Overview

The article "Master Schedule R: A Step-by-Step Guide for Disabled Americans" serves as a compassionate resource for disabled individuals seeking to navigate the complexities of Schedule R to claim the Credit for the Elderly or Disabled. We understand that this process can feel overwhelming, but gathering the necessary documentation is the first step towards empowerment.

By following the detailed steps outlined in the guide, you can ensure accurate completion of Schedule R. It's common to encounter challenges along the way, but this guide also addresses troubleshooting common issues, making it easier for you to manage your tax responsibilities.

Remember, you are not alone in this journey. This guide is designed to help you reduce financial burdens and navigate the tax system with confidence. We’re here to help, and with the right information and support, you can take control of your financial future.

Introduction

Navigating the complexities of the tax system can be particularly daunting for disabled Americans, who often face unique financial challenges. We understand that this journey can feel overwhelming, but there is hope. Schedule R, a crucial tool for those eligible for the Credit for the Elderly or Disabled, offers an opportunity for significant tax relief. This relief can empower individuals to manage their finances more effectively and find some peace of mind.

However, you may wonder: how can you ensure that you are fully leveraging this resource while avoiding common pitfalls in the process? This guide aims to demystify Schedule R, providing step-by-step instructions and essential tips to help you secure the benefits you deserve. Remember, you're not alone in this journey—we're here to help you every step of the way.

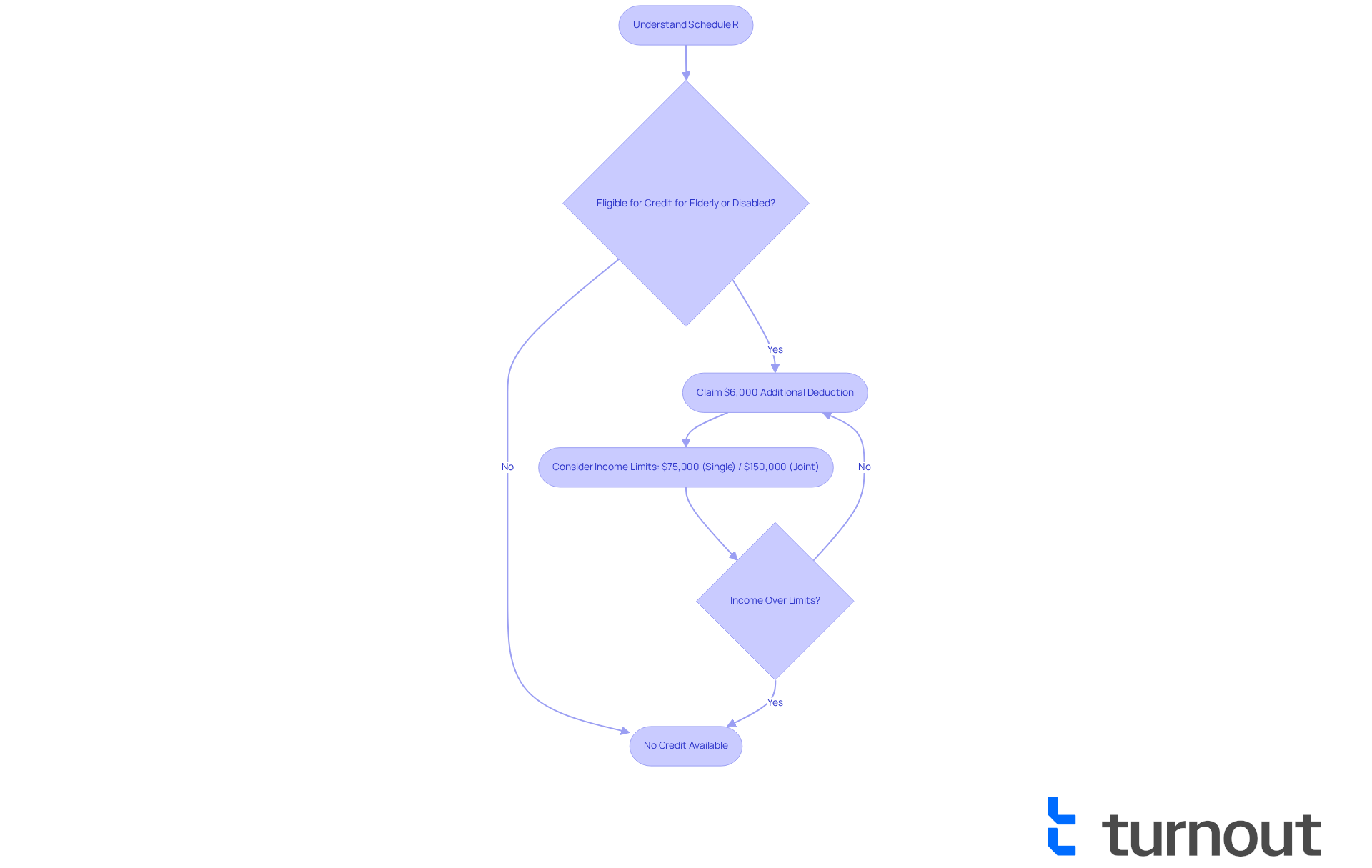

Understand Schedule R: Importance for Exempt Organizations

Form R (Form 1040) is a vital resource for those who qualify to compute the . This credit can significantly for individuals who meet the criteria. We understand that this credit is especially important for , as it acknowledges their unique financial challenges and provides essential support.

By effectively utilizing , individuals can gain that empowers them to navigate the with greater confidence. It's common to feel overwhelmed by , but recent updates bring good news: individuals aged 65 and older can now claim an , further enhancing their tax benefits.

This deduction phases out for modified adjusted gross income over $75,000 for individuals and $150,000 for joint filers. This ensures that those who need it most receive the assistance they deserve. Real-world examples show how Plan R has enabled many disabled individuals to lessen their tax burdens, allowing them to allocate more resources toward their essential needs.

As the landscape of evolves, grasping the implications of Schedule R becomes increasingly important. We’re here to help disabled Americans maximize their financial relief. Remember, you are not alone in this journey; understanding these benefits can make a significant difference.

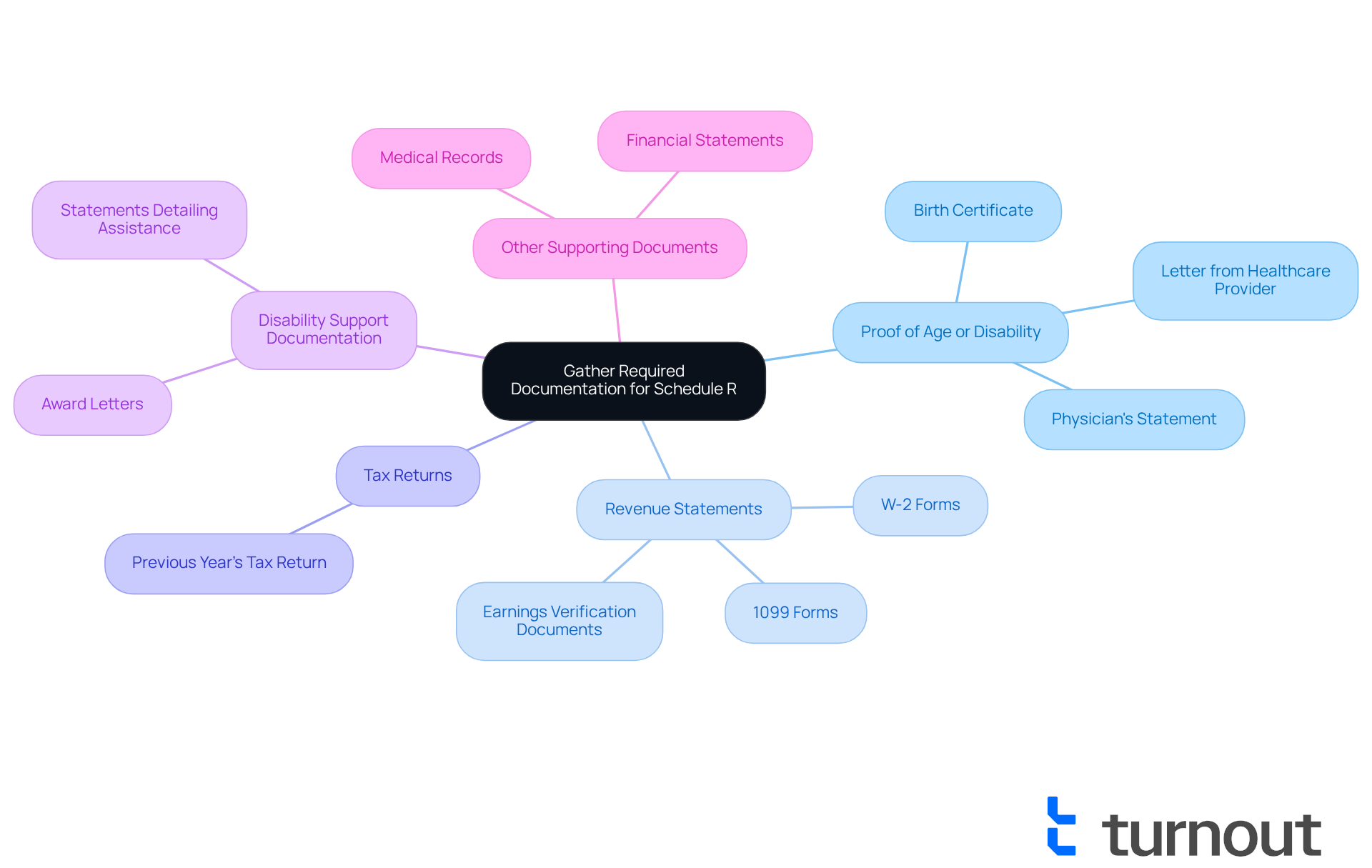

Gather Required Documentation and Information

Before completing , it’s essential to gather the following documentation:

- : This can include a birth certificate or a letter from a healthcare provider confirming your disability status. A physician's statement may also be necessary to certify that your condition prevents you from engaging in substantial gainful activity.

- Revenue Statements: Gather all pertinent earnings documents, such as W-2 forms, 1099 forms, and any other earnings verification. Ensure that your adjusted gross income includes nontaxable Social Security, pensions, and disability income within specific limits.

- : Have your previous year’s tax return handy for reference, as it can provide context for your current filing.

- : If you receive disability support, include any relevant statements or award letters that detail the assistance you are entitled to.

- Other Supporting Documents: Gather any additional documents that may support your claim, such as medical records or financial statements. Proper documentation is crucial for and can significantly impact your eligibility for the schedule R.

We understand that organizing these documents can feel overwhelming. However, arranging them beforehand will simplify the process and help ensure you have everything needed to complete Form R accurately. Remember, can also maximize your benefits and ensure you are claiming all the credits available to you. You are not alone in this journey; we’re here to help.

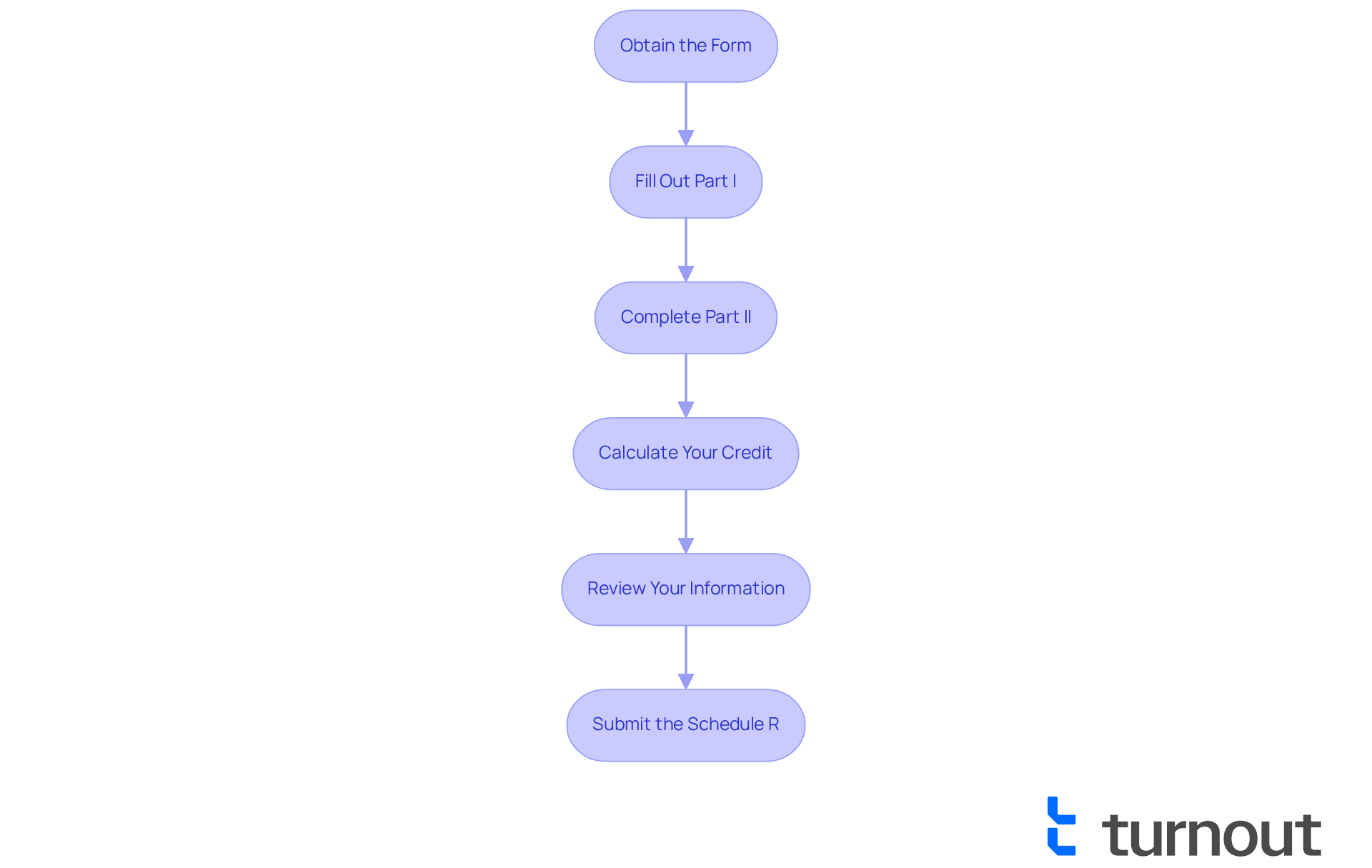

Complete Schedule R: Step-by-Step Instructions

Completing may seem daunting, but we're here to assist you with it. Just follow these simple steps:

- Obtain the Form: You can easily download the Schedule R form from the IRS website or pick up a physical copy at your local tax office.

- Fill Out Part I: Start by answering questions about your age and disability status. Be sure to check the right boxes to show your eligibility. If you’re under 6, remember that you need to have from an employer's plan to qualify.

- Complete Part II: Accurately report your earnings. Include all taxable and nontaxable earnings, as missing out on nontaxable amounts could lead to incorrect adjusted gross income (AGI) calculations.

- Calculate Your Credit: Use the provided tables and worksheets to figure out the credit amount you qualify for based on your reported earnings and eligibility. The credit can range from $3,750 to $7,500, depending on your filing status and earnings.

- Review Your Information: Take a moment to double-check all your entries for accuracy. Make sure all required documentation, such as proof of age or disability, is attached. Common mistakes include claiming the credit when over income limits and making incorrect AGI calculations.

- Submit the Schedule R: Finally, along with your Form 1040 by the tax deadline, which is typically April 15. If you’re submitting electronically, just follow the prompts to include Form R in your submission.

By carefully following these steps, you can ensure that your application for the is completed accurately and submitted on time. Remember, you are not alone in this journey. The IRS offers free through programs like VITA, which can guide you through the process effectively.

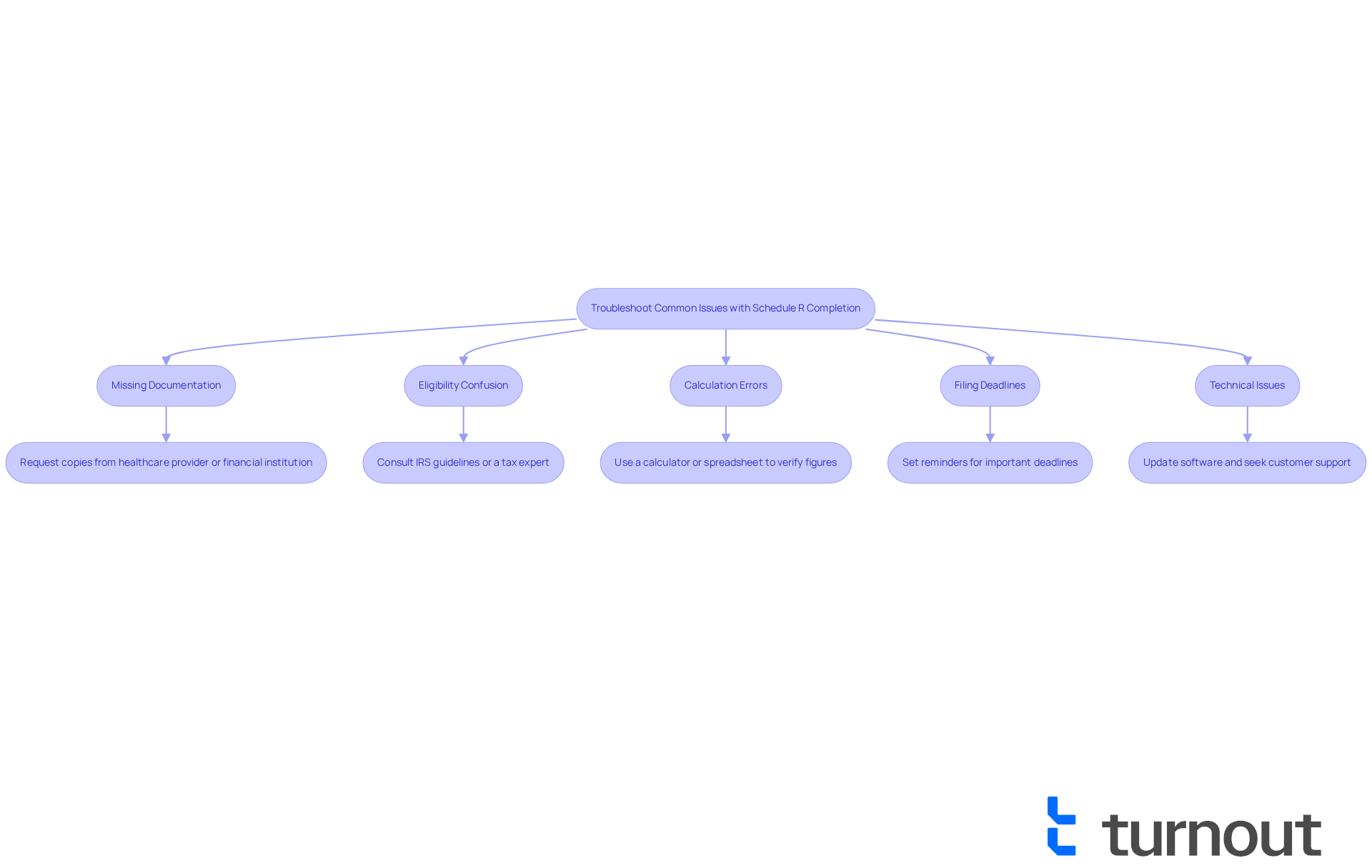

Troubleshoot Common Issues with Schedule R Completion

Completing Schedule R can pose several challenges for individuals with disabilities. We understand that , but there are effective ways to troubleshoot these common issues.

- Missing Documentation: If you find yourself without certain necessary documents, promptly reach out to your healthcare provider or financial institution to request copies. This proactive step can help you avoid delays in your filing.

- Eligibility Confusion: It's common to feel uncertain about your eligibility. Statistics show that disabled individuals are more than twice as likely as those without disabilities to live below the poverty line due to . To clarify your status, or seek guidance from a tax expert knowledgeable about disability programs. to assist you in navigating these complexities, ensuring you comprehend your eligibility for assistance without offering legal representation.

- Calculation Errors: We encourage you to ensure your calculations are precise, particularly when determining your credit. Utilize a calculator or spreadsheet to verify your figures, as even minor errors can lead to significant discrepancies.

- Filing Deadlines: Staying organized is key. , and consider setting reminders as the tax deadline approaches to avoid late submissions, which can complicate your financial situation. Turnout's tools can help you manage these deadlines effectively.

- Technical Issues: If you choose to file electronically, make sure your software is updated. Should you encounter any errors, refer to the software’s help section or reach out to customer support for assistance.

By addressing these common issues proactively, you can navigate the Schedule R process with greater ease and confidence. As one SSDI recipient mentioned, "Interacting with my local Social Security office has not been enjoyable because they’re constantly identifying problems that don’t exist and attempting to remove my support." This highlights the importance of being prepared and informed throughout the process. Remember, you are not alone in this journey, and and financial support.

Conclusion

Understanding and effectively utilizing Schedule R is crucial for disabled Americans seeking financial relief through the Credit for the Elderly or Disabled. We recognize that navigating the complexities of this tax form can be daunting, but this guide offers the support you need to alleviate financial burdens and enhance your quality of life.

Gathering the necessary documentation is an important first step. With clear, step-by-step instructions for completing Schedule R, you can confidently approach your tax filings. We understand that issues may arise during this process, and we are here to help troubleshoot those common challenges.

Ultimately, navigating Schedule R effectively can lead to substantial financial benefits. This means more resources for your essential needs. It’s vital to remain informed and proactive about these benefits, as they can significantly impact your financial stability. Remember, you are not alone in this journey. Seeking assistance from tax professionals or support organizations can further enhance your experience, ensuring that you receive the credits you deserve.

Frequently Asked Questions

What is Schedule R and why is it important for exempt organizations?

Schedule R is a vital resource for individuals who qualify to compute the Credit for the Elderly or Disabled, which can significantly reduce tax obligations for those who meet the criteria.

Who benefits the most from the Credit for the Elderly or Disabled?

The credit is especially important for disabled Americans, as it acknowledges their unique financial challenges and provides essential support.

How can individuals utilize Schedule R to gain financial relief?

By effectively utilizing Schedule R, individuals can navigate the tax system with greater confidence and potentially lessen their tax burdens.

What recent updates have been made regarding deductions for individuals aged 65 and older?

Individuals aged 65 and older can now claim an additional deduction of $6,000, enhancing their tax benefits.

Is there an income limit for claiming the additional deduction?

Yes, the additional deduction phases out for modified adjusted gross income over $75,000 for individuals and $150,000 for joint filers.

How has Schedule R impacted disabled individuals in real-world scenarios?

Schedule R has enabled many disabled individuals to lessen their tax burdens, allowing them to allocate more resources toward their essential needs.

Why is it important to understand the implications of Schedule R as tax credits evolve?

Grasping the implications of Schedule R is increasingly important as the landscape of tax credits changes, helping disabled Americans maximize their financial relief.