Overview

Navigating the world of tax services can feel overwhelming, and you're not alone in this journey. Many businesses face the challenge of finding the right solution that truly meets their needs. In this article, we explore various options available to you, including DIY software and professional services, so you can make an informed choice.

It's important to evaluate key criteria, such as:

- Cost

- Scope of offerings

- User experience

- Customer support

- Provider reputation

By doing so, you can ensure that the service you choose aligns with your unique requirements. Remember, this decision is not just about numbers; it’s about finding a partner who understands your concerns.

We understand that making such choices can be daunting. To help you, we encourage you to reflect on your experiences and consider what matters most to you. Are you looking for:

- Affordability

- Comprehensive services

- Exceptional support

Whatever your priorities, there’s a solution out there for you.

Take a moment to assess your options. With the right information and support, you can confidently choose a tax service that feels just right. You're not alone in this process, and we're here to help you every step of the way.

Introduction

Navigating the intricate world of tax services for businesses can often feel overwhelming, filled with complexities and uncertainties. We understand that as companies grapple with diverse options—from DIY software to professional tax preparers—the decision-making process becomes crucial for financial success. This article explores the essential criteria for comparing tax service providers, shedding light on the unique advantages and challenges each option presents. With an increasing number of small enterprises opting for self-service solutions, it’s common to feel uncertain about how to choose the right tax service that aligns with your specific needs and goals. We're here to help you through this journey.

Understanding Tax Services for Businesses

Tax service for business includes a variety of options designed to ease the often daunting processes of tax preparation, submission, and adherence. We understand that navigating these complexities can be overwhelming. From basic tax filing to strategic tax planning and support during audits, there are various tax service for business solutions available to meet your needs. Businesses can choose between DIY software solutions, professional tax preparers, or full-service accounting firms, each offering a different tax service for business that presents unique advantages and challenges based on their specific financial situations and required expertise.

It's common to feel uncertain about which path to take. Recent trends reveal a growing preference for DIY tax software among smaller enterprises. Platforms like TurboTax provide user-friendly interfaces that simplify the filing process, making it accessible for many. On the other hand, larger enterprises often seek the expertise of established firms such as H&R Block or TaxAct, which provide tax service for business with tailored solutions to address their specific needs. According to industry insights, around 60% of small enterprises utilize DIY tax software, while 40% rely on expert assistance. This indicates a notable shift towards self-help options, reflecting the desire for greater control over financial matters.

Real-world examples highlight the effectiveness of these offerings. For instance, a small retail operation successfully navigated its tax obligations using DIY software, resulting in significant savings and a more streamlined filing process. Conversely, a mid-sized manufacturing firm opted for professional tax preparation assistance to ensure compliance with complex regulations. This choice ultimately enhanced its financial strategy and reduced audit risks through the implementation of a tax service for business.

As you assess your tax preparation choices, remember that grasping the latest trends and accessible offerings is essential. You're not alone in this journey; we're here to help you make informed decisions that align with your financial objectives. Take the time to explore your options and find the support that best suits your needs.

Criteria for Comparing Tax Service Providers

When it comes to choosing the right tax service for business, we understand that it can feel overwhelming. There are several key criteria you should consider to ensure you make the best decision for your unique needs.

- Cost: It's important to assess the pricing structure, including any hidden charges or additional expenses for services. For example, disorganized tax documents can lead to extra charges averaging $166, while the average cost for basic tax preparation can start around $220. Understanding these potential costs is crucial for budgeting effectively.

- Scope of Offerings: Consider whether the provider offers comprehensive assistance, including tax planning, filing, and audit support. If you have a complex tax situation, such as owning a business or having multiple income sources, fees can increase. A provider that offers a broad range of solutions can help optimize your tax processes and ensure compliance with various requirements.

- User Experience: The ease of use of their platforms or services, especially for software solutions, is vital. A user-friendly interface can significantly enhance the efficiency of tax preparation and filing.

- Customer Support: Look for companies that provide strong customer assistance, including access to tax experts for inquiries and advice. Ongoing support is especially important during peak tax seasons; effective assistance can make a substantial difference.

- Reputation: Research reviews and testimonials to gauge the provider's reliability and effectiveness. It's also essential to verify a tax advisor's qualifications and understand their fee arrangements. A solid reputation often correlates with high-quality assistance and customer satisfaction.

- Technology: Consider whether the provider employs advanced technology, such as AI, to streamline processes and enhance user experience. Providers utilizing technology can often deliver quicker and more precise solutions, reducing the overall compliance burden. While online tax preparation options generally range from $50 to $150, they may not provide the personalized analysis needed for tax savings, which is an important factor.

By carefully evaluating these criteria, you can make informed decisions that align with your unique financial goals and the appropriate tax service for business to meet your tax needs. Remember, you're not alone in this journey; we're here to help you navigate through it.

Comparative Analysis of Leading Tax Service Providers

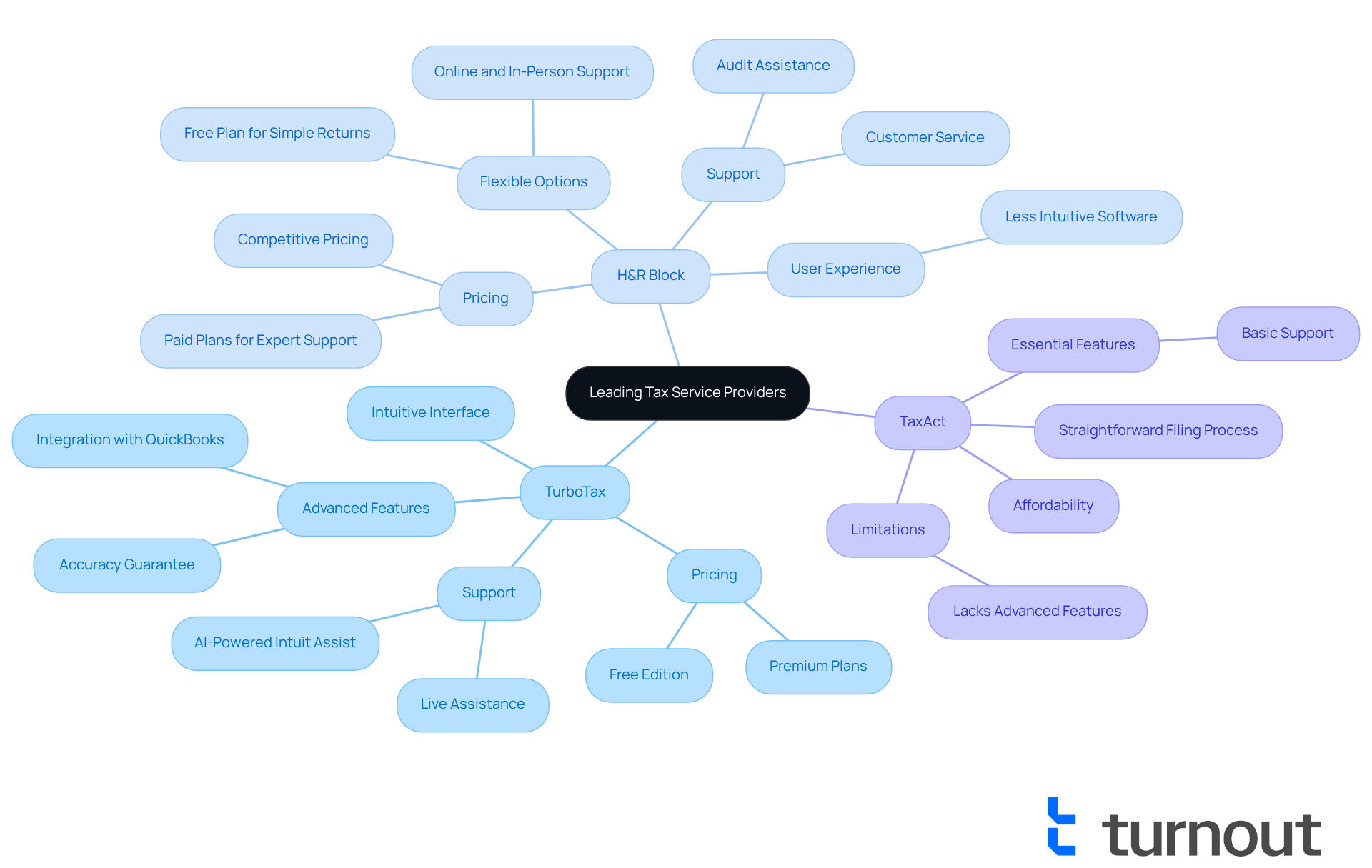

In this comparative analysis, we understand that navigating a tax service for business can be daunting. Let’s explore three leading tax providers that may help ease your concerns: TurboTax, H&R Block, and TaxAct.

- TurboTax: Known for its intuitive interface and extensive features, TurboTax offers a variety of plans tailored to meet diverse organizational needs. It provides robust support for various tax situations and industry-specific deductions. While it can be on the pricier side, especially for more complex filings, many users find its features invaluable.

- H&R Block: H&R Block combines online offerings with in-person assistance, creating a flexible choice for those who value direct interaction. Their competitive pricing and strong range of options, including audit assistance, can be comforting. However, it’s common for some users to feel that their software is less intuitive than TurboTax.

- TaxAct: TaxAct is often praised for its affordability and straightforward filing process. It offers essential features for small enterprises at a lower cost, making it an appealing option for budget-minded entrepreneurs. However, it may lack some advanced features found in TurboTax and H&R Block, which could be a concern for more complex tax situations.

Ultimately, each of these firms offering tax service for business has its advantages and disadvantages. We encourage you to evaluate your specific needs and preferences to choose the most suitable option for your tax preparation. Remember, you are not alone in this journey; we’re here to help you find the right support.

Choosing the Right Tax Service Provider for Your Business

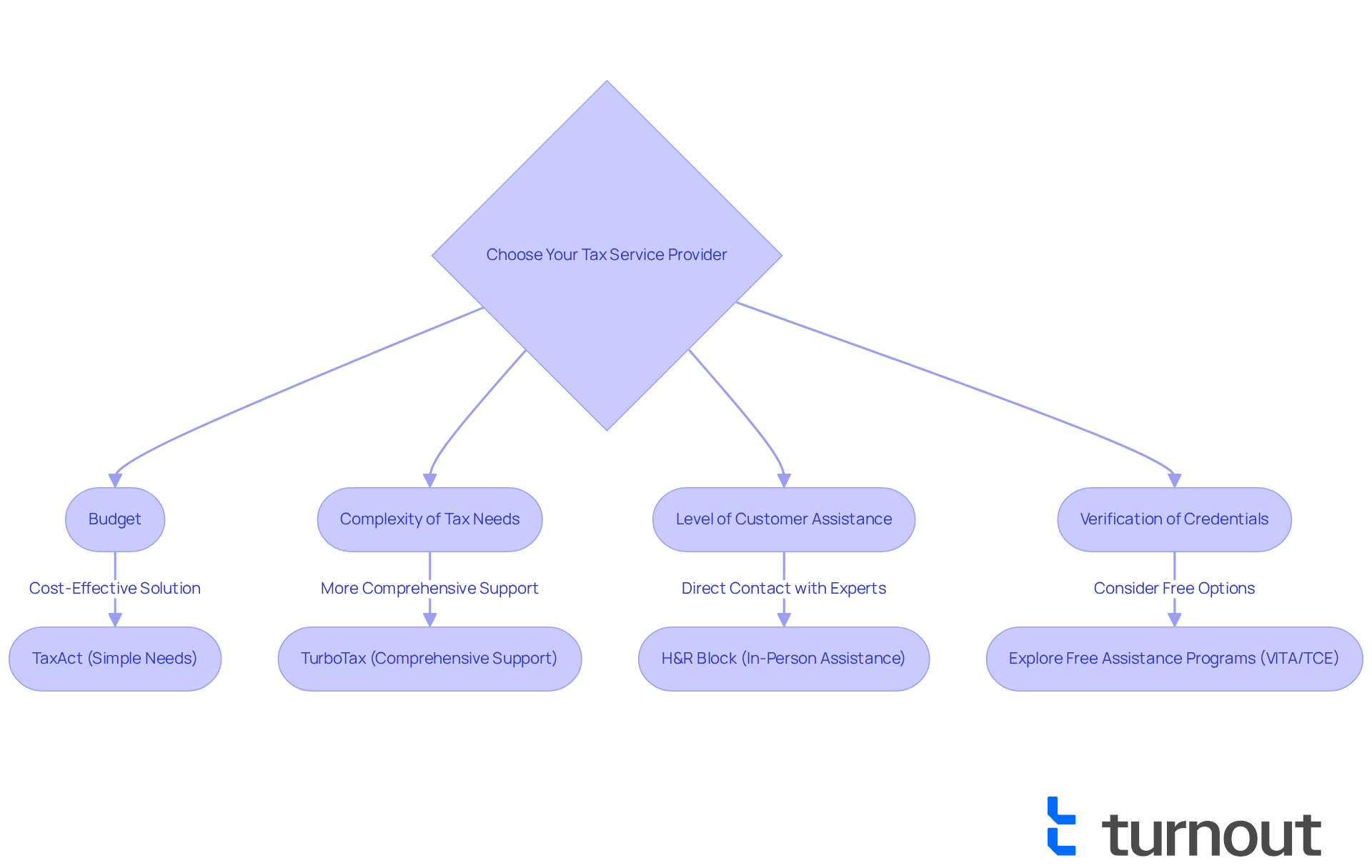

Selecting the right tax service for business provider can feel overwhelming, but we're here to help you navigate this important decision. Start by considering your budget and the complexity of your tax situation. If your company has straightforward tax needs, a cost-effective solution like TaxAct might be just what you need. However, if you require more comprehensive support, TurboTax or H&R Block could be better suited for your organization.

It's also essential to think about the level of customer assistance you desire. Do you prefer direct contact with tax experts? If so, H&R Block's face-to-face offerings might be a great advantage for you. And remember, verifying a preparer's credentials is crucial; ensure they possess a valid Preparer Tax Identification Number (PTIN).

With earnings for tax service for business projected to reach $14.5 billion in 2025, the choice of service entity can significantly impact your business's success. Have you considered exploring free tax assistance programs available through IRS-certified volunteers at VITA or TCE sites? These can be invaluable resources for those facing financial constraints.

Finally, take the time to read reviews and seek recommendations. Ensuring that the provider you choose has a solid reputation for reliability and customer satisfaction can bring you peace of mind. You're not alone in this journey; we're here to support you every step of the way.

Conclusion

Selecting the right tax service for your business is a crucial decision that can greatly impact your financial health and compliance. We understand that navigating the various options, from DIY software to professional services, can feel overwhelming. However, having a clear understanding of these choices empowers you to make informed decisions that truly cater to your unique needs and circumstances.

In this article, we have explored the different types of tax services available, the criteria for comparing providers, and provided a detailed analysis of leading firms such as TurboTax, H&R Block, and TaxAct. Key considerations include:

- Cost

- Scope of offerings

- User experience

- Customer support

- Reputation

- Technology

Each of these factors plays a vital role in determining which service aligns best with your specific tax requirements and financial goals.

Ultimately, choosing a tax service provider should reflect a balance between cost-effectiveness and the level of expertise you require. As the landscape of tax services continues to evolve, remaining proactive and informed is essential. We encourage you to assess your needs, explore the available resources, and seek assistance when necessary. Remember, navigating the complexities of tax preparation is a journey, and you are not alone in this process. Choosing the right tax service is not just about compliance; it’s an investment in the future financial stability and growth of your business.

Frequently Asked Questions

What are tax services for businesses?

Tax services for businesses include various options designed to simplify tax preparation, submission, and compliance. These services range from basic tax filing to strategic tax planning and support during audits.

What options do businesses have for tax services?

Businesses can choose from DIY software solutions, professional tax preparers, or full-service accounting firms. Each option offers unique advantages and challenges based on the specific financial situations and expertise required.

What is the trend regarding DIY tax software among businesses?

There is a growing preference for DIY tax software among smaller enterprises. Approximately 60% of small businesses use DIY software like TurboTax, reflecting a desire for greater control over their financial matters.

What do larger enterprises typically prefer for tax services?

Larger enterprises often seek the expertise of established firms such as H&R Block or TaxAct, which provide tailored solutions to meet their specific tax service needs.

Can you provide examples of businesses using different tax services?

A small retail operation successfully used DIY software to navigate tax obligations, resulting in savings and a streamlined filing process. In contrast, a mid-sized manufacturing firm opted for professional tax preparation assistance to ensure compliance with complex regulations, enhancing its financial strategy and reducing audit risks.

What should businesses consider when choosing tax preparation options?

Businesses should assess their tax preparation choices by understanding the latest trends and available offerings. It is important to explore options that align with their financial objectives and needs.