Overview

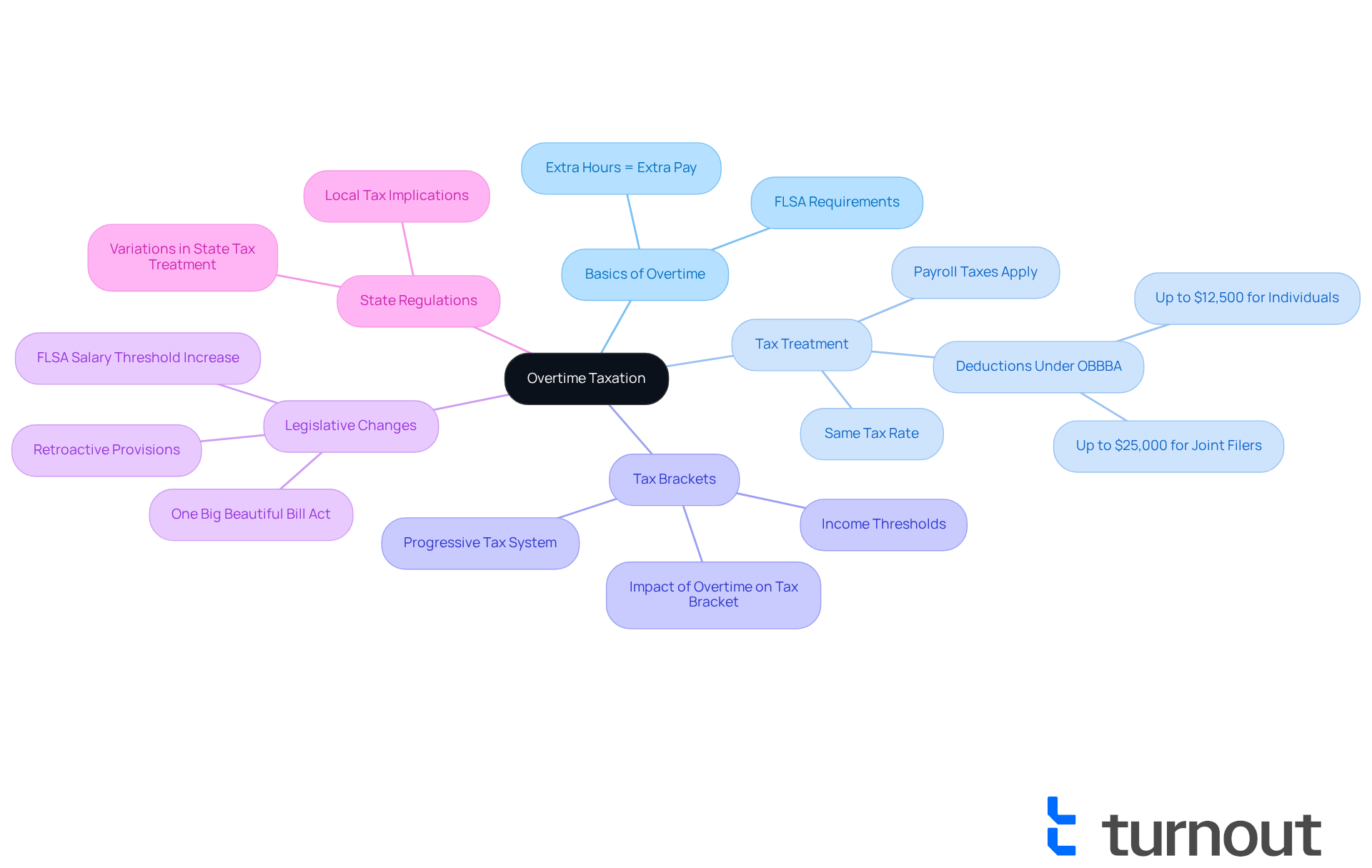

We understand that navigating the complexities of overtime pay and taxation can be overwhelming. It's common to feel concerned about how your hard-earned overtime might impact your overall tax situation. However, it's important to know that overtime is not taxed at a higher rate than your regular wages. Instead, it is treated as ordinary income and taxed according to your individual tax bracket.

While the additional income from overtime may indeed push your total earnings into a higher tax bracket, leading to a perception of increased taxation, the reality is that most of your earnings will still be taxed at the lower rates. Additionally, state-specific tax regulations can influence how much you ultimately owe on your overtime pay.

Remember, you are not alone in this journey. If you have questions or need assistance, we're here to help you navigate these financial waters with confidence.

Introduction

Understanding the nuances of overtime taxation can feel overwhelming for many workers. We recognize the effort you put in to maximize your earnings while navigating complex tax regulations. Overtime pay, often viewed as a reward for hard work, raises important questions about its effect on your overall income and tax liability.

This article explores the critical differences in how various states tax overtime, revealing both opportunities and challenges for employees like you who aim to optimize their financial outcomes.

How can you effectively plan for potential tax implications while ensuring you benefit from those extra hours?

Understand Overtime Taxation: Basics and Definitions

Overtime pay is more than just ; it’s about ensuring you receive fair compensation for your hard work. When you work beyond the standard 40-hour workweek in the U.S., you earn . This extra compensation is treated as ordinary income under current tax regulations, meaning it’s subject to the same federal and state tax rates as your regular wages. Starting in 2025, you can subtract up to $12,500 from your taxable income for those extra hours, and if you file jointly, that amount increases to $25,000. is vital for grasping how it may affect your overall tax liability.

However, it’s common to feel concerned about how increased earnings from overtime is , which might push you into a higher . For example, if your base salary is $42,000 and you earn an additional $8,000 from extra hours, your total income of $50,000 could place you partially in the 22% tax bracket. This can be confusing, as it may seem like overtime is taxed at a higher rate. In reality, only the income above the threshold is overtime taxed at a higher rate, while the majority of your earnings continue to be taxed at the lower rate.

Real-world experiences show that while additional pay is taxed similarly across regions, differences in state . Some states have varying tax rates or exemptions that can change how your extra hours are taxed. It’s essential to grasp these subtleties to manage your financial planning effectively. Recent legislative changes, like the One Big Beautiful Bill Act, enacted on July 4, 2025, include a retroactive clause effective from January 1, 2025, until the end of 2028. Additionally, the FLSA salary limit will rise to $58,656 per year on January 1, 2025, which may affect your eligibility for extra pay.

According to the IRS, "No, additional pay is not taxed differently than your standard pay." This statement emphasizes that additional hours worked are taxed at the same rate as your regular earnings, depending on your tax bracket. Remember, you are not alone in navigating these complexities, and we’re here to help you understand them better.

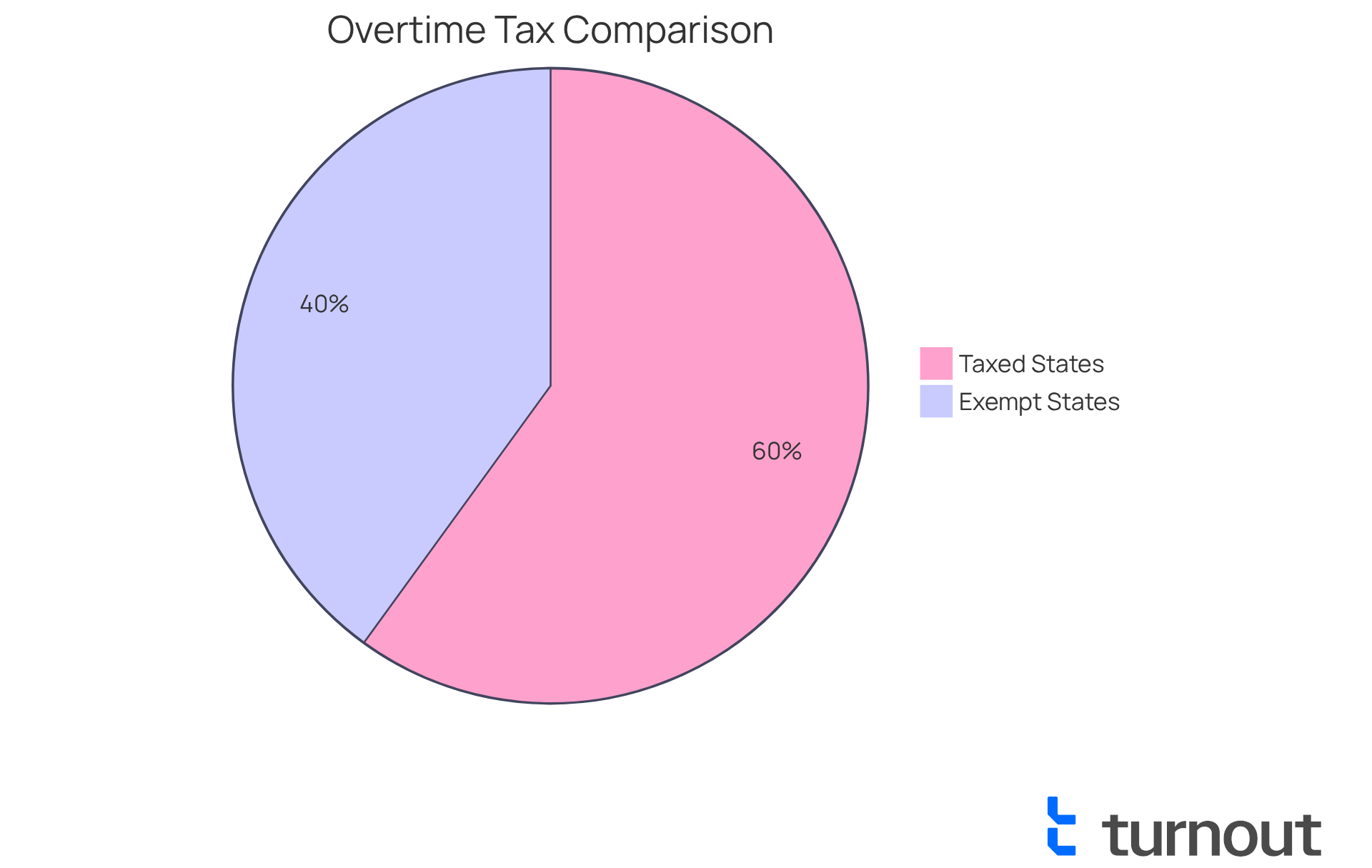

Compare Overtime Tax Rates: State-by-State Analysis

In the United States, navigating additional pay can feel overwhelming, as handling varies significantly by region. For instance, in Alabama, regulations have been put in place that exclude extra hours compensation from local income tax, providing a to employees. On the other hand, states like California enforce strict extra hour regulations and tax systems, which is why overtime is , potentially leading to a heavier for workers.

We understand that these differences can have a profound impact on your financial situation. This section will delve into specific examples, comparing states that offer with those that do not. By exploring these contrasts, we aim to shed light on how they can influence your financial well-being.

It's common to feel uncertain about how these factors affect your . Understanding these nuances is crucial for making informed decisions. Remember, you are not alone in this journey; we’re here to help you .

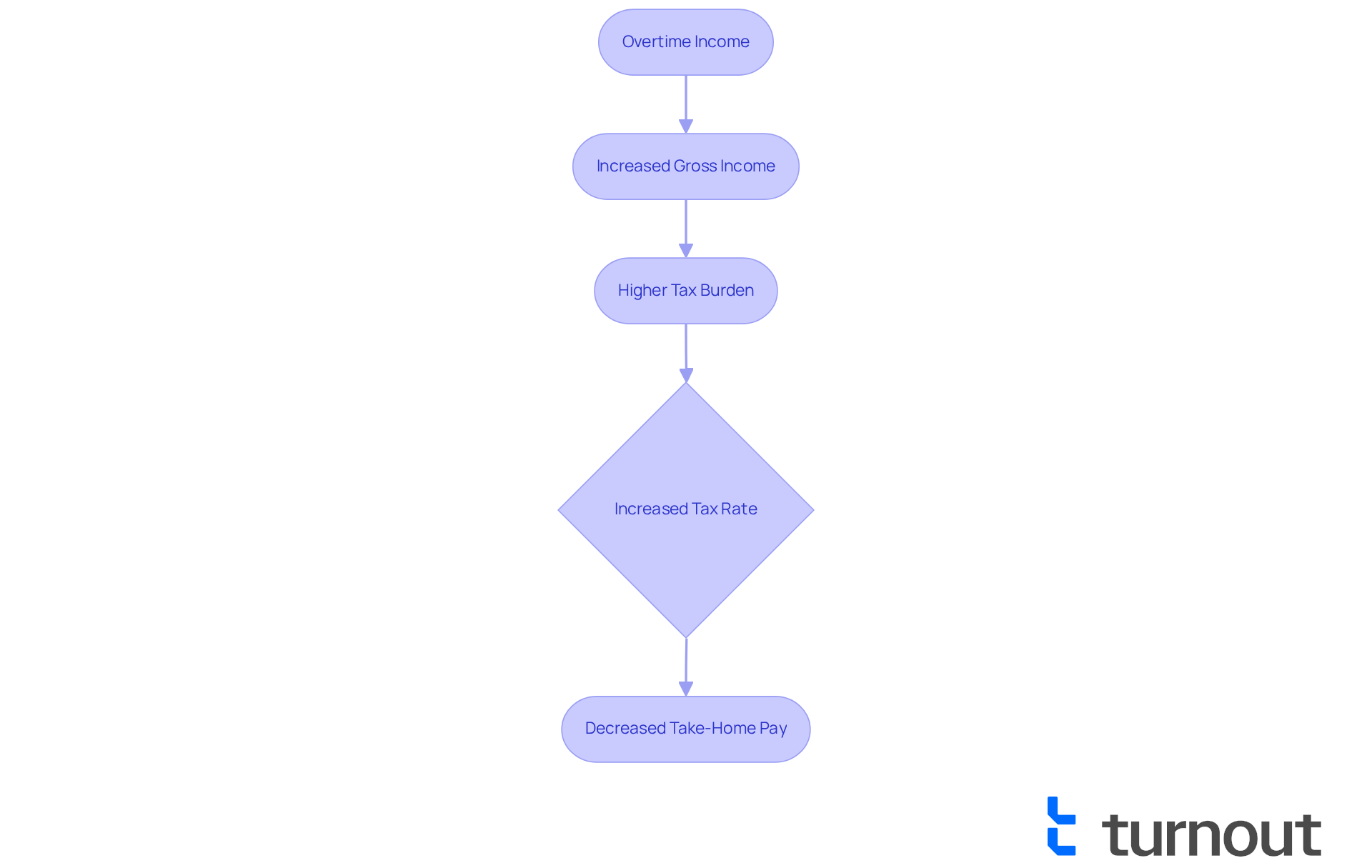

Evaluate the Impact of Overtime Taxation on Workers' Finances

The financial implications of extra hours taxation can be profound for workers. We understand that while additional pay raises gross income, they can also lead to a greater , particularly because , which may push employees into a higher tax bracket. For example, a worker earning $50,000 each year who takes on $10,000 in extra hours may find themselves facing a significantly elevated tax rate on that extra income because overtime is taxed at a higher rate.

This section will explore case studies and hypothetical scenarios to illustrate how taxation on additional work hours can impact take-home pay, savings potential, and overall . It's common to feel overwhelmed by these complexities, but is crucial for making and financial goals. Remember, you are not alone in this journey; we’re here to help you these challenges.

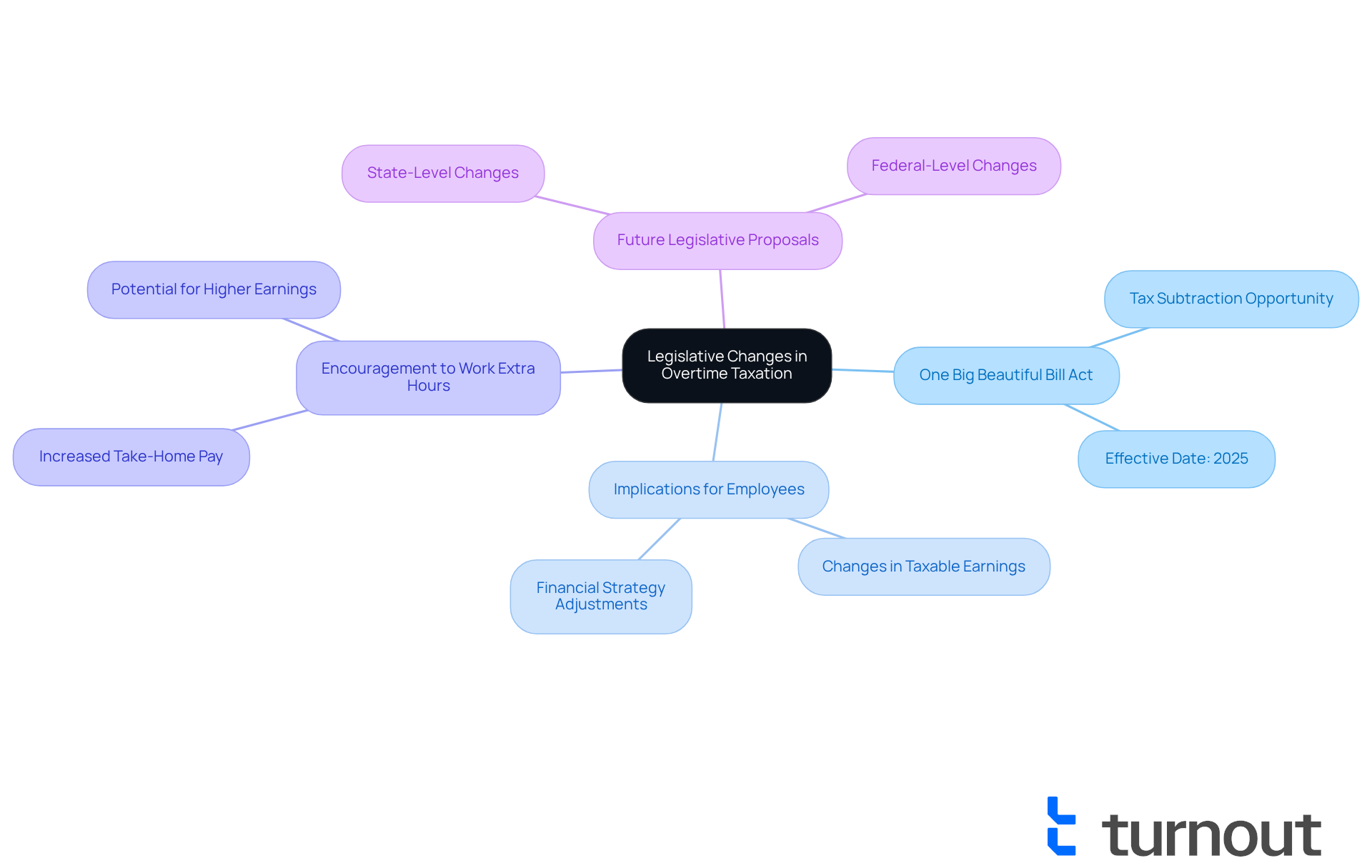

Examine Future Trends: Legislative Changes in Overtime Taxation

Recent legislative changes, especially the introduction of the One Big Beautiful Bill Act, carry important implications for how . Starting in 2025, qualified employees will have the chance to subtract up to $12,500 of their extra compensation from their taxable earnings. This modification could significantly change how you think about working extra hours.

We understand that navigating these changes can be overwhelming. This section will explore the potential impacts of this legislation on your . It may even encourage more employees to consider working additional hours.

Moreover, we will look into other proposed changes at both the state and federal levels that could further affect how overtime is taxed at a higher rate. By doing so, we aim to provide you with a comprehensive view of the future landscape of overtime pay and taxation. Remember, you're not alone in this journey, and we're here to help you make sense of these developments.

Conclusion

Understanding the intricacies of overtime taxation is essential for workers like you who aim to maximize your earnings and manage your financial future effectively. While overtime pay provides additional income, it is subject to the same tax rates as regular wages, which can understandably create confusion about potential higher tax burdens. It's important to know that only the income exceeding certain thresholds is taxed at a higher rate. Recognizing this can alleviate concerns about how extra hours impact your overall tax liability.

We understand that navigating these complexities can feel overwhelming. Key points to consider include:

- The importance of knowing state-specific regulations that can significantly affect your net income.

- For instance, states like Alabama provide tax exemptions for overtime, while others, such as California, impose stricter tax rates.

- Furthermore, recent legislative changes, including the One Big Beautiful Bill Act, promise to reshape how overtime earnings are treated, offering potential deductions that can ease the tax burden for many workers.

As the landscape of overtime taxation evolves, it is crucial for you to stay informed and proactive in your financial planning. Understanding how different states tax overtime can empower you to make strategic decisions about your work hours and overall financial health. Engaging with these complexities not only prepares you for upcoming changes but also equips you to optimize your earnings and navigate the financial implications of your labor effectively. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is overtime pay and how is it taxed?

Overtime pay is compensation for hours worked beyond the standard 40-hour workweek. It is treated as ordinary income and is subject to the same federal and state tax rates as regular wages.

Can I subtract any amount from my taxable income for overtime pay?

Starting in 2025, you can subtract up to $12,500 from your taxable income for overtime pay, which increases to $25,000 if you file jointly.

Will earning overtime push me into a higher tax bracket?

Earning overtime may increase your total income, which could place you partially in a higher tax bracket. However, only the income above the threshold is taxed at the higher rate; the majority of your earnings remain taxed at the lower rate.

Do state tax regulations affect how overtime is taxed?

Yes, state tax regulations can vary, impacting how your overtime pay is taxed. Some states have different tax rates or exemptions that can change your net income.

What recent legislative changes affect overtime pay and taxation?

The One Big Beautiful Bill Act, enacted on July 4, 2025, includes a retroactive clause effective from January 1, 2025, until the end of 2028. Additionally, the FLSA salary limit will rise to $58,656 per year on January 1, 2025, which may affect eligibility for extra pay.

Is overtime pay taxed differently than standard pay?

No, according to the IRS, additional pay is not taxed differently than standard pay. It is taxed at the same rate as regular earnings based on your tax bracket.