Overview

The article emphasizes the Iowa Department of Revenue's dedication to assisting residents as they navigate tax relief options. Programs like the Offer in Compromise and organized payment plans are highlighted, showcasing the support available to those in need.

We understand that managing tax liabilities can be overwhelming, and it's crucial to gather the necessary documentation to effectively address these challenges. By understanding the resources available, individuals can take meaningful steps toward financial recovery.

Remember, you are not alone in this journey. The Iowa Department of Revenue is here to help guide you through the process, ensuring you have the support you need to regain control of your financial situation.

Introduction

Navigating the complexities of tax obligations can often feel overwhelming, especially for those facing financial challenges. We understand that this journey can be tough, but the Iowa Department of Revenue is here to help. They offer various tax relief programs designed to lighten the load of tax debt.

But how can you effectively access these resources? What steps must you take to secure the relief you need? In this article, we will explore the essential processes and documentation required to successfully navigate tax relief with the Iowa Department of Revenue. Together, we will ensure you are equipped to tackle these challenges head-on.

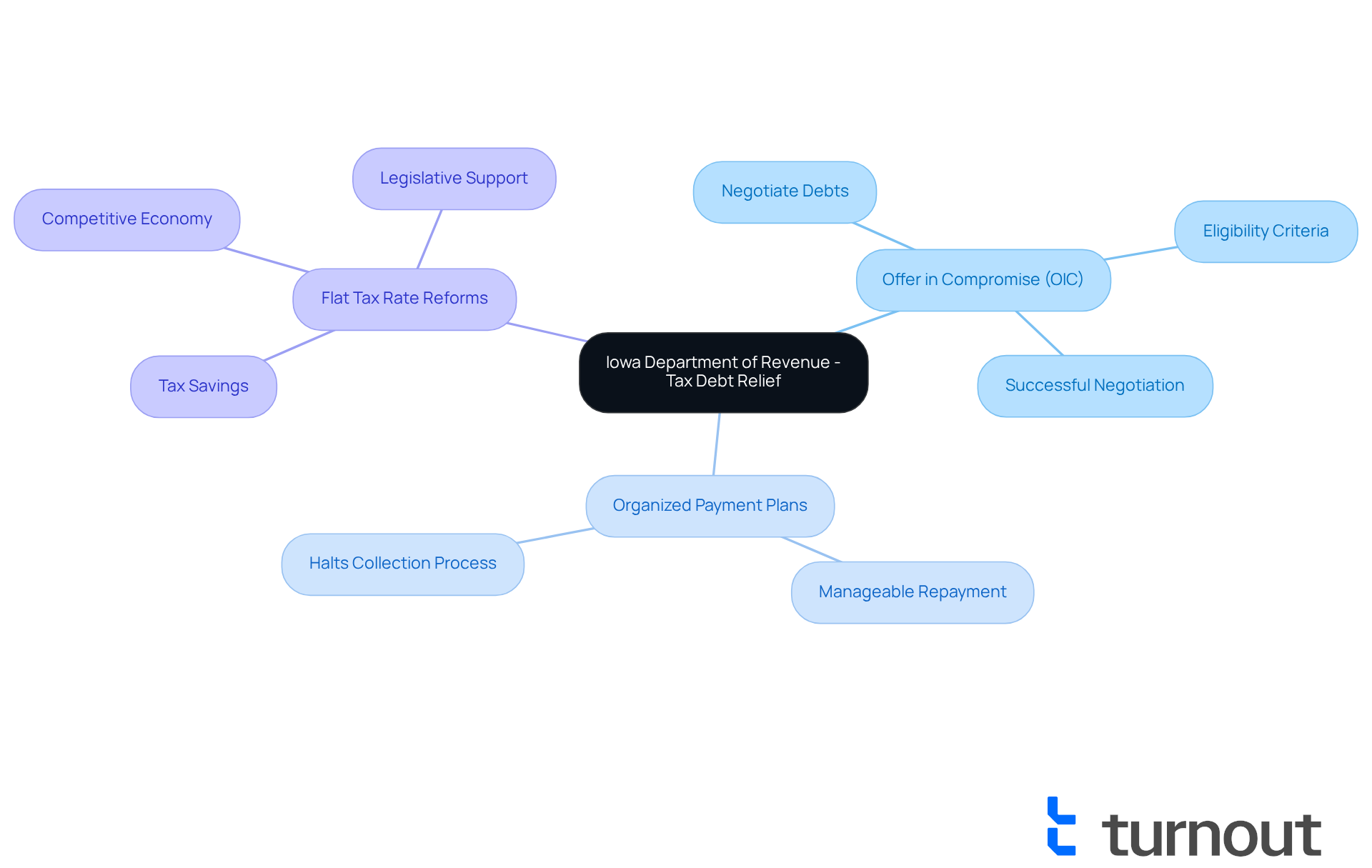

Understand the Iowa Department of Revenue's Role in Tax Debt Relief

The Iowa Department of Revenue plays a vital role in providing tax debt relief for residents by offering a variety of programs designed to support individuals and businesses facing tax liabilities. One of its key offerings is the Offer in Compromise (OIC), which allows taxpayers to negotiate their debts for less than the total amount owed. This presents a feasible path toward economic recovery.

We understand that managing tax obligations can be overwhelming. That's why the Iowa Department of Revenue also provides organized payment plans, enabling manageable repayment over time. This approach helps taxpayers address their obligations without the burden of excessive financial pressure.

Recent reforms have introduced a flat tax rate of 3.8%, making Iowa's rate the sixth lowest in the nation. This change is expected to save taxpayers over $1 billion in the coming years. Not only does this alleviate the tax burden, but it also enhances the overall economic landscape for residents.

Understanding these options is crucial for navigating tax challenges effectively. We encourage you to explore the resources available through the Iowa Department of Revenue, as they demonstrate the department's commitment to being a supportive partner in your journey toward tax assistance. Remember, you are not alone in this process; we are here to help.

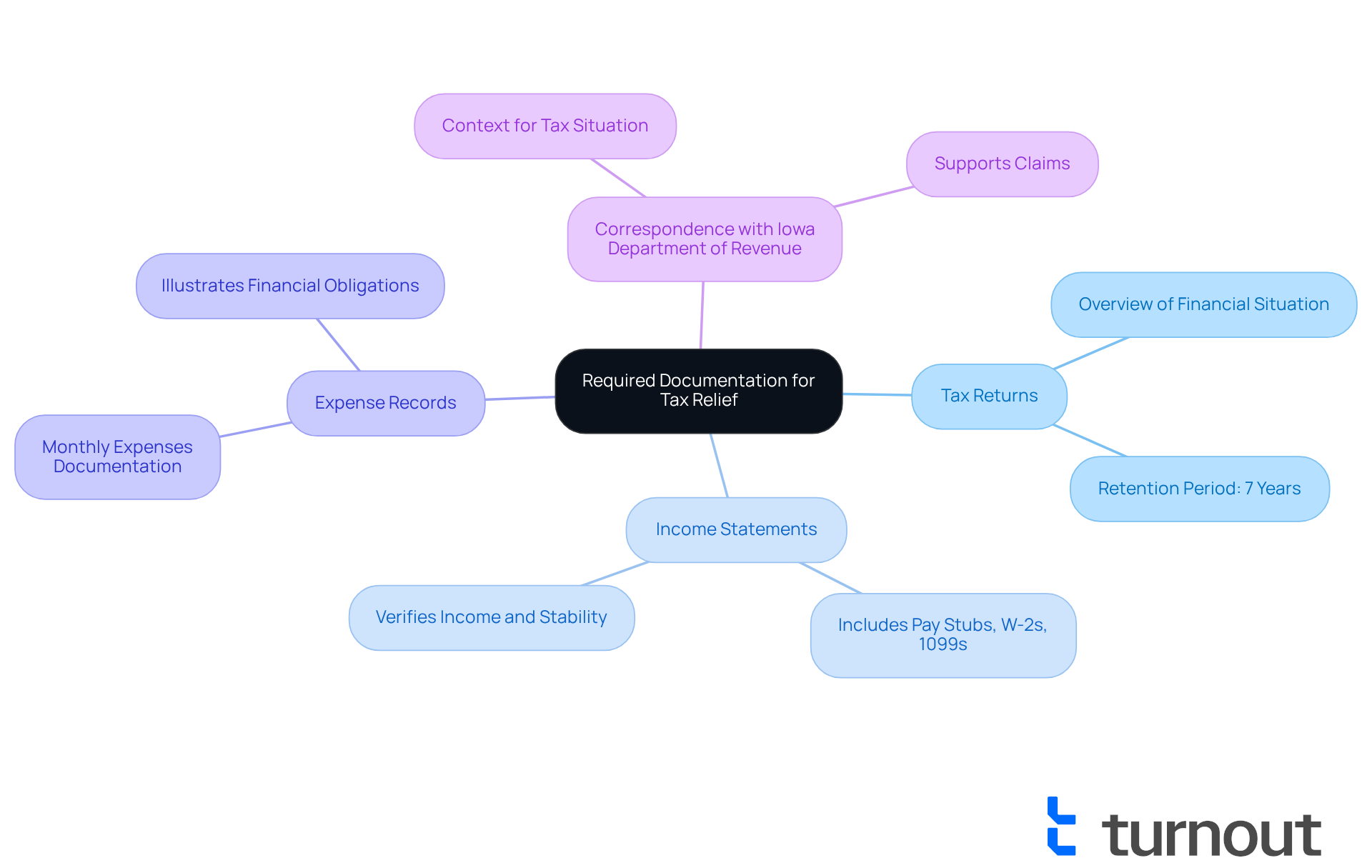

Gather Required Documentation and Information

Before you begin your tax relief request, we understand how overwhelming this process can feel. It’s crucial to gather all relevant documentation to support your case. This includes:

- Tax Returns: Collect copies of your most recent tax returns, as they provide a comprehensive overview of your financial situation. Retaining tax returns for seven years is advisable, as this is the standard period for potential audits.

- Income Statements: Include pay stubs, W-2 forms, or 1099s to verify your income. These documents are essential for showcasing your earnings and economic stability.

- Expense Records: Document your monthly expenses, such as rent, utilities, and other bills, to illustrate your financial obligations. A transparent account of expenses can assist in discussing assistance alternatives.

- Correspondence with Iowa Department of Revenue: Keep any letters or notices received from the Iowa Department of Revenue regarding your tax situation. This correspondence can provide context and support your claims.

Organizing these documents effectively will not only streamline the process but also help you present a compelling case for relief. Creating a secure filing system, whether physical or digital, ensures that you can easily access and manage your important financial records. As Ameriprise emphasizes, "The most important factor is creating a system that makes sense to you — and to be consistent with file naming and location."

We encourage you to consistently review and eliminate obsolete documents. This practice is crucial for ensuring clarity and security in your money management. Additionally, consider shredding documents that contain sensitive information, as this helps protect your personal data. Finally, maintaining a secure list of your financial accounts and passwords can further enhance your organization and accessibility. Remember, you are not alone in this journey; we’re here to help you every step of the way.

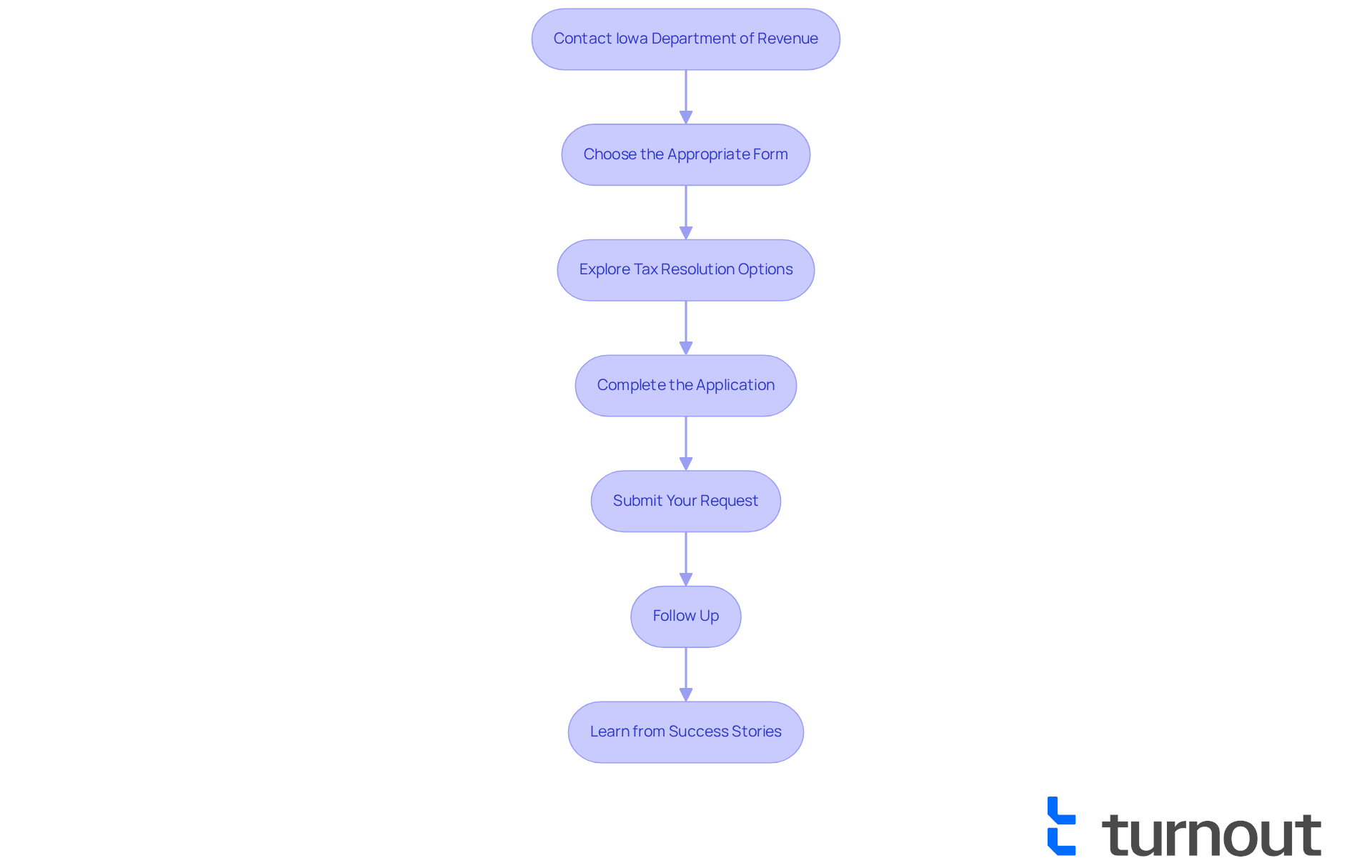

Initiate Contact and Submit Your Tax Relief Request

We understand that navigating tax relief can feel overwhelming. To help you through this process, follow these steps:

- To reach out for assistance, contact the Iowa Department of Revenue by calling their taxpayer services at 515-281-3114 or 800-367-3388. Their website also offers additional resources that may assist you.

- Choose the Appropriate Form: Depending on your unique situation, you may need to fill out specific forms, such as the Offer in Compromise application or a payment plan request. It’s essential to select the correct form that meets your needs.

- Explore Tax Resolution Options: Familiarize yourself with the various options available for tax resolution. These include currently not collectible status, offers in compromise, and installment agreements. Understanding these options can empower you to choose the best path for your circumstances.

- Complete the Application: Take your time to fill out the form thoroughly. Provide all requested information and attach the necessary documentation you gathered earlier.

- Submit Your Request: Once your application is complete, send it to the IDR via mail or electronically, if applicable. Remember to keep a copy of everything you submit for your records.

- Follow Up: After submission, it’s a good idea to follow up with the IDR to confirm they received your application and to inquire about the processing timeline. Additionally, consider consulting with Turnout's trained nonlawyer advocates or IRS-licensed enrolled agents. They can assist you in navigating this process and managing your tax liabilities effectively.

- Learn from Success Stories: Many individuals have successfully resolved their tax issues through payment plans. For instance, Turnout has helped clients manage their back tax liabilities, showing that timely payments can halt collection actions and lead to favorable outcomes. Remember, you are not alone in this journey; we’re here to help.

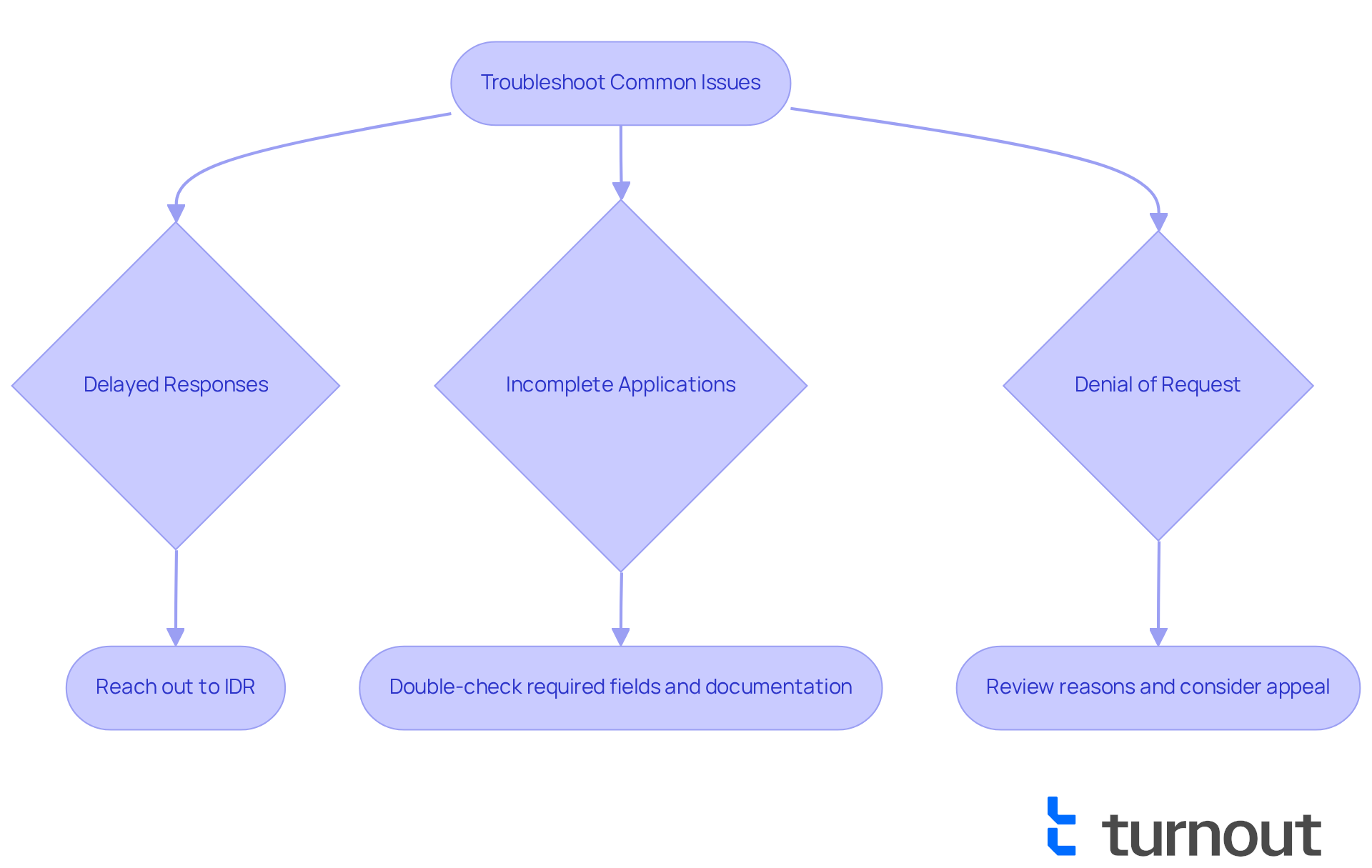

Troubleshoot Common Issues and Delays

Navigating the tax assistance process can be challenging, and we understand that it can feel overwhelming at times. Here’s how to troubleshoot common issues effectively:

- Delayed Responses: If you haven’t received a response within the expected timeframe, it’s important to reach out to the Iowa Department of Revenue (IDR) to check the status of your application. Delays can happen, but a simple follow-up can help move things along.

- Incomplete Applications: Ensure that all required fields are filled out, and that you have attached all necessary documentation. Missing information is a frequent cause of delays, so double-checking your application can save you valuable time.

- Denial of Request: If your request is denied, take a moment to carefully review the reasons provided by the Iowa Department of Revenue. You may have the option to appeal the decision or submit additional information to support your case. Understanding the denial can empower you to address any issues effectively.

If you’re struggling to meet the terms of a payment plan, please don’t hesitate to reach out to the Iowa Department of Revenue to discuss your situation. They may offer alternative arrangements based on your financial circumstances, which can help alleviate stress and keep you on track.

By being proactive and informed, you can effectively tackle these challenges and keep your tax assistance process moving forward. Remember, many individuals in Iowa face delays with their tax assistance requests, so staying engaged with the Iowa Department of Revenue is crucial for a smoother experience.

Turnout is not a law firm and does not provide legal advice. We utilize trained nonlawyer advocates for SSD claims and work with IRS-licensed enrolled agents for tax debt relief, ensuring you have the guidance needed to navigate these processes effectively. You are not alone in this journey; we’re here to help.

Conclusion

Navigating tax relief through the Iowa Department of Revenue is a vital step for individuals and businesses facing financial challenges. We understand that this journey can feel overwhelming. The department offers various programs, including the Offer in Compromise and structured payment plans, designed to alleviate tax burdens and promote economic recovery. By understanding these options, you can equip yourself with the tools necessary to manage your obligations effectively.

Key insights discussed throughout the article emphasize the importance of thorough documentation and proactive communication with the Iowa Department of Revenue. Gathering necessary financial records and being aware of potential issues can help you streamline your relief requests and increase the likelihood of successful resolutions. The recent introduction of a flat tax rate further underscores the department's commitment to easing the financial strain on residents.

Ultimately, taking action is crucial in this process. By reaching out to the Iowa Department of Revenue, understanding available options, and remaining engaged throughout the application process, you can navigate your tax challenges with confidence. This journey may seem daunting, but remember, support is available, and many have successfully found relief. Empowerment through knowledge and proactive steps can lead to a more secure financial future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the role of the Iowa Department of Revenue in tax debt relief?

The Iowa Department of Revenue provides tax debt relief through various programs designed to support individuals and businesses facing tax liabilities.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that allows taxpayers to negotiate their debts for less than the total amount owed, providing a feasible path toward economic recovery.

How does the Iowa Department of Revenue help taxpayers manage their tax obligations?

The Iowa Department of Revenue offers organized payment plans that enable manageable repayment over time, helping taxpayers address their obligations without excessive financial pressure.

What recent tax reform has been implemented in Iowa?

Recent reforms introduced a flat tax rate of 3.8%, making Iowa's rate the sixth lowest in the nation, which is expected to save taxpayers over $1 billion in the coming years.

How does the flat tax rate benefit Iowa residents?

The flat tax rate alleviates the tax burden on residents and enhances the overall economic landscape in Iowa.

Where can individuals find resources for tax assistance in Iowa?

Individuals can explore the resources available through the Iowa Department of Revenue, which demonstrates the department's commitment to supporting taxpayers in their journey toward tax assistance.