Overview

The primary aim of this article is to offer a comprehensive guide on how to effectively utilize the IRS long-term payment plan for managing your tax obligations. We understand that navigating tax responsibilities can be overwhelming, especially during challenging financial times. This guide outlines the eligibility criteria, application methods, and management strategies available to you.

These payment plans are designed with your needs in mind, providing flexibility and support for taxpayers facing financial difficulties. It's common to feel stressed about compliance with tax responsibilities, but rest assured, you are not alone in this journey. Our goal is to help you find a manageable path forward.

By following the steps outlined in this article, you can take control of your tax situation while ensuring that you meet your obligations. We’re here to help you every step of the way, offering reassurance that there are solutions available to ease your concerns.

Introduction

Navigating tax obligations can often feel overwhelming, especially when faced with the prospect of unpaid debts to the IRS. We understand that this situation can create significant stress and uncertainty. Fortunately, the IRS long-term payment plan offers a structured solution for taxpayers seeking relief, allowing them to spread payments over an extended period. This article delves into the intricacies of establishing and managing these payment plans, highlighting the significant benefits they offer, such as reduced financial stress and enhanced compliance.

But what happens if circumstances change, or if the application process feels daunting? It's common to feel apprehensive about these challenges. Understanding these nuances is crucial for taxpayers aiming to regain control over their financial situations while ensuring they meet their obligations. Remember, you're not alone in this journey; we're here to help you navigate these complexities with confidence.

Understand IRS Long-Term Payment Plans

A long-term , often referred to as an installment agreement, is a thoughtful option for taxpayers looking to utilize the to resolve their over a period of time. We understand that not everyone can pay their tax bill in full by the due date, and this arrangement provides a lifeline. Typically, these agreements can extend up to 72 months, depending on the total amount owed, offering you significant flexibility. This structure alleviates immediate financial pressure, allowing you to manage your finances more effectively while ensuring compliance with your tax obligations.

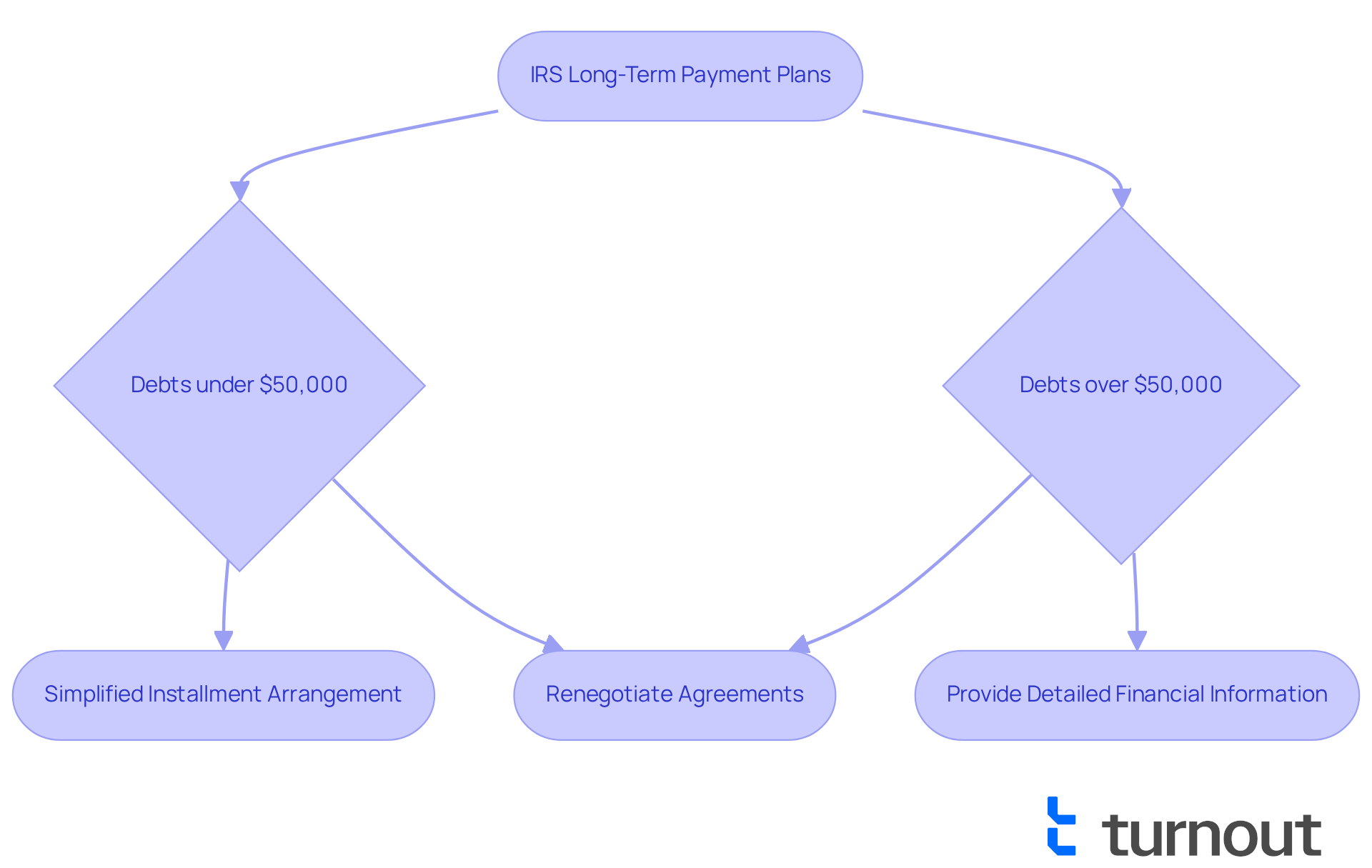

In 2025, the IRS has made it easier for taxpayers to , recognizing the challenges many face. For instance, if your debts are under $50,000, you can set up a , which accounts for nearly 70% of all IRS repayment options. Additionally, it's worth noting that 88% of individual taxpayers owe less than $25,000 to the IRS, making this option particularly relevant for many of you. Establishing this option before the IRS files a tax lien allows you to avoid that additional stress, further enhancing its appeal.

Real-world examples highlight the effectiveness of these strategies. For example, consider a taxpayer with a balance of $25,000 who opts for an IRS long term payment plan. Distributing payments over six years can significantly ease the financial burden. If your debts exceed $50,000, you will need to provide detailed financial information to establish settlement agreements, which can feel daunting. However, remember that you can renegotiate your financial agreements if your circumstances change, ensuring that support remains accessible.

It's important to be aware that the interest on unpaid taxes currently stands at 7% for individuals, which can impact the total amount owed over time. Overall, the IRS long term payment plan offers a practical solution for those facing substantial tax obligations, enabling you to maintain economic stability while fulfilling your tax duties. The fastest and simplest way to enroll is by using the Online Payment Agreement tool, allowing you to establish a financial arrangement quickly and receive instant confirmation of acceptance. Remember, we're here to help you navigate this journey.

Determine Your Eligibility for a Long-Term Payment Plan

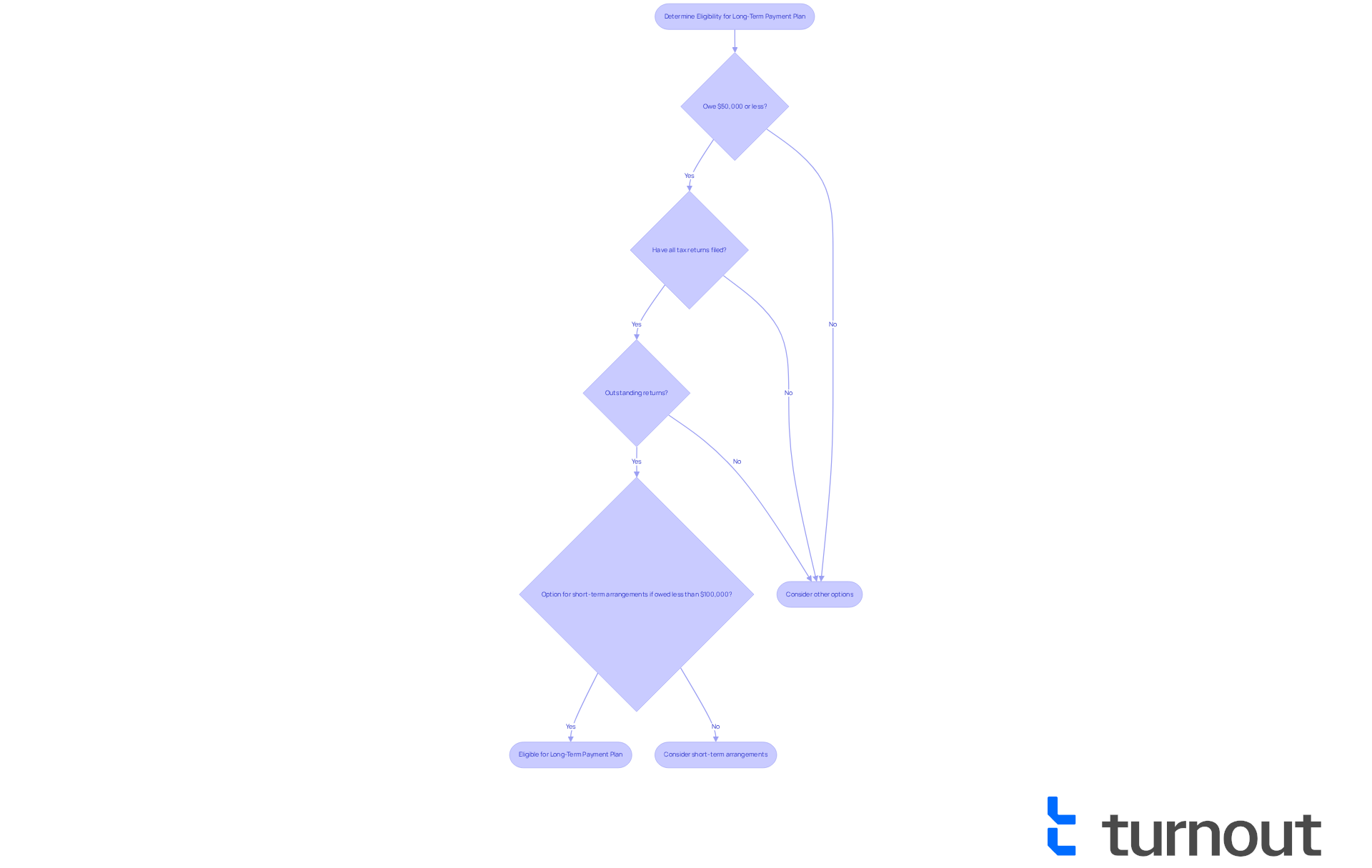

If you're facing challenges with your , it's important to know that the is an option that can help you. To qualify, specific criteria must be satisfied. Generally, you should owe $50,000 or less in combined tax, penalties, and interest, and it's essential that all required tax returns are filed. If you have outstanding returns, addressing those is crucial before applying.

For business taxpayers, there are varying limits that may apply. For instance, if you owe less than $25,000, you can establish a financing arrangement for as long as 24 months. We understand that navigating these requirements can be overwhelming, but you're not alone in this journey.

In 2025, approximately 70% of taxpayers qualify for . Most can utilize the (OPA) for a streamlined application process. This online system allows you to apply quickly, often without the need for paperwork or direct contact with the IRS.

If you owe less than $100,000, you have the option of , which provide an extra 180 days to settle your balance. If you find yourself unable to pay your full tax liability, consider gathering your financial information, including your total tax liability and any outstanding returns. This preparation is vital to ensure you meet the eligibility requirements for the IRS long term payment plan before applying.

Moreover, for your transactions is highly recommended. It streamlines the process and minimizes the chance of default. Remember, this preparation can greatly improve your opportunities for effectively establishing a financial arrangement. We're here to help you through this process, and taking these steps can make a significant difference.

Apply for Your IRS Long-Term Payment Plan

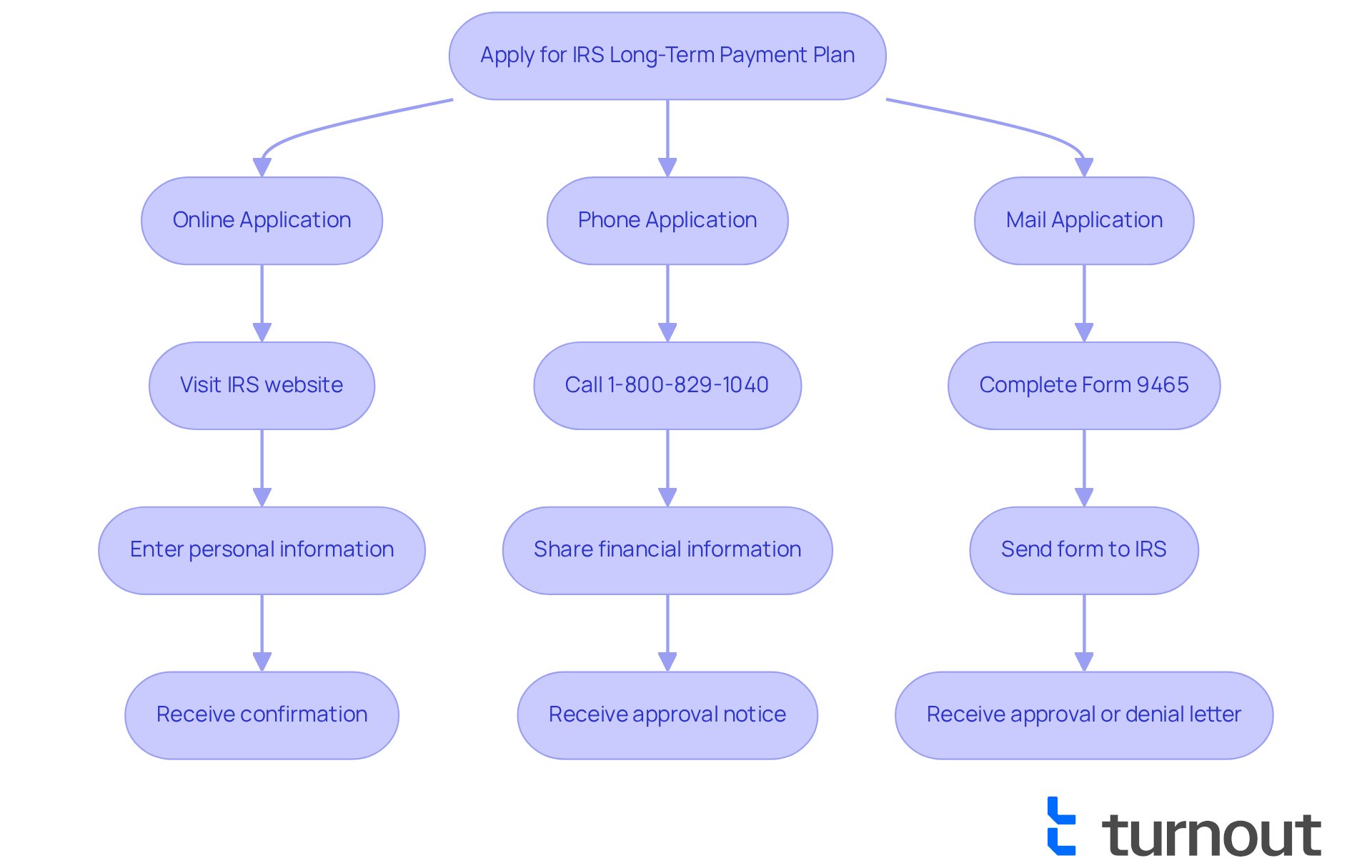

Applying for the can feel daunting, but we're here to help. You can choose from online, phone, or mail methods to proceed with your application. Here’s how to :

Online Application: Visit the IRS website and use the Online Payment Agreement tool. You’ll need to enter your personal information, including your Social Security number, along with details about your tax liability. If you qualify for the Simple Payment Plan, you won’t need to provide a collection information statement, making this method quick and straightforward. Plus, this option often provides prompt confirmation of your application, especially for streamlined requests under $50,000.

Phone Application: If you prefer speaking to someone directly, call the IRS at 1-800-829-1040. Be prepared to share your financial information and tax details during the call. This option allows for direct interaction with IRS representatives who can walk you through the process, ensuring you feel supported.

Mail Application: For those who prefer a more traditional approach, complete Form 9465, , and send it to the address specified in the form instructions. Remember to include any required documentation to avoid delays.

Regardless of the method you choose, it’s crucial to keep a copy of your application and any correspondence with the IRS for your records. Many taxpayers have successfully navigated this process, with streamlined online applications seeing high approval rates, particularly for those with balances under $50,000. As tax experts note, setting up or modifying an in 2025 is designed to be straightforward, allowing you to take control of your .

It's important to remember that for balances between $25,000 and $50,000, direct debit is required. Additionally, setup fees for [IRS Installment Agreement](https://blog.myturnout.com/master-instalment-payment-irs-eligibility-application-and-costs)s are $0 for short-term options and $22 for Direct Debit long-term options. Be mindful that missing payments can lead to default and resumption of collection actions, so sticking to your schedule is essential. After reviewing your request, the IRS will send a formal approval or denial letter to your mailing address, ensuring you stay informed about your application status. Lastly, please remember to file your returns and pay as much as possible by April 15 to avoid late filing penalties. You are not alone in this journey, and taking these steps can help you regain control.

Manage Your Long-Term Payment Plan Effectively

Once you've established your IRS , effective management becomes crucial to avoid penalties and ensure compliance. We understand that navigating these waters can be challenging, so here are some essential strategies to help you feel more secure:

- Establish : Whenever feasible, sign up for automatic transactions. This proactive approach helps ensure you never miss a due date, allowing you to avoid late fees and penalties that can accumulate significantly over time. Remember, while interest continues to accrue, setting up a plan halts the failure-to-pay penalty (0.5% per month), preventing it from climbing further.

- Keep Track of Your Transactions: Maintaining a detailed record of all transactions—dates and amounts—can empower you to monitor your progress and confirm that your account remains up to date. This practice can provide peace of mind.

- Contact the IRS: If you encounter that may affect your ability to meet your obligations, reach out to the IRS promptly. They may offer alternatives to modify your , allowing for increased flexibility during tough times. It's important to stay in contact, as the IRS can cancel a financial arrangement if installments are missed or adherence is not upheld.

- Evaluate Your Strategy Frequently: Regularly reviewing your financial status and the conditions of your repayment arrangement is vital. If your circumstances change, you may qualify for a modification of your agreement, which could ease your financial burden. The IRS understands that genuine financial hardship can occur, and they offer flexibility for taxpayers facing such challenges.

By applying these strategies, you can effectively manage your long-term financial plan and work towards settling your with the IRS long term payment plan. Many taxpayers have successfully navigated their by utilizing automatic deductions. This not only streamlines the process but also significantly reduces the risk of facing penalties. Financial experts emphasize that maintaining open communication with the IRS and regularly reviewing your financial situation are key components of effective tax management. Automatic payments can positively impact your overall financial health, ensuring you stay on track with your obligations while minimizing stress. Remember, you are not alone in this journey—we're here to help.

Conclusion

Establishing an IRS long-term payment plan can be a vital lifeline for taxpayers facing challenges in meeting their obligations. This structured arrangement alleviates immediate financial pressure and offers the flexibility needed to manage tax debts over time. By understanding the eligibility requirements and application processes, you can navigate these waters with confidence, securing a path toward financial stability.

We understand that the journey can feel overwhelming. Throughout this article, we’ve shared key insights, including:

- The importance of qualifying for a payment plan

- The various application methods available

- Effective management strategies to avoid penalties

It’s encouraging to note that the IRS has simplified the process in 2025, making it easier for many to establish these agreements. Automatic transactions, regular evaluations of your financial circumstances, and open communication with the IRS are essential practices for maintaining compliance and ensuring a successful repayment journey.

Ultimately, mastering the IRS long-term payment plan is significant. By taking proactive steps and utilizing available resources, you can regain control over your financial situation, reduce stress, and work toward fulfilling your tax responsibilities. Engaging with the IRS and understanding the various options can transform a daunting challenge into a manageable process. Remember, you are not alone in this journey; we’re here to help pave the way for a brighter financial future.

Frequently Asked Questions

What is an IRS long-term payment plan?

An IRS long-term payment plan, also known as an installment agreement, is a financial arrangement that allows taxpayers to resolve their tax obligations over an extended period, typically up to 72 months.

Who can benefit from an IRS long-term payment plan?

Taxpayers who cannot pay their tax bill in full by the due date can benefit from this arrangement, as it provides flexibility and alleviates immediate financial pressure.

What are the eligibility criteria for setting up a simplified installment arrangement?

If your tax debts are under $50,000, you can set up a simplified installment arrangement, which is available to nearly 70% of all IRS repayment options.

How many individual taxpayers owe less than $25,000 to the IRS?

Approximately 88% of individual taxpayers owe less than $25,000 to the IRS, making the long-term payment plan particularly relevant for many.

What happens if I establish a payment plan before the IRS files a tax lien?

Establishing a payment plan before the IRS files a tax lien allows you to avoid additional stress and complications associated with a lien.

What if my tax debts exceed $50,000?

If your tax debts exceed $50,000, you will need to provide detailed financial information to establish settlement agreements.

Can I renegotiate my payment agreement if my financial situation changes?

Yes, you can renegotiate your financial agreements if your circumstances change, ensuring continued support.

What is the current interest rate on unpaid taxes?

The interest on unpaid taxes currently stands at 7% for individuals, which can affect the total amount owed over time.

How can I enroll in an IRS long-term payment plan?

The fastest and simplest way to enroll is by using the Online Payment Agreement tool, which allows you to establish a financial arrangement quickly and receive instant confirmation of acceptance.