Overview

We understand that managing tax liabilities can be overwhelming. The IRS offers payment plans that allow individuals to gradually address their tax obligations, providing both short-term and long-term options tailored to your financial situation. This article guides you through the application process, eligibility requirements, and associated costs.

These arrangements are designed to relieve immediate financial burdens while ensuring you remain compliant with your tax responsibilities. Remember, you are not alone in this journey, and we're here to help you navigate these options with care and understanding.

Introduction

Navigating tax obligations can often feel like a daunting task. We understand that facing the challenge of settling debts with the IRS can lead to overwhelming stress and financial strain. The prospect of immediate payment may seem insurmountable for many individuals. Fortunately, the IRS offers payment plans designed to alleviate this burden, allowing taxpayers to manage their obligations in a more structured and manageable way.

But how does one go about setting up these arrangements? What factors should be considered when choosing between short-term and long-term options? This guide will explore the intricacies of IRS payment plans, providing clarity on:

- Eligibility

- Application processes

- Associated costs

You are not alone in this journey; we’re here to help empower you to regain control over your financial future.

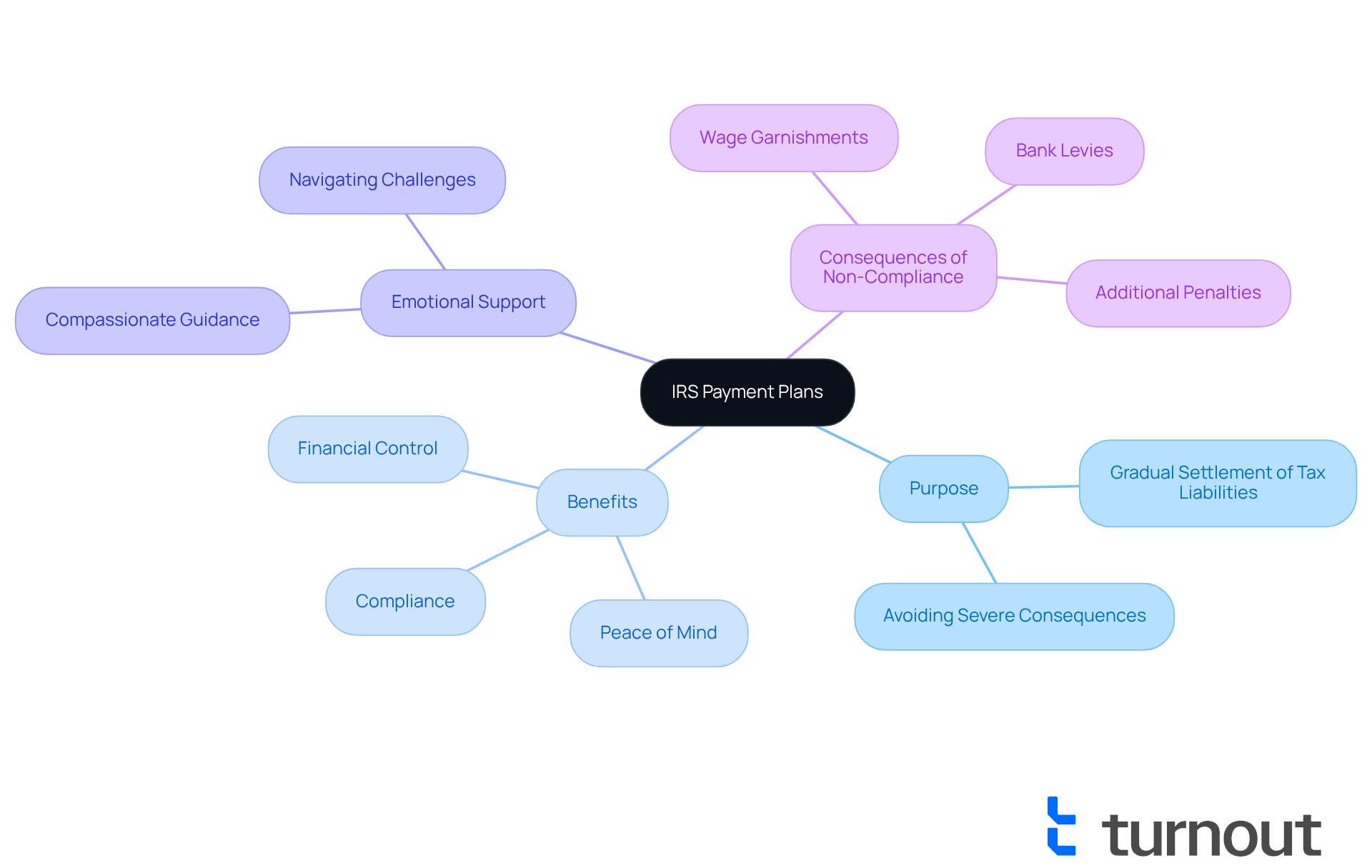

Define IRS Payment Plans and Their Purpose

are agreements between individuals and the Internal Revenue Service (IRS) that allow you to settle your tax liabilities gradually, rather than all at once. We understand that financial difficulties can make it challenging to pay your entire tax obligation right away. These arrangements are designed to assist those who find themselves in such situations, providing a pathway to without overwhelming stress.

By establishing a , you can avoid more severe consequences, such as wage garnishments or bank levies. This approach not only helps you stay compliant with your tax responsibilities but also offers peace of mind. The main goal of these strategies is to provide a feasible way for you to address your debts without excessive financial burden.

Ultimately, this can empower you to regain control over your finances and prevent additional penalties. Remember, you are not alone in this journey; we’re here to help you with compassion and understanding.

Explore Types of IRS Payment Plans: Short-Term vs. Long-Term

Navigating tax obligations can be overwhelming, and it's important to know that there are options available to help you manage your payments. One question that often arises is, does the for its payment arrangements, which can be categorized as short-term and long-term?

: If you can settle your tax debt within 120 days, this arrangement might be the right choice for you. There’s no setup fee involved, but keep in mind that interest and penalties will continue to accrue until your balance is fully paid. This option is ideal for those who anticipate having the necessary funds soon and wish to minimize additional costs.

, also known as Installment Agreements, provide insight into how the IRS sets up payment plans that allow you to pay off your tax obligations over a longer period, typically exceeding 120 days. A setup charge applies, which varies depending on whether you choose direct debit or another payment method. These extended strategies are suitable for individuals who need more time to settle their debts and prefer a structured repayment schedule. Understanding the differences between these options can empower you to choose the most suitable alternative based on your financial situation.

Remember, you are not alone in this journey. We're here to help you find the best solution for your needs.

Guide to Applying for an IRS Payment Plan: Steps and Requirements

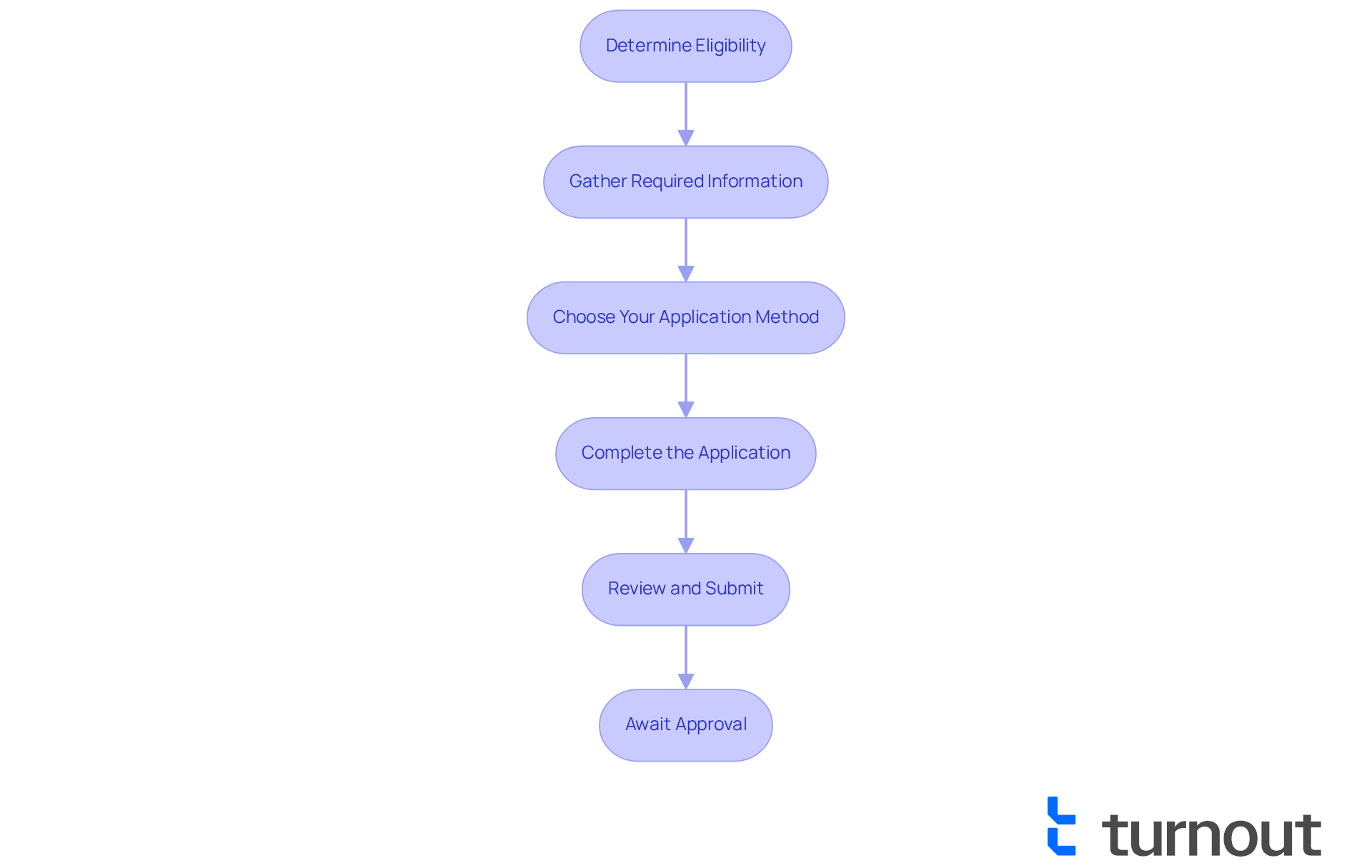

Applying for an can feel overwhelming, but we're here to help you understand . Here are some key steps to guide you:

- Determine Eligibility: We understand that can be challenging. Before applying, please ensure that you owe $50,000 or less in combined tax, penalties, and interest if you are an individual taxpayer, or $25,000 or less if you are a business taxpayer.

- Gather Required Information: Collecting the necessary documentation is crucial. Make sure to have your number, tax return information, and details about your income and expenses ready.

- Choose Your Application Method: You have options! You can apply online through the IRS website, by phone, or by submitting Form 9465 (Installment Agreement Request) via mail. Choose the method that feels most comfortable for you.

- Complete the Application: Take your time filling out the application form accurately. If you're applying online, just follow the prompts to complete the process smoothly.

- Review and Submit: Before submitting, double-check your application for accuracy. If you apply online, you will receive immediate confirmation. If you submit by mail, be sure to keep a copy for your records.

- : We know waiting can be stressful. The IRS will review your application and notify you of their decision. If approved, you will receive , including details on how does the IRS set up payment plans, the monthly installment amount, and due dates.

Remember, you're not alone in this journey. We are here to support you every step of the way.

Understand Costs and Fees Related to IRS Payment Plans

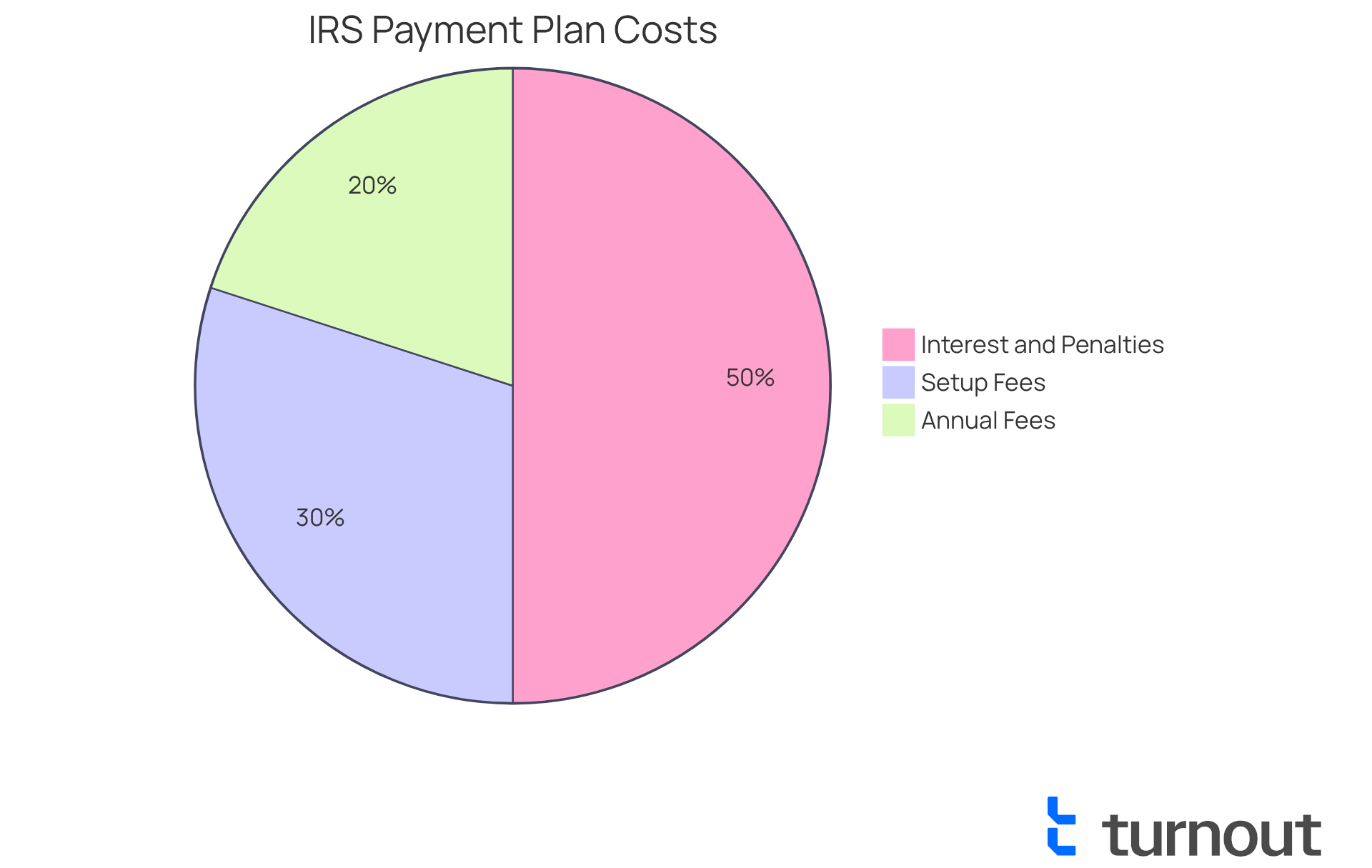

When considering , it’s important to be aware of the associated costs and fees that may arise. We understand that navigating these can be overwhelming, so here’s what you need to know:

- Setup Fees: For long-term payment plans, a is required, and this can vary based on the payment method. For example, opting for direct debit might lead to a lower fee compared to other payment methods.

- Interest and Penalties: While you’re on a repayment plan, it’s common for on the outstanding balance. Additionally, penalties may apply if any installments are missed. Being aware of these potential costs can help you anticipate the total amount you’ll be responsible for over time.

- : Some payment arrangements might also include annual fees, particularly for long-term contracts. It’s crucial to review the terms of your specific plan to fully understand how does the IRS set up payment plans and the possible costs involved.

By staying informed about these fees, you can better manage your finances and avoid unexpected surprises as you work towards . Remember, you are not alone in this journey, and we’re here to help you navigate it.

Conclusion

Establishing an IRS payment plan can be a vital step for individuals facing financial strain due to tax liabilities. We understand that managing these obligations can feel overwhelming, but these structured agreements enable taxpayers to handle their debts over time. This alleviates the pressure of immediate payment and allows for a more manageable approach to fulfilling tax responsibilities.

Throughout this article, we’ve shared key insights about the different types of IRS payment plans, including short-term and long-term options.

- Short-term plans are ideal for those who can pay within 120 days without incurring setup fees.

- Long-term plans offer a more extended repayment schedule, albeit with some associated costs.

Our step-by-step guide provided practical advice on applying for these plans, emphasizing the importance of understanding eligibility criteria and gathering necessary documentation. Additionally, being aware of potential costs, such as setup fees and interest, is crucial for effective financial planning.

In conclusion, navigating tax obligations with the support of an IRS payment plan can significantly enhance your financial stability and peace of mind. By understanding the options available and following the application process, you can take proactive steps toward resolving your tax debts. Remember, you are not alone in this journey; it’s essential to stay informed and seek assistance when needed. Taking control of your tax liabilities not only prevents further complications but also empowers you to regain your financial footing. We're here to help you every step of the way.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans are agreements between individuals and the Internal Revenue Service (IRS) that allow taxpayers to settle their tax liabilities gradually rather than all at once.

Why are IRS payment plans necessary?

They are designed to assist individuals who face financial difficulties and cannot pay their entire tax obligation immediately, providing a manageable way to address debts without overwhelming stress.

What are the benefits of establishing an IRS payment plan?

By establishing a payment plan, taxpayers can avoid severe consequences such as wage garnishments or bank levies, stay compliant with tax responsibilities, and gain peace of mind.

How do IRS payment plans help with financial management?

These plans provide a feasible way to manage tax debts without excessive financial burden, empowering individuals to regain control over their finances and prevent additional penalties.

Is support available for individuals navigating IRS payment plans?

Yes, there is support available to help individuals navigate through the challenges of establishing and maintaining IRS payment plans with compassion and understanding.