Overview

Facing financial hardships can be overwhelming, and we understand that. The New Jersey State Tax Payment Plan is here to help. This plan allows individuals like you to pay outstanding tax balances in manageable monthly installments, rather than a daunting lump sum.

To qualify for this supportive initiative, you will need to:

- Provide proof of economic hardship

- Complete the necessary documentation

It’s essential to adhere to the payment schedule to avoid penalties and ensure compliance. Remember, you are not alone in this journey; we’re here to guide you through the process.

Taking this step can ease your financial burden and provide peace of mind. If you have any questions or need assistance, please don’t hesitate to reach out. Together, we can navigate these challenges.

Introduction

Navigating tax obligations can feel overwhelming, particularly for those experiencing financial difficulties. We understand that this can be a challenging time, and the New Jersey State Tax Payment Plan offers a lifeline. This program allows individuals to manage their tax responsibilities through manageable monthly payments instead of a daunting lump sum. In this article, we will explore the eligibility requirements, application process, and compliance strategies for this essential program.

How can taxpayers effectively leverage this plan to regain control over their financial situations while avoiding the pitfalls of non-compliance? You're not alone in this journey, and we're here to help.

Overview of the New Jersey State Tax Payment Plan

If you're struggling to meet your state tax obligations, the nj state tax payment plan is here to support you. We understand that financial challenges can be overwhelming, and the nj state tax payment plan allows you to manage your tax responsibilities through manageable monthly payments instead of requiring a lump sum. This approach not only eases the economic burden but also helps you maintain your budget while fulfilling your obligations.

For those facing economic hardships, the nj state tax payment plan is particularly beneficial. It aids in addressing tax obligations while minimizing the penalties and interest that can accumulate on overdue amounts. Typically, the nj state tax payment plan lasts between 12 to 36 months, featuring fixed monthly payments that ensure stability for your budgeting needs.

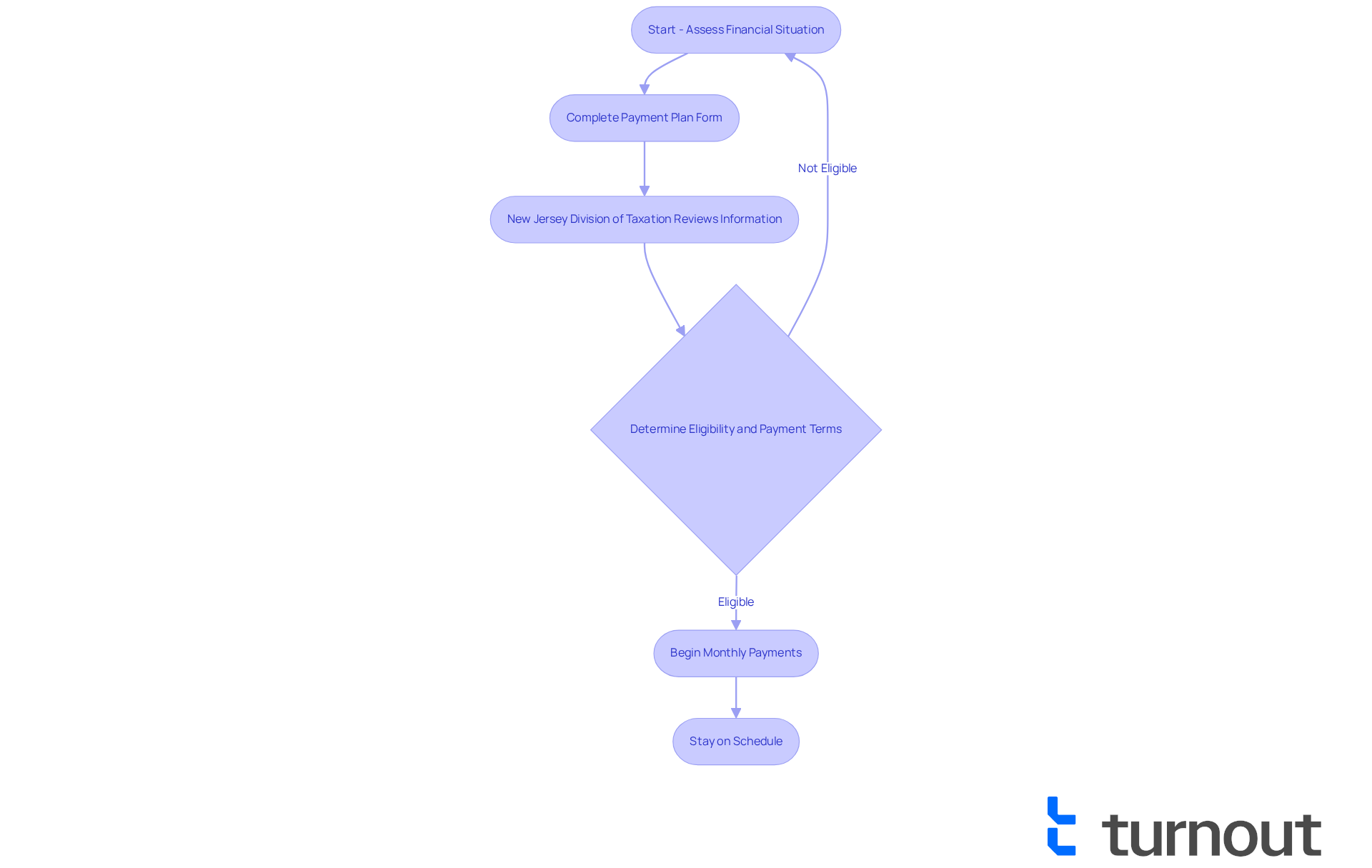

To get started, you’ll need to complete a form detailing your financial situation. The New Jersey Division of Taxation will review this information to determine your eligibility for the nj state tax payment plan and to establish the payment terms. It’s essential to provide accurate financial details and all necessary tax returns to avoid any complications.

Many individuals who have successfully navigated this repayment plan have shared their relief from the burden of tax debt. This newfound peace allows them to focus on other financial responsibilities. However, it’s important to [stay on track with your payment schedule](https://blog.turnout.co/4-steps-to-navigate-social-security-colorado-springs-office). Missing payments can lead to serious consequences, including the resumption of aggressive collection efforts.

Overall, the nj state tax payment plan is a vital resource for those striving to regain control over their financial situations while effectively managing their tax obligations. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Eligibility Requirements for the Payment Plan

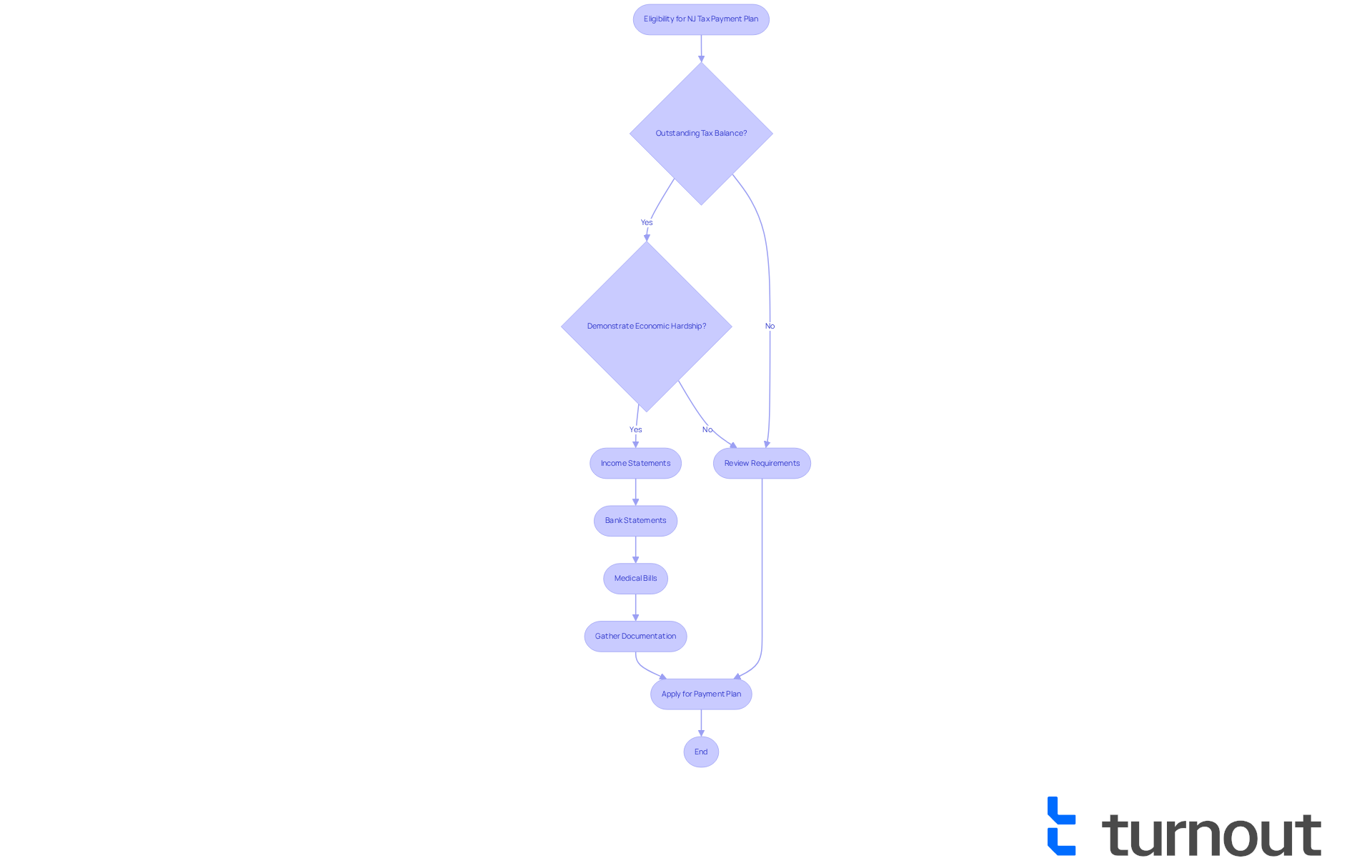

We understand that navigating tax obligations can be challenging, especially when faced with financial difficulties. To qualify for the NJ state tax payment plan, it's important to understand the eligibility criteria.

Firstly, you must have an outstanding tax balance owed to the state of New Jersey. Additionally, demonstrating economic hardship is essential. This may include factors such as unemployment, medical expenses, or other significant financial burdens that make it hard to pay your taxes in full. In fact, in 2025, around 20% of New Jersey taxpayers reported experiencing economic difficulties, underscoring the need for accessible settlement options.

If you find yourself in this situation, you will typically need to provide documentation to support your claims of economic hardship. This might include:

- Income statements

- Bank statements

- Any relevant bills or expenses

It's also crucial that you have filed all required tax returns and are current on other tax obligations to be considered for the payment plan. We encourage you to review these requirements carefully and gather the necessary documentation before applying, ensuring a smoother application process.

Expert insights highlight the importance of understanding the specific economic hardships that qualify for the NJ state tax payment plan. Acceptable documentation includes:

- Proof of unemployment benefits

- Medical bills

- Other financial records that illustrate your situation

Remember, it's vital to recognize that interest and penalties will continue to accrue on outstanding balances, even within a tax settlement arrangement. By meeting all criteria and organizing your documentation, you can enhance your chances of successfully joining this financial plan.

It's essential to adhere to the payment schedule, as failing to make a contribution could lead to the termination of your installment agreement and a restart of full collection efforts. You're not alone in this journey; we're here to help you navigate these challenges and find a path forward.

Application Process for the Payment Plan

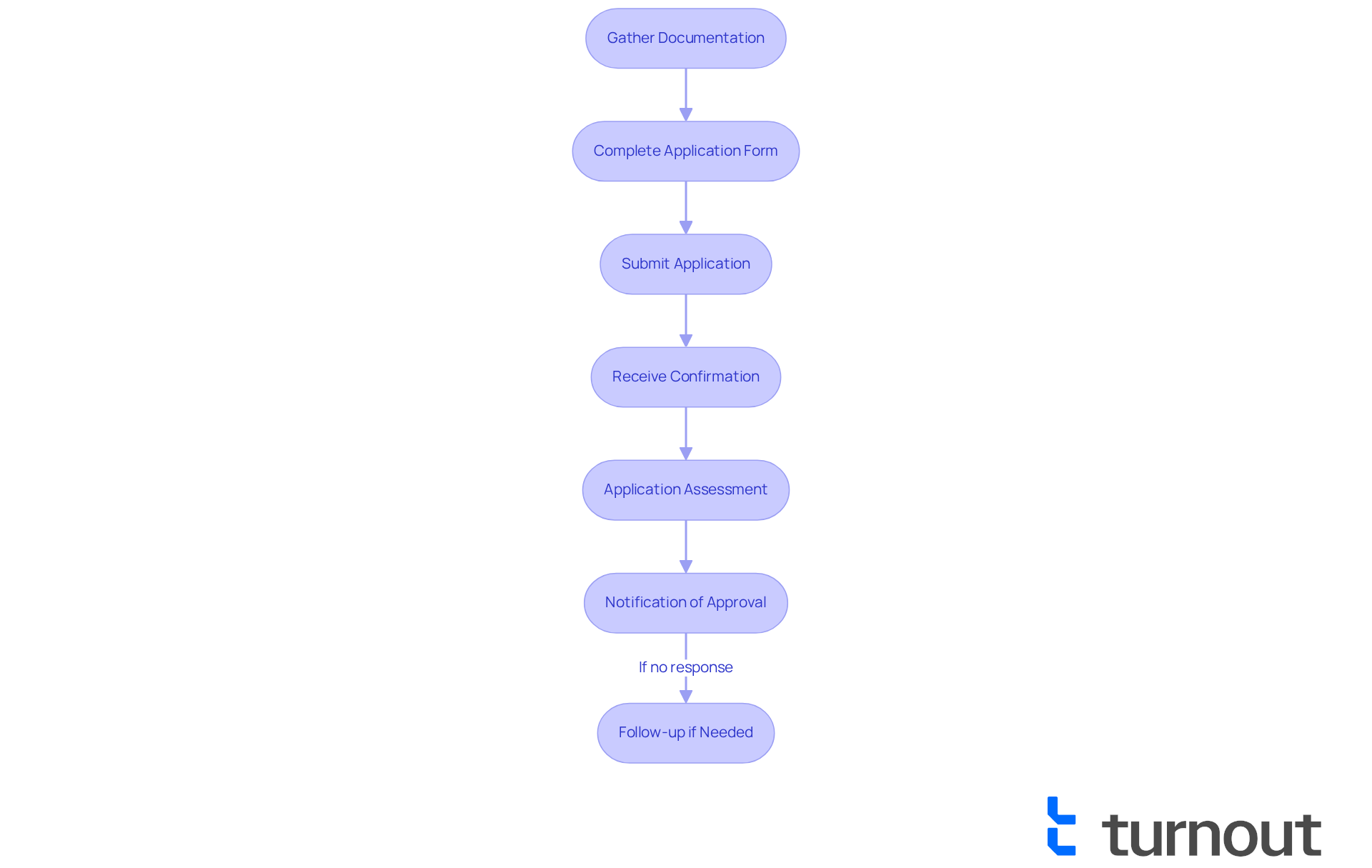

Navigating the application process for the NJ state tax payment plan can feel overwhelming, but we're here to help you every step of the way. First, it's important to gather all necessary documentation that reflects your financial situation. This includes:

- Proof of income

- A breakdown of monthly expenses

- Relevant tax documents

- Prior tax returns

Once you have everything ready, you can complete the application form for the NJ state tax payment plan available on the New Jersey Division of Taxation website. Remember, providing accurate and comprehensive information is crucial to prevent any delays in processing your application. After you submit your application, you will receive confirmation about its status.

The Division of Taxation will assess your application for a financial plan and may assign a caseworker to guide you through the process, offering additional support. If your application is approved, you will be notified of the transaction terms, including the NJ state tax payment plan, as well as the amount and frequency of your contributions.

It's common to feel anxious during this time, so staying proactive is vital. If you haven't received timely updates, don't hesitate to follow up. Many successful applicants emphasize the importance of submitting complete financial information and maintaining open communication with the tax authority to ensure a smooth approval process.

Keep in mind, the NJ state tax payment plan has a lowest monthly contribution of $25, which is applicable to all categories of outstanding tax amounts. Agreements under the NJ state tax payment plan can extend from 12 to 60 months, depending on your overall tax liability and personal situation. To retain eligibility for the installment arrangement, it's essential to submit all necessary tax returns on time. Missing contributions or accruing additional tax obligations could lead to defaulting on the arrangement. Additionally, if your tax account is referred to a collection agency, be aware that extra fees may apply.

You're not alone in this journey, and with the right information and support, you can navigate this process successfully.

Maintaining Compliance with the Payment Plan

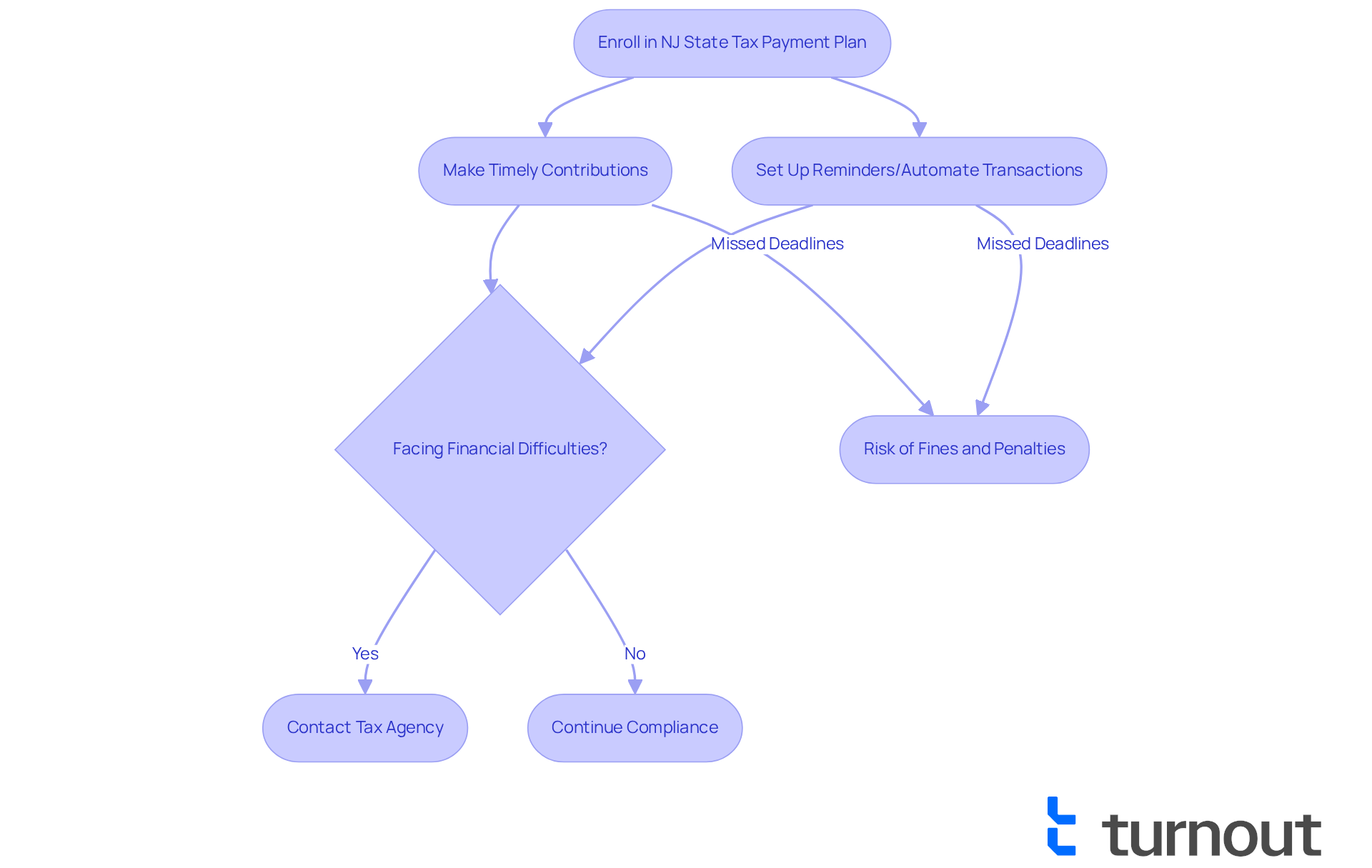

Once enrolled in the nj state tax payment plan, it is vital to adhere to the established schedule. We understand that making timely contributions in the correct amounts as specified in your agreement can feel overwhelming. However, failing to comply with the nj state tax payment plan can lead to serious consequences, including fines, accumulating interest, and even the termination of your nj state tax payment plan, which may exacerbate your financial challenges. For instance, a taxpayer with $700,000 in sales faced a tax obligation of $46,000 due to non-compliance, highlighting the potential economic risks involved.

To help you stay on track, consider:

- Setting up reminders

- Automating transactions

If you encounter unexpected financial difficulties, it's crucial to reach out to the tax agency to discuss the nj state tax payment plan as soon as possible. They can assist you in exploring options to modify your arrangement. Remember, neglecting your obligation can result in a 5% fine for each month a fee is overdue, capped at 25%, along with a late fee of 0.5% per month. These charges can accumulate quickly and significantly impact your overall financial stability.

Real-world experiences show that proactive communication with tax authorities can lead to successful management of payment plan compliance. Those who reach out early often discover solutions that help avoid further penalties and maintain their financial health. You're not alone in this journey; we're here to help you navigate these challenges.

Conclusion

The NJ State Tax Payment Plan is a vital resource for those facing financial challenges, providing a compassionate alternative to the stress of immediate lump-sum payments. By enabling taxpayers to manage their obligations through structured monthly payments, this plan not only eases financial pressure but also fosters a sense of control over budgeting and financial responsibilities.

In this guide, we've explored essential aspects of the NJ State Tax Payment Plan, including:

- Eligibility requirements

- The application process

- The importance of compliance

Understanding the criteria for qualification—such as demonstrating economic hardship and providing necessary documentation—is crucial for a successful application. It’s common to feel overwhelmed, but staying proactive and communicating with tax authorities can help navigate potential challenges and avoid penalties.

Ultimately, the NJ State Tax Payment Plan stands as a significant support system for those seeking to regain stability in their financial lives. If you find yourself struggling with tax obligations, we encourage you to take action, evaluate your circumstances, and consider applying for this plan. By doing so, you can pave the way towards financial recovery and peace of mind, knowing that you have the support needed to manage your tax responsibilities effectively.

Frequently Asked Questions

What is the New Jersey State Tax Payment Plan?

The New Jersey State Tax Payment Plan allows individuals struggling to meet their state tax obligations to manage their tax responsibilities through manageable monthly payments instead of a lump sum.

Who can benefit from the New Jersey State Tax Payment Plan?

The plan is particularly beneficial for individuals facing economic hardships, as it helps address tax obligations while minimizing penalties and interest on overdue amounts.

How long does the New Jersey State Tax Payment Plan typically last?

The plan typically lasts between 12 to 36 months, featuring fixed monthly payments to ensure stability for budgeting.

What is required to get started with the New Jersey State Tax Payment Plan?

To get started, you need to complete a form detailing your financial situation, which the New Jersey Division of Taxation will review to determine your eligibility and establish payment terms.

What should I ensure when providing information for the payment plan?

It is essential to provide accurate financial details and all necessary tax returns to avoid complications in the application process.

What happens if I miss a payment under the New Jersey State Tax Payment Plan?

Missing payments can lead to serious consequences, including the resumption of aggressive collection efforts.

How has the New Jersey State Tax Payment Plan helped individuals?

Many individuals have reported relief from the burden of tax debt, allowing them to focus on other financial responsibilities.

Is support available for those using the New Jersey State Tax Payment Plan?

Yes, the plan is a vital resource for individuals striving to regain control over their financial situations, and support is available throughout the process.