Overview

Understanding the meaning of an IRS levy is crucial for anyone facing tax challenges. An IRS levy is a legal action that allows the IRS to seize a taxpayer's property or assets to settle unpaid tax debts. This can involve garnishing wages or confiscating funds from bank accounts, which can feel overwhelming.

We understand that receiving such notifications can be distressing. It’s important to recognize the notifications taxpayers receive before a levy is enacted. Ignoring these communications can lead to severe financial consequences, heightening the urgency for timely responses.

You are not alone in this journey. There are options available for relief, and we’re here to help you navigate this process. Taking action now can make a significant difference in your financial well-being. Please consider your options and reach out for support.

Introduction

Understanding the implications of an IRS levy is crucial for taxpayers navigating the complexities of tax obligations. We recognize that this legal tool enables the IRS to seize assets directly to settle unpaid taxes, which can lead to significant financial distress if not addressed promptly. It's common to feel overwhelmed by the daunting reality of potential wage garnishments or bank account seizures.

So, how can you effectively manage and mitigate the risks associated with an IRS levy? This guide delves into the essential aspects of IRS levies, offering insights and strategies to empower you in reclaiming control over your financial situation. Remember, you are not alone in this journey; we're here to help.

Define IRS Levy: Understanding the Basics

The refers to a directly to settle a tax obligation. Unlike a lien, which merely asserts an interest in your property, a seizure enables the IRS to take specific assets. This could involve garnishing wages, confiscating funds from bank accounts, or even seizing real estate. , as it highlights the seriousness of unpaid tax obligations and the potential consequences of ignoring IRS communications, which relates directly to the IRS levy meaning.

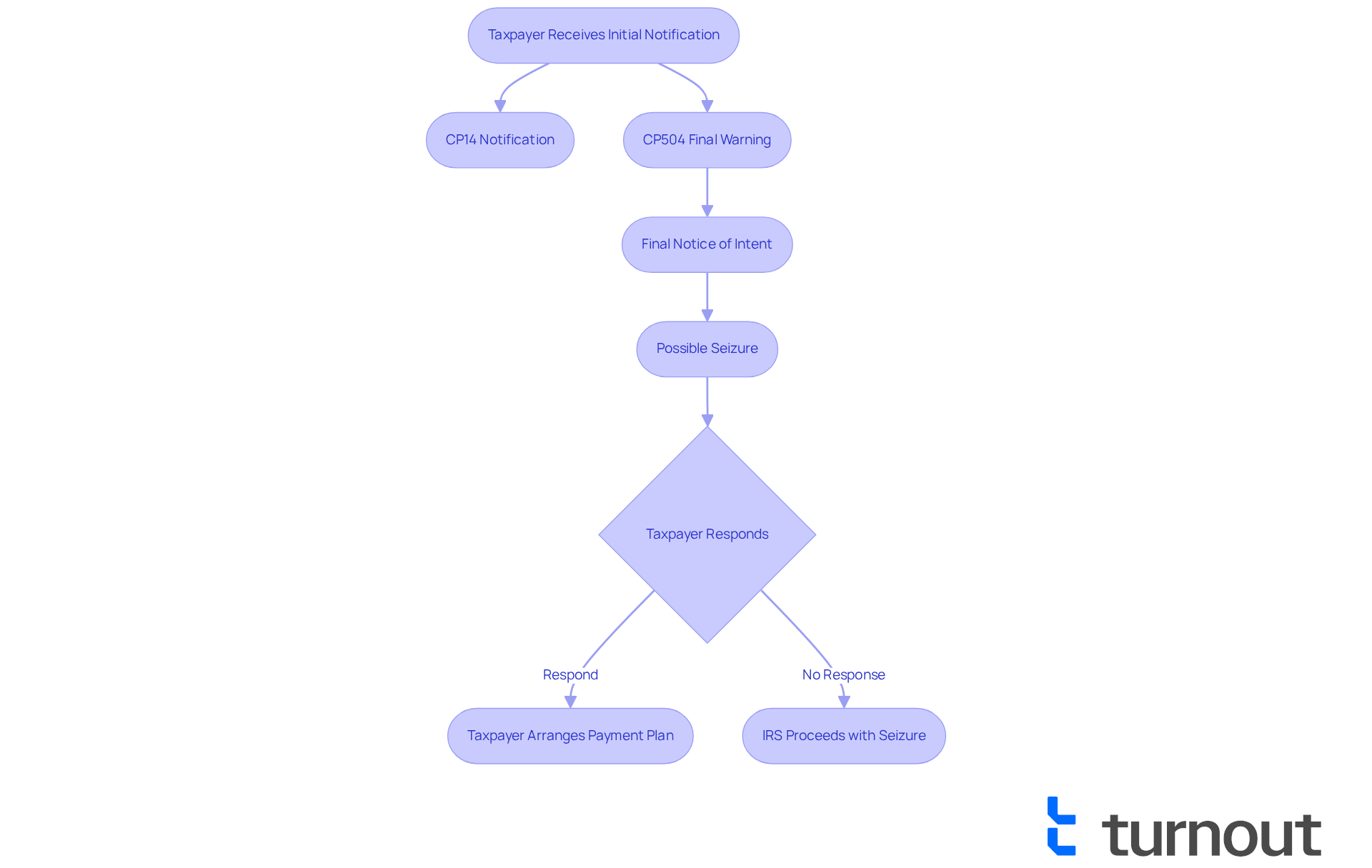

Each year, the IRS issues thousands of financial claims that impact many individuals. Typically, taxpayers receive a series of notifications before a seizure is enacted. This includes:

- The CP14, which informs them of the amount due

- The CP504, a final warning before enforcement actions begin

Moreover, the IRS must send a to Impose and Notice of Your Right to a Hearing at least 30 days prior to any seizure. If a or arrange for payment, the IRS may proceed with the seizure, leading to immediate financial hardship, such as insufficient funds for daily expenses.

Real-life examples illustrate the significant impact of . Imagine a taxpayer who ignored several notices only to find their bank account drained overnight, leaving them unable to pay essential bills. Understanding the taxation process and being aware of your rights can empower individuals to . Taxpayers can negotiate with the IRS to establish a payment plan or even have an IRS levy meaning lifted if it causes sudden economic difficulty or was issued in error. The IRS also allows up to 180 days to settle the obligation in full, providing additional options for those facing garnishment. Knowing these rights is crucial for anyone facing the threat of an IRS seizure.

We understand that confronting the IRS can be daunting, but remember, you are not alone in this journey. There are resources and support available to help you manage your situation. It's important to reach out and explore your options. We're here to help you find a way forward.

How IRS Levies Work: Processes and Procedures

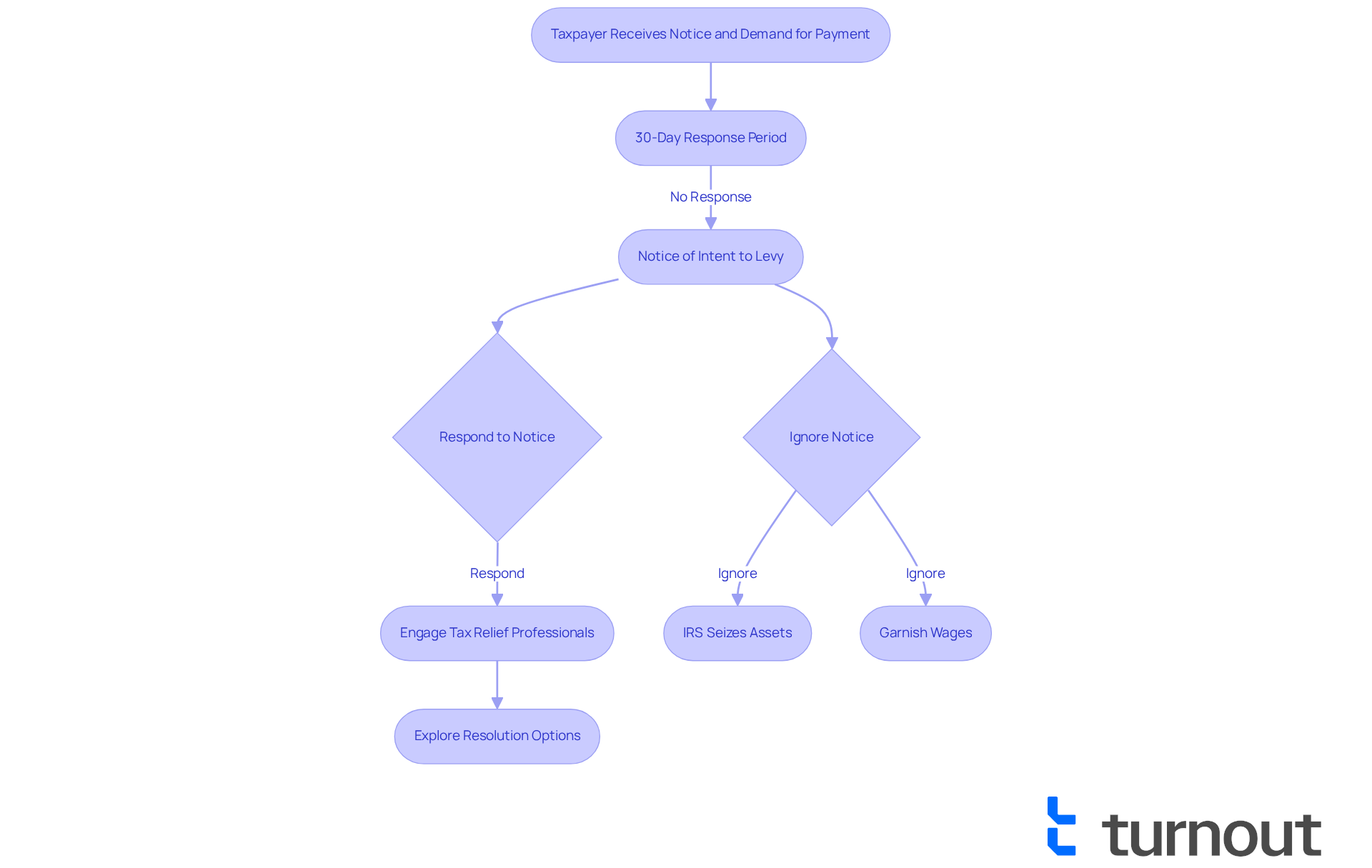

Dealing with tax issues can be overwhelming, especially when the IRS initiates collection actions. Typically, this begins after a taxpayer has not responded to several notifications regarding outstanding taxes. It starts with a Notice and Demand for Payment, and if the debt remains unresolved, a , reflecting the , follows. We understand that this can be a stressful time, and you are given a 30-day grace period to respond before the .

Once a charge is issued, the IRS levy meaning allows them to , garnish wages, or even take possession of property. In 2024 alone, the , highlighting the IRS levy meaning, and more than 3.8 million levy actions were taken against individuals in the last decade. This highlights the urgency for you to act promptly. Ignoring IRS notices can lead to immediate asset seizure and long-term credit damage, which illustrates the IRS levy meaning and can be quite daunting.

Understanding this timeline is crucial to avoid severe financial repercussions. Engaging with can provide valuable assistance in navigating these complex processes. They can help you explore resolution options, including:

- Offers in Compromise

- Penalty Abatements

- Installment Agreements

Remember, you are not alone in this journey, and we're here to help you find the best path forward.

Types of IRS Levies: Exploring Asset Seizure Methods

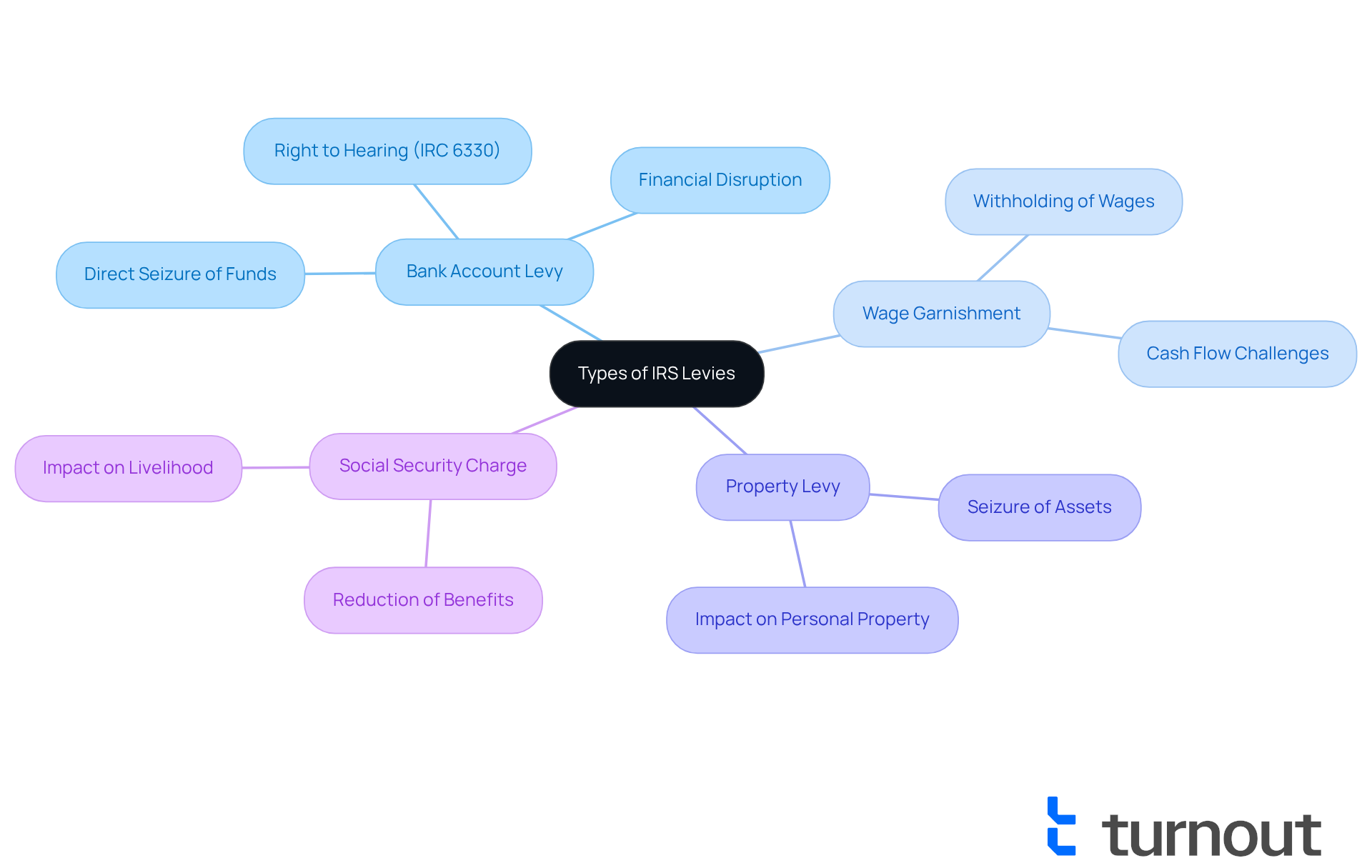

Understanding the is essential, as the IRS employs various methods of collection to recover unpaid taxes, each carrying distinct consequences for those who owe. Understanding these methods can empower you to manage your financial responsibilities more effectively, particularly in relation to IRS levy meaning. Here are the primary types of IRS levies:

- : This approach allows the IRS to seize funds directly from your bank account to satisfy . Many taxpayers experience significant disruption when funds are unexpectedly withdrawn, leading to financial strain. If the IRS conducts this assessment without informing you of your right to a hearing under IRC 6330, they are required to return the seized funds.

- : In this situation, a portion of your wages is withheld by your employer and sent directly to the IRS. This can create immediate cash flow challenges, making it difficult to cover everyday expenses.

- Property Levy: The IRS can take possession of various assets, including vehicles and real estate, to sell and recover owed taxes. This process can be particularly distressing, as it affects your personal property and stability.

- Social Security Charge: For those receiving , the IRS can take a portion of these payments to cover tax debts. This can have a significant impact on individuals relying on these funds for their livelihood.

The specific procedures and timelines for each type of levy are important to understand, particularly the IRS levy meaning. Typically, the IRS issues a warning of intent to levy, which highlights the IRS levy meaning, giving you 30 days to respond before further actions are taken. Recently, the , signaling a return to more assertive collection efforts following the pandemic. The LT11 alert, in particular, is seen as a more serious collection notice compared to earlier reminders, underscoring the urgency of the situation.

Experts highlight the importance of understanding the IRS levy meaning in relation to these processes. If a bank account seizure occurs, you may face sudden financial difficulties, as funds are often taken without prior notice. It’s important to know that if you can demonstrate economic hardship. The , which is a significant aspect of its collection strategy. If you find yourself facing such actions, , ensuring you are not caught off guard by the IRS levy meaning and its collection methods.

Mitigate IRS Levies: Strategies for Taxpayers

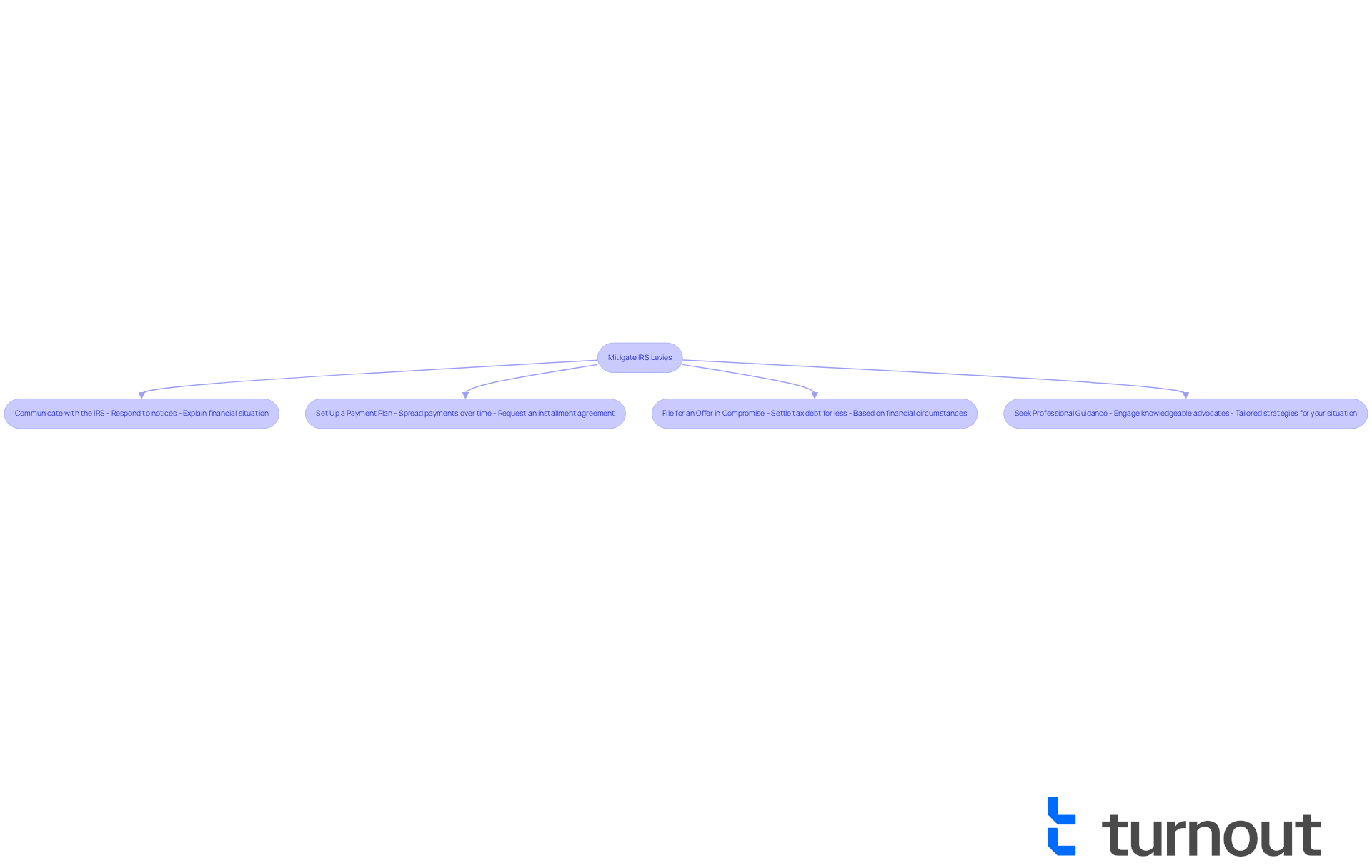

To mitigate the impact of what the entails, we understand that you may feel overwhelmed. Here are some compassionate strategies to consider:

- : Promptly responding to IRS notices and clearly explaining your financial situation can lead to alternative arrangements. We encourage you to engage in open discussions, as this can sometimes help prevent charges from being implemented.

- Set Up a : If paying your tax debt in full feels daunting, requesting a payment plan allows you to spread payments over time. The IRS handles a considerable number of , showing their willingness to collaborate with individuals who are committed to settling their debts.

- : This option enables you to settle your tax debt for less than the total amount owed, based on your financial circumstances. It’s a viable route for those who qualify, providing a pathway to financial relief.

- : can offer personalized strategies tailored to your specific situation. Their expertise can help and enhance your chances of a favorable outcome.

Taking these proactive steps can help you or lessen its impact. Remember, you are not alone in this journey, and we’re here to help you maintain control over your financial situation.

Conclusion

Understanding the IRS levy meaning is essential for taxpayers navigating the complexities of tax obligations. We recognize that facing tax issues can be overwhelming. This legal measure allows the IRS to seize assets directly to settle unpaid taxes, highlighting the importance of addressing these matters promptly. Ignoring IRS communications can lead to severe financial consequences, making it crucial for individuals to be informed and proactive in managing their tax responsibilities.

Throughout this article, we have highlighted key points, including the various types of IRS levies such as:

- Bank account levies

- Wage garnishments

- Property seizures

Each method carries its own implications, and it's common to feel anxious about the limited window to respond before the IRS takes action. We’ve explored strategies for mitigating the impact of an IRS levy, including:

- Communicating with the IRS

- Setting up payment plans

- Seeking professional guidance

These insights empower you to take control of your financial situation and avoid the pitfalls of IRS enforcement.

Ultimately, staying informed about the IRS levy meaning and the associated processes is vital for anyone facing tax challenges. It’s important to recognize that there are options available to manage and potentially alleviate the burden of tax debts. Taking proactive steps and seeking assistance can make a significant difference in navigating these difficult circumstances. Remember, you are not alone in this journey, and we’re here to help you find a path forward.

Frequently Asked Questions

What is an IRS levy?

An IRS levy is a legal measure that allows the IRS to take your property directly to settle a tax obligation. This can include garnishing wages, confiscating funds from bank accounts, or seizing real estate.

How does an IRS levy differ from an IRS lien?

An IRS lien merely asserts an interest in your property, while a levy enables the IRS to take specific assets to satisfy a tax debt.

What notifications does the IRS send before enacting a levy?

The IRS typically sends a series of notifications, including the CP14, which informs taxpayers of the amount due, and the CP504, which serves as a final warning before enforcement actions begin. Additionally, a Final Notice of Intent to Impose and Notice of Your Right to a Hearing must be sent at least 30 days prior to any seizure.

What happens if a taxpayer ignores IRS notifications?

If a taxpayer does not respond or arrange for payment after receiving notifications, the IRS may proceed with the seizure, which can lead to immediate financial hardship.

Can taxpayers negotiate with the IRS regarding a levy?

Yes, taxpayers can negotiate with the IRS to establish a payment plan or have an IRS levy lifted if it causes sudden economic difficulty or was issued in error.

How long do taxpayers have to settle their obligation after a levy is issued?

Taxpayers have up to 180 days to settle their obligation in full after a levy is issued.

What should individuals do if they are facing an IRS levy?

Individuals should reach out for resources and support to manage their situation, as there are options available to help navigate the challenges of dealing with the IRS.