Overview

We understand that navigating the complexities of Social Security Disability Insurance (SSDI) can be overwhelming. The amount of payment you receive under SSDI is primarily determined by your work history, including your Average Indexed Monthly Earnings (AIME) and the number of work credits you have earned. It's important to know that SSDI benefits are calculated using a specific formula based on your earnings, adjusted for inflation and cost-of-living, rather than the severity of your disability itself. This highlights how crucial your employment contributions are to the Social Security system.

You are not alone in this journey. Many individuals face similar challenges, and it's common to feel uncertain about what to expect. Understanding how your SSDI benefits are calculated can empower you to take informed steps forward. Remember, we’re here to help you navigate these waters and ensure you receive the support you deserve.

Introduction

Navigating the intricacies of Social Security Disability Insurance (SSDI) can feel overwhelming, especially for those facing the challenges of disability. We understand that this federal program is not just about financial support; it also depends on factors like work history and medical eligibility. As you seek to understand how much support you might receive, it's common to have questions about the calculations and various influencing elements.

What steps can you take to accurately estimate your SSDI benefits?

How can you ensure that you are maximizing the assistance available to you?

We're here to help you through this journey.

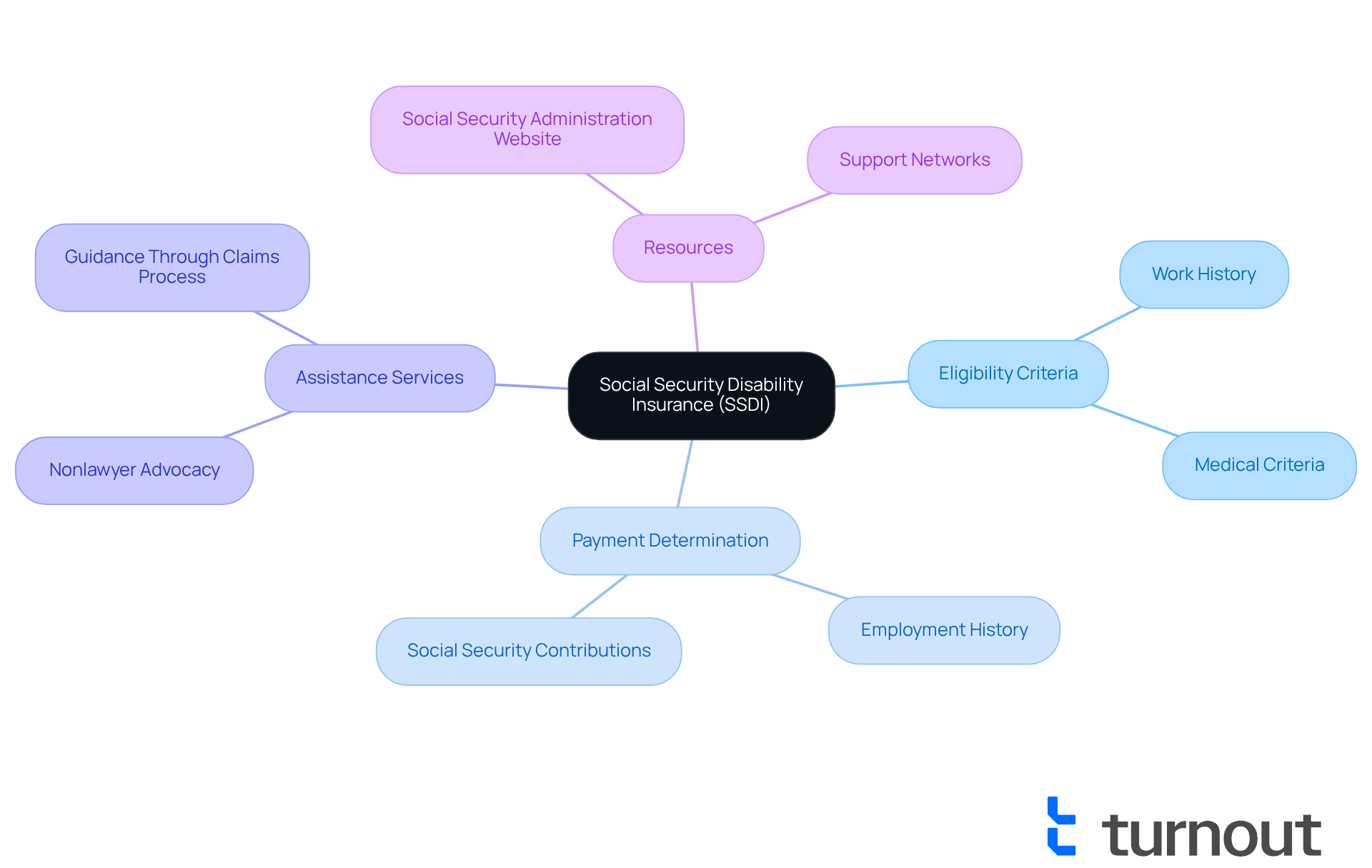

Understand Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a federal program designed to provide financial support to individuals who are unable to work due to a disability. If you're considering applying for disability benefits, it’s important to understand how much payment for disability depends on having a work history that includes paying Social Security taxes and meeting specific medical criteria. This program aims to assist those whose disabilities hinder them from engaging in substantial gainful activity (SGA). Remember, how much payment for disability you receive is not based on the severity of your disability but rather on your employment history and contributions to the Social Security system.

At Turnout, we understand that navigating the complexities of disability claims can feel overwhelming. Our trained nonlawyer advocates are here to guide you every step of the way, ensuring you receive the support you deserve. Please keep in mind that Turnout is not a law firm and does not provide legal advice or establish an attorney-client relationship. Our services are specifically tailored to help you obtain SSD advantages without the need for legal representation.

You are not alone in this journey. For more detailed information, we encourage you to visit the . We're here to help you find the assistance you need.

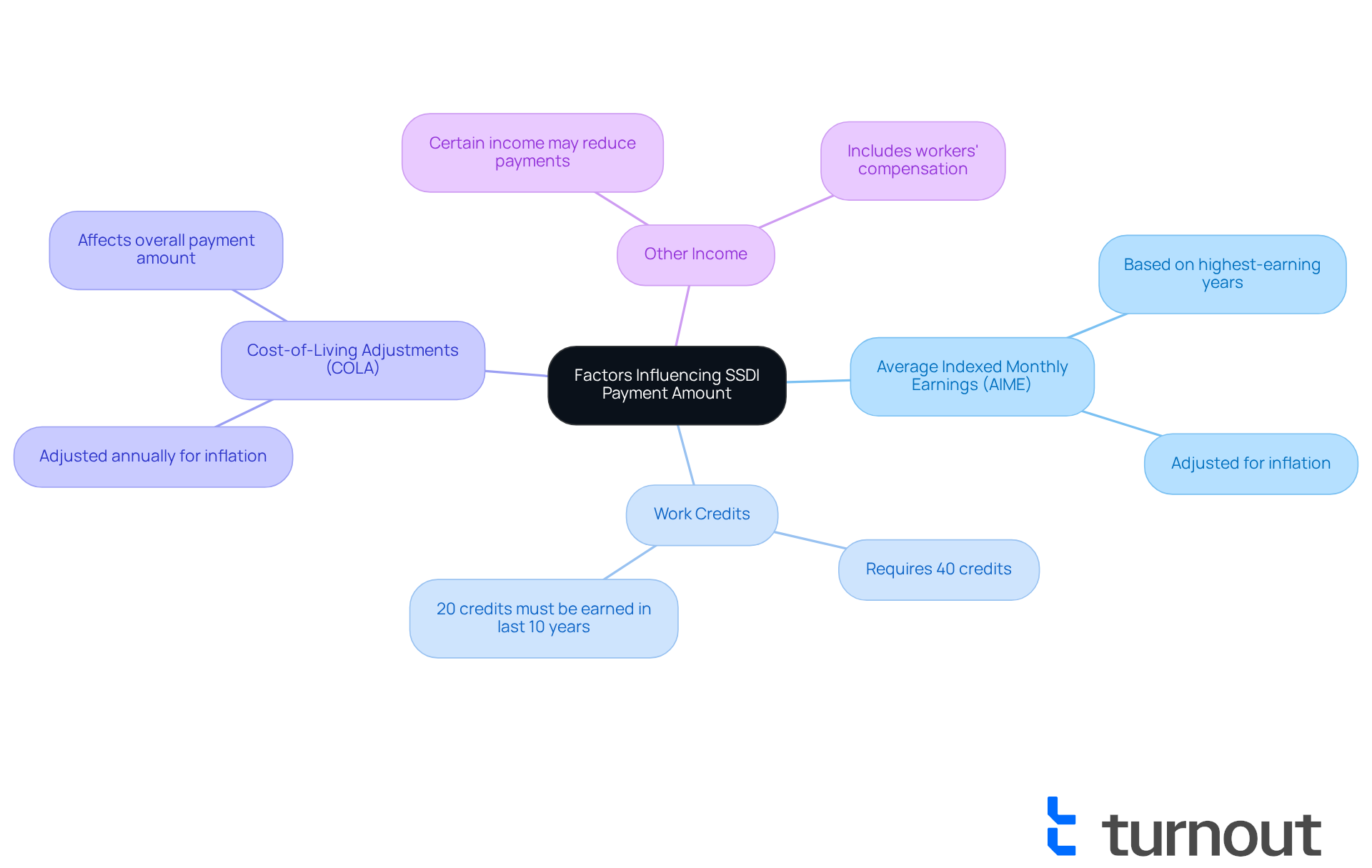

Identify Factors Influencing Your SSDI Payment Amount

Several factors can influence how much payment for disability benefits you may receive, and we understand that navigating this process can feel overwhelming. Here are some key elements to consider:

- Average Indexed Monthly Earnings (AIME): This is determined based on your highest-earning years, adjusted for inflation. The SSA uses your AIME to calculate your Primary Insurance Amount (PIA).

- Work Credits: You need to have earned a specific number of work credits, which are based on your total annual wages or self-employment income. Generally, you need 40 credits, with 20 earned in the last 10 years.

- Cost-of-Living Adjustments (COLA): Disability payments are adjusted each year according to inflation, which can affect the overall amount you receive.

- Other Income: Certain forms of income, such as workers' compensation, may reduce your disability payments. Understanding these factors is crucial for determining how much payment for disability you might be eligible to receive as compensation.

At Turnout, we're here to help you access government benefits like disability support. Our expert assistance, provided by trained non-legal advocates, simplifies the process for you. It's important to note that Turnout is not a law firm, allowing you to navigate the complexities of SSD claims effectively—without the need for legal representation. You are not alone in this journey; we are committed to supporting you every step of the way.

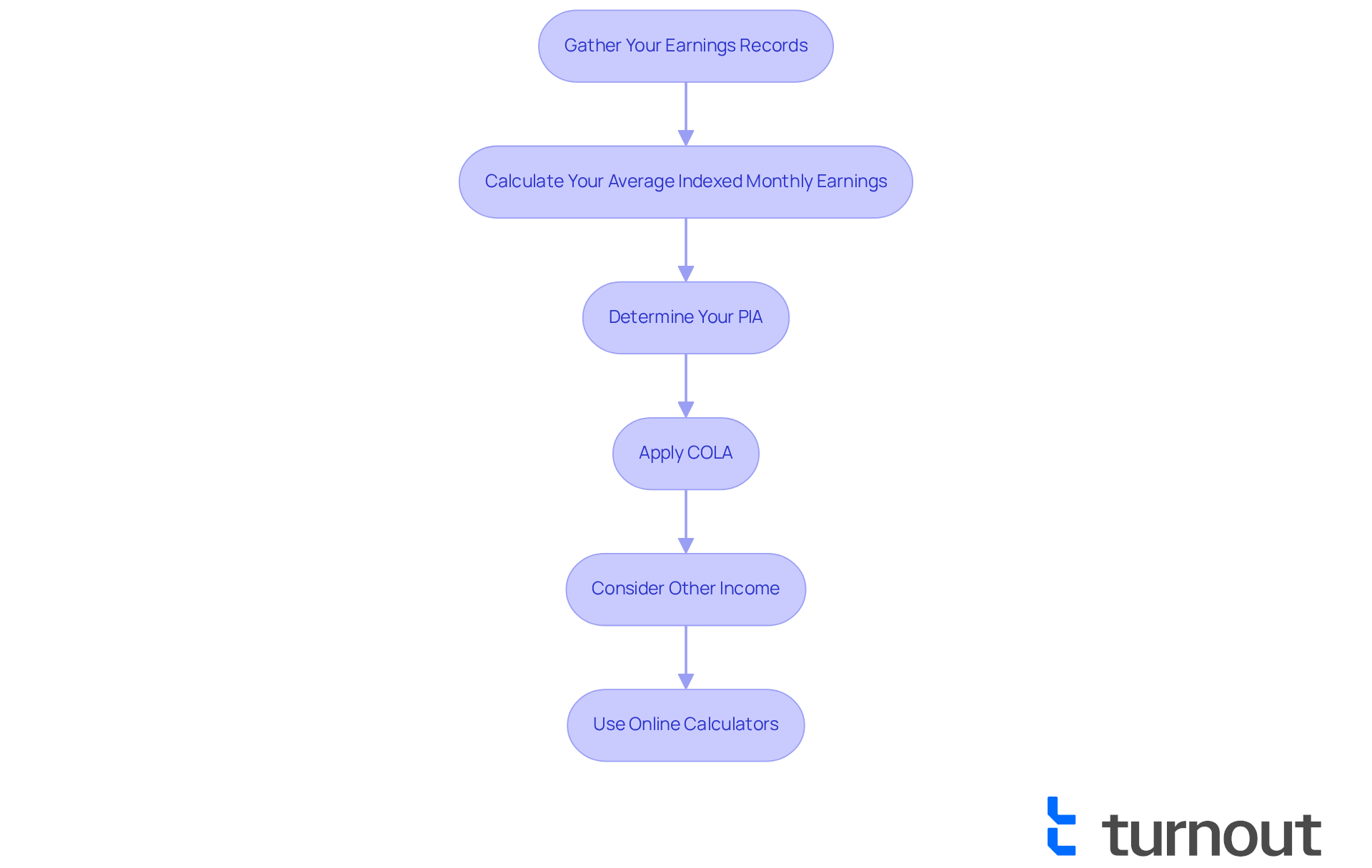

Calculate Your Estimated SSDI Payment Step-by-Step

Calculating your estimated SSDI payment can feel overwhelming, but we're here to help you through the process. Follow these steps to guide you along the way:

-

Gather Your Earnings Records: Start by collecting your earnings history for the years you worked and paid Social Security taxes. You can easily access this information through your .

-

Calculate Your Average Indexed Monthly Earnings: Next, add your highest-earning years (up to 35 years) and divide by the total number of months in those years. Remember to adjust for inflation using the SSA's indexing factors.

-

Determine Your PIA: Now, let’s calculate your Primary Insurance Amount (PIA) using this formula based on your Average Indexed Monthly Earnings (AIME):

- 90% of the first $1,174 of AIME

- 32% of AIME between $1,175 and $7,078

- 15% of AIME above $7,078

-

Apply COLA: Don’t forget to modify your PIA for any relevant cost-of-living adjustments. This will help you determine how much payment for disability you may receive monthly.

-

Consider Other Income: It’s important to take into account any additional income that may influence your disability benefits, such as workers' compensation.

-

For a more straightforward approach, consider utilizing online calculators available on the SSA website or other credible resources to estimate how much payment for disability you may receive. Remember, you are not alone in this journey, and there are tools available to assist you.

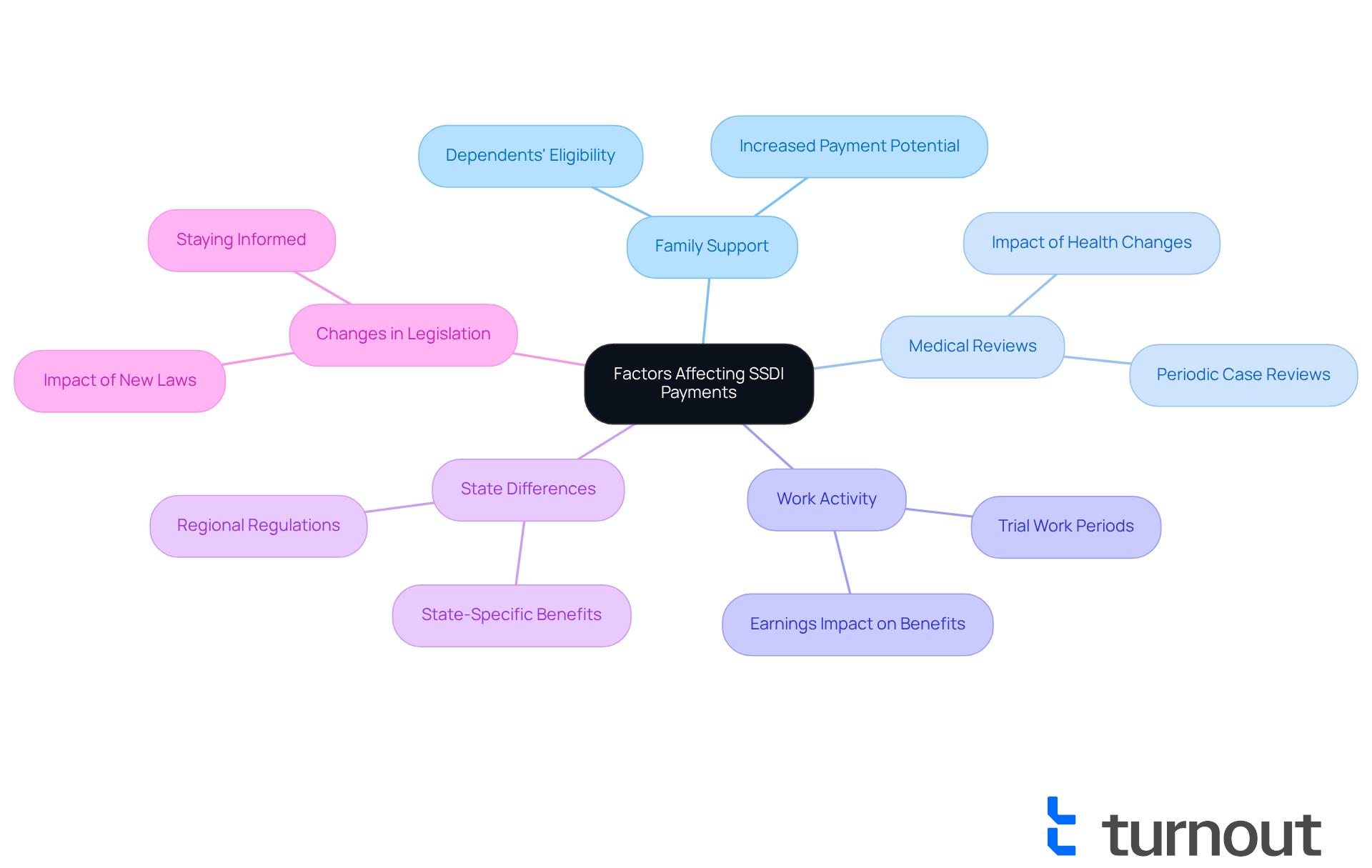

Consider Additional Factors Affecting SSDI Payments

In addition to the primary factors affecting your SSDI payment, it's important to consider a few key aspects that may impact your situation:

- Family Support: If you have dependents, they might qualify for assistance based on your disability payments. This can significantly raise how much payment for disability you receive, which provides a crucial safety net for your family.

- Medical Reviews: We understand that the SSA periodically reviews cases to determine if beneficiaries still meet the disability criteria. Changes in your medical condition can influence your benefits, so it's essential to stay informed about your health status.

- Work Activity: It's common to feel the desire to resume work, but be aware that your disability payments may be impacted. The SSA has specific rules regarding trial work periods and how your earnings affect your benefits. We’re here to help you navigate these complexities.

- State Differences: Different regions may offer extra advantages or have distinct regulations regarding how much payment for disability support disbursements. This can affect the overall sum you obtain, so it's wise to explore how much payment for disability is provided by your state.

- Changes in Legislation: Staying informed about any changes in laws or regulations is crucial, as these can impact your SSDI benefits. Remember, you are not alone in this journey; we encourage you to seek assistance and stay updated on your rights.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for anyone considering applying for benefits. We recognize that navigating this system can feel overwhelming. The payment amount for disability is primarily determined by your work history and contributions to the Social Security system, rather than the severity of your condition. This program serves as a vital financial lifeline for individuals unable to work due to disabilities, ensuring they receive the support they need during challenging times.

Throughout this guide, we have highlighted key points such as:

- The importance of Average Indexed Monthly Earnings (AIME)

- The necessity of work credits

- The impact of cost-of-living adjustments (COLA)

It's common to feel uncertain about these factors. Additionally, we discussed elements like:

- Family support

- Medical reviews

- Work activity

- Regional differences

This emphasizes the complexity of SSDI payments. The step-by-step calculation process provided aims to empower you to estimate your potential benefits with confidence.

Ultimately, staying informed about the various elements influencing SSDI payments can significantly impact your financial planning. We encourage you to engage with resources and seek assistance, as this can simplify the claims process and enhance your understanding of your rights and benefits. Remember, you are not alone in this journey. Taking proactive steps in navigating this system is crucial, ensuring that the support available meets the needs of you and your family effectively.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance is a federal program that provides financial support to individuals who are unable to work due to a disability.

How is the payment amount for SSDI determined?

The payment amount for SSDI depends on an individual's work history, specifically their contributions to Social Security through taxes, and not on the severity of their disability.

What criteria must be met to qualify for SSDI?

To qualify for SSDI, individuals must have a work history that includes paying Social Security taxes and must meet specific medical criteria that demonstrate their inability to engage in substantial gainful activity (SGA).

Can I receive legal advice from Turnout regarding SSDI?

No, Turnout is not a law firm and does not provide legal advice or establish an attorney-client relationship. They offer support to help you obtain SSD advantages without legal representation.

How can Turnout assist me with my SSDI application?

Turnout provides guidance through the complexities of disability claims, helping you navigate the application process to ensure you receive the support you deserve.

Where can I find more information about SSDI?

For more detailed information about SSDI, it is recommended to visit the Social Security Administration's website.