns initiated in 2025 further highlights the growing trend of , showcasing its effectiveness in rallying during times of need.

You are not alone in this journey. Together, we can make a difference.

Explore Tax Deductibility of GoFundMe Donations

Understanding if can be a bit overwhelming, and we want to help clarify this for you. A common question is whether [donations on GoFundMe are tax deductible](https://jacksonhewitt.com/tax-help/questions-and-answers/can-i-deduct-charitable-donations-made-through-gofundme) when made to registered charity fundraisers. These campaigns are linked to 501(c)(3) organizations recognized by the IRS, which is good news for those wanting to contribute to a cause.

However, it’s important to note that donations to personal fundraisers—like those aimed at covering medical bills or personal expenses—often lead to the question: are donations on GoFundMe tax deductible? This raises the question of whether donations on GoFundMe are tax deductible. We understand that this distinction can be confusing, but it’s crucial for you to know, as it impacts your ability to claim deductions on your tax returns.

According to the IRS, only contributions to approved charitable organizations can be deducted, which raises the question of whether donations on GoFundMe are tax deductible. Therefore, it is essential to confirm if donations on GoFundMe are tax deductible before you give. Additionally, if you donate $250 or more, you’ll need to claim your tax deduction, so please keep that documentation safe.

It’s also worth mentioning that the crowdfunding platform itself is a for-profit entity and not a 501(c)(3) organization. This factor influences the tax deductibility of your contributions. If you’re considering making larger , be aware that the annual gift exclusion for 2025 is $19,000, which is important for understanding potential .

We encourage you to regarding your tax situation. Remember, if you receive something of value in return for your contributions, those funds may be taxable as business income. To deduct crowdfunding contributions, you’ll need to submit Schedule A, Form 1040, to detail your deductions. You are not alone in navigating these complexities; we’re here to help you through it.

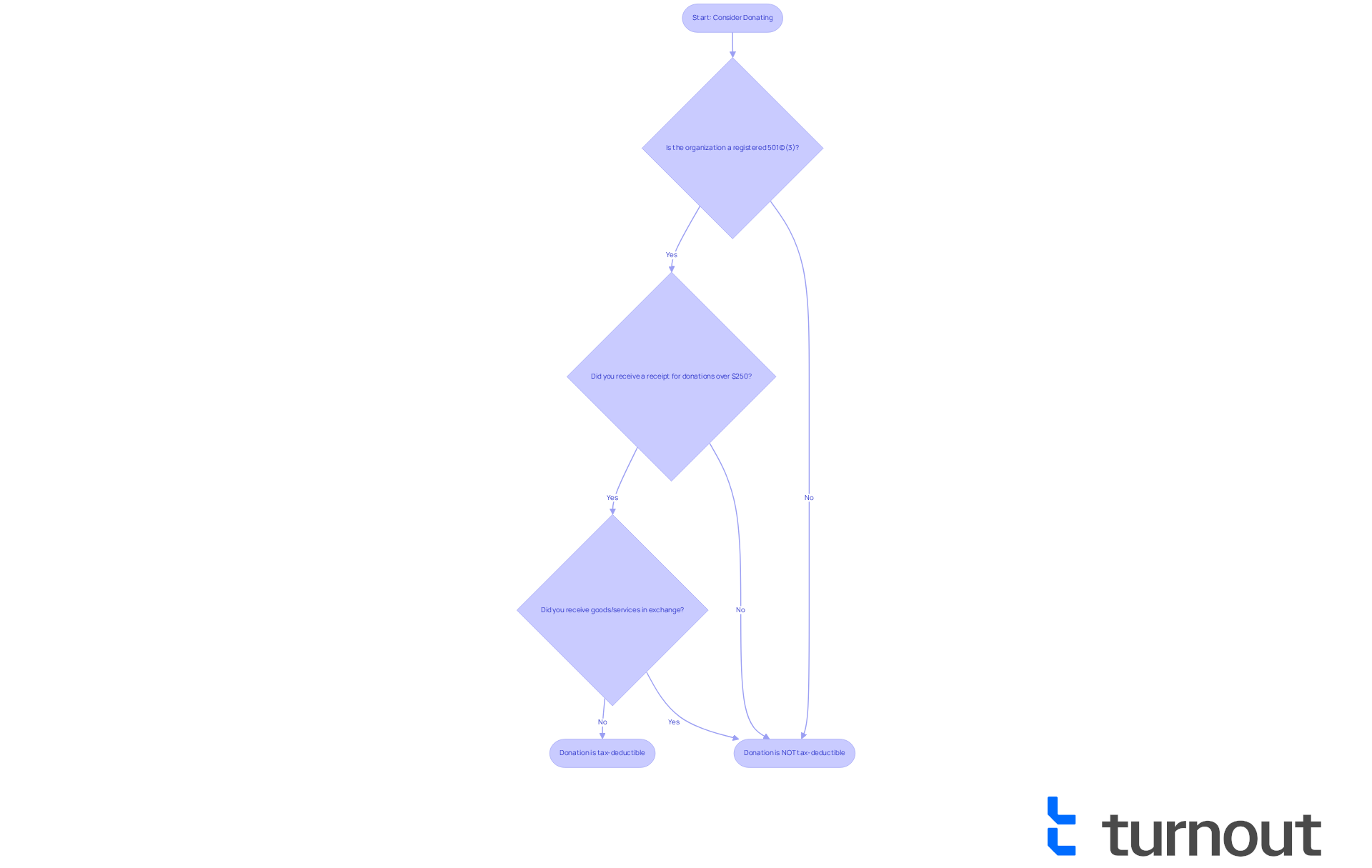

Identify Criteria for Tax-Deductible Donations

We understand that navigating tax deductions can be overwhelming, especially when it comes to . To qualify for these deductions, it's essential to meet specific criteria. First, your contribution should be directed to a registered 501(c)(3) organization, confirming that the recipient is recognized as a charitable entity by the IRS. It's important to note that contributions to personal are generally regarded as personal gifts, leading many to wonder, are ?

Additionally, donors must obtain a receipt or acknowledgment from the organization, particularly for gifts surpassing $250. This documentation is vital for . For contributions below $250, we recommend keeping bank records or receipts to ensure you have the necessary information at hand.

Moreover, the gift must be made without receiving any goods or services in exchange. If you do receive something in return, it would be categorized as a purchase rather than a charitable contribution. Remember, only contributions made to GoFundMe.org or recognized nonprofits are donations on GoFundMe tax deductible, since GoFundMe itself is not a qualified 501(c)(3) organization.

Understanding these criteria is crucial for donors aiming to maximize their while supporting meaningful causes. For instance, donations made to campaigns organized through recognized nonprofits can be tax-deductible, provided they adhere to these guidelines. Furthermore, it's helpful to be aware of the annual gift exclusion amount, which allows individuals to give a certain amount without incurring gift taxes.

Keeping comprehensive records of all donations, including receipts, can greatly assist in clarifying your tax responsibilities and ensuring adherence to . Remember, we're here to help you navigate this journey with confidence.

Summarize Key Insights on GoFundMe Donations and Taxes

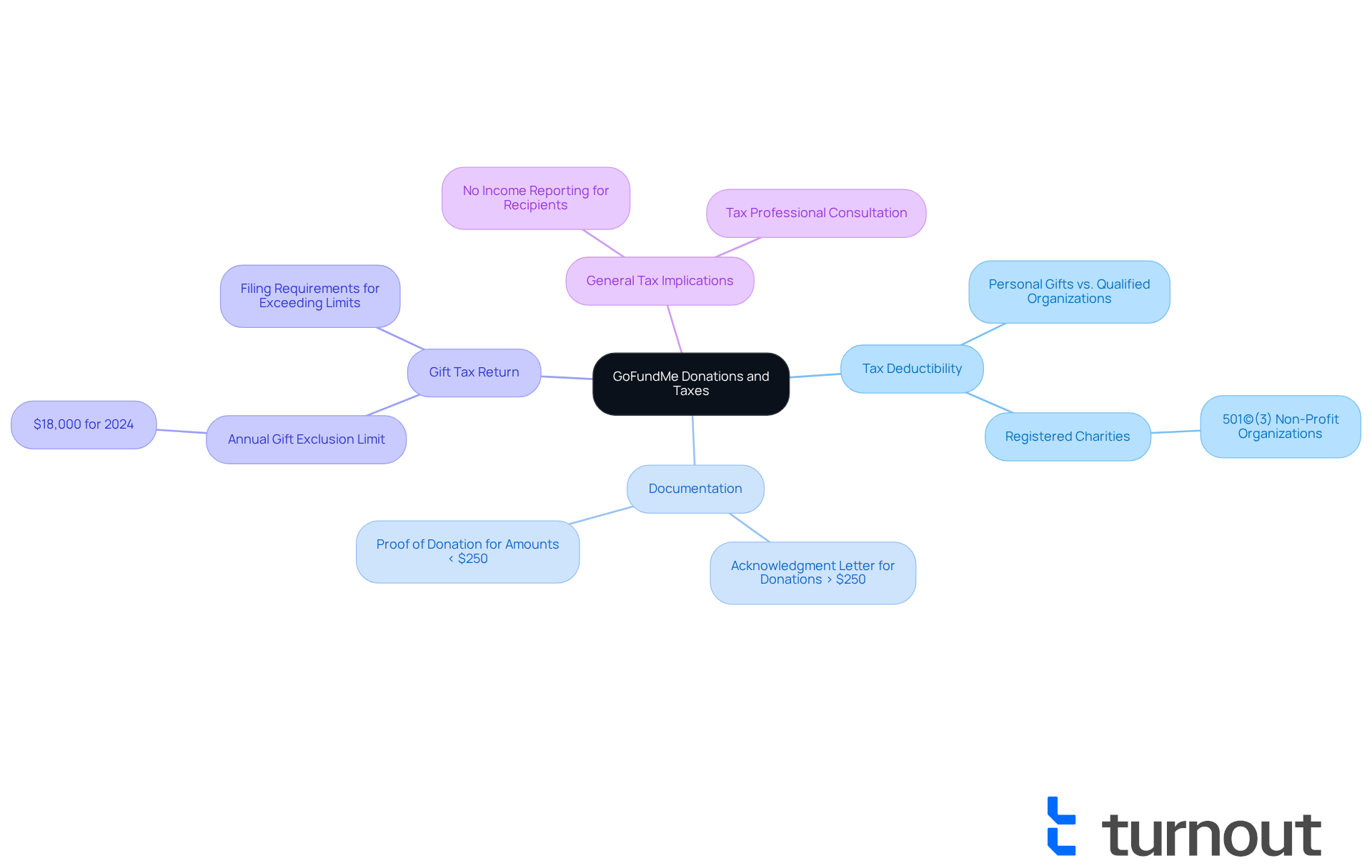

In summary, we understand that GoFundMe donations can be a for personal and charitable causes. However, it's common to feel uncertain about whether donations on GoFundMe are . While personal gifts typically are not, many people wonder if . To ensure your contributions are impactful, please verify that you are donating to qualified organizations and , while maintaining .

For amounts exceeding $250, an . It's also important to note that contributions to GoFundMe campaigns are classified as individual-to-individual gifts. This means recipients do not need to report these funds as income, as highlighted by tax professional Jeff Dvorachek. Additionally, if a donor exceeds the annual gift exclusion limit—set at $18,000 for 2024—they must file a gift tax return, although they may not owe any taxes.

By understanding these nuances, both donors and recipients can navigate the of crowdfunding more effectively. Remember, you're not alone in this journey; make the most of your contributions.

Conclusion

Understanding the tax implications of GoFundMe donations is essential for both donors and recipients as they navigate the complexities of crowdfunding. We recognize that these contributions serve as vital support for personal and charitable causes. However, it’s important to understand that not all donations are tax deductible. Contributions directed to registered 501(c)(3) organizations can qualify for deductions, while personal gifts typically do not. This distinction is fundamental for individuals looking to maximize their financial support while adhering to IRS guidelines.

Key insights reveal that maintaining proper documentation, such as acknowledgment letters for larger contributions, is critical for claiming any potential tax deductions. It's common to feel overwhelmed by the annual gift exclusion limit, which also plays a significant role in understanding the financial responsibilities associated with these donations. By grasping these nuances, you can confidently engage in crowdfunding, ensuring your contributions are both impactful and compliant with tax regulations.

Ultimately, as crowdfunding continues to grow in popularity, comprehending the tax status of GoFundMe donations becomes increasingly significant. Whether you’re supporting a friend in need or contributing to a community project, being informed about the eligibility for tax deductions can enhance your giving experience. Embracing this knowledge empowers you to make thoughtful contributions while navigating the intricacies of tax laws effectively. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What are GoFundMe donations?

GoFundMe donations are financial contributions made through a fundraising platform, aimed at assisting individuals in gathering funds for personal causes such as medical expenses, education, and community projects.

What is the purpose of GoFundMe donations?

The purpose of GoFundMe donations is to provide essential financial support to individuals or groups during difficult times, helping them navigate crises more effectively.

How does GoFundMe differ from traditional fundraising methods?

GoFundMe empowers individuals to create customized campaigns that can be widely shared, significantly increasing their visibility to potential supporters, unlike traditional fundraising methods.

How popular has GoFundMe become?

GoFundMe has seen remarkable popularity, with over 42 million contributions made in one year alone, averaging two contributions every second.

What additional benefits do crowdfunding platforms provide?

Beyond financial aid, crowdfunding platforms foster a sense of community and solidarity among contributors and beneficiaries, making a broader impact on social connections.

What does the increase in campaigns initiated in 2025 indicate?

The increase in campaigns initiated in 2025 indicates a growing trend of personal fundraising through online platforms, showcasing its effectiveness in rallying community support during times of need.