Overview

This article aims to help you understand the amounts and eligibility criteria for Social Security Disability Benefits (SSDI). These benefits are designed to provide financial support for individuals who are unable to work due to medical conditions. We recognize that navigating this process can feel overwhelming, and we’re here to guide you through it.

Eligibility for SSDI can be complex, and it’s important to know the requirements that determine if you qualify. The amount you may receive is calculated based on your work history and earnings. Additionally, understanding the impact of your income on these benefits is crucial. It’s common to feel confused about how these factors interact, but we want to reassure you that support is available.

The application process can be daunting, filled with forms and requirements that may seem insurmountable. However, you are not alone in this journey. Many have successfully navigated the system, and with the right information and support, you can too. Remember, reaching out for help is a sign of strength. If you have questions or need assistance, don’t hesitate to seek guidance. You deserve the support you need to move forward.

Introduction

Understanding Social Security Disability Benefits is crucial for individuals facing the challenges of long-term medical conditions that hinder their ability to work. We understand that navigating this landscape can be overwhelming. These benefits provide essential financial support, yet the complexities surrounding eligibility and benefit calculations can leave many feeling lost. How can one find their way through this intricate web of requirements and ensure they receive the support they deserve?

This article delves into the specifics of Social Security Disability Benefits, offering clarity on eligibility criteria, benefit amounts, and the impact of income. Our goal is to empower you to take informed steps toward securing your financial future. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Define Social Security Disability Benefits

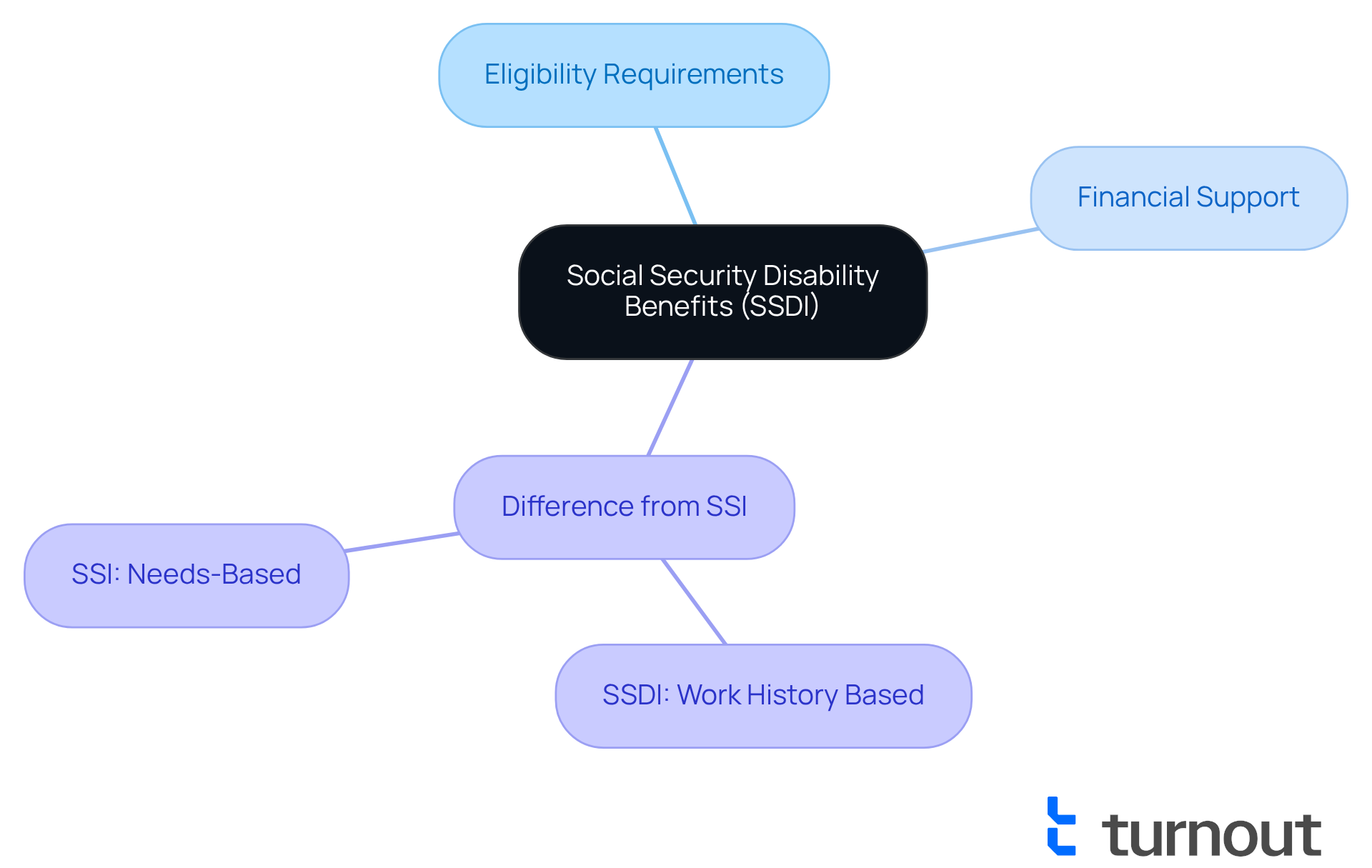

Social Security Disability Benefits (SSDI) provide essential monthly payments to individuals who are unable to work due to a medical condition, with the [social security benefits disability amount](https://blog.turnout.co/understanding-high-blood-pressure-va-rating-for-veterans-benefits) being a critical factor in their support. This condition is expected to last for at least one year or may even lead to death. We understand that navigating this process can be overwhelming, and the social security benefits disability amount is designed to offer financial support to those who have contributed to the Social Insurance system through their work history.

It's important to note that SSDI is different from Supplemental Income (SSI), which is a needs-based program for individuals with limited income and resources. Understanding this distinction is vital for applicants, as it directly impacts their eligibility and the types of benefits they may receive. Remember, you are not alone in this journey; we’re here to help you through the process and ensure you get the support you need.

Outline Eligibility Requirements for Disability Benefits

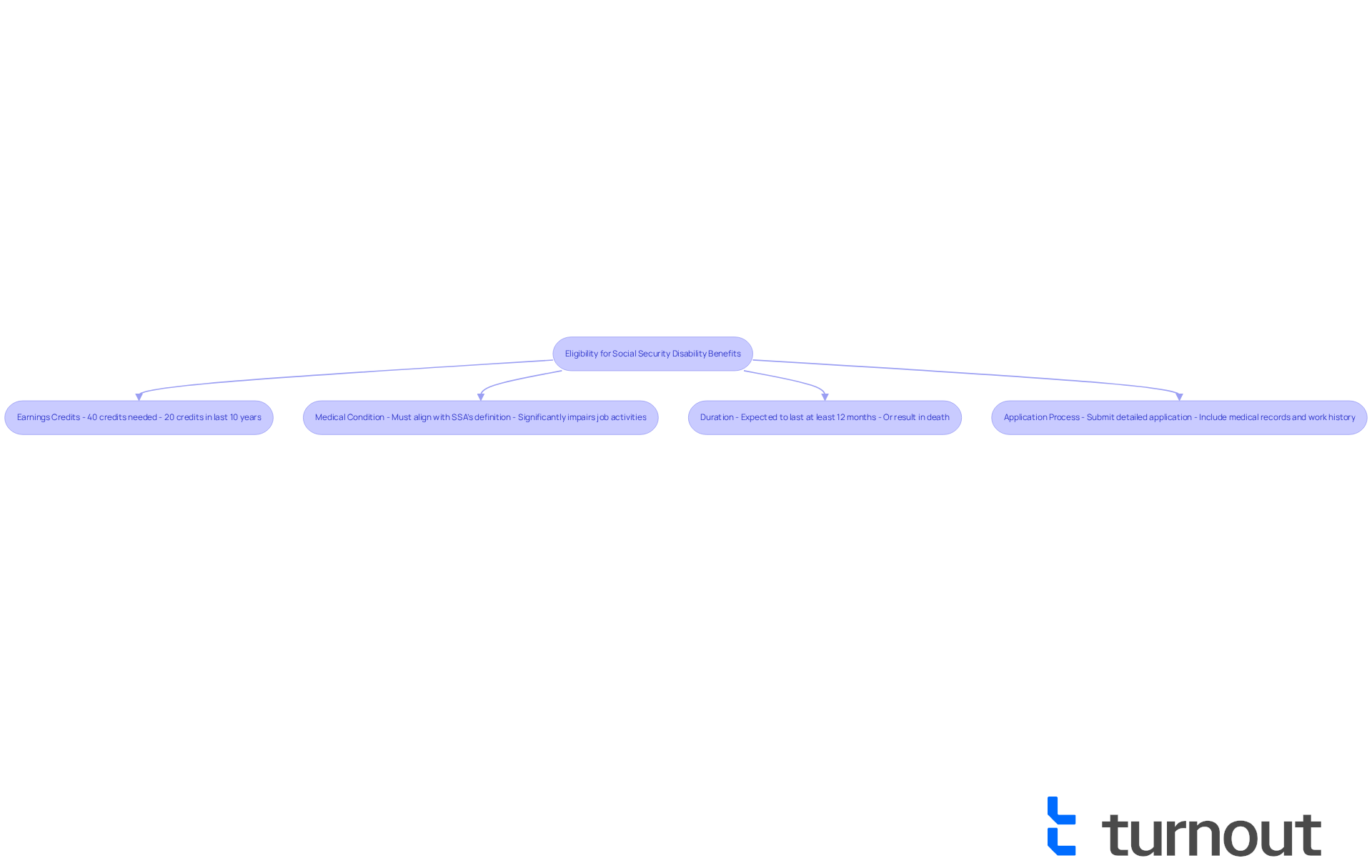

To qualify for Social Security Disability Benefits, it's important to understand the specific criteria that you must meet:

- Earnings Credits: Typically, you will need to have obtained 40 earning credits, with 20 of those credits acquired in the past 10 years before your disability began. If you are younger, you may qualify with fewer credits.

- Medical Condition: Your medical condition must align with the SSA's definition of disability, meaning it should significantly impair your ability to perform essential job activities.

- Duration: The condition should be expected to last at least 12 months or result in death.

- Application Process: You will need to submit a detailed application, including your medical records and work history, to demonstrate your eligibility.

We understand that navigating the SSD claims process can feel overwhelming. At Turnout, our trained nonlawyer advocates are here to support you in understanding these eligibility requirements. We guide you through the application process for the social security benefits disability amount, ensuring you have the assistance you need to pursue your benefits. Remember, you are not alone in this journey. Please note that Turnout is not a law firm and does not provide legal advice; our services are designed to help you navigate the SSD claims process effectively.

Explain How Benefit Amounts Are Calculated

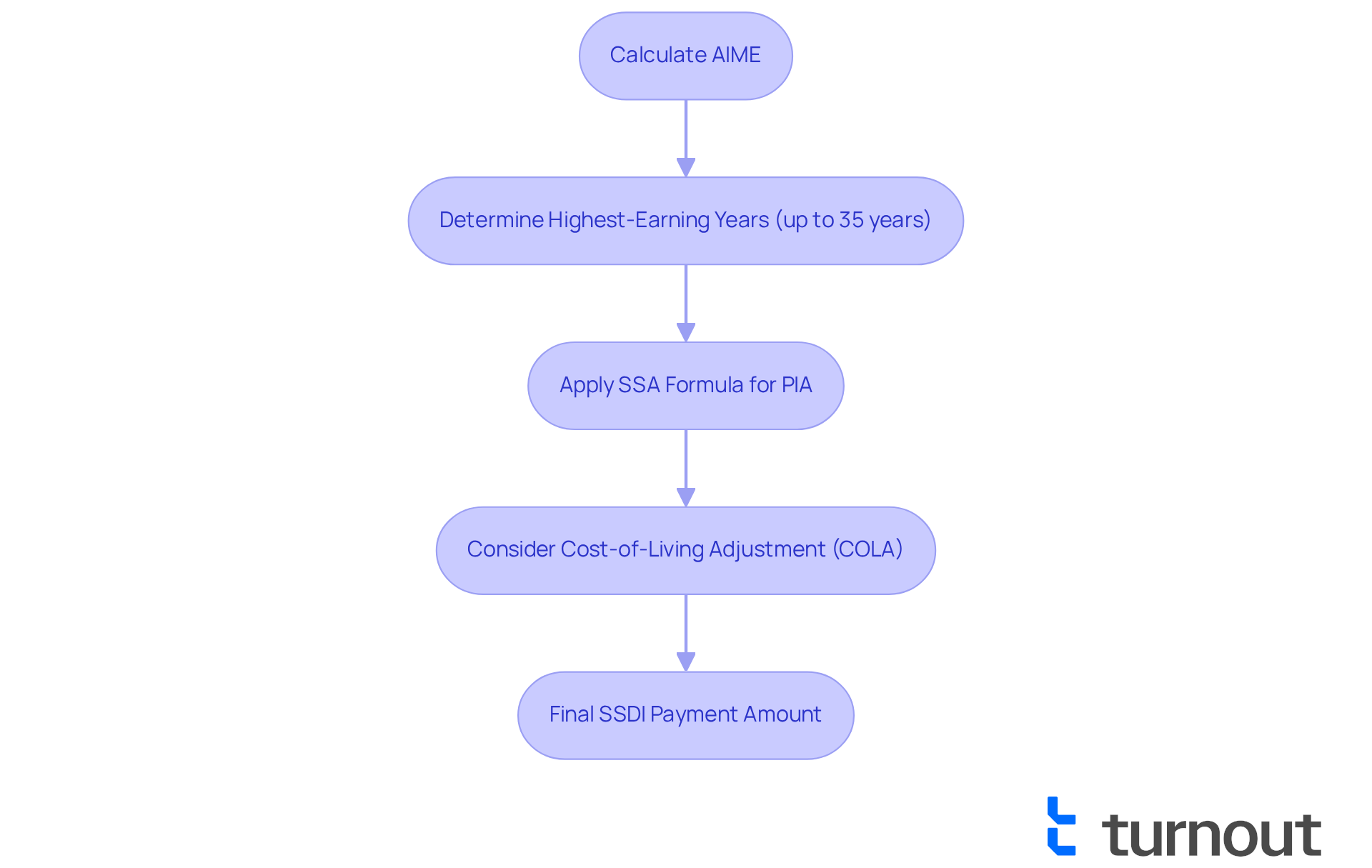

Navigating the complexities of Social Security Disability Benefits can feel overwhelming. We understand that many individuals face challenges when trying to secure the support they need. The calculation of the social security benefits disability amount is based on your Average Indexed Monthly Earnings (AIME), which reflects your highest-earning years—typically drawn from up to 35 years of work history.

The Social Security Administration (SSA) uses a specific formula to determine your Primary Insurance Amount (PIA). This foundational sum serves as the basis for assistance before any adjustments are made. For 2025, the maximum SSDI payment is projected to be around $4,018 per month. However, the actual amount you receive as social security benefits disability amount will depend on your unique earnings record.

It's important to know that the SSA also applies a Cost-of-Living Adjustment (COLA) each year to help account for inflation. This adjustment can significantly influence the social security benefits disability amount that you receive. At Turnout, we’re here to help simplify your access to these benefits. Our team offers expert guidance and support throughout the SSD claims process.

Please note that Turnout is not a law firm and does not provide legal representation. Instead, we employ trained non-professional advocates who are dedicated to assisting you in navigating the complexities of government support. You are not alone in this journey; we are committed to helping you every step of the way.

Discuss Income Impact on Disability Benefits

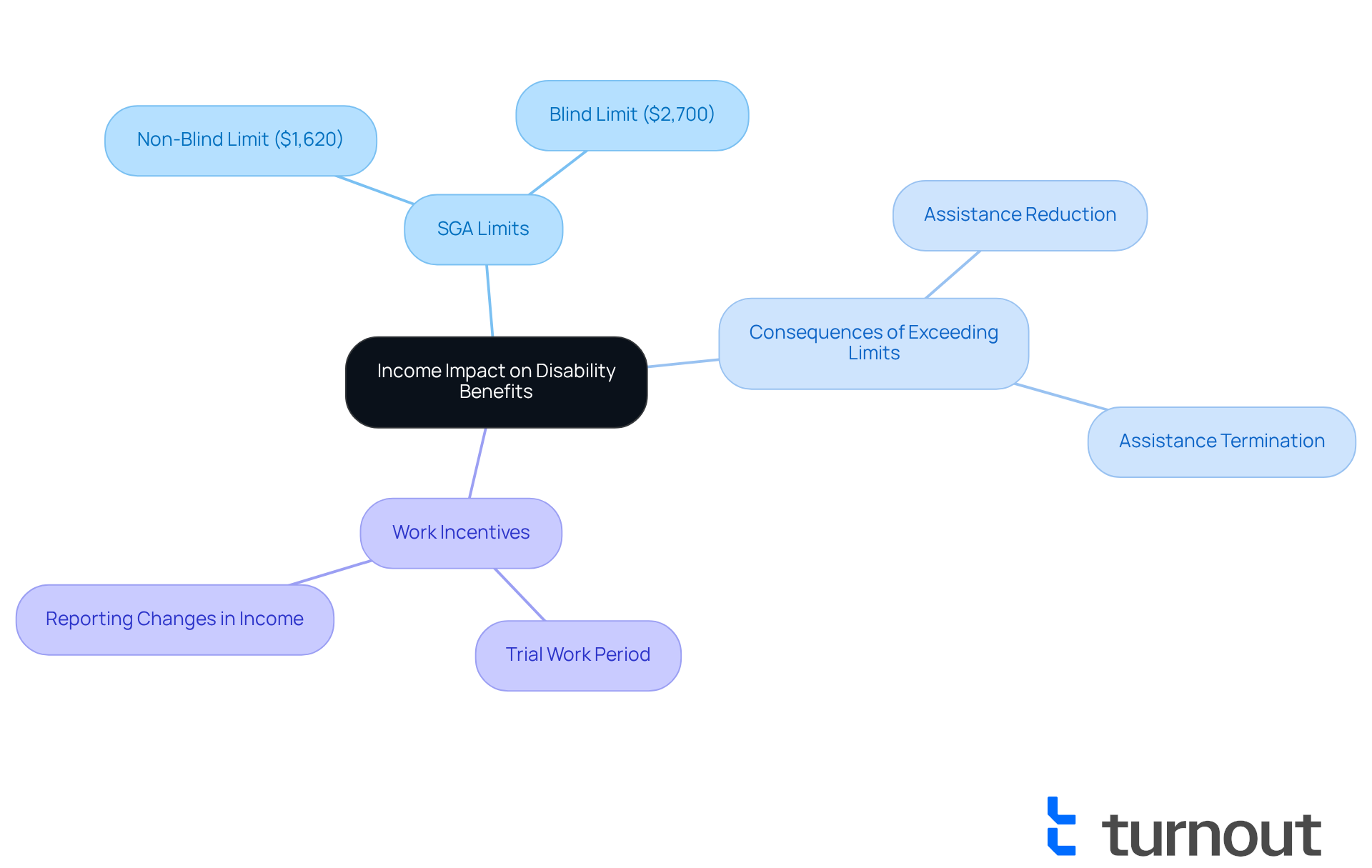

Income can significantly impact the social security benefits disability amount you are eligible to receive. We understand that navigating these waters can feel overwhelming. The SSA has established a Substantial Gainful Activity (SGA) limit, which is the maximum amount you can earn while still qualifying for assistance. In 2025, the SGA limit for non-blind individuals is $1,620 per month, whereas for blind individuals, it stands at $2,700. If your earnings exceed these thresholds, your assistance may be reduced or terminated.

However, it's important to know that the SSA provides certain work incentives, such as the Trial Work Period. This allows beneficiaries like you to test your ability to work without losing benefits. We recognize that reporting any changes in income to the SSA can be daunting, but it's essential to avoid complications.

At Turnout, we're here to help you navigate these complexities. We offer various tools and services, including personalized guidance and resources. Our aim is to ensure you understand how income affects your SSD claims and the social security benefits disability amount, while exploring available options for financial assistance. Remember, you are not alone in this journey. Our services are designed to assist you without implying that legal representation is typically necessary.

Conclusion

Understanding Social Security Disability Benefits is crucial for individuals unable to work due to medical conditions. These benefits provide essential financial support, serving as a lifeline for many. We understand that navigating this complex system can be overwhelming. This article has explored the intricate details of eligibility, the calculation of benefit amounts, and the impact of income on these benefits, ensuring you are well-informed about your rights and options.

Key insights include specific eligibility requirements, such as earning credits and the necessity of a qualifying medical condition. The article also detailed how the Social Security Administration calculates benefit amounts based on your work history and earnings. Understanding the Average Indexed Monthly Earnings (AIME) and the Primary Insurance Amount (PIA) is vital. Additionally, the discussion on income limits and work incentives, like the Trial Work Period, illustrates the complexities you may face in maintaining your benefits while exploring potential employment opportunities.

Ultimately, the significance of this information cannot be overstated. It’s common to feel uncertain about your eligibility and the factors that influence your benefits. By staying informed and seeking assistance from resources like Turnout, you can better navigate the SSD claims process and secure the support you need. Remember, empowerment through knowledge is key. Taking action today can lead to a more stable and secure future. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What are Social Security Disability Benefits (SSDI)?

Social Security Disability Benefits (SSDI) provide monthly payments to individuals who cannot work due to a medical condition expected to last at least one year or lead to death.

Who is eligible for SSDI?

Individuals who have contributed to the Social Insurance system through their work history and are unable to work due to a qualifying medical condition may be eligible for SSDI.

How does SSDI differ from Supplemental Income (SSI)?

SSDI is based on work history and contributions to the Social Insurance system, while Supplemental Income (SSI) is a needs-based program for individuals with limited income and resources.

What is the purpose of SSDI?

The purpose of SSDI is to provide financial support to individuals who are unable to work due to a medical condition, helping them manage their living expenses during a challenging time.

Can I receive help with the SSDI application process?

Yes, there are resources available to assist you with the SSDI application process to ensure you receive the support you need.