Overview

Navigating IRS tax debt can be overwhelming, but there are steps you can take to find relief through various forgiveness programs. Options like:

- Offer in Compromise (OIC)

- Currently Not Collectible (CNC) status

- Penalty abatement

may be available to you. It's important to understand the eligibility criteria and gather the necessary documentation to explore these options effectively.

Did you know that about 30% of individuals may qualify for some form of tax relief? This statistic highlights the importance of seeking professional assistance. With the right support, you can enhance your chances of a successful application. Remember, you are not alone in this journey, and we’re here to help you through the process.

Take a moment to reflect on your situation. Understanding your options is the first step toward regaining control. By reaching out for guidance, you can take meaningful action toward resolving your tax debt. Together, we can navigate these challenges and work toward a brighter financial future.

Introduction

Navigating the complexities of IRS tax debt forgiveness can feel like an uphill battle. We understand that many individuals are facing financial strain and may feel overwhelmed. With various programs designed to alleviate tax burdens, such as the Offer in Compromise and Currently Not Collectible status, understanding these options is crucial for those seeking relief. It's common to wonder how to effectively maneuver through the application process and overcome potential roadblocks.

Recent statistics reveal that nearly 30% of taxpayers may qualify for some form of assistance. This guide aims to illuminate the path toward securing IRS tax relief, empowering you to take control of your financial future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

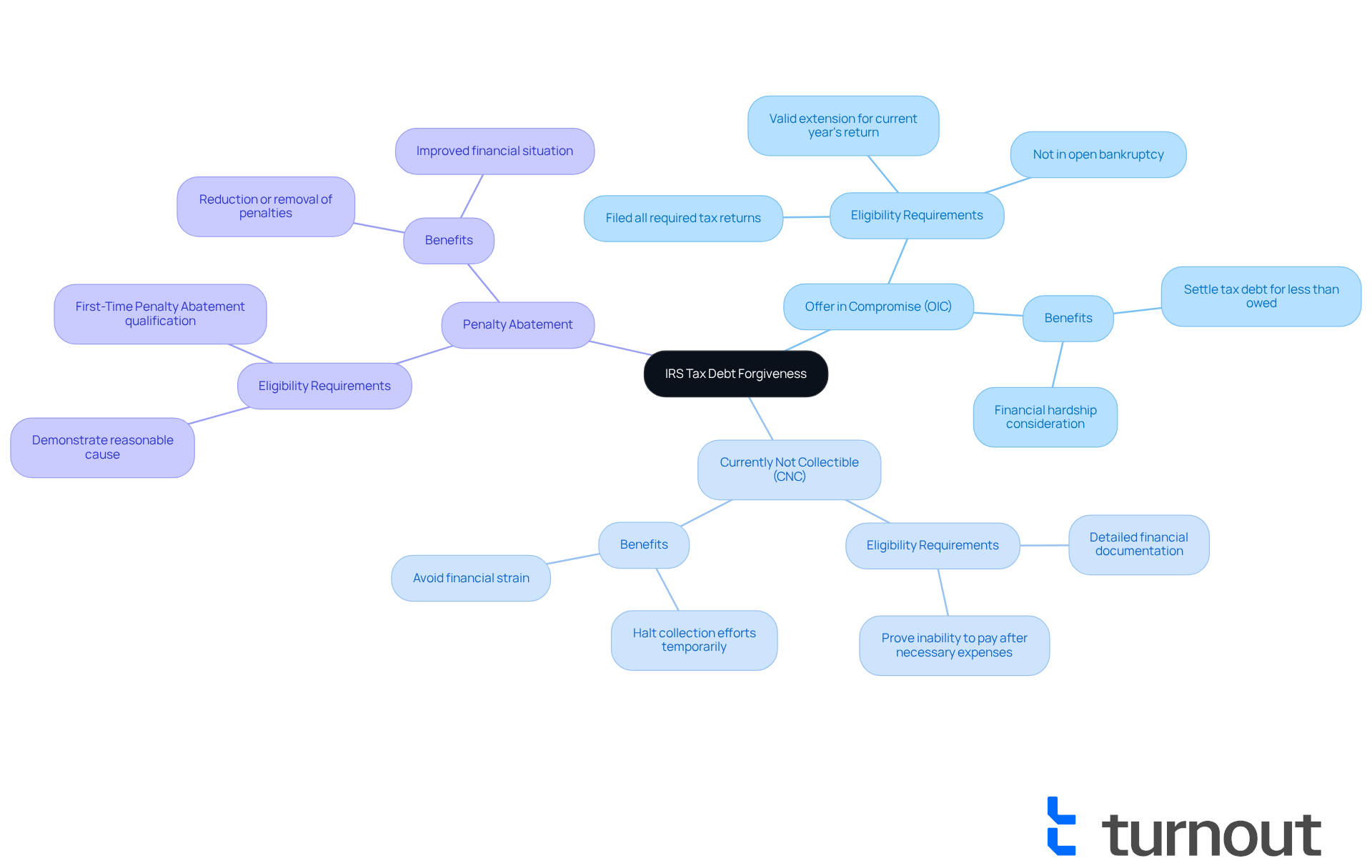

Understand IRS Tax Debt Forgiveness

IRS forgiving tax debt includes several initiatives designed to assist individuals in reducing or eliminating their tax obligations. We understand that financial challenges can be overwhelming, and these options provide essential support. Key alternatives include:

- Offer in Compromise (OIC)

- Currently Not Collectible (CNC) status

- Penalty abatement

Each program has unique eligibility requirements and application procedures that can significantly affect your financial situation.

Recent updates reveal that approximately 30% of individuals may qualify for some form of IRS tax debt relief. This highlights the importance of understanding your options. The OIC allows qualifying individuals to resolve their tax liabilities for an amount lower than what is owed, particularly when full payment would lead to financial hardship. On the other hand, CNC status offers temporary relief by halting collection efforts when you cannot pay your outstanding balance without experiencing financial strain.

Tax experts emphasize the importance of seeking assistance when navigating these initiatives. A representative from TaxAudit noted, "Understanding the eligibility criteria and submitting accurate documentation is crucial for the Offer in Compromise application process." Many have successfully lowered their tax obligations through OICs, enabling them to regain financial stability.

Receiving IRS Notices such as CP503 or CP504 can signal serious matters that require immediate attention. It's common to feel anxious in these situations, which underscores the need for prompt action. Overall, becoming familiar with the IRS forgiving tax debt options is vital for anyone facing significant tax burdens. By exploring these options and consulting with tax professionals, you can take the first step toward achieving financial relief and a more manageable tax situation. Remember, you are not alone in this journey; we're here to help.

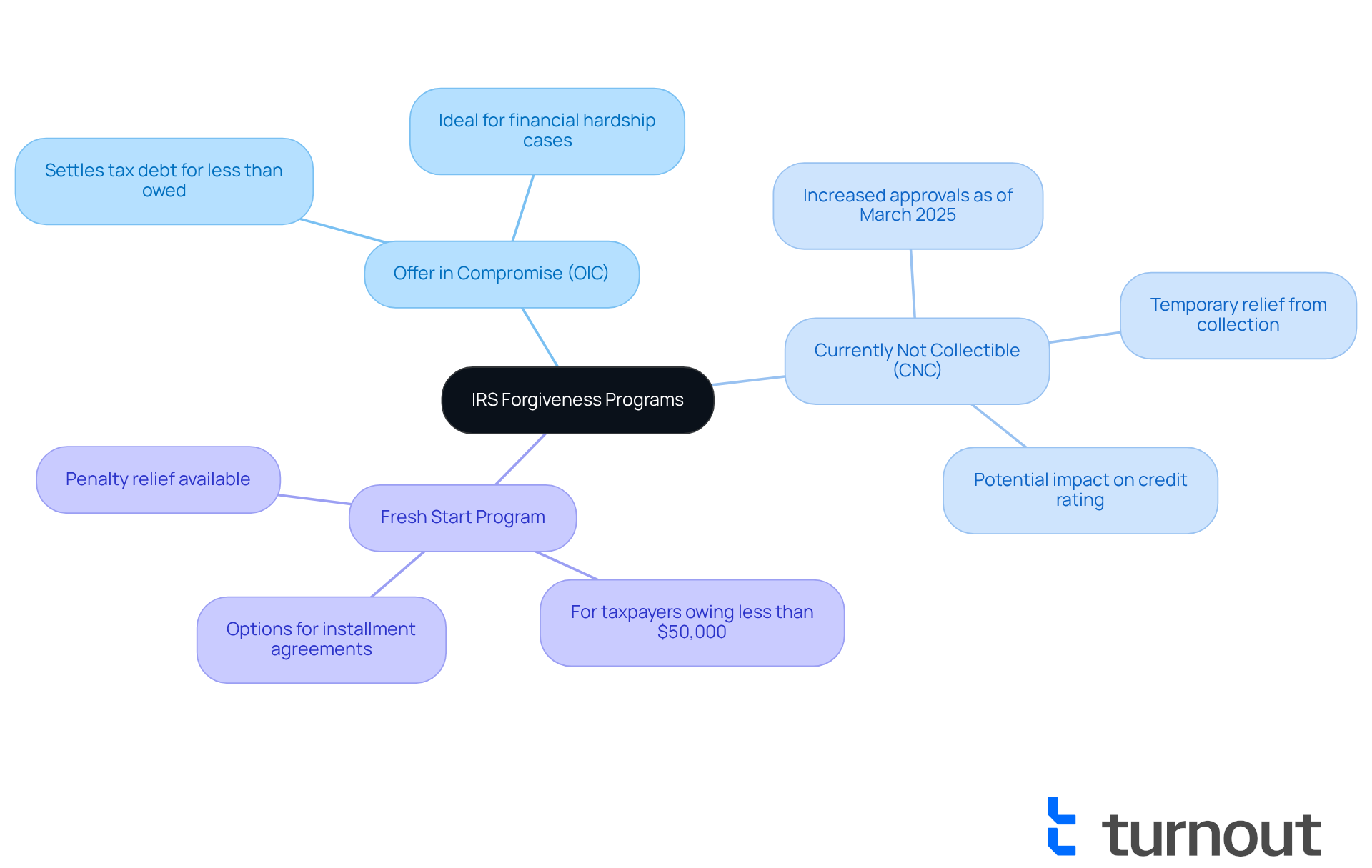

Explore Available IRS Forgiveness Programs

The IRS offers various relief initiatives, including programs for IRS forgiving tax debt, designed to support individuals as they navigate their debt challenges. If you find yourself struggling, it’s important to know that there are options available to help you regain your footing.

- Offer in Compromise (OIC): This program allows eligible taxpayers to benefit from the IRS forgiving tax debt by settling their tax debt for less than the full amount owed. It's especially beneficial for those facing financial hardships who cannot pay their tax liabilities in full due to the IRS forgiving tax debt.

- Currently Not Collectible (CNC): If you're experiencing severe financial difficulties, you may qualify for CNC status, which temporarily allows for IRS forgiving tax debt. This status can provide you with some breathing room while you work on improving your financial situation. As of March 3, 2025, the IRS forgiving tax debt has streamlined the approval process for CNC status, making it more accessible for those in need. Recent data shows that approvals for CNC status have increased, reflecting a growing understanding of the challenges individuals face. However, it's important to remember that while in CNC status, the IRS may file a Notice of Federal Tax Lien (NFTL), which can impact your credit rating.

- Fresh Start Program: This initiative is designed for taxpayers who owe less than $50,000, providing options for installment agreements and penalty relief, as part of the IRS forgiving tax debt. It aims to make repayment more manageable for you.

Understanding these systems is crucial for identifying the best course of action for your tax situation, particularly in light of the IRS forgiving tax debt. Remember, you are not alone in this journey, and we’re here to help you find the right path forward.

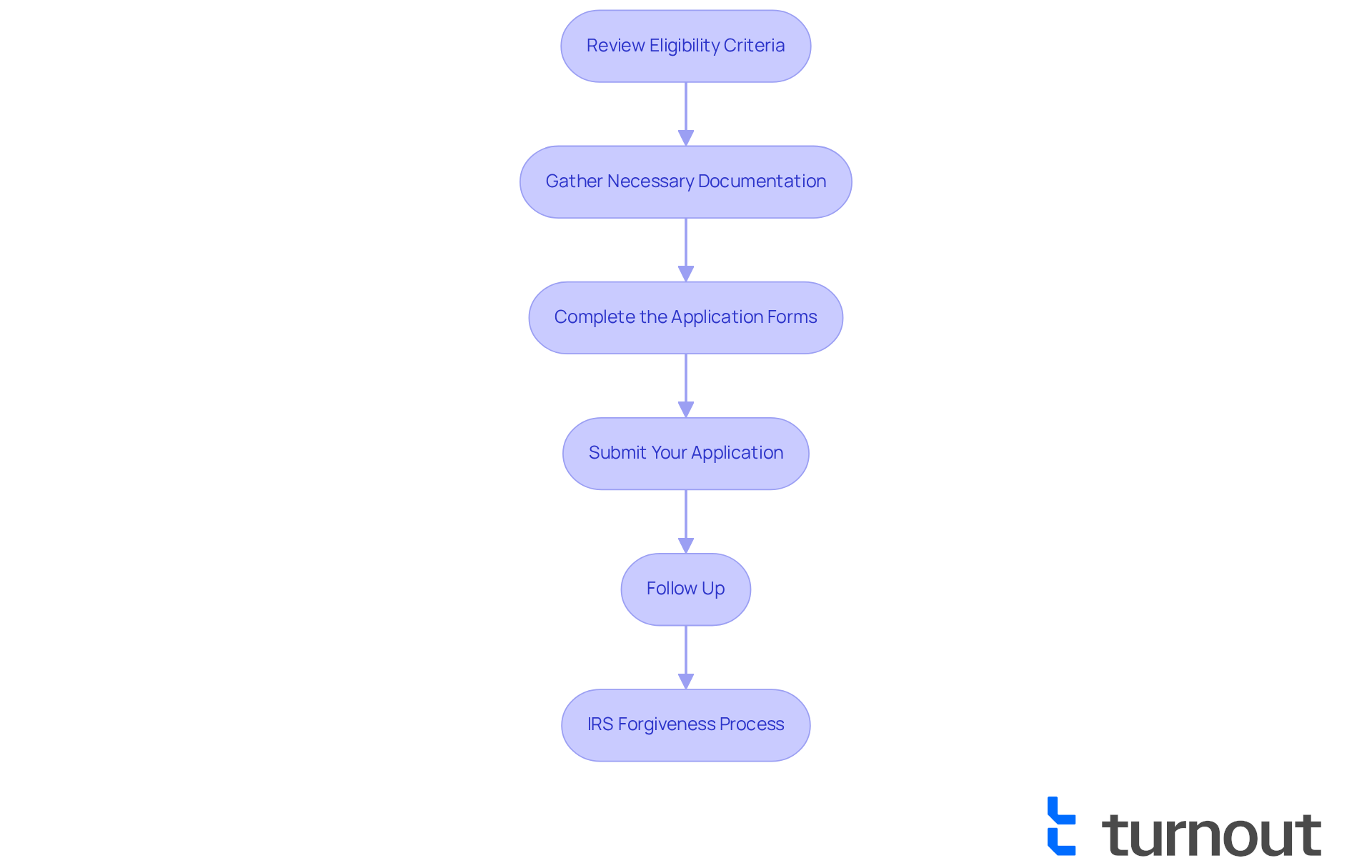

Determine Eligibility and Apply for Forgiveness

Seeking IRS forgiving tax debt can feel overwhelming, but remember, you are not alone in this journey. To help you navigate this process, it’s important to first assess your eligibility for the different options available. Here are the steps we recommend:

- Review Eligibility Criteria: Each initiative has specific requirements. For instance, the Offer in Compromise (OIC) requires you to demonstrate that you cannot pay your tax debt in full and that settling for a lesser amount is in the best interest of both you and the IRS.

- Gather Necessary Documentation: Collect all relevant financial documents, including income statements, expenses, and tax returns. This information will be crucial for your application, and having everything organized can ease your stress.

- Complete the Application Forms: Depending on the program you choose, you may need to fill out specific forms, such as Form 656 for the OIC. Ensure that all information is accurate and complete to avoid delays. We understand that paperwork can be daunting, but taking your time here is essential.

- Submit Your Application: Once your application is complete, send it along with any required fees to the IRS. Remember to keep copies of everything for your records, as it’s important to have a backup.

- Follow Up: After submission, monitor the status of your application. The IRS may request additional information, so be prepared to respond promptly. It’s common to feel anxious during this waiting period, but staying proactive can help alleviate some of that worry.

We’re here to help you through this process, and taking these steps can lead you toward relief from your tax debt due to the IRS forgiving tax debt.

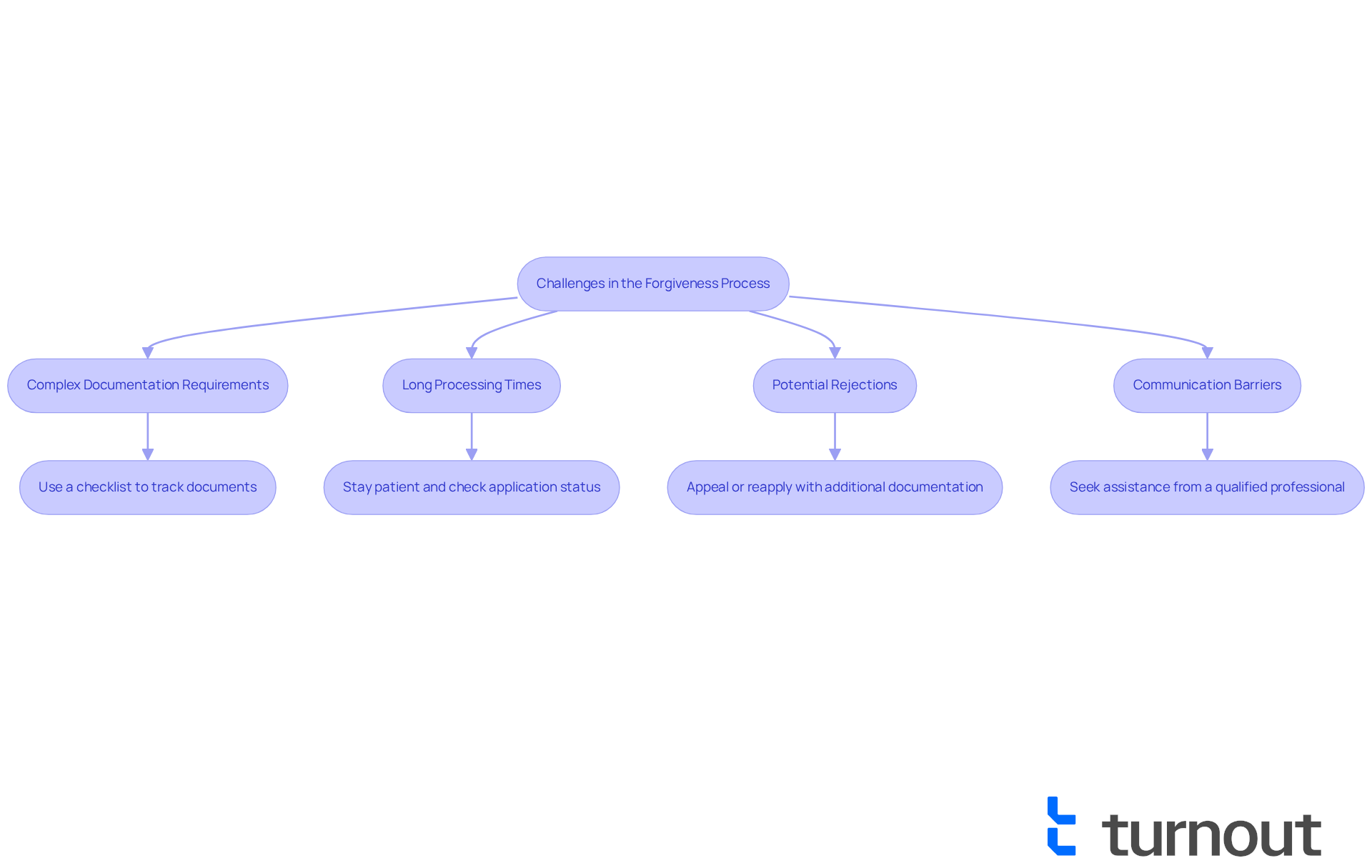

Overcome Challenges in the Forgiveness Process

Navigating the process of IRS forgiving tax debt can indeed be challenging, but being prepared can help you overcome these hurdles. We understand that facing obstacles can be overwhelming, so here are some common challenges and supportive strategies to address them:

- Complex Documentation Requirements: It’s essential to have all necessary documents organized and ready for submission. Consider using a checklist to track what you need. According to the Taxpayer Advocate Service, understanding your documentation requirements is crucial for a smooth application process.

- Long Processing Times: We know that the IRS may take considerable time to review applications, often averaging several months. In fact, the average processing time for forgiveness applications can extend beyond six months. Stay patient and check your application status regularly. If you haven't heard back in a reasonable time, it's perfectly okay to follow up with the IRS.

- Potential Rejections: If your application is denied, please don’t be discouraged. You can appeal the decision or reapply with additional documentation that addresses the reasons for the denial. Success stories from the Taxpayer Advocate Service highlight that many taxpayers have successfully appealed IRS forgiveness denials by providing comprehensive documentation.

- Communication Barriers: If you encounter difficulties communicating with the IRS, consider seeking assistance from a qualified professional who can help advocate on your behalf. As stated by the Taxpayer Advocate Service, "Our advocates can help if you have tax problems that you can’t resolve on your own."

By anticipating these challenges and preparing accordingly, you can enhance your chances of successfully securing tax debt forgiveness. Remember, you are not alone in this journey; we're here to help.

Conclusion

Understanding the pathways to IRS tax debt forgiveness is essential for anyone grappling with financial challenges related to tax obligations. We recognize that navigating these waters can be overwhelming, but various relief programs, such as the Offer in Compromise, Currently Not Collectible status, and the Fresh Start Program, serve as lifelines for individuals seeking to alleviate their tax burdens. These initiatives not only provide financial relief but also foster a sense of hope for those feeling weighed down by their tax liabilities.

Throughout this article, we have highlighted key insights into the eligibility criteria and application processes for these forgiveness programs. It’s important to emphasize that accurate documentation and proactive communication with the IRS can significantly enhance your chances of securing relief. We understand that the journey may present common challenges, such as complex documentation requirements and long processing times. However, being informed equips you with the knowledge needed to navigate this process more effectively.

Ultimately, the message is clear: IRS tax debt forgiveness is not just a distant possibility; it is an achievable goal for many. By taking the time to explore available options, seeking professional guidance, and remaining persistent in the face of challenges, you can take meaningful steps toward regaining financial stability. Remember, you are not alone in this journey. The path to relief may seem daunting, but with the right information and support, it is within reach.

Frequently Asked Questions

What is IRS tax debt forgiveness?

IRS tax debt forgiveness includes several initiatives designed to assist individuals in reducing or eliminating their tax obligations, providing essential support during financial challenges.

What are the main programs available for IRS tax debt forgiveness?

The main programs include Offer in Compromise (OIC), Currently Not Collectible (CNC) status, and penalty abatement.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) allows qualifying individuals to resolve their tax liabilities for an amount lower than what is owed, particularly when full payment would lead to financial hardship.

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible (CNC) status offers temporary relief by halting collection efforts when an individual cannot pay their outstanding balance without experiencing financial strain.

How many individuals may qualify for IRS tax debt relief?

Approximately 30% of individuals may qualify for some form of IRS tax debt relief.

Why is it important to seek assistance when applying for tax debt forgiveness?

Seeking assistance is crucial because understanding eligibility criteria and submitting accurate documentation is vital for the Offer in Compromise application process.

What should I do if I receive IRS Notices like CP503 or CP504?

Receiving IRS Notices such as CP503 or CP504 signals serious matters that require immediate attention, and it is important to take prompt action in these situations.

How can tax professionals help individuals facing tax burdens?

Tax professionals can provide guidance on exploring IRS tax debt forgiveness options and assist with the application process, helping individuals achieve financial relief and a more manageable tax situation.