Overview

We understand that navigating tax obligations can be overwhelming. A tax levy is the government's legal authority to seize a taxpayer's property or assets to satisfy unpaid tax debts. This is different from a tax lien, which simply signifies a claim against property. Recognizing this distinction is crucial.

The article outlines the processes involved in tax levies, the rights of taxpayers, and the serious financial implications of failing to address tax obligations promptly. It's common to feel anxious about these matters, but understanding these concepts is vital for effective financial management. Remember, you're not alone in this journey, and we're here to help you navigate these challenges with confidence.

Introduction

Understanding the complexities of tax assessments can feel overwhelming, especially in a world where financial stability is often precarious. A tax levy, which many see as a daunting threat, represents the government's power to seize assets to satisfy unpaid taxes. This can leave individuals grappling with immediate financial repercussions. We understand that this situation can be distressing.

In this article, we will delve into the nuances of tax levies. We’ll explore their implications, clarify how they differ from tax liens, and highlight the essential rights you possess during this challenging process. It’s common to feel lost in these circumstances, but remember, you are not alone in this journey.

So, how can you effectively navigate the treacherous waters of tax assessments and protect your financial well-being? We’re here to help you find the answers and regain your peace of mind.

Define Tax Levy: Core Concepts and Implications

A tax assessment can be a daunting experience, initiated by the government, particularly the Internal Revenue Service (IRS), to seize a taxpayer's property or assets in order to satisfy an outstanding tax debt. We understand that this process can feel overwhelming, as it allows the IRS to collect unpaid taxes through methods like garnishing wages, seizing funds from bank accounts, or taking possession of other assets. Unlike a tax lien, which serves as a claim against property to ensure payment, a seizure means the actual physical confiscation of property. This differentiation is crucial for individuals who pay taxes, as a charge can lead to immediate and significant financial consequences.

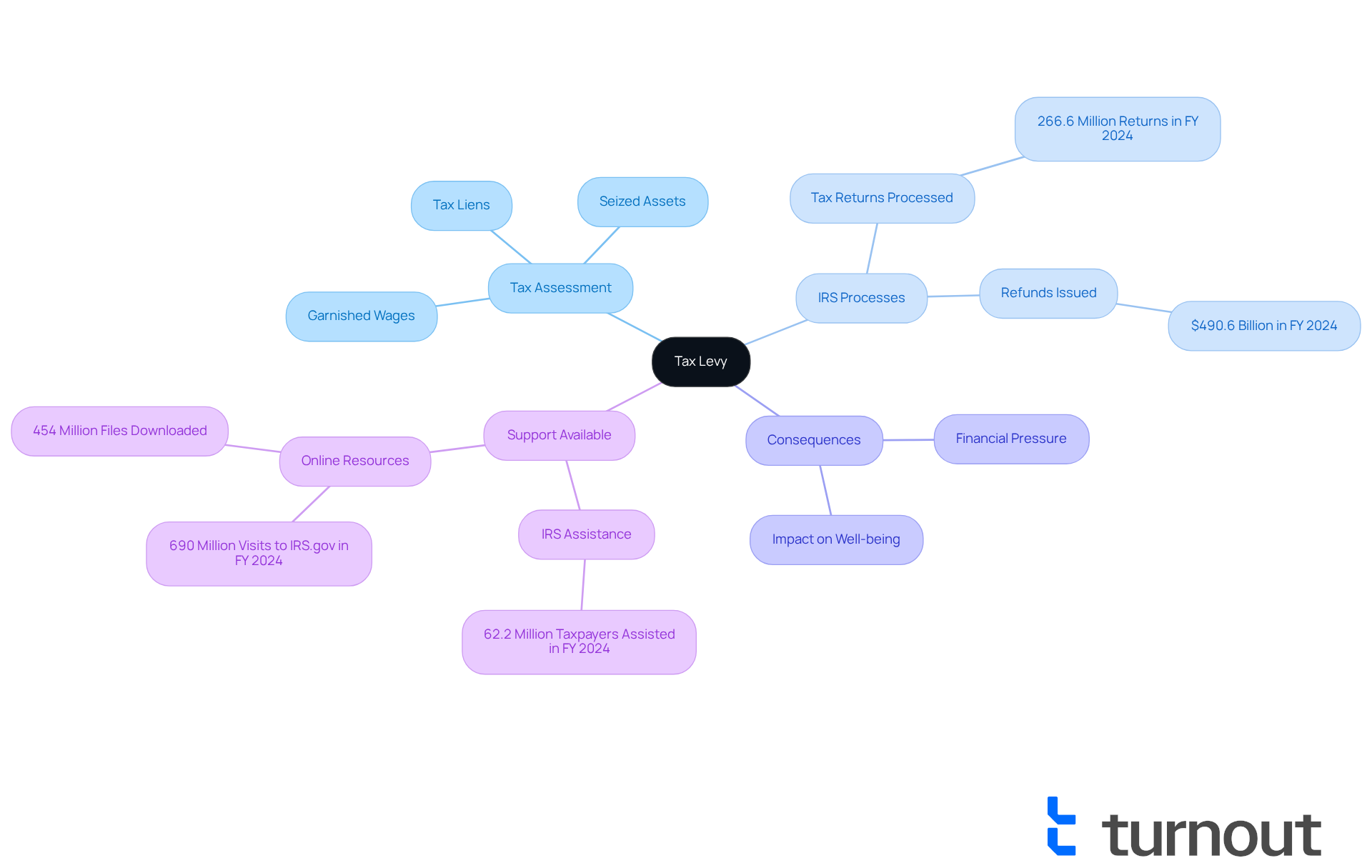

In 2024, the IRS processed over 266.6 million tax returns and issued nearly $490.6 billion in refunds. This highlights the scale of IRS operations and the importance of understanding the tax levy meaning within the broader tax system. The IRS also provided assistance to around 62.2 million individuals through calls or visits, demonstrating the support available for those facing tax challenges, including garnishments. It's common to feel the weight of tax assessments; for instance, individuals facing a charge may experience garnished wages, which can significantly reduce disposable income and increase financial pressure. Tax experts emphasize that understanding the tax levy meaning and the implications of a tax seizure is vital for effective financial planning and management. As one specialist pointed out, 'The consequences of a tax imposed can disturb not only financial stability but also personal well-being.'

Practical examples illustrate this: individuals who have encountered financial assessments often report considerable difficulties in managing their everyday expenses. This underscores the importance of addressing tax obligations before they escalate into severe actions. Remember, you are not alone in this journey; seeking help can make a world of difference.

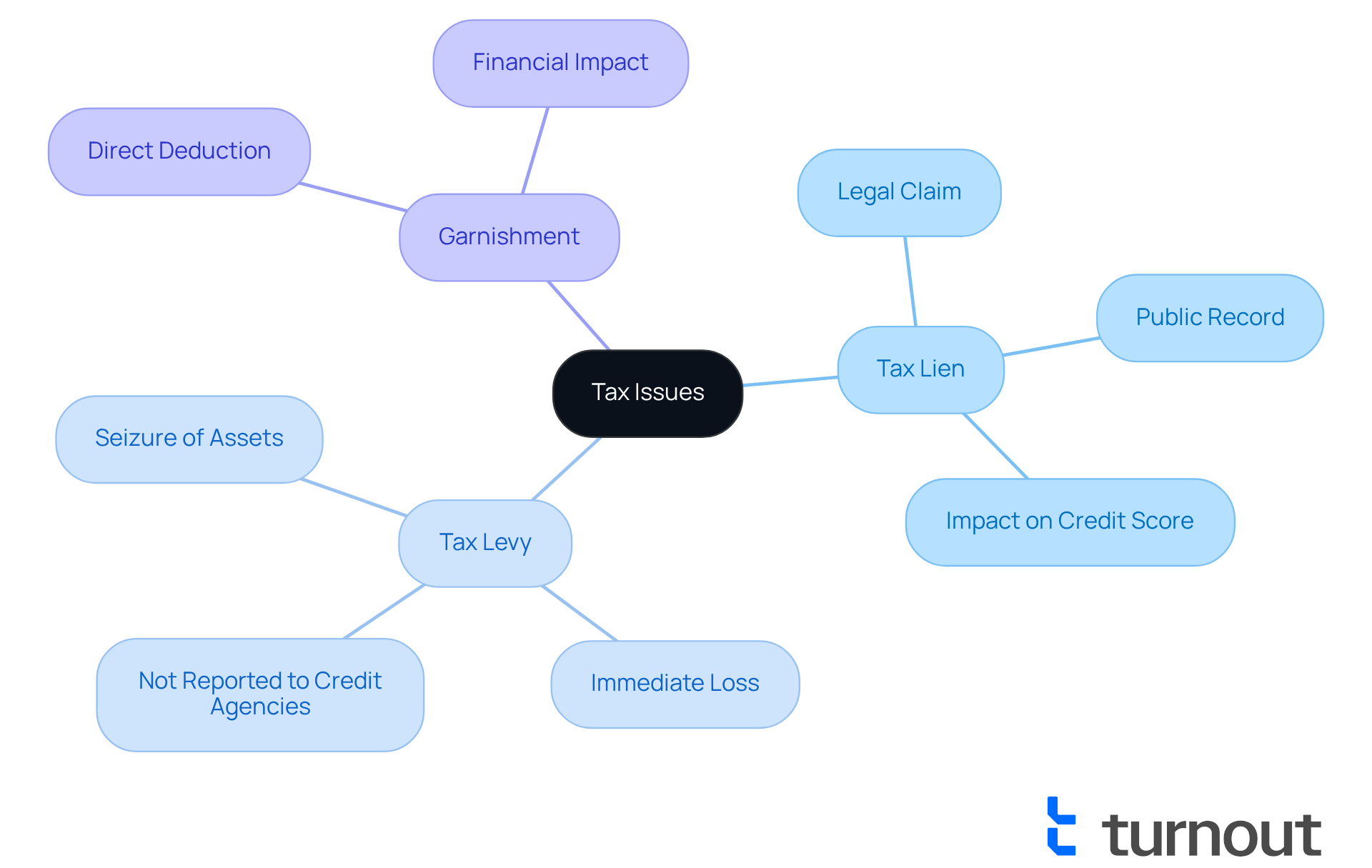

Differentiate Tax Levy from Tax Lien and Other Related Terms

Understanding tax issues can be overwhelming, and it's important to grasp the differences between a tax levy and a tax lien. A tax lien represents a legal claim against your property, signaling to other creditors that the IRS has a right to your assets until the debt is settled. This can restrict your ability to sell or refinance your property, as it becomes a public record and may impact your credit score negatively. On the other hand, the tax levy meaning relates to a tax assessment that involves the actual seizure of assets, which can lead to an immediate loss of funds or property. While a charge is not reported to credit agencies, it can still result in significant financial loss.

You might have heard the term 'garnishment.' This refers to the process of deducting money directly from your wages or bank account to satisfy a debt. It's a type of charge that can greatly affect your financial situation.

Recognizing these distinctions is crucial for anyone facing tax problems. Each term carries specific implications. Many taxpayers are unaware of the differences between tax liens and enforcement actions, which can lead to serious financial consequences if not addressed. If you receive a Notice of Federal Tax Lien, it's a signal that further action, like a seizure, may follow if the debt remains unpaid.

Consider this: a taxpayer with an unpaid tax debt may first face a lien, which limits their ability to refinance their home. If the lien isn't resolved, the IRS could proceed to seize funds directly from their bank account or earnings. This progression underscores the importance of taking prompt action to address tax debts and comprehend the tax levy meaning to avoid the serious repercussions tied to both liens and collections.

But remember, there are options available. Taxpayers have alternatives such as an Offer in Compromise or a payment plan to stop enforcement actions. It's essential to know that both lien and enforcement actions require the IRS to notify you before taking further steps. Additionally, a timely Collection Due Process hearing can pause a garnishment while your appeal is being reviewed. You're not alone in this journey, and we're here to help you navigate these challenges.

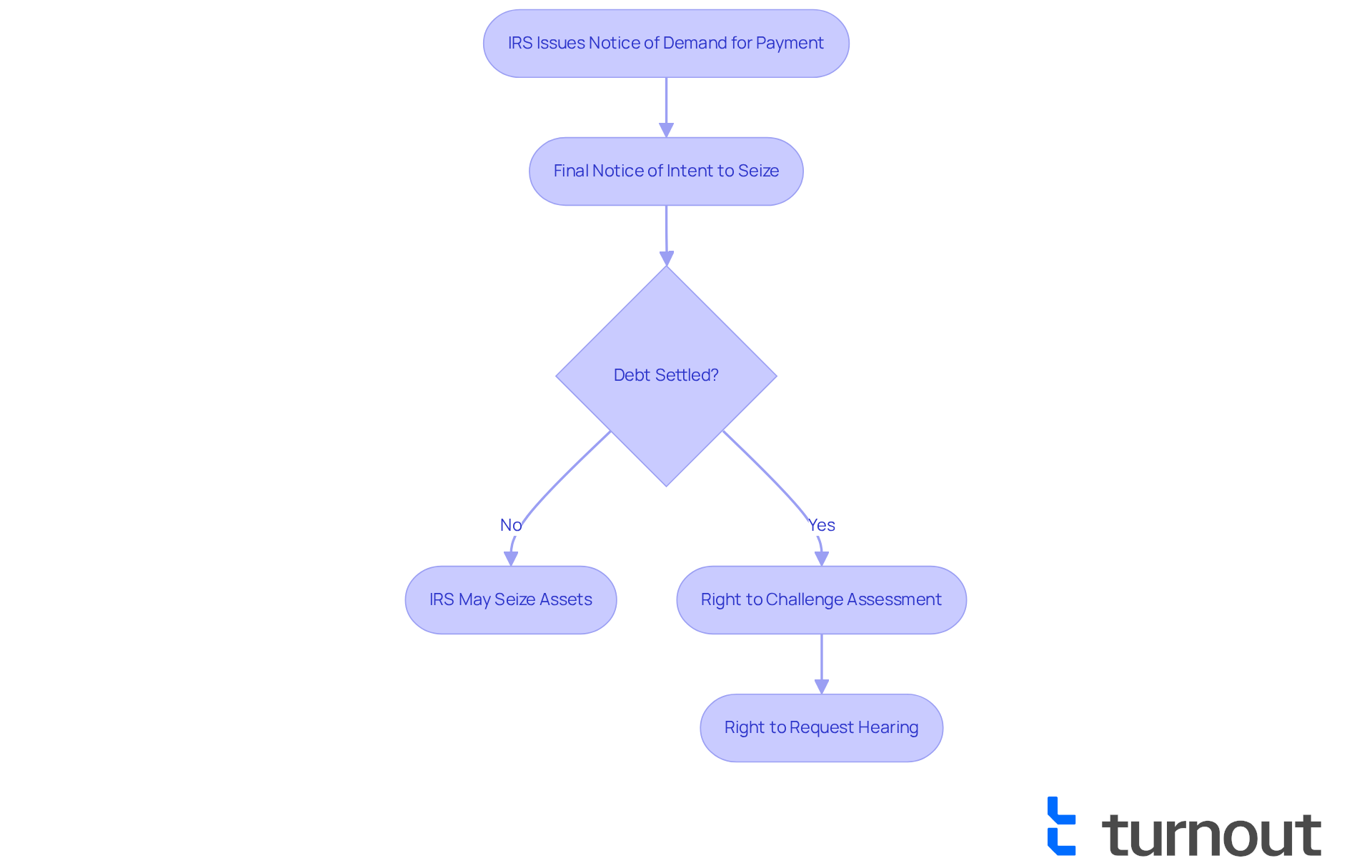

Outline the Tax Levy Process: Key Steps and Consumer Rights

Navigating the tax assessment procedure can be daunting, and it’s essential for individuals responsible for taxes to understand the steps involved. Initially, the IRS issues a series of notices, starting with a Notice of Demand for Payment. This notice informs you about your outstanding tax debt. If the debt remains unsettled, the IRS sends a Final Notice of Intent to Seize, providing one last opportunity for you to resolve the matter before any seizure occurs. Once the tax is implemented, the IRS has the authority to confiscate assets, including bank funds and salaries.

Throughout this process, it’s important to remember that you have rights. You have the right to:

- Challenge the assessment, allowing you to dispute the IRS's actions.

- Request a hearing to discuss your financial circumstances, ensuring that your situation is taken into account.

Understanding these rights is crucial for effectively navigating the process of tax levy meaning and advocating for yourself.

For example, you have the right to expect that the IRS will consider your objections and documentation promptly and fairly. This is illustrated in the case study titled 'The Right to Challenge the IRS's Position and Be Heard,' where individuals successfully raised objections and received prompt responses from the IRS. Moreover, the Taxpayer Advocate Service emphasizes that you are entitled to clear explanations of the laws and IRS procedures, reinforcing the importance of being informed during this challenging process.

As we approach 2025, it remains vital for you to be aware of your rights during a tax enforcement action. This includes:

- The right to contest

- The right to an equitable hearing

- The right to appoint an authorized representative of your choice to act on your behalf in interactions with the IRS

If you are experiencing financial difficulty, you can seek assistance from the Taxpayer Advocate Service if the IRS has not resolved your tax issues properly and timely. These protections empower you to navigate the complexities of tax issues with confidence, including knowing the maximum time you have to challenge the IRS’s position, as highlighted in the case study 'The Right to Finality.

Address Common Concerns: Duration, Credit Impact, and Avoidance Strategies

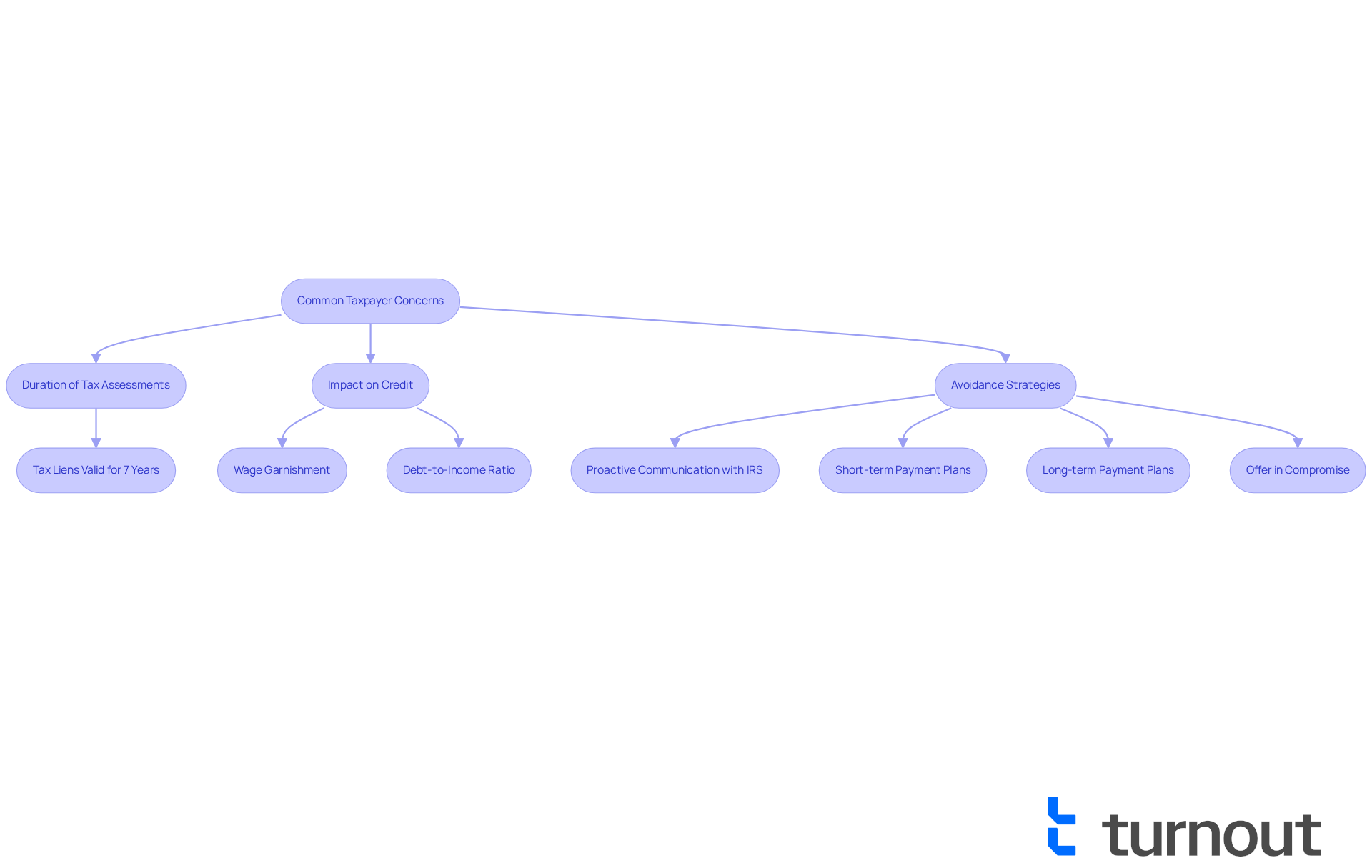

We understand that taxpayers often feel anxious about the length of a tax assessment, its potential impact on credit ratings, and ways to prevent such situations. A tax assessment can stay in effect until the related tax obligation is fully resolved, which may lead to ongoing financial challenges. Tax liens can remain valid for seven years unless a continuation is filed, adding to the complexity of tax-related issues.

It's common to feel concerned about how a tax charge may affect your credit score. While a tax charge does not directly lower credit scores, the resulting inability to meet other financial obligations can certainly impact your creditworthiness. For instance, wage garnishment—a frequent consequence of tax impositions—can reduce your take-home pay, increasing your debt-to-income ratio and complicating the management of other expenses.

Since April 2018, tax liens are no longer included in credit reports by credit reporting agencies, which is an important consideration for taxpayers. To reduce the risk of facing a tax charge, proactive communication with the IRS is essential. We encourage you to explore available payment plans, such as:

- Short-term options that allow for debt repayment within 180 days without setup fees

- Long-term plans that extend up to 72 months

Additionally, considering an Offer in Compromise can provide a pathway to settle debts for less than the total amount owed. By staying informed and taking proactive measures, you can significantly lower your chances of facing a tax levy meaning and its associated financial repercussions. Remember, you are not alone in this journey—there are resources and support available to help you navigate these challenges.

Conclusion

Understanding the intricacies of a tax levy is crucial for individuals navigating the complexities of tax obligations. We recognize that this can be a daunting experience. This article has detailed the fundamental concepts surrounding tax levies, emphasizing their implications for taxpayers and the importance of recognizing the differences between a tax levy and a tax lien. By grasping these distinctions, you can better prepare yourself to manage potential financial repercussions stemming from unpaid taxes.

Key insights include:

- The step-by-step process of a tax levy

- The rights you possess during this process

- The potential impact on credit scores

It’s common to feel overwhelmed, but the information presented highlights the urgency of addressing tax debts before they escalate into more severe actions. Proactive communication with the IRS and exploring available options, such as payment plans or Offers in Compromise, can significantly mitigate the risks associated with tax levies.

Ultimately, being informed and proactive is essential in navigating tax challenges. Remember, you are not alone in this journey; resources and support are available to help you effectively manage your tax obligations and protect your financial well-being. Taking action now can pave the way for a more secure financial future, ensuring that tax levies do not disrupt your personal stability and peace of mind.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal action initiated by the government, particularly the IRS, to seize a taxpayer's property or assets in order to satisfy an outstanding tax debt.

How does a tax levy differ from a tax lien?

A tax lien serves as a claim against property to ensure payment of taxes, while a tax levy involves the actual physical confiscation of property or assets.

What methods can the IRS use to collect unpaid taxes through a tax levy?

The IRS can collect unpaid taxes by garnishing wages, seizing funds from bank accounts, or taking possession of other assets.

What was the scale of IRS operations in 2024?

In 2024, the IRS processed over 266.6 million tax returns and issued nearly $490.6 billion in refunds, indicating the scale of its operations.

How many individuals did the IRS assist in 2024?

The IRS provided assistance to around 62.2 million individuals through calls or visits, helping those facing tax challenges, including garnishments.

What are the financial consequences of a tax levy?

A tax levy can lead to significant financial consequences, such as reduced disposable income due to garnished wages, which can increase financial pressure on individuals.

Why is it important to understand the implications of a tax levy?

Understanding the tax levy meaning and the implications of a tax seizure is vital for effective financial planning and management, as it can disturb financial stability and personal well-being.

What should individuals do if they face tax obligations?

Individuals should address their tax obligations before they escalate into severe actions, and seeking help can make a significant difference in managing the situation.