Overview

You may be wondering about the possibility of collecting Long-Term Disability (LTD) and Social Security Retirement benefits at the same time. It's important to know that while this is possible, your LTD payments might be reduced based on what you receive from Social Security Disability Insurance due to an offset. We understand that navigating these benefits can be challenging.

This reduction means that if you receive both benefits, your LTD payment will be adjusted to account for the Social Security benefits. This adjustment is crucial for effective financial planning. Remember, you are not alone in this journey; we're here to help you make sense of it all.

By understanding how these benefits interact, you can better prepare for your financial future. It's common to feel overwhelmed, but with the right information, you can take control of your situation. We encourage you to explore your options and seek assistance if needed.

Introduction

Understanding the intricacies of Long-Term Disability (LTD) and Social Security Disability Insurance (SSDI) is essential for millions of Americans facing disabling conditions. We understand that navigating these benefits can feel overwhelming, especially as the landscape of disability support evolves. This journey can significantly impact your financial stability.

A pressing question often arises: can individuals collect both long-term disability and social security retirement benefits simultaneously? Exploring this topic not only sheds light on the eligibility criteria and application processes but also uncovers the potential financial implications of overlapping benefits.

You're not alone in this; we're here to help you through it.

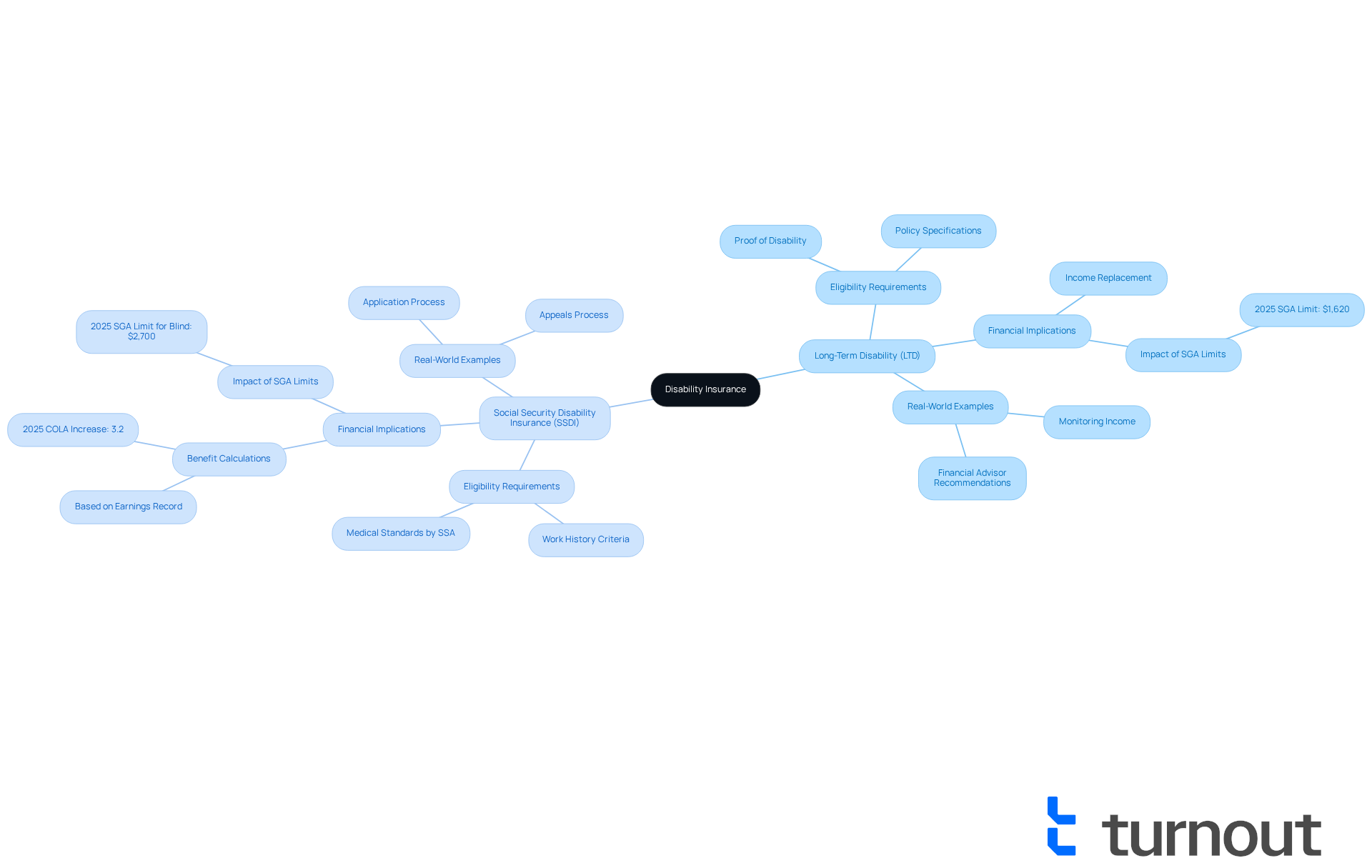

Understand Long-Term Disability and Social Security Disability Insurance

Long-Term Disability (LTD) insurance offers a vital lifeline for individuals unable to work due to a disabling condition. Typically provided through employers or purchased individually, it serves as an essential source of income replacement. In contrast, Social Security Disability Insurance is a federal program designed for those who have contributed to Social Security and can no longer work because of a disability. Understanding these differences is crucial, as they significantly impact financial planning and eligibility for assistance.

As we look ahead to 2025, it's important to recognize that around 9 million Americans rely on disability support. This statistic underscores the significance of these programs for individuals facing disabilities. However, the eligibility requirements for LTD and Social Security Disability Insurance vary. While LTD policies may require proof of disability as specified by the policy, Social Security Disability Insurance has more stringent criteria, demanding that applicants meet specific work history and medical standards set by the Social Security Administration (SSA).

For instance, disability payments are based on a person’s earnings record, with the highest monthly payment influenced by peak earning years. In 2025, the monthly Substantial Gainful Activity (SGA) limit is set at $1,620 for non-blind individuals. This means that earning above this threshold could jeopardize eligibility for disability benefits.

Real-world examples highlight the importance of understanding both programs. Imagine a financial advisor recommending that a client receiving LTD payments closely monitor their income. Surpassing the SGA threshold could lead to denied disability claims, which can be disheartening. Additionally, with the 2025 Cost-of-Living Adjustment (COLA) at 3.2%, those receiving disability support will see an increase in their assistance, providing some relief in managing living expenses.

Financial planners emphasize the need to grasp these distinctions: "Understanding the nuances between LTD and SSDI is vital for effective financial planning, especially as eligibility criteria evolve."

Both programs have unique application processes and compensation amounts, which we will explore further in the following sections. Remember, you are not alone in this journey, and we’re here to help you navigate these options.

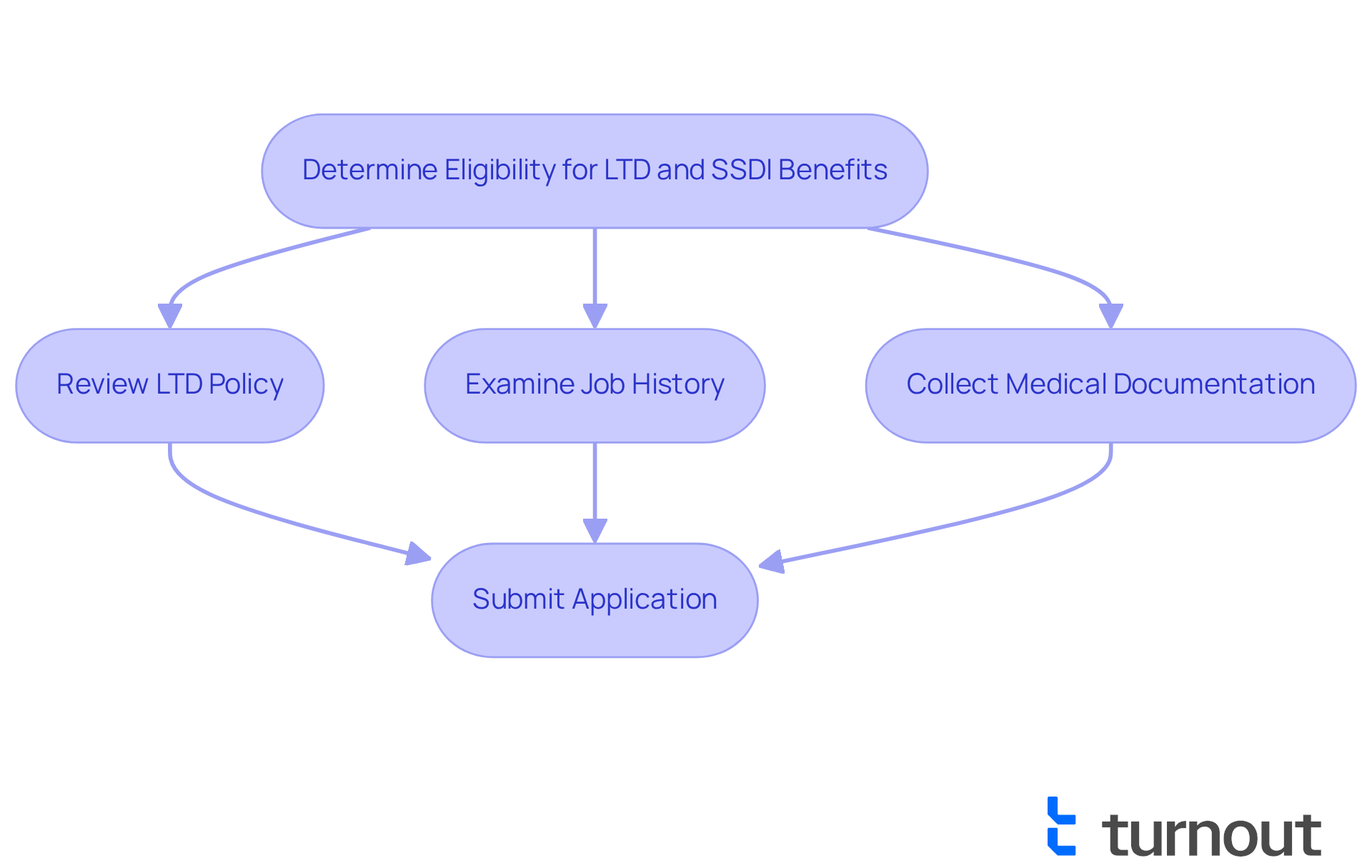

Determine Eligibility for LTD and SSDI Benefits

To qualify for Long-Term Disability (LTD) assistance, it's essential to show that you cannot perform your job duties due to a medical condition. This often requires thorough documentation from healthcare providers and may involve a waiting period before benefits begin. When it comes to [Social Security Disability Insurance (SSDI)](https://usafacts.org/data-projects/disability-benefit-process), you need a qualifying work history along with a medical condition that meets the Social Security Administration's (SSA) definition of disability. Your condition must significantly limit your ability to carry out basic work activities.

We understand that navigating these processes can be overwhelming. [Turnout simplifies access to government assistance](https://blog.myturnout.com/10-essential-steps-for-successful-tdiu-claims) by offering tools and services designed to help you through these complexities. For SSD claims, Turnout employs trained nonlawyer advocates who can assist you in gathering the necessary documentation and understanding the eligibility criteria.

To determine your eligibility, consider the following steps:

- Review your LTD policy for specific criteria.

- Examine your job history to confirm that you have enough work credits for disability benefits, keeping in mind the two five-year regulations regarding work credit prerequisites.

- Collect medical documentation that supports your disability claim.

The waiting period for LTD benefits can vary, often spanning several months depending on your specific policy and the nature of your condition. Generally, the typical waiting time for disability benefit requests is about 204 days, or roughly seven months. Additionally, the SSA has updated its disability definitions, highlighting the importance of clear medical evidence to support claims. Advocates stress that meeting eligibility criteria is crucial, as only around 22% of initial submissions receive approval. This underscores the significance of careful preparation and documentation.

It's also important to note that [70% of long-term disability insurance claims are denied](https://jpgonzalez-sirgo.com/blog/statistics-show-that-70-of-long-term-disability-claims-are-denied.cfm), which illustrates the challenges many applicants face. However, you may have the option to return to work without losing your benefits, and expedited procedures are available for those with serious health issues, potentially speeding up requests. Remember, you are not alone in this journey; we’re here to help you every step of the way.

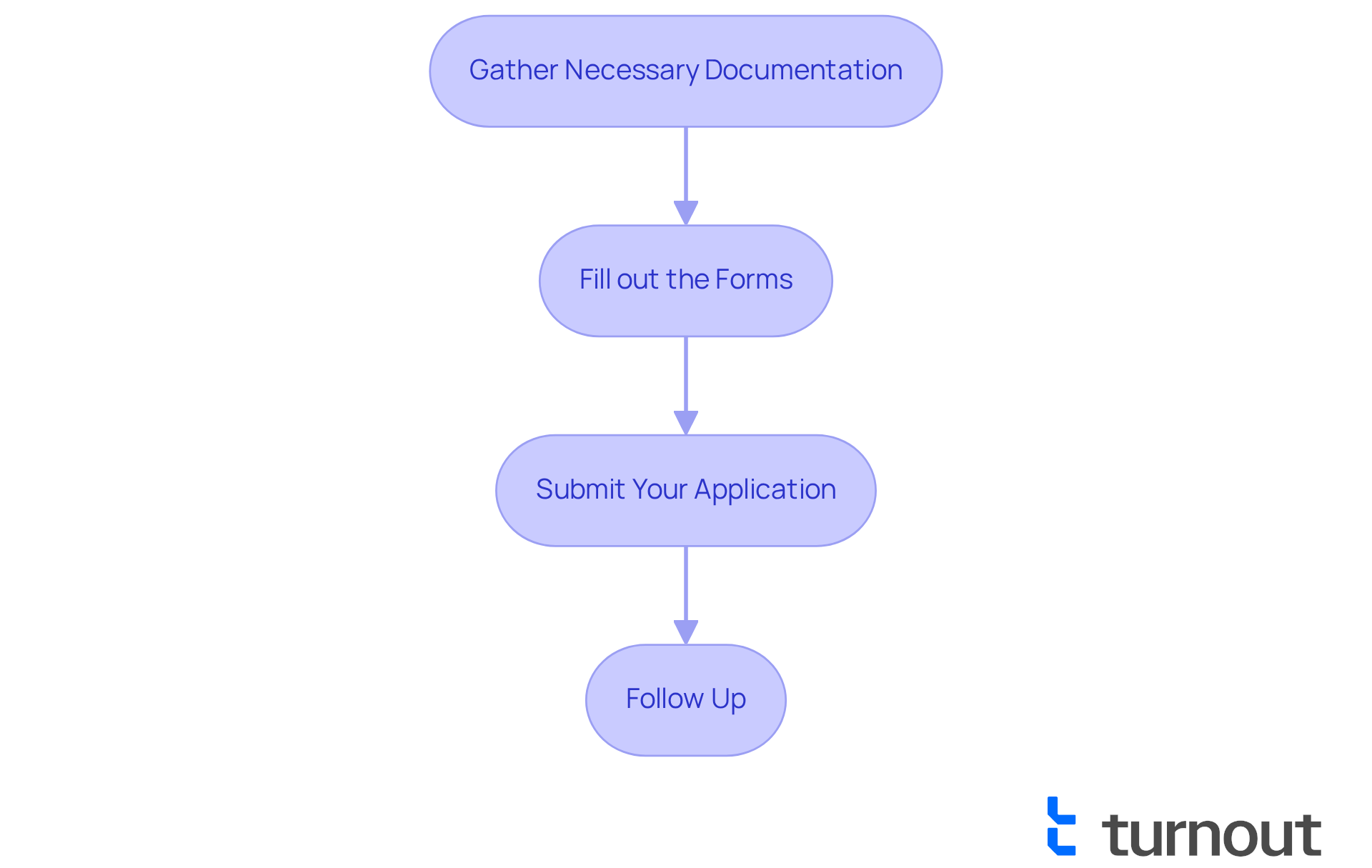

Apply for Long-Term Disability and Social Security Benefits

Navigating the process for Long-Term Disability (LTD) and Social Security Disability Benefits can feel overwhelming. We understand that breaking it down into manageable steps can make it more accessible. Turnout offers valuable tools and services to help you navigate these complex systems without the need for legal representation, as Turnout is not a law firm and does not provide legal advice.

- Gather Necessary Documentation: Begin by collecting essential documents such as medical records, employment history, and any other relevant information that supports your claim. It's important to note that thorough documentation greatly enhances approval probabilities, particularly for conditions such as arthritis, which is often accepted for disability benefits.

- Fill out the Forms: For LTD, make sure to follow your insurer's specific submission guidelines. When it comes to Social Security Disability Insurance, you can conveniently apply online through the Social Security Administration (SSA) website or visit your local SSA office. The SSDI submission procedure usually entails multiple steps, such as an initial review and possible inquiries for further information.

- Submit Your Application: Before submission, ensure that all forms are filled out completely and accurately. Incomplete submissions can lead to delays or rejections, so double-check your work. Turnout's trained non-legal advocates are here to help ensure your submission is thorough and well-prepared.

- Follow Up: After sending your request, keep track of its status. Respond promptly to any requests for additional information from your insurer or the SSA. The disability approval process can take three to five months, but remaining proactive can assist in speeding up your case.

In addition to SSD claims, Turnout also offers assistance with tax debt relief, providing a comprehensive approach to navigating financial challenges.

As Andrew Hurst, a licensed insurance specialist, indicates, "Comprehending the procedure and possessing the correct documentation can greatly ease your experience and enhance your likelihood of approval."

By following these steps and confirming you possess the required documentation, you may wonder, can you collect long-term disability and social security retirement at the same time to streamline the application process for both LTD and social security disability? This can enhance your likelihood of obtaining the support you deserve, and remember, you are not alone in this journey; Turnout is here to help.

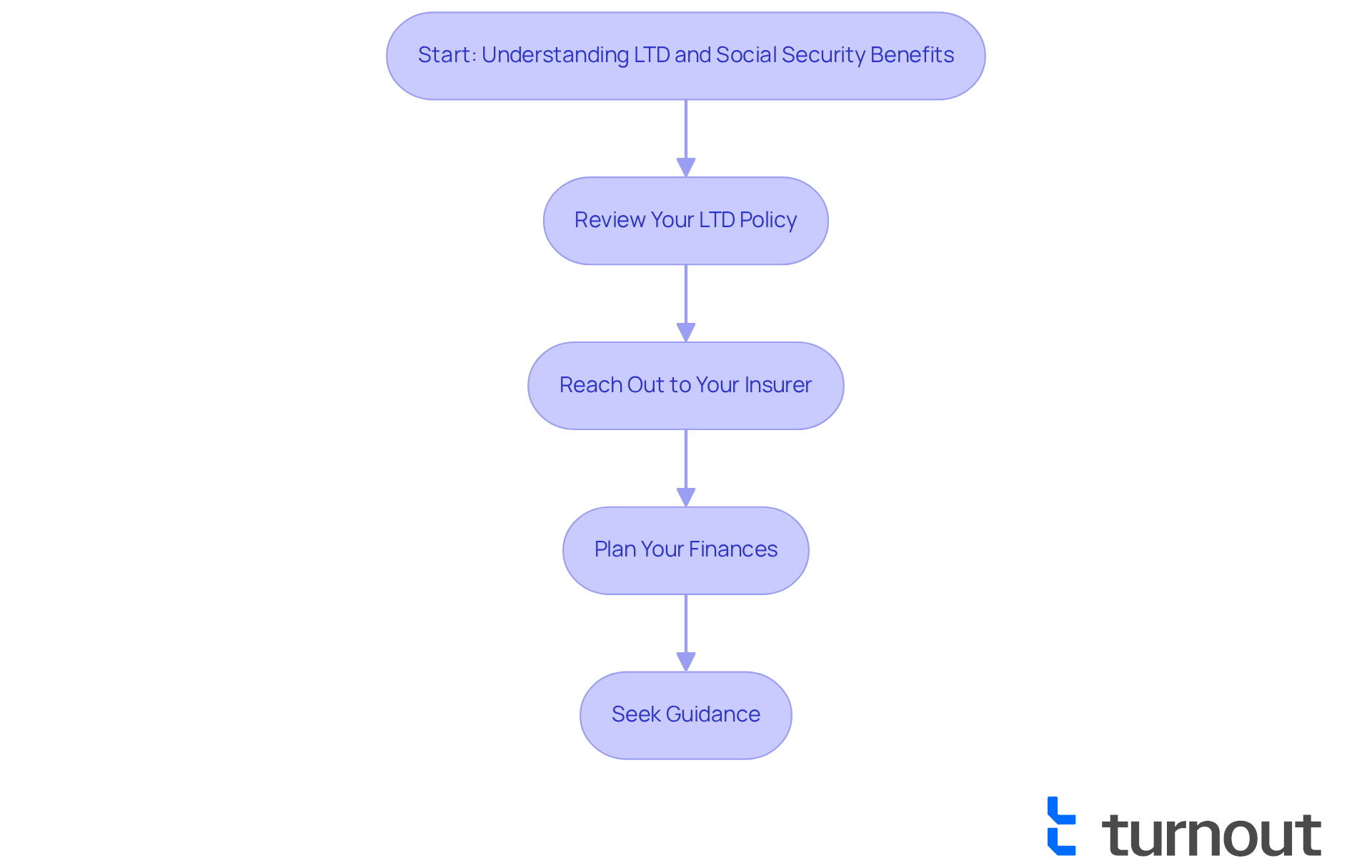

Navigate Offsets and Interactions Between Benefits

When navigating the complexities of Long-Term Disability (LTD) and Social Security payments, it's crucial to understand if you can collect long-term disability and social security retirement at the same time. We recognize that this can be overwhelming. Typically, LTD benefits may be reduced by the amount received from Social Security Disability Insurance, a process known as an offset. For instance, if you receive $2,500 in LTD and $1,000 from Social Security Disability Insurance, your LTD payment could be adjusted to $1,500.

To help you through these interactions, consider the following steps:

- Review Your LTD Policy: Take a moment to examine your policy for any clauses regarding offsets and their relation to disability payments. Many policies state that assistance from other sources, including Social Security Disability Insurance, can reduce your LTD payments, leading to the question of whether you can collect long-term disability and social security retirement at the same time.

- Reach Out to Your Insurer: Once you receive approval for Social Security Disability Insurance, inform your LTD insurer. This information can directly affect your compensation amount, and insurers often need it to adjust your payments accordingly.

- Plan Your Finances: It's important to assess how the offset will impact your overall income. For example, if your expected total monthly income after offsets is $2,200, effective budgeting is essential to accommodate any changes. If your LTD pays $2,500 and SSDI grants $800, your LTD payment may be reduced to $1,700, prompting the question, can you collect long-term disability and social security retirement at the same time, which can significantly influence your financial planning.

- Seek Guidance: If the interactions between these benefits feel confusing, know that you're not alone. Consulting with a knowledgeable supporter can provide tailored guidance and help you plan to maximize your benefits.

Recent changes in assistance interactions, effective in 2025, make it even more important to stay informed. For instance, the Social Security Administration has announced that retroactive payments will begin processing in February 2025, which may impact your financial planning. Understanding these dynamics is essential to ensure you receive the full benefits you are entitled to. Remember, we're here to help you through this journey.

Conclusion

Understanding the intricacies of Long-Term Disability (LTD) and Social Security Disability Insurance (SSDI) is essential for anyone facing the challenges of financial support during periods of disability. We recognize that navigating these waters can be overwhelming. Both programs serve distinct purposes and have unique eligibility requirements, yet they can significantly impact one another. It’s crucial to understand how these benefits interact, particularly regarding offsets, to effectively plan your finances and ensure you receive the support you deserve.

This article outlines the key differences between LTD and SSDI, emphasizing the importance of understanding eligibility criteria, application processes, and potential offsets between benefits. With around 9 million Americans relying on disability support, the nuances of these programs are more relevant than ever. We understand that the process can feel daunting, especially when considering documentation, waiting periods, and the potential for denied claims. This underscores the necessity of thorough preparation when applying for these benefits. Furthermore, insights into the financial implications of offsets highlight the importance of strategic planning to maximize your available resources.

Ultimately, staying informed about the evolving landscape of disability benefits is vital. As changes take effect in 2025, we encourage you to seek guidance and utilize available resources to navigate these complex systems. By understanding the interplay between Long-Term Disability and Social Security benefits, you can better position yourself to secure the financial assistance you need during these challenging times. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Long-Term Disability (LTD) insurance?

Long-Term Disability insurance provides income replacement for individuals unable to work due to a disabling condition. It is typically offered through employers or can be purchased individually.

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance is a federal program designed for individuals who have contributed to Social Security and can no longer work due to a disability.

Why is it important to understand the differences between LTD and SSDI?

Understanding the differences is crucial because they significantly impact financial planning and eligibility for assistance, as the requirements for each program vary.

How many Americans rely on disability support?

Approximately 9 million Americans rely on disability support, highlighting the importance of programs like LTD and SSDI for those facing disabilities.

What are the eligibility requirements for LTD and SSDI?

LTD policies typically require proof of disability as specified in the policy, while SSDI has more stringent criteria, requiring applicants to meet specific work history and medical standards set by the Social Security Administration (SSA).

How are SSDI payments calculated?

SSDI payments are based on a person's earnings record, with the highest monthly payment influenced by their peak earning years.

What is the Substantial Gainful Activity (SGA) limit for 2025?

The SGA limit for 2025 is set at $1,620 for non-blind individuals, meaning that earning above this threshold could jeopardize eligibility for disability benefits.

What is the significance of the Cost-of-Living Adjustment (COLA) for disability support in 2025?

In 2025, the COLA is set at 3.2%, which means that those receiving disability support will see an increase in their assistance, helping them manage living expenses.

What should individuals receiving LTD payments be cautious about?

Individuals receiving LTD payments should closely monitor their income to avoid surpassing the SGA threshold, which could lead to denied disability claims.

Why is it important to consult financial planners regarding LTD and SSDI?

Financial planners emphasize the necessity of understanding the nuances between LTD and SSDI for effective financial planning, especially as eligibility criteria may evolve.