Overview

The primary focus of this article is to guide you through the step-by-step process of completing Form 8812, helping you maximize the benefits from the Child Tax Credit and related programs. We understand that navigating tax forms can be overwhelming, and it's essential to grasp the eligibility requirements fully. By following the detailed instructions provided, you can avoid common pitfalls and ensure that your family receives the financial relief you deserve.

Completing this form is not just about paperwork; it plays a critical role in effective tax planning. We’re here to help you understand the process and feel confident in your ability to secure the benefits you are entitled to. Remember, you are not alone in this journey, and we are committed to supporting you every step of the way.

Introduction

Navigating the complexities of tax filings can feel overwhelming, especially for families striving to maximize their financial support through credits like the Child Tax Credit (CTC). We understand that understanding Form 8812 is essential; it acts as a gateway to significant tax benefits, potentially saving families thousands of dollars. Yet, many taxpayers often find themselves lost amidst the eligibility requirements and intricate instructions.

What if there was a way to simplify this process and ensure that no potential benefits are left on the table? You're not alone in this journey, and we’re here to help.

Understand the Purpose of Form 8812

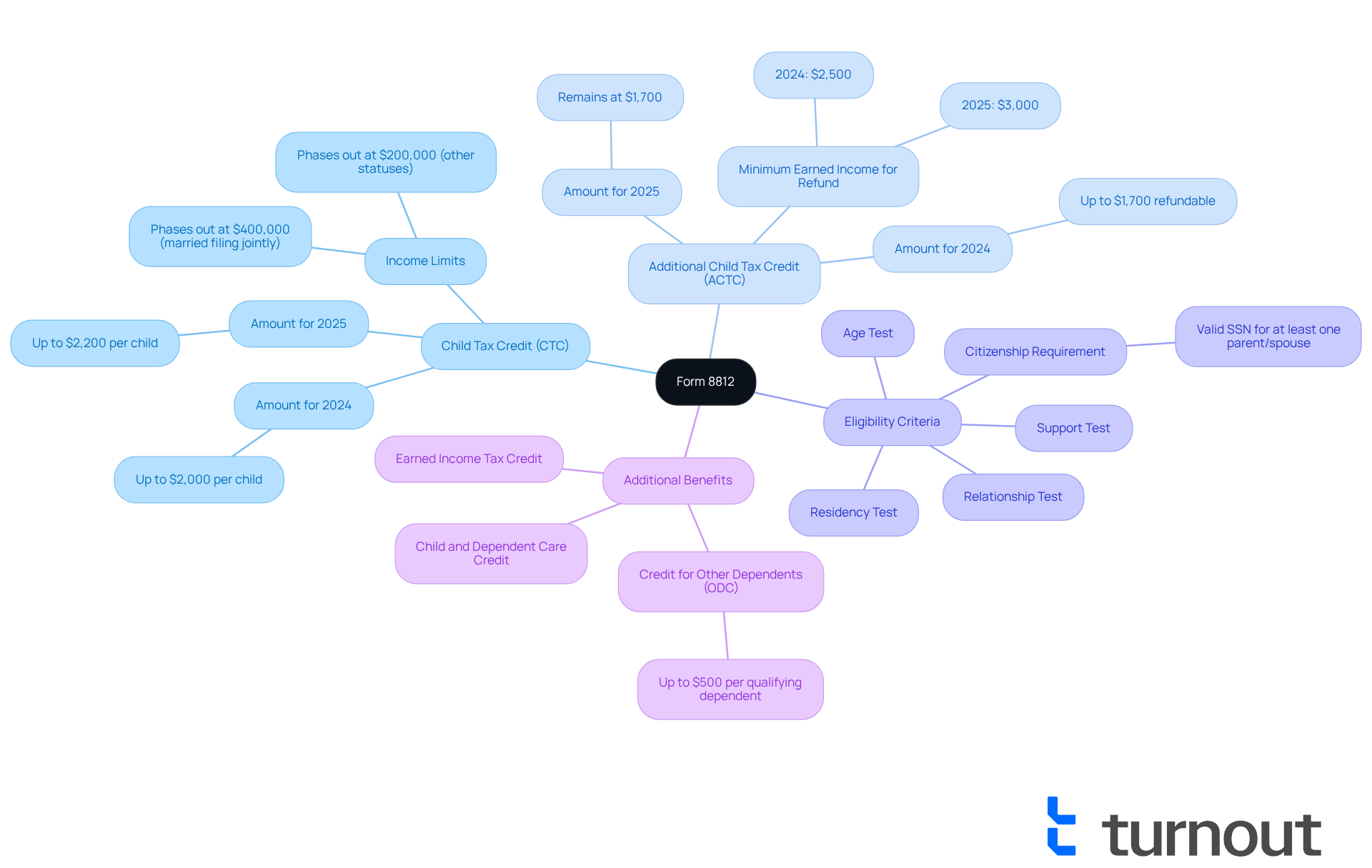

Form 8812, also referred to as Schedule 8812, plays a crucial role in helping families calculate the Child Tax Credit (CTC), the Additional Child Tax Credit (ACTC), and the Credit for Other Dependents (ODC). Understanding its purpose is essential for taxpayers eager to claim these valuable benefits. The CTC offers financial relief to families with qualifying children, providing up to $2,000 per child for the 2024 tax year, which will increase to $2,200 per child in 2025. If the CTC exceeds tax liability, the ACTC allows for a refundable benefit. Following the 8812 form instructions accurately is vital for ensuring families receive the maximum benefits available under current tax laws, especially for the 2024 tax year and beyond. By doing so, taxpayers can significantly lower their tax liability and may even receive a refund.

Families that qualify for the CTC may also be eligible for additional benefits, such as the Child and Dependent Care Assistance and the Earned Income Tax Benefit, which can further enhance their overall financial support. It’s important to remember that to qualify for the CTC in 2025, at least one parent or spouse must possess a valid Social Security Number. Moreover, understanding the eligibility criteria—covering relationship, age, residency, support, and citizenship requirements—is crucial for taxpayers to ensure they can secure these benefits effectively.

Additionally, families have the opportunity to claim any overlooked incentives by submitting revised returns, which can further amplify their advantages. Tax professionals emphasize the significance of the 8812 form instructions, noting that it can provide substantial financial relief for families dealing with the complexities of tax filings. Real-world examples illustrate this impact: families utilizing Schedule 8812 have successfully accessed thousands in tax benefits, greatly improving their financial situations. By grasping the eligibility criteria and accurately following the 8812 form instructions, families can reap meaningful benefits, making it an indispensable tool in tax planning.

Identify Eligibility Requirements for the Child Tax Credit

To qualify for the Child Tax Benefit, it's important for taxpayers to meet specific eligibility requirements. We understand that navigating these can be challenging, so here’s what you need to know:

- Qualifying Child: The child must be under the age of 17 at the end of the tax year.

- Dependent Status: The child must be claimed as a dependent on your tax return.

- Residency: The child must have lived with you for more than half of the tax year.

- Income Limits: Your modified adjusted gross income (MAGI) must be below certain thresholds, which for 2024 are $200,000 for single filers and $400,000 for married couples filing jointly.

- Joint Return: The child should not file a joint return for the year, except to claim a refund.

- Social Security Number: The child must have a valid Social Security number issued before the tax return due date.

By confirming that you satisfy these requirements, you can confidently move forward with the 8812 form instructions and request the benefits you are eligible for. It’s significant to note that many families are anticipated to meet the criteria for the Child Tax Benefit in 2024, underscoring its vital role in providing financial assistance.

Tax advisors often highlight common eligibility issues. For instance, it’s crucial to ensure that the child does not provide more than half of their own support and has a valid Social Security number. Furthermore, families successfully claiming the Child Tax Benefit may also qualify for additional benefits, such as the Child and Dependent Care Assistance, which can further enhance their financial support.

Remember, you may be able to claim the Child Tax Benefit even if you do not typically submit a tax return. We’re here to help you access this essential advantage. You are not alone in this journey, and we encourage you to take the next step toward securing the support you deserve.

Follow Step-by-Step Instructions to Complete Form 8812

Completing the 8812 form instructions can feel overwhelming, but we're here to help you through the process. Follow these steps to ensure you maximize your potential tax benefits:

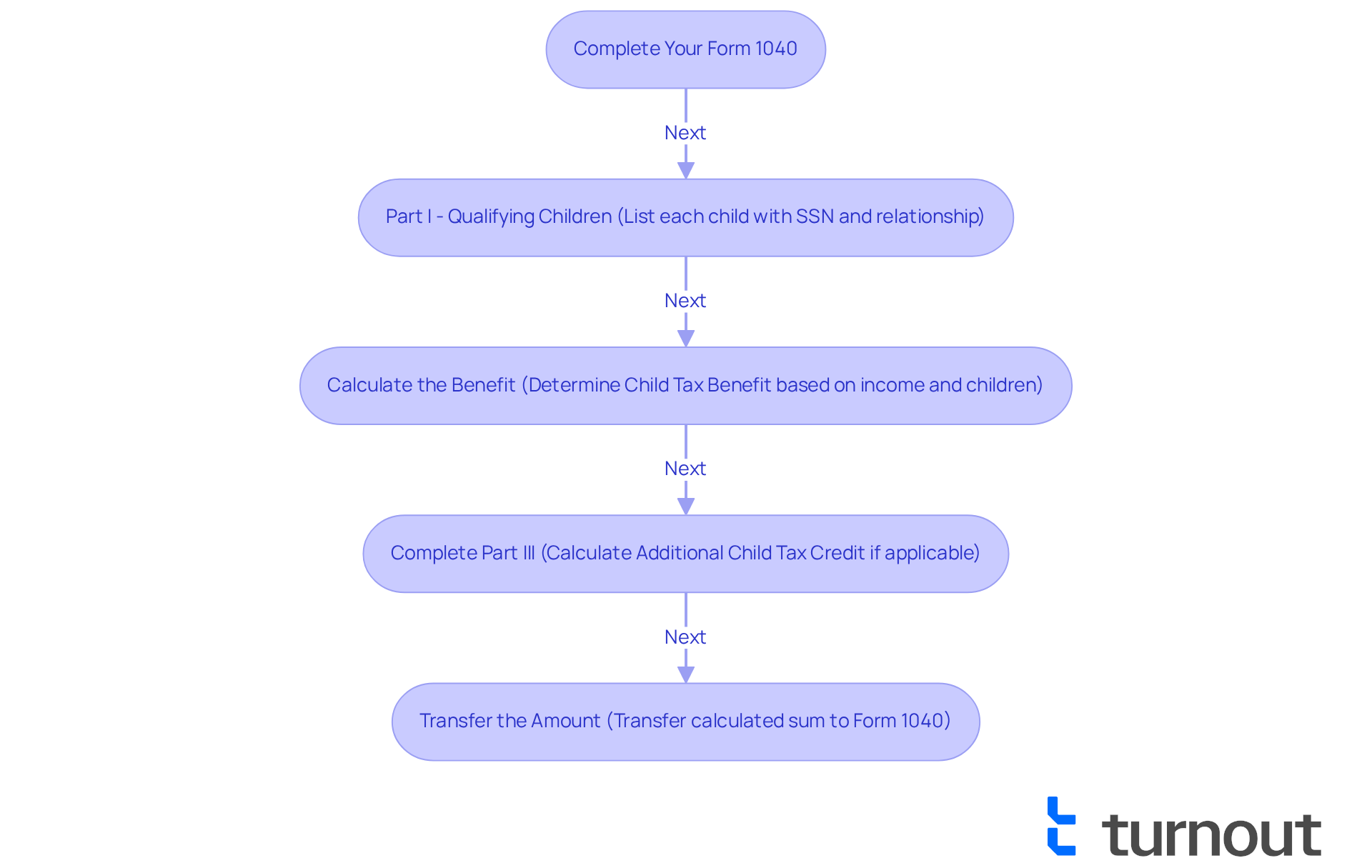

- Complete Your Form 1040: Before diving into Form 8812, make sure your Form 1040 is filled out through line 15. This is an essential first step.

- Part I - Qualifying Children: In Part I, list each qualifying child. You will need their name, Social Security Number (SSN), and relationship to you. Remember, accuracy with the SSN is crucial to avoid any delays.

- Calculate the Benefit: Next, follow the instructions in Part II to determine your Child Tax Benefit. This will involve assessing your credit based on your income and the number of qualifying children. For the 2024 tax year, the maximum Child Tax Benefit is $2,000 per child, and it's important to note that you need at least $2,500 in earned income to qualify for the refundable portion of the Additional Child Tax Benefit (ACTB).

- Complete Part III: If applicable, complete Part III to calculate the Additional Child Tax Credit. This section is vital for those whose CTC exceeds their tax liability. It's common to feel anxious about this part, but be mindful that errors can lead to a two-year suspension if deemed reckless.

- Transfer the Amount: Finally, transfer the calculated sum to your Form 1040 as instructed.

By carefully following the 8812 form instructions, you can feel confident that Form 8812 is completed accurately, helping you to maximize your tax benefits. Common errors include incorrect SSNs and miscalculations of income, so take your time. Ensure you have the necessary documentation, such as Social Security Numbers for qualifying children, to support your claims. If you've overlooked claiming Child Tax Benefits in previous years, remember that you can submit amended returns to reclaim those benefits. You are not alone in this journey, and taking these steps can lead to a brighter financial future.

Avoid Common Mistakes and Troubleshoot Issues

When completing Form 8812, we understand that it’s crucial to avoid some common mistakes that can lead to unnecessary stress:

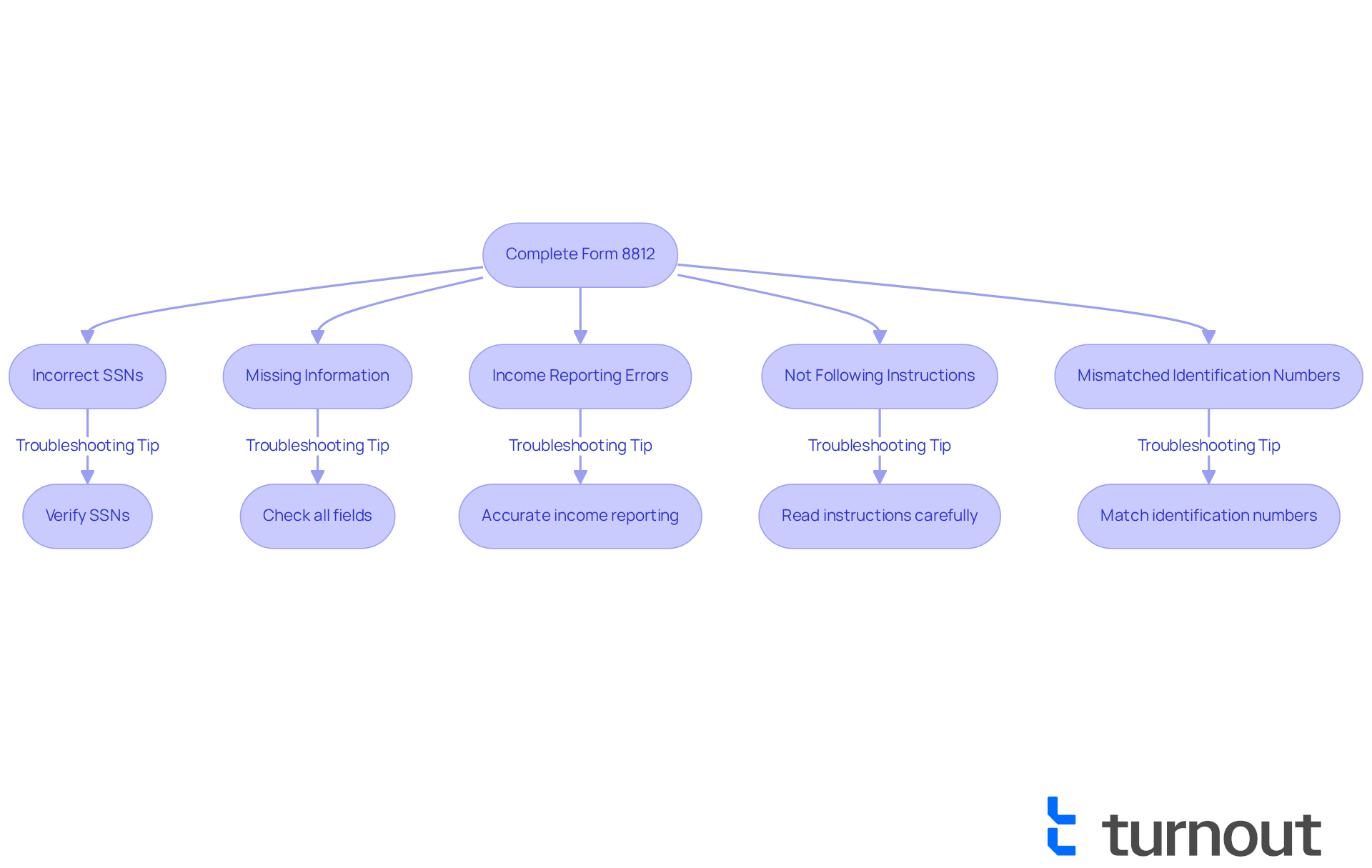

- Incorrect Social Security Numbers: Please verify that the Social Security Numbers (SSNs) for all qualifying children are accurate. Errors can lead to significant delays in processing, which we know can be frustrating.

- Missing Information: Ensure that all required fields are filled out completely. Incomplete forms can result in processing delays and complications with your claims, adding to your worries.

- Income Reporting Errors: Accurately report your modified adjusted gross income, as this directly affects your eligibility for benefits. Misreporting can lead to denied claims. Be careful not to overstate or understate income and expenses, as this can impact your tax benefits.

- Not Following Instructions: It's common to feel overwhelmed, but carefully reading the instructions for each section of the form can make a big difference. Misunderstanding the requirements can result in incorrect calculations and lost benefits, which we want to help you avoid.

- Mismatched Identification Numbers: Ensure that the taxpayer identification number matches the dependent's name. Filing with mismatched information is a common mistake that can complicate your claims.

Troubleshooting Tips:

- If you receive a notice from the IRS regarding discrepancies, take a moment to compare your submitted information against your records to identify any errors. You are not alone in this process.

- Keep documentation, such as W-2s and 1099s, readily available to verify your income and dependent information. This can help ease your mind.

- For persistent issues, consider consulting a tax professional for tailored assistance. Remember, reaching out for help is a sign of strength.

By being vigilant about these common pitfalls and following the troubleshooting tips, you can significantly improve your chances of successfully claiming your tax credits. And remember, beginning in the 2025 filing season, the IRS will accept Forms 1040, 1040-NR, and 1040-SS even if a dependent has already been claimed on a previously filed return. This change can simplify your filing process, making it easier for you.

Conclusion

Mastering Form 8812 is essential for families seeking to maximize their tax benefits through the Child Tax Credit and related programs. This form serves as a critical tool in navigating the complexities of tax filings. It allows eligible taxpayers to secure financial relief that can significantly impact their household budgets. Understanding the intricacies of Form 8812 and its connection to various tax credits ensures that families can take full advantage of the financial support available to them.

We understand that tax season can be overwhelming, and throughout the article, we highlighted key points to support you. This includes:

- The importance of understanding eligibility requirements for the Child Tax Credit

- Step-by-step instructions for completing Form 8812

- Common pitfalls to avoid during the filing process

By adhering to these guidelines, families can confidently navigate their tax responsibilities and potentially reclaim overlooked benefits from previous years. The insights provided emphasize the necessity of accuracy and thoroughness when completing the form, as well as the potential for substantial financial relief that can be achieved.

In conclusion, the significance of Form 8812 cannot be overstated for those looking to enhance their financial well-being through tax credits. We encourage families to take proactive steps in understanding the requirements and following the detailed instructions provided. By doing so, you not only position yourselves for immediate benefits but also lay the groundwork for future financial stability. Embracing this knowledge and taking action can lead to a more secure financial future. Remember, you are not alone in this journey—mastering Form 8812 is a crucial step towards achieving the financial relief you deserve.

Frequently Asked Questions

What is Form 8812 and why is it important?

Form 8812, also known as Schedule 8812, is essential for families to calculate the Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), and Credit for Other Dependents (ODC). It helps taxpayers claim these valuable benefits, which can significantly lower their tax liability and potentially provide a refund.

What are the benefits of the Child Tax Credit (CTC)?

The CTC offers financial relief to families with qualifying children, providing up to $2,000 per child for the 2024 tax year, increasing to $2,200 per child in 2025. If the CTC exceeds a taxpayer's tax liability, the ACTC allows for a refundable benefit.

What additional benefits might families qualify for alongside the CTC?

Families that qualify for the CTC may also be eligible for benefits such as the Child and Dependent Care Assistance and the Earned Income Tax Benefit, which can further enhance their financial support.

What are the eligibility requirements for the CTC in 2025?

To qualify for the CTC in 2025, at least one parent or spouse must have a valid Social Security Number. Other eligibility criteria include relationship, age, residency, support, and citizenship requirements.

How can families claim overlooked incentives?

Families can claim any overlooked incentives by submitting revised returns, which can amplify their tax benefits.

What is the significance of following the Form 8812 instructions accurately?

Accurately following the Form 8812 instructions is vital for families to receive the maximum benefits available under current tax laws, especially for the 2024 tax year and beyond. This can lead to substantial financial relief for families navigating tax filings.

Can you provide an example of the impact of using Schedule 8812?

Families utilizing Schedule 8812 have successfully accessed thousands in tax benefits, greatly improving their financial situations by understanding eligibility criteria and accurately following the form's instructions.