Overview

Navigating IRS problems can be daunting, and we understand that many individuals face significant challenges in this area. To effectively seek help, there are four essential steps to consider:

- Identify the specific issue at hand.

- Gather the required documentation that will support your case.

- Seek professional assistance to guide you through the complexities.

- Explore the resolution options available to you.

Each of these steps is vital in preparing for the journey ahead. Understanding your situation is crucial, and professional guidance can make a substantial difference. Remember, you are not alone in this journey. With the right support, you can achieve more successful outcomes. We're here to help you every step of the way.

Introduction

Navigating the complexities of IRS issues can feel like an uphill battle. Many taxpayers face daunting challenges, such as unpaid taxes, audits, and confusing notices. We understand that these problems can be overwhelming. Understanding the intricacies of these situations is crucial, as it sets the foundation for effective resolution strategies.

With nearly 25% of taxpayers projected to have outstanding dues in the coming years, the urgency to address these concerns becomes apparent. How can you effectively identify your IRS problems and find the right support to resolve them? This article outlines four essential steps to help you tackle your IRS challenges with confidence and clarity.

Remember, you are not alone in this journey; we’re here to help.

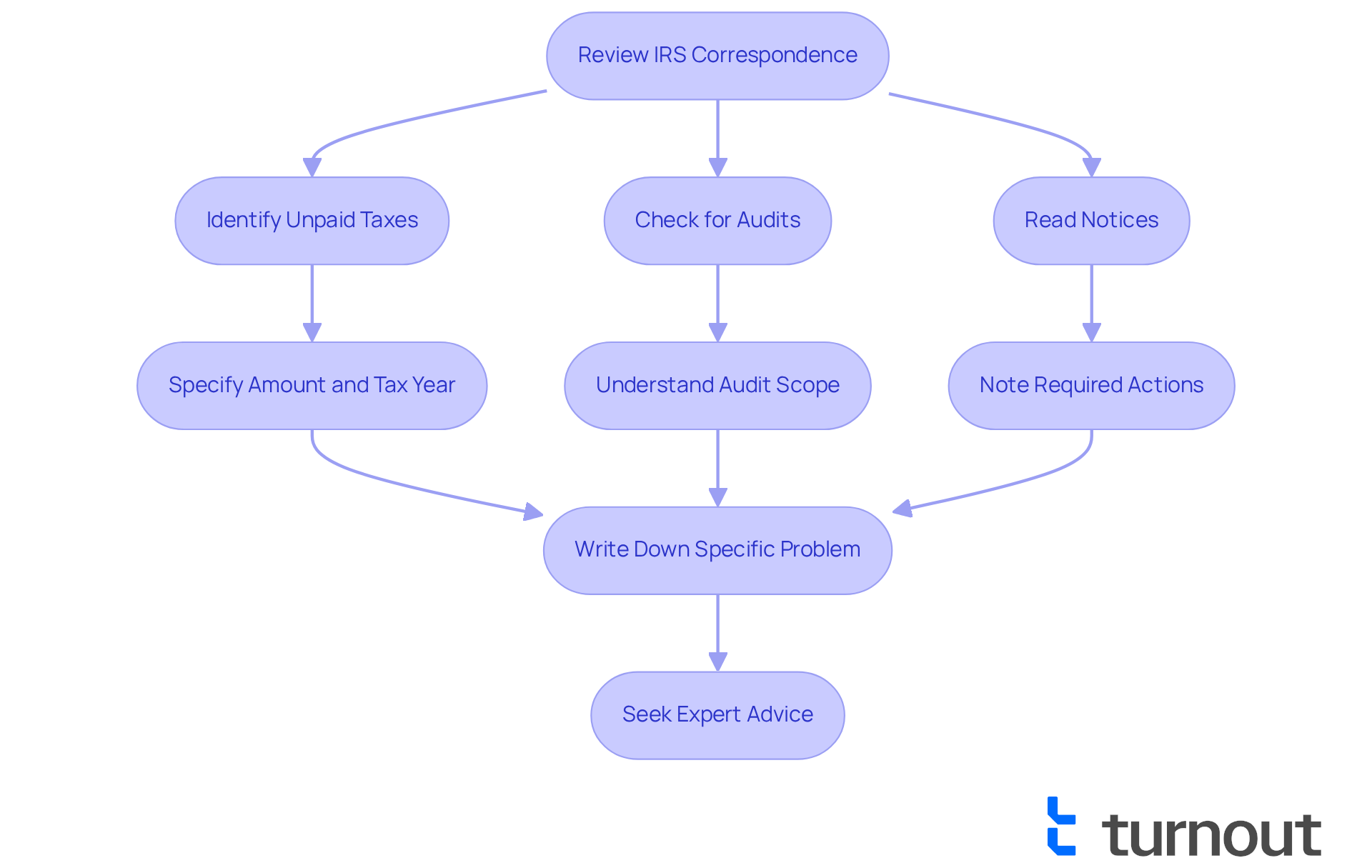

Identify Your IRS Problem

Begin by reviewing any correspondence from the IRS. We understand that this can be a daunting task. Look for announcements that outline the specifics of your concern, such as outstanding dues, inconsistencies in your financial return, or audit alerts. Common problems include:

- Unpaid Taxes: If you owe money, identify the amount and the tax year.

- Audits: Determine if you have been selected for an audit and understand the scope.

- Notices: Read any IRS notices carefully to understand what actions are required from you.

It's common to feel overwhelmed. In 2025, approximately 25% of contributors are anticipated to have outstanding dues, underscoring the commonality of this concern. In FY 2024, the IRS collected $120.2 billion in unpaid assessments, highlighting the importance of addressing unpaid taxes. Once you have identified your specific problem, write it down clearly. This will guide your next steps and assist you in communicating effectively with any experts you may seek advice from. Tax experts frequently emphasize that comprehending the essence of your IRS challenges is essential for effective help for IRS problems. For instance, Gabriella Cruz-Martínez, a tax writer, noted that "the first step in addressing IRS problems is to clearly identify what the IRS is communicating." Real-world examples show that individuals who invest time in recording their concerns often achieve better outcomes when seeking help. Furthermore, with the IRS staff reduced by more than 25%, addressing these matters may be more challenging, underscoring the necessity of being thoroughly prepared. Remember, you are not alone in this journey, and we’re here to offer help for IRS problems as you navigate through it.

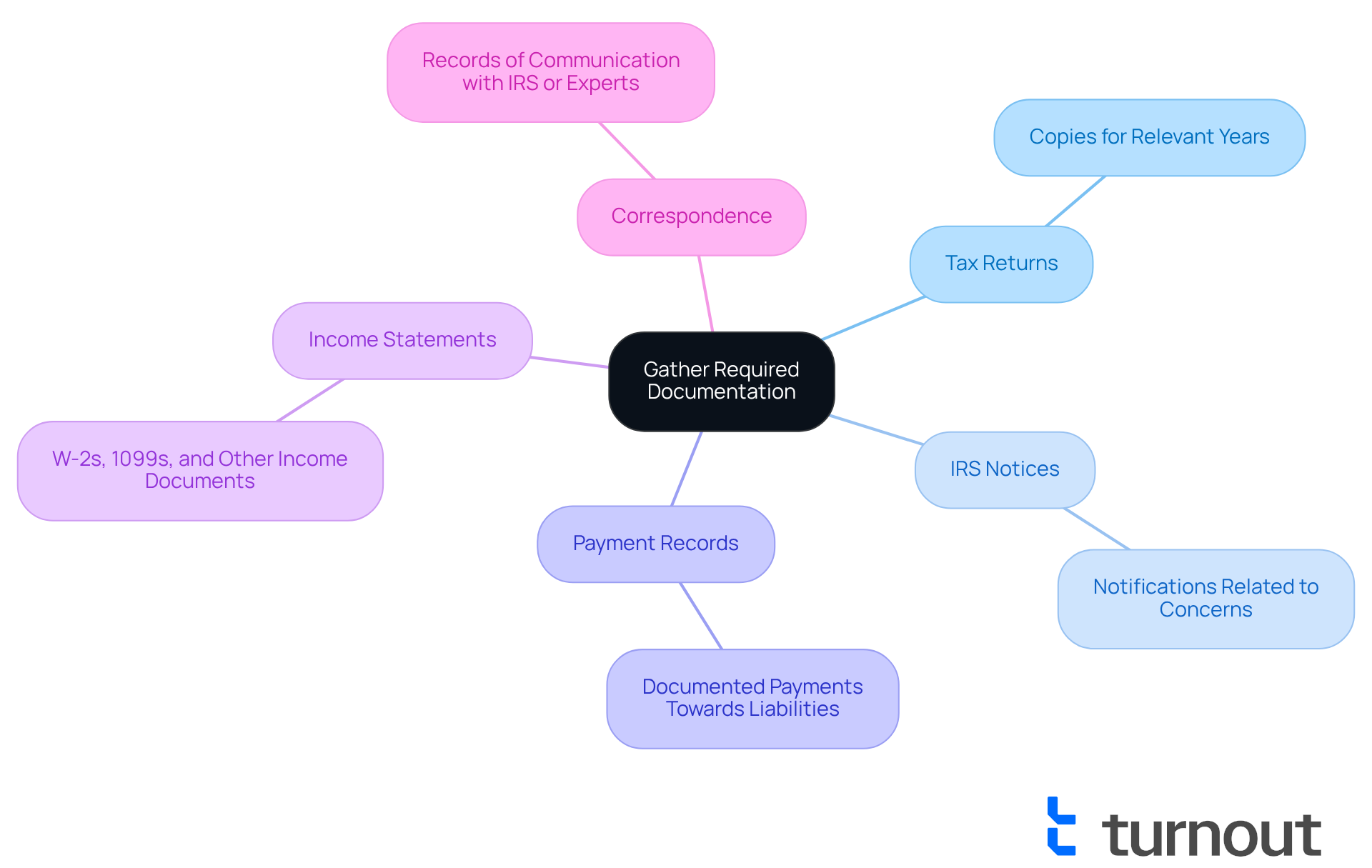

Gather Required Documentation

To effectively tackle your IRS concerns, we provide help for IRS problems, as we understand it can feel overwhelming. Collecting all pertinent documents related to your tax situation is essential. This includes:

- Tax Returns: Ensure you have copies of your tax returns for the years in question.

- IRS Notices: Gather any notifications received from the IRS that relate to your concern.

- Payment Records: Document any payments made towards your tax liabilities to establish your compliance.

- Income Statements: Include W-2s, 1099s, or other income statements that support your claims.

- Correspondence: Maintain records of any communication with the IRS or tax experts for reference.

Organizing these documents in a dedicated folder, whether physical or digital, will facilitate easy access when needed. It's common to feel burdened by the significant paperwork demands of the IRS, with taxpayers spending an average of 25 hours on tax-related tasks. However, proper documentation can streamline the resolution process. Experts emphasize that having organized records is essential for effective communication with the IRS. As Sam Batkins notes, "the average working American spends more than a week sifting through paperwork and preparing to file."

Successful cases frequently highlight the importance of being equipped with all essential documentation, which can greatly lessen the time and effort needed to find help for IRS problems. Remember, you are not alone in this journey, as there is help for IRS problems available. Additionally, utilizing the IRS Online Account can help you manage your tax-related tasks efficiently, providing easy access to essential information and resources. We're here to help you navigate this process.

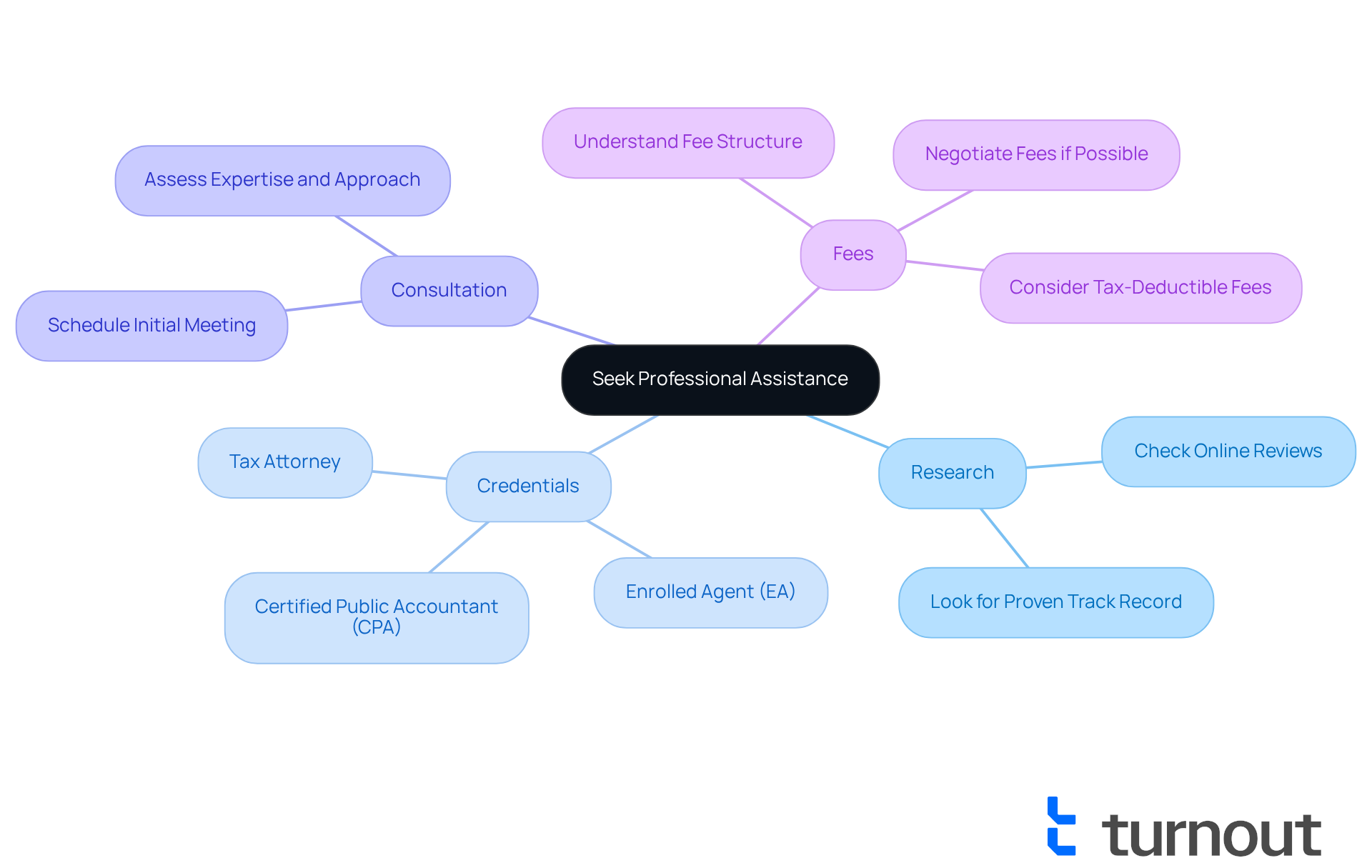

Seek Professional Assistance

If you're feeling overwhelmed by IRS matters, consider reaching out to a qualified tax expert who can offer help for IRS problems. Finding the right help can make a significant difference. Here are some supportive tips to guide you:

- Research: It's important to look for professionals who have positive reviews and a proven track record in resolving IRS problems. Checking online ratings and testimonials from previous clients can be a great start.

- Credentials: Make sure your chosen expert possesses relevant qualifications, such as being a certified public accountant (CPA) or an enrolled agent (EA). These specialists have the necessary training to provide help for IRS problems and navigate complex tax situations. Notably, enrolled agents often charge the lowest fees for IRS audit representation, typically ranging from $100 to $400 per hour.

- Consultation: Scheduling a consultation can be a helpful step in discussing your specific circumstances. This meeting allows you to assess their expertise and approach to problem-solving, ensuring you feel comfortable moving forward.

- Fees: It's wise to understand their fee structure upfront to avoid unexpected costs later. CPAs may charge between $150 and $450 per hour, depending on their experience and the complexity of your case.

Having a knowledgeable advocate by your side can significantly provide help for IRS problems and ease the burden of navigating the complexities of the IRS. As one tax advisor wisely noted, "Cost is a big factor, but it shouldn’t be the only basis for your decision." Involving the appropriate expert can lead to successful outcomes. Remember, expert representation is often considered a smart investment for taxpayers who need help for IRS problems during audits. You're not alone in this journey, and we're here to help you find the support you need.

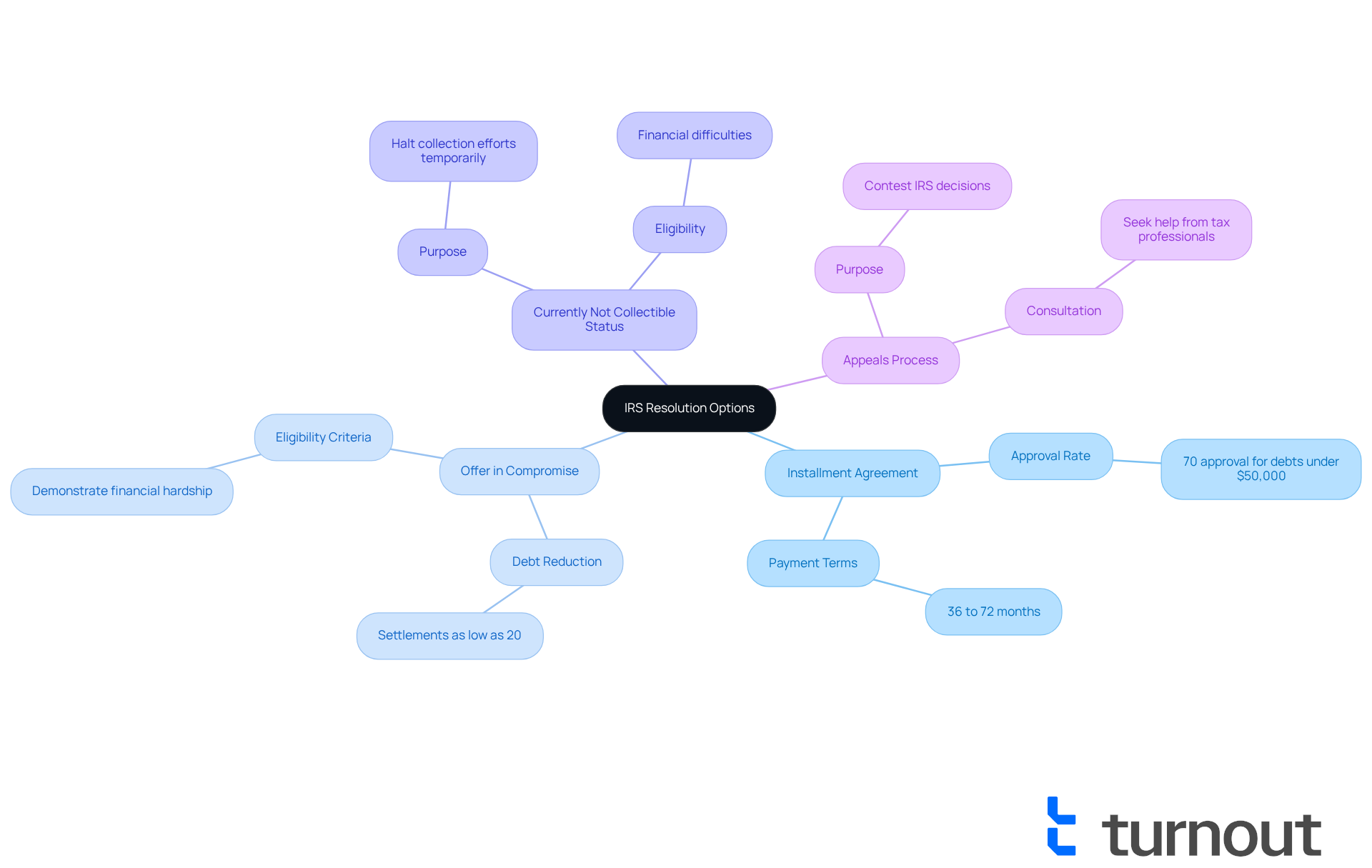

Explore IRS Resolution Options

Once you have identified your problem and gathered your documentation, we understand that you may need help for IRS problems, as navigating tax issues can be overwhelming. Here are some IRS resolution options that may help you find relief:

- Installment Agreement: If you owe taxes, you may qualify for a payment plan that allows you to pay your debt over time. Approximately 70% of taxpayers who apply for an installment agreement and owe less than $50,000 are approved. This option can be a viable path for many.

- Offer in Compromise: This option lets you settle your tax debt for less than the full amount owed if you can demonstrate financial hardship. Many taxpayers have successfully reduced their liabilities, settling for as little as 20% of what they owe.

- Currently Not Collectible Status: If you cannot pay your tax debt due to financial difficulties, you can request this status, which temporarily halts collection efforts. This can provide immediate relief, allowing you to stabilize your financial situation without the pressure of IRS collections.

- Appeals Process: If you disagree with an IRS decision, you can appeal it through the IRS appeals process. This allows you to contest decisions regarding your tax obligations and seek a fair resolution.

We encourage you to consult with your tax professional to determine which option is best suited for your situation and to provide help for IRS problems during the application process. Remember, understanding your options is crucial for effective tax resolution, and having the right help for IRS problems can truly make all the difference. You are not alone in this journey.

Conclusion

Identifying and addressing IRS problems can feel overwhelming, but taking proactive steps is essential to resolve these issues effectively. We understand that facing specific tax challenges can be daunting. Gathering necessary documentation, seeking professional assistance, and exploring resolution options are critical components in navigating the complexities of the IRS. By taking these steps, you can better equip yourself to handle your tax situation and find appropriate solutions.

Throughout this article, we’ve discussed key strategies that can make a difference. Clearly identifying the problem, organizing your documentation, and consulting with qualified tax experts are vital steps in simplifying the process. Each of these actions prepares you to tackle your issues head-on. Moreover, exploring various IRS resolution options can provide relief and pave the way for a more manageable path forward.

Ultimately, you don’t have to embark on this journey alone. By leveraging available resources and support, you can regain control over your tax situation and work towards a resolution. Taking the initiative to seek help is not just a smart choice; it’s a necessary step in alleviating the stress and uncertainty that often accompany tax issues. Embracing these strategies can lead to a more secure financial future and peace of mind. Remember, we’re here to help, and you are not alone in this journey.

Frequently Asked Questions

What is the first step in addressing an IRS problem?

The first step is to review any correspondence from the IRS to identify the specifics of your concern, such as outstanding dues, inconsistencies in your financial return, or audit alerts.

What are common IRS problems individuals may face?

Common IRS problems include unpaid taxes, audits, and various notices from the IRS that outline required actions.

How can I identify the amount I owe in unpaid taxes?

To identify the amount owed, review the IRS correspondence for details regarding the specific tax year and the outstanding amount.

What should I do if I am selected for an audit?

Determine if you have been selected for an audit and understand the scope of the audit by reviewing the information provided by the IRS.

Why is it important to write down my IRS problem?

Writing down your IRS problem clearly helps guide your next steps and assists in communicating effectively with any experts you may seek advice from.

How common is it for individuals to have outstanding dues with the IRS?

In 2025, it is anticipated that approximately 25% of contributors will have outstanding dues, indicating that this is a common issue.

What did the IRS collect in unpaid assessments in FY 2024?

In FY 2024, the IRS collected $120.2 billion in unpaid assessments.

Why is it essential to understand the essence of my IRS challenges?

Comprehending the essence of your IRS challenges is essential for receiving effective help, as noted by tax experts.

What is the current state of the IRS staff?

The IRS has reduced its staff by more than 25%, which may make addressing IRS matters more challenging.

Is it normal to feel overwhelmed when dealing with IRS issues?

Yes, it is common to feel overwhelmed when addressing IRS issues, but it is important to remember that help is available.