Overview

This article offers a compassionate guide to mastering your Social Security payment estimate through a five-step process. We understand that navigating this topic can be overwhelming, so we focus on key areas:

- Understanding your benefits

- Verifying wage information

- Calculating Average Indexed Monthly Earnings (AIME)

- Determining your Primary Insurance Amount (PIA)

- Considering crucial factors that may impact your estimate

Each step is thoughtfully supported with practical advice and calculations, emphasizing the importance of accurate income records and the strategic age at which to claim benefits. Remember, you are not alone in this journey; we’re here to help you maximize your potential benefits.

Introduction

Navigating the complexities of Social Security payments can feel overwhelming, especially when your financial stability during retirement or unexpected life changes is at stake. We understand that the intricacies of how benefits are calculated can be confusing. That’s why it’s essential for anyone looking to maximize their entitlements to grasp these nuances. In this guide, we will break down the five crucial steps to mastering your Social Security payment estimate, empowering you to take control of your financial future.

But what happens if the calculations reveal discrepancies or unexpected outcomes? It's common to feel anxious about these possibilities. Exploring these intricacies could mean the difference between a secure retirement and financial uncertainty. Remember, you are not alone in this journey—we're here to help you navigate through it.

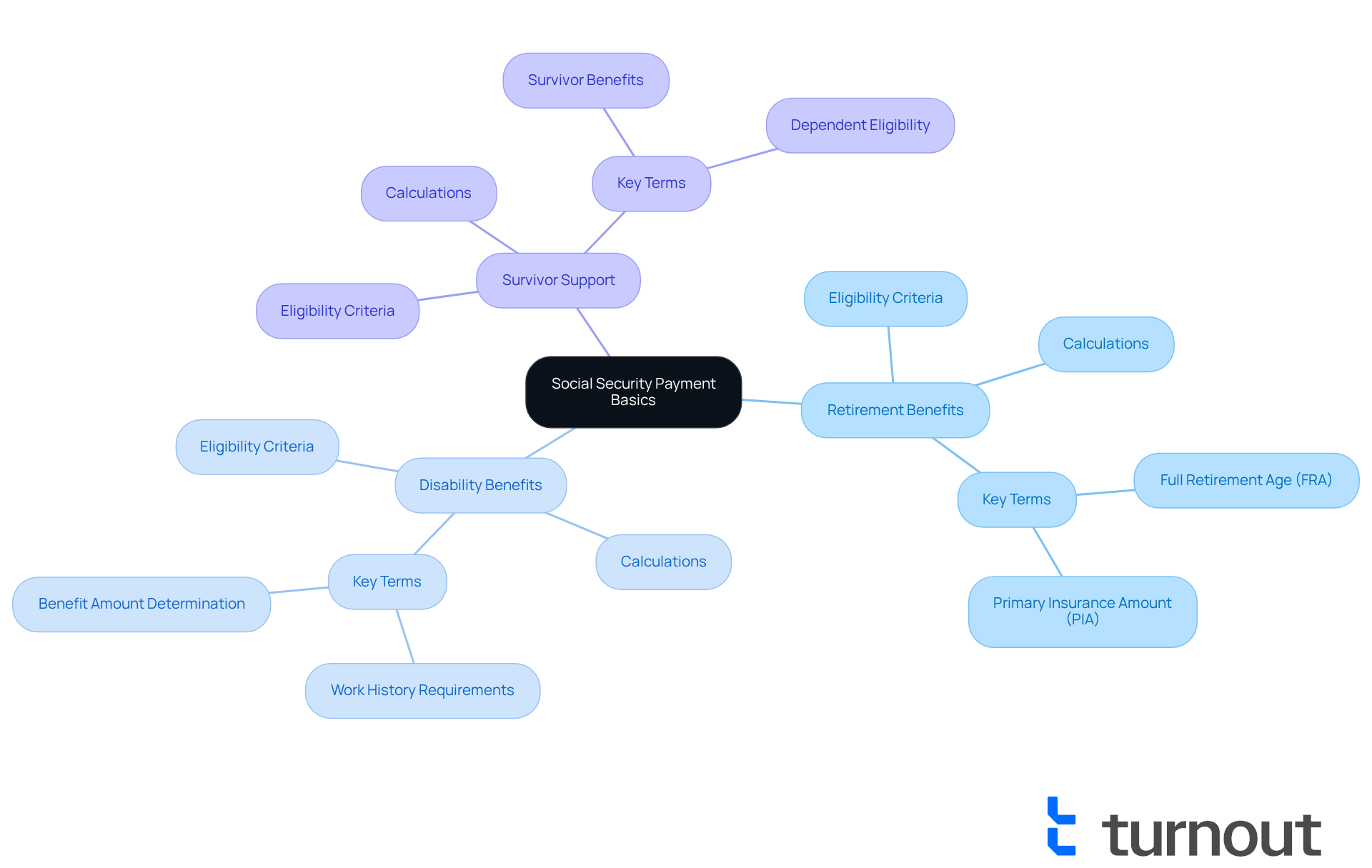

Understand Social Security Payment Basics

Retirement funds are designed to provide financial support during significant life changes, such as retirement, disability, or the loss of a loved one. We understand that navigating these transitions can be challenging. The amount you receive as a social security payment estimate is closely tied to your earnings record, specifically the income on which you have paid public insurance taxes.

It's crucial to grasp the different types of benefits available—retirement, disability, and survivor support. Each category has its own eligibility criteria and calculations, yet they all connect back to your work history and contributions to the system. At Turnout, we’re here to help you through the complexities of SSD claims. Our trained nonlawyer advocates are ready to assist you without the need for legal representation.

As you begin this journey, familiarize yourself with terms like 'Full Retirement Age' (FRA) and 'Primary Insurance Amount' (PIA). These terms will be important as you navigate the social security payment estimate process. Remember, you are not alone in this journey; we are here to support you every step of the way.

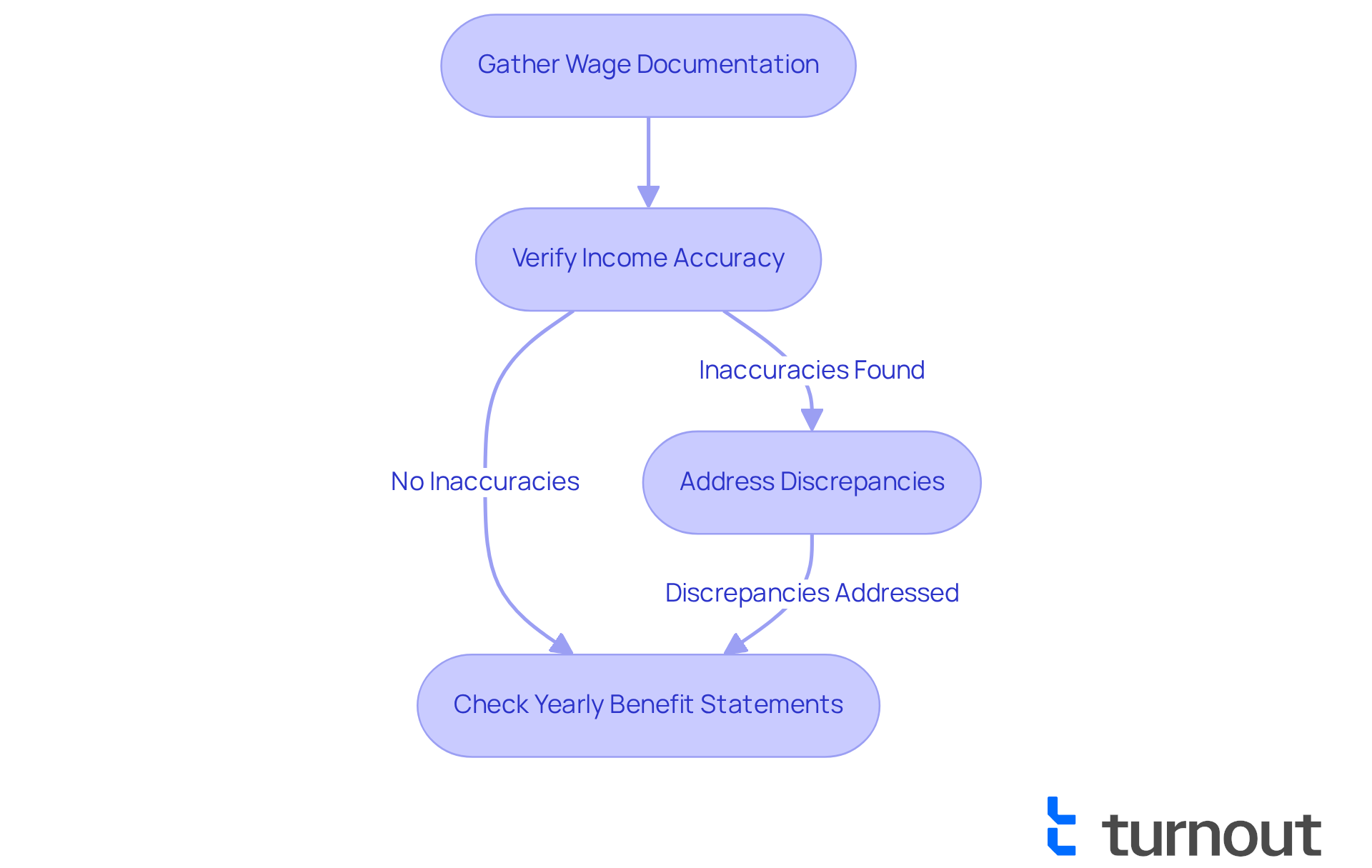

Gather and Verify Your Wage Information

To help you accurately assess your federal benefits, we encourage you to start by gathering your wage documentation. This includes your W-2 forms, 1099 forms, and any other records that reflect your income over the years. You can view your income history through your benefit account online or by requesting a copy of your benefit statement.

It’s important to confirm that all reported income is correct. Research shows that approximately 25% of individuals discover inconsistencies in their benefits income records. These errors may arise from incorrect reporting by employers or unreported name changes. If you notice any inaccuracies, please reach out to the Social Security Administration (SSA) as soon as possible. Bring your W-2 form or Schedule SE to your local SSA office before proceeding with your social security payment estimate.

Ensuring the accuracy of your income history is essential. Mistakes can lead to lower payouts, which may impact your financial security. As Donna LeValley wisely notes, "Errors in your income record can result in reduced payouts, so it’s crucial to identify and rectify any mistakes promptly."

Additionally, remember to check your Social Security benefit statements each year to make sure there are no mistakes in your income history. You're not alone in this journey; we're here to help you navigate these important steps.

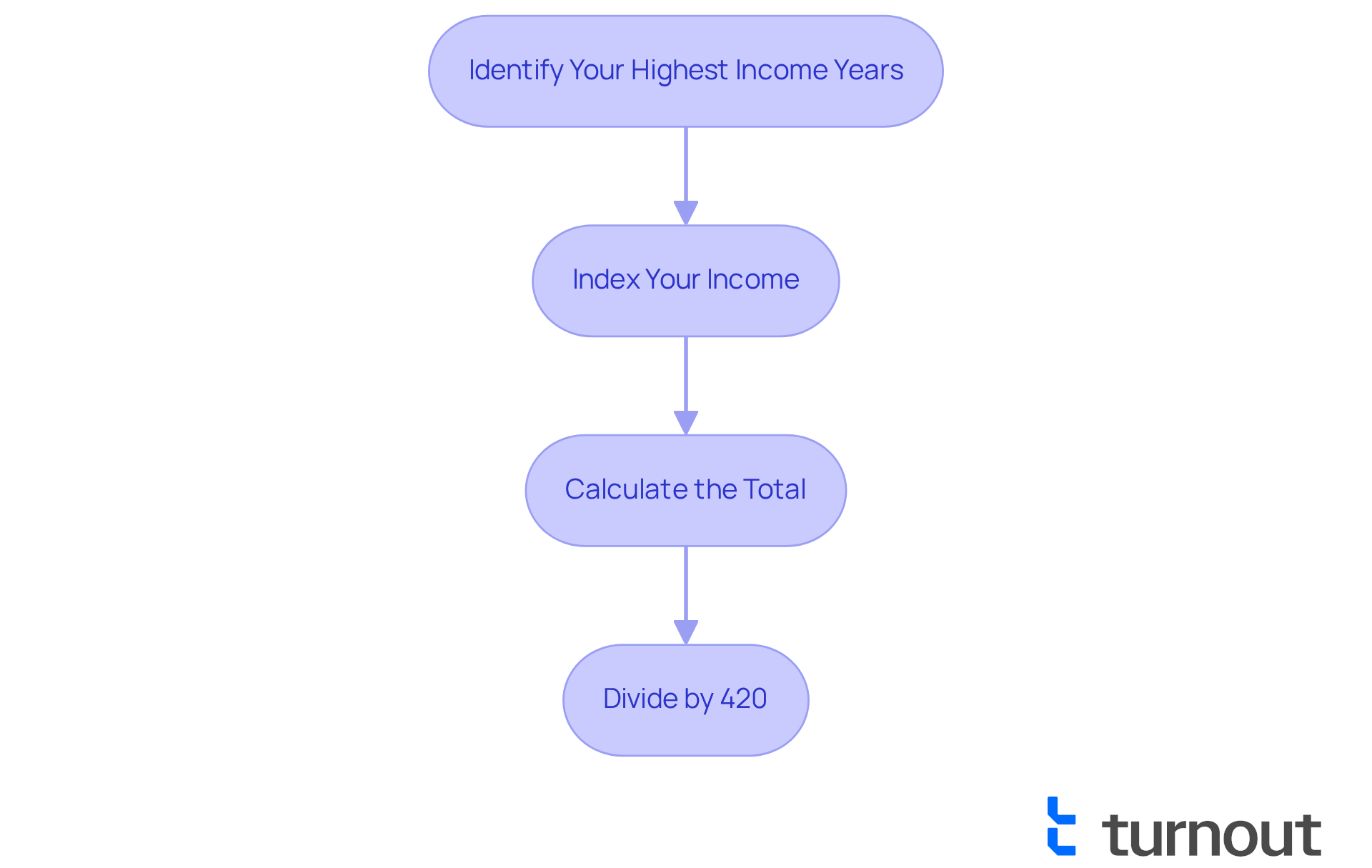

Calculate Your Average Indexed Monthly Earnings (AIME)

Calculating your Average Indexed Monthly Earnings (AIME) can feel overwhelming, but we're here to guide you through it step by step.

- Identify Your Highest Income Years: Start by gathering your income for the 35 most lucrative years of your career. If you have fewer than 35 years of income, don’t worry—just include zeros for the years you’re missing. It's important to note that about 30% of individuals may not meet this threshold, which can significantly impact their benefits.

- Index Your Income: Next, adjust your past income for inflation using the Social Security Administration's indexing factors. This adjustment ensures that your income reflects current wage levels, which is crucial for accurate calculations.

- Calculate the Total: Now, add your indexed earnings together. This total will form the foundation of your AIME calculation.

- Divide by 420: Finally, divide the total by 420—the number of months in 35 years—to find your AIME. This figure is essential as it will be used to determine your Primary Insurance Amount (PIA).

We understand that your peak earning years are vital in this computation, as they directly influence the support you can receive. As one financial advisor wisely noted, maximizing your AIME can result in a rise of up to $23,760 in your social security payment estimate. Additionally, keep in mind that the maximum SSDI payment in 2025 is $3,822, which underscores the importance of optimizing your social security payment estimate calculation. Remember, you are not alone in this journey, and taking these steps can significantly impact your financial future.

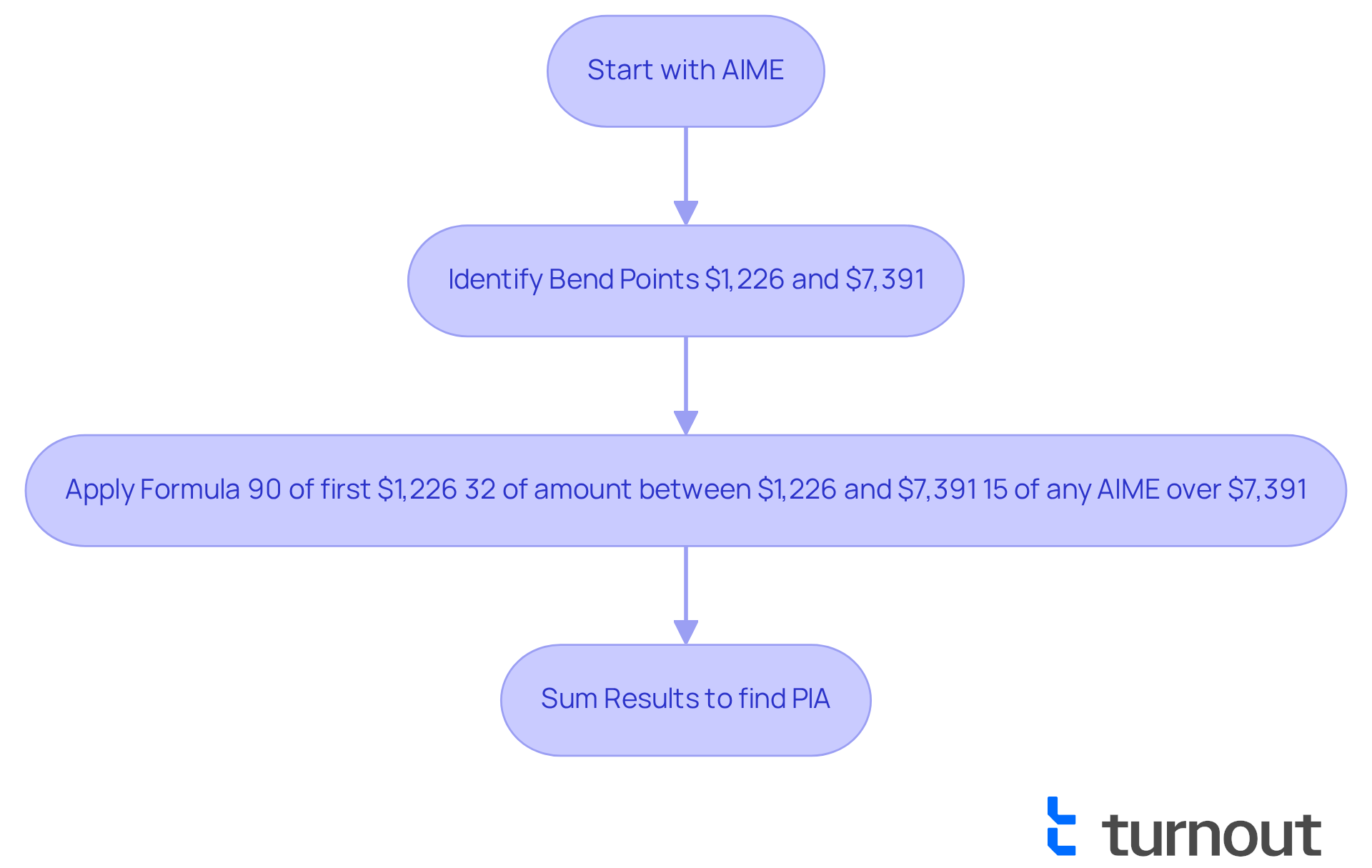

Determine Your Primary Insurance Amount (PIA)

Determining your Primary Insurance Amount (PIA) can feel overwhelming, but we're here to help you through the process. By using your Average Indexed Monthly Earnings (AIME), you can navigate this important step with confidence.

- Identify the Bend Points: For 2025, the bend points are set at $1,226 and $7,391. Understanding these figures is crucial, as they significantly impact your benefits.

- Apply the Formula: Your PIA is calculated as follows: 90% of the first $1,226 of your AIME, plus 32% of the AIME between $1,226 and $7,391, and finally, 15% of any AIME exceeding $7,391. This formula is designed to ensure that your benefits reflect your earnings.

- Sum the Results: Add these amounts together to arrive at your PIA. This figure represents the social security payment estimate for the monthly advantage you would receive if you claim at your Full Retirement Age.

For example, if your AIME is $7,500, your PIA would be calculated as follows: 90% of $1,226 equals $1,103.40; 32% of the amount between $1,226 and $7,391 (which is $6,165) equals $1,972.80; and 15% of the amount over $7,391 (which is $109) equals $16.35. Adding these together gives a total PIA of $3,092.55.

This calculation demonstrates how grasping the bend points can greatly affect your public insurance advantages. As Jim Blankenship wisely noted, "The social security payment estimate is merely one of the elements considered in calculating the actual sum of your retirement compensation - the other element being the date when you choose to start receiving retirement payments."

It's essential to recognize that the PIA is modified for inflation through annual cost-of-living adjustments (COLAs) starting at age 62, regardless of whether you have claimed benefits. Historical changes in bend points also play a crucial role in understanding how advantages have evolved over time. Remember, you are not alone in this journey; accurately calculating your AIME and applying the correct percentages is key to securing your financial future.

Finalize Your Estimate by Considering Key Factors

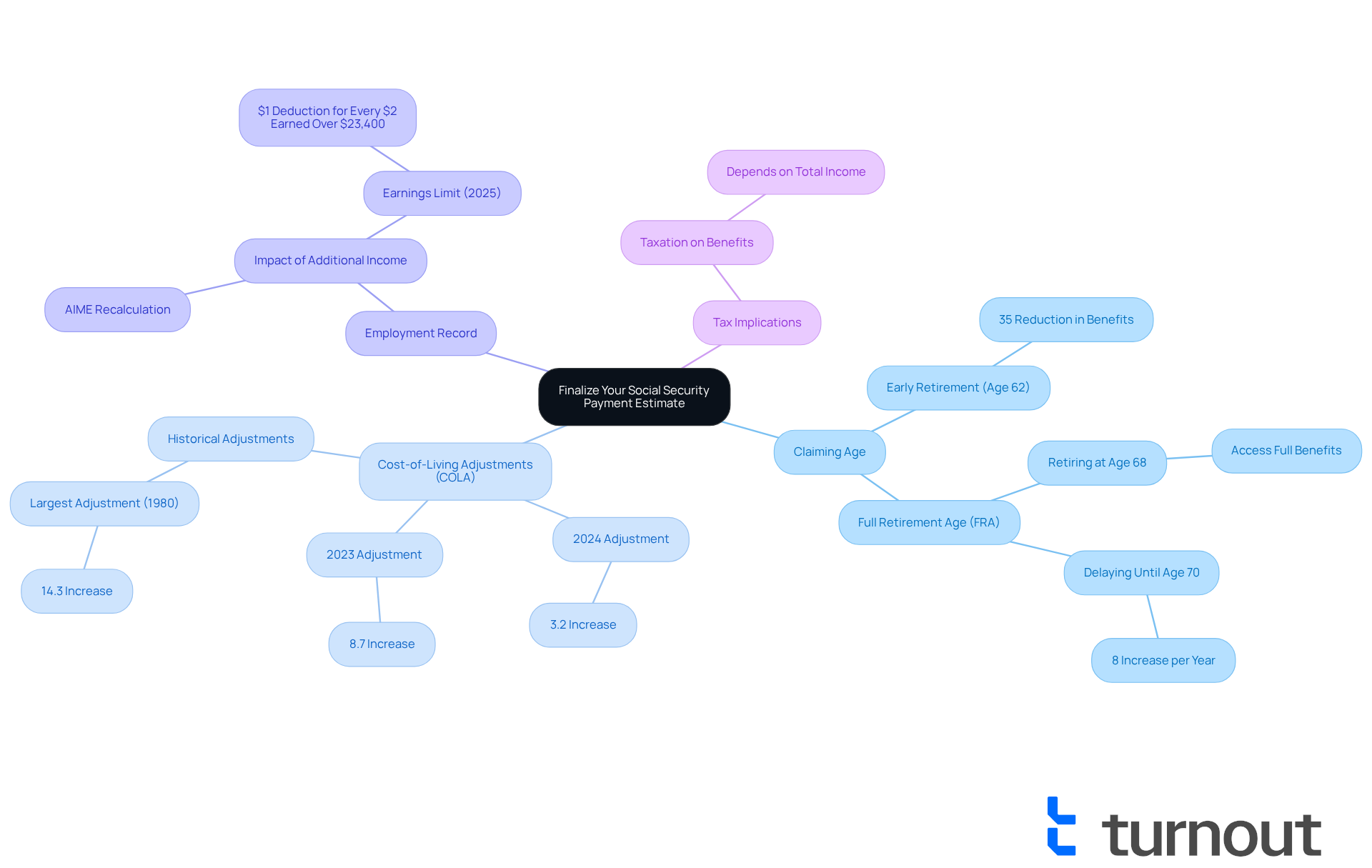

To finalize your social security payment estimate, it's important to consider a few essential factors that can significantly affect your future.

- Claiming Age: The age at which you start receiving payments plays a crucial role in determining your monthly amount. Claiming early, before your Full Retirement Age (FRA), can lead to decreased payouts. However, postponing your claim can enhance your benefits. For instance, delaying until age 70 can increase your monthly payments by approximately 8% each year. If you choose to retire at age 68, you can access full advantages.

- Cost-of-Living Adjustments (COLA): Each year, payments from the public assistance program are adjusted for inflation, which can greatly impact your overall benefits over time. In the past decade, COLA adjustments have varied, with notable increases such as 8.7% in 2023 and 3.2% in 2024. The largest adjustment recorded was 14.3% in 1980, underscoring the importance of these modifications in helping beneficiaries keep pace with rising living costs.

- Employment Record: Additional income earned after your initial assessment can influence your benefits. The Administration recalculates your Average Indexed Monthly Earnings (AIME) based on your highest 35 years of income. Starting in 2025, for every $2 earned above $23,400, $1 will be deducted from your payments. This illustrates how your work history can affect your entitlements.

- Tax Implications: It's essential to recognize that some of your public benefits may be subject to taxation, depending on your total income.

By carefully considering these factors, you can arrive at a more accurate social security payment estimate for your potential payments. Remember, we're here to help you navigate this journey, and you are not alone in this process.

Conclusion

Understanding and mastering the process of estimating social security payments is essential for anyone preparing for retirement or navigating significant life changes. We recognize that this can feel overwhelming. By following the outlined steps, you can gain clarity on how your benefits are calculated, ensuring you make informed decisions about your financial future.

Key insights discussed in this article highlight the importance of:

- Accurate wage records

- Calculating your Average Indexed Monthly Earnings (AIME)

- Determining your Primary Insurance Amount (PIA)

Each step builds upon the previous one, emphasizing the interconnectedness of your work history, earnings, and the timing of claims. It’s common to feel uncertain about how factors such as claiming age, cost-of-living adjustments, and ongoing employment can impact your payment estimate. Recognizing these elements can further refine your understanding, leading to a more secure financial outlook.

Ultimately, taking the time to understand and navigate the complexities of social security payment estimates can lead to significant benefits down the line. We encourage you to approach this process with diligence and awareness. The choices you make today can profoundly influence your financial stability in the future. Engaging with resources and support systems can enhance this journey, empowering you to secure your well-deserved benefits and enjoy peace of mind. Remember, you're not alone in this journey; we're here to help.

Frequently Asked Questions

What are the main types of Social Security benefits?

The main types of Social Security benefits are retirement, disability, and survivor support. Each type has its own eligibility criteria and calculations based on your work history and contributions to the system.

How is the amount of Social Security payment estimated?

The amount you receive as a Social Security payment estimate is closely tied to your earnings record, specifically the income on which you have paid public insurance taxes.

What are 'Full Retirement Age' (FRA) and 'Primary Insurance Amount' (PIA)?

'Full Retirement Age' (FRA) and 'Primary Insurance Amount' (PIA) are important terms related to Social Security payments that you should familiarize yourself with as you navigate the payment estimate process.

How can I gather my wage information for Social Security benefits?

You can gather your wage information by collecting your W-2 forms, 1099 forms, and any other income records. You can also view your income history through your benefit account online or by requesting a copy of your benefit statement.

What should I do if I find inaccuracies in my income records?

If you notice any inaccuracies in your income records, you should contact the Social Security Administration (SSA) as soon as possible. Bring your W-2 form or Schedule SE to your local SSA office to address the discrepancies.

Why is it important to verify my income history for Social Security benefits?

Verifying your income history is crucial because mistakes can lead to lower payouts, which may impact your financial security. Research shows that about 25% of individuals find inconsistencies in their benefits income records.

How often should I check my Social Security benefit statements?

You should check your Social Security benefit statements each year to ensure there are no mistakes in your income history.