Overview

We understand that the thought of filing taxes can be overwhelming. However, it's important to recognize the potential consequences of not filing. These can include:

- Significant financial penalties

- The potential loss of refunds and credits

- Difficulties in accessing essential government benefits

Failing to file can lead to fines that accumulate over time, which can be stressful. It can also impact your credit score and hinder your eligibility for assistance programs. This highlights the importance of timely tax submissions—not just for compliance, but to maintain your financial stability and access to vital resources.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and ensure you have the support you need. Taking action now can lead to a brighter financial future.

Introduction

Neglecting to file taxes can lead to serious consequences that go far beyond just financial penalties. We understand that individuals may face hefty fines and interest, but they could also miss out on valuable tax credits and essential government benefits. These resources can provide vital support, especially during challenging times.

The pressing question is: how can you navigate the complexities of tax compliance while safeguarding your financial future? Understanding the potential repercussions of non-filing is crucial, particularly for those who rely on government assistance. It directly impacts access to vital resources and long-term stability.

You are not alone in this journey. Many people feel overwhelmed by tax issues, but there are ways to find clarity and support. Together, we can explore the steps you can take to ensure compliance and protect your financial well-being.

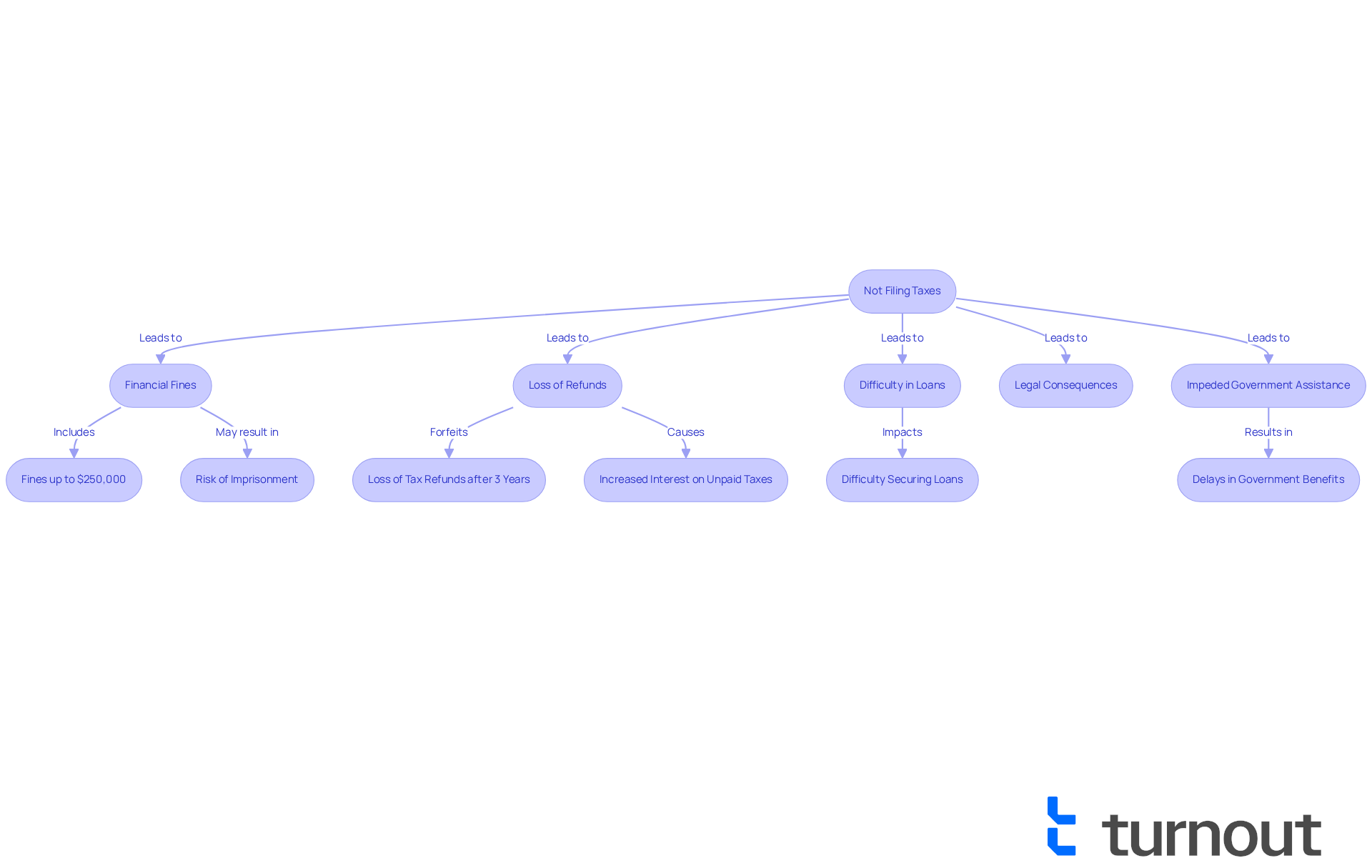

Define the Consequences of Not Filing Taxes

Failing to submit taxes can lead to , such as substantial financial fines, the loss of possible refunds, and difficulties in obtaining crucial government assistance. We understand that can be overwhelming. Individuals who are not filing taxes may miss out on that could help alleviate their tax burden. The IRS enforces fines for late submission, which can increase over time, resulting in a significant financial burden. For instance, the failure to submit can reach as high as 25% of outstanding dues, while interest on unpaid sums keeps accumulating, worsening the financial effect.

The consequences extend beyond immediate financial repercussions; they can also threaten . It's common to feel anxious about securing loans or mortgages, as as proof of income. This can adversely affect credit scores and limit access to favorable interest rates.

Additionally, neglecting to submit financial documents can impede qualification for . For example, individuals relying on may face delays or complications in receiving their benefits if their tax filings are not up to date. The potential loss of refunds is another critical concern; taxpayers not filing taxes within the three-year window to claim refunds forfeit their right to these funds, leading to significant financial loss.

Real-world examples illustrate the gravity of these consequences. Individuals who have faced legal actions due to tax evasion can incur fines up to $250,000 and risk imprisonment for up to five years. Additionally, the IRS can place liens on property or levy assets to satisfy tax liabilities, resulting in immediate financial implications and long-term damage to creditworthiness. Understanding these consequences is vital for individuals, particularly those dependent on government benefits, as it directly impacts their financial health and access to necessary resources.

At Turnout, we recognize that tax issues can be daunting. We are not a law firm and do not provide legal advice. Instead, we offer access to tools and services that help navigate these complex systems, ensuring that individuals can address their effectively. Our trained nonlawyer advocates and IRS-licensed enrolled agents are here to assist you in navigating these challenges without the need for legal representation. Remember, you are not alone in this journey; we’re here to help.

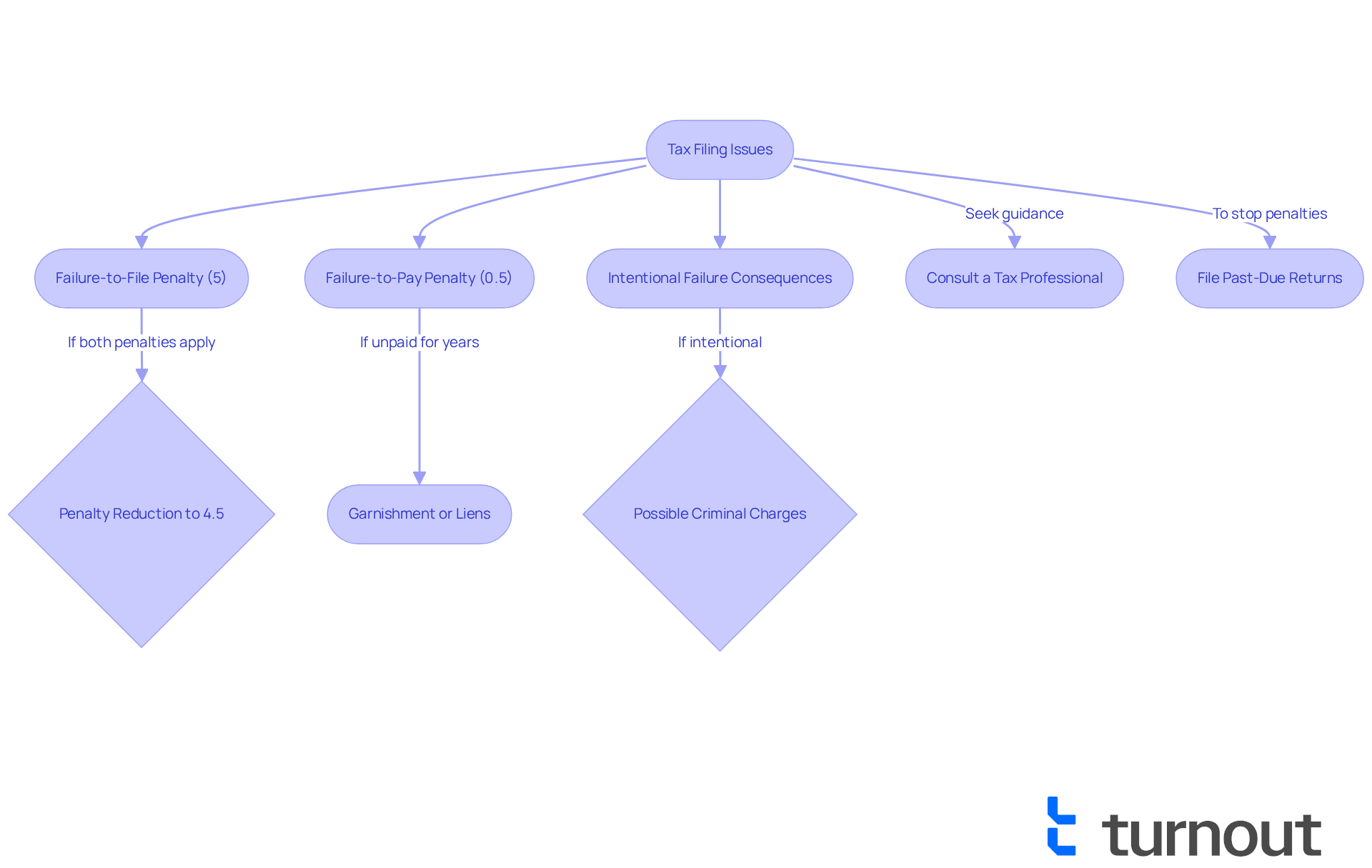

Explore Penalties and Legal Repercussions

We understand that dealing with can be overwhelming. The enforces , including a failure-to-submit charge of 5% of the owed tax for each month the return is delayed, capped at 25%. If both failure-to-file and failure-to-pay penalties apply in the same month, the failure-to-file penalty is reduced to 4.5%. It's important to note that if the IRS determines that the failure to submit was intentional, individuals may face even harsher repercussions, including criminal charges. In severe cases, tax evasion could lead to jail time.

The IRS generally has 10 years to collect on unpaid taxes, which underscores the . Understanding these sanctions is essential for grasping the significance of adhering to tax regulations and the of not filing taxes. Not filing taxes only exacerbates the situation, as fines and interest continue to accrue. For instance, the failure-to-pay charge is 0.5% of the unpaid tax each month. While this is less than the , it can still accumulate significantly over time.

If taxes remain unpaid for years, the IRS may garnish wages or place a lien on property. However, taking swift measures, such as submitting overdue returns, can prevent the buildup of fines and demonstrate a commitment to compliance, even if full payment isn't feasible. It's also reassuring to know that there is no penalty for filing late if the IRS owes you money. You may qualify for or first-time offenses.

We encourage you to who can provide guidance on navigating these complexities. Remember, you are not alone in this journey, and there are resources available to help you through these challenges.

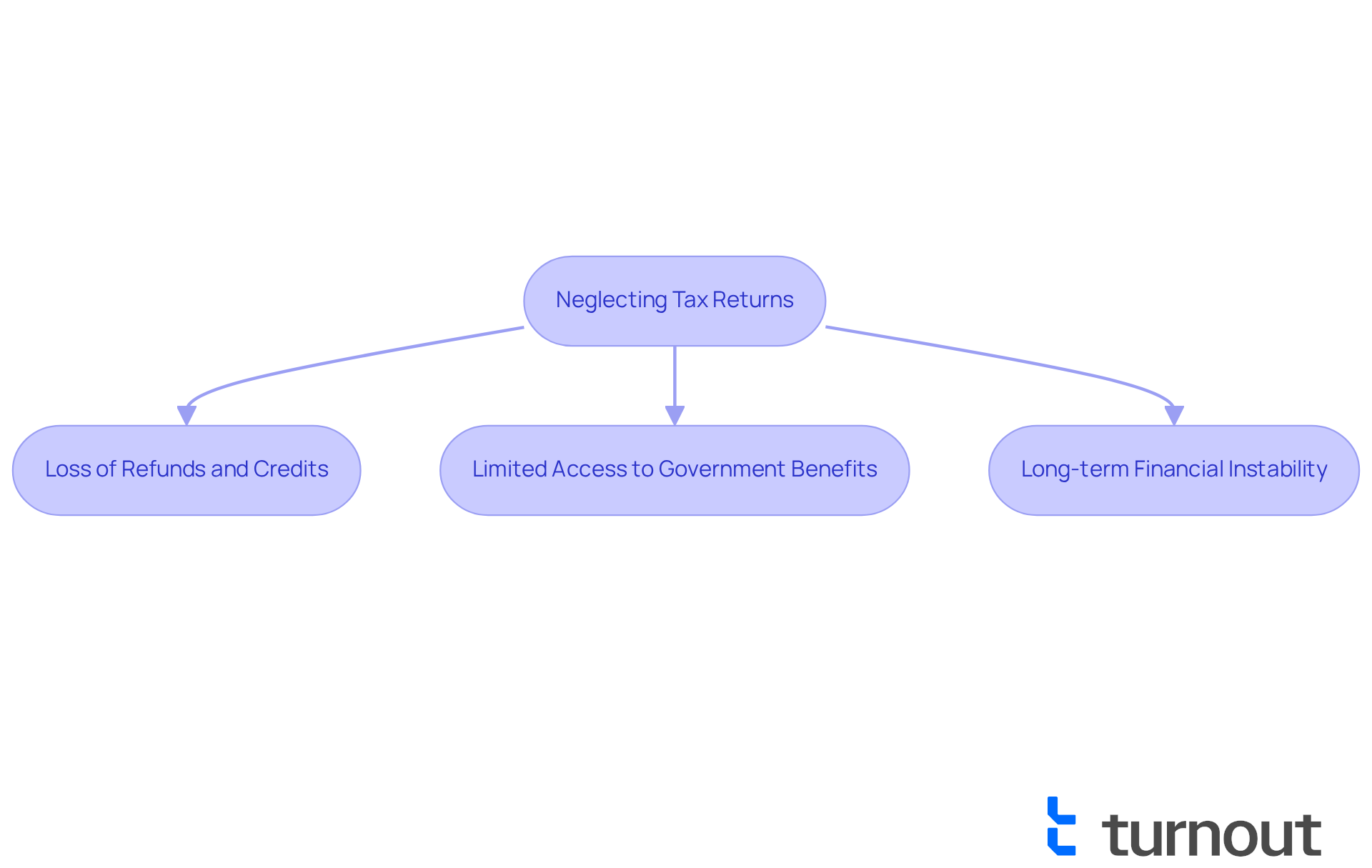

Assess Financial Implications and Missed Benefits

Neglecting to submit your tax returns can lead to , including losing valuable refunds and credits that could ease your financial burden. For instance, if you qualify for the Earned Income Tax Credit (EITC), you risk missing out on substantial refunds by not filing your returns. In March 2025, the IRS revealed that $1 billion in unpaid refunds from 2021 would be forfeited by taxpayers who missed the deadline. This underscores the urgency of timely submissions.

We understand that , such as Social Security Disability. Tax returns are often necessary to verify income and eligibility, creating a cycle of financial instability that makes it harder to secure the support you need.

At Turnout, we provide tools and services designed to help you navigate these complexities. Our trained nonlawyer advocates and IRS-licensed enrolled agents offer and . It's important to remember that Turnout is not a law firm and does not provide legal advice.

The repercussions of not filing taxes go beyond immediate financial losses; they can impact your long-term . , you should still submit your tax return and explore the various payment options available for the remaining amount. According to the IRS, "Taxpayers who cannot pay in full by the tax deadline should still submit their tax return, pay what they can, and investigate various payment options available for the remaining balance." You're not alone in this journey; we're here to help you find the best path forward.

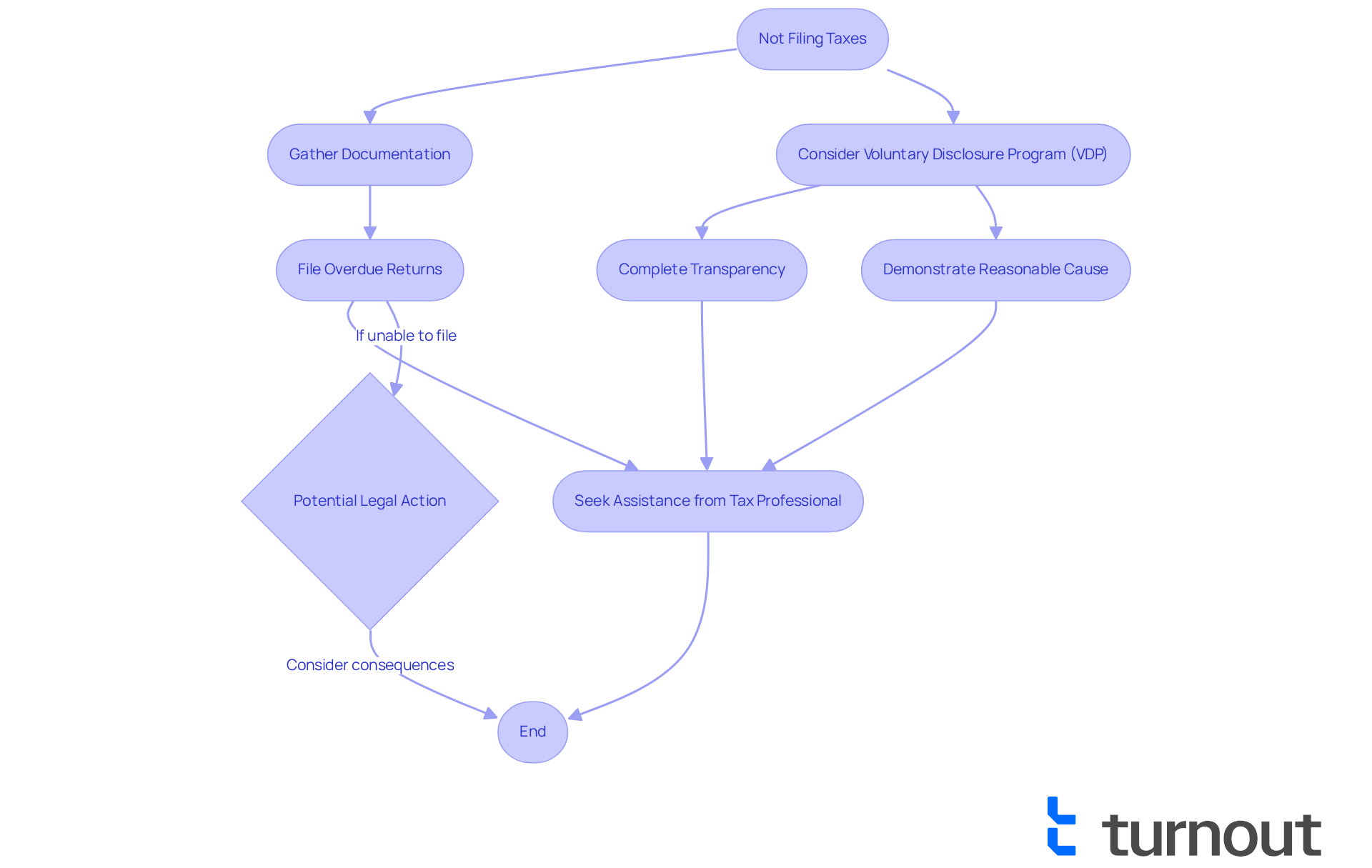

Identify Options for Rectifying Non-Filing Situations

If you are , it's important to know that there are several options available to help you rectify the situation effectively. First, gather all necessary documentation for the years in question and aim to file your as soon as possible. The IRS offers a (VDP) that allows you to proactively disclose unfiled returns before being contacted by the agency. This program can be especially beneficial for those who may have intentionally chosen not filing taxes, as it provides a way to address their situation while potentially avoiding serious consequences.

To participate in the VDP, complete transparency regarding previous noncompliance is required, along with the payment of all taxes, fines, and interest. Recently, the , removing the controversial willfulness checkbox, which may encourage more taxpayers to come forward. However, it's important to note that the program imposes a civil fraud charge of 75% on the year with the highest tax liability, which might deter some individuals from stepping forward. As of August 31, 2024, the IRS had completed only 161 criminal VDP cases since fiscal year 2019. This highlights the low participation rate and the challenges many taxpayers face.

Additionally, if you can demonstrate reasonable cause for your inability to submit, you may qualify for penalty relief. The IRS tends to be more forgiving when taxpayers willingly submit overdue returns, making it essential to act sooner rather than later. Remember, not filing taxes can lead to , including levies, liens, or wage garnishments. can provide valuable guidance in navigating the complexities of and addressing any outstanding obligations. Regular consultations can help optimize your deductions and prevent future tax problems, ensuring that you remain compliant moving forward.

In summary, taking proactive steps to file and utilizing the IRS Voluntary Disclosure Program can significantly mitigate the consequences of non-filing. You have the opportunity to regain control over your tax situation, and remember, you're not alone in this journey. .

Conclusion

Neglecting to file taxes can lead to significant consequences that extend beyond immediate financial penalties. We understand that failing to submit tax returns jeopardizes not only potential refunds and credits but also access to essential government benefits. This can create a cycle of financial instability that feels overwhelming. Recognizing these implications is crucial for anyone who may be affected, as the repercussions can significantly impact both short-term and long-term financial health.

Key points to consider include:

- The substantial fines imposed by the IRS

- The potential loss of tax credits like the Earned Income Tax Credit (EITC)

- The long-term effects on creditworthiness and eligibility for government assistance

Real-world examples highlight the severity of legal repercussions, including the risk of criminal charges for intentional non-filing. It's common to feel anxious about these outcomes, but proactive measures, such as utilizing the IRS Voluntary Disclosure Program, can help individuals regain control over their tax situations and mitigate potential penalties.

Ultimately, the importance of timely tax filing cannot be overstated. Taking action to address overdue returns not only helps avoid severe penalties but also ensures access to valuable financial resources and benefits. If you find yourself facing these challenges, we encourage you to seek assistance from tax professionals who can provide guidance and support in navigating the complexities of tax compliance. By understanding and addressing the consequences of not filing taxes, you can take significant steps toward securing your financial future. Remember, you are not alone in this journey, and there are resources available to help you move forward.

Frequently Asked Questions

What are the main consequences of not filing taxes?

Failing to file taxes can lead to substantial financial fines, loss of possible refunds, and difficulties in obtaining government assistance. It can also result in missing out on valuable tax credits and deductions.

How do financial penalties for late tax submission work?

The IRS enforces fines for late submissions, which can increase over time. The failure to submit can result in fines as high as 25% of outstanding dues, and interest on unpaid amounts continues to accumulate.

What impact does not filing taxes have on long-term financial stability?

Not filing taxes can threaten long-term financial stability by making it difficult to secure loans or mortgages, as financial institutions often require tax returns as proof of income. This can adversely affect credit scores and limit access to favorable interest rates.

How does failing to file taxes affect government assistance eligibility?

Neglecting to submit tax documents can impede qualification for essential government assistance programs, such as Social Security Disability, potentially causing delays or complications in receiving benefits.

What happens to unclaimed tax refunds if taxes are not filed?

Taxpayers who do not file taxes within the three-year window to claim refunds forfeit their right to those funds, leading to significant financial loss.

What are some severe legal consequences of tax evasion?

Individuals facing legal actions for tax evasion can incur fines up to $250,000 and risk imprisonment for up to five years. The IRS can also place liens on property or levy assets to satisfy tax liabilities.

How can individuals get help with tax filing issues?

Turnout offers access to tools and services to help navigate tax filing issues. Their trained nonlawyer advocates and IRS-licensed enrolled agents assist individuals without the need for legal representation.