Overview

We understand that navigating tax forms can be overwhelming, especially when it comes to claiming the Additional Child Tax Benefit (ACTB). This article offers detailed, step-by-step instructions for completing Schedule 8812, designed to help you maximize your eligible tax credits. By accurately reporting your dependent information and understanding the eligibility criteria, you can significantly influence the potential tax benefits your family may receive.

It's common to feel uncertain about recent changes to income limits and credit amounts. That's why it's crucial to have clear guidance on these matters. Knowing the ins and outs of the ACTB can make a real difference for families seeking financial support. Remember, you are not alone in this journey—many taxpayers share your concerns and are looking for clarity.

As you read through the instructions, take your time to reflect on your situation and how these benefits can help your family thrive. We're here to help you through this process, ensuring you feel confident in your ability to claim the benefits you deserve.

Introduction

Navigating the complexities of tax benefits can often feel daunting. We understand that the intricacies of Schedule 8812, the Additional Dependent Tax Benefit form, may leave you feeling overwhelmed. This essential document holds the key to unlocking significant financial support for families. It allows access to various credits that can dramatically reduce your tax burden. However, with recent changes in eligibility criteria and potential pitfalls in the application process, it’s common to wonder: how can you ensure you maximize your benefits and avoid costly mistakes? We're here to help you through this journey.

Understand Schedule 8812 and Its Purpose

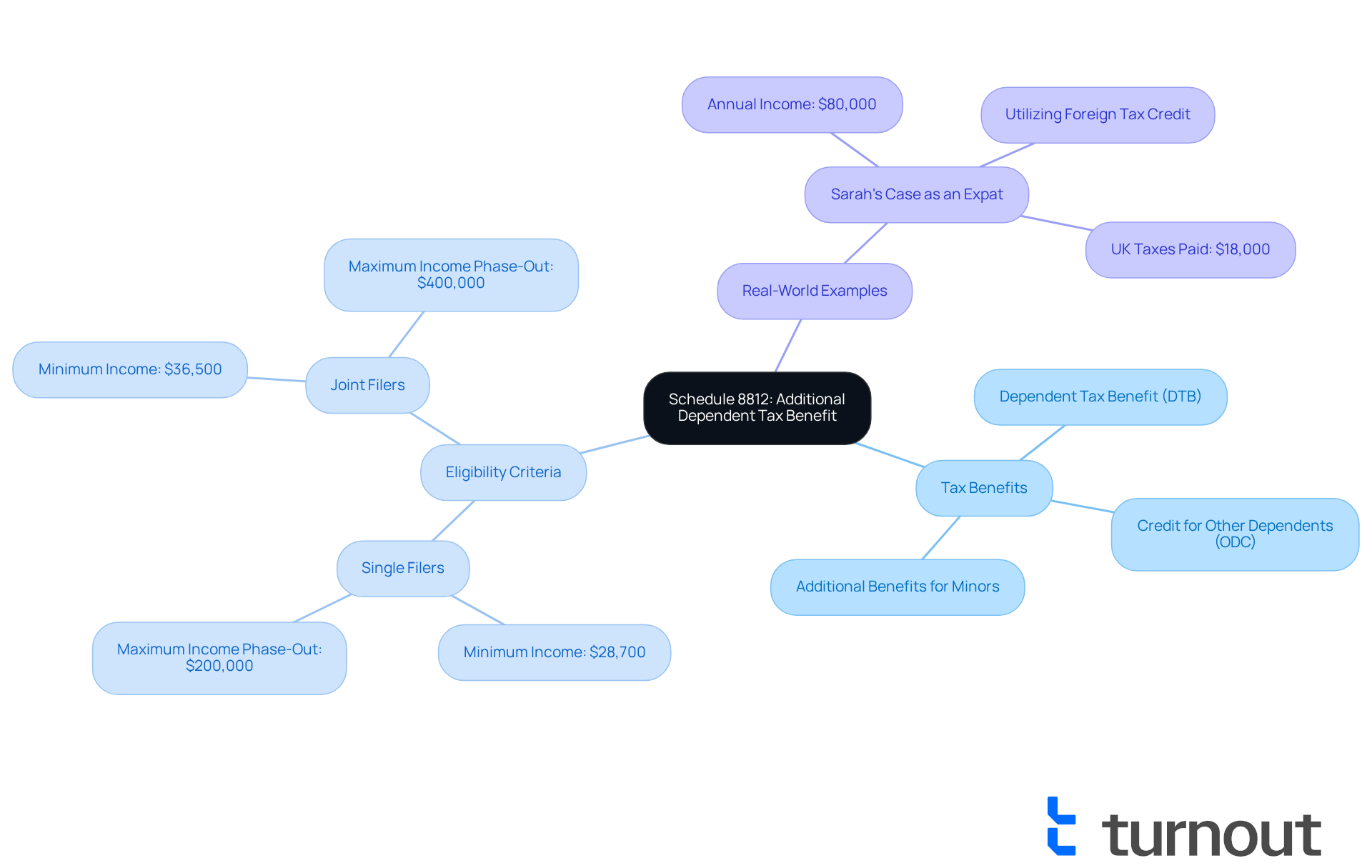

The , also referred to as the Additional (ACTB) form, are essential for taxpayers who wish to determine their eligibility for dependent . Understanding this form is crucial for accessing the Dependent Tax Benefit (DTB), (ODC), and additional benefits available for eligible minors. By grasping its purpose, taxpayers can ensure they utilize all qualifying benefits, which can significantly reduce their .

For the 2025 tax year, the (CTC) increases to $2,200 for each dependent, while the ACTC remains at $1,700 for both 2024 and 2025. These adjustments reflect a permanent change aimed at providing more substantial financial support to families. However, it’s important to note that recent eligibility changes require families to meet higher income limits to qualify for the full benefit amount. For example:

- Single filers must earn at least $28,700 to access the complete benefit.

- Joint filers need to earn at least $36,500.

- Families earning under $2,500 will not receive any tax benefit for dependents.

The significance of the schedule 8812 instructions is especially pronounced for families with children under 17. This form allows them to gain through refundable tax incentives, even if they do not owe taxes. For instance, families utilizing the ACTC could potentially unlock thousands of dollars in , which can be particularly helpful given their unique financial situations.

Real-world examples illustrate the impact of the Additional Child Tax Benefit on families. Take Sarah, an American expat in the UK, who earns $80,000 annually and pays $18,000 in UK taxes. By strategically using the Foreign Tax Incentive, she can maintain her eligibility for the ACTC, leading to significant financial benefits despite her complex tax situation. This highlights how understanding and effectively utilizing the schedule 8812 instructions can provide substantial support for families navigating intricate tax systems.

Additionally, it’s essential to be aware that the IRS will not issue refunds for returns claiming ACTC before mid-February 2025. This timing detail is crucial for taxpayers to keep in mind as they plan their finances.

Determine Eligibility for the Child Tax Credit

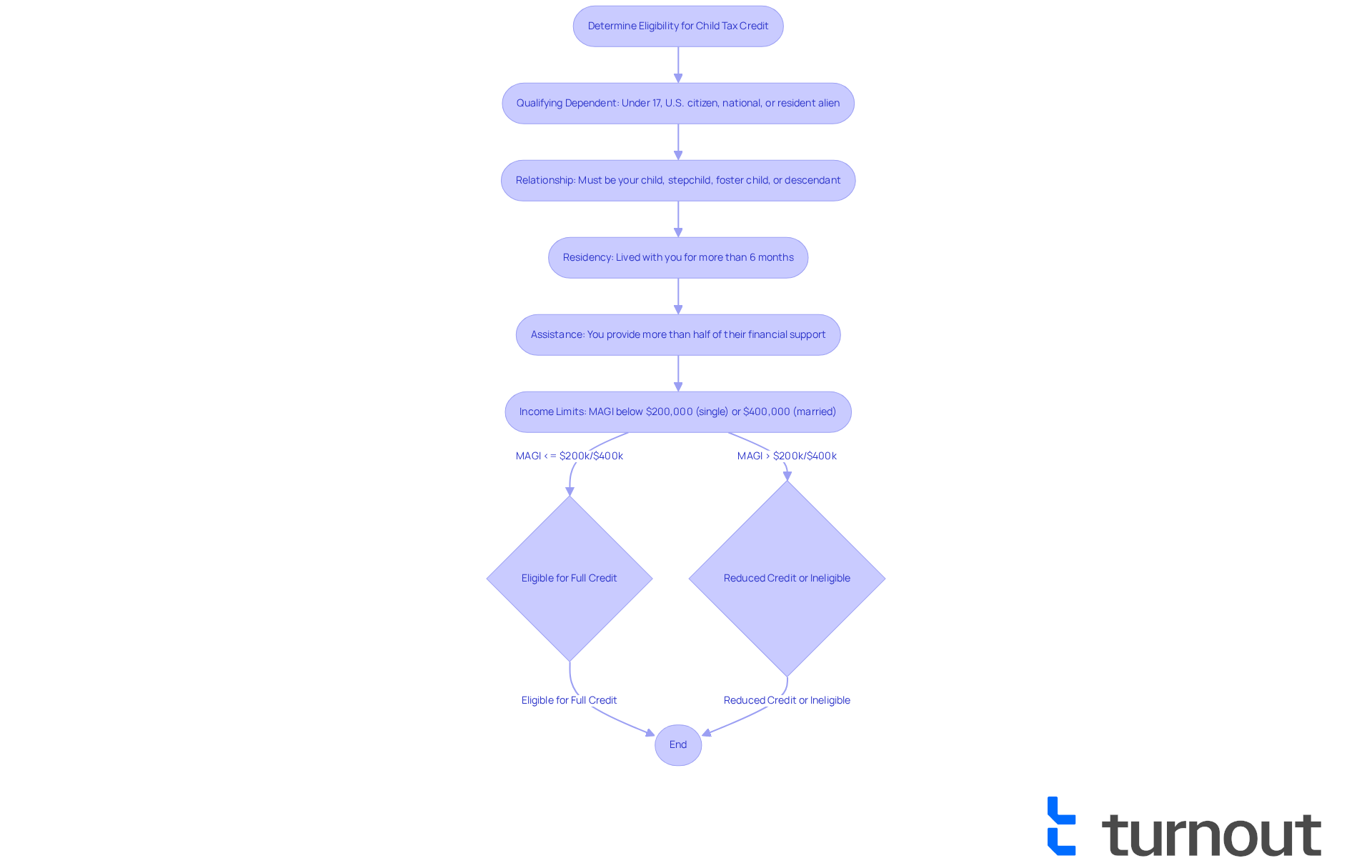

Determining your eligibility for the can feel overwhelming, but we're here to help. You must meet several key criteria:

- : Your dependent should be under 17 years old at the end of the tax year and must be a U.S. citizen, national, or resident alien.

- Relationship: This young person must be your son, daughter, stepchild, foster child, or a descendant of any of these.

- Residency: The minor needs to have lived with you for more than six months, though there are exceptions to this rule.

- Assistance: You must provide more than half of their financial support during the year.

- : Your modified adjusted gross income (MAGI) should be below certain thresholds. For 2025, the phase-out begins at $200,000 for single filers and $400,000 for married couples filing jointly. The credit decreases by $50 for every $1,000 of income over these limits.

By confirming these criteria, you can ensure that you are eligible to claim the Dependent Tax Credit, which has been made permanent and is set at a in the 2025 tax year. Even families with no tax obligation can receive a refundable amount of up to $1,700 for each dependent. This benefit can significantly impact your tax refund, with families eligible for an average refund of $3,207 in the past filing season.

Understanding these requirements not only helps you but also maximizes your potential refund. It's common to feel uncertain about these processes, so be cautious; erroneous claims may incur penalties. If you have questions, consider consulting tax experts or using tax software for assistance. Remember, you are not alone in this journey, and to ensure you receive the benefits you deserve.

Complete Schedule 8812: Step-by-Step Instructions

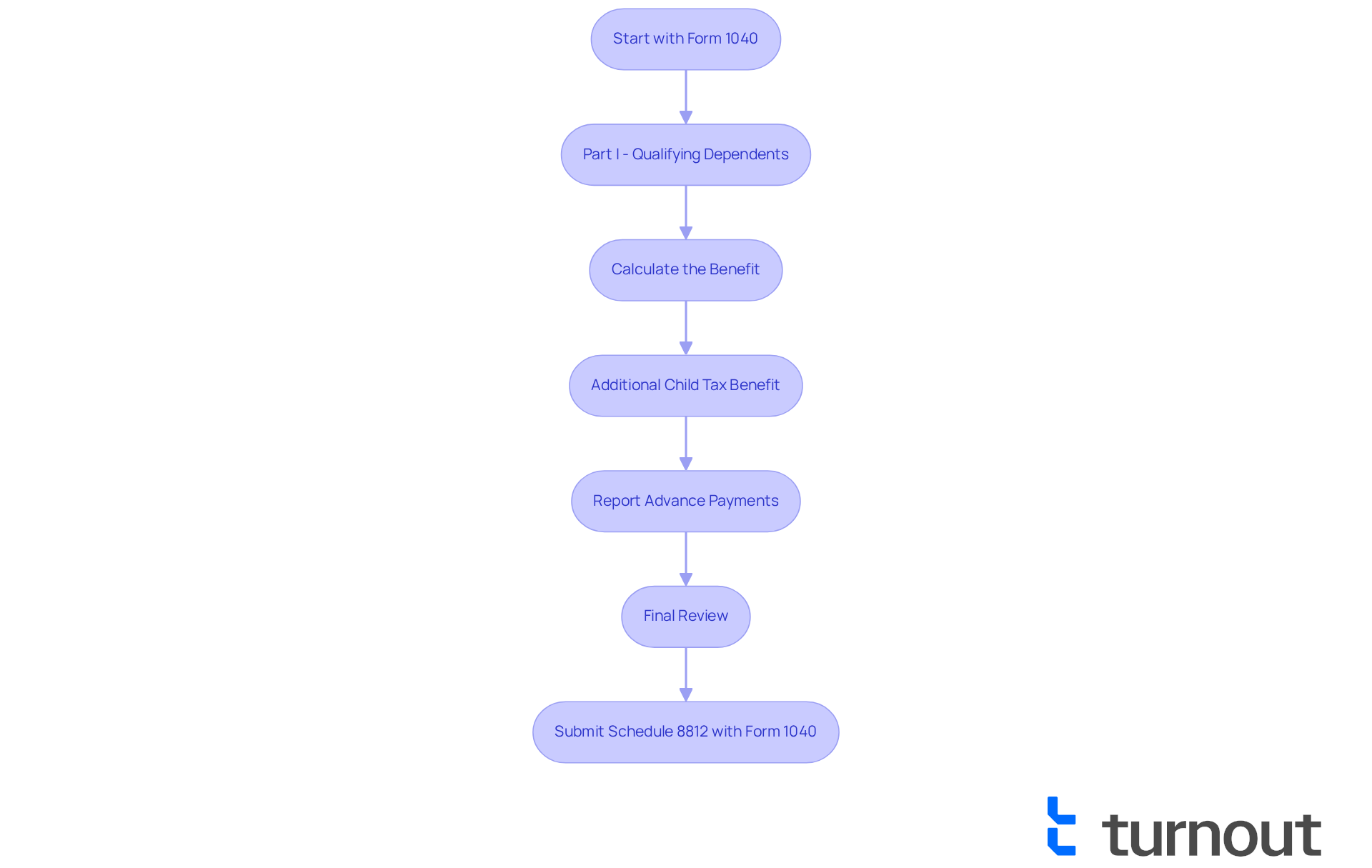

To accurately complete Schedule 8812, follow these detailed steps:

- Start with : We understand that tax season can be overwhelming. Ensure that you have completed your [Form 1040](https://irs.gov/instructions/i1040s8) through line 2. Please refer to the and Schedule 3, line 11 before beginning the schedule 8812 instructions.

- Part I - : Enter the number of qualifying dependents on line 1. This is crucial as it directly affects the funding you might receive, and we want to ensure you get every benefit available.

- Calculate the Benefit: On line 4, multiply the number of qualifying dependents by the applicable amount, which can be up to $2,000 per dependent for the 2024 tax year and rises to $2,200 per dependent for 2025. It’s important to get this right.

- : If your is less than the total amount calculated, you may qualify for the Additional Child Tax Benefit (ACTB). Complete Part II to determine the refundable portion, which can be as much as $1,000 per eligible dependent. We want you to .

- : If you received advance payments of the Child Tax Credit, report these amounts in the designated section to reconcile your total credit accurately. This step helps avoid any surprises later.

- : Double-check all entries for accuracy, ensuring that the numbers align with your Form 1040 and any supporting documents. Frequent mistakes involve misreporting the number of eligible dependents or neglecting to include advance payments. Additionally, ensure that your child has resided with you for at least half the year, as this is a critical requirement for eligibility. Remember, we’re here to help you navigate this process.

Please refer to the schedule 8812 instructions. Submit Schedule 8812 with your Form 1040 when filing your tax return.

By carefully adhering to the schedule 8812 instructions, you can confidently finalize your benefits request and maximize your potential refund. Keep in mind, mistakes on your tax form can postpone your refund or the dependent tax benefit portion of your refund, so precision is essential. As pointed out by tax specialists, if the IRS concludes that your request for the benefit is incorrect, you may face penalties of up to 20% of the benefit amount requested. You're not alone in this journey; take your time and ensure everything is correct.

Troubleshoot Common Issues with Schedule 8812

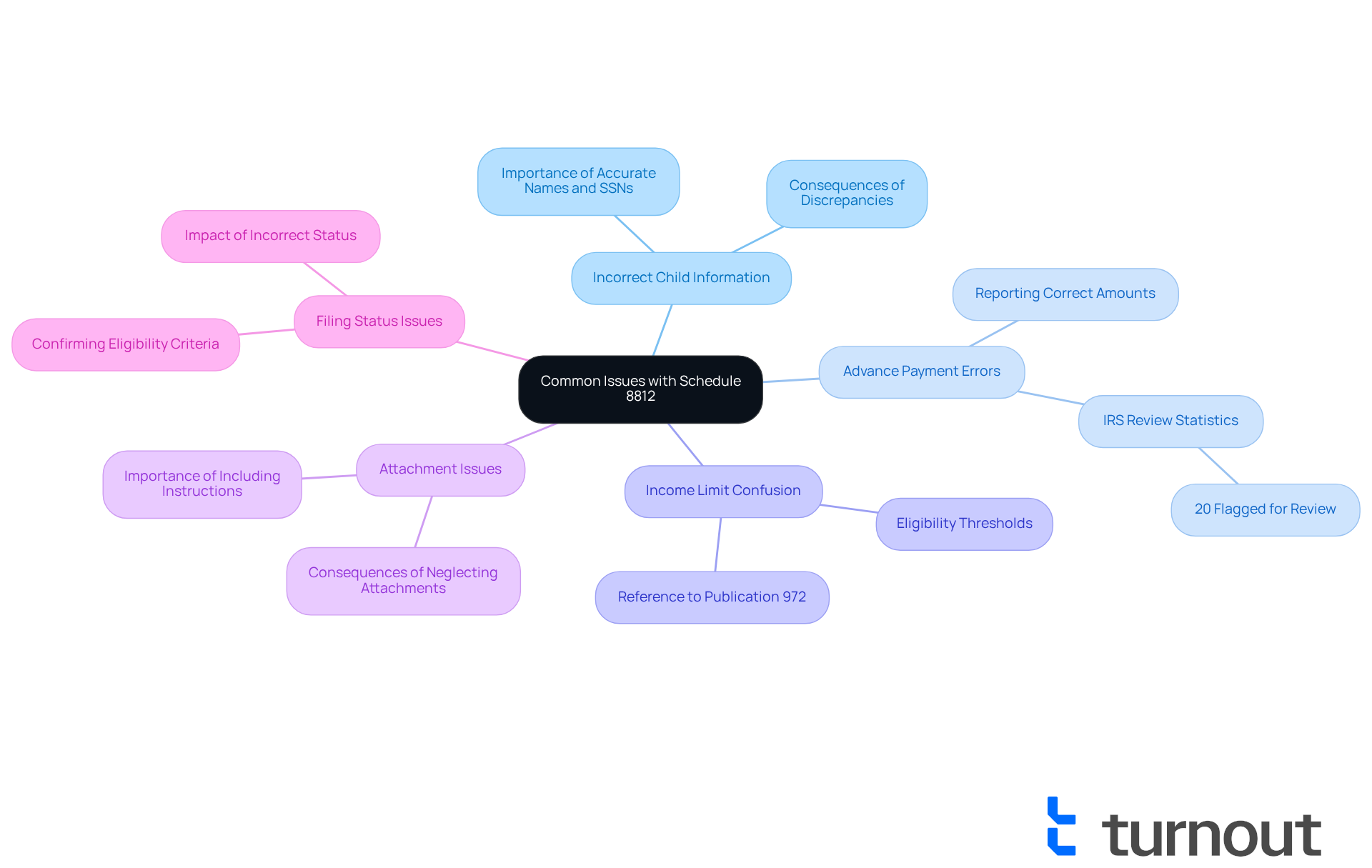

When completing Schedule 8812, we understand that you may encounter several common issues that can hinder your :

- Incorrect Child Information: It’s crucial to ensure that the names and Social Security numbers of your qualifying children are accurate. Any discrepancies can lead to delays or refusals of your benefits.

- Advance Payment Errors: If you received advance payments of the , please make sure to report the correct amounts. Mismatched figures can trigger an , which is unfortunately common with this form. According to IRS statistics, approximately 20% of submissions for Schedule 8812 are flagged for review due to such discrepancies.

- Income Limit Confusion: Be aware of the income limits for eligibility. If your income exceeds the threshold, you may not qualify for the full credit. We encourage you to refer to Publication 972 for detailed information on the .

- Remember to attach the to your Form 1040, the U.S. Individual Income Tax Return. Neglecting to do so can result in significant processing delays.

- : It’s important to confirm that your filing status aligns with the eligibility criteria for the Child Tax Credit. An incorrect filing status can adversely affect your credit amount.

If you encounter any issues, please take a moment to carefully review your entries. Consulting the IRS instructions or a tax professional can provide further assistance. Remember, staying informed about these common pitfalls can help streamline your filing process and maximize your benefits. You are not alone in this journey; we’re here to help.

Conclusion

Understanding and effectively utilizing Schedule 8812 is vital for taxpayers seeking to maximize their benefits from the Additional Child Tax Benefit and other related credits. We understand that navigating tax forms can be overwhelming, but by familiarizing yourself with this form, you can significantly lower your tax liabilities and ensure you receive the financial support you deserve, especially in light of the recent changes to income eligibility thresholds.

This article outlines the key components of Schedule 8812, including:

- Its purpose

- Eligibility criteria for the Child Tax Credit

- Detailed step-by-step instructions for completion

- Common pitfalls to avoid during the filing process

Taking the time to accurately complete this form can lead to substantial financial benefits, particularly for families with dependents under 17. Moreover, being aware of critical details, such as the timing of refunds and the importance of accurate information, is essential for a smooth filing experience.

In conclusion, we encourage you to approach the completion of Schedule 8812 with diligence and care. By leveraging the insights provided in this guide, you can navigate the complexities of tax benefits more effectively. Seeking assistance from tax professionals or utilizing reliable tax software can further enhance your accuracy and confidence in the filing process. Remember, the potential financial relief that comes from understanding and applying the instructions for Schedule 8812 can make a significant difference in the lives of families. You are not alone in this journey; being informed and proactive about tax benefits is key.

Frequently Asked Questions

What is Schedule 8812 and why is it important?

Schedule 8812, also known as the Additional Dependent Tax Benefit (ACTB) form, is essential for taxpayers to determine their eligibility for dependent tax benefits, including the Dependent Tax Benefit (DTB) and Credit for Other Dependents (ODC). Understanding this form helps taxpayers access all qualifying benefits, which can significantly reduce their tax burden.

What are the benefits associated with Schedule 8812 for the 2025 tax year?

For the 2025 tax year, the Child Tax Credit (CTC) increases to $2,200 for each dependent, while the ACTC remains at $1,700 for both 2024 and 2025. These adjustments aim to provide more financial support to families.

What are the income limits for qualifying for the full benefits of Schedule 8812?

To qualify for the full benefit amount, single filers must earn at least $28,700, and joint filers need to earn at least $36,500. Families earning under $2,500 will not receive any tax benefit for dependents.

How does Schedule 8812 benefit families with children under 17?

Schedule 8812 allows families with children under 17 to gain financial assistance through refundable tax incentives, even if they do not owe taxes. This can potentially unlock thousands of dollars in tax credits, providing significant support for their financial situations.

Can you provide an example of how the Additional Child Tax Benefit impacts families?

For instance, Sarah, an American expat in the UK earning $80,000 annually and paying $18,000 in UK taxes, can maintain her eligibility for the ACTC by strategically using the Foreign Tax Incentive. This demonstrates how understanding and effectively utilizing Schedule 8812 can lead to substantial financial benefits.

When can taxpayers expect refunds for returns claiming ACTC?

The IRS will not issue refunds for returns claiming ACTC before mid-February 2025, which is an important timing detail for taxpayers to consider as they plan their finances.