Overview

The article titled "Top Rated Tax Preparation Near Me: H&R Block and More" aims to support you in finding reliable tax preparation services in your area, with a special focus on H&R Block. We understand that navigating tax season can be overwhelming, and it’s important to have a trusted partner by your side.

H&R Block stands out due to its extensive experience and commitment to customer satisfaction. With a variety of services tailored to meet your needs, they have built a reputation as a dependable provider for individuals seeking efficient and effective tax preparation assistance. You are not alone in this journey; many have benefited from their expertise.

As you consider your options, remember that reaching out for help is a positive step forward. H&R Block is here to guide you through the process, ensuring that your tax preparation experience is as smooth and stress-free as possible. We’re here to help you take the next step with confidence.

Introduction

Navigating the complexities of tax preparation can often feel overwhelming. We understand that with the ever-evolving landscape of tax laws and services, uncertainty can weigh heavily on individuals. As you seek reliable and efficient solutions to ensure your financial well-being, know that you are not alone in this journey.

This article explores top-rated tax preparation services, highlighting key players like H&R Block, which has built a strong reputation for customer satisfaction and innovative tools. However, as you explore your options, it's common to wonder: how can you choose the best service that meets your needs and provides peace of mind during tax season?

Turnout: AI-Powered Advocacy for Tax Debt Relief

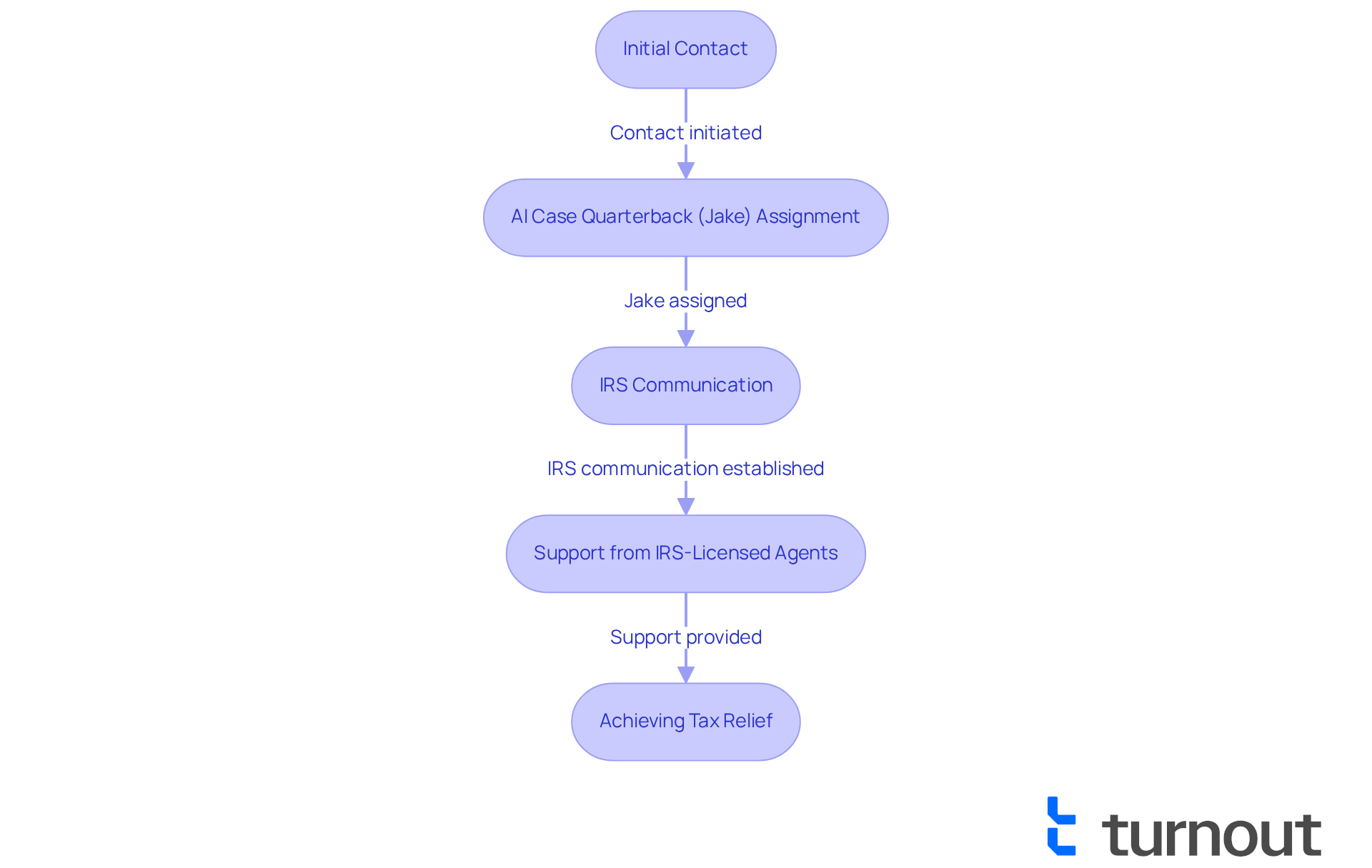

Turnout is transforming by harnessing the power of AI technology to streamline the advocacy process. We understand that , and that’s why central to this initiative is Jake, the . Jake ensures that you receive timely updates and support throughout your . This innovative approach not only enhances operational efficiency but also empowers you to confront your with confidence. It makes the often-daunting process of tax debt relief more manageable and accessible.

As Turnout utilizes IRS-licensed enrolled agents rather than attorneys, you can without the need for legal representation. It's common to feel uncertain about these processes, but as AI continues to evolve, its integration into is proving essential. This technology enables faster responses to and improves overall outcomes for those seeking relief.

The are reshaping how you navigate tax complexities, ensuring that you are better equipped to handle your financial obligations. Remember, you're not alone in this journey. We're here to help you find the relief you deserve.

H&R Block: Trusted Tax Preparation Services with Proven Results

At H&R, we understand that finding top rated near me can be overwhelming. That's why we have established ourselves as a premier provider of , offering a comprehensive suite of services tailored to meet the diverse needs of taxpayers like you. Our commitment to accuracy and has earned us a strong reputation as one of the top rated tax preparation near me, delivering dependable results.

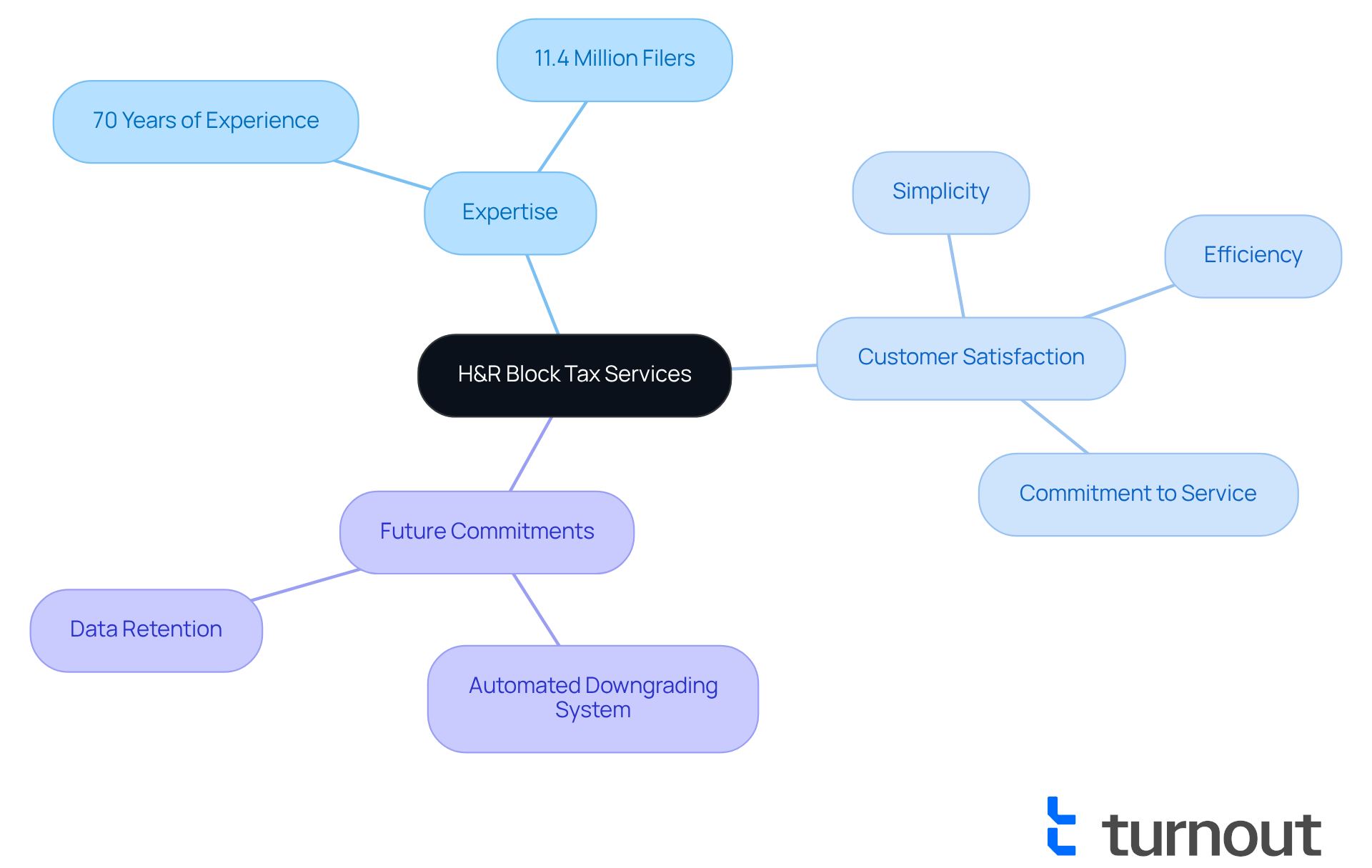

With nearly 70 years of expertise, our proficient tax specialists are here to help you , including locating top rated tax preparation near me. We aim to ensure that you . Each year, we assist 11.4 million filers and submit 20 million tax returns, reinforcing our position as a trusted partner for individuals seeking top rated tax preparation near me to enhance their financial outcomes during tax season.

In 2025, our customer satisfaction ratings reflect our ongoing commitment to service excellence. Many of our customers commend the simplicity and efficiency of our tax preparation solutions, which is a testament to our dedication to your needs. Furthermore, we are committed to implementing a system that allows you to downgrade products through automated means by February 15, 2025. We will also ensure that your previously entered information is not deleted when downgrading by the 2026 tax filing season.

These measures highlight our commitment to transparency and . At H&R, you are not alone in this journey—we are here to support you every step of the way.

H&R Block: User-Friendly Tax Filing Experience

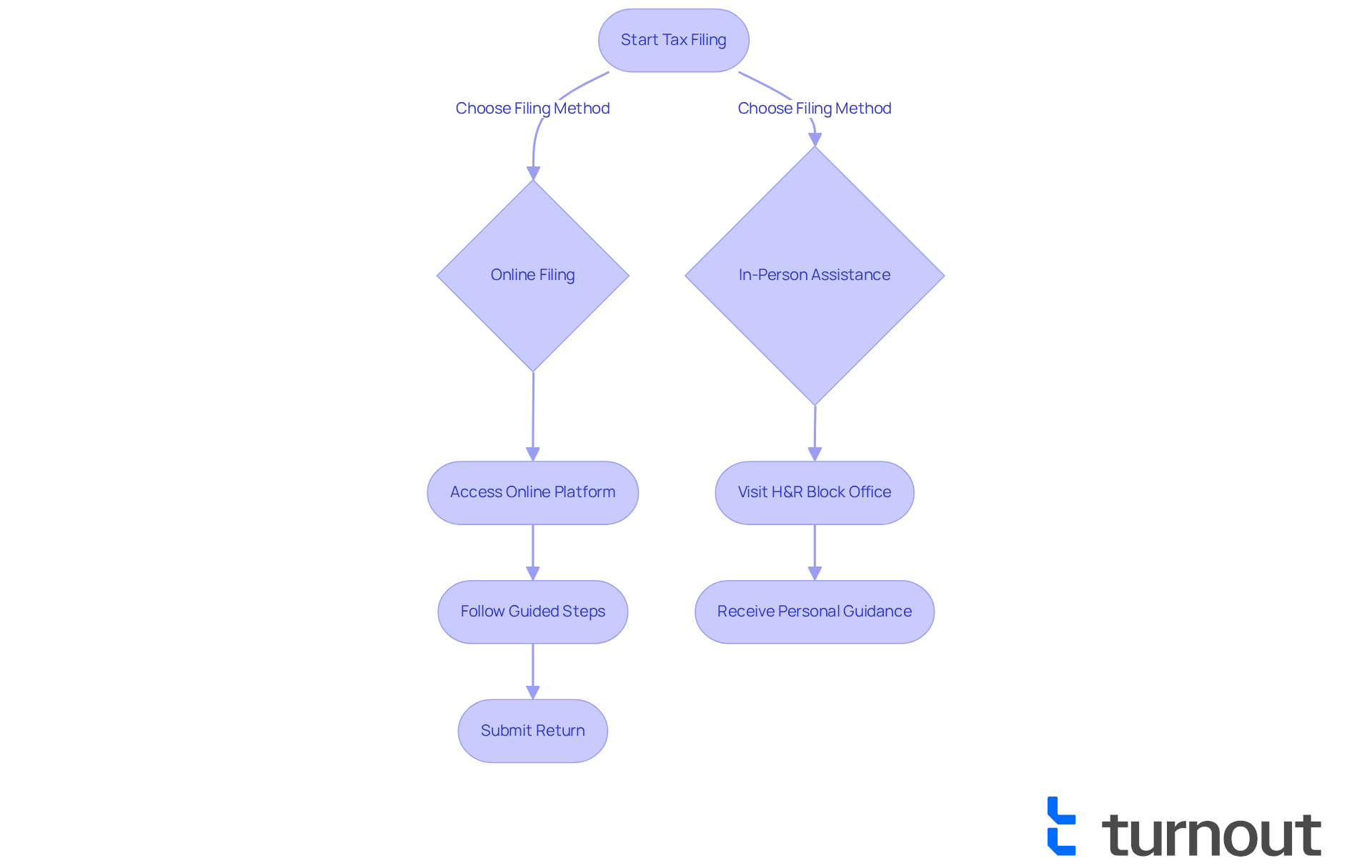

At H&R, we truly understand that can be overwhelming. That’s why we prioritize a , making it simple and accessible for everyone. Our intuitive online platform gently guides you through each step of the filing process. Even if you have minimal tax knowledge, you can .

We also recognize that some of you may prefer face-to-face interactions. That’s why H&R offers , ensuring that you have the . You're not alone in this journey; we're here to help .

H&R Block: No Surprise Pricing for Peace of Mind

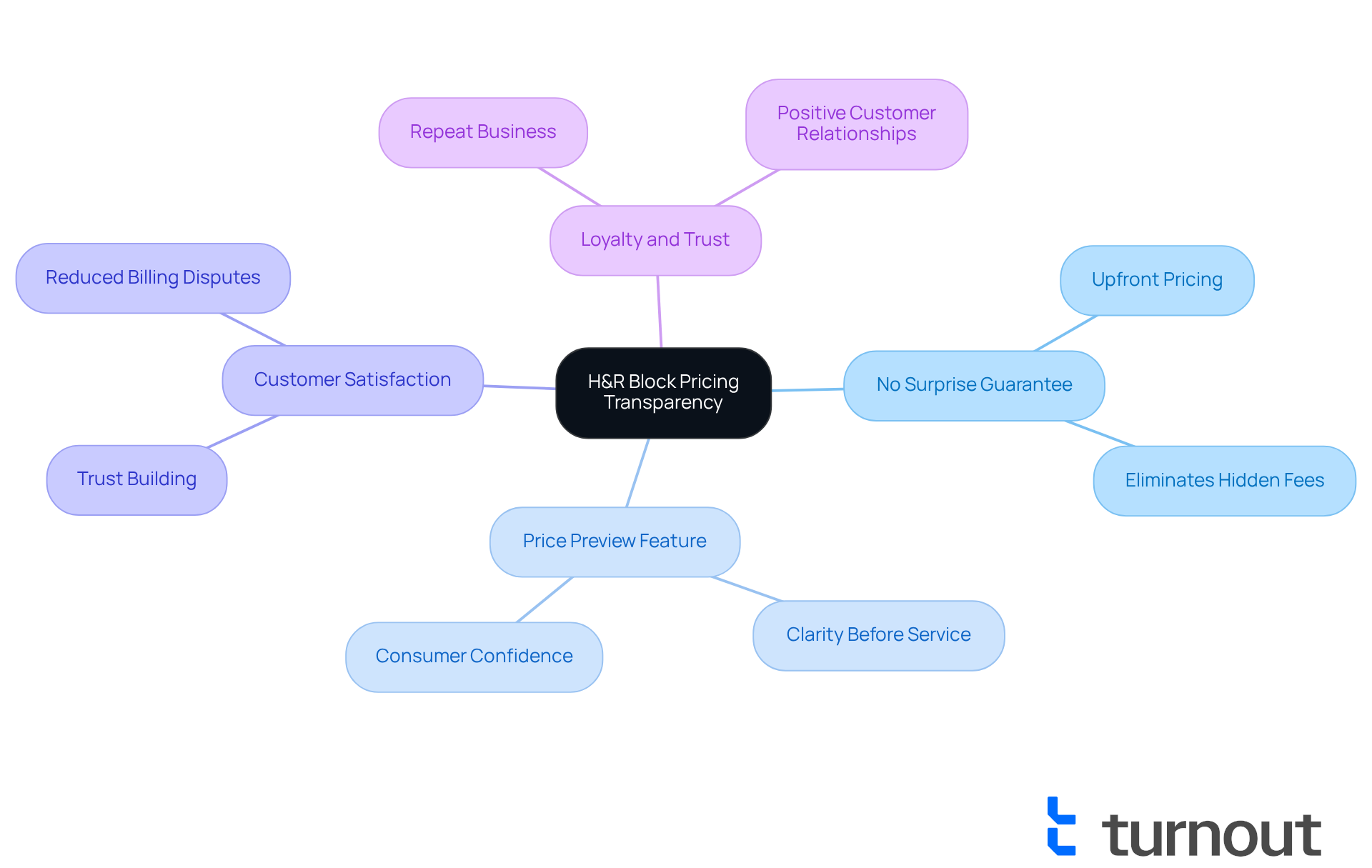

At H&R Block, we understand that navigating can be stressful, especially when it comes to . That's why we emphasize with our no surprise guarantee. You can rest assured that you will know your costs before starting the filing process. This , allowing you to focus on what matters most—your tax preparation—without the worry of .

Our new is designed with you in mind, providing clarity on pricing before tax preparation begins. This commitment to transparency not only cultivates trust but also boosts your confidence in our services. Financial specialists agree that clear pricing is crucial in tax-related offerings, greatly enhancing and loyalty.

When you have confidence in a provider's transparency regarding costs, you are more likely to return for future services. Many businesses that adopt similar transparent pricing strategies find that they enjoy . It's a testament to the importance of . Remember, we’re here to help you every step of the way.

H&R Block: Comprehensive Tools and Resources for Tax Filers

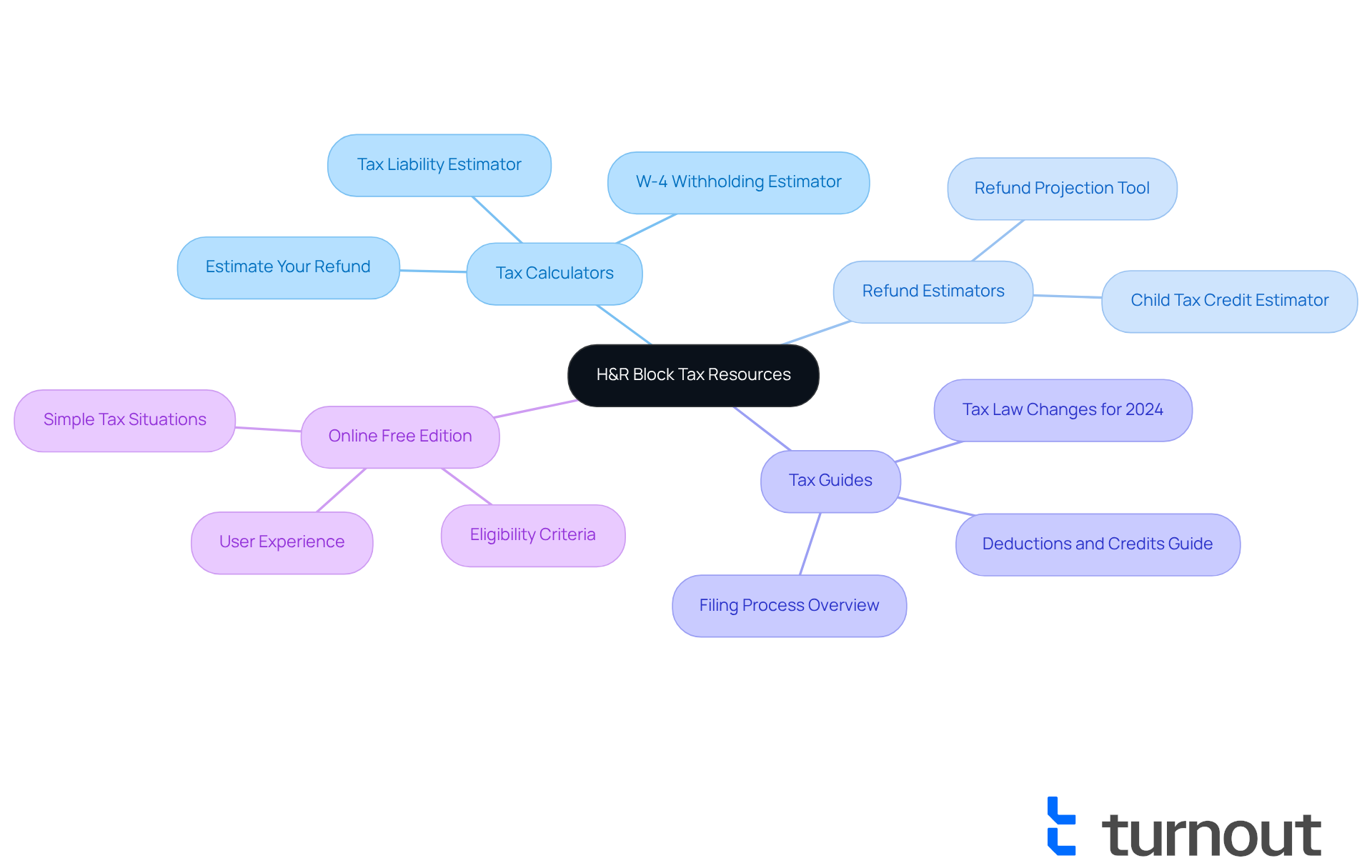

At H&R Services, we understand that navigating the can be overwhelming. That's why we provide an abundance of tools and resources designed to support you at every phase. From and to detailed guides on , you have access to everything you need to make . These resources empower you to , ensuring you can and minimize your liabilities.

Did you know that approximately 55% of filers qualify for H&R Block's Online Free Edition? This option is specifically tailored for simple tax situations, making it easier for you to find the right fit. Our tax calculators allow you to input various income sources and deductions, assisting you in estimating your refunds or taxes due based on your unique financial situation. This proactive approach enables you to plan for payments or adjust your withholdings accordingly.

Moreover, the integration of refund estimators enhances your overall experience, providing accurate projections that guide you in making informed decisions. As H&R explains, "Knowing your tax refund estimate can also help you plan for payments or extra income in advance." By utilizing these resources, we aim to and more manageable, ensuring you feel assured and . Remember, you are not alone in this journey; we're here to help.

H&R Block: High Customer Satisfaction and Positive Reviews

At H&R, we genuinely care about our clients, which is reflected in the for . Many positive reviews highlight our professionalism, expertise, and unwavering dedication to achieving success for our customers. We understand that navigating can be daunting, and that’s why clients often praise the , fostering a supportive atmosphere throughout the process.

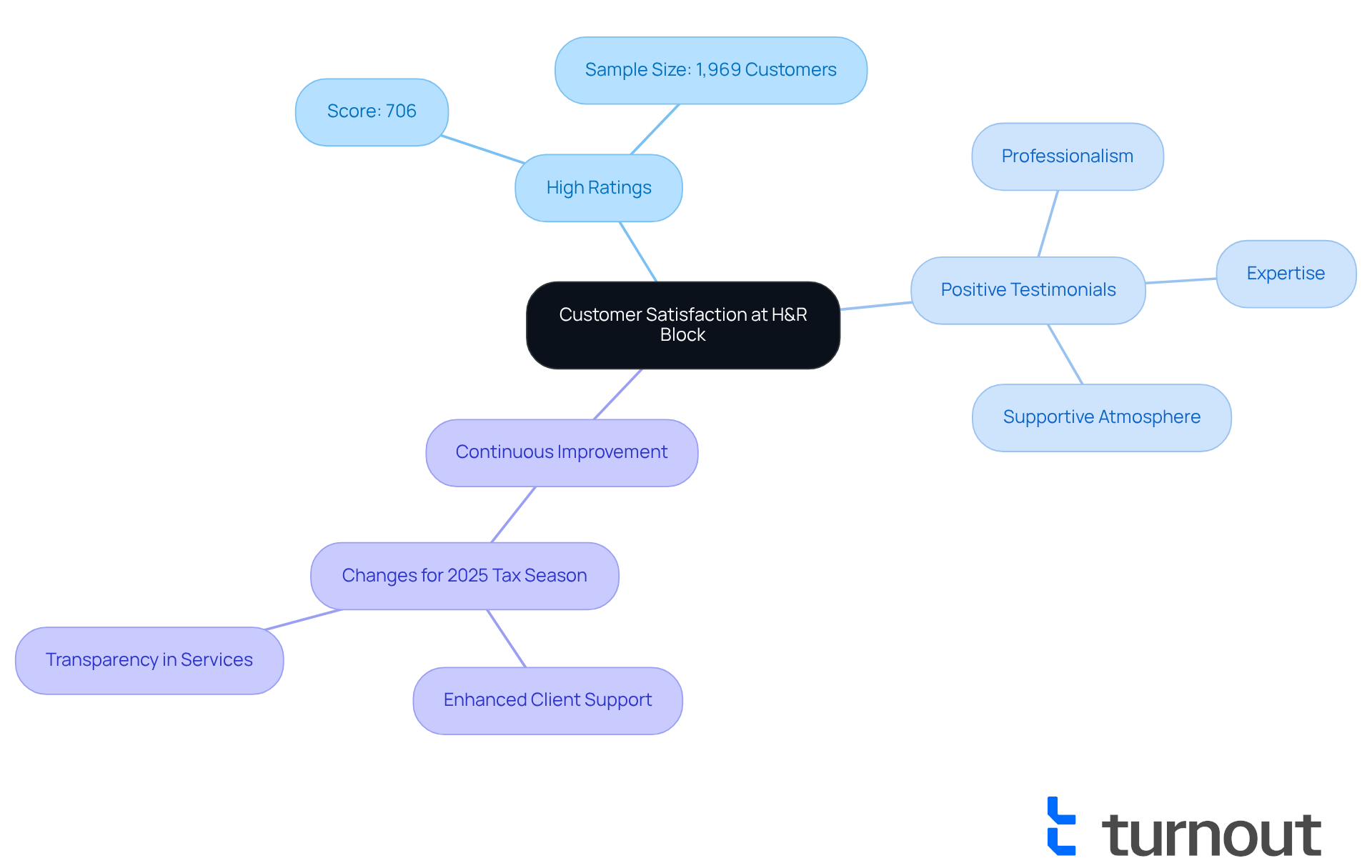

Our underscores our commitment to meeting the unique needs of each individual. According to the , which gathered insights from 1,969 customers, H&R achieved an impressive score of 706, making it one of the top rated tax preparation near me in the industry. Numerous testimonials commend the simplicity of communication and the thoroughness of our tax preparation procedures, reinforcing our priority of customer satisfaction and our goal to create a seamless experience for all users.

Moreover, we recognize the importance of continuous improvement. Following the , H&R Group is making significant changes for the 2025 tax filing season to enhance client support and transparency. We’re here to help you every step of the way, showcasing our dedication to . Remember, you are not alone in this journey; we are committed to .

H&R Block: Fast and Efficient Tax Preparation

At H&R, we understand that can be a daunting task. Our swift and effective offerings allow you to finish your filings quickly, alleviating some of that stress. With the support of knowledgeable tax experts, we significantly , enabling you to file your taxes efficiently without sacrificing quality. This is particularly beneficial if you're facing tight deadlines or .

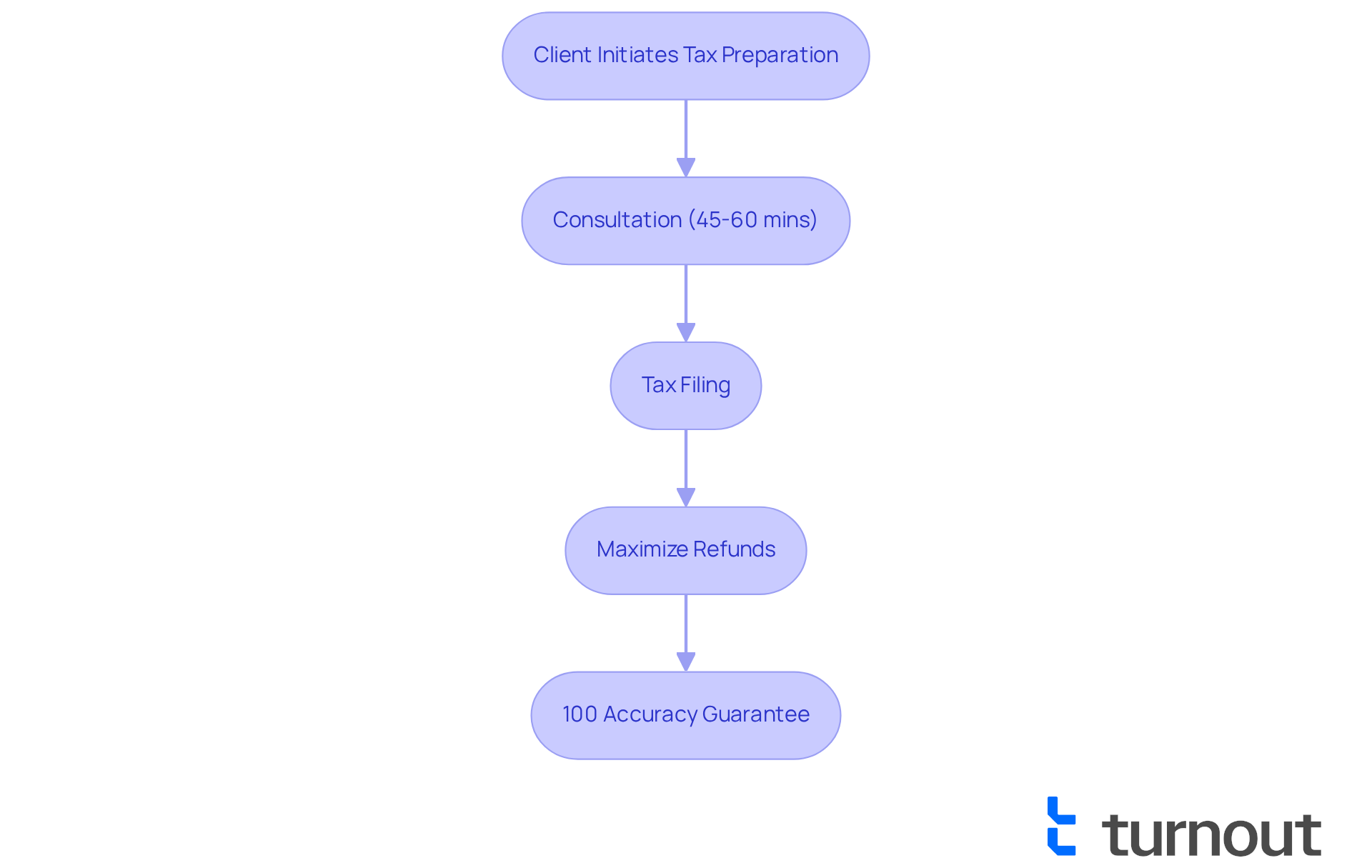

In 2025, taxpayers are expected to spend around 7.1 billion hours adhering to the tax code for Tax Year 2024. This highlights the importance of , like those we provide at H&R. During an average appointment, which lasts between 45 minutes to an hour—though this may vary based on your unique tax situation—you can expect a thorough yet quick consultation. Our goal is to help you while minimizing the stress associated with .

We also take pride in our . This ensures that if no errors are found in your tax return, you can have knowing that your returns are managed with precision. As costs reach $464 billion, choosing a service that prioritizes speed and accuracy can truly enhance your overall experience. Remember, you're not alone in this journey; we're here to help you every step of the way.

H&R Block: Convenient Office Locations for Personal Support

At H&R Block, we understand that navigating can be overwhelming. With a vast network of more than 9,000 office locations throughout the U.S., you can easily find top rated near me whenever you need personal assistance. Our offices are strategically located in accessible areas, enabling you to receive from who truly care about your needs.

It's common to have during the tax preparation process, and we're here to help. Our commitment to is highlighted by our , which ensures that you will be reimbursed for any federal or state fees incurred due to mistakes.

For those considering their options, H&R Block offers services starting at $0 for basic online filing, with additional fees for more extensive plans. This makes us a looking for . Remember, you are not alone in this journey; we are dedicated to supporting you every step of the way.

H&R Block: Refund Estimation Tools for Better Planning

At H&R, we truly understand the challenges individuals face when it comes to tax season. That’s why we provide effective refund estimation tools designed to help you forecast your possible tax refunds with precision. By leveraging these resources, you can strategically plan your finances, leading to informed decisions about spending, saving, and investing.

This proactive approach not only but also fosters a sense of empowerment as you . As Benjamin Franklin wisely noted, 'An investment in knowledge pays the best interest.' This highlights the importance of understanding your financial landscape.

Moreover, through can significantly impact your overall . It allows you to align your goals with your available resources. By prioritizing , you can better prepare for future expenses and investments, ultimately leading to greater financial stability.

With the , you can accurately estimate your , possible deductions, and tax refund amounts. This user-friendly tool is mobile-compatible, empowering you to make and maximize your tax savings.

We encourage you to explore the H&R Tax Calculator for personalized estimations. Remember, you are not alone in this journey; we’re here to help you every step of the way.

H&R Block: Flexible Tax Filing Options Tailored to You

At H&R Block, we understand that navigating can be challenging. That's why we offer a tailored to meet your specific needs. Whether you prefer to file online, visit a local office, or use a hybrid approach, we are here to accommodate your preferences. This flexibility ensures that you can select the method that suits you best, and satisfaction with the process.

For eligible users, our is particularly noteworthy, as it can in annual tax filing fees. We know that ease of use and cost are top priorities when choosing a tax filing method, reflecting the increasing demand for .

However, we also recognize that there have been concerns, such as the recent FTC complaint against H&R Block regarding . This highlights our ongoing commitment to transparency and in the ever-evolving tax preparation landscape. Remember, you are not alone in this journey; we are here to help you every step of the way.

Conclusion

Navigating the complexities of tax preparation can feel overwhelming, but we want you to know that there are transformative solutions available to help you. With innovative services like Turnout’s AI-powered advocacy for tax debt relief and H&R Block's comprehensive tax preparation options, you can find the support you need to manage your financial obligations effectively.

H&R Block’s services stand out for their efficiency and transparency. They offer user-friendly tools and resources, all while prioritizing customer satisfaction. The integration of AI in tax debt relief not only streamlines the process but also empowers you to tackle your tax challenges with confidence. Moreover, H&R Block’s emphasis on flexible filing options ensures that you can find a method that suits your unique needs.

Ultimately, the message is clear: you do not have to face your financial responsibilities alone. By leveraging the resources and expertise available through services like H&R Block and innovative solutions like Turnout, you can navigate tax season with greater ease and assurance. Embracing these tools and services not only enhances your financial stability but also fosters a proactive approach to managing tax obligations, leading to a more empowered and informed taxpayer experience. Remember, we're here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist with tax debt relief?

Turnout is an AI-powered initiative that transforms tax debt relief by streamlining the advocacy process. It utilizes an AI case quarterback named Jake to provide timely updates and support throughout the tax relief journey, making the process more manageable and accessible.

Who does Turnout use to help with tax obligations?

Turnout employs IRS-licensed enrolled agents instead of attorneys, allowing individuals to navigate their tax obligations without the need for legal representation.

How does AI technology improve the tax debt relief process?

AI technology enables faster responses to IRS communications and improves overall outcomes for those seeking tax relief, enhancing operational efficiency and empowering individuals to confront their tax challenges confidently.

What services does H&R Block offer for tax preparation?

H&R Block provides a comprehensive suite of tax preparation services tailored to meet diverse taxpayer needs, focusing on accuracy and customer satisfaction to optimize refunds and reduce tax obligations.

How experienced is H&R Block in tax preparation?

H&R Block has nearly 70 years of expertise and assists 11.4 million filers by submitting 20 million tax returns annually, establishing itself as a trusted partner for taxpayers.

What measures is H&R Block implementing to enhance customer satisfaction?

H&R Block is committed to transparency and consumer rights, including a system that allows customers to downgrade products automatically by February 15, 2025, without losing previously entered information.

How does H&R Block ensure a user-friendly tax filing experience?

H&R Block prioritizes a user-friendly experience through an intuitive online platform that guides users through the filing process, and also offers in-person assistance for those who prefer face-to-face interactions.