Overview

We understand that losing a loved one is an incredibly challenging experience, especially for the spouses of deceased veterans. You are entitled to various benefits designed to support you during this difficult time. These include:

- Dependency and Indemnity Compensation (DIC)

- Survivors Pension

- Health care coverage

- Educational support

- Home loan guarantees

Recent legislative changes have aimed to improve financial support and simplify the application process for bereaved partners like you. These adjustments are intended to address the unique challenges you may face during this transition, ensuring that you have access to the help you need.

We want you to know that you are not alone in this journey. Many resources are available to assist you, and we’re here to help you navigate through them. Your well-being is important, and these benefits are in place to provide you with the support you deserve.

Introduction

Navigating the aftermath of losing a partner who served in the military can be an overwhelming experience, filled with emotional and financial challenges. We understand that for spouses of deceased veterans, grasping the array of benefits available is crucial for securing the support needed during this difficult time.

With upcoming changes in 2025, including enhancements to Dependency and Indemnity Compensation (DIC) and the Survivors Pension, a wealth of resources exists to aid in this transition. Yet, many survivors may still wonder:

- How can they effectively access these benefits?

- What steps must they take to ensure they receive the assistance they deserve?

You're not alone in this journey; we're here to help.

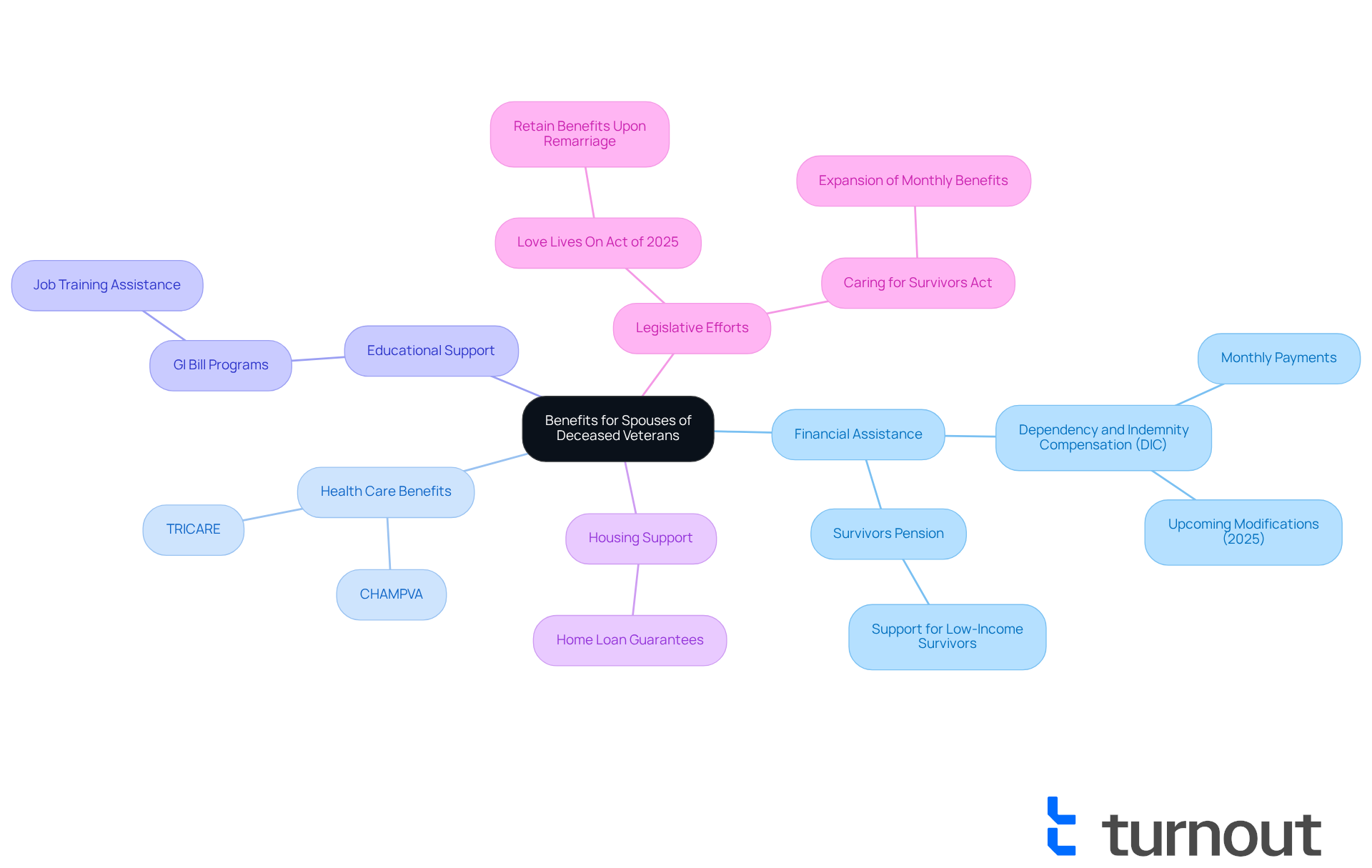

Overview of Benefits for Spouses of Deceased Veterans

Partners of fallen veterans face significant challenges during a difficult transition, and we understand that navigating this journey can be overwhelming. Fortunately, there are a variety of services designed to provide crucial financial assistance. Key among these is Dependency and Indemnity Compensation (DIC), a monthly payment available to qualified widowed partners. Starting in 2025, the DIC program will undergo major modifications, including enhancements aimed at aligning benefits with other federal survivor initiatives. These changes address persistent shortcomings that have left many survivors in financial distress.

In addition to DIC, remaining partners may be eligible for the Survivors Pension, which offers vital support to individuals with limited income. This pension is especially important for low-income survivors, ensuring they have the resources necessary to maintain their quality of life.

Health care benefits are also available, with programs like CHAMPVA and TRICARE providing essential medical coverage. Furthermore, educational support through GI Bill programs can assist bereaved partners in pursuing additional education or job training, thereby enhancing their long-term economic stability.

Home loan guarantees represent another crucial advantage, allowing remaining partners to secure housing without the burden of overwhelming financial pressure. This support is vital for those striving to build a new life after the loss of their partner.

Recent legislative efforts, including the Love Lives On Act of 2025, aim to further enhance these benefits by allowing surviving partners to retain specific survivor entitlements upon remarriage, regardless of age. This change acknowledges the unique challenges faced by military families and seeks to provide them with the economic stability they deserve.

Understanding what benefits do spouses of deceased veterans get is essential for partners navigating the complexities of the application process. Turnout is dedicated to simplifying access to government benefits and financial support, including assistance with SSD claims and tax debt relief. By offering expert guidance, Turnout helps bereaved partners confidently navigate these options. Remember, you are not alone in this journey; by being aware of your choices, you can secure the assistance needed to move forward with confidence.

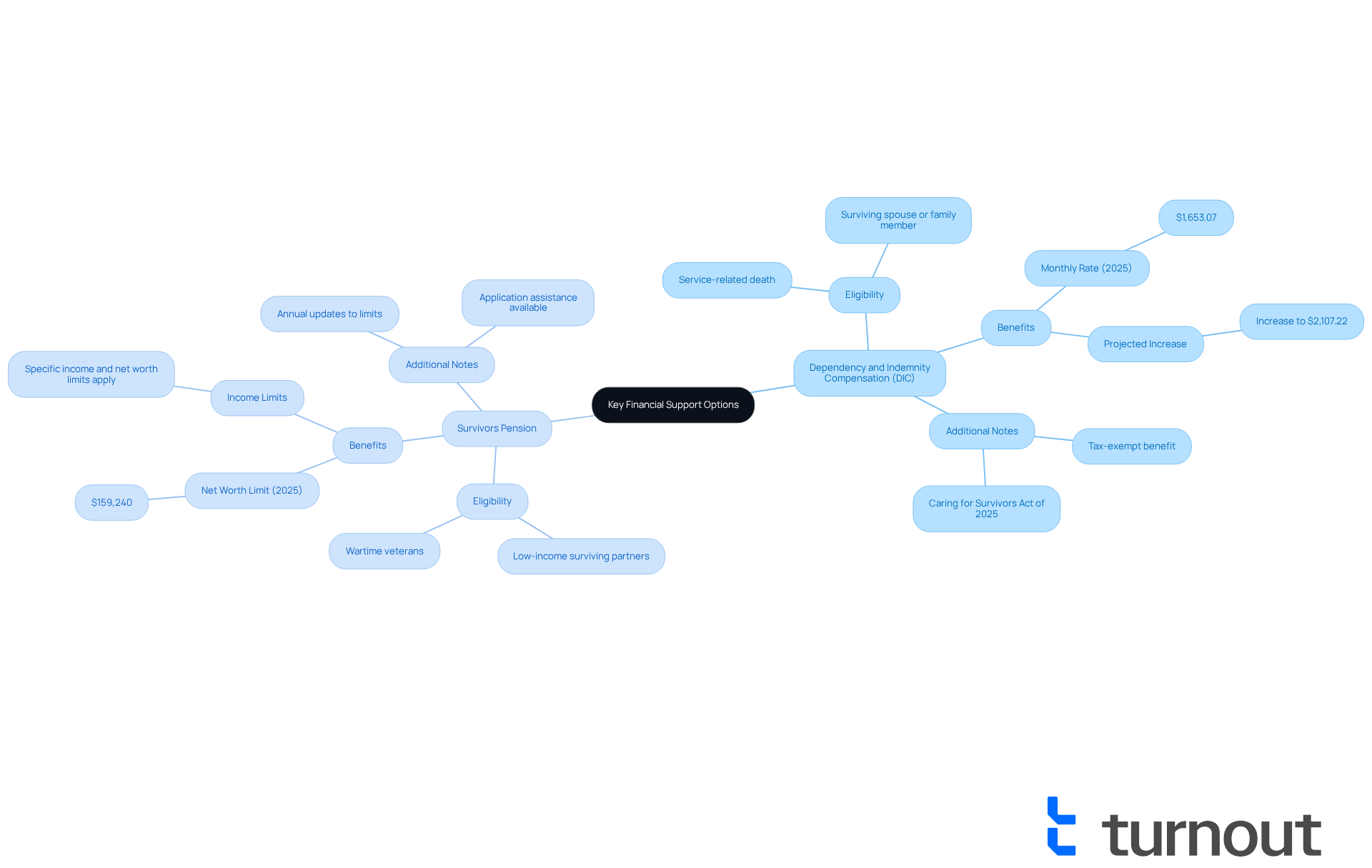

Key Financial Support Options: DIC and Survivors Pension

If you are a spouse of a deceased veteran, you may wonder what benefits do spouses of deceased veterans get, including access to two primary financial support options: Dependency and Indemnity Compensation (DIC) and the Survivors Pension. We understand that navigating these options can be overwhelming, but we’re here to help you find the support you need.

DIC is a tax-exempt benefit available to partners of veterans whose deaths were caused by service-related injuries or conditions. For 2025, the monthly DIC rate is projected to be $1,653.07. In contrast, the Survivors Pension is designed for low-income surviving partners of wartime veterans. To qualify, applicants must meet specific income and net worth limits, which are updated annually. From December 1, 2024, to November 30, 2025, the net worth limit is set at $159,240.

Understanding what benefits do spouses of deceased veterans get is essential for you to secure the financial aid you deserve. Turnout simplifies access to these government benefits. Our trained nonlawyer advocates provide expert guidance to help you navigate the application processes for both DIC and the Survivors Pension. It’s important to note that Turnout is not a law firm and is not affiliated with any law firm or government agency, ensuring that you have clear expectations about the nature of the assistance provided. You are not alone in this journey; we are here to support you every step of the way.

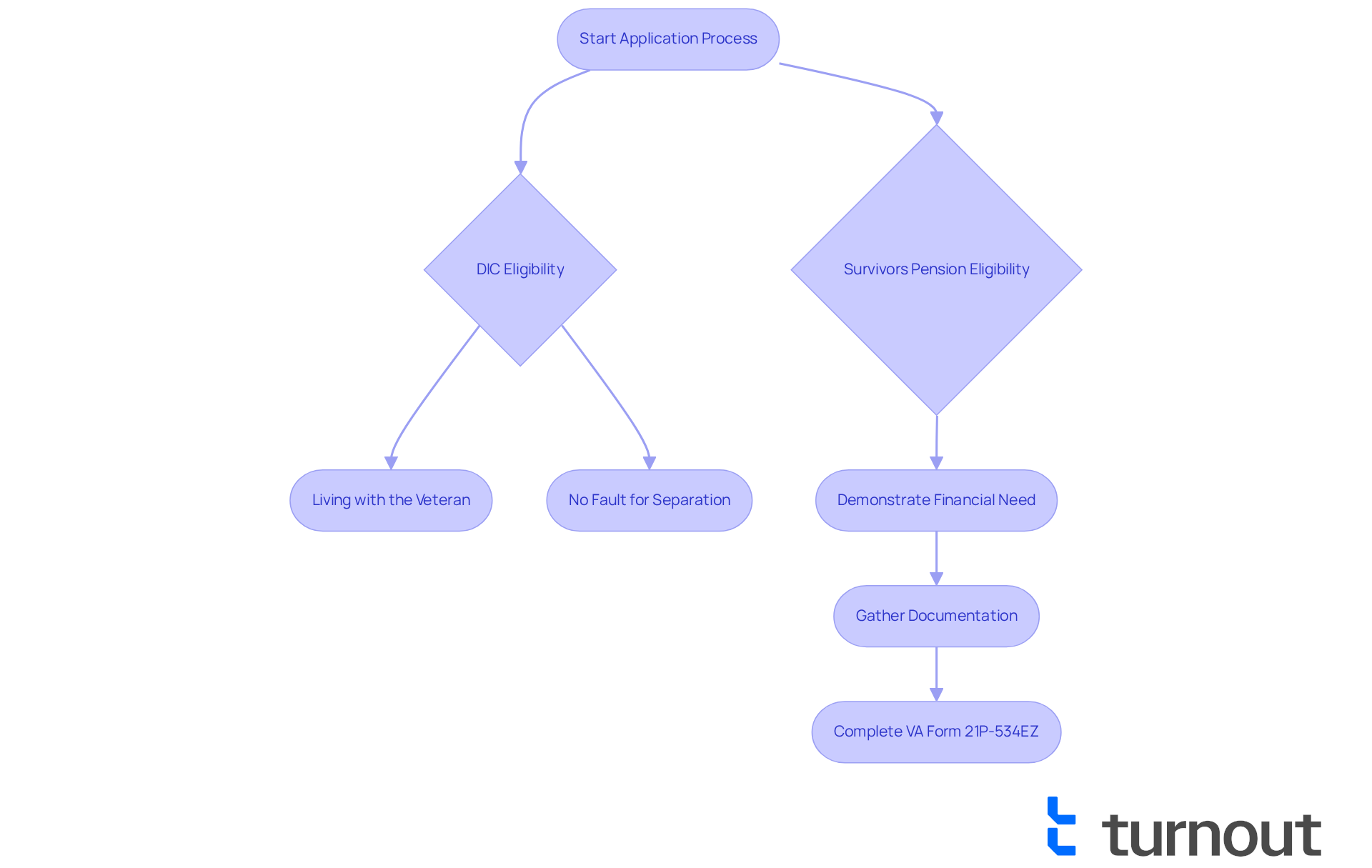

Eligibility Requirements and Application Process for Benefits

We understand that navigating the application process for Dependency and Indemnity Compensation (DIC) can be challenging during such a difficult time. To qualify for DIC, it’s important that the surviving partner lived with the veteran without interruption until their passing. If there was a separation, the spouse should not have been at fault for that separation.

For those considering the Survivors Pension, demonstrating financial need is essential. This requires documentation of income and assets to support your application. The process typically involves completing VA Form 21P-534EZ, which serves as the application for DIC, Survivors Pension, and/or Accrued Benefits.

To facilitate a smooth application experience, it's crucial to gather necessary documents. This includes:

- The veteran's discharge papers

- Death certificate

- Marriage certificate

Familiarizing yourself with these requirements can significantly improve your chances of a successful claim.

In fiscal 2025, the VA processed over 2.5 million claims, reflecting their commitment to supporting veterans' families. We want you to know that understanding the nuances of the application process is key to discovering what benefits do spouses of deceased veterans get. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the aftermath of losing a veteran partner can feel overwhelming. We understand that this time can be filled with uncertainty and grief. However, it’s crucial to recognize the benefits available to spouses of deceased veterans, as they can provide the support needed during this challenging journey.

The article highlights various financial assistance options, including:

- Dependency and Indemnity Compensation (DIC)

- The Survivors Pension

- Health care benefits

- Educational support

- Home loan guarantees

These resources collectively aim to create a safety net for bereaved partners, offering significant financial relief through DIC and the Survivors Pension. These benefits are essential for ensuring economic stability.

Understanding eligibility requirements and the application process is vital to accessing these benefits effectively. Legislative efforts, like the Love Lives On Act of 2025, enhance the support available, acknowledging the unique challenges faced by military families and striving to provide lasting financial security.

Ultimately, it is important for surviving spouses to be informed about their options. We encourage you to seek assistance in navigating the complexities of benefit applications. By empowering yourself with knowledge and utilizing available resources, you can secure the help you need to rebuild your life with confidence and dignity. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Dependency and Indemnity Compensation (DIC)?

DIC is a monthly payment available to qualified widowed partners of deceased veterans, providing crucial financial assistance during their transition.

What changes are expected in the DIC program starting in 2025?

Starting in 2025, the DIC program will undergo major modifications to enhance benefits and align them with other federal survivor initiatives, addressing persistent shortcomings that have affected many survivors financially.

What is the Survivors Pension and who is eligible for it?

The Survivors Pension offers vital support to individuals with limited income, particularly low-income survivors, ensuring they have the resources necessary to maintain their quality of life.

What health care benefits are available to spouses of deceased veterans?

Health care benefits include programs like CHAMPVA and TRICARE, which provide essential medical coverage for surviving partners.

How can educational support assist bereaved partners?

Educational support through GI Bill programs can help bereaved partners pursue additional education or job training, enhancing their long-term economic stability.

What are home loan guarantees and how do they benefit surviving partners?

Home loan guarantees allow remaining partners to secure housing without overwhelming financial pressure, which is vital for those looking to build a new life after their partner's loss.

What is the Love Lives On Act of 2025?

The Love Lives On Act of 2025 aims to enhance benefits for surviving partners by allowing them to retain specific survivor entitlements upon remarriage, regardless of age.

How can Turnout assist spouses of deceased veterans?

Turnout simplifies access to government benefits and financial support, offering expert guidance to help bereaved partners navigate options like SSD claims and tax debt relief, ensuring they are aware of their choices.