Overview

Verifying your insured status is essential for understanding your eligibility for Social Security benefits. It plays a crucial role in determining whether you have accumulated enough work credits through your employment history. We understand that this process can feel overwhelming, but rest assured, we’re here to help you navigate it.

This article outlines a step-by-step process for verifying your status. Accurate documentation and open communication with the Social Security Administration (SSA) are vital to address any discrepancies or issues that may arise. Remember, you are not alone in this journey; many have faced similar challenges and found their way through.

As you read through the steps, take a moment to reflect on your own experiences. It’s common to feel uncertain, but understanding your insured status can empower you to take the next steps toward securing your benefits. Together, we can ensure that you have the support you need.

Introduction

Understanding your insured status is crucial for securing essential benefits, especially when it comes to Social Security. We recognize that navigating this can be overwhelming. This guide aims to provide you with a clear roadmap to verify your coverage, empowering you to tackle the complexities of eligibility requirements.

It's common to feel uncertain about recent changes in regulations and how they affect your work credits. Many individuals share this concern. You might be wondering: how can you confidently ascertain your insured status amidst these challenges? Rest assured, you are not alone in this journey, and we are here to help you every step of the way.

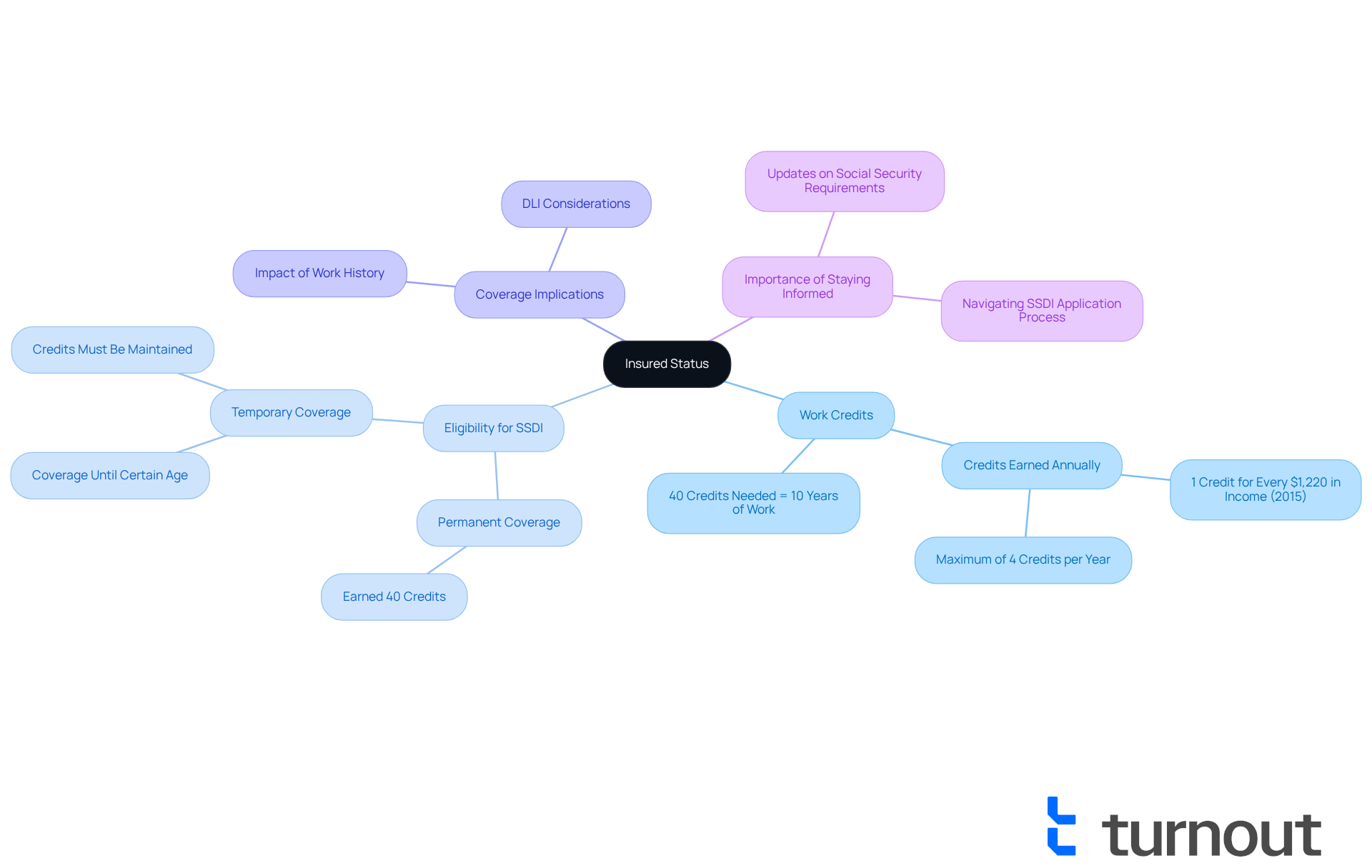

Understand Insured Status and Its Importance

Understanding your insured status is crucial. It indicates whether you have accumulated enough work credits from your employment history to [qualify for Social Security assistance](https://firstbusiness.bank/resource-center/determining-eligibility-for-social-security-benefits). Typically, to be fully covered, you need to earn 40 credits, which is roughly equivalent to 10 years of work. This coverage is crucial, as it directly impacts your insured status and eligibility for assistance, such as Social Security Disability Insurance (SSDI).

We understand that navigating these requirements can be overwhelming. Without meeting the eligibility criteria, your request for support may be denied, regardless of your situation or need for help. For instance, if you have reached the maximum of 40 credits, you are permanently covered and can access assistance even if you stop working. However, if you have only accumulated 28 credits, you may be covered until a certain age, but this condition will not last indefinitely.

It's essential to comprehend and verify your insured status. This is the first step to ensuring you receive the benefits you deserve. Recent updates to Social Security requirements highlight the importance of maintaining your work credits, especially as economic changes can influence how these credits are earned. Therefore, staying informed about your coverage is crucial for successfully managing the complexities of the SSDI application process.

Remember, you are not alone in this journey. We’re here to help you understand your options and support you every step of the way.

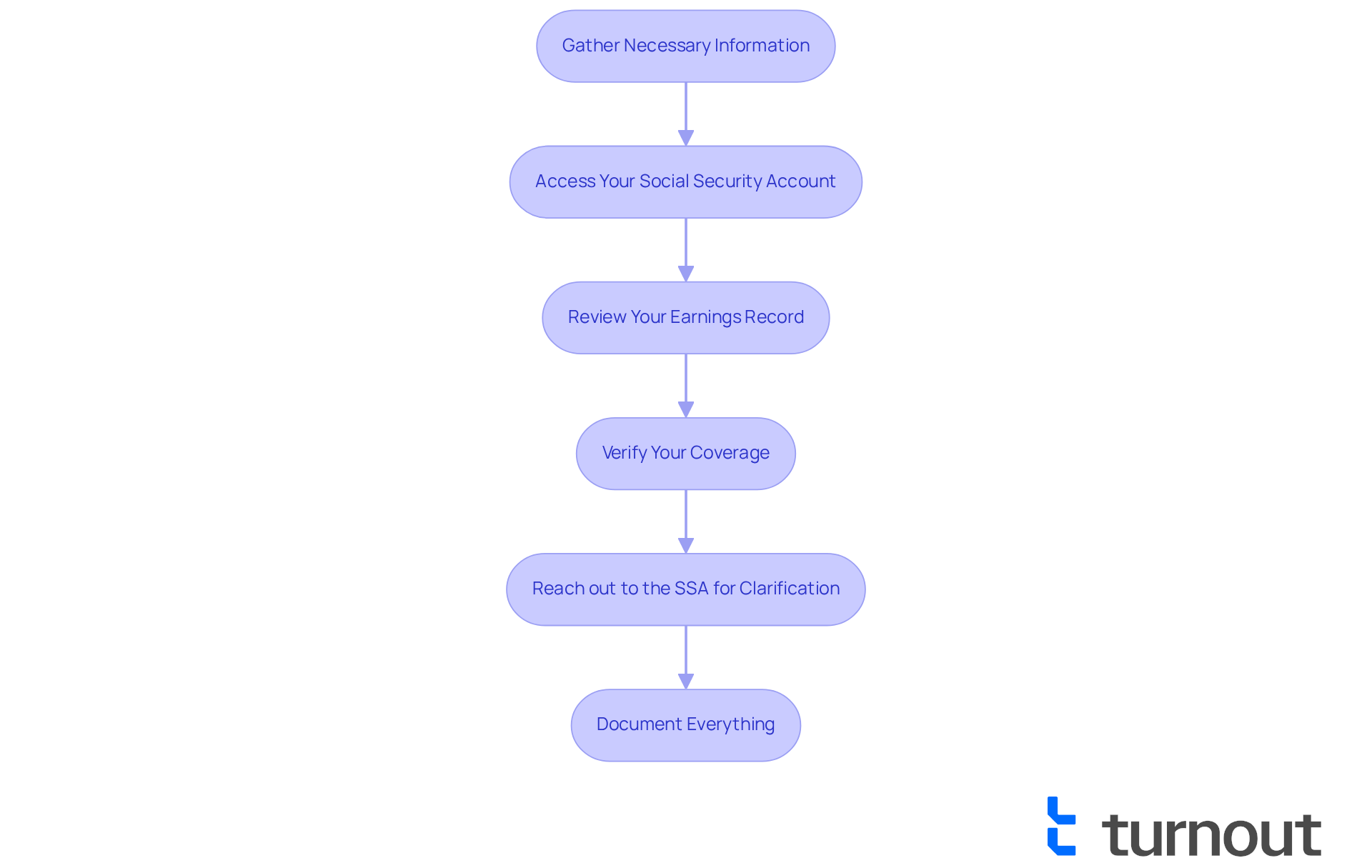

Follow Steps to Verify Your Insured Status

We understand that verifying your insured status can feel overwhelming. Here are some steps to guide you through the process:

- Gather Necessary Information: Start by collecting your Social Security number, work history, and any relevant documentation that shows your earnings. This foundational step is crucial for what comes next.

- Access Your Social Security Account: If you don’t have an account yet, creating one on the Social Security Administration (SSA) website is a great first step. This account will enable you to view your insured status and earnings record. As of December 2022, approximately 66 million beneficiaries were receiving payments, highlighting the program's extensive reach and support.

- Review Your Earnings Record: Once you’re logged in, navigate to the section displaying your earnings history. Take a moment to ensure that all your reported earnings are accurate and up-to-date. Remember, discrepancies can affect your eligibility for benefits, so it’s important to double-check.

- Verify Your Coverage: Look for the section that shows your coverage information. This will inform you whether you are fully insured, currently insured, or not insured at all. Understanding your insured status is essential, as it directly impacts your ability to obtain benefits.

- Reach out to the SSA for Clarification: If you discover inconsistencies or have questions about your situation, don’t hesitate to reach out to the SSA directly. You can call their customer service number or visit a local office for support. Clear communication with SSA representatives is key to resolving issues efficiently. Additionally, if you need further assistance, Turnout offers trained nonlawyer advocates who can help you navigate these processes without the need for legal representation. Remember, Turnout is not affiliated with any law firm, and we’re here to support you.

- Document Everything: Keep a record of your findings and any communications with the SSA. This documentation could be invaluable if you need to contest a decision or explain your situation later on. Keeping detailed records is a best practice for managing the intricacies of Social Security assistance.

We’re here to help you through this journey, and you are not alone in seeking the support you deserve.

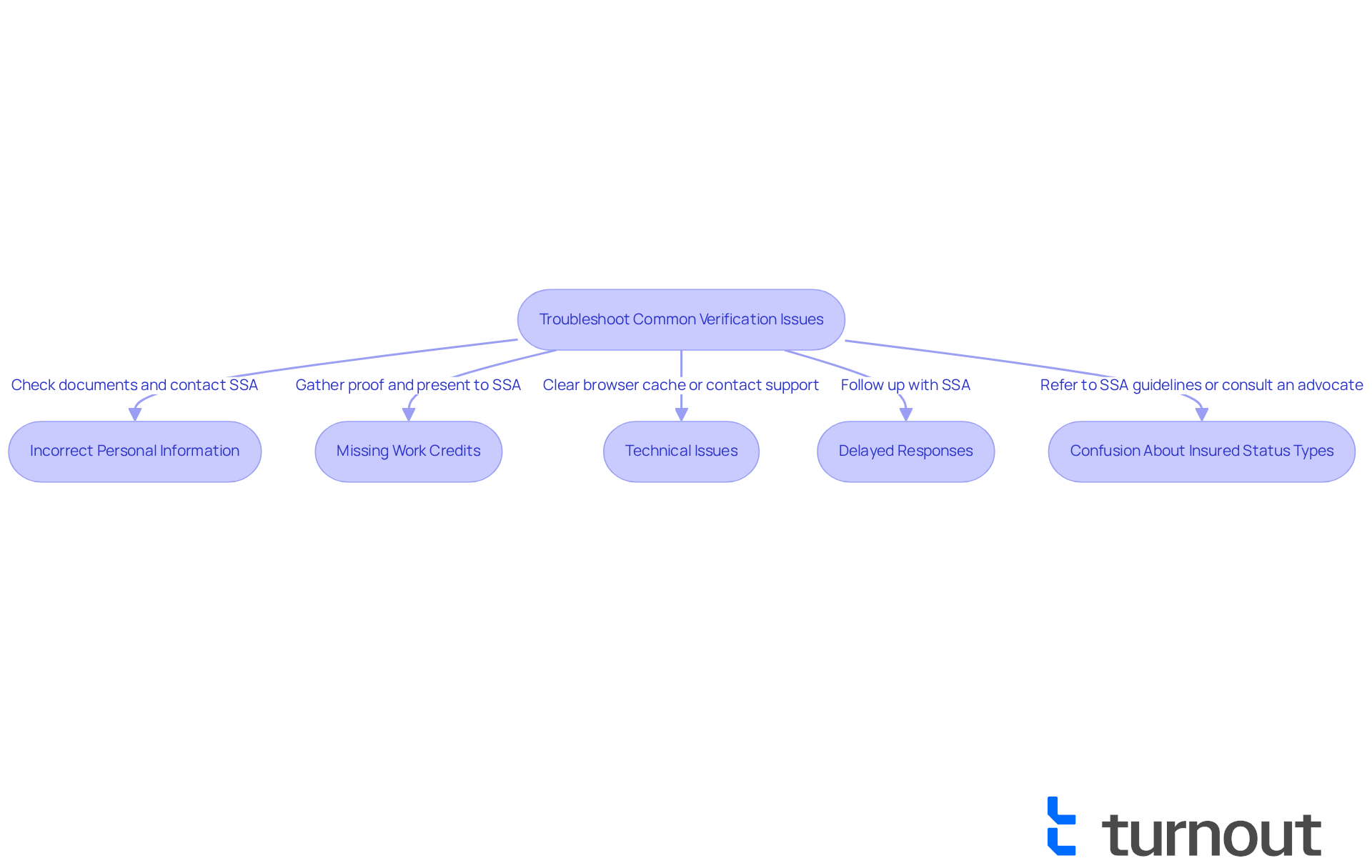

Troubleshoot Common Verification Issues

While confirming your coverage status, you may encounter several common issues. We understand that this can be a bit overwhelming, so here’s how to troubleshoot them:

- Incorrect Personal Information: If your name or Social Security number doesn’t match the records, please double-check your documents for accuracy. If discrepancies exist, don’t hesitate to contact the SSA to correct them. You deserve to have your information accurately reflected.

- Missing Work Credits: If you believe you have enough work credits but they aren’t showing in your record, gather proof of your employment history, such as pay stubs or W-2 forms, and present them to the SSA. Remember, you’ve worked hard for these credits, and it’s important they are recognized.

- Technical Issues with the SSA Website: It’s common to feel frustrated when facing technical difficulties. Recent reports indicate that around 70 million users have encountered issues on the SSA website, including outages lasting up to a full day. If you experience difficulties accessing your account or navigating the site, try clearing your browser cache or using a different browser. If problems persist, please reach out to SSA technical support for assistance.

- Delayed Responses from the SSA: If you’ve reached out to the SSA and haven’t received a timely response, consider following up with a phone call or visiting a local office for in-person assistance. Given the current staffing reductions, delays are common, so persistence may be necessary. Remember, you’re not alone in this, and there are ways to ensure your concerns are addressed.

- Confusion About Insured Status Types: If you’re unsure about the differences between fully insured and currently insured, we encourage you to refer to the SSA’s guidelines or consult with a benefits advocate. Turnout offers trained nonlawyer advocates who can assist you in understanding these distinctions. This understanding is crucial, especially considering that only 38% of SSD applications were approved in 2024. Utilizing Turnout's services can help improve your chances of a successful application. We’re here to help you navigate this journey.

Conclusion

Understanding and verifying your insured status is a crucial step for anyone seeking access to Social Security benefits. This process not only determines your eligibility for essential assistance programs like Social Security Disability Insurance (SSDI) but also empowers you to take control of your financial future. By ensuring that you have accumulated the necessary work credits and confirming your coverage, you position yourself to receive the support you deserve.

We understand that gathering accurate information can feel overwhelming. Accessing your Social Security account and reviewing your earnings record are vital steps in this journey. Additionally, troubleshooting common verification issues—such as discrepancies in personal information or missing work credits—can help you navigate the complexities of the Social Security system. Engaging with the Social Security Administration (SSA) and utilizing available resources, like nonlawyer advocates, can significantly enhance your understanding and management of your insured status.

Ultimately, verifying your insured status is not just a procedural task; it is a vital step towards securing your financial well-being. By staying informed and proactive, you can ensure that you are adequately prepared to face any challenges that may arise in the benefits application process. Remember, you are not alone in this journey. Take the initiative today to verify your insured status, as doing so can open doors to essential support and resources when they are needed most.

Frequently Asked Questions

What is insured status in relation to Social Security?

Insured status indicates whether you have accumulated enough work credits from your employment history to qualify for Social Security assistance, such as Social Security Disability Insurance (SSDI).

How many work credits are needed to be fully covered?

To be fully covered, you typically need to earn 40 credits, which is roughly equivalent to 10 years of work.

What happens if I have reached the maximum of 40 credits?

If you have reached the maximum of 40 credits, you are permanently covered and can access assistance even if you stop working.

What if I have only accumulated a certain number of credits, like 28?

If you have only accumulated 28 credits, you may be covered until a certain age, but this coverage will not last indefinitely.

Why is it important to understand and verify my insured status?

Understanding and verifying your insured status is crucial to ensure you receive the benefits you deserve and to avoid denial of support due to not meeting eligibility criteria.

How can economic changes affect my work credits?

Economic changes can influence how work credits are earned, making it essential to stay informed about your coverage and maintain your work credits.

What support is available for understanding my options regarding insured status?

There is support available to help you understand your options and navigate the complexities of the SSDI application process. You are not alone in this journey.