Overview

Navigating the process of filing back taxes can feel overwhelming, and it’s important to understand your unique tax situation. Gathering the necessary documents is a crucial first step, and we understand that this can be a daunting task. You are not alone in this journey; many face similar challenges when trying to achieve resolution.

To help you manage your tax obligations effectively, we outline actionable steps that can make a difference:

- Consider reaching out to tax authorities—this can provide clarity and guidance.

- Utilize available resources to empower you to regain your financial stability.

Remember, it’s common to feel uncertain about where to start. By taking these steps, you’re not just addressing your tax situation; you’re also taking control of your financial future. We’re here to help you every step of the way.

Introduction

Filing back taxes can often feel like navigating a labyrinth of financial stress and uncertainty. We understand that millions of Americans are grappling with the consequences of unpaid taxes—such as wage garnishments and property liens. This makes it more critical than ever to recognize the importance of addressing these obligations. This guide offers a clear, step-by-step approach to help you tackle your back tax situation, empowering you to regain control over your financial future.

But what happens when the path to resolution seems overwhelming? It's common to feel the fear of penalties looming large. Rest assured, you are not alone in this journey. We're here to help you find your way through this challenging time.

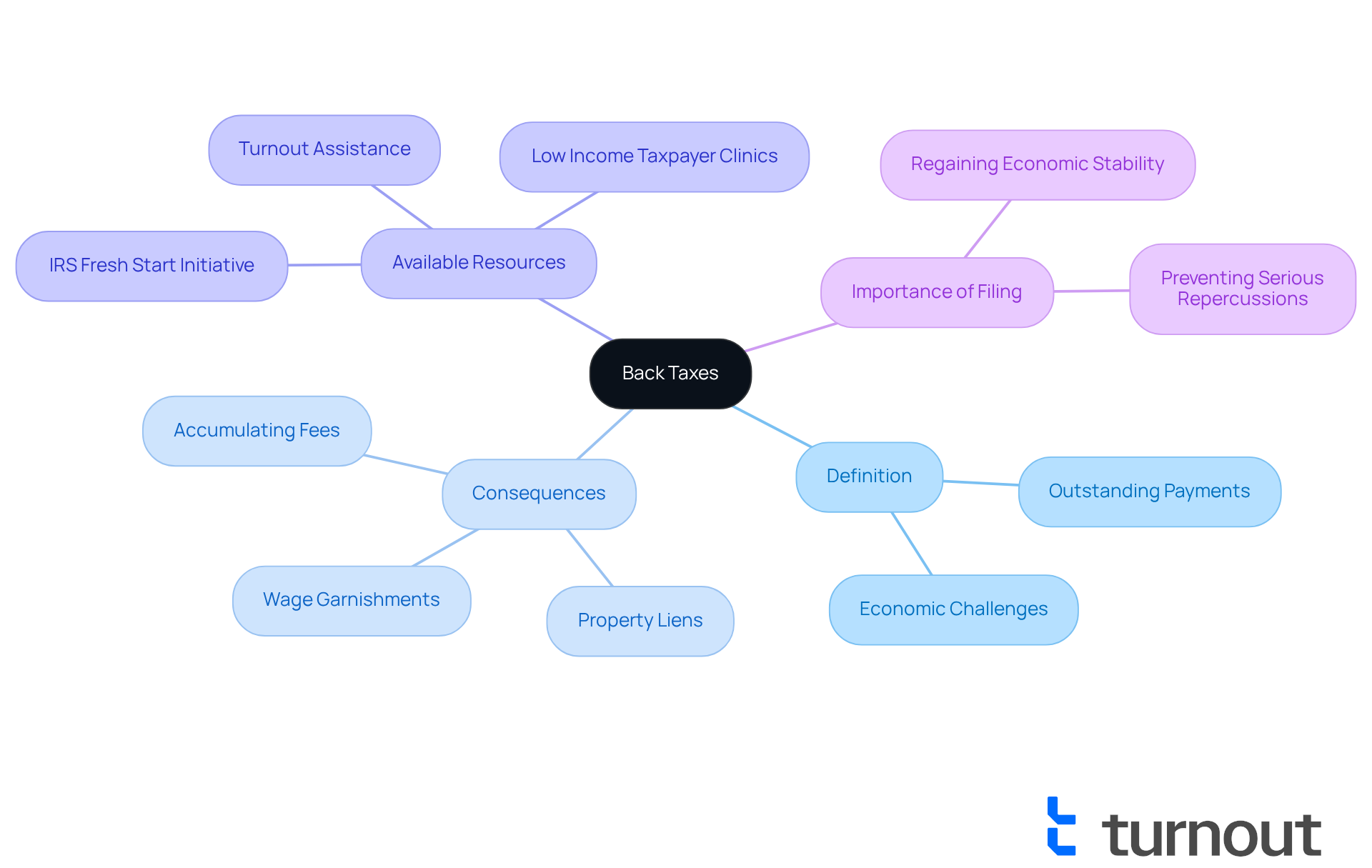

Understand Back Taxes: Definition and Importance

Outstanding payments are dues that remain unsettled beyond their deadline. They often arise from economic challenges, misunderstandings of obligations, or simple neglect. We understand that this can be a stressful situation. It’s essential to recognize the consequences of owed payments, as they can accumulate interest and fees, intensifying the monetary pressure over time.

In 2025, unpaid levies significantly impact American families. Millions face potential wage garnishments or property liens due to unresolved financial obligations. Resolving overdue payments promptly is crucial, and filing back taxes helps to prevent these serious repercussions and regain economic stability.

Resources such as the IRS Fresh Start Initiative and Low Income Taxpayer Clinics (LITCs) offer valuable support for individuals in need of filing back taxes help while navigating tax challenges. Additionally, Turnout offers assistance through trained nonlawyer advocates and IRS-licensed enrolled agents. They help clients manage their tax debt relief without the need for legal representation. Remember, you are not alone in this journey.

Real-world examples illustrate that those who proactively engage with these resources can successfully resolve their tax issues, showing how filing back taxes helps in overcoming challenges. As Gary Mehta emphasizes, "Don't face the IRS alone - contact a professional today for a confidential consultation and let them help you find peace of mind."

Filing back taxes helps not only reduce immediate monetary strain but also promotes long-term tranquility. This is an essential measure for regaining control over your economic future. Additionally, understanding options such as penalty abatement programs and the 'currently-not-collectible' status can further empower individuals experiencing economic hardship. We’re here to help you navigate these challenges.

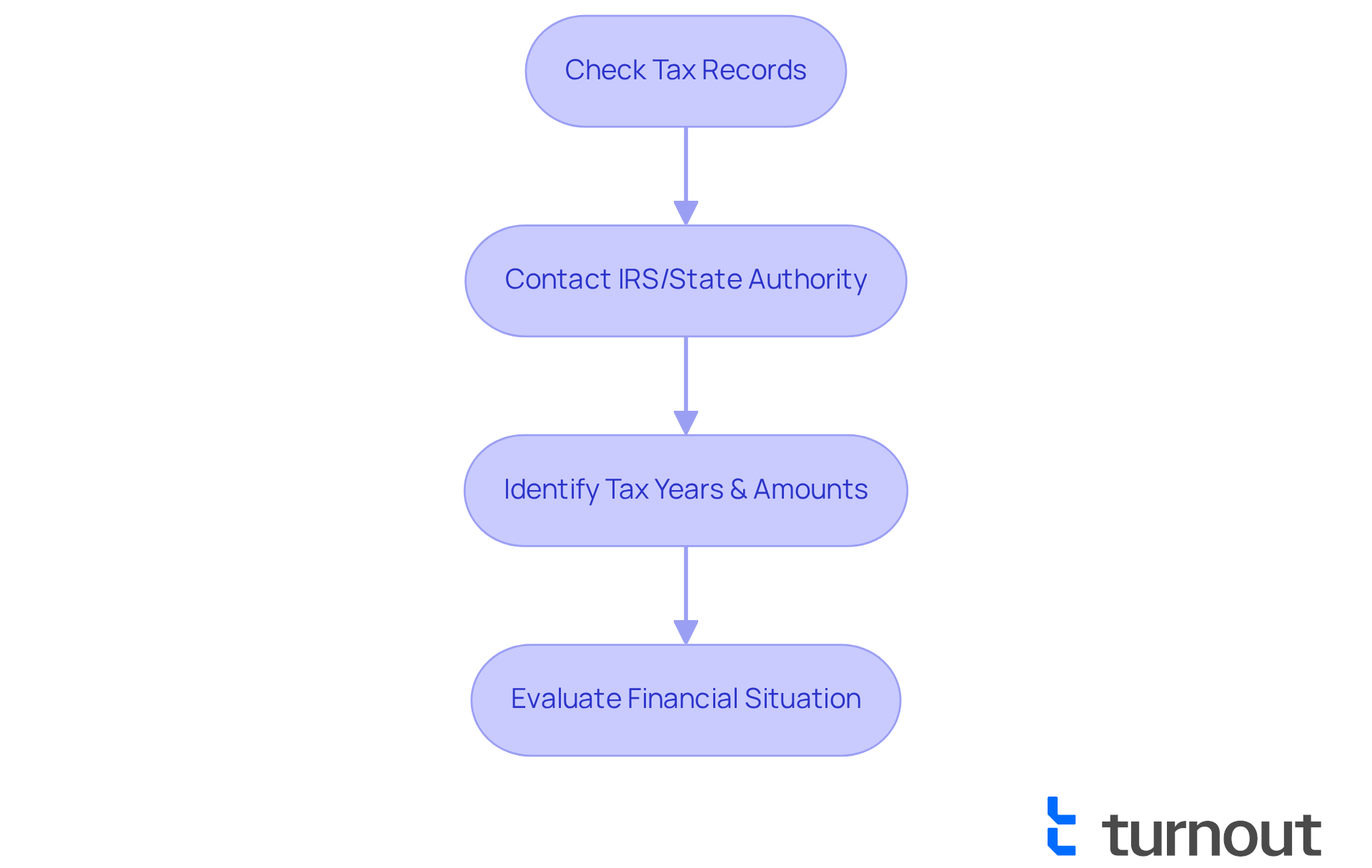

Assess Your Back Tax Situation: Steps to Take

Navigating your back tax situation can feel overwhelming, but we're here to help. Start by checking your tax records. Gather any tax returns you've filed in recent years. This simple step can help you identify discrepancies or any unfiled returns, and filing back taxes help alleviate the stress they may cause.

Next, consider reaching out to the IRS or your state tax authority. Obtaining a transcript of your tax account can provide clarity. This document will show your filing history and any outstanding balances, helping you understand where you stand.

Now, take a moment to identify which tax years you owe and the amount for each year. Knowing this will help you prioritize your debts, and filing back taxes help you to address the most pressing issues first.

Finally, evaluate your financial situation. Take stock of your income, expenses, and any assets. This assessment will guide you in determining your ability to settle overdue obligations or arrange a manageable payment plan. Remember, you're not alone in this journey, and taking these steps can lead you toward resolution.

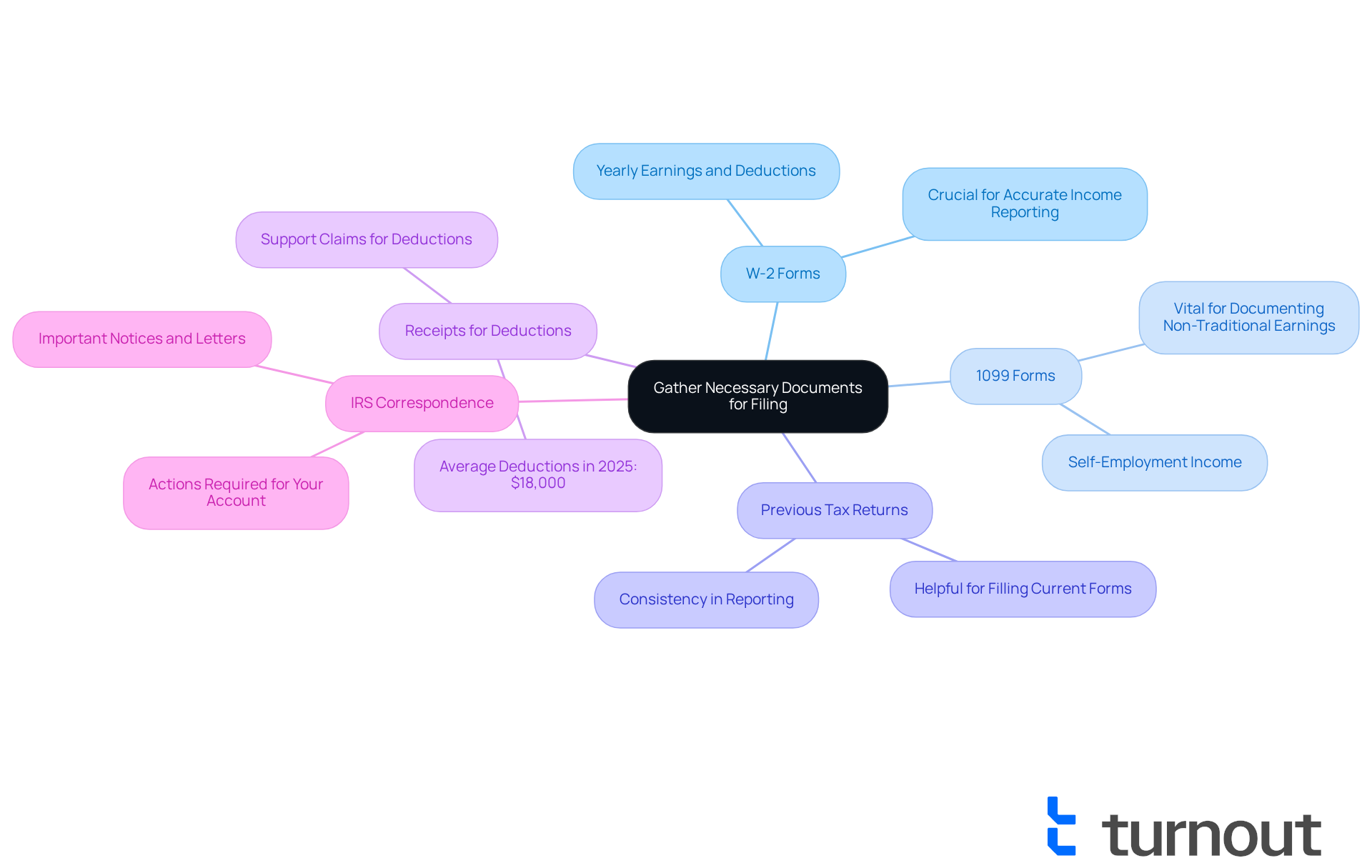

Gather Necessary Documents for Filing

Before filing back taxes help, we understand that it can feel overwhelming. Gathering the right documents is essential, and we're here to guide you through this process. Here’s what you need to collect:

- W-2 Forms: These documents detail your yearly earnings and the deductions from your paycheck. Be sure to gather W-2s for each year you are filing, as they are crucial for accurately reporting your income.

- 1099 Forms: If you were self-employed or received other income, it's important to gather any 1099 forms that report that income. These are vital for documenting earnings outside of traditional employment.

- Previous Tax Returns: Having copies of your previous tax returns can help you fill out your current forms accurately and ensure consistency in your reporting.

- Receipts and Documentation for Deductions: If you plan to claim deductions, collect receipts and documentation that support your claims, such as medical expenses or charitable contributions. In 2025, Americans claimed an average of $18,000 in tax deductions, highlighting the importance of thorough documentation.

- IRS Correspondence: Include any letters or notices from the IRS regarding your tax situation. These may contain important information about your account and any actions you need to take.

Consider the case of a disabled individual who successfully gathered their W-2 and 1099 forms after receiving assistance from a consumer advocacy platform. They were able to compile their documents efficiently, simplifying their filing process and maximizing their potential refunds.

Accountants emphasize the importance of these documents, noting that "W-2 and 1099 forms are foundational for accurate tax filing and maximizing potential refunds." Collecting these forms can streamline the filing process and filing back taxes help you avoid complications with the IRS. Additionally, it's important to stay informed about any updates to W-2 and 1099 forms for the 2025 tax year, as these changes can impact your filing process. Remember, you are not alone in this journey; we’re here to help you every step of the way.

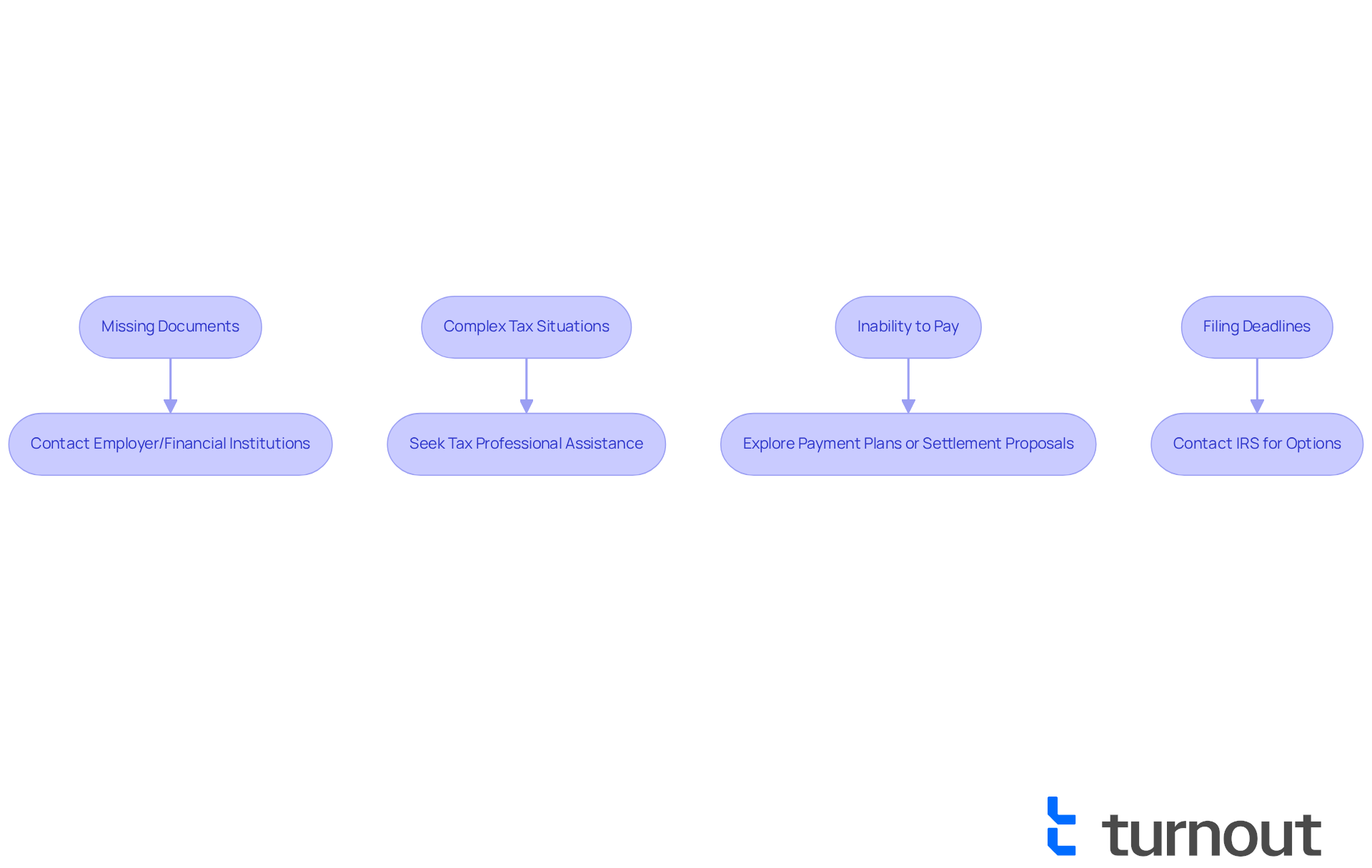

Navigate Potential Issues: Common Challenges and Solutions

When filing back taxes help, it’s common to encounter various difficulties with overdue payments. We understand that navigating this process can be overwhelming, but we’re here to provide filing back taxes help. Here are some common issues you might face, along with supportive solutions:

- Missing Documents: If you're struggling to locate certain documents, reach out to your employer or financial institutions for copies. You can also request transcripts of your tax records from the IRS.

- If your tax situation feels complicated, seeking assistance from a tax professional or a consumer advocacy organization can provide valuable filing back taxes help. They can help ensure your filing is accurate and stress-free.

- Inability to Pay: If settling your owed amounts in full feels impossible, remember there are alternatives available. Options like a payment plan or a settlement proposal can allow you to resolve your financial obligation for less than the total sum due.

- Filing Deadlines: It’s important to stay aware of deadlines for submitting overdue payments and any related penalties. If you happen to miss a deadline, don’t hesitate to contact the IRS to discuss your options. Remember, you are not alone in this journey.

Make Payments or Arrange a Payment Plan

Once you have submitted your previous financial obligations, managing your financial responsibility is essential. We understand that this process can feel overwhelming, but we’re here to help you with filing back taxes help effectively.

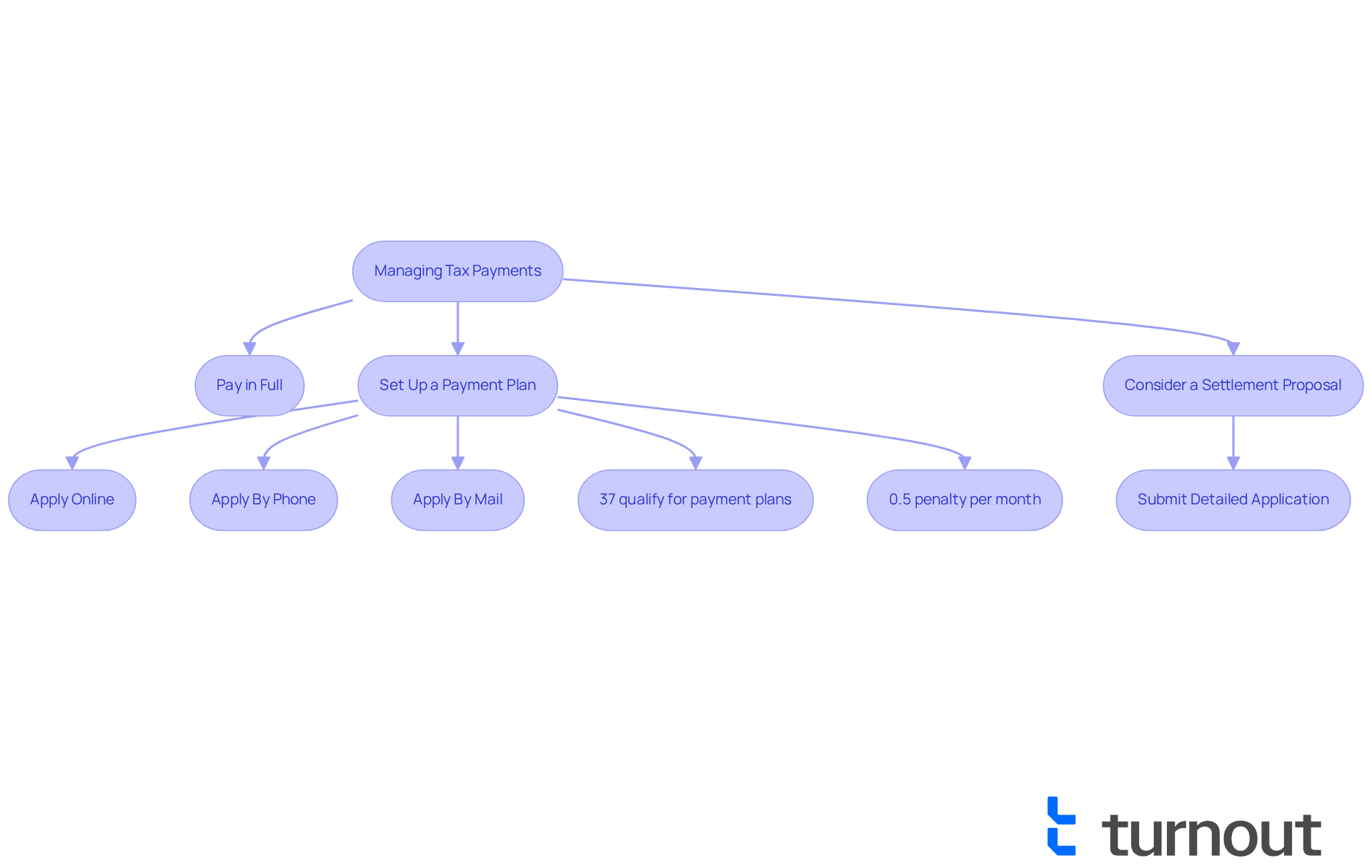

Paying in Full: If you can afford to pay your owed taxes in full, you can do so directly through the IRS website or by mailing a check. Remember to include your Social Security number and the tax year on your payment to ensure proper processing.

Setting Up a Payment Plan: If paying in full isn't feasible, consider applying for an IRS payment plan. This option allows you to pay your tax debt in manageable installments over time. You can apply online, by phone, or by mail. As of 2025, the average duration for back tax payment plans can extend up to 72 months, while short-term plans are available for up to 180 days. Setup fees for these plans can range from $0 to $225, and roughly 37% of taxpayers qualify for them, providing flexibility for those in need.

Consider a Settlement Proposal: For individuals experiencing considerable economic difficulty, a settlement proposal may be a feasible choice. This allows you to settle your tax debt for less than the total amount owed. To qualify, you must submit a detailed application along with your monetary information to the IRS. Many individuals have successfully negotiated offers in compromise, significantly reducing their tax burdens.

Stay Informed: After establishing a payment plan, it’s essential to keep track of your payments and monitor your tax account status. We know that staying vigilant can help avoid unexpected issues, such as penalties or additional interest accruing on your balance. Remember, the failure-to-pay penalty is 0.5% per month until the balance is cleared, so timely payments are crucial.

Utilize Available Resources: The IRS provides various tools and resources to assist taxpayers in managing their obligations. For instance, the Online Payment Agreement tool can assist you with filing back taxes help by allowing you to modify your payment plan, ensuring it aligns with your financial situation. Quotes from tax professionals emphasize the importance of exploring different tax debt relief options to find one that suits you best. Staying proactive and informed is key to successfully navigating your tax responsibilities. You are not alone in this journey; support is available to guide you every step of the way.

Conclusion

Filing back taxes is a vital step toward regaining your financial stability and avoiding the serious consequences of unpaid obligations. We understand that addressing these outstanding payments can feel overwhelming, but by recognizing their importance, you can take proactive measures to reduce stress and regain control over your economic future.

In this guide, we've outlined essential steps to help you navigate the complexities of back taxes:

- Assessing your tax situation

- Gathering necessary documents

- Exploring payment options

- Seeking professional help

Each phase is designed to empower you in facing tax challenges. Remember, timely action is crucial, and utilizing available resources, such as the IRS Fresh Start Initiative and consumer advocacy platforms, can make a significant difference.

You are not alone in this journey. By taking advantage of the support systems and resources available, you can effectively manage your financial responsibilities and work toward a brighter, more secure economic future. Addressing back taxes not only alleviates immediate financial pressure but also paves the way for long-term peace of mind. Taking the first step today can lead to a more stable tomorrow.

Frequently Asked Questions

What are back taxes?

Back taxes are outstanding payments that remain unsettled beyond their deadline, often arising from economic challenges, misunderstandings of obligations, or neglect.

Why is it important to resolve back taxes?

Resolving back taxes is crucial because unpaid levies can lead to significant consequences, such as wage garnishments or property liens. Additionally, overdue payments can accumulate interest and fees, increasing financial pressure.

What resources are available for individuals facing back tax issues?

Resources include the IRS Fresh Start Initiative, Low Income Taxpayer Clinics (LITCs), and assistance from organizations like Turnout, which provides support through trained nonlawyer advocates and IRS-licensed enrolled agents.

How can filing back taxes help individuals?

Filing back taxes can reduce immediate monetary strain, prevent serious repercussions from unresolved financial obligations, and promote long-term economic stability.

What steps should I take to assess my back tax situation?

Start by checking your tax records and gathering any filed tax returns. Next, reach out to the IRS or your state tax authority for a transcript of your tax account, identify which tax years you owe, and evaluate your financial situation to determine your ability to settle overdue obligations.

What should I do if I feel overwhelmed by my back tax situation?

It's important to remember that you are not alone. Taking proactive steps, such as reaching out for professional help and utilizing available resources, can lead you toward resolution.