Overview

This article highlights the significant milestones in the history of Cost-of-Living Adjustments (COLA) for Social Security benefits, focusing on how these adjustments play a crucial role in the financial stability of beneficiaries. We understand that many individuals rely on these benefits to navigate their daily lives, and it’s important to recognize the changes that have occurred over the years.

For instance, the introduction of automatic COLAs in 1975 was a pivotal moment, ensuring that recipients could better cope with inflation. Additionally, the adoption of the CPI-W in 1983 further aimed to protect recipients and maintain their purchasing power.

These developments reflect a commitment to supporting those who depend on Social Security, and we’re here to help you understand how they affect your financial well-being.

Introduction

The history of Cost-of-Living Adjustments (COLA) for Social Security benefits tells a story of resilience in the face of economic challenges that impact millions of Americans. We understand that as inflation rates fluctuate and living costs rise, it becomes increasingly important for beneficiaries to grasp these adjustments to maintain their financial stability. This article explores nine pivotal milestones in COLA history, shedding light on how each change has shaped the benefits that recipients depend on.

What challenges and opportunities lie ahead as policymakers contemplate future adjustments? It's common to feel uncertain about what these changes may mean for you. By examining these key moments, we hope to provide insights into the ongoing evolution of Social Security and its profound impact on those who rely on it. Remember, you are not alone in this journey, and we’re here to help you navigate these important changes.

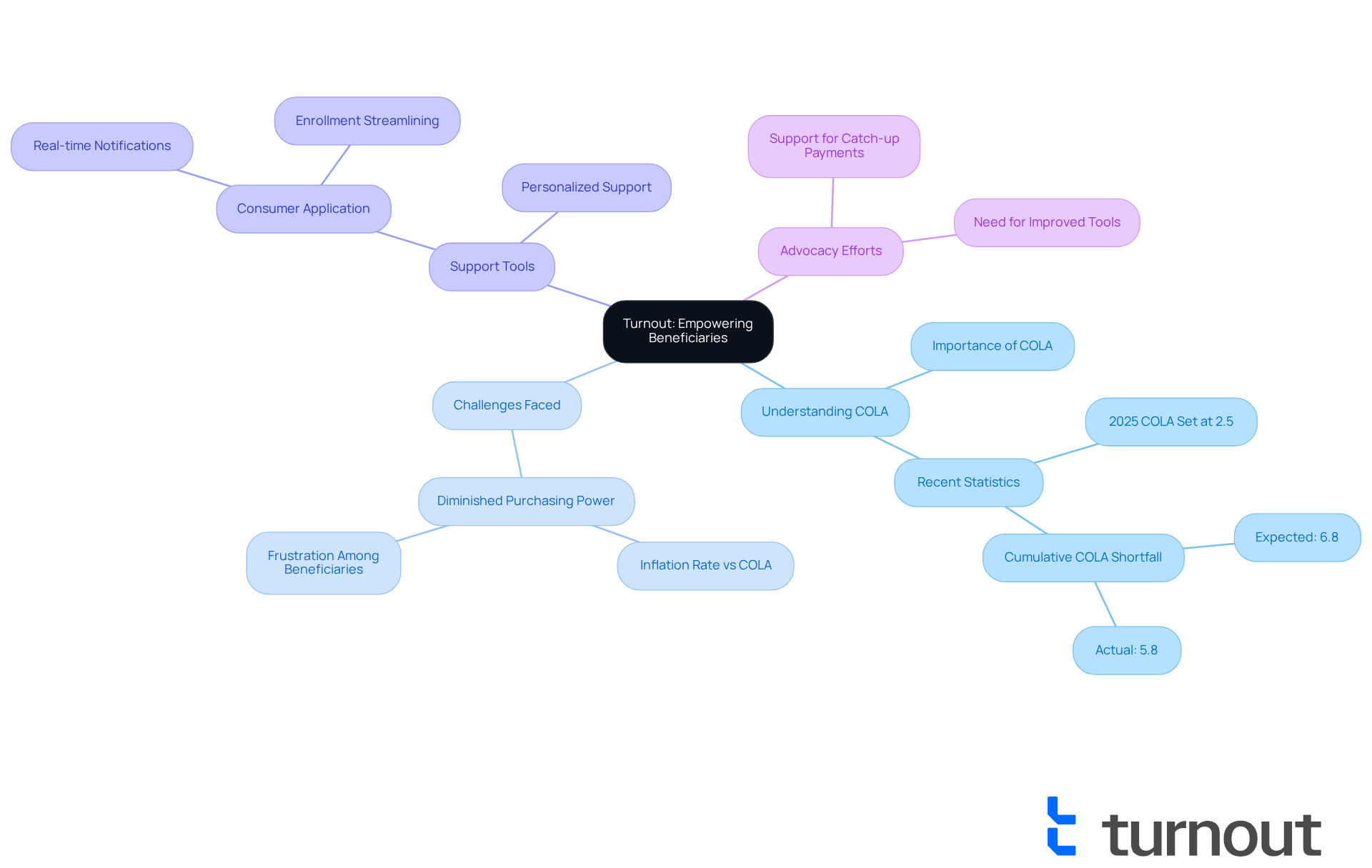

Turnout: Empowering Beneficiaries to Navigate COLA Changes

is dedicated to transforming how recipients understand and manage the intricacies of for benefits. We understand that can be overwhelming. By harnessing technology and offering tailored support, Turnout empowers individuals to make informed decisions, ensuring they receive the benefits they deserve. This advocacy is essential, particularly as in the cola history social security that affects the who depend on it.

In 2025, the cost-of-living adjustment was set at 2.5%, a figure that fell short of the full-year CPI-W inflation of 2.9% for 2024, resulting in . It's common to feel frustrated when the adjustments do not meet expectations. The total cost-of-living adjustment over the last two years was 5.8%, whereas it ought to have been 6.8%, resulting in a difference of $228 for the typical retired employee. Such shortfalls emphasize the significance of comprehending cost-of-living changes and their effects on financial stability.

Turnout provides access to tools and services that help consumers navigate these complexities, including assistance with SSD claims and . Technology plays a pivotal role in enhancing recipients' understanding of these adjustments. For example, Turnout's consumer application streamlines the process of enrolling in benefits and offers real-time notifications on cost-of-living adjustments, allowing users to remain informed and take initiative. Additionally, personalized support from advocates ensures that individuals can navigate the complexities of their benefits with confidence.

It's important to note that Turnout is not a law firm and does not provide legal advice. Consumer advocates stress the necessity for improved tools and resources to assist recipients in comprehending the intricacies of cost-of-living adjustments. As inflation continues to fluctuate, the ability to access clear information and guidance becomes increasingly vital. With rising expenses for products and services, many older adults express concern that the existing cost-of-living adjustments do not sufficiently represent their financial situations. By leveraging technology and advocacy, Turnout is at the forefront of empowering individuals to navigate these challenges effectively. Remember, you are not alone in this journey; we’re here to help.

1975: Introduction of Annual COLA Adjustments for Social Security

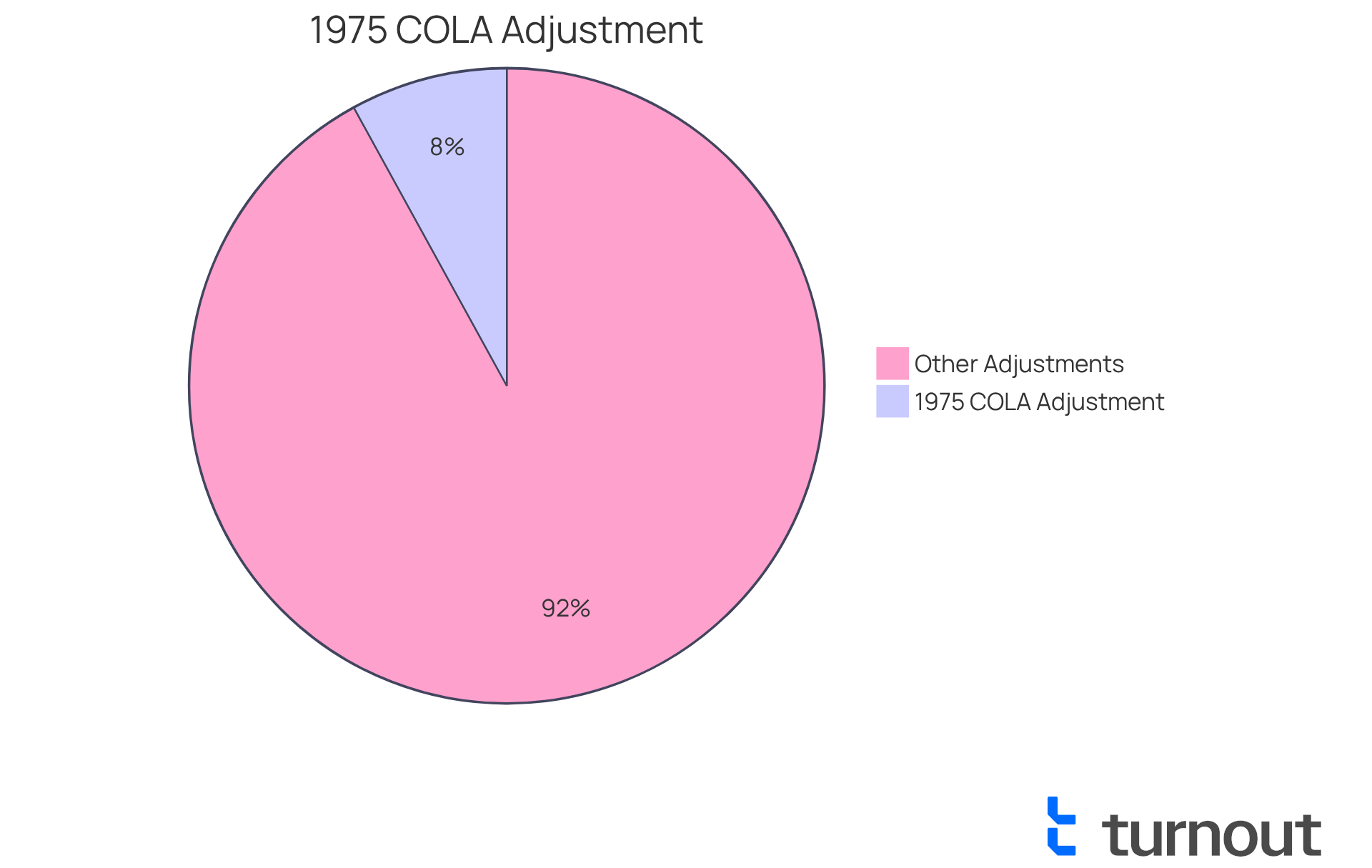

In 1975, the Social Security Administration took a significant step by implementing the initial automatic yearly . This adjustment, determined using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), was designed with you in mind. We understand that , and this crucial modification aims to protect you from its negative impacts. By ensuring that benefits correspond with the rising cost of living, the COLA provides a vital safety net for recipients.

The inaugural COLA was set at an impressive 8%. This change was not just a number; it represented a and adjusted each year. This adjustment offered immediate financial relief, allowing you to feel more secure in your day-to-day life. It also established a framework for future adjustments, ensuring that you can maintain your purchasing power even as economic conditions fluctuate.

The introduction of in the cola . It reflects a growing acknowledgment of the need for responsive measures to like you from inflationary pressures. Remember, you are not alone in this journey; we’re here to help you navigate these challenges with compassion and understanding.

1983: Shift to Consumer Price Index for Urban Wage Earners (CPI-W)

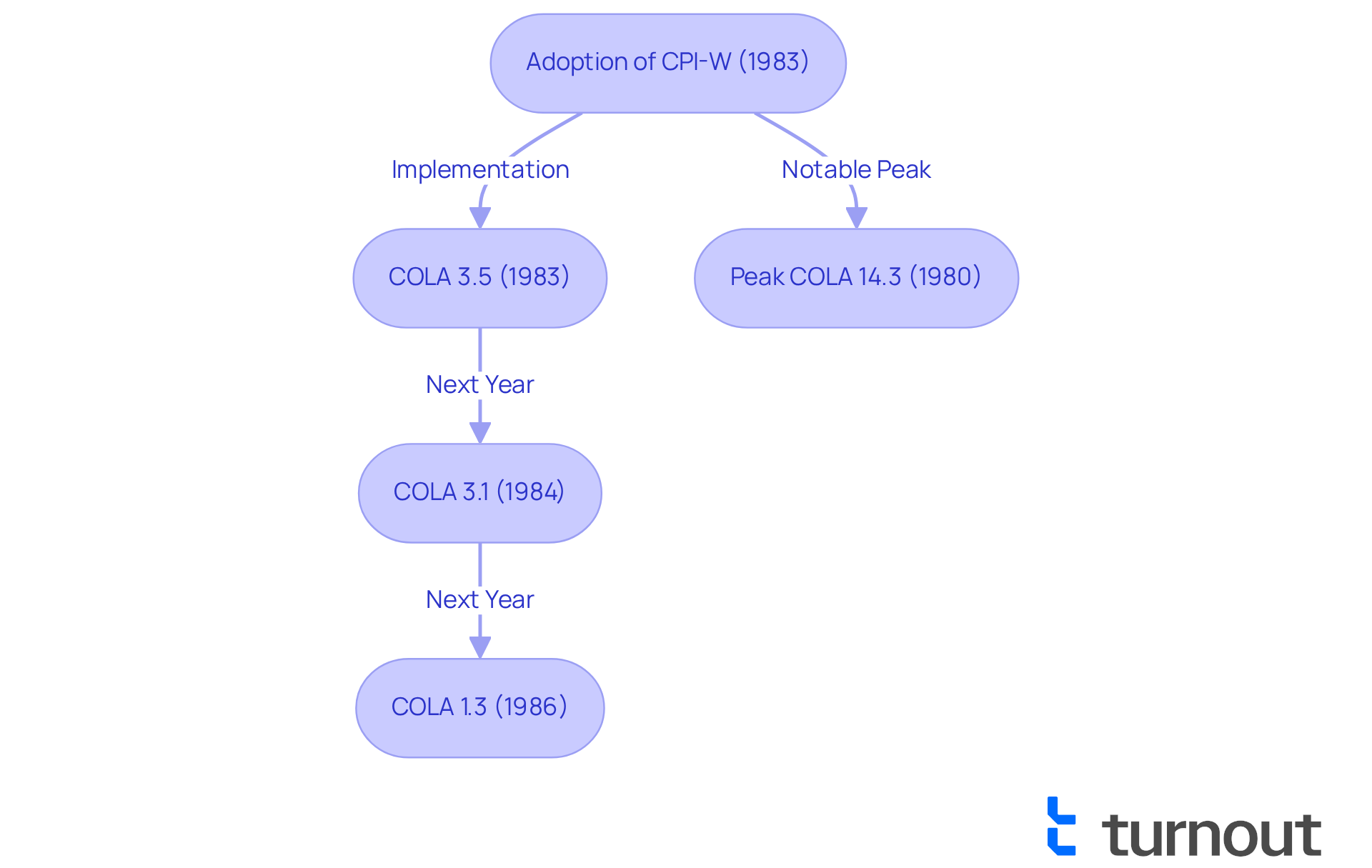

In 1983, we took a significant step forward in determining as part of the cola history by adopting the . This important change aimed to provide a clearer picture of the inflation that working individuals face, ensuring that the truly help protect recipients' . For instance, the cost-of-living increase for 1983 was set at 3.5%, reflecting the adjustments made to better serve the community.

Since implementing this methodology, recipients have experienced various adjustments that align closely with inflation rates. It's important to note that the COLA for 1980 reached a notable peak of 14.3%, showcasing the significant inflationary pressures at that time. In the following years, we saw fluctuations, such as 3.1% in 1984 and 1.3% in 1986. as a vital indicator, reflecting the spending habits of urban wage earners, which makes it a more relevant measure of inflation for those relying on benefits.

Sean Williams highlighted a crucial point: "The result is lower benefits for those who retire early, but also for those who wait until age 70." This underscores the necessity of accurately reflecting inflation in benefit calculations. These adjustments have been essential in of benefits in the context of cola history social security, especially as inflation rates have varied over the decades.

The 1983 modifications not only addressed immediate concerns about benefit adequacy but also contributed to cola history social security by setting a precedent for future changes, ensuring that our security system remains responsive to economic shifts. Additionally, from 65 to between 66 and 67 years, depending on birth year, illustrates the comprehensive nature of these reforms and their lasting impact on current retirees. Remember, you're not alone in navigating these changes; we're here to help you understand how they affect your future.

1996: Introduction of the Chained Consumer Price Index (C-CPI-U)

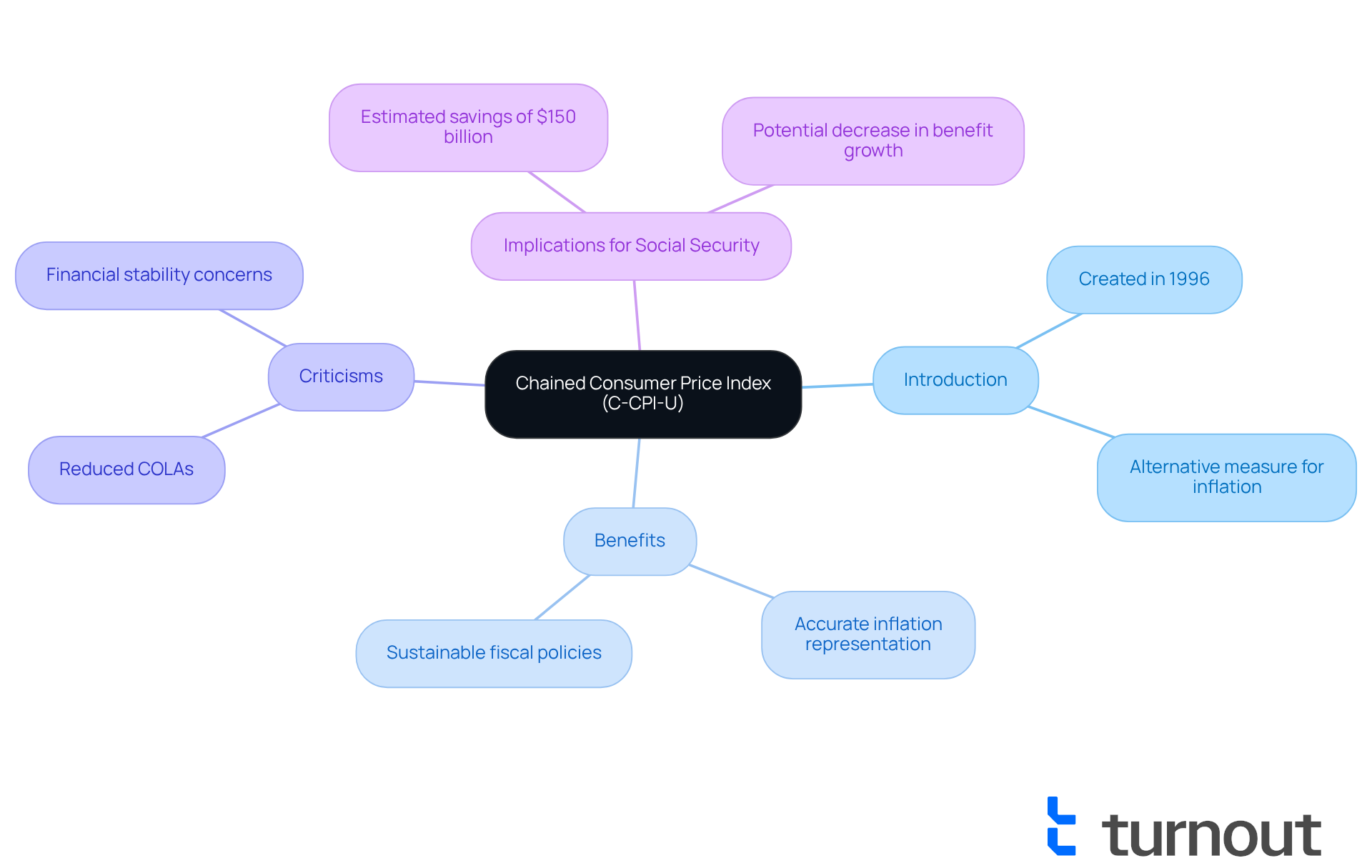

In 1996, the for All Urban Consumers (C-CPI-U) was introduced as an alternative measure for calculating inflation. We understand that inflation can be a daunting issue for many, and this index accounts for changes in consumer behavior, such as substituting cheaper goods when prices rise. By doing so, it aims to provide a more accurate representation of inflation, which can be crucial for your .

Proponents of the C-CPI-U argue that it better captures the realities of consumer spending, potentially leading to more sustainable fiscal policies. However, it's common to feel concerned about the implications of such changes. Critics warn that its implementation could lead to reduced (COLAs) in the beneficiaries, which may threaten their over time.

For instance, the Congressional Budget Office estimates that switching to the C-CPI-U could save about $150 billion in the cola history of Social Security over ten years. While this may seem beneficial on the surface, it could come at the cost of reduced benefit increases for many recipients, particularly in terms of , leaving them vulnerable.

Furthermore, the effect of the C-CPI-U on cost-of-living adjustments has been substantial. Historical data suggests that utilizing this index in the context of cola history social security might result in a decrease in benefit growth relative to conventional measures. As consumer behavior continues to evolve, particularly in response to price increases, the implications of the C-CPI-U remain a critical topic of discussion among economists and policymakers alike.

It's essential to consider the voices of experts in this conversation. Robert Greenstein emphasizes that the C-CPI-U should be considered only if accompanied by strong protections for vulnerable populations. This highlights the need for a balanced approach, ensuring that those who are most affected are not left behind. Remember, you are not alone in this journey, and we are here to together.

2008: COLA Increase Amid Rising Inflation Concerns

In 2008, many beneficiaries faced significant challenges due to rising living costs. They experienced a substantial , driven by growing inflation worries, particularly in energy and food prices. This adjustment was crucial for of over 55 million recipients, reflecting the during a time of economic uncertainty.

We understand that the rise in living expenses can be overwhelming. The increase highlighted the importance of timely in safeguarding the , emphasizing the relevance of [cola history social security](https://myturnout.com). Economists noted that the rise in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) underscored the urgent need for this change, as many recipients were facing heightened costs for essential goods.

For instance, the average monthly benefit rose from $1,090 to $1,153, marking the . This increase provided vital support to those grappling with escalating living expenses. This , based on the CPI-W, is vital in the cola history social security context for helping recipients manage the financial challenges posed by inflation.

As Finance Committee Chairman Max Baucus stated, "This new retirement benefits adjustment of 5.8 percent reflects recent price increases." While it may not solve all the financial issues faced by Social Security recipients, this year’s cost-of-living adjustment is part of the cola history social security, offering some assistance in meeting daily needs. Remember, you are not alone in this journey; we are here to help.

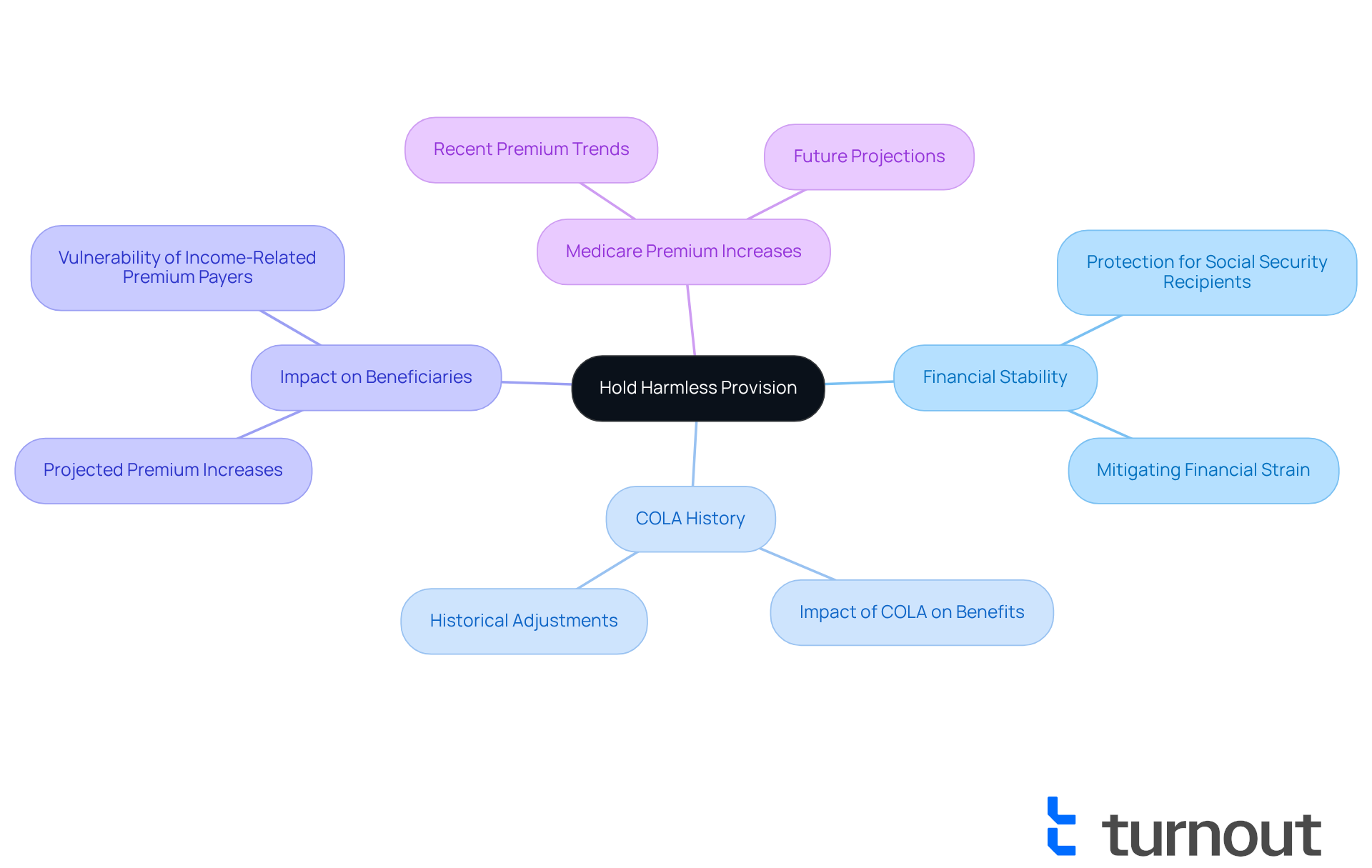

1989: Hold Harmless Provision Protects Beneficiaries from Medicare Premium Increases

Founded in 1989, the serves as a vital safeguard for those receiving government assistance. It ensures that their net benefits remain stable, even as rise. We understand that is crucial, especially for individuals who rely on , highlighting the importance of in this context. This provision is particularly important during years when .

When Medicare premiums rise beyond the cost-of-living adjustment (COLA), it is important to understand the COLA history of Social Security payments, which do not decrease. This protection helps prevent the that many recipients might otherwise face in an already complex healthcare landscape. Analysts emphasize that without this provision, many would experience reduced income, leading to greater financial challenges.

Projections indicate that as Medicare premiums continue to climb, the Hold Harmless Provision will become even more essential for preserving the purchasing power of Social Security benefits, particularly in light of COLA history and its . For instance, in 2022, the typical Medicare Part B premium surged by a historic 14.5%. This situation highlights the ongoing financial hurdles that recipients encounter.

It's important to note that individuals paying income-related premiums do not benefit from this provision. This exclusion can leave them vulnerable to reductions in their net benefits. Remember, you are not alone in this journey; we’re here to help you .

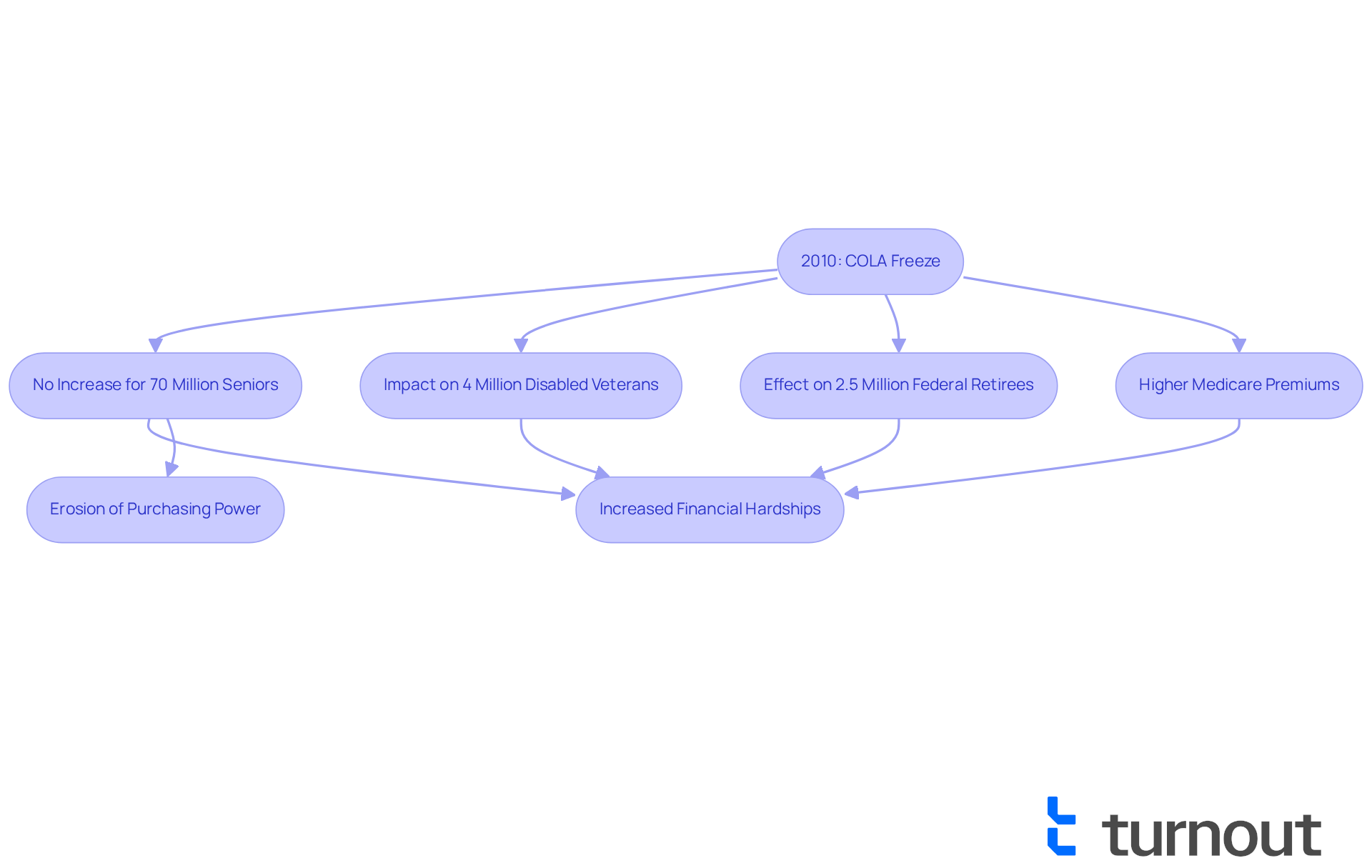

2010: No COLA for the First Time Since 1975

In 2010, the cola history of experienced an unusual freeze, marking the first time since the introduction of automatic cost-of-living increases in 1975 that recipients saw no rise in their benefits. This situation emerged from a notable decline in consumer prices, largely due to falling gas prices, which significantly impacted the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The reveals that the highlighted the , many of whom depend on fixed incomes that fail to keep pace with inflation.

We understand that this freeze raised deep concerns among advocates regarding the erosion of purchasing power. Seniors and disabled individuals faced rising living costs without any corresponding increase in their cola history social security benefits. The economic decline had already strained many households, and the lack of an adjustment in cola history social security intensified with stagnant earnings.

This freeze not only affected Social Security recipients but also had ripple effects on approximately 4 million disabled veterans and 2.5 million federal retirees, highlighting the importance of cola history social security. It underscores the widespread implications of , including cola history social security. Notably, this was only the third time in 40 years that payments remained flat, highlighting the rarity of such an occurrence.

Moreover, the national 'hold harmless' regulation protected most recipients from decreased payments during this freeze. However, many still faced related to cola history social security, further complicating their financial situations. In this context, we want you to know that Turnout offers valuable assistance to individuals navigating these challenges. We provide access to for SSD claims and IRS-licensed enrolled agents for . You are not alone in this journey; we ensure that clients receive the necessary support without the complexities of legal representation.

2021: Significant COLA Increase Due to Pandemic-Driven Inflation

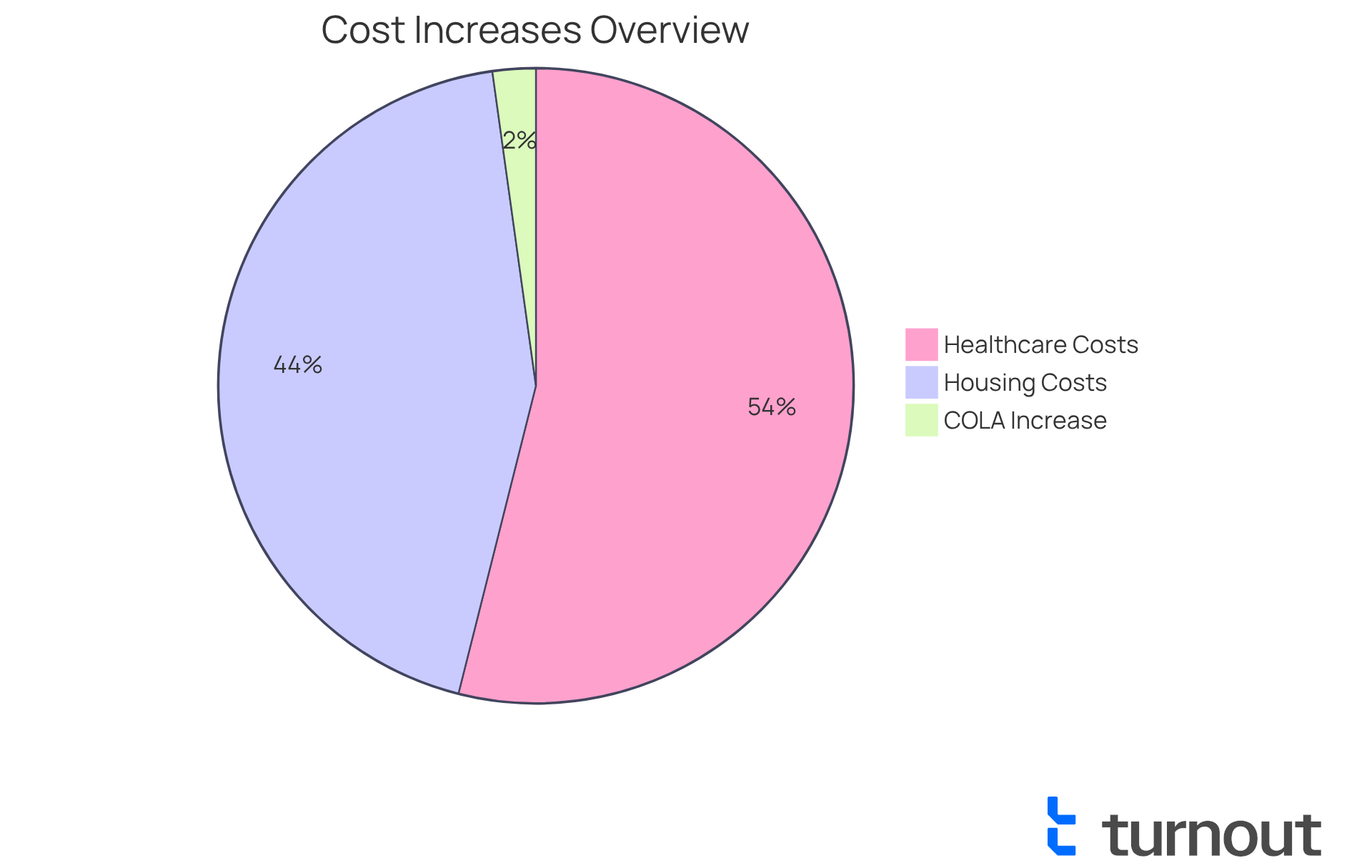

In 2021, beneficiaries experienced a in their , a necessary response to the inflationary pressures stemming from the COVID-19 pandemic. This adjustment was crucial for helping recipients manage the increasing costs of essentials like healthcare and housing. We understand that with housing costs soaring nearly 118% and healthcare expenses escalating by 145% since 2000, the increase has been vital in supporting the of recipients during these challenging economic times.

Jo Ann Jenkins, CEO of AARP, highlighted the importance of the COLA increase, stating that it is more critical than ever as millions of Americans continue to of the pandemic. It's common to feel , especially when retirement benefits have lost 32% of their purchasing power since 2000. This stark reality underscores the inadequacy of previous adjustments in keeping pace with living expenses.

Nearly 9 out of 10 individuals aged 65 or older rely on , which underscores the urgent need for timely adjustments in to enhance their financial stability. Additionally, significant price hikes in goods and services, including gas and rental cars, have only intensified the inflationary pressures faced by recipients. Despite the cost-of-living adjustment, the typical benefit payment increased by only $20 from 2020, highlighting the ongoing financial challenges many beneficiaries encounter. Remember, you are not alone in this journey; we’re here to help you navigate these difficult times.

2022: Record COLA Increase Amid Economic Recovery Efforts

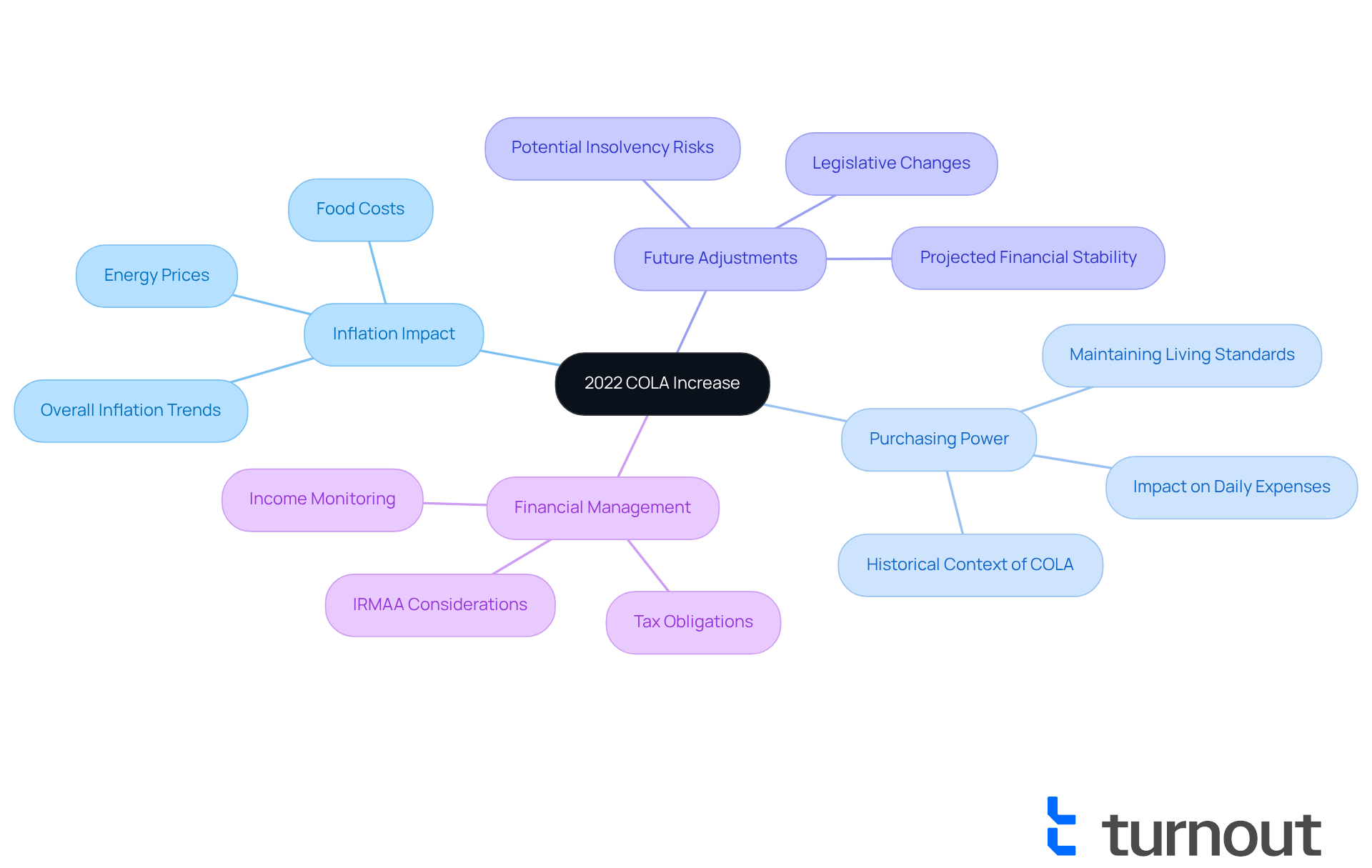

In 2022, the cola history of recipients included a significant , marking the largest rise in four decades. This increase, driven by persistent inflation and escalating costs in essential areas like energy and food, has raised important concerns. We understand that these inflationary pressures reflect deeper economic trends, which may affect future modifications to benefits.

For instance, the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W) highlights a . This notable change is crucial for helping beneficiaries maintain their purchasing power and navigate the ongoing economic recovery following the pandemic. However, it's common to feel anxious about the implications of this increase; higher benefits could lead to a cost rise that surpasses revenue, potentially accelerating the program's insolvency.

Beneficiaries, particularly those managing , should recognize how rising prices for daily goods and services not only affect their current financial situation but may also influence future adjustments related to cola history social security. Financial specialists emphasize that the is substantial. Diligent oversight of income is essential to avoid unexpected tax obligations, such as being moved into different IRMAA brackets.

We’re here to assist you in understanding these complexities and accessing the you need without the burden of legal representation. Remember, you are not alone in this journey.

2025: Anticipated Changes in COLA Calculations and Their Impact on Benefits

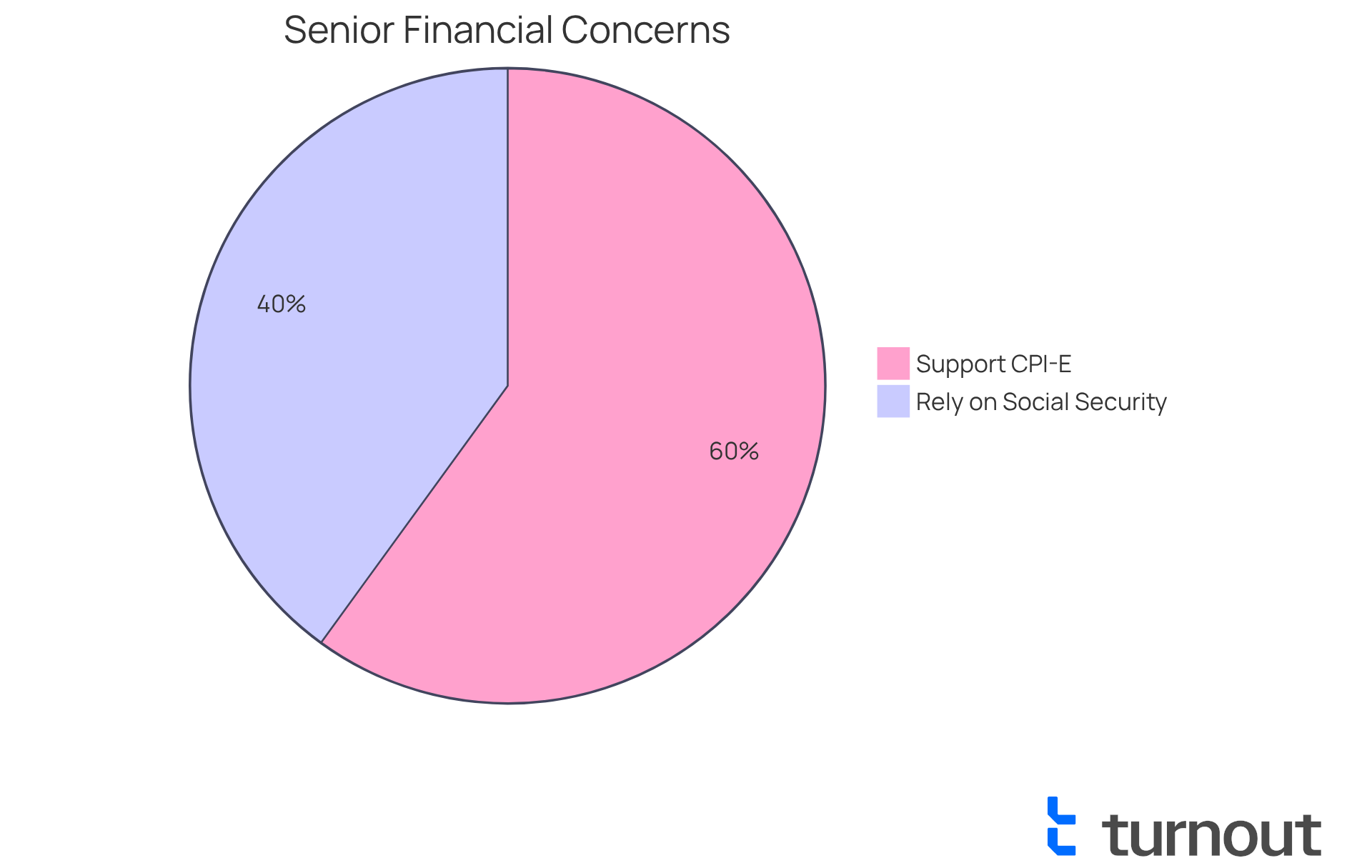

As we approach 2025, many are understandably concerned about whether the current calculations of cola history for the are sufficient. Policymakers are actively considering changes to the methodology used for calculating COLA, which is part of the , and this could significantly impact millions of Social Security recipients. A common sentiment among seniors is a wish for Congress to adopt the instead of the traditional CPI-W. This is because the CPI-E better reflects the expenses faced by older adults. In fact, a significant three-quarters of respondents (75%) expressed a desire for Congress to pass legislation that would base COLAs on the CPI-E. Such a change could lead to more meaningful adjustments in benefits, helping to alleviate some of the many seniors currently face due to .

The potential effects of these adjustments are profound. Currently, half of seniors rely on Social Security benefits for at least 50% of their household income, with a quarter depending on these benefits for 90% or more. As inflation continues to affect essential living expenses, the need for a more adaptable cost-of-living adjustment calculation becomes increasingly urgent. Analysts are predicting that the 2025 Social Security COLA will be considerably lower than in previous years, with estimates around 2.57%, compared to 3.2% in 2024 and 8.7% in 2023. This decrease raises valid concerns among recipients about their .

Moreover, if the methodology for calculating the cost-of-living adjustment were to change, it could lead to a more favorable adjustment for beneficiaries, potentially easing some of the financial burdens they face. With inflation being a top concern for 71% of seniors, staying informed about these potential changes is crucial for and overall well-being. More than three-quarters (78%) of seniors reported that their like housing, food, and medicine has increased compared to last year, highlighting the urgency of this issue. The ongoing discussions among policymakers underline the importance of adapting the cola history social security calculations to better meet the needs of Social Security recipients in our ever-evolving economic landscape.

Conclusion

The evolution of Cost-of-Living Adjustments (COLA) in Social Security benefits reflects our ongoing commitment to meet the financial needs of millions of Americans. Key milestones, such as:

- The introduction of annual adjustments in 1975

- The switch to the Consumer Price Index for Urban Wage Earners (CPI-W) in 1983

are essential for understanding how these changes affect beneficiaries.

Notable events, including:

- The significant 8.7% COLA increase in 2022

- The potential transition to the Consumer Price Index for the Elderly (CPI-E)

underscore the importance of adjustments that truly reflect inflation and rising living costs. These changes are vital for preserving the purchasing power of Social Security recipients, particularly as healthcare and housing expenses continue to rise.

As conversations around COLA calculations evolve, we understand that it is crucial for beneficiaries to stay informed and proactive. Advocacy organizations like Turnout provide necessary resources and support, empowering individuals to navigate the complexities of COLA changes. By remaining engaged and advocating for fair adjustments, beneficiaries can work towards ensuring that Social Security benefits effectively meet their financial needs in an ever-changing economic landscape. Remember, you are not alone in this journey; we are here to help.

Frequently Asked Questions

What is Turnout and what does it aim to achieve?

Turnout is an organization dedicated to helping beneficiaries understand and manage the complexities of Cost-of-Living Adjustments (COLA) for benefits. It empowers individuals to make informed decisions about their benefits by providing tailored support and utilizing technology.

How does Turnout assist beneficiaries with COLA changes?

Turnout offers tools and services, including assistance with Social Security Disability (SSD) claims and tax debt relief. Its consumer application helps users enroll in benefits and provides real-time notifications on COLA changes, ensuring they stay informed.

Why are Cost-of-Living Adjustments important?

COLA adjustments are crucial because they help maintain the purchasing power of benefits in the face of inflation, which affects the financial stability of millions of Americans who rely on these benefits.

What was the COLA set for in 2025, and how does it compare to inflation?

The COLA for 2025 was set at 2.5%, which was below the full-year Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) inflation of 2.9% for 2024, resulting in reduced purchasing power for beneficiaries.

What historical changes have been made to COLA adjustments?

In 1975, the Social Security Administration introduced automatic yearly COLA adjustments based on CPI-W to protect beneficiaries from inflation. In 1983, the methodology shifted to the CPI-W to better reflect the inflation faced by urban wage earners.

What was the impact of the 1983 COLA adjustment changes?

The 1983 changes aimed to provide a more accurate reflection of inflation, resulting in adjustments that better safeguarded the purchasing power of benefits. It also established a precedent for future adjustments and increased the full retirement age from 65 to between 66 and 67 years.

Does Turnout provide legal advice?

No, Turnout is not a law firm and does not provide legal advice. It focuses on offering support and resources to help beneficiaries navigate their benefits.

Why is it important for beneficiaries to understand COLA adjustments?

Understanding COLA adjustments is vital as it directly affects beneficiaries' financial stability, especially during times of fluctuating inflation and rising costs of living. Access to clear information and guidance helps individuals make informed decisions about their benefits.