Overview

If you're feeling overwhelmed by tax debts, you're not alone. IRS tax relief programs are here to help individuals like you find a way through options such as:

- Offer in Compromise

- Installment agreements

- Penalty relief

Understanding these programs and their eligibility criteria can significantly ease your financial burdens. Many have successfully reduced their tax obligations through these initiatives, and you can too. We encourage you to explore these options and take the first step towards relief.

Introduction

Navigating the complexities of tax obligations can often feel like an uphill battle, especially for those facing financial hardships. We understand that this journey can be overwhelming.

IRS tax relief programs are here to provide crucial support, offering various options that can alleviate the burden of tax debt, including:

- Payment plans

- Potential debt forgiveness

However, many individuals remain unaware of their eligibility for these valuable resources. This raises an important question: how can you effectively tap into these programs to regain financial stability?

Understanding the ins and outs of IRS tax relief initiatives could be the key to transforming your overwhelming tax responsibilities into manageable solutions.

You're not alone in this journey, and there is help available to guide you through.

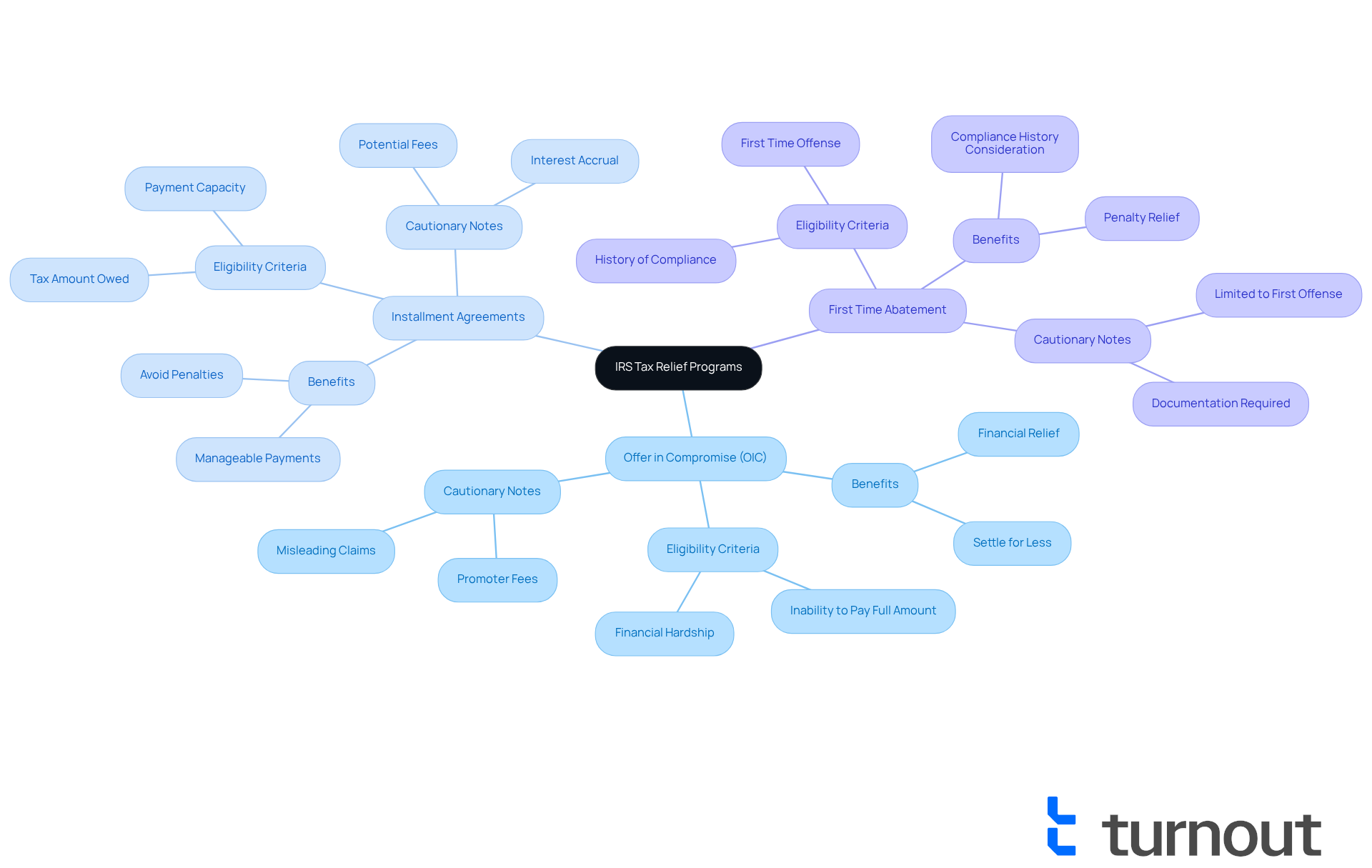

Defining IRS Tax Relief Programs

are intended to assist individuals who may be struggling to meet their tax responsibilities. We understand that , and these initiatives aim to alleviate that financial burden through various mechanisms, including , , and debt forgiveness options. By comprehending these resources, you can navigate your financial challenges more effectively and discover solutions tailored to your unique situation.

The IRS offers a variety of choices, such as:

- (OIC), which allows individuals to settle their debts for less than the total amount owed.

- Installment agreements that enable manageable payments over time.

- First Time Abatement program for those with a history of compliance, providing further assistance options.

However, it’s essential to be cautious of promoter fees charged by offer in compromise mills, which can lead to unnecessary expenses without additional benefits. Remember, if you’ve made an effort to comply with tax regulations but faced unavoidable circumstances, you may qualify for penalty assistance.

Tax specialists emphasize the importance of understanding these support options. Many individuals are unaware of their eligibility for initiatives like the OIC, resulting in missed opportunities for financial relief. For instance, one individual successfully navigated the OIC process and saw their tax obligation drop from $20,000 to just $5,000, highlighting the potential benefits of these programs.

As awareness and utilization of IRS tax relief programs grow, the IRS continues to refine these programs, ensuring that individuals can access the necessary resources to manage their tax obligations effectively. By leveraging these programs, you can find personalized solutions to your financial challenges, paving a more manageable path forward.

It’s also crucial to verify the date of IRS news items before relying on the information, as updates may not always reflect the most current guidance. Additionally, requesting an offer in compromise requires a fee of $205, although individuals with low incomes may have these fees waived. Understanding the specific eligibility criteria for the Offer in Compromise can help you evaluate your qualifications for this valuable initiative. Remember, we’re here to help, and you are not alone in this journey.

Types of IRS Tax Relief Programs

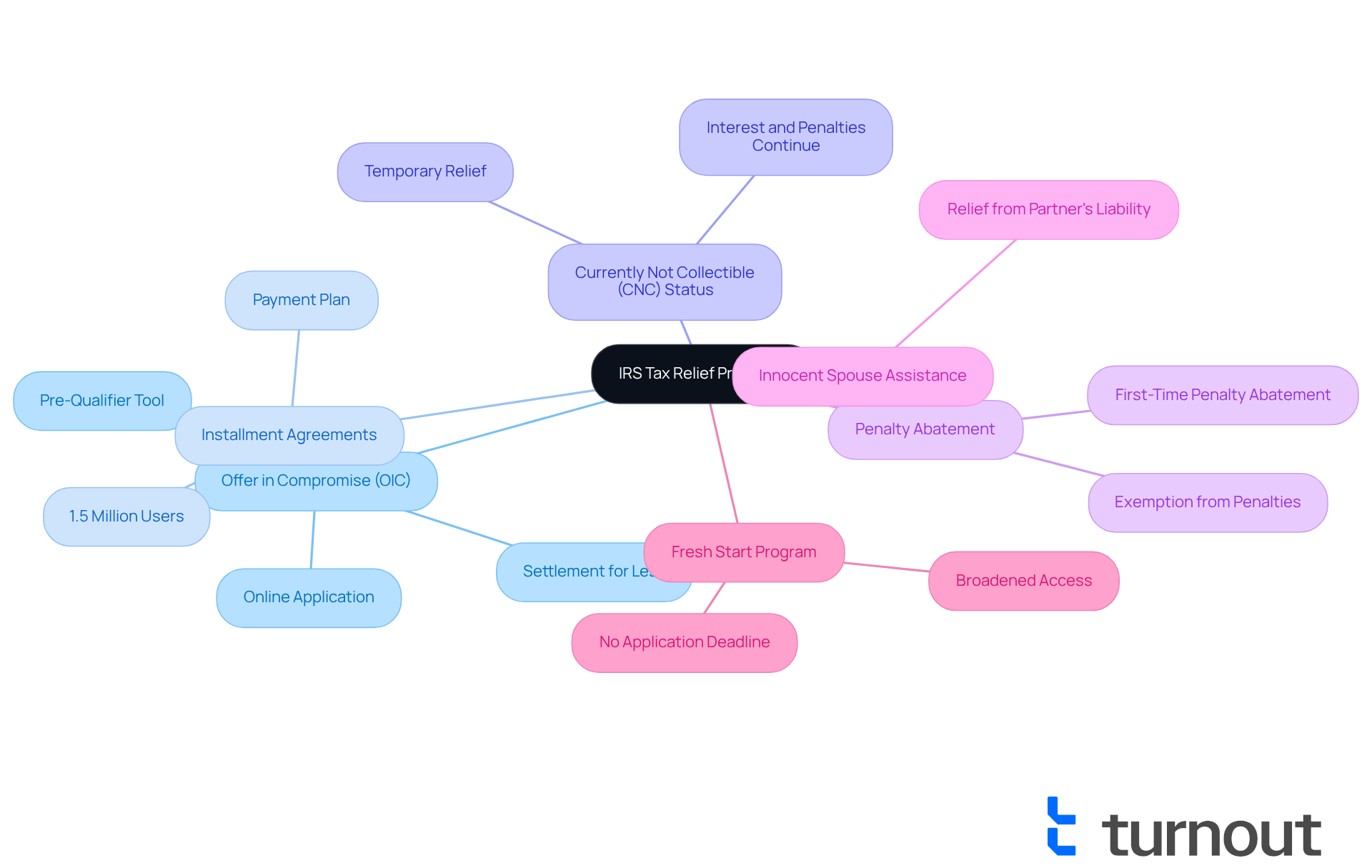

Managing tax obligations can feel overwhelming, but several key are here to help you navigate these challenges with greater ease:

- (OIC): If you’re struggling with s, this program allows you to settle for less than what you owe, based on your financial situation. In 2025, the IRS has made the OIC more accessible, allowing you to apply online and use a pre-qualifier tool to check your eligibility.

- : You can set up a payment plan to gradually pay off your tax debt, making it more manageable. As of 2025, around 1.5 million individuals are using installment agreements, a testament to their effectiveness for those facing financial difficulties.

- (CNC) Status: If you can show financial hardship, this status temporarily halts collection efforts, allowing you to focus on essential living expenses without the added stress of . Keep in mind that while in CNC status, interest and penalties will continue to accrue, but actions like levies and garnishments are paused.

- Penalty Abatement: You may qualify for exemption from penalties if you can demonstrate reasonable cause for not meeting your tax obligations. The IRS has broadened its standards, enabling more individuals to benefit from this assistance. Additionally, the First-Time Penalty Abatement policy can help you avoid specific penalties for one tax period if you have a clean compliance record for the past three years.

- Innocent Spouse Assistance: This provision allows one spouse to seek relief from tax liability incurred by the other under certain conditions, providing a safety net for those affected by their partner's tax issues.

- : This initiative broadens access to tax support options, making it easier for you to qualify for various forms of assistance. Timing is crucial; applying too late may result in enforced collection actions.

We understand that navigating these options can feel daunting. Tax advisors often highlight the effectiveness of both the Offer in Compromise and Installment Agreements as they relate to IRS tax relief programs. By proactively engaging with the IRS and understanding these options, you can take timely action to significantly reduce your tax burdens and work towards regaining your financial stability. Remember, you are not alone in this journey; we're here to help.

Eligibility Criteria for Tax Relief Programs

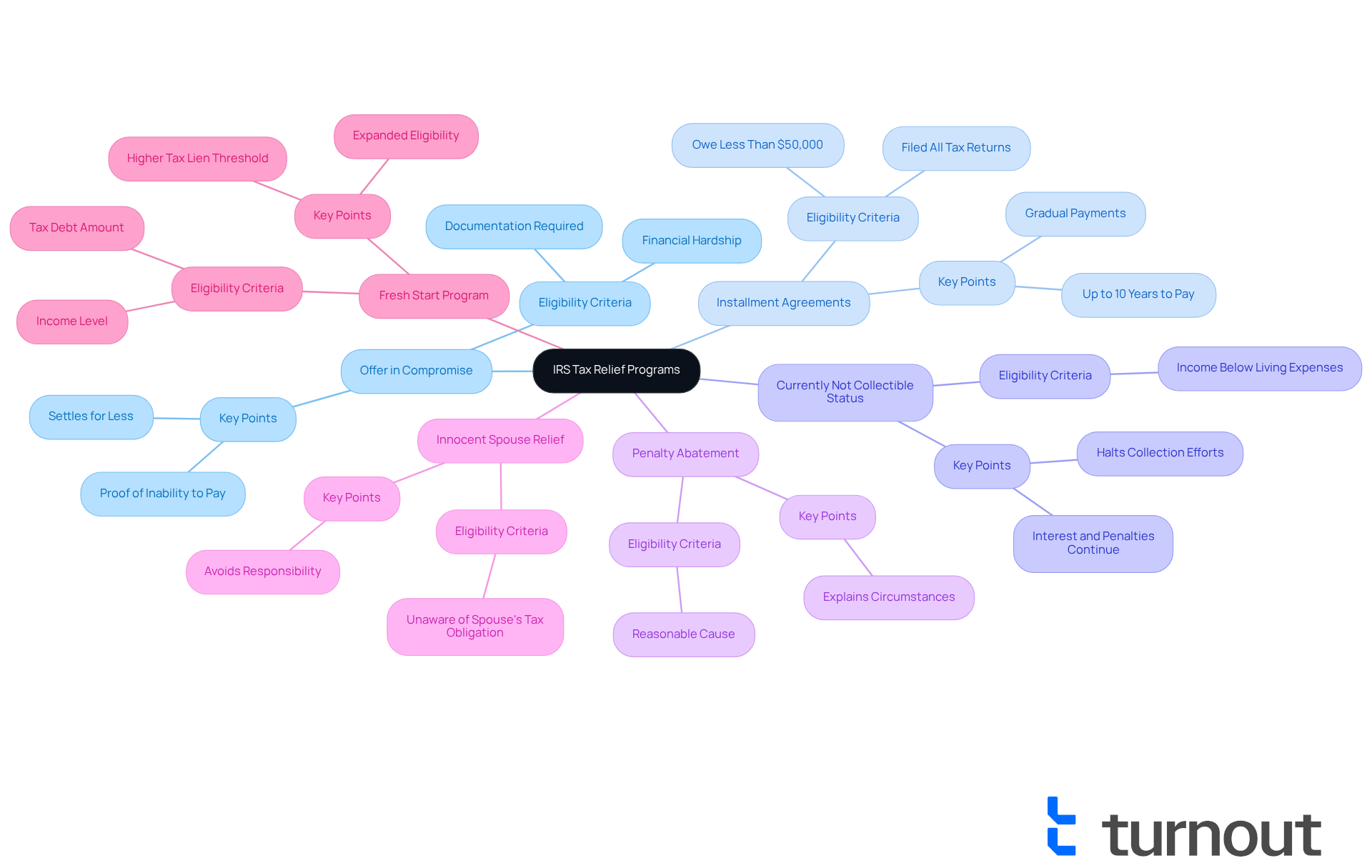

Understanding your eligibility for the may seem overwhelming, but we’re here to assist you. Each of the IRS tax relief programs has specific criteria, and knowing these can empower you to take the next steps toward relief.

- Offer in Compromise: If you’re struggling to pay the full amount owed, this option may be for you. You’ll need to show your financial situation through detailed documentation. This program is part of the IRS for less than what you owe, which can be a lifeline during tough times.

- : If you owe less than $50,000 and have filed all necessary tax returns, you may qualify for this option. It allows you to pay off your debts gradually, often through manageable monthly payments.

- : If your income isn’t enough to cover basic living expenses, this status could provide temporary relief. It halts collection efforts, though it’s important to note that interest and penalties will still accrue.

- : If you have a reasonable cause for not meeting your tax obligations, this may be an avenue worth exploring. Life can throw unexpected challenges your way, and you deserve a chance to explain your situation.

- Innocent Spouse Relief: If you were unaware of a tax obligation incurred by your spouse, this relief can help. It allows you to avoid responsibility for debts you didn’t know about, providing some peace of mind.

- : This initiative has expanded eligibility, allowing more individuals to qualify based on their financial circumstances. If you’ve been disqualified in the past, it’s worth looking into the IRS tax relief programs again.

It's common to feel uncertain about your financial situation when seeking assistance. Many applicants find it challenging to demonstrate financial hardship, especially when detailed records are required. However, understanding these criteria and gathering the necessary documentation can significantly increase your chances of receiving the help you need. Remember, you are not alone in this journey, and there are resources available to support you.

Applying for IRS Tax Relief Programs

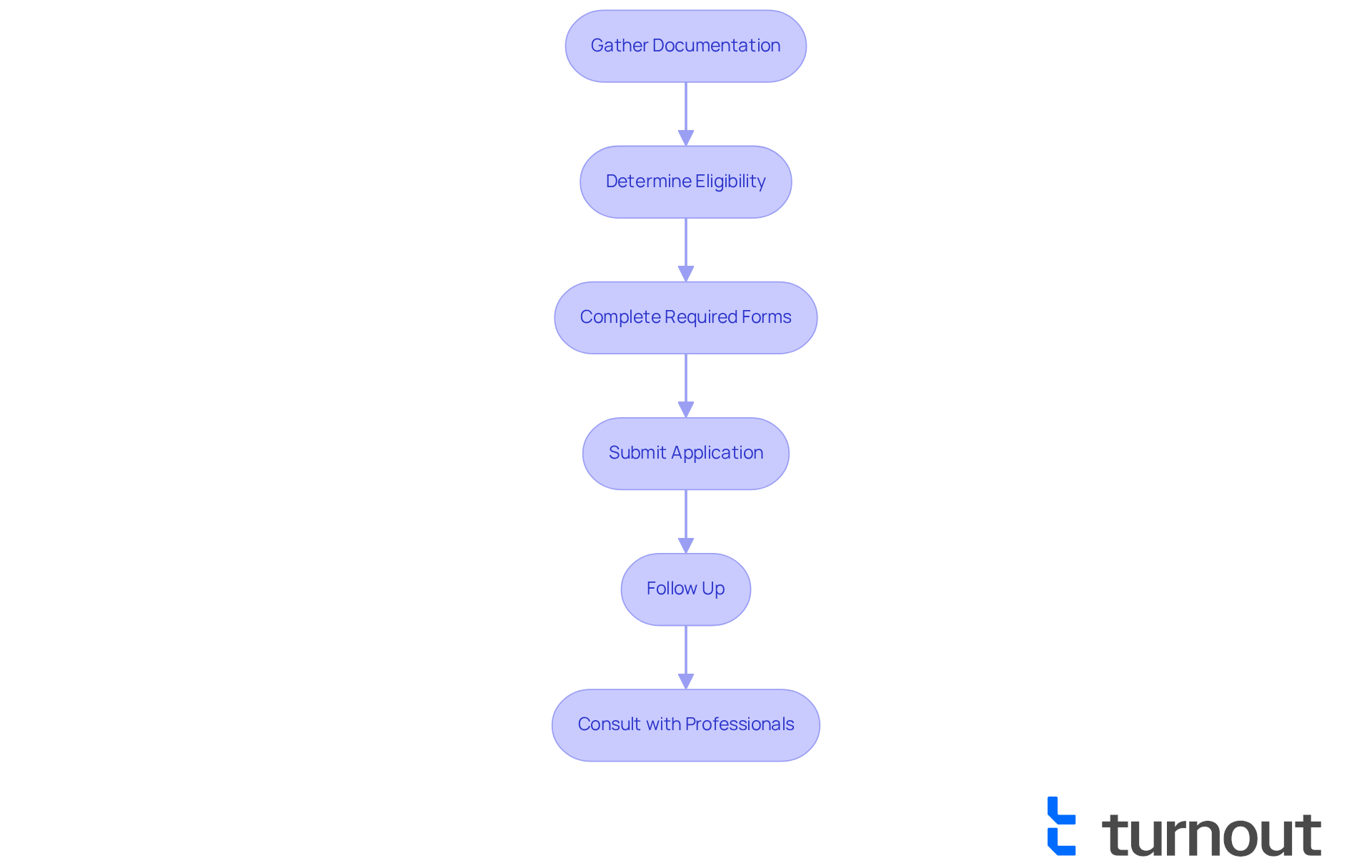

Applying for may seem overwhelming, but approaching it step by step can make the process more manageable. Here’s how you can navigate this journey with confidence:

- : Start by collecting all relevant financial documents, such as income statements, expenses, and tax returns. Precise documentation is crucial, as the IRS assesses your ability to pay based on your financial situation.

- Determine Eligibility: Take a moment to review the eligibility criteria for the specific assistance initiative. For instance, the requires individuals to demonstrate circumstances like uncertainty regarding collectibility or efficient tax management.

- Complete Required Forms: Depending on the initiative, you may need to fill out specific forms, like Form 656 for an Offer in Compromise or Form 9465 for an installment agreement. Ensuring all forms are completed correctly can significantly impact your application’s outcome.

- Submit Application: You can submit your application online through the IRS website or by mail, depending on the initiative. Remember, is essential to avoid penalties and interest on unpaid taxes.

- Follow Up: After submitting your application, keep an eye on its status and respond promptly to any requests for additional information from the IRS. This proactive approach can help prevent delays in processing.

- : If your case is complex, seeking assistance from knowledgeable advocates can be invaluable. Professional guidance can clarify eligibility and lead to tailored solutions that suit your individual circumstances.

Real-world examples illustrate the potential benefits of these initiatives. For instance, one individual successfully reduced their tax liability by over 90% through the Offer in Compromise program, showcasing the possibility for significant relief. Another person benefited from a First-Time Penalty Abatement, which lowered their total debt and established a manageable monthly payment plan.

By following these steps and utilizing available resources, you can effectively . Remember, you're not alone in this journey, and we're here to help you work towards resolving your tax obligations.

Conclusion

Understanding IRS tax relief programs is crucial for those experiencing financial challenges related to tax obligations. These programs offer various paths to relief, such as:

- Offer in Compromise

- Installment agreements

- Penalty abatement options

By familiarizing yourself with these resources, you can take proactive steps to alleviate your tax burdens and work toward regaining financial stability.

Throughout this article, we’ve shared key insights about the types of IRS tax relief programs available, the specific eligibility criteria for each, and the application process. From the Offer in Compromise that can significantly reduce tax debts to the Currently Not Collectible status that halts collection efforts, these programs are designed to assist individuals like you. Real-world examples illustrate the transformative potential of these initiatives, showing that relief is attainable for many.

Ultimately, the importance of IRS tax relief programs cannot be overstated. They serve as a lifeline for individuals grappling with tax debt, offering hope and solutions tailored to your unique situation. If you're facing challenges, remember that you are not alone in this journey. Explore these options, seek professional guidance, and take action to secure the relief you deserve.

Frequently Asked Questions

What are IRS tax relief programs?

IRS tax relief programs are initiatives designed to assist individuals who are struggling to meet their tax responsibilities, offering various mechanisms such as payment plans, penalty relief, and debt forgiveness options.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) allows individuals to settle their tax debts for less than the total amount owed, providing a potential way to alleviate financial burdens.

What are installment agreements?

Installment agreements are arrangements that enable taxpayers to make manageable payments over time, rather than paying their tax debt in a single lump sum.

Who can benefit from the First Time Abatement program?

The First Time Abatement program is available for individuals with a history of compliance who may need additional assistance with their tax obligations.

What should I be cautious about when seeking tax relief?

Individuals should be cautious of promoter fees charged by offer in compromise mills, as these can lead to unnecessary expenses without providing additional benefits.

How can I qualify for penalty assistance?

If you have made an effort to comply with tax regulations but have faced unavoidable circumstances, you may qualify for penalty assistance from the IRS.

Why is it important to understand IRS tax relief options?

Many individuals are unaware of their eligibility for programs like the OIC, which can lead to missed opportunities for financial relief. Understanding these options can help navigate financial challenges more effectively.

What is the fee for requesting an Offer in Compromise?

There is a fee of $205 to request an Offer in Compromise, although individuals with low incomes may have this fee waived.

How can I verify the accuracy of IRS news items?

It is crucial to verify the date of IRS news items before relying on the information, as updates may not always reflect the most current guidance.

What should I do if I need help with my tax obligations?

If you need assistance with your tax obligations, it is recommended to seek help from tax specialists who can guide you through the available relief programs and evaluate your qualifications.