Overview

Navigating the Social Security system in Oregon can feel overwhelming, and we understand that many individuals face significant challenges. This article aims to provide you with the information you need to effectively manage your journey, detailing eligibility criteria, the application process, and common hurdles that applicants encounter.

It’s essential to grasp the differences between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). By understanding these distinctions, you can better position yourself to secure the benefits that are right for you. We’ll also offer practical solutions to help you overcome obstacles such as application denials and long wait times.

Remember, you are not alone in this journey. Many have faced similar challenges and have found ways to navigate the system successfully. We encourage you to explore the insights shared in this article, as they are designed to empower you and provide the support you need.

In closing, we want to reassure you that help is available. If you have questions or need further assistance, please reach out. Together, we can work towards securing the benefits you deserve.

Introduction

Navigating the intricacies of Social Security can feel overwhelming, especially for those seeking assistance in Oregon. We understand that millions rely on this essential program for financial support.

It’s crucial to grasp the distinctions between Disability Insurance (SSDI) and Supplemental Income (SSI) in order to secure the benefits you deserve. However, the complexities of eligibility criteria, application processes, and potential obstacles can leave many feeling lost.

How can you effectively maneuver through these challenges to access the support you need? Remember, you are not alone in this journey; we're here to help.

Clarify the Basics of Social Security in Oregon

This assistance program is a national initiative designed to provide financial support to individuals who are retired, disabled, or survivors of deceased employees. In Oregon, this program offers various advantages related to Social Security, including Disability Insurance (SSDI) and Supplemental Security Income (SSI). SSDI is specifically tailored for individuals who have worked and contributed to the system through payroll taxes, while SSI supports those with limited income and resources, regardless of their work history. Understanding these distinctions is crucial for determining eligibility and effectively navigating the application process.

We understand that applying for benefits can feel overwhelming. In Oregon, local offices are available to support applicants in accessing social security oregon benefits through the Administration, making it easier to obtain these essential services. The program is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA). As of 2025, cost-of-living adjustments (COLA) have been implemented, resulting in increased benefit amounts for recipients. For instance, the maximum Federal SSI payment for an eligible individual is set at $967, reflecting a 2.5 percent increase aimed at maintaining purchasing power against inflation.

Currently, approximately 69.6 million beneficiaries receive monthly cash benefits nationwide, with a significant portion of those relying on social security oregon. Grasping the subtleties of SSDI and SSI, along with the recent updates and modifications, is crucial for individuals aiming to obtain benefits from the administration successfully. Getting acquainted with these basics is the initial step toward managing the intricacies of the welfare system.

Turnout provides access to various tools and services designed to assist individuals in navigating these complex processes, particularly for SSD claims and tax debt relief. Utilizing trained nonlawyer advocates for SSD claims and collaborating with IRS-licensed enrolled agents for tax relief, Turnout ensures that clients receive the necessary support without offering legal representation. This comprehensive approach helps beneficiaries understand their options and make informed decisions regarding their benefits. Remember, you are not alone in this journey; we’re here to help.

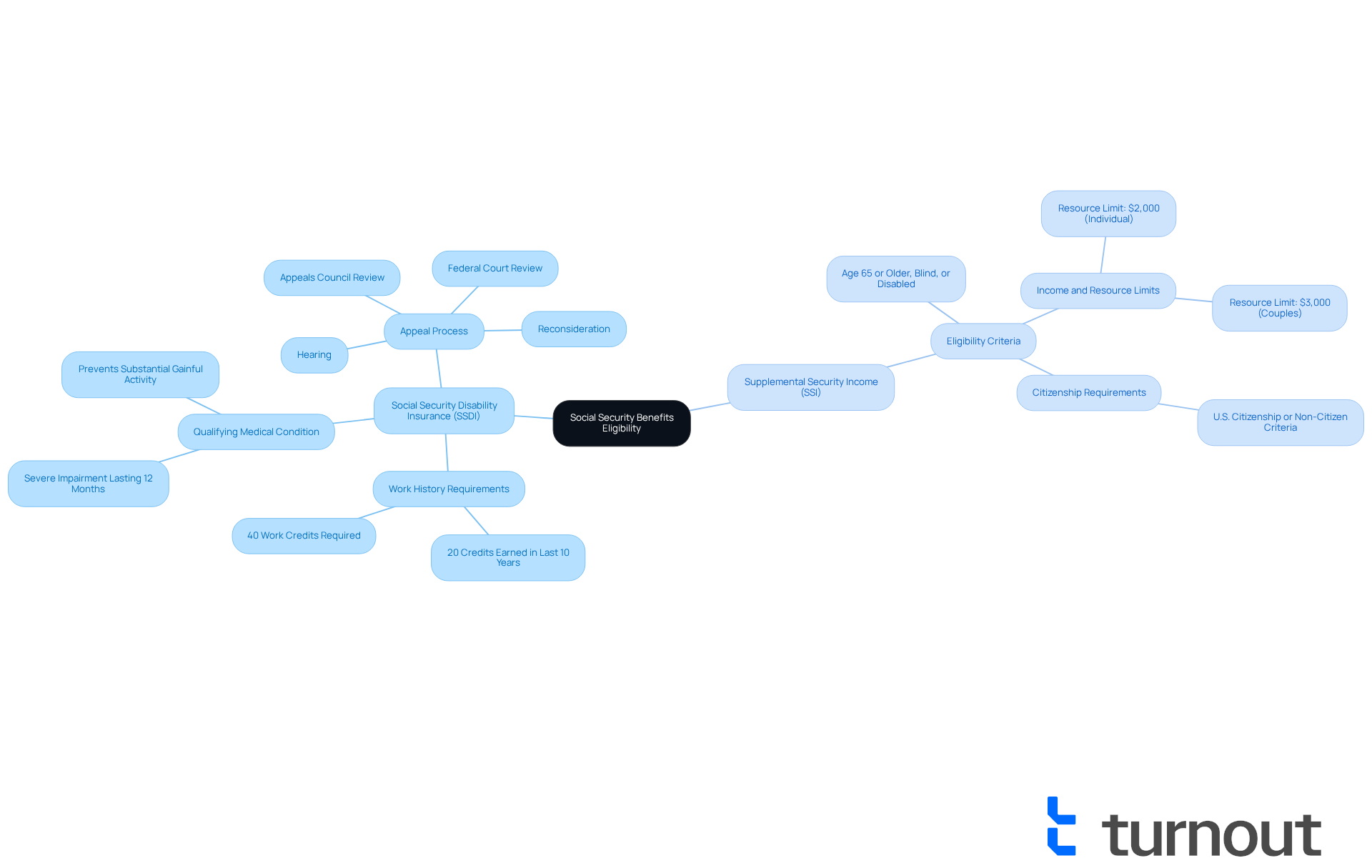

Outline Eligibility Criteria for Social Security Benefits

Navigating the path to social security oregon benefits can feel overwhelming, but understanding the eligibility criteria is the first step toward securing the support you need. Let's explore the two main types of benefits available:

-

Social Security Disability Insurance (SSDI):

- To qualify, you must have a work history that includes paying Social Security taxes.

- Typically, a total of 40 work credits is required, with at least 20 earned in the last 10 years.

- A qualifying medical condition must prevent you from engaging in substantial gainful activity due to a severe impairment lasting at least 12 months.

- If your SSDI claim is rejected, remember that you have the right to contest this decision, providing various opportunities to obtain benefits through a structured process.

Turnout offers compassionate support through skilled nonlawyer advocates who assist you in navigating SSD claims, specifically for social security oregon, ensuring you understand your rights and options.

-

Supplemental Security Income (SSI):

- To be eligible, you must be aged 65 or older, blind, or disabled.

- There are also limits on income and resources, with a resource limit of $2,000 for individuals and $3,000 for couples in 2025.

- Additionally, U.S. citizenship or meeting specific non-citizen criteria is necessary.

Turnout's services are designed to streamline access to social security oregon benefits, guiding you through the complexities of the SSI submission process.

Understanding these criteria is essential for assessing your eligibility and preparing effectively for the application process. At Turnout, we want you to know that we are here to help. We are not a law firm and are not affiliated with or endorsed by any law firm or government agency, ensuring that you receive unbiased support. Furthermore, Turnout offers services related to tax debt relief, assisting clients in navigating financial challenges. With these resources, you are not alone in this journey; you can feel supported every step of the way.

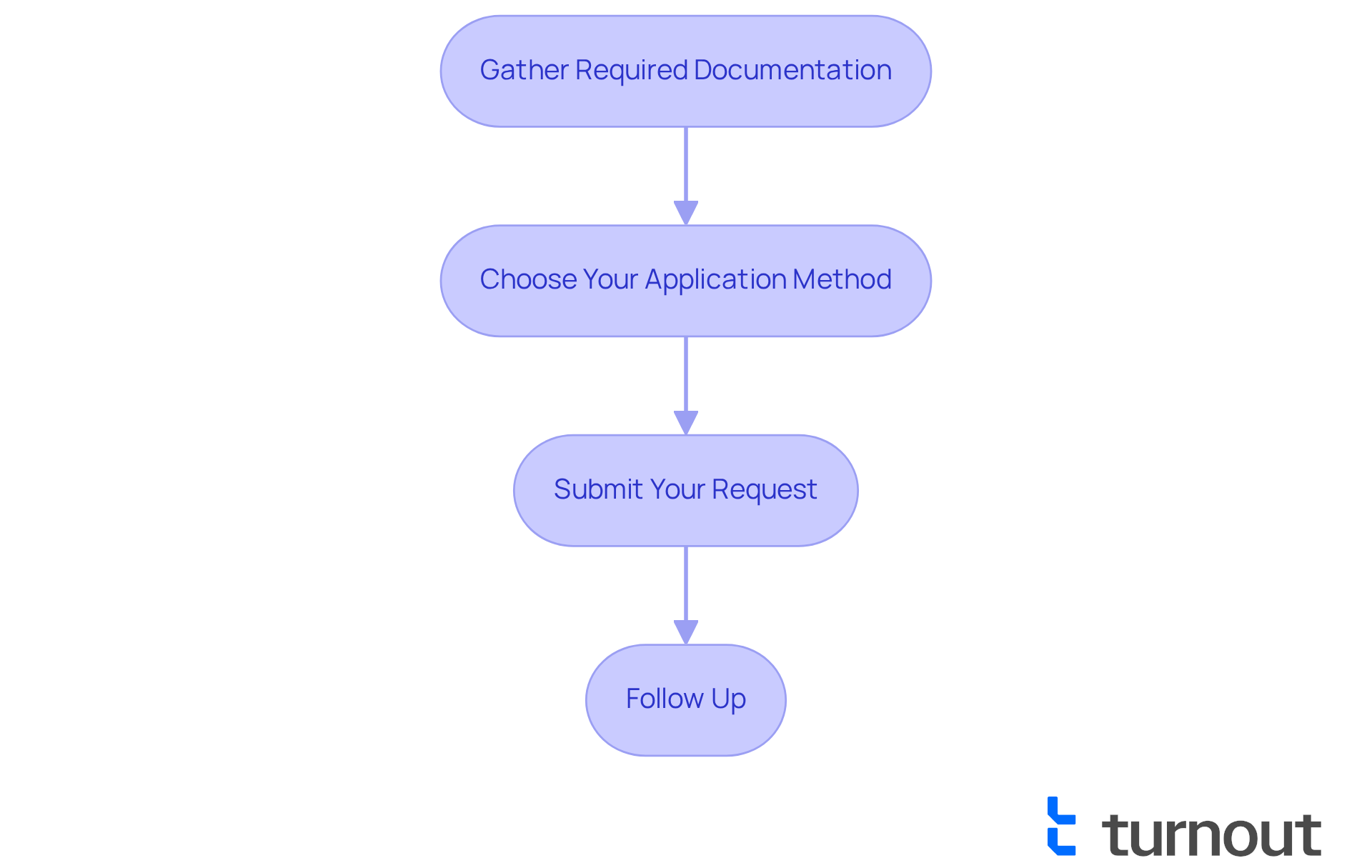

Detail the Application Process and Required Documentation

Applying for social security oregon benefits can feel overwhelming, but we're here to help you navigate this important process with care and clarity. It involves several essential steps and specific documentation requirements that are crucial to your success.

-

Gather Required Documentation: Start by collecting the necessary documents. This includes your personal identification, such as your birth certificate, Social Security card, and proof of U.S. citizenship or legal residency. Next, gather your medical records, which should detail your medical condition, treatment history, and how these affect your ability to work. Additionally, provide your work history through pay stubs, W-2 forms, or tax returns to verify your earnings. Lastly, prepare your financial information, including bank statements and details about any other income or resources you may have.

-

Choose Your Application Method: You have options for applying. For convenience, you can complete your application online through the SSA website. Alternatively, if you prefer speaking to someone, you can call the SSA at 1-800-772-1213 to apply over the phone. If you feel more comfortable in person, schedule an appointment at your local Social Security office for direct assistance.

-

Submit Your Request: Once you've gathered everything, ensure that all necessary documents are included with your submission. After submitting, you will receive a confirmation and may be asked to provide additional information if needed.

-

Follow Up: It's common to feel anxious during this process, but monitoring your status through your online account or by reaching out to the SSA can provide peace of mind. Be prepared to respond promptly to any requests for further documentation. Remember to keep a thorough record of your correspondence with the SSA, including dates and names of representatives contacted; this can assist in managing your request more efficiently.

Turnout offers valuable assistance during this procedure, employing trained nonlegal advocates to help with SSD claims. This ensures that applicants receive the support they need without requiring legal representation. Successful documentation strategies include keeping copies of all submitted documents and maintaining a detailed record of communications with the SSA. This proactive approach can significantly enhance your experience with the system and help prevent delays.

In Oregon, the typical paperwork needed for social security oregon requests conforms to these guidelines, ensuring that you are well-prepared to manage the procedure effectively. Additionally, consider utilizing the Disability Starter Kits available on the SSA website, which offer vital information and resources for your submission. Remember, providing accurate information is crucial; inaccuracies can lead to delays or rejections. Many Portland residents now receive initial decisions on their requests within weeks instead of months, reflecting improvements in the processing system. You are not alone in this journey, and with the right preparation, you can navigate it successfully.

Identify Challenges and Solutions in Securing Benefits

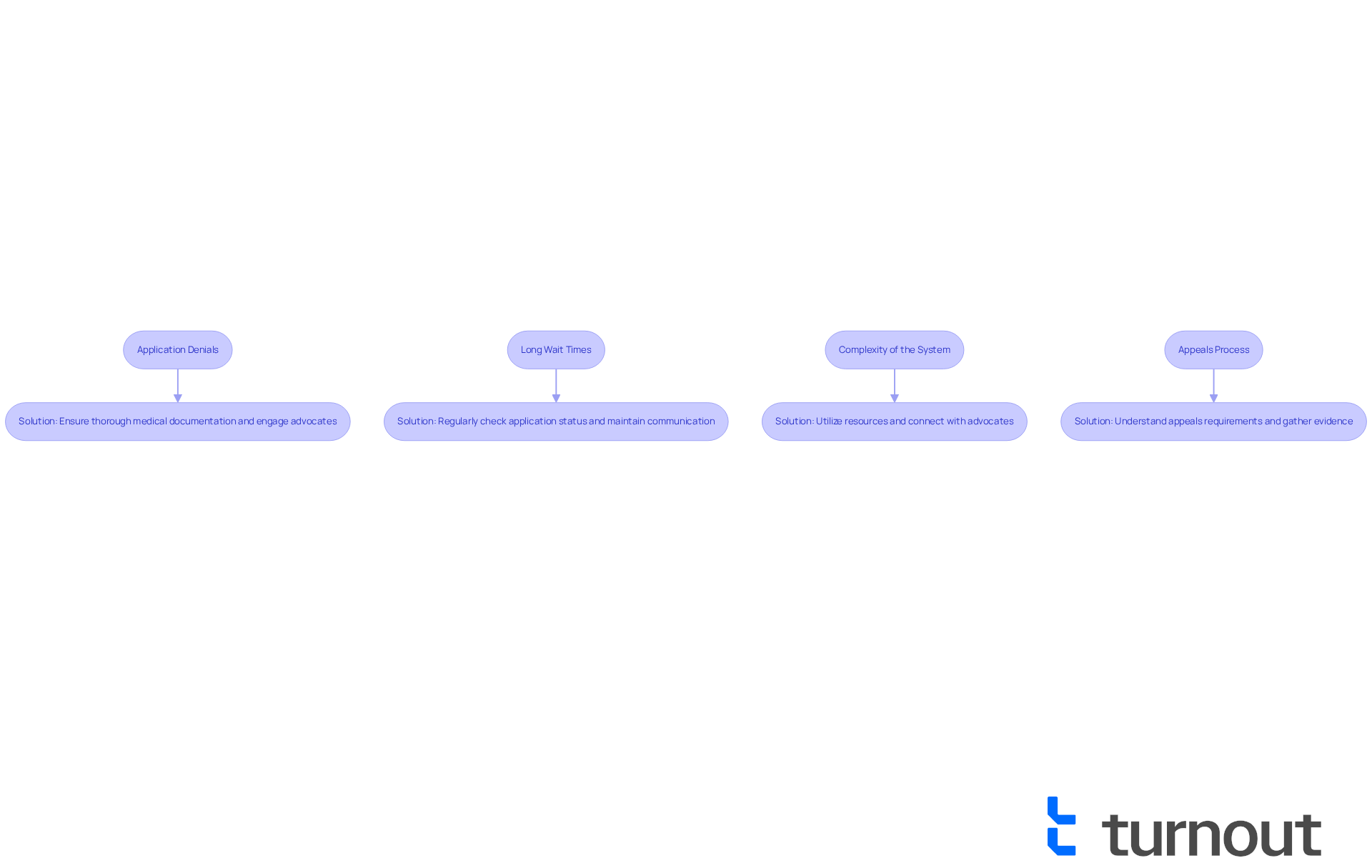

Securing social security oregon benefits can be fraught with challenges, and we understand how overwhelming this process can feel. Here are some common obstacles and solutions that may help you navigate this journey:

-

Application Denials:

- Challenge: Many initial applications are denied, with nearly 67% of initial SSDI applications denied nationwide due to insufficient medical evidence or failure to meet eligibility criteria.

- Solution: To improve your chances, ensure that all medical documentation is thorough and clearly demonstrates how your condition affects your daily life and ability to work. Engaging with informed supporters, like Turnout's trained non-professional advocates, can greatly enhance your submission. They can assist in pinpointing weaknesses and ensuring all required evidence is incorporated.

-

Long Wait Times:

- Challenge: It's common for applicants to face long wait times for decisions on their applications, with beneficiaries typically waiting over 28 days for the next available appointment. Additionally, the wait for a call back from Social Security can be two and a half hours.

- Solution: Stay proactive by regularly checking your application status and responding quickly to any requests from the SSA. Keeping organized records and maintaining consistent communication can help speed up the procedure.

-

Complexity of the System:

- Challenge: The Social Security system can feel confusing, with numerous rules and regulations that can overwhelm applicants.

- Solution: Utilize resources such as local advocacy groups or online forums for guidance. Connecting with seasoned supporters, such as those at Turnout, can offer clarity and assistance during this journey, helping you navigate the complexities more effectively.

-

Appeals Process:

- Challenge: If denied, navigating the appeals process can be daunting. Even after going through multiple steps of appealing denials, only about 30 percent win benefits in the end.

- Solution: It's important to understand the appeals timeline and requirements. Gather additional evidence and consider professional assistance from trained advocates to improve your chances of a successful appeal. Many applicants find that having support during this stage can make a significant difference in their outcomes.

Remember, you're not alone in this journey. We're here to help you every step of the way.

Conclusion

Navigating the landscape of Social Security benefits in Oregon is essential for individuals seeking financial support during retirement, disability, or as survivors. We understand that understanding the distinctions between programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can feel overwhelming. It's crucial for determining eligibility and successfully applying for benefits. With the right knowledge and resources, you can effectively maneuver through the complexities of the application process and secure the assistance you need.

This article outlines the eligibility criteria for both SSDI and SSI, emphasizing the importance of thorough documentation and understanding the application process. We recognize that challenges, such as application denials and long wait times, can be discouraging. However, practical solutions exist, including advocacy services like Turnout, which provides valuable support without legal representation. By being proactive and informed, you can enhance your chances of success and navigate the Social Security system more effectively.

In conclusion, securing Social Security benefits in Oregon is a vital step for many individuals facing financial uncertainty. Awareness of eligibility requirements, detailed preparation for the application process, and the utilization of available support services can significantly alleviate the burdens associated with obtaining benefits. Remember, you are not alone in this journey. Assistance is available, and taking action now can lead to a more secure financial future.

Frequently Asked Questions

What is the purpose of the Social Security program in Oregon?

The Social Security program in Oregon provides financial support to individuals who are retired, disabled, or survivors of deceased employees.

What are the two main types of Social Security benefits available in Oregon?

The two main types of Social Security benefits in Oregon are Disability Insurance (SSDI) for individuals who have worked and contributed to the system, and Supplemental Income (SSI) for those with limited income and resources, regardless of their work history.

How is the Social Security program funded?

The Social Security program is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA).

What recent changes have been made to Social Security benefits in Oregon?

As of 2025, cost-of-living adjustments (COLA) have been implemented, resulting in increased benefit amounts for recipients, such as the maximum Federal SSI payment for an eligible individual, which is set at $967.

How many beneficiaries receive Social Security benefits nationwide?

Approximately 69.6 million beneficiaries receive monthly cash benefits nationwide, with a significant portion relying on Social Security in Oregon.

What resources are available for individuals applying for Social Security benefits in Oregon?

Local offices in Oregon are available to support applicants in accessing Social Security benefits, and organizations like Turnout provide tools and services to assist individuals with SSD claims and tax debt relief.

What assistance does Turnout provide for Social Security Disability claims?

Turnout offers access to trained nonlawyer advocates for SSD claims and collaborates with IRS-licensed enrolled agents for tax relief, helping clients navigate the process without providing legal representation.