Overview

If you haven't filed your taxes in the past three years, we understand that this can feel overwhelming. It's crucial to take immediate steps to mitigate potential fines, interest, and legal repercussions from the IRS. Gathering the necessary documentation is a good first step. Seeking professional assistance can also provide you with the guidance you need. Utilizing the Voluntary Disclosures Program can significantly alleviate the stress of late filings.

Remember, you're not alone in this journey. Many have faced similar challenges, and there are solutions available to help you ensure compliance while minimizing penalties. Taking action now can lead to a more secure financial future. We're here to help you navigate this process and find peace of mind.

Introduction

Neglecting to file taxes for three years can lead to a daunting array of consequences, including hefty fines and potential legal action. We understand that facing the anxiety of overdue returns can be overwhelming. This article offers a comprehensive guide on the steps you can take if taxes have been neglected.

We’ll discuss:

- How to gather necessary documentation

- The benefits of seeking professional assistance

- The potential relief available through the Voluntary Disclosures Program

What strategies can you implement to regain control over your tax obligations and avoid overwhelming penalties? Remember, you are not alone in this journey.

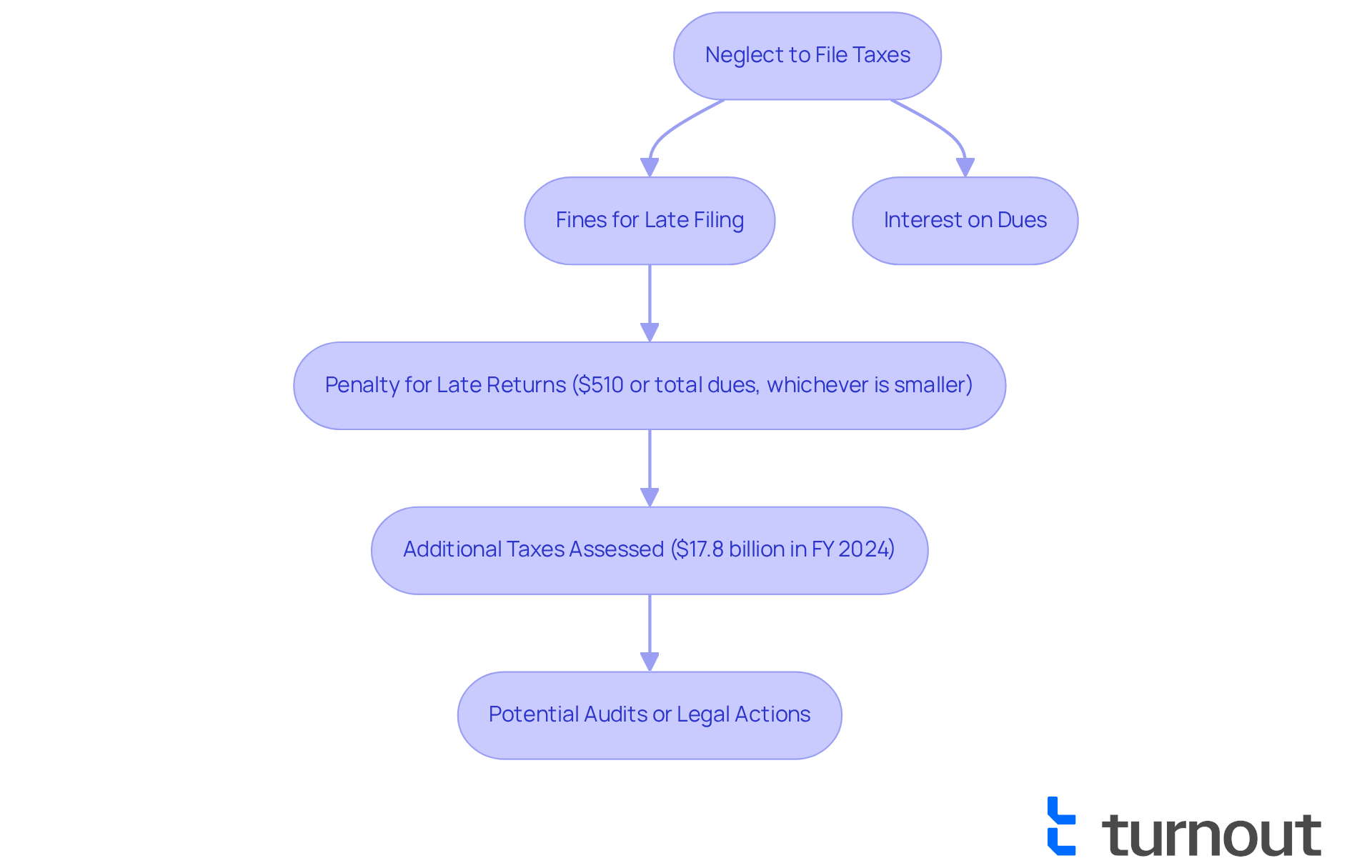

Understand the Consequences of Not Filing Taxes

Neglecting to submit returns can lead to , especially for those who , and we understand that this can be overwhelming. The IRS enforces fines for , which can accumulate significantly over time. For instance, if a return is submitted more than 60 days overdue, the lowest fine may reach $510 or the total amount of outstanding dues, whichever is smaller. Additionally, interest on these dues begins to accumulate 45 days after the IRS receives the return, further adding to your .

In fiscal year 2024 alone, the IRS assessed a staggering $17.8 billion in additional taxes due to late filings. This figure underscores the and the scale of non-compliance. Beyond the financial implications, individuals may face , including potential audits or enforcement actions. The IRS has the authority to obtain unfiled tax returns and may pursue civil sanctions or even criminal inquiries for non-compliance.

is crucial for motivating action and helping those who haven't filed taxes in 3 years avoid further complications with the IRS. It's common to feel anxious about these matters, but it’s important to know that you are not alone in this journey. We encourage you to as soon as possible to mitigate penalties and interest. Remember, taxpayers have three years from the original due date to claim any refunds before they expire, so taking action now can make a difference.

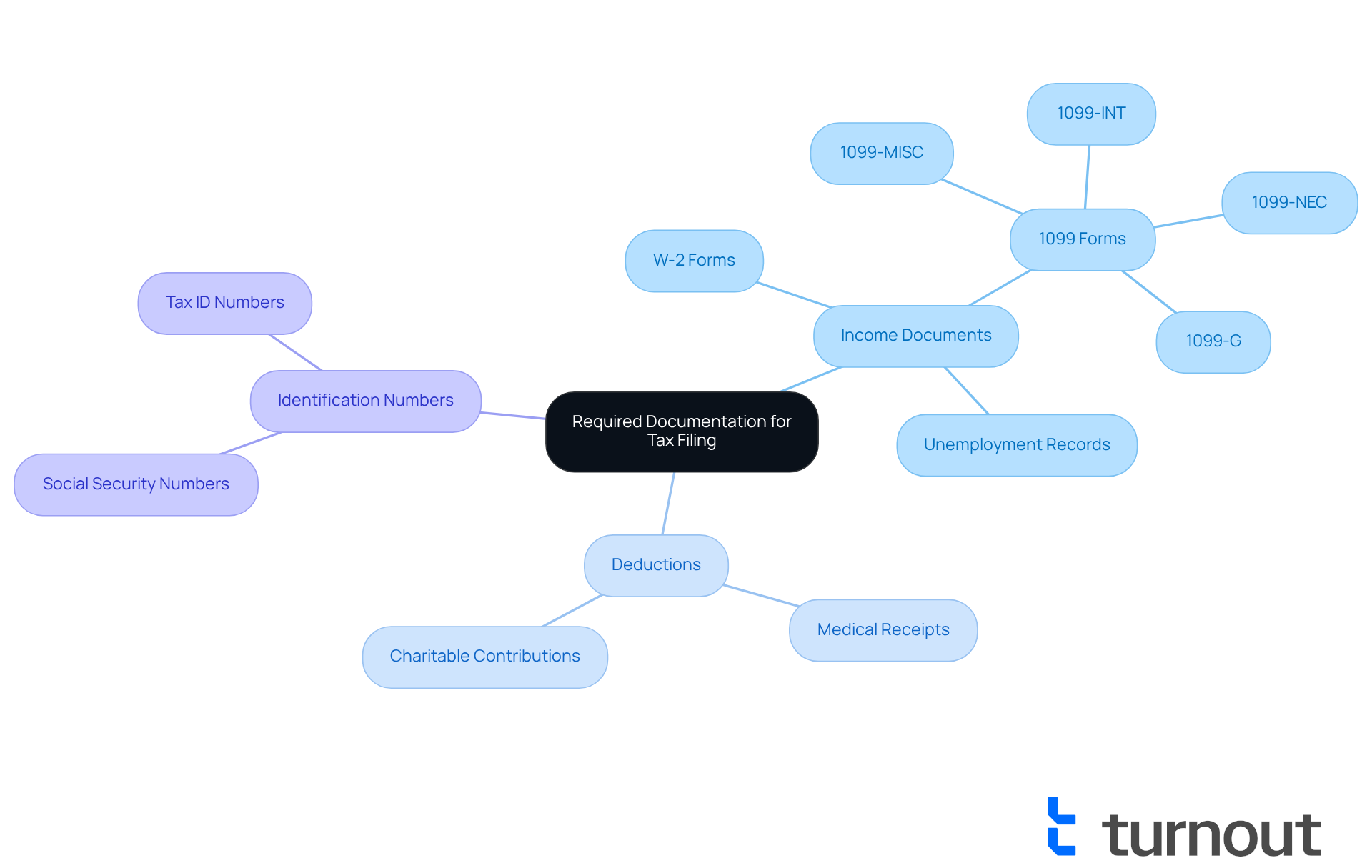

Gather Required Documentation for Tax Filing

We understand that if you haven't filed taxes in 3 years, submitting your can seem overwhelming. To help you navigate this process, it’s essential to gather some . Start with your W-2 forms from employers for each year you missed; these provide crucial income information. If you are self-employed, please collect your 1099 forms along with any records of income and expenses. Additionally, don’t forget to gather relevant receipts for deductions, such as medical expenses or charitable contributions. If you received unemployment benefits, include those records as well.

It's also important to have your numbers and tax ID numbers ready for yourself and any dependents. On average, you may need to compile around 10 to 15 documents, depending on your financial activities. As a , having all ready is vital to avoid refund delays and ensure a complete and accurate tax return.

You can also utilize the IRS Online Account to manage your effectively. By preparing in advance, especially if you haven't filed taxes in 3 years, you can navigate the complexities of with greater confidence. Remember, you are not alone in this journey; every step of the way.

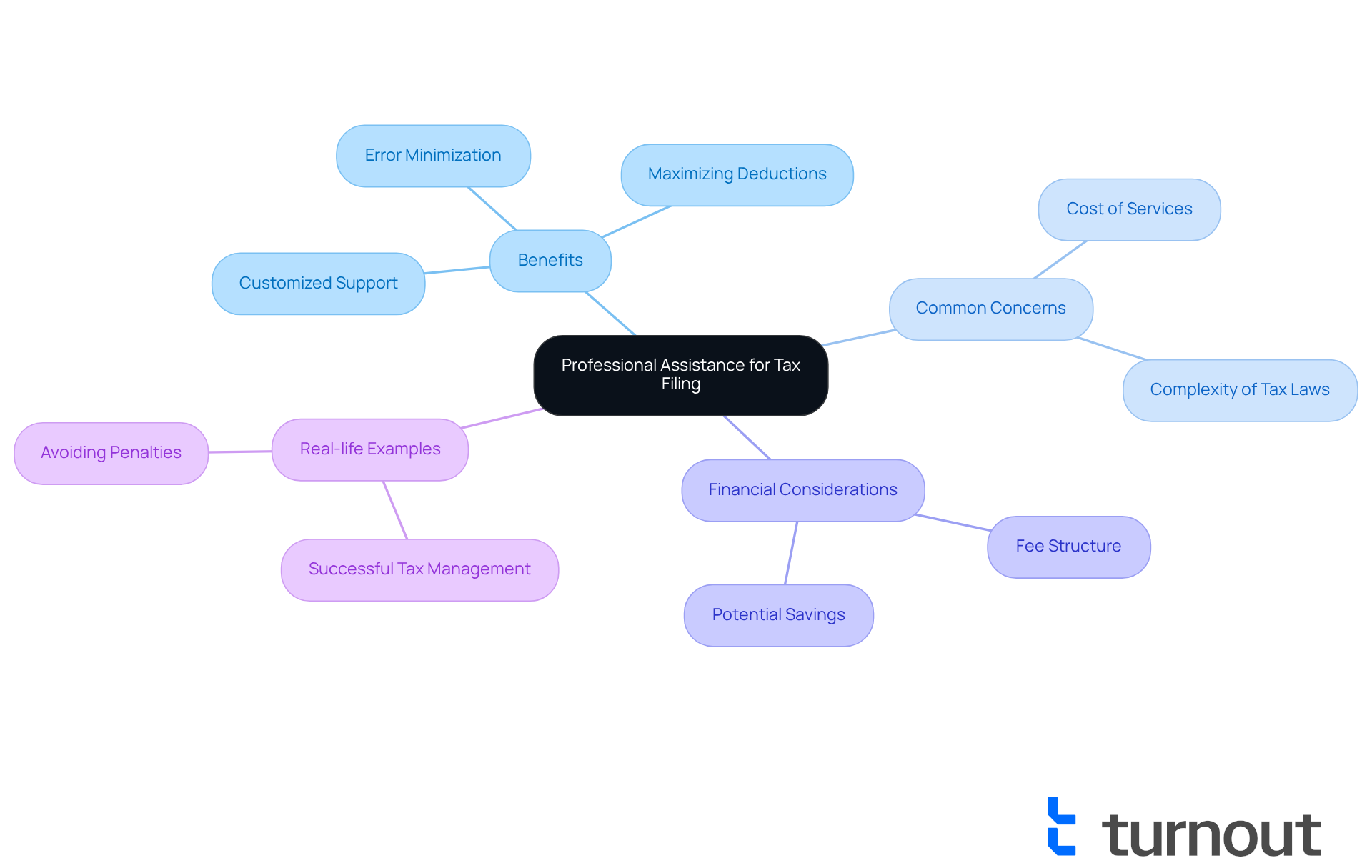

Consider Professional Assistance for Tax Filing

Feeling overwhelmed by the thought of submitting taxes when you haven't filed taxes in 3 years is a common experience. However, can make this process much more manageable. Tax experts provide customized support tailored to your specific situation, helping you navigate the intricacies of . They ensure you understand your options and maximize any available deductions or credits, which can significantly reduce your tax liability.

For individuals facing complicated financial situations—such as multiple income sources or significant life changes—the expertise of can be invaluable. These experts can help identify potential deductions that may have been overlooked, ensuring that your tax returns are accurate and compliant with current laws.

Statistics show that can lead to . Many clients discover that the cost of professional services is offset by the deductions and credits they secure, ultimately resulting in a lower tax bill. Moreover, tax professionals are skilled at minimizing errors in tax documents, helping to prevent costly mistakes and potential audits.

Real-life examples highlight the value of seeking help after you haven't filed taxes in 3 years. Many individuals have successfully managed their tax responsibilities with the assistance of tax experts, who provided essential advice to become current on submissions and avoid fines. As one tax consultant noted, ' of various income sources can be daunting, but with the right support, you can ensure compliance and peace of mind.'

When engaging with services like Turnout, it's important to be aware of the . Some services may be free, while others will incur service fees, and government fees are separate and must be paid before any paperwork can be submitted on your behalf. Understanding these fees can empower you to make informed decisions about your .

In conclusion, enlisting a tax expert not only alleviates the stress related to late submissions but also enhances your likelihood of achieving . By creating improved tax strategies and organizational methods with their support, you can prevent future late submissions, making it a proactive step toward financial stability. Furthermore, you can expect to receive all communications electronically, including notices and agreements, which can streamline the process and keep you informed.

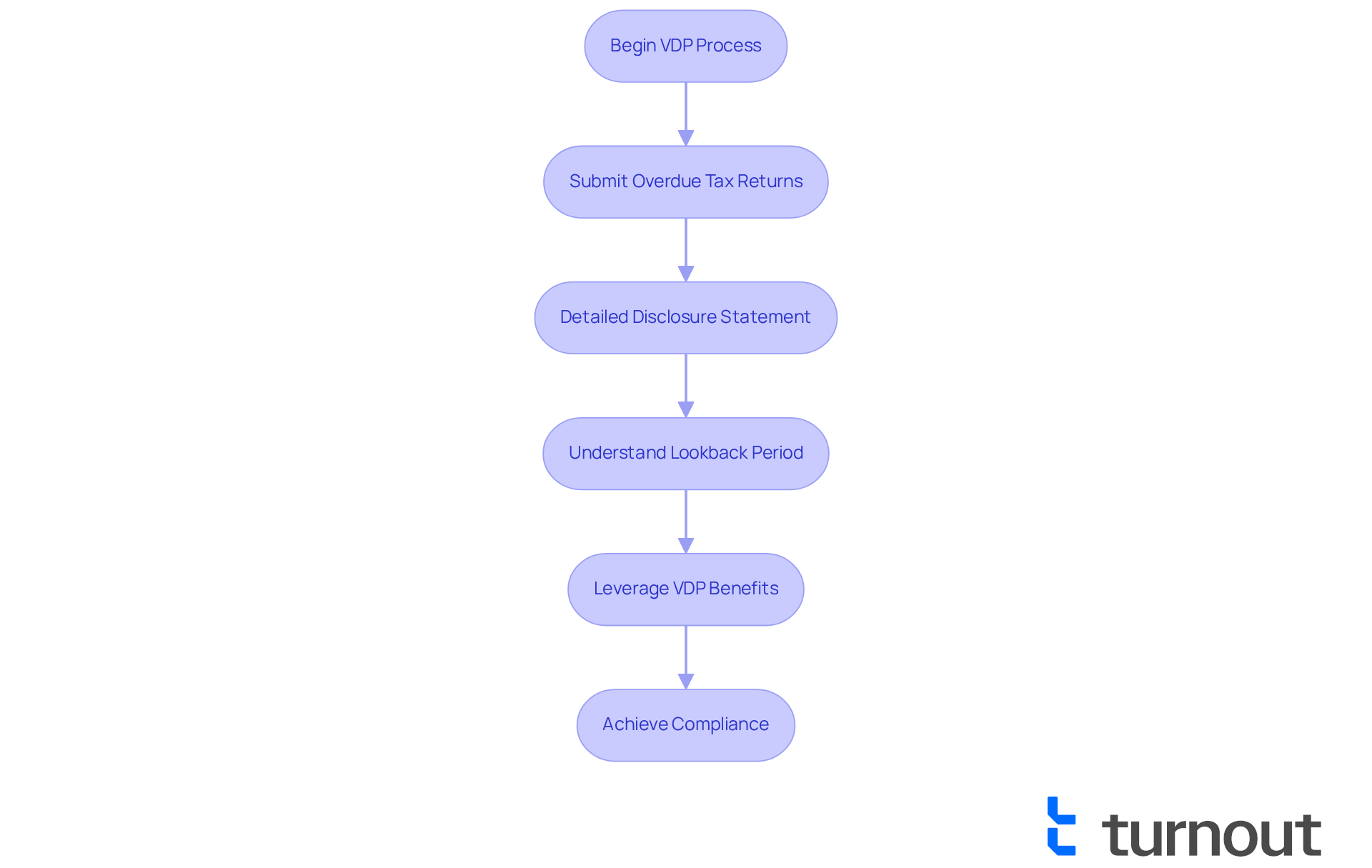

Utilize the Voluntary Disclosures Program (VDP) for Relief

The is a vital resource for individuals who haven't filed taxes in 3 years. It offers a way to achieve compliance without the stress of harsh consequences. By willingly revealing your tax circumstances, you may find the opportunity to decrease or even remove penalties related to late submission. Many taxpayers using the VDP have reported significant reductions in fines, with some experiencing a remarkable 75% decrease based on their unique situations. The on tax, interest, and fees collected through the VDP further highlights its effectiveness.

To effectively leverage the VDP, it’s important to:

- Submit your along with a detailed disclosure statement that outlines your situation.

- Understand that the relevant lookback period for the VDP is typically six years, which is crucial for grasping your obligations and the program's scope.

This with the IRS but also alleviates the stress associated with unresolved . Real-life examples illustrate how individuals have successfully navigated the VDP, demonstrating how it enabled them to correct their tax status and avoid severe consequences.

Experts emphasize the importance of utilizing the VDP for late tax filings, noting that it provides a . As one tax professional stated, 'The VDP is a crucial tool for those looking to come back into compliance without facing the full brunt of penalties.' Additionally, the IRS's decision to is a significant change that could ease concerns for taxpayers considering the VDP. By taking advantage of this program, you can over your tax situation and move forward with confidence. However, it’s essential to remain aware of the complexities and risks associated with the VDP process. Remember, you are not alone in this journey; we’re here to help you .

Conclusion

Neglecting to file taxes for three years can lead to significant consequences, and we understand that this can feel overwhelming. However, taking proactive steps can help mitigate these issues. By understanding the implications of non-filing, gathering necessary documentation, seeking professional assistance, and utilizing the Voluntary Disclosures Program (VDP), you can pave the way toward compliance and financial clarity.

Throughout this article, we have highlighted key strategies to support you on this journey. It's important to be aware of potential penalties, collect relevant financial documents, and enlist the help of tax professionals. The VDP stands out as a particularly effective resource, offering you the chance to rectify your tax situation while potentially reducing penalties. Each of these steps is designed to empower you, ensuring you don't have to face these challenges alone.

Ultimately, taking action is essential for regaining control over your tax responsibilities. By addressing overdue filings and utilizing available resources, you can avoid further complications with the IRS and work toward financial stability. Embracing these steps not only fosters compliance but also alleviates the stress associated with unresolved tax issues. This allows for a fresh start and peace of mind. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to serious repercussions, including fines for late filing, accumulation of interest on dues, and potential legal actions such as audits or enforcement measures by the IRS.

What fines does the IRS impose for late tax filing?

If a tax return is submitted more than 60 days overdue, the lowest fine may reach $510 or the total amount of outstanding dues, whichever is smaller.

When does interest on overdue taxes begin to accumulate?

Interest on overdue taxes begins to accumulate 45 days after the IRS receives the late return.

How much additional tax was assessed by the IRS in fiscal year 2024 due to late filings?

In fiscal year 2024, the IRS assessed $17.8 billion in additional taxes due to late filings.

What legal repercussions can individuals face for not filing taxes?

Individuals may face audits, civil sanctions, or even criminal inquiries for non-compliance with tax filing requirements.

How long do taxpayers have to claim refunds for overdue returns?

Taxpayers have three years from the original due date to claim any refunds before they expire.

What should individuals do if they haven't filed taxes in three years?

Individuals who haven't filed taxes in three years are encouraged to file any overdue returns as soon as possible to mitigate penalties and interest.