Overview

Navigating the payment plan for New Jersey taxes can feel overwhelming, but you're not alone in this journey. This article serves as a comprehensive step-by-step guide designed to help you master the process. We will explore the types of arrangements available, the eligibility criteria, the application process, and the potential consequences of non-compliance.

Understanding the minimum payment requirements is crucial. It's also essential to submit your tax returns on time. We understand that life can get busy, and sometimes things slip through the cracks. That's why maintaining open communication with the New Jersey Division of Taxation is vital; they can help you navigate any potential challenges effectively.

Remember, you have options, and we’re here to help you find the best path forward. By taking these steps, you can ease your worries and ensure that you are on the right track. Don't hesitate to reach out for assistance—your peace of mind is worth it.

Introduction

Navigating the complexities of tax liabilities can often feel like an uphill battle. We understand that residents of New Jersey may be facing mounting financial obligations, which can be overwhelming. Fortunately, New Jersey offers structured payment plans designed to alleviate this burden and provide taxpayers with a manageable path to compliance. However, with various options and eligibility criteria to consider, many may wonder: how can one effectively master the payment plan process to avoid pitfalls and ensure timely payments?

This guide aims to demystify the application process, highlight essential steps, and address common challenges. We want to empower you to take control of your financial responsibilities with confidence. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Understand New Jersey Tax Payment Plans

Navigating tax liabilities can be overwhelming, but New Jersey provides a payment plan for NJ taxes that is designed to help you manage these responsibilities with ease. Here’s what you need to know:

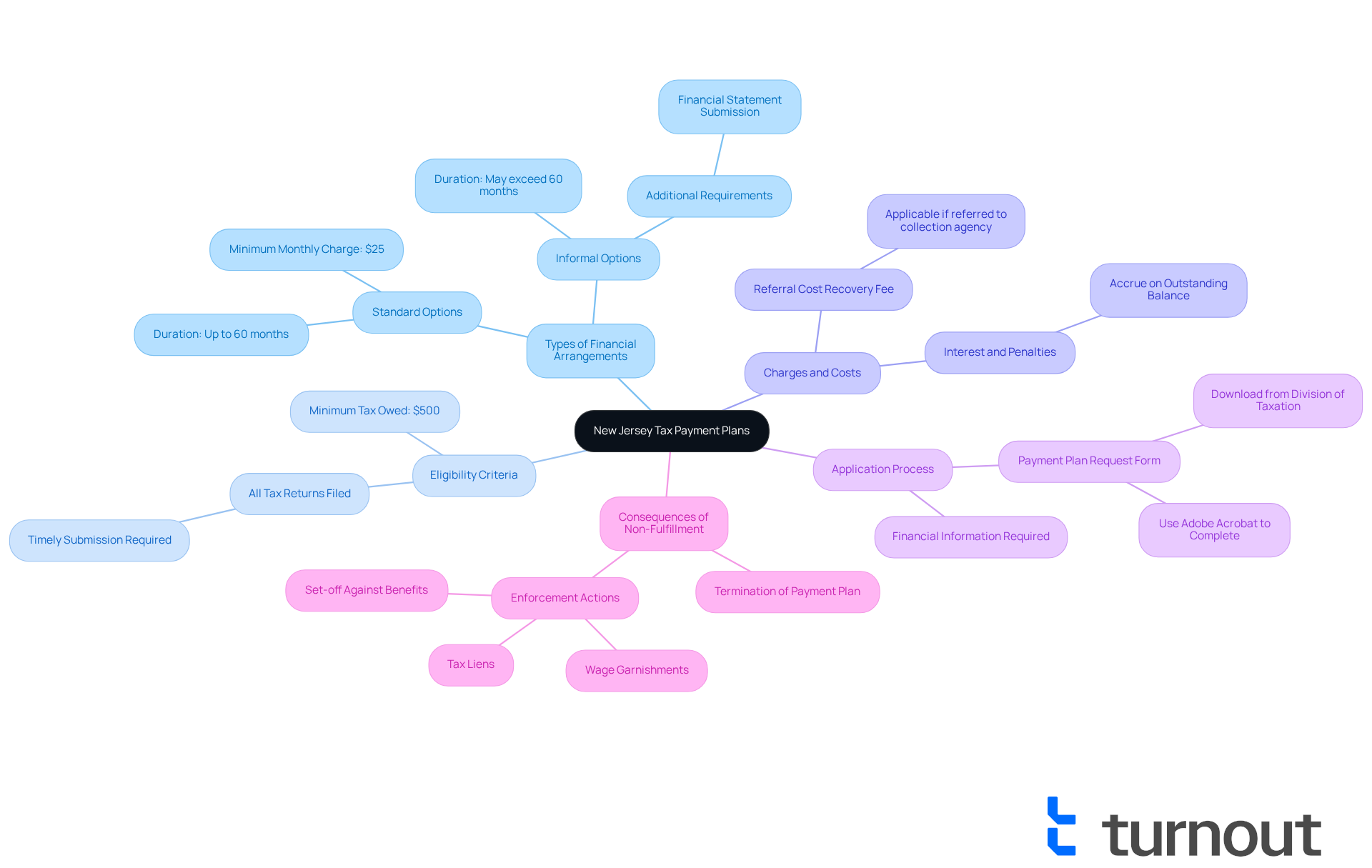

- Types of Financial Arrangements: New Jersey provides several financial arrangements, including standard options lasting up to 60 months and informal options that may extend beyond that. With a minimum monthly charge set at $25, the payment plan for NJ taxes is accessible for many taxpayers. If you need a plan that lasts longer than 60 months, be prepared for additional requirements and the submission of a financial statement for approval.

- Eligibility Criteria: To qualify for a financial arrangement, ensure you owe at least $500 in taxes (excluding cigarette taxes). It’s crucial to have all your tax returns filed before applying, as this ensures your tax situation is thoroughly documented. Remember, timely submission of all necessary tax returns is vital to keep your financial arrangement active.

- Charges and Costs: While you're enrolled in a financial arrangement, interest and penalties will continue to accrue on your outstanding balance. This ongoing accumulation of interest is important to consider when budgeting your monthly expenses. Additionally, be aware that a Referral Cost Recovery Fee may apply if your tax account is referred to a collection agency.

- Application Process: Understanding the application process is essential. You will need to provide financial information and complete a form for a payment plan for NJ taxes, which is available for download from the New Jersey Division of Taxation's website. It’s important to fill out this form using Adobe Acrobat, as completing it in a web browser may cause issues.

- Consequences of Non-Fulfillment: We understand that failing to meet financial obligations can be concerning. It may lead to the termination of your plan and possible enforcement actions, such as tax liens or wage garnishments. Additionally, unpaid balances might result in a set-off against your government benefits or tax refund. Staying current with your payments is crucial to avoid these serious repercussions.

Tax experts emphasize the importance of open communication with the Division of Taxation to address any concerns regarding payments. Many successful case studies show that taxpayers who consistently make their contributions and stay informed about their responsibilities often achieve positive outcomes, effectively reducing their overall tax liabilities. As we look towards 2025, it’s encouraging to see a growing number of taxpayers taking advantage of these financial arrangements, reflecting a rising trend in organized debt management in New Jersey. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Apply for a New Jersey Tax Payment Plan

Applying for a payment plan for NJ taxes can feel overwhelming, but we're here to help. Follow these steps to navigate the process with confidence:

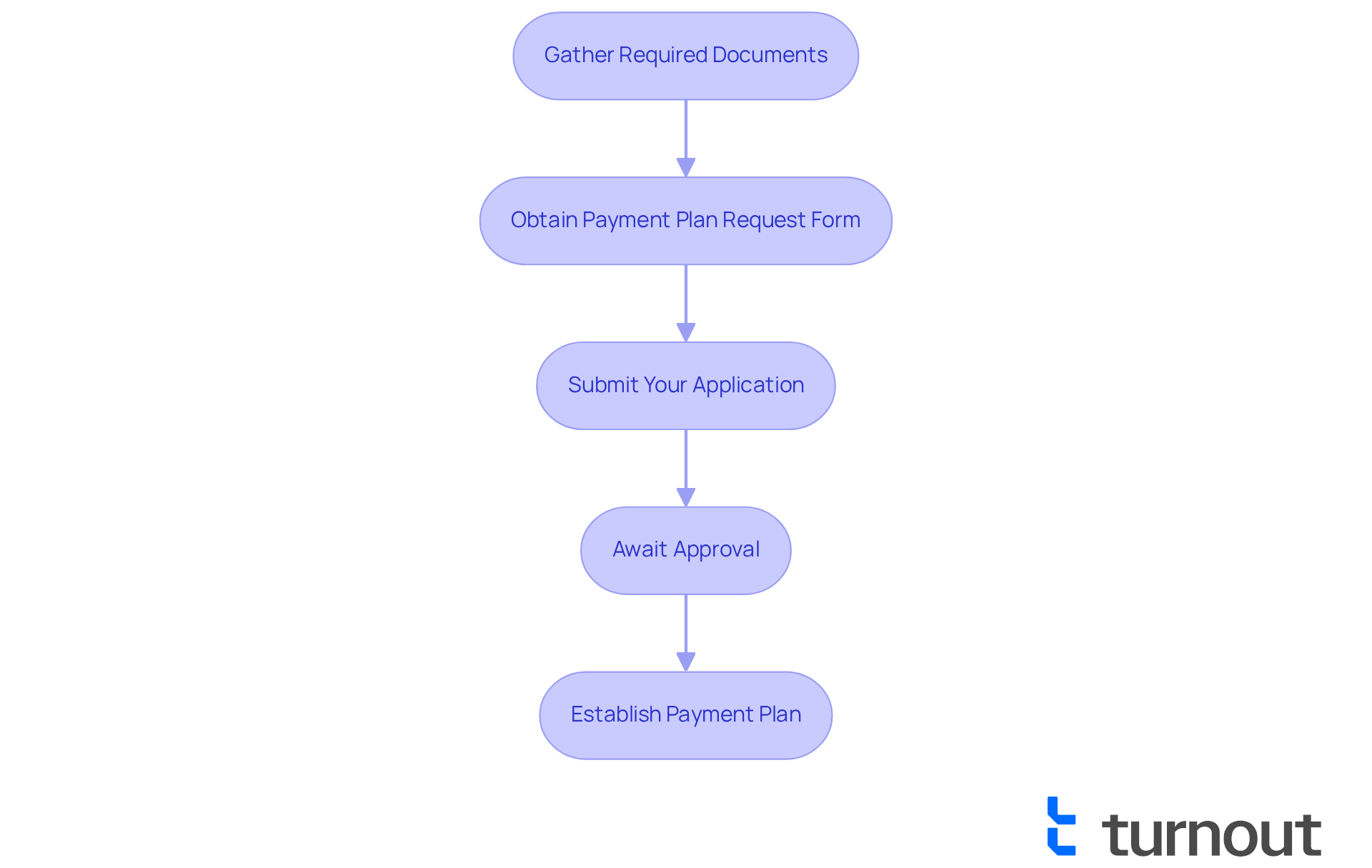

- Gather Required Documents: Start by collecting all necessary documents, such as your tax returns, proof of income, and any other financial information that shows your ability to pay. We understand that having accurate and up-to-date records is crucial, so take your time to ensure everything is in order.

- To complete the payment plan for NJ taxes, visit the New Jersey Division of Taxation's website to obtain the Payment Plan Request Form. As you fill it out, please double-check that all information is accurate. This helps avoid delays in processing and eases your journey.

- Submit Your Application: Once your form is complete, send it along with any required documentation to the New Jersey Division of Taxation. You can submit your application online or via mail, depending on what works best for you. Remember, including all necessary documents will facilitate a smoother review process.

- Await Approval: After you've submitted your application, the Division of Taxation will review it. This process may take several weeks, so we encourage you to be patient. If you wish, you can check the status of your application by contacting their office for updates.

- Establishing a payment plan for NJ taxes: Once your application is approved, you will receive details about your payment schedule. It's important to follow this schedule to avoid penalties or cancellation of your arrangement. Please keep in mind that failing to make payments can lead to serious consequences, including intense collection efforts. Additionally, interest and fees will continue to accumulate on outstanding amounts, even within a repayment plan, and the minimum monthly contribution must be no less than $25.

You are not alone in this journey. We're here to support you every step of the way.

Troubleshoot Common Issues in the Application Process

When seeking a payment plan for NJ taxes, we understand that you may face several common challenges. Here’s how we can help you troubleshoot them:

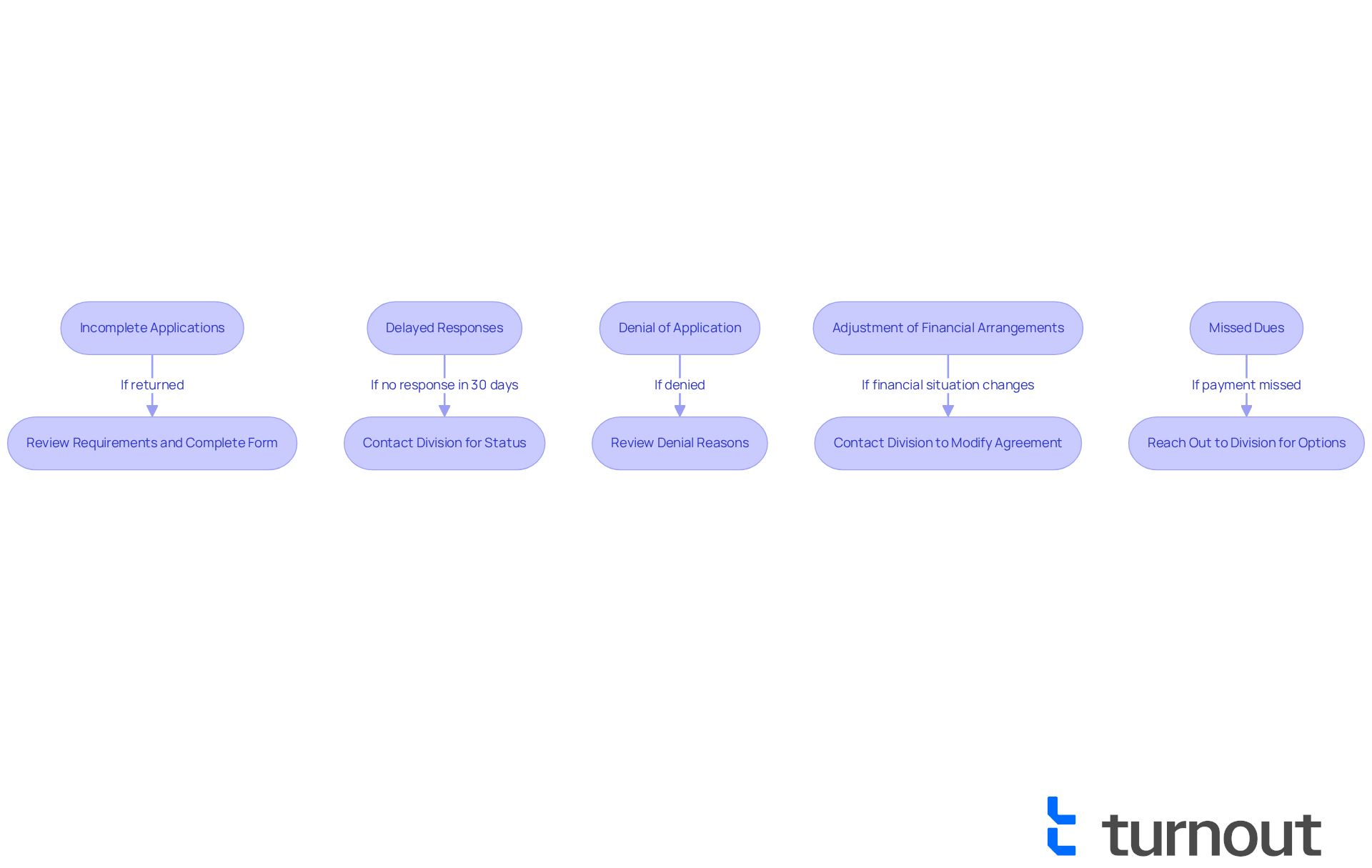

- Incomplete Applications: If your application is returned due to missing information, take a moment to carefully review the requirements. Ensure all sections of the form are filled out completely. Importantly, all required tax returns must be filed before your application can be approved. Double-check that all necessary documents are included to avoid delays.

- Delayed Responses: It's common to feel anxious if you haven’t received a response within 30 days. We encourage you to contact the New Jersey Division of Taxation to inquire about your application status. Typically, taxpayers receive a reply concerning their arrangement request within this timeframe. Keeping a record of your submission date and any correspondence can be helpful.

- Denial of Application: If your application is denied, take a moment to review the reasons provided. Common issues include outstanding tax returns or insufficient financial documentation. It's worth noting that a significant percentage of applications are denied due to incomplete submissions. Address these concerns, and remember, you can consider reapplying once resolved.

- Adjustment of Financial Arrangements: If your monetary circumstances change, and you need to alter your financial agreement, we recommend reaching out to the Division of Taxation quickly. They can help you explore your options for amending the contract. Providing updated financial documents will be essential for this process.

- Missed Dues: If you miss a payment, it’s important to act promptly. Reach out to the Division to clarify your circumstances. They may present options to restore your arrangement or offer advice on subsequent actions to prevent additional penalties. Missing a payment can lead to cancellation of the installment agreement and resumption of full collection efforts, so timely communication is crucial to maintaining your payment plan. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of tax liabilities can indeed feel overwhelming. However, understanding the payment plans available in New Jersey can illuminate a pathway to financial relief. These plans are thoughtfully structured to accommodate diverse needs, ensuring that taxpayers can manage their obligations without excessive stress. By exploring the types of arrangements, eligibility criteria, and the application process, you can take proactive steps toward resolving your tax issues.

We understand that being well-prepared when applying for a payment plan is crucial. Gathering necessary documents and grasping the consequences of missed payments are vital steps in successfully managing tax liabilities. Open communication with the New Jersey Division of Taxation is essential; it fosters a cooperative relationship that can lead to favorable outcomes.

Ultimately, mastering the payment plan for NJ taxes transcends mere compliance; it empowers you to regain control over your financial situation. By taking advantage of these arrangements, you can pave the way for a more organized approach to debt management. The journey may present challenges, but with the right knowledge and support, it is entirely achievable. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What types of financial arrangements are available for New Jersey tax payments?

New Jersey offers several financial arrangements, including standard options lasting up to 60 months and informal options that may extend beyond that. The minimum monthly charge is set at $25.

What are the eligibility criteria for a payment plan in New Jersey?

To qualify for a financial arrangement, you must owe at least $500 in taxes (excluding cigarette taxes) and have all your tax returns filed before applying.

What charges and costs should I be aware of while enrolled in a payment plan?

While enrolled, interest and penalties will continue to accrue on your outstanding balance. Additionally, a Referral Cost Recovery Fee may apply if your tax account is referred to a collection agency.

How do I apply for a New Jersey tax payment plan?

You need to provide financial information and complete a form for the payment plan, which can be downloaded from the New Jersey Division of Taxation's website. It is recommended to fill out the form using Adobe Acrobat to avoid issues.

What are the consequences of failing to fulfill my payment plan obligations?

Failing to meet your obligations may lead to the termination of your plan, possible enforcement actions such as tax liens or wage garnishments, and unpaid balances might result in a set-off against your government benefits or tax refund.

How can I ensure the success of my payment plan?

Maintaining open communication with the Division of Taxation and consistently making your payments are crucial for achieving positive outcomes and effectively managing your tax liabilities.