Overview

We understand that managing tax debts can be overwhelming. IRS payment plans do charge interest on outstanding amounts, which can add to your worries. The interest rate is determined quarterly, based on the federal short-term rate plus 3%. While installment agreements can be a helpful way to manage your tax obligations, it's important to be aware that they may lead to increased total amounts owed due to interest accumulation and potential setup fees.

It's common to feel anxious about how these fees can impact your financial situation. You are not alone in this journey, and we're here to help guide you through your options. By understanding the implications of IRS payment plans, you can make more informed decisions that align with your financial goals. Remember, taking the first step to seek assistance is a sign of strength.

Introduction

Navigating tax obligations can often feel overwhelming, especially when faced with unpaid debts. We understand that the prospect of managing these responsibilities may seem daunting. IRS payment plans provide a structured solution, allowing you to tackle your liabilities over time rather than all at once. However, a common concern arises: do these payment plans come with interest charges that could complicate your financial recovery?

It's crucial to grasp the nuances of interest rates and fees associated with IRS installment agreements. This understanding can help you avoid unexpected financial burdens while seeking the relief you deserve.

Defining IRS Payment Plans: An Overview

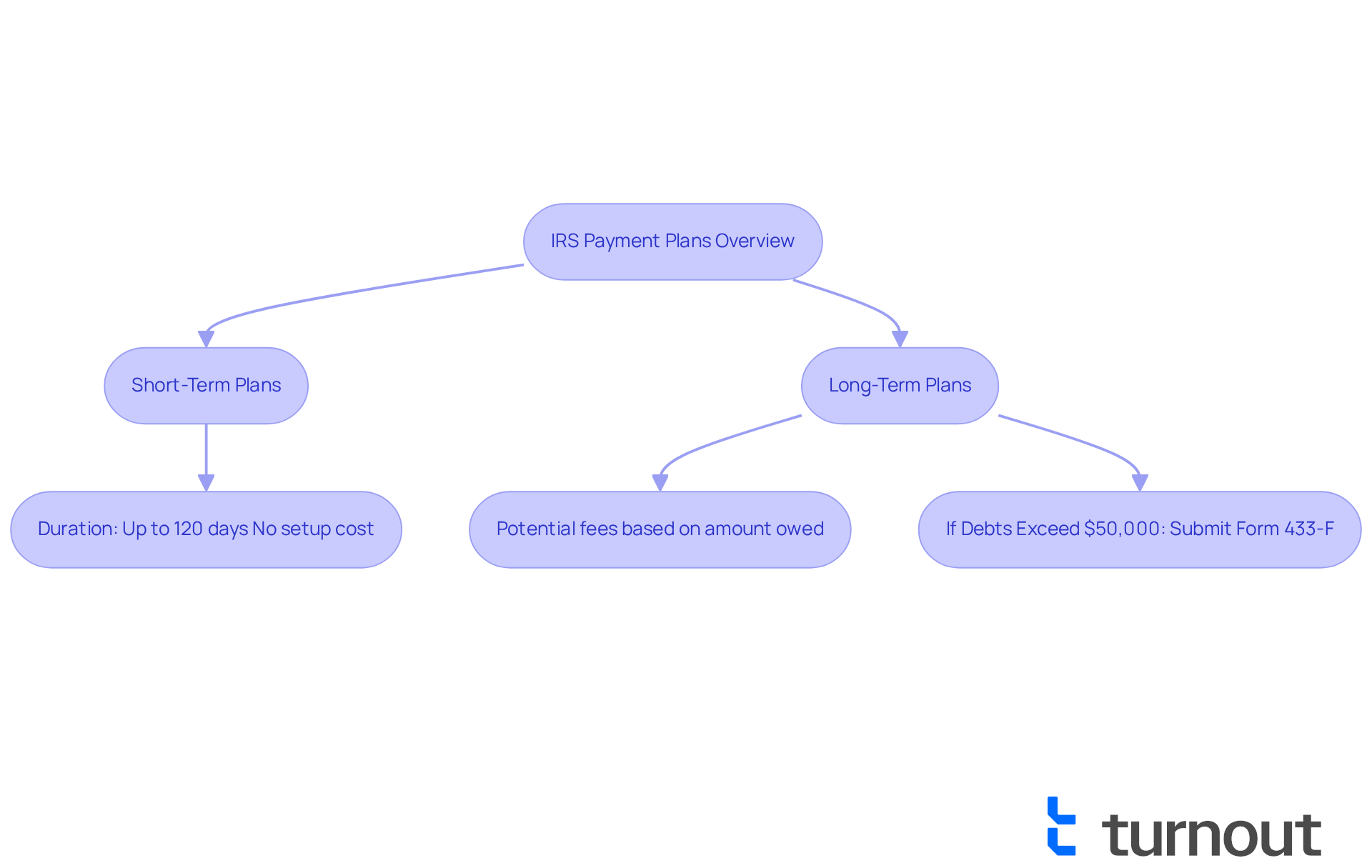

IRS installment arrangements, also known as installment agreements, are designed to help you settle your tax obligations gradually rather than all at once. We understand that paying taxes can be overwhelming, especially if you're unable to pay in full. These arrangements offer a structured way to manage your debts and find relief. The IRS provides various options, including:

- Short-term plans lasting up to 120 days with no setup cost

- Long-term arrangements that may involve fees based on the amount owed

Many wonder, does the IRS payment plan charge interest?

In 2025, millions of taxpayers are finding comfort in IRS arrangements to manage their tax responsibilities effectively. If your debts exceed $50,000, you may need to submit Form 433-F, the Collection Information Statement, to clarify your financial situation. Understanding the details of these strategies is essential for avoiding penalties and ensuring compliance with your tax obligations.

Tax professionals emphasize the importance of sticking to the terms of these agreements. Brad Thibeau, Head of Growth & Partnerships, shares, "Ideally, settling your tax bill in full minimizes penalties and interest." By making on-time minimum payments and managing your plan proactively, you can avoid legal consequences and maintain flexibility if your financial situation changes. If you find that an installment arrangement doesn't suit your needs, exploring options like compromises or even bankruptcy might be necessary. Thibeau cautions, "Remember, failing to file can result in severe penalties, exacerbating your financial strain."

Overall, IRS installment agreements are a vital tool for taxpayers like you, particularly in understanding whether the IRS payment plan charges interest, as they help navigate tax liabilities with greater ease. You're not alone in this journey, and we're here to help you find the best path forward.

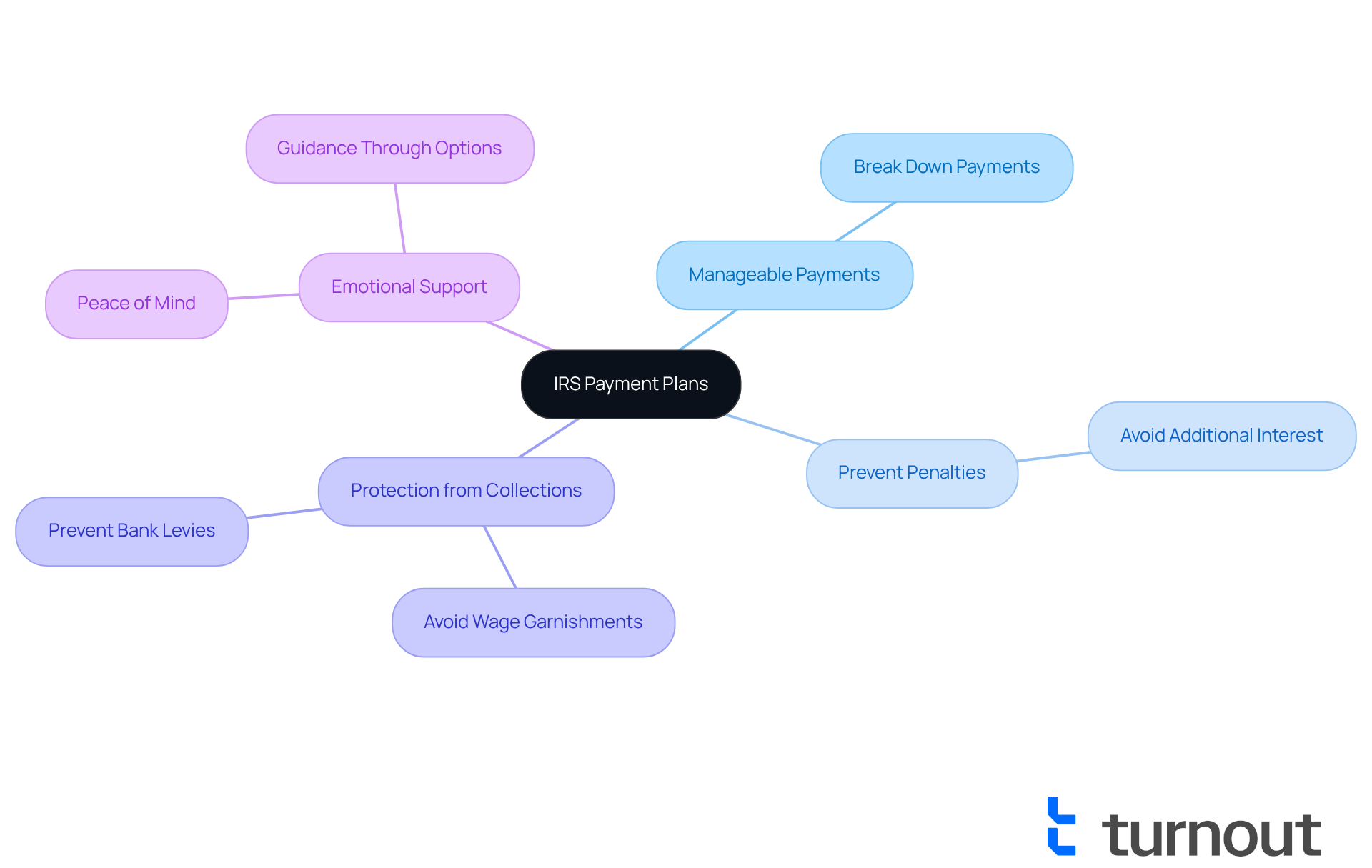

Understanding the Purpose and Importance of IRS Payment Plans

We understand that managing tax obligations can be overwhelming. The primary goal of IRS financing options is to provide you with a feasible way to settle your tax responsibilities without facing sudden financial hardship. These arrangements help prevent the buildup of additional penalties and interest that can arise from unpaid taxes by allowing you to break down your payments into smaller, more manageable amounts, which leads to the question of whether an IRS payment plan charges interest.

Moreover, participating in a financial arrangement can protect you from more aggressive collection actions, such as wage garnishments or bank levies. This support can offer you peace of mind during challenging economic times. Remember, you are not alone in this journey; we’re here to help you navigate these options and find a solution that works for you.

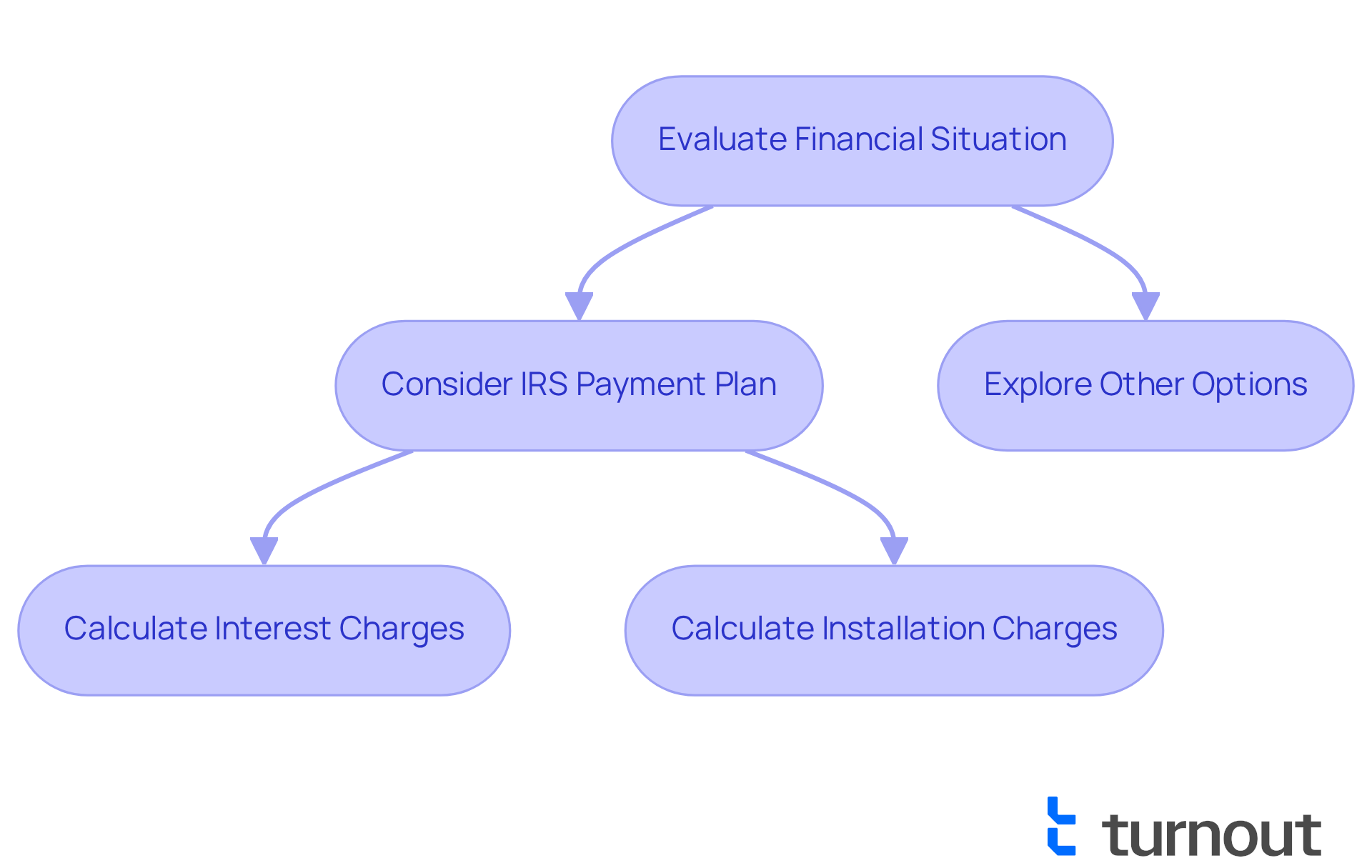

Examining Interest Charges on IRS Payment Plans

We understand that dealing with IRS installment arrangements can be overwhelming. These arrangements often lead to inquiries about whether an IRS payment plan charges interest on the outstanding amount, which can build up over time. The interest rate is determined quarterly, based on the federal short-term rate plus 3%. Additionally, there may be an installation charge for setting up the financial arrangement, varying depending on the chosen option.

It's common to feel that while installment arrangements can relieve short-term financial pressures, one might wonder, does IRS payment plan charge interest, which could increase the total amount owed as time passes. Therefore, it’s wise to evaluate your financial condition thoughtfully. Consider whether a payment arrangement is the best choice for your situation. Remember, you are not alone in this journey; we're here to help you navigate through these challenges.

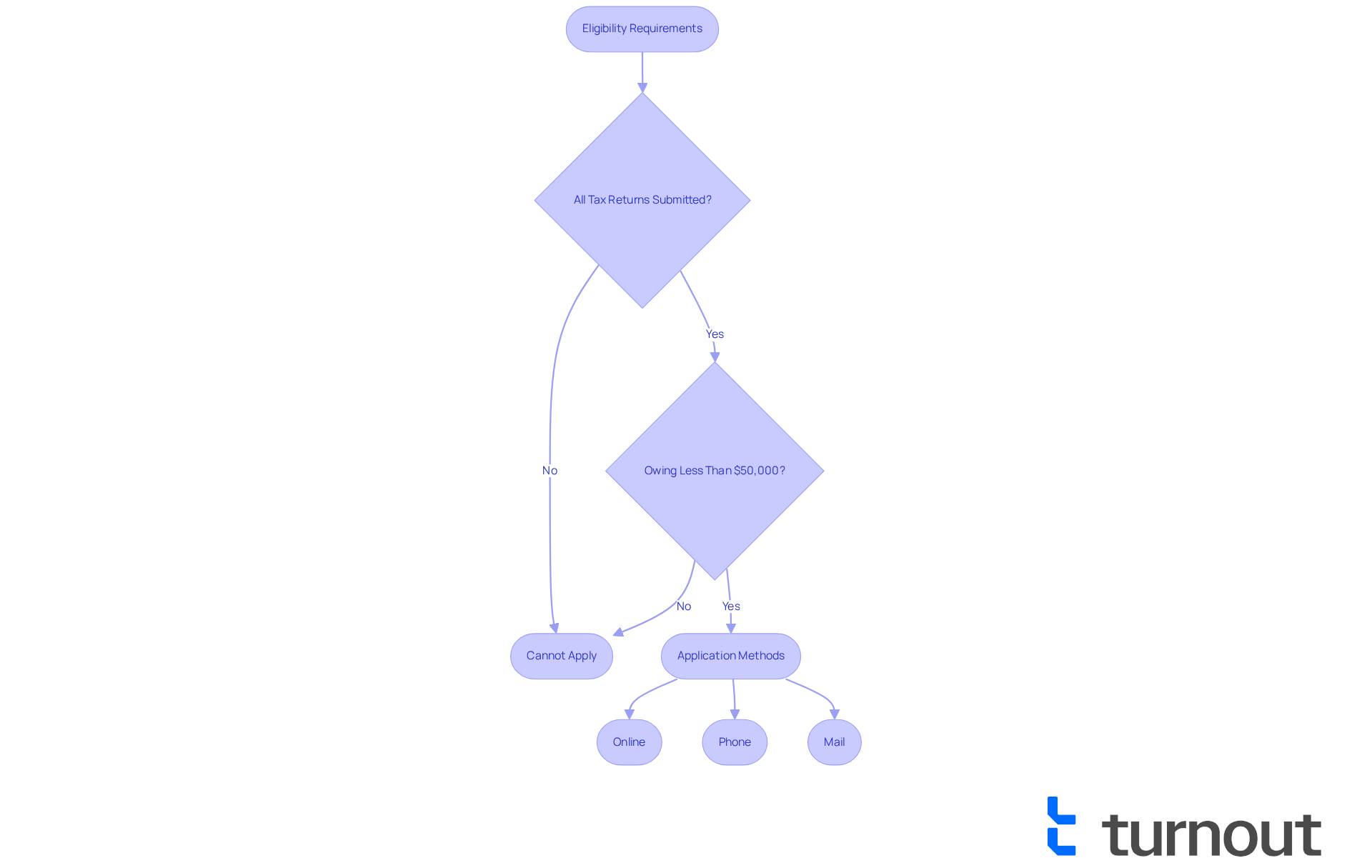

Eligibility and Application Process for IRS Payment Plans

We understand that navigating tax obligations can be overwhelming. To qualify for an IRS installment option, it's important to know that you must meet specific eligibility requirements. This includes:

- Having submitted all necessary tax returns.

- Owing less than $50,000 in total tax, penalties, and interest if you are an individual, or $25,000 for businesses.

The application process is designed to be accessible. You can initiate it:

- Online through the IRS website.

- By phone.

- Via mail.

As you prepare, you will need to provide personal information, details about your tax obligations, and the amounts you suggest for settlement.

Once you submit your application, the IRS will review it and notify you of your approval status. They will also inform you if the [IRS payment plan charges interest](https://blog.myturnout.com/do-you-have-to-pay-taxes-on-go-fund-me-understand-the-essentials) and any applicable fees or terms associated with your payment plan. Remember, you are not alone in this journey, and we’re here to help you through it.

Conclusion

IRS payment plans serve as a crucial lifeline for taxpayers who may be feeling overwhelmed by their tax obligations. We understand that managing financial strain can be daunting, and these arrangements allow individuals to settle their debts in manageable installments. This not only alleviates immediate pressure but also provides a structured path toward compliance. It's essential to grasp the nuances of these plans, especially regarding interest charges, to make informed decisions about managing tax liabilities.

Throughout our discussion, we've uncovered key insights about the types of IRS payment plans available, the potential for interest charges, and the eligibility criteria necessary for participation. Short-term plans offer immediate relief without setup costs, while long-term arrangements may incur fees based on the amount owed. Additionally, understanding that the interest rate is determined by the federal short-term rate plus 3% underscores the importance of evaluating your financial situation before committing to a payment plan.

Ultimately, navigating IRS payment plans is not just about fulfilling tax obligations; it’s about regaining control over your personal finances and preventing more severe consequences, such as wage garnishments. You are encouraged to explore these options and seek assistance if needed. Understanding and utilizing IRS payment plans can pave the way for financial stability and peace of mind. Taking proactive steps now can lead to a more secure financial future, making it vital to stay informed and engaged with the resources available. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, allow taxpayers to settle their tax obligations gradually rather than paying the full amount at once.

What types of IRS payment plans are available?

The IRS offers short-term plans lasting up to 120 days with no setup cost and long-term arrangements that may involve fees based on the amount owed.

Does the IRS payment plan charge interest?

Yes, IRS payment plans can charge interest, and it is important to understand the terms of the agreement to avoid penalties.

What should I do if my tax debts exceed $50,000?

If your tax debts exceed $50,000, you may need to submit Form 433-F, the Collection Information Statement, to clarify your financial situation.

Why is it important to stick to the terms of an IRS payment plan?

Sticking to the terms of the agreement helps avoid legal consequences, penalties, and interest, and allows for more flexibility if your financial situation changes.

What should I consider if an installment arrangement doesn't suit my needs?

If an installment arrangement doesn't work for you, exploring options like compromises or bankruptcy might be necessary.

What are the consequences of failing to file taxes?

Failing to file taxes can result in severe penalties, which can exacerbate your financial strain.