Overview

The California Board of Equalization (BOE) plays a vital role in tax administration, ensuring fair assessments of real estate taxes. We understand that navigating tax issues can be overwhelming, especially when it affects your eligibility for financial support and benefits. This article highlights the BOE's commitment to assisting taxpayers through its various functions, including:

- Tax administration

- Appeals

- Policy development

- Public engagement

Recent reforms have been implemented to enhance transparency and efficiency, making it easier for you to find the support you need. We recognize the importance of these changes in helping you navigate complex tax situations with confidence. You are not alone in this journey; the BOE is here to help you every step of the way.

By focusing on your needs, the BOE aims to create a more supportive environment for all taxpayers. We invite you to explore the resources available and take advantage of the assistance offered. Together, we can work towards a more equitable tax experience for everyone.

Introduction

Navigating the complexities of tax administration can often feel like wandering through a labyrinth, especially for those seeking financial benefits in California. We understand that this journey can be overwhelming. The California Board of Equalization (BOE) is here to help, standing as a pivotal agency dedicated to ensuring fair tax assessments and compliance across the state.

With recent reforms aimed at enhancing transparency and efficiency, the BOE not only influences tax policy but also plays a crucial role in determining eligibility for various financial support programs.

It's common to wonder: how can you effectively leverage the resources and support offered by the BOE to navigate your unique tax challenges? You're not alone in this journey, and there are solutions available to guide you through.

Overview of the California Board of Equalization

The is a vital public agency dedicated to managing and ensuring fair assessments of real estate taxes across California's 58 counties. Established in 1879, the BOE's mission is to serve Californians through effective and efficient tax management. It plays an essential role in overseeing various taxes, including real estate taxes, the Alcoholic Beverage Tax, and the Tax on Insurers. Comprising five elected members, including the State Controller, the BOE collaborates to ensure compliance with tax laws and regulations.

We understand that navigating tax matters can be challenging, especially for those seeking benefits. Understanding the BOE's functions is crucial, as its decisions can significantly impact eligibility for . Recent updates indicate that the BOE for the fiscal year 2025-26, reflecting an 8.4% increase from the previous year. This adjustment is expected to generate around $2.8 billion in , providing essential funding for community services and educational institutions.

It's common to feel uncertain about tax policies, but the BOE is here to listen. The yearly , scheduled for August 20, 2025, invites taxpayers and stakeholders to share their experiences and recommendations regarding California's real estate tax system. This engagement underscores the BOE's commitment to fostering just and impartial evaluations, particularly for individuals facing complex tax situations.

In summary, the board of equalization California plays a crucial role in tax administration, influencing the financial landscape for benefits seekers. By ensuring that tax policies are implemented fairly and effectively, the BOE is dedicated to supporting you in this journey.

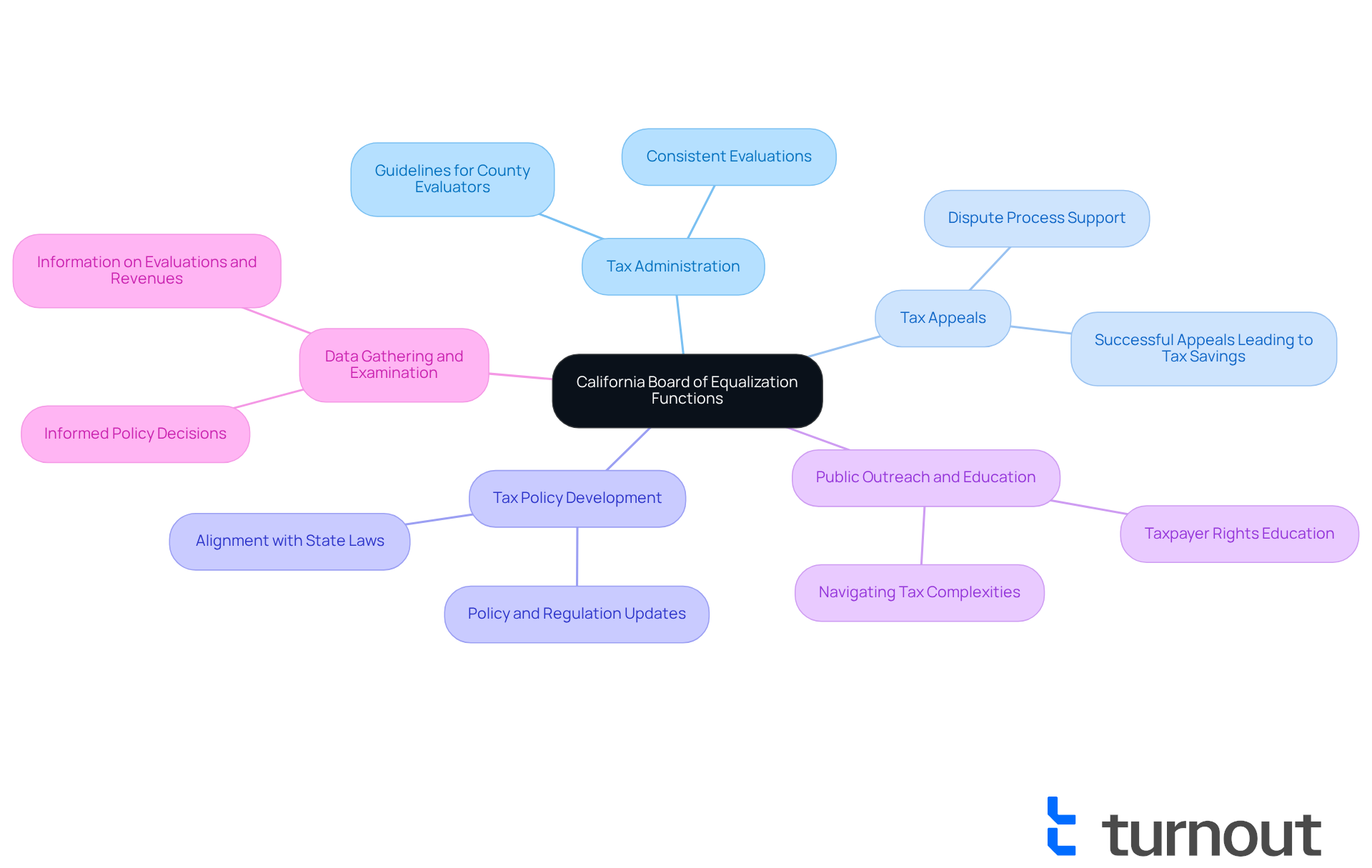

Functions and Responsibilities of the BOE

The plays a crucial role in and compliance across our state. We understand that navigating can be overwhelming, and the board of equalization California is available to help. Its primary functions include:

- Tax Administration: The BOE guarantees consistent real estate tax evaluations throughout California's 58 counties, offering vital guidelines and supervision to county evaluators. This consistency is essential for maintaining fairness in tax obligations according to the board of equalization California.

- : If you are disputing your real estate tax evaluations, the board of equalization California aids the appeals procedure. This enables you to contest your asset valuations, ensuring they reflect precise market conditions. Many taxpayers have successfully contested their evaluations in recent years, leading to significant tax decreases. In fact, the board of equalization California has reported that successful appeals have resulted in millions in tax savings for residents of California.

- Tax Policy Development: The board of equalization California is responsible for developing policies and regulations that govern tax administration, ensuring alignment with state laws and the public interest. This includes ongoing updates to adapt to changing economic conditions and your needs as a taxpayer.

- : Engaging in outreach efforts, the board of equalization California educates taxpayers about their rights and responsibilities, helping you navigate the complexities of the tax system. This initiative is especially beneficial for individuals unfamiliar with tax processes related to real estate.

- Data Gathering and Examination: The BOE gathers and examines information related to and tax revenues, which informs policy decisions and public reporting. As of January 1, 2024, California's total statewide evaluated real estate value reached $8.7 trillion, contributing to around $97.9 billion in tax revenue. This highlights the significance of precise evaluations for local funding.

Understanding these functions enables you to effectively utilize the board of equalization California's resources, whether you are challenging a tax evaluation or seeking information on available . The commitment of the board of equalization California to transparency and fairness is essential for ensuring that all taxpayers receive equitable treatment. Additionally, as the only elected tax board in the United States, the board of equalization California holds a unique position of accountability. We encourage you to participate in the upcoming on August 20, 2025, to voice your concerns and suggest improvements. You are not alone in this journey; we are here to support you.

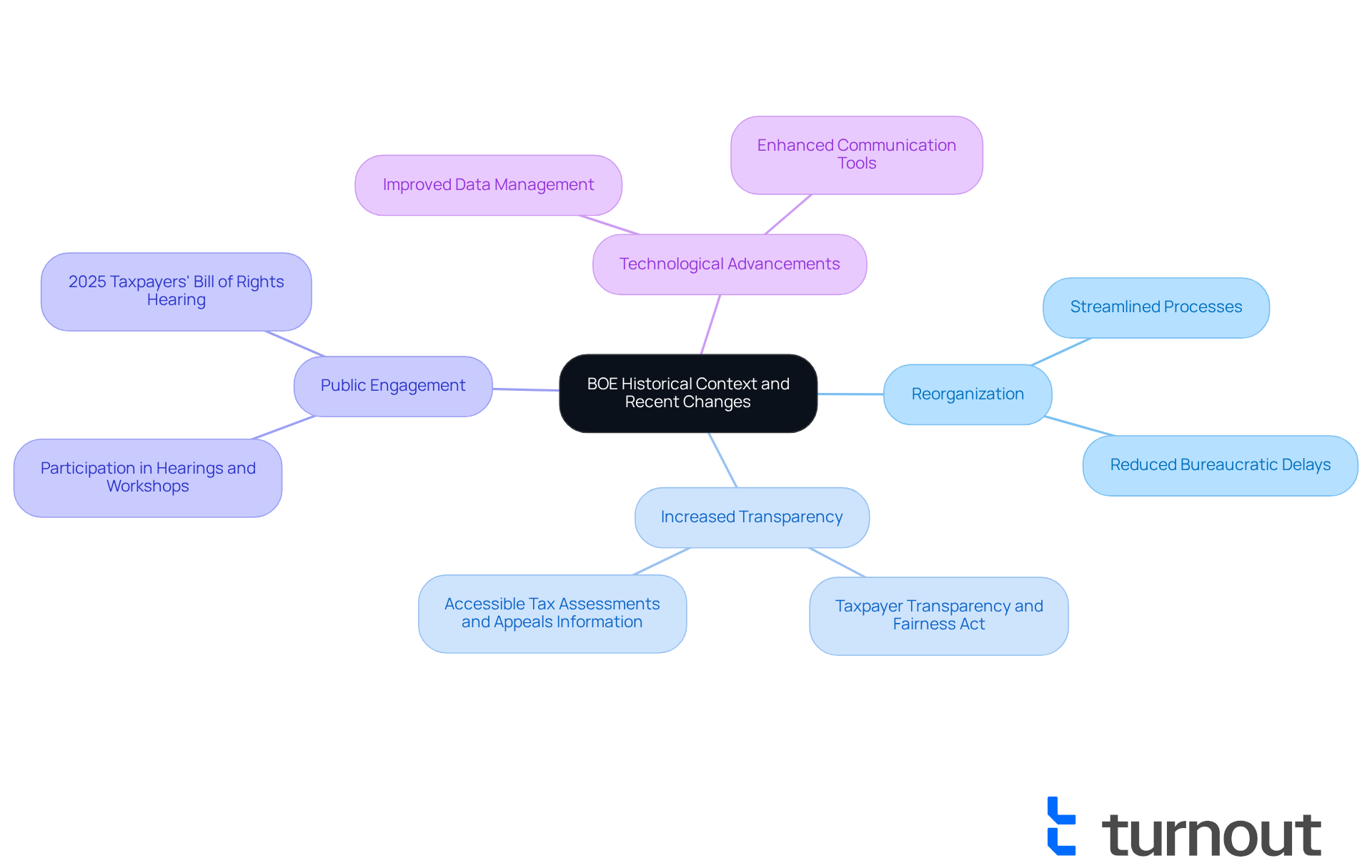

Historical Context and Recent Changes in the BOE

Since its inception in 1879, the has undergone significant changes. We understand that navigating can be challenging, and the BOE was originally assigned to guarantee fairness in this process. However, the agency has faced numerous obstacles, including claims of mismanagement and inefficiency. In light of these concerns, have been implemented to within the agency.

- Reorganization: To better serve you, the BOE has restructured its operations, focusing on . This change aims to improve efficiency and responsiveness.

- Increased Transparency: Recent initiatives have aimed to make the BOE's operations more transparent. We want you to access information about tax assessments and appeals easily. The has been pivotal in highlighting issues with the BOE's reporting, underscoring the need for these reforms.

- Public Engagement: The BOE is committed to engaging with the public. We invite you to participate in hearings and workshops where your feedback is valued. You can join the upcoming in person, by phone, or online, emphasizing our dedication to accessibility.

- Technological Advancements: New technologies have been adopted to improve data management and communication. This makes it easier for you to interact with the BOE and access the support you need.

These changes reflect our commitment to serving Californians more effectively as guided by the board of equalization California. We recognize the growing need for accessible information and support for those . It's important to note that in 2018, taxpayers prevailed in only 3% of appeals, which highlights the necessity for these reforms. Additionally, serious errors in tax allocation further emphasize the need for a more accountable and transparent agency. Remember, you are not alone in this journey; we are here to help.

Conclusion

The California Board of Equalization (BOE) plays a vital role in ensuring fair tax administration and equitable assessments across our state. We understand that navigating tax regulations can be overwhelming, especially for those seeking benefits who depend on accurate evaluations and potential tax relief options. By familiarizing yourself with the BOE's functions and responsibilities, you can feel more empowered to manage these complexities and advocate for your rights.

Throughout this article, we explored key points about the BOE's essential functions, including:

- Tax administration

- Appeals

- Policy development

- Public outreach

- Data gathering

Recent reforms aimed at enhancing transparency and accountability within the agency reflect its commitment to serving Californians better. Engaging with the community through events like the Taxpayers' Bill of Rights Hearing demonstrates the BOE's dedication to listening to taxpayer concerns and improving the overall tax experience.

Ultimately, the significance of the California Board of Equalization extends far beyond mere tax administration. It stands as a cornerstone for financial fairness, ensuring that taxpayers are treated equitably and have access to the necessary resources and support. By actively participating in the BOE's initiatives and staying informed about tax policies, you can empower yourself and contribute to a more just tax system in California. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What is the California Board of Equalization (BOE)?

The California Board of Equalization is a public agency responsible for managing tax administration and ensuring fair assessments of real estate taxes across California's 58 counties.

When was the BOE established?

The BOE was established in 1879.

What is the mission of the BOE?

The mission of the BOE is to serve Californians through effective and efficient tax management.

What types of taxes does the BOE oversee?

The BOE oversees various taxes, including real estate taxes, the Alcoholic Beverage Tax, and the Tax on Insurers.

How is the BOE structured?

The BOE is comprised of five elected members, including the State Controller.

What recent financial updates has the BOE announced?

The BOE adopted $167.2 billion in state-assessed asset values for the fiscal year 2025-26, reflecting an 8.4% increase from the previous year, which is expected to generate around $2.8 billion in real estate tax revenue.

How does the BOE impact taxpayers and benefits seekers?

The BOE's decisions can significantly impact eligibility for financial support and tax relief options for taxpayers and benefits seekers.

What is the Taxpayers' Bill of Rights Hearing?

The Taxpayers' Bill of Rights Hearing is an annual event where taxpayers and stakeholders can share their experiences and recommendations regarding California's real estate tax system. The next hearing is scheduled for August 20, 2025.

What is the BOE's commitment to taxpayers?

The BOE is committed to fostering just and impartial evaluations, particularly for individuals facing complex tax situations.