Overview

Navigating the complexities of Social Security Disability Insurance (SSDI) can be challenging, and we understand the emotional toll it can take. This article explores the key factors that influence the SSDI amount, such as your work history and Average Indexed Monthly Earnings (AIME). By shedding light on these elements, we aim to empower you with the knowledge you need.

In addition to understanding how SSDI amounts are determined, we offer valuable tips for successfully maneuvering through the application process. It's common to feel overwhelmed by the forms and requirements, but we’re here to help you avoid common pitfalls that could hinder your chances of approval. Remember, you are not alone in this journey.

As you prepare your application, keep in mind that small mistakes can make a big difference. By focusing on the details and following our guidance, you can enhance your likelihood of receiving the support you deserve. We encourage you to take the first step with confidence, knowing that assistance is within reach.

Introduction

Understanding the intricacies of Social Security Disability Insurance (SSDI) is crucial for millions who rely on it for financial support during challenging times. We understand that navigating this federal program can feel overwhelming. It not only provides essential assistance to those unable to work due to disabilities but also involves a complex qualification process and payment calculation. As the landscape of SSDI evolves, it’s common to feel uncertain about how various factors influence your benefits and how to avoid common pitfalls in your applications.

How can you ensure that you are maximizing your SSDI payments while successfully maneuvering through the application process? You're not alone in this journey, and we’re here to help you find the answers you need.

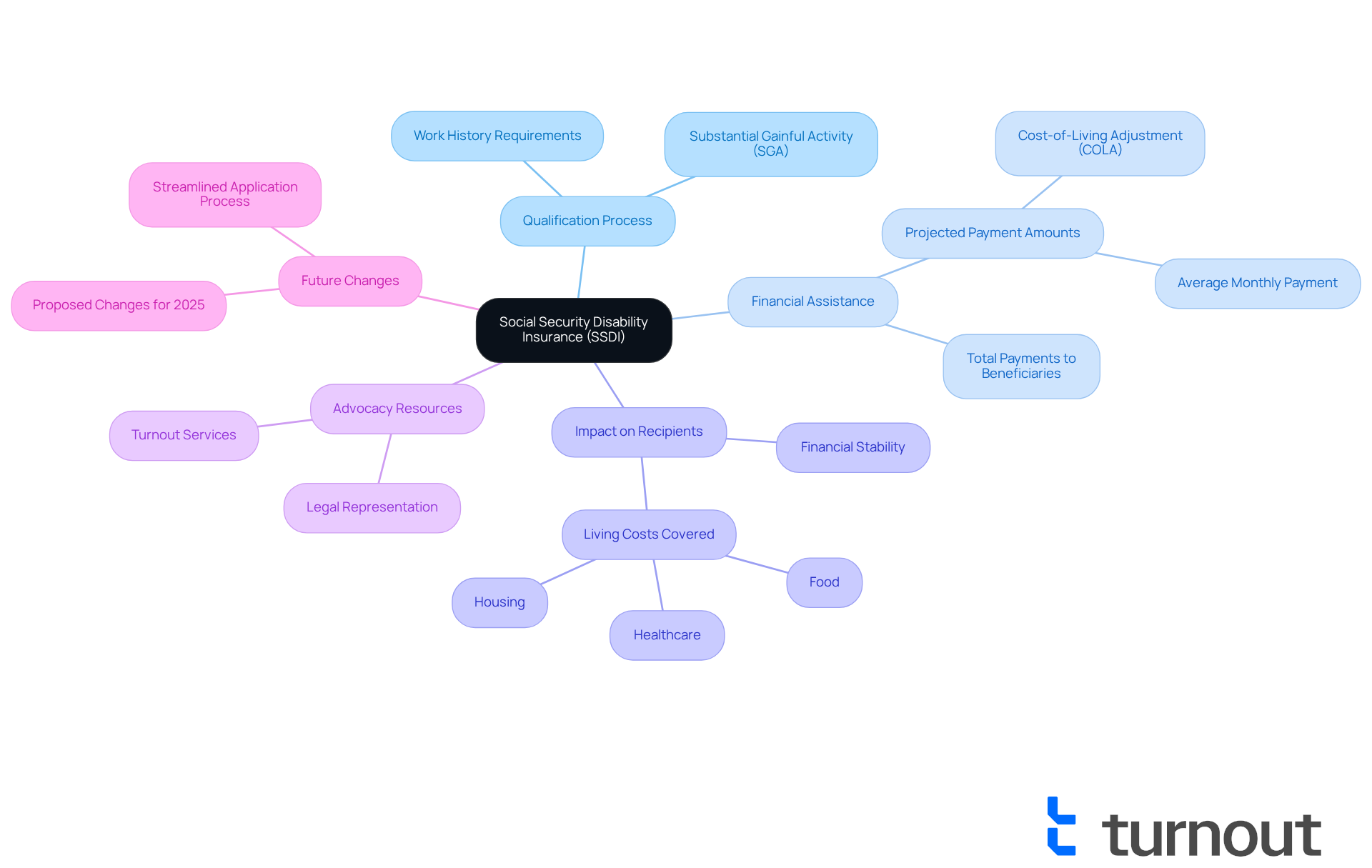

Define Social Security Disability Insurance (SSDI)

Insurance is a vital federal initiative that offers essential financial assistance, known as the , to individuals who are unable to work due to significant disabilities. We understand that the qualification process can be daunting. To qualify, applicants must:

- Demonstrate a work history that includes paying Social Security taxes.

- Show that their disability prevents them from engaging in substantial gainful activity (SGA).

In 2025, these will be especially crucial, helping recipients cover essential living costs such as housing, food, and healthcare. With a 2.5% cost-of-living adjustment (COLA) expected, the average monthly disbursements, which include the ssdi amount, are projected to rise to around $2,800.

As of December 2023, over 8.7 million individuals with disabilities received support payments, totaling nearly $12.7 billion. This program not only replaces a portion of lost income but also ensures the ssdi amount, playing a critical role in maintaining financial stability during challenging times. Advocates emphasize the importance of [Social Security Disability Insurance](https://ssa.gov/policy/docs/statcomps/di_asr), highlighting that the ssdi amount serves as a safety net for those facing the difficulties of living with a disability.

to these benefits by offering resources and services that assist consumers in navigating the disability benefits process. It's important to clarify that Turnout is not a law firm and has no affiliation with any law firm or government agency. By employing skilled non-professional advocates, Turnout helps clients and the necessary steps to apply for Social Security Disability Insurance, ensuring they receive the support they need without the burdens of legal guidance.

Success stories illustrate the program's positive impact, with the Social Security Administration working to simplify the disability benefits application process to ensure that applicants understand the ssdi amount through initiatives like enhancing online applications and reducing the number of questions. These efforts are expected to significantly shorten wait times for individuals with severe disabilities. The introduction of a new digital claims system aims to expedite processing times, allowing applicants to receive decisions more swiftly.

Moreover, the ssdi amount serves as a crucial support for many individuals. Approximately 85% of disabled recipients are employees who rely on this assistance to manage their daily lives. As the landscape of disability assistance evolves, it is essential to stay informed about changes in Social Security Disability Insurance. Understanding these changes can help individuals grasp their impacts on assistance and eligibility. Remember, you are not alone in this journey; we are here to help.

Calculate Your SSDI Payments: Key Factors and Methods

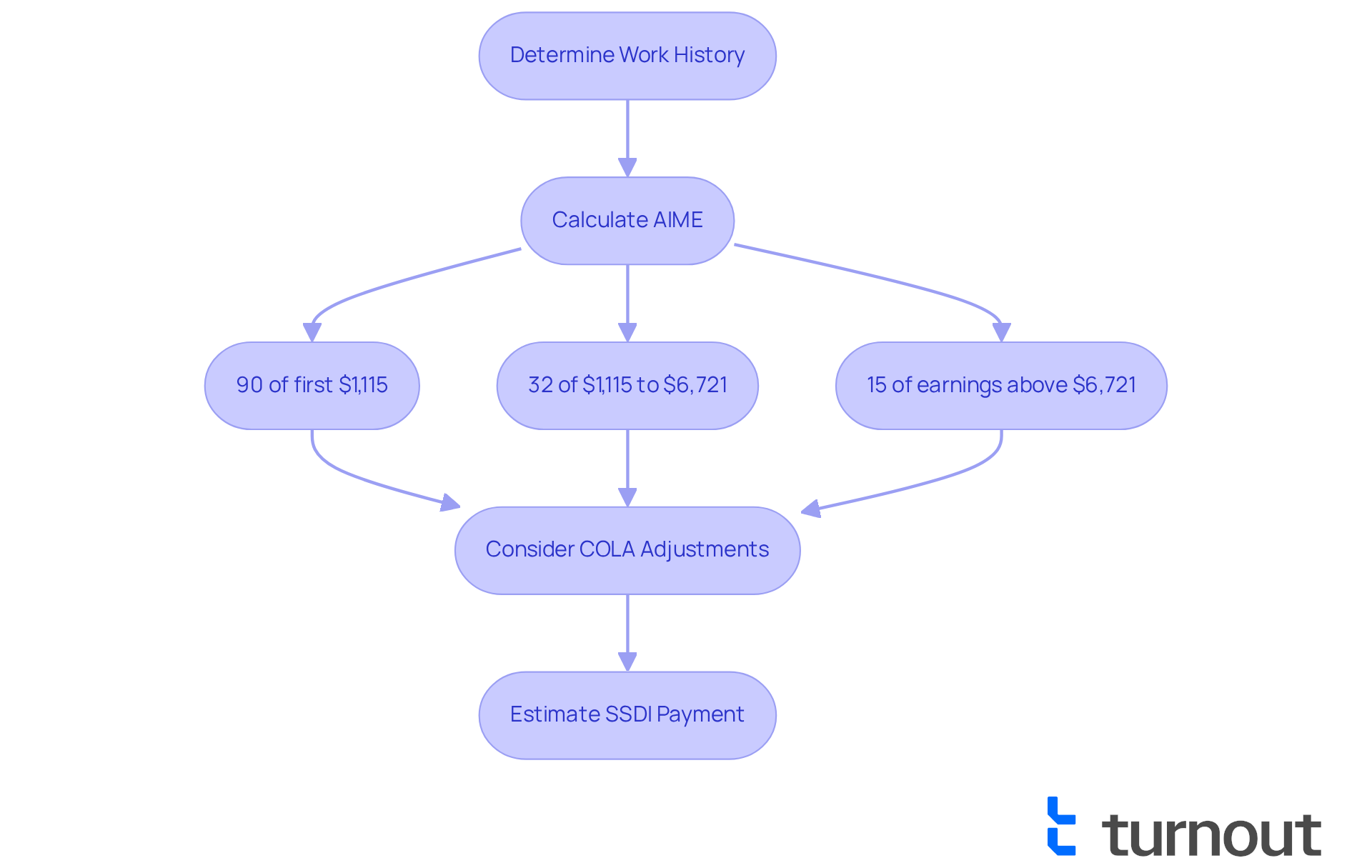

Navigating the process of determining your can feel overwhelming, but can provide you with some peace of mind. The formula set by the (SSA) centers around your (AIME), and several key factors influence this calculation.

First, consider your Work History. Your earnings throughout your career are crucial in determining your AIME. The SSA looks at your top-earning years, typically assessing up to 35 years of income to establish your .

Next, there's the (PIA). This figure is calculated from your AIME using a specific formula that applies different percentages to various portions of your earnings. For example:

- 90% of the first $1,115 of your AIME

- 32% of the amount between $1,115 and $6,721

- 15% of any earnings that exceed that threshold

Additionally, (COLA) can impact the SSDI amount of your payments. These adjustments to the payment amount are made annually based on inflation, which can significantly affect the SSDI amount over time.

To estimate your SSDI amount, we encourage you to use online calculators provided by the SSA or other trustworthy platforms. By entering your birth year and typical yearly earnings, you can get a rough estimate of your monthly payments. For instance, if your AIME is calculated at $2,000, your PIA could be around $1,400, reflecting the application of the percentages mentioned earlier.

We understand that , but grasping these calculations can empower you to navigate your situation more effectively. Remember, you are not alone in this journey, and we're here to help you secure the benefits you deserve.

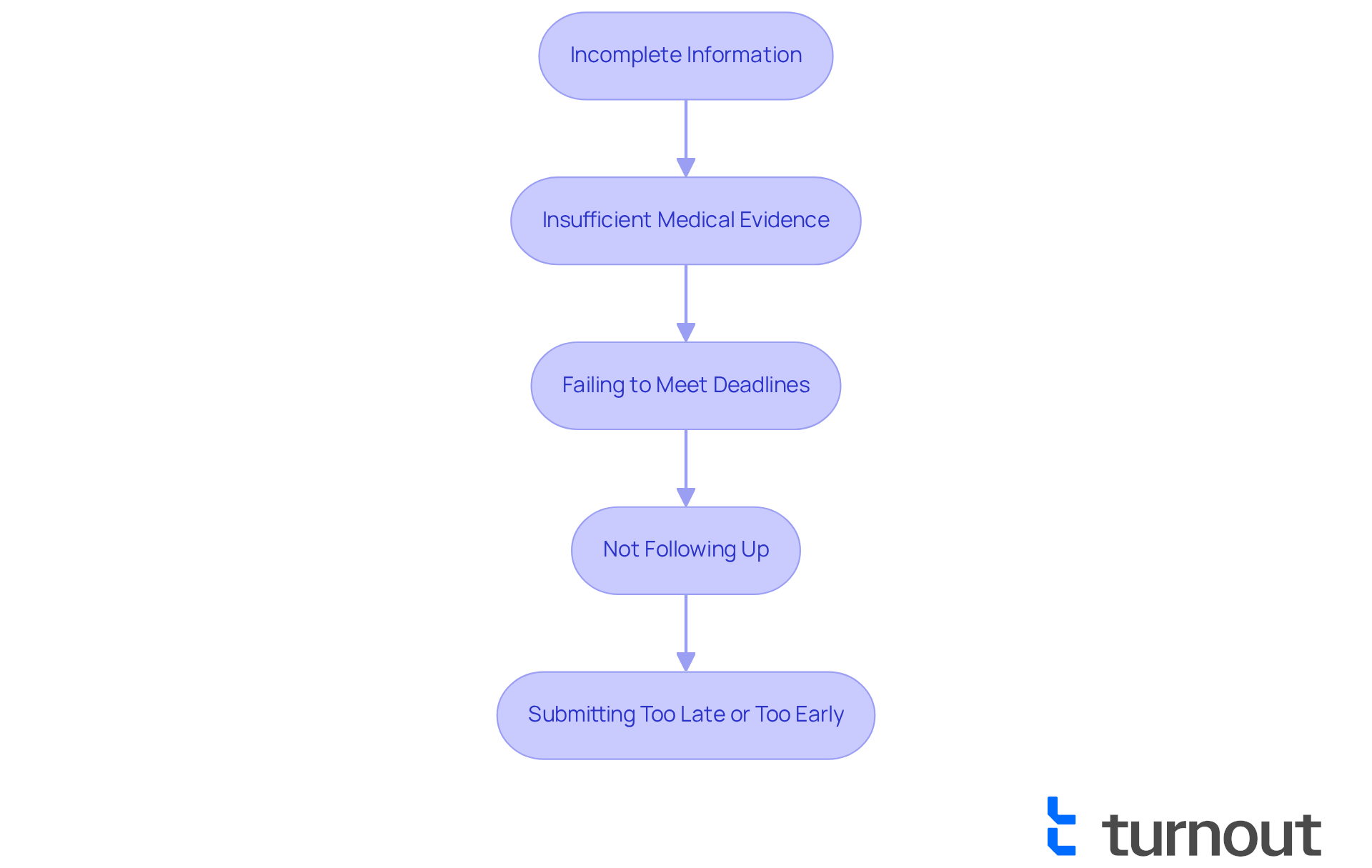

Avoid Common Mistakes in Your SSDI Application Process

When seeking , we understand that can greatly improve your likelihood of approval. Here are some pitfalls to watch out for:

- Incomplete Information: It’s crucial to ensure that all sections of the form are filled out completely. Lacking information can lead to setbacks or refusals, with around 65-70% of initial SSDI requests being rejected due to insufficient details regarding the .

- Insufficient : Providing comprehensive medical documentation that clearly outlines your disability and its impact on your ability to work is essential. This includes treatment records, test results, and statements from healthcare providers. Relying solely on the consultative exam for medical proof is a common mistake; additional supporting evidence is crucial for determining the SSDI amount in a .

- Failing to Meet Deadlines: Be mindful of the deadlines for submitting forms and responding to requests from the SSA. Overlooking these can jeopardize your submission, as strict timelines are enforced by the Social Security Administration.

- Not Following Up: After submitting your request, regularly check the status and respond promptly to any inquiries from the SSA. This proactive approach can help keep your case moving forward and prevent unnecessary delays.

- Submitting Too Late or Too Early: is essential. Apply as soon as you become disabled, but ensure you meet the eligibility criteria, as applying prematurely can lead to denials. Consulting with your healthcare provider to confirm that your condition is expected to last for at least 12 months before applying is a wise step.

At , we’re here to help you navigate the intricacies of the disability benefits application process. Our trained nonlawyer advocates provide expert guidance to ensure that you avoid these and enhance your chances of a successful claim. Please note that Turnout is not a law firm and does not provide legal representation. You are not alone in this journey, and we are committed to supporting you every step of the way.

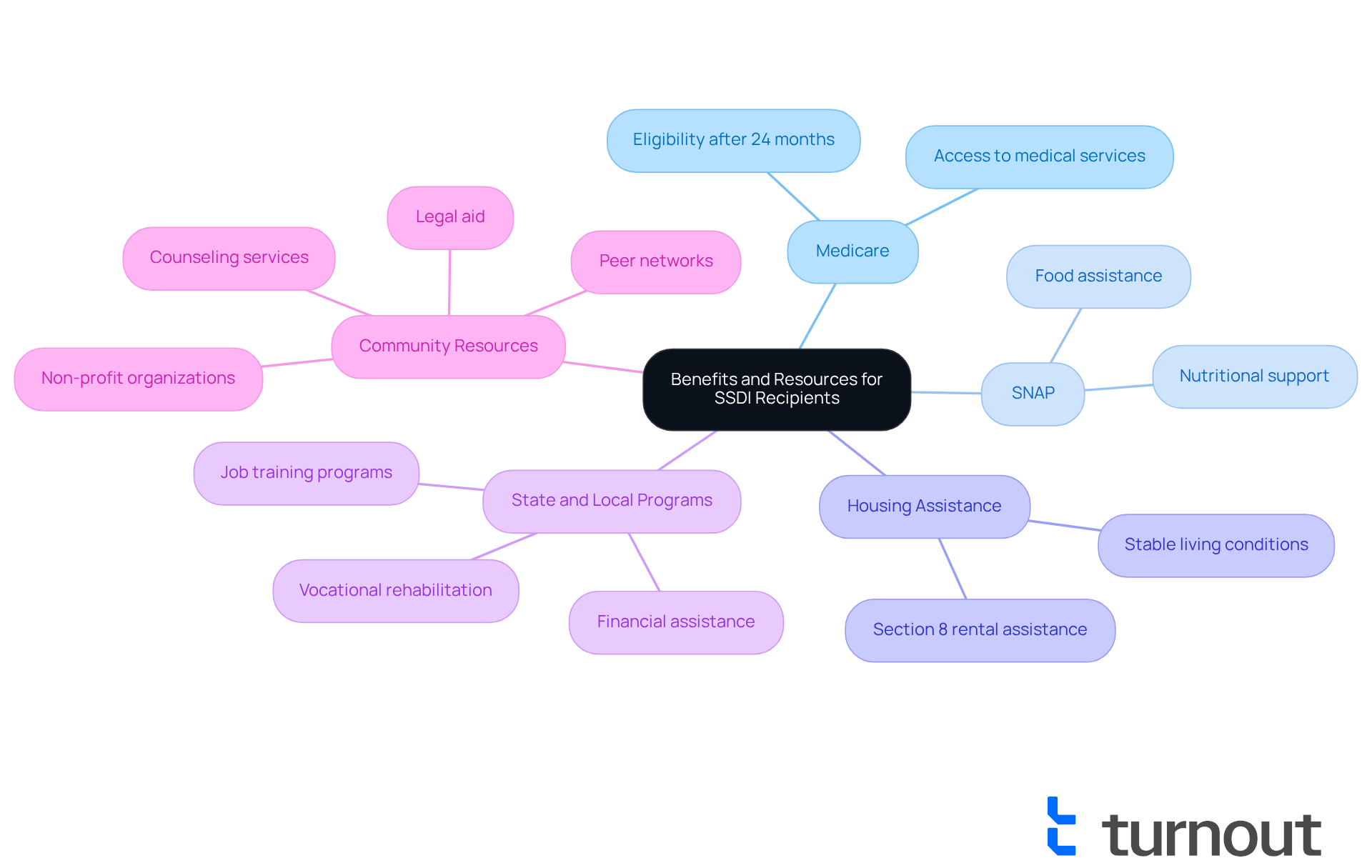

Explore Additional Benefits and Resources for SSDI Recipients

Individuals receiving disability support often face financial strains, and it's essential to know that there are extra services and resources available to help ease these burdens. Here are some key options to consider:

- Medicare: After 24 months of receiving disability payments, you generally become eligible for Medicare. This crucial health coverage guarantees access to necessary medical services, providing peace of mind.

- : Many SSDI recipients may qualify for SNAP, which offers vital food assistance to help cover grocery costs and improve nutritional intake.

- : Programs like Section 8 provide rental assistance, making it easier to manage housing expenses and maintain stable living conditions.

- State and Local Programs: Numerous states offer additional benefits for individuals with disabilities, including , vocational rehabilitation, and job training programs designed to enhance employability.

- Community Resources: Local non-profit organizations and advocacy groups often provide support services such as counseling, legal aid, and peer networks. Engaging with these resources can significantly strengthen your support network and improve your overall quality of life.

At , we are dedicated to making access to these government resources and financial assistance options easier for you, including . By employing trained non-professional advocates, we help navigate the complexities of these processes without needing legal representation. Understanding these alternatives is crucial for optimizing the benefits available to you as a disability aid recipient, ensuring you have the support necessary to manage everyday challenges effectively.

As one recipient of disability benefits shared, "The support from SNAP has made a huge difference in my ability to afford healthy food, which is vital for my health." With the recent 8.7% COLA increase for SSDI recipients in 2024, the SSDI amount has become more important than ever in helping individuals manage their financial situations. Remember, you are not alone in this journey—we're here to help you every step of the way.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for individuals navigating the challenges of significant disabilities. We recognize that this program not only provides crucial financial support but also serves as a lifeline for those unable to work. By grasping the factors that influence the SSDI amount, such as work history and the primary insurance amount, you can better prepare for your financial future and secure the benefits you deserve.

Throughout this article, we have shared key insights, including:

- The importance of accurate application processes

- The calculation of SSDI payments

- The additional resources available to recipients

It's common to feel overwhelmed, and we have highlighted common pitfalls in the application process, emphasizing the need for complete information and timely submissions. Furthermore, valuable resources like Medicare and SNAP have been outlined, showcasing the broader support network available to SSDI beneficiaries.

Ultimately, staying informed about SSDI and its associated benefits is crucial for optimizing financial assistance during difficult times. By leveraging available resources and understanding the application process, you can enhance your chances of success. Remember, support is available, and seeking guidance can make a significant difference in navigating the complexities of disability benefits. You are not alone in this journey; we are here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) is a federal program that provides financial assistance to individuals who are unable to work due to significant disabilities.

What are the qualifications for SSDI?

To qualify for SSDI, applicants must demonstrate a work history that includes paying Social Security taxes and show that their disability prevents them from engaging in substantial gainful activity (SGA).

How much financial assistance can recipients expect from SSDI in 2025?

In 2025, the average monthly disbursements from SSDI are projected to rise to around $2,800, reflecting a 2.5% cost-of-living adjustment (COLA).

How many individuals currently receive SSDI benefits?

As of December 2023, over 8.7 million individuals with disabilities receive SSDI support payments, totaling nearly $12.7 billion.

What role does SSDI play for individuals with disabilities?

SSDI replaces a portion of lost income and serves as a critical safety net for those living with disabilities, helping them maintain financial stability.

What resources does Turnout offer for SSDI applicants?

Turnout provides resources and services to assist consumers in navigating the disability benefits process, helping them understand eligibility and the application steps without legal guidance.

Is Turnout affiliated with any law firm or government agency?

No, Turnout is not a law firm and has no affiliation with any law firm or government agency.

How is the SSDI application process being improved?

The Social Security Administration is working to simplify the SSDI application process by enhancing online applications, reducing the number of questions, and introducing a new digital claims system to expedite processing times.

What percentage of SSDI recipients are employees?

Approximately 85% of disabled recipients are employees who rely on SSDI assistance to manage their daily lives.

Why is it important to stay informed about changes in SSDI?

Staying informed about changes in Social Security Disability Insurance is essential to understanding their impact on assistance and eligibility for individuals with disabilities.