Overview

This article explores the implications of living in states within the USA that do not impose a state income tax. We understand that many individuals are drawn to this arrangement, seeking both financial relief and a better quality of life. While residents in states like Florida and Texas often enjoy increased disposable income thanks to the absence of state taxes, it’s important to consider the potential drawbacks.

It's common to feel uncertain about the trade-offs involved. Higher sales or property taxes may come into play, and there could be concerns about the underfunding of public services. These factors can significantly impact your overall quality of life.

As you navigate these choices, remember that you are not alone in this journey. We’re here to help you understand both the benefits and challenges, ensuring you make informed decisions that align with your needs and values.

Introduction

The landscape of taxation in the United States reveals a striking divide: some states impose income taxes, while others do not. For many, the allure of living in states without state tax, such as Florida and Texas, presents a tantalizing opportunity for increased financial freedom and disposable income. We understand that this enticing prospect can feel like a dream come true.

However, it’s essential to recognize that this choice comes with its own set of complexities and trade-offs. These factors can significantly affect residents' quality of life. What are the real implications of choosing to reside in a no-state-tax state? How do these decisions shape the financial futures of individuals and families?

It's common to feel overwhelmed by these questions. We’re here to help you navigate this journey and make informed decisions that align with your values and goals.

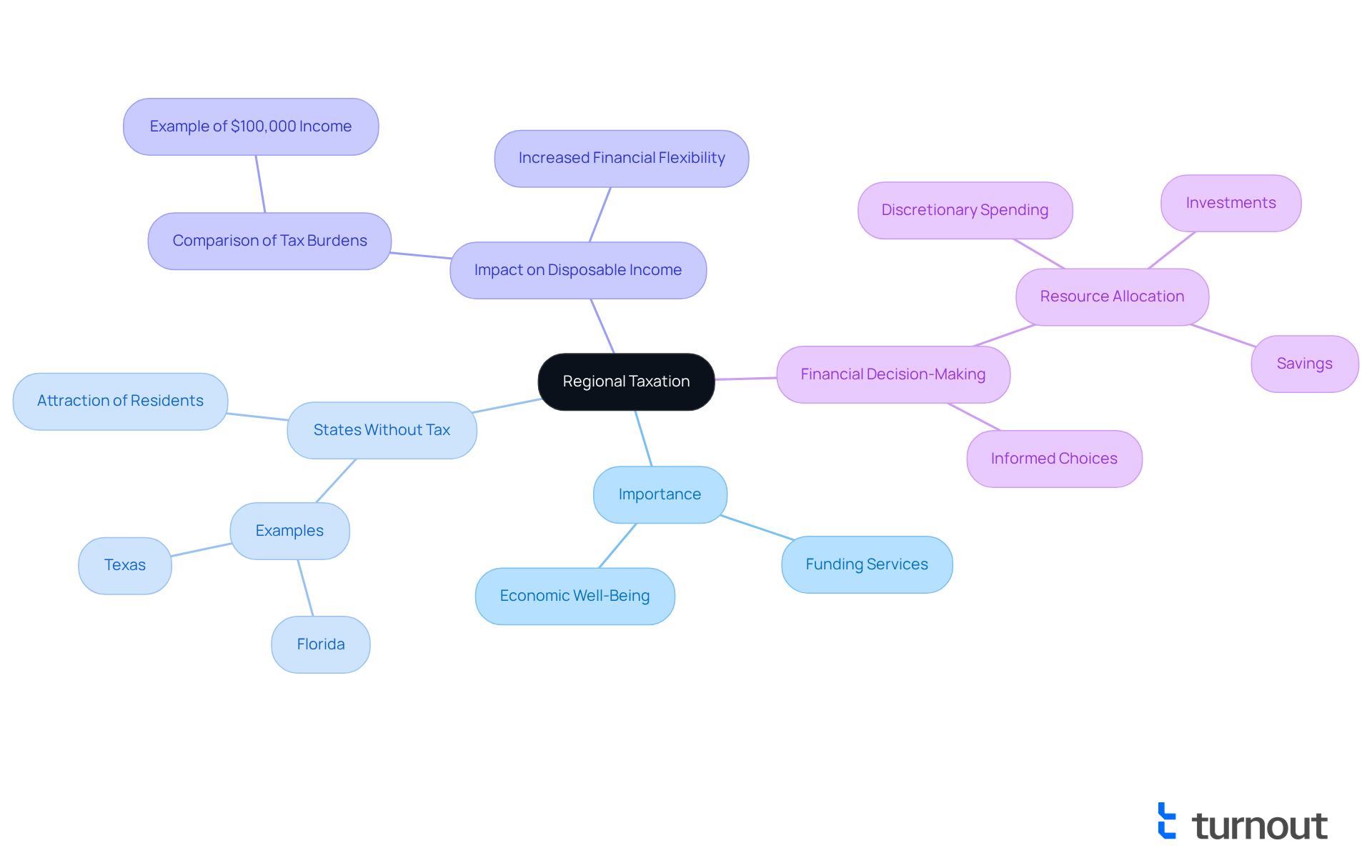

Defining State Tax: What It Is and Its Importance

Regional taxation encompasses the levies imposed by various jurisdictions on residents' earnings, property, or sales. This system plays a crucial role in funding essential services like education, healthcare, and infrastructure. We understand that the absence of a regional tax on earnings can significantly influence individuals' financial situations, often leading to an increase in their available funds. For instance, states in the USA without state tax, like Florida and Texas, tend to attract individuals and businesses looking to enhance their profits and minimize tax burdens. This can lead to a better standard of living and greater financial flexibility for residents.

Statistics reveal that the states in the USA without state tax can boost disposable income by thousands of dollars annually compared to regions with higher tax rates. Imagine someone earning $100,000 in a place with a 5% income tax—this individual would pay $5,000 in taxes. In contrast, in a jurisdiction without income tax, that entire amount remains available for spending or saving. Such differences can profoundly impact financial planning, allowing residents to allocate more resources toward investments, savings, or discretionary spending.

Understanding the implications of regional tax is vital for consumers, as it directly affects their financial planning and decision-making processes. By reflecting on the tax landscape, individuals can make informed choices about where to live and work, ultimately enhancing their overall economic well-being. Remember, you're not alone in navigating these complexities; we're here to help you make the best decisions for your future.

Historical Context: The Evolution of States Without State Tax

The concept of regions without earnings levies dates back to the early 1900s, a time when many areas began implementing revenue levies to fund public services. However, some regions, such as Alaska and Florida, are classified as states in the USA without state tax, having chosen to forgo income levies to attract residents and businesses. This decision often stems from the belief that lower tax burdens can foster economic growth and encourage population influx. Over the years, these states have upheld their tax structures, turning to alternative revenue sources such as sales taxes and natural resource revenues.

For instance, Florida welcomed 819,000 net individuals from interstate migration between April 2020 and June 2023. Similarly, Texas saw a net increase of 656,000 individuals during that same period. Arizona also attracted 218,000 net inhabitants, showcasing the appeal of reduced tax obligations. Notably, high-tax regions experienced a net decrease of 2.8 million inhabitants moving to low-tax areas during this time, emphasizing a broader trend driven by tax obligations.

As Preston Brashers, a Research Fellow in Tax Policy, insightfully noted, 'The trend of high-tax regions losing inhabitants to low-tax regions is too significant to attribute to chance.' These patterns suggest that the states in the USA without state tax can create a more favorable economic environment, attracting individuals and businesses looking to alleviate their tax burdens. We understand that navigating these choices can be challenging, but know that there are options available to help you find a more advantageous situation.

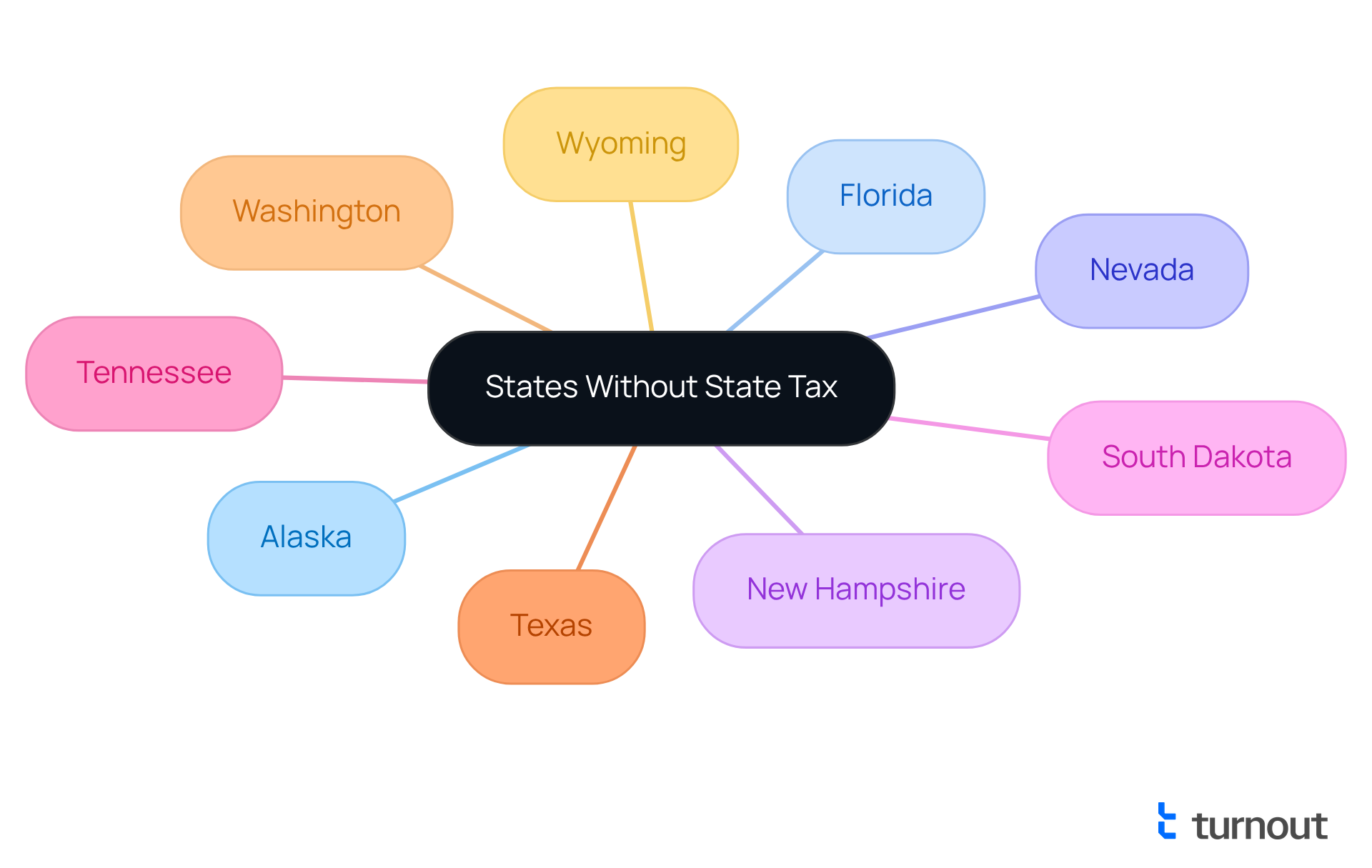

List of States in the USA Without State Tax

As of 2025, many individuals may be exploring their options in states in USA without state tax. The states in USA without state tax include:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Each of these regions has its own unique tax system, often balancing the absence of an earnings tax with higher sales or property taxes.

We understand that navigating tax regulations can be overwhelming, especially when considering relocation or investment opportunities. It’s essential to grasp the specific tax structures in these areas to make informed decisions.

Remember, you are not alone in this journey. We’re here to help you understand your options and find the best path forward.

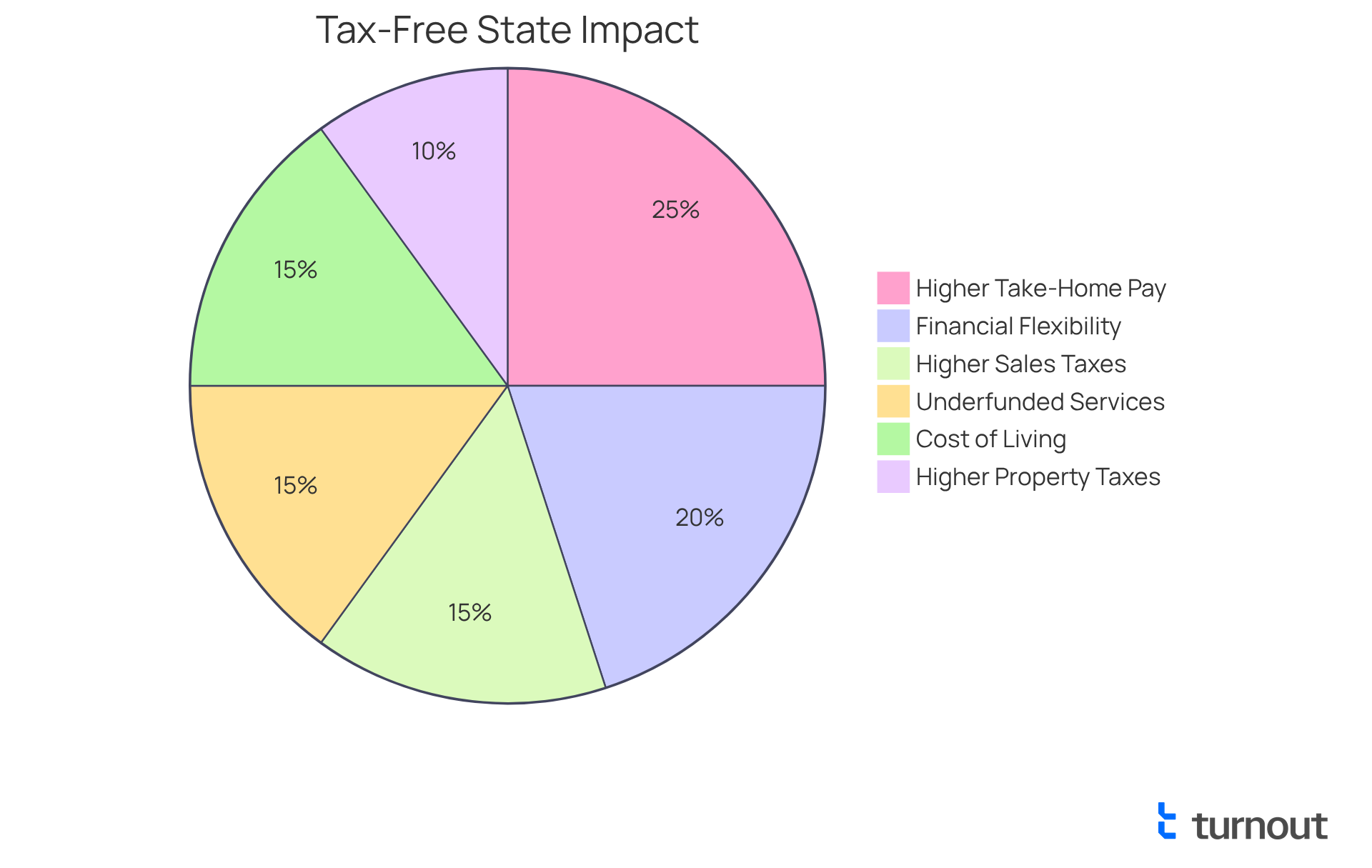

Pros and Cons of Residing in No-State-Tax States

Living in states in USA without state tax can bring significant advantages. You might enjoy a greater take-home pay, leading to enhanced financial flexibility and increased spending power. As Tanza Loudenback notes, "Residents residing in regions without a tax on earnings may gain from increased take-home pay compared to individuals living in areas that do impose such taxes." However, we understand that it’s essential to consider potential drawbacks as well.

States in USA without state tax often compensate for this by implementing higher sales or property taxes. This can diminish the financial benefits of living in a no-tax state. For instance, Tennessee has one of the highest combined local and regional sales tax rates at 9.548%. Additionally, the absence of income tax revenue can lead to underfunded public services, which affects crucial sectors like education, healthcare, and infrastructure. In fact, personal earnings taxes accounted for nearly 48% of local tax revenues in 2022, highlighting the reliance on these funds for public services.

Moreover, while Alaska may not impose an income tax, it also has one of the highest cost-of-living indexes in the nation. Therefore, if you’re contemplating a move to states in USA without state tax, it’s important to carefully evaluate your financial situation and lifestyle preferences. Consider both the potential savings and the trade-offs in public services. Remember, you are not alone in this journey, and we're here to help you navigate these decisions.

Conclusion

Living in states in the USA without state tax offers a unique financial landscape that can significantly enhance your disposable income and overall economic flexibility. By choosing to reside in these regions, you can enjoy a meaningful boost in your take-home pay, allowing for more substantial investments, savings, or leisure spending. This freedom from state income tax can be a compelling reason to consider relocating, especially in states like Florida and Texas, where the absence of such taxes is paired with a thriving economy.

Throughout this article, we've explored key insights into the historical context, benefits, and drawbacks of living in no-state-tax states. The evolution of tax policies has shaped these regions into attractive destinations for those seeking financial relief from state income taxes. While the advantages of higher disposable income and potential economic growth are clear, it’s essential to also consider the trade-offs, such as increased sales taxes and potential impacts on public services. Understanding the nuances of each state's tax structure is crucial for making informed decisions about relocation or investment.

Ultimately, the decision to move to a state without income tax should be approached with thoughtful consideration of your personal financial goals and lifestyle preferences. The potential for greater economic freedom and an enhanced quality of life is significant. However, it is vital to weigh these benefits against the realities of living in areas that may have different funding mechanisms for essential services. By evaluating these factors, you can make empowered choices that align with your financial aspirations and long-term well-being. Remember, you are not alone in this journey, and we’re here to help you navigate these important decisions.

Frequently Asked Questions

What is state tax and why is it important?

State tax refers to the levies imposed by various jurisdictions on residents' earnings, property, or sales. It is important because it funds essential services like education, healthcare, and infrastructure.

How does the absence of state tax affect individuals financially?

The absence of a state tax on earnings can significantly increase individuals' available funds, enhancing their financial flexibility and standard of living.

Which states in the USA do not have a state income tax?

States like Florida and Texas do not have a state income tax, attracting individuals and businesses looking to reduce their tax burdens.

What is the financial impact of living in a state without income tax?

Living in a state without income tax can boost disposable income by thousands of dollars annually compared to regions with higher tax rates.

How does state tax influence financial planning?

Understanding the implications of state tax is vital for financial planning, as it affects how individuals allocate resources toward investments, savings, or discretionary spending.

Why is it important for consumers to consider the tax landscape?

It is important for consumers to consider the tax landscape because it directly impacts their financial decision-making and overall economic well-being.