Overview

A levy on property is a legal mechanism that the government may use to seize assets, often in cases of unpaid taxes. We understand how overwhelming this process can be, especially when it leads to significant financial hardship for property owners like you. It's crucial to grasp the implications of this situation, as neglecting tax obligations can result in severe consequences, including wage garnishment and asset confiscation.

We want you to know that you are not alone in this journey. By proactively managing your tax responsibilities, you can navigate these challenges more effectively. It's common to feel anxious about your financial obligations, but addressing them head-on can help you regain control. Remember, seeking assistance is a positive step towards resolving your concerns.

We’re here to help you understand your options. Taking action now can prevent further complications and provide peace of mind. You deserve support and guidance as you work through these issues, and together, we can find a way forward.

Introduction

Understanding the implications of property levies is essential for homeowners like you, who may be grappling with the complexities of tax obligations. We know that as real estate taxes rise, so does the risk of government actions that can lead to the confiscation of your assets. This can leave many wondering about the true nature of a levy on property. With the potential for severe financial consequences looming, you might be asking yourself: how can I navigate this challenging landscape and protect my assets?

This article delves into the purpose, process, and impact of property levies, equipping you with the knowledge needed to mitigate risks and make informed decisions. Remember, you are not alone in this journey; we're here to help you understand and manage these challenges with confidence.

Define Levy: Understanding the Concept and Its Implications

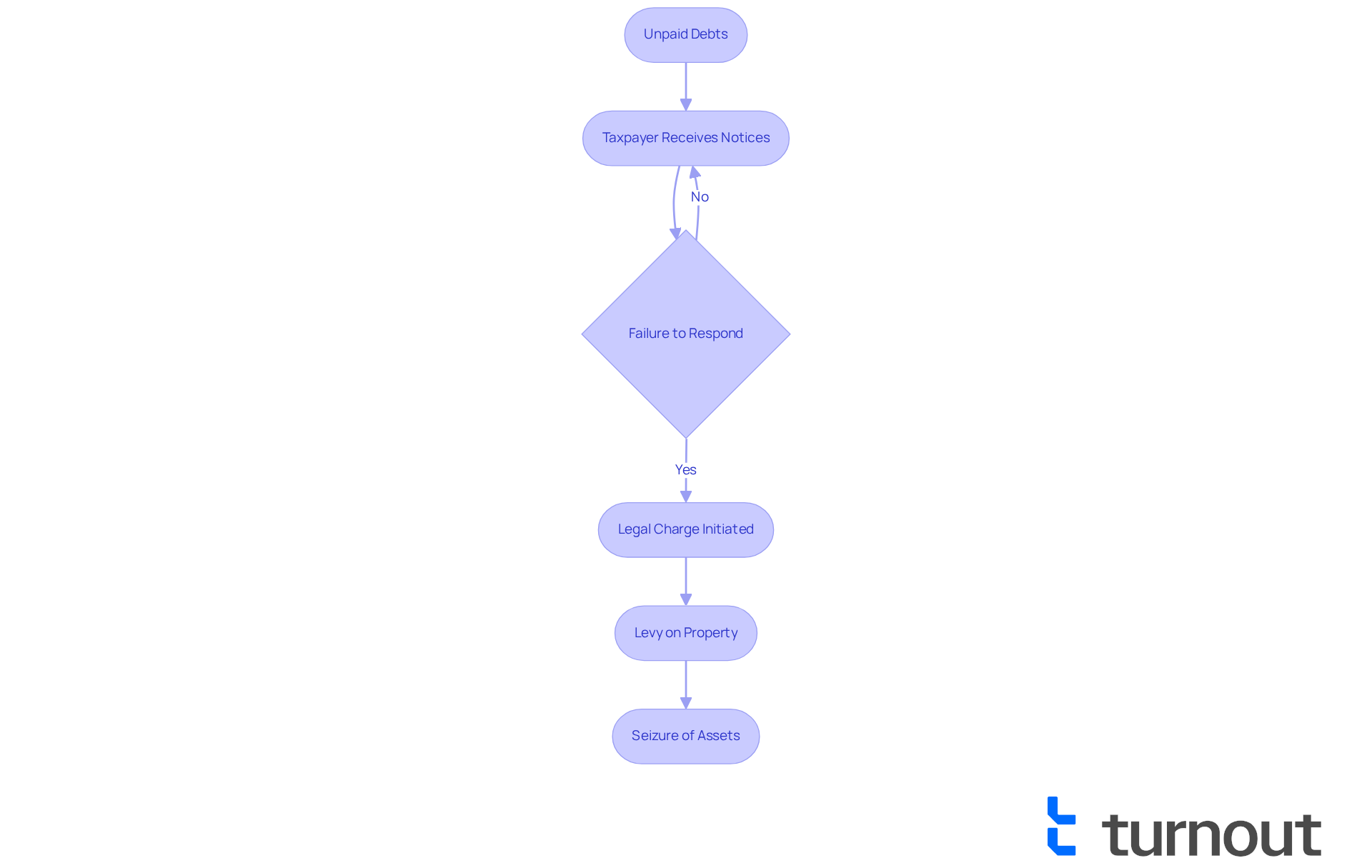

A charge serves as a legal tool that government officials use to confiscate assets in order to fulfill a debt, often related to for unpaid taxes. Unlike a lien, which merely claims against assets to secure payment, a seizure results in the actual . This can include bank accounts, wages, or tangible items. Understanding what is a levy on property is crucial for asset holders, as failing to address the consequences of a tax charge can lead to significant economic hardship and the loss of important possessions.

The process typically begins when a taxpayer does not respond to notices about unpaid debts. This marks a serious repercussion of . In 2025, the impact of has become increasingly evident. Real estate tax delinquencies have climbed to 5.1%, up from 4.5% in 2024. This troubling trend can largely be attributed to , leading many to wonder what is a levy on property, which have surged by 27% since 2019. This places additional strain on homeowners, particularly those who lack sufficient financial buffers.

Real-world examples illustrate the seriousness of this issue. For instance, the Taxpayer Advocate Service stepped in for a taxpayer facing an IRS seizure of their . They ensured this individual maintained access to vital funds for living costs. Such cases highlight the importance of and the potential for relief from financial burdens, especially given the economic difficulties they can create.

As landowners navigate these challenges, it's essential to understand what is a levy on property and the distinctions between charges and liens. Proactive communication with tax officials can be crucial in reducing the risks associated with tax delinquency. Remember, you are not alone in this journey; we’re here to help you understand your options and find a way forward.

Explore the Purpose of a Levy: Why It Matters for Property Owners

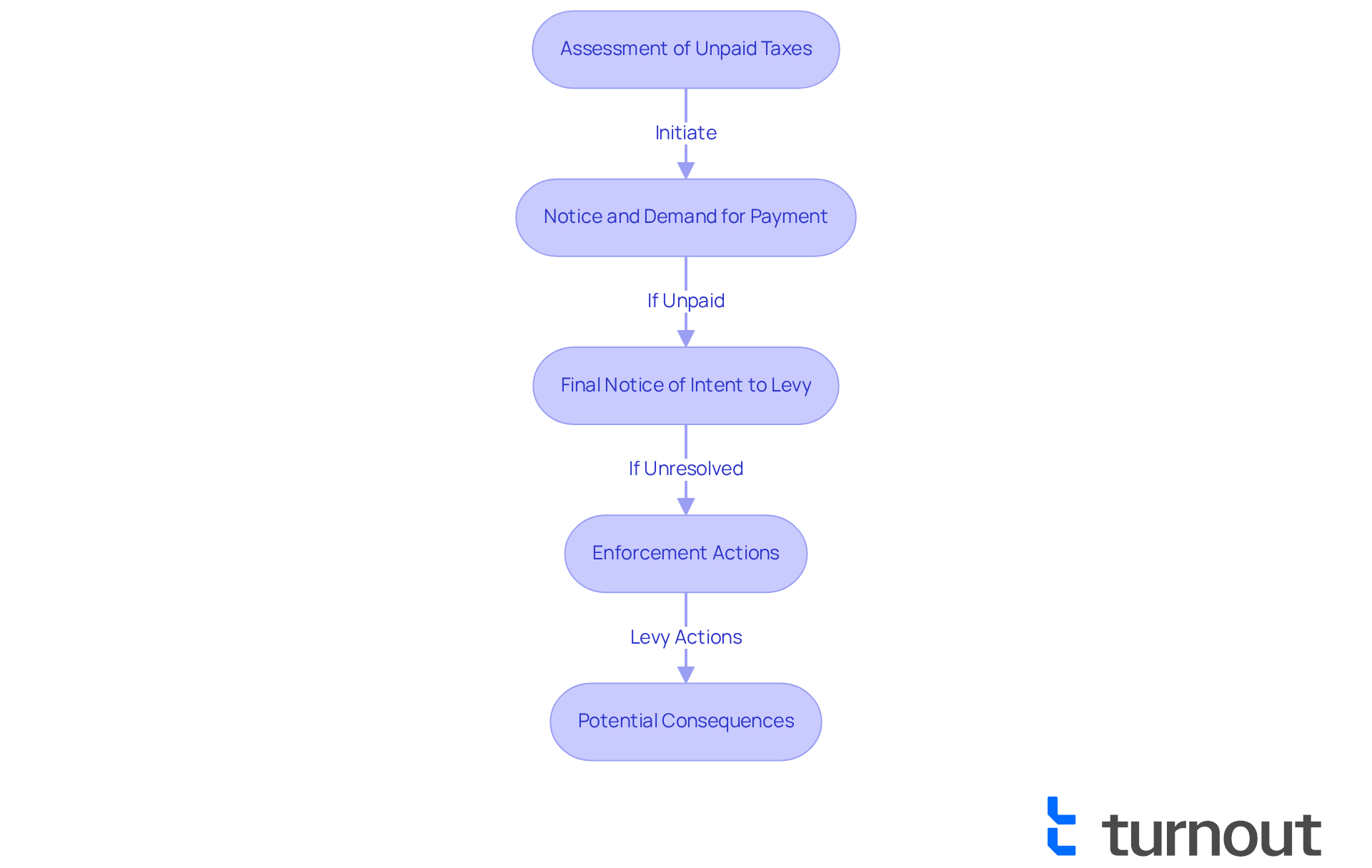

The main objective of an assessment is to enforce , ensuring that government entities can recover owed debts. We understand that in 2025, millions of asset holders face the daunting threat of charges due to unpaid dues, which can lead to the loss of holdings—an outcome that can be devastating. For instance, the takes action after several attempts to recover unpaid taxes, often following a tax lien that has been overlooked. This process involves sending a 'Notice and Demand for Payment' and a 'Final Notice of Intent to Levy,' providing ample warning before any enforcement actions are initiated.

to encourage compliance with tax laws, thereby safeguarding the integrity of public funding. Government officials emphasize that these measures are vital for ensuring that . Understanding is essential for real estate owners, as it highlights the importance of actively managing tax responsibilities to avoid severe .

can be significant. When a tax is imposed, it can lead to wage garnishment, freezing of bank accounts, and potential seizure of personal property, highlighting the importance of . These actions can drastically diminish a taxpayer's income and access to funds, creating a cycle of financial strain. Therefore, addressing promptly is crucial to prevent the escalation of tax issues into more serious consequences. Remember, you are not alone in this journey; taking proactive steps can make all the difference.

Explain How a Levy Works: The Process and Mechanisms Involved

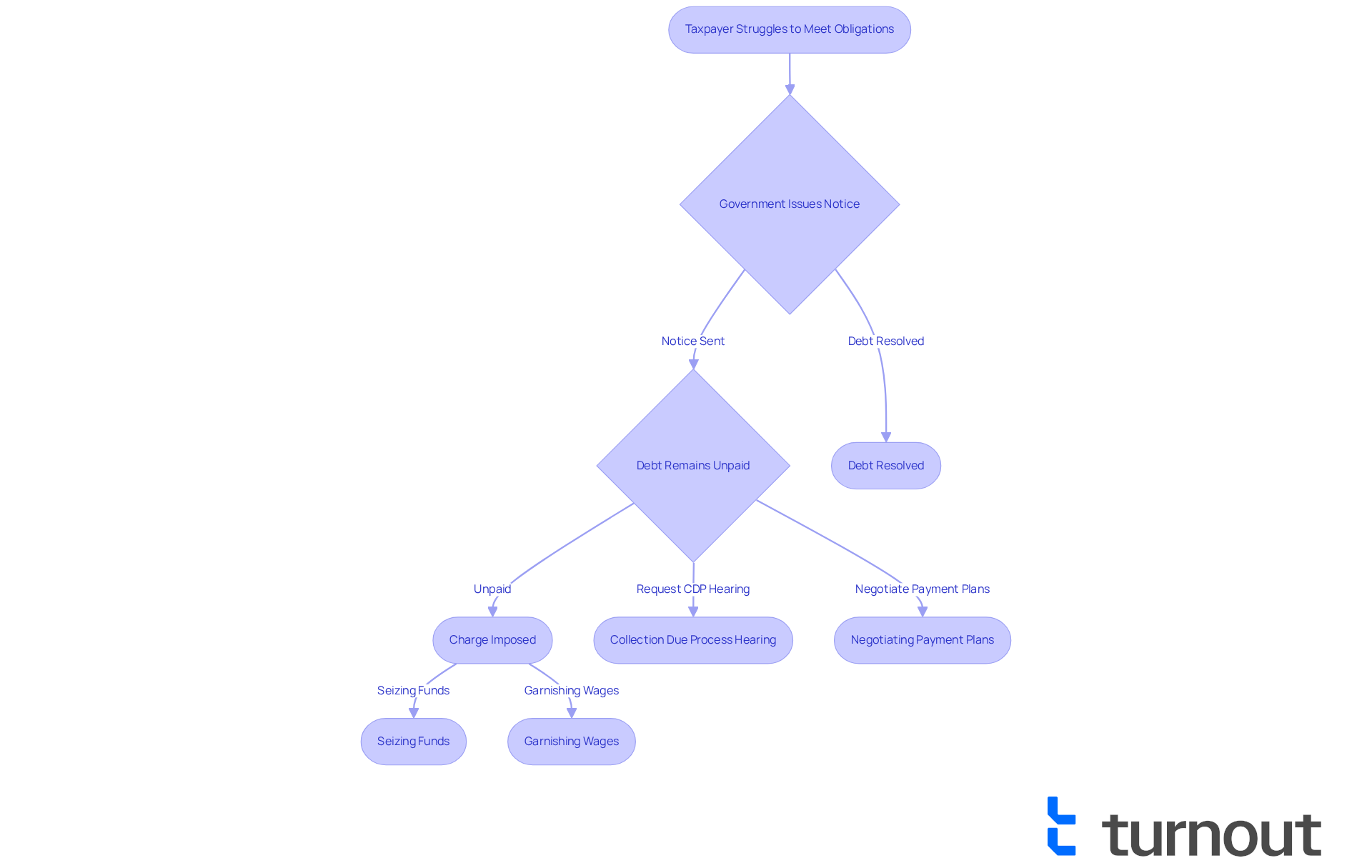

The collection process often begins when a taxpayer struggles to meet their . We understand that this can be a daunting situation. The government typically issues a series of notices, warning you of possible actions. If the debt remains unpaid, the government may impose a charge, which could involve seizing funds directly from your bank account or garnishing your wages. Property owners are usually given a notice of the charge, allowing a brief period to respond or resolve the obligation before any confiscation occurs. is crucial for property owners to effectively manage potential charges and seek resolution before their assets are at risk.

Recent changes in the IRS's approach, including the renewed use of the , have heightened the risk of enforced collection actions for taxpayers who do not respond to notices. Remember, you have the legal right to request a , which can pause the collection process while you work toward a resolution.

. The IRS acknowledges that a tax seizure can profoundly impact your credit and peace of mind. They have also begun sending collection notices using Form 668-W, which instructs employers to withhold wages or other earnings for overdue tax responsibilities.

Finding successful solutions before property seizure often involves negotiating payment plans or demonstrating economic hardship to request currently not collectible status. Many taxpayers who have navigated this process emphasize the importance of understanding their rights and options. Proactive involvement can lead to positive outcomes and help you avoid the emotional and financial turmoil associated with these impositions. Remember, you are not alone in this journey; we're here to help you find the best path forward.

Differentiate Types of Levies: Tax, Property, and Beyond

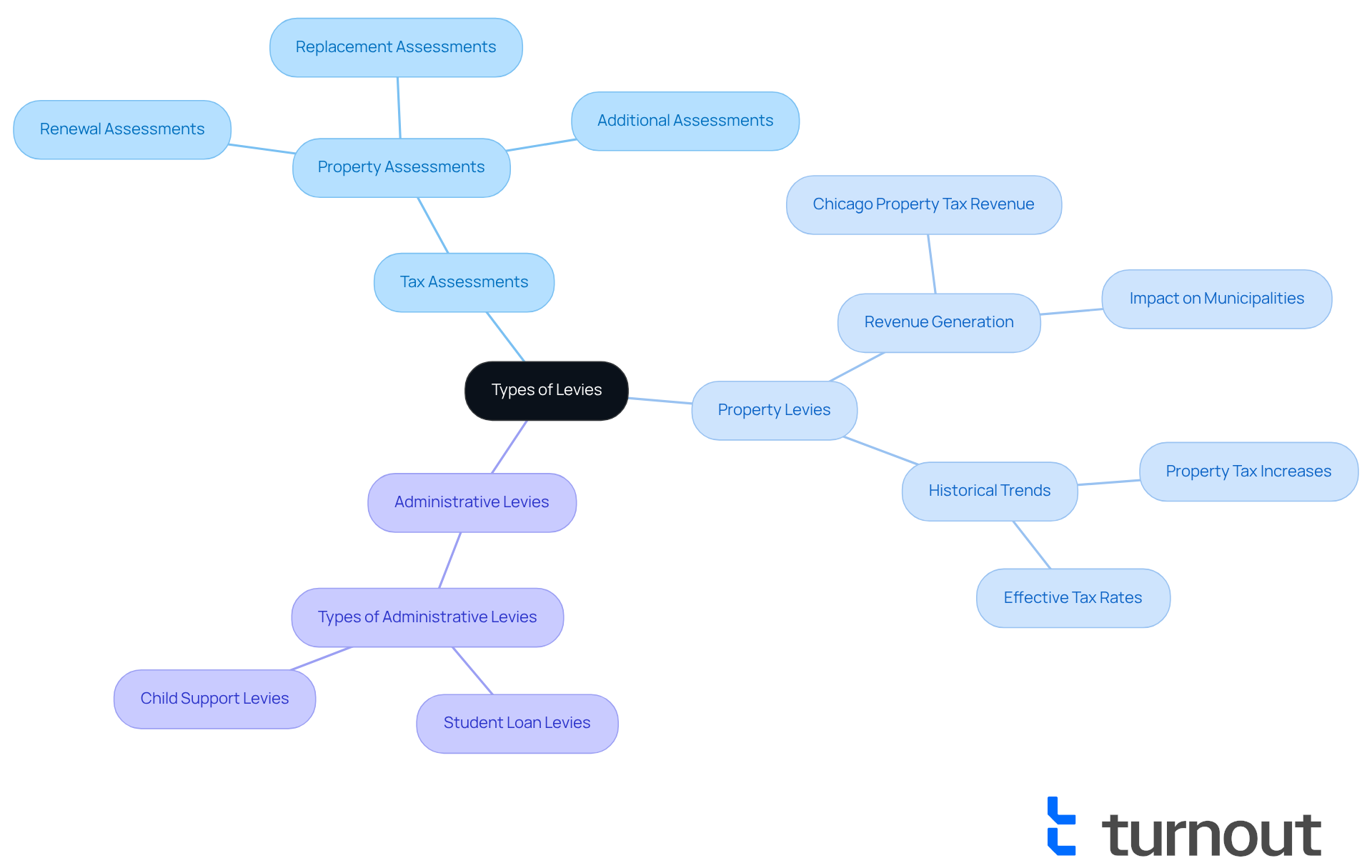

There are various forms of taxes, each fulfilling distinct functions. , illustrating , where government authorities confiscate property to recover unpaid taxes. It's common to feel overwhelmed by the thought of property assessments, which may involve the seizure of physical assets, such as vehicles or real estate, to satisfy debts. Additionally, can be enacted by various government agencies for different types of debts, including student loans or child support. Comprehending these differences is essential for asset owners to identify the particular risks they encounter and the suitable measures they can implement to .

Recent developments suggest that for municipalities. For instance, the City of Chicago is expected to produce around $1.7 billion in FY2023 from property levies alone. This highlights the significance of . On the upcoming November 4, 2025 ballot, various types of assessments will be showcased, including:

- Renewal Assessments, which maintain existing rates

- Replacement Assessments, which reset reduced rates to their original levels

- Additional Assessments that introduce new taxes

These charges can greatly influence property owners' budgeting, and we recognize that this can be a source of stress.

emphasize the importance of . They suggest keeping detailed accounts of all monetary responsibilities and investigating available exemptions or assistance programs that may lessen the effect of charges. For instance, grasping the implications of real estate tax increases, which have historically surged significantly—by 102% over the past decade in Chicago—can assist homeowners in preparing for potential financial strain. Remember, you are not alone in this journey; there are resources available to help you.

In practice, tax impositions often appear through government actions to recover unpaid taxes, while asset seizures may involve the confiscation of specific belongings. For instance, a homeowner facing tax delinquency might see their property subjected to a tax levy, which raises the question of what is a levy on property, while an individual with outstanding debts could have their vehicle seized under a property levy. Recognizing these differences is essential for effective financial planning and asset management. We understand that navigating these complexities can be daunting, but with the right information and support, you can take proactive steps to protect your assets.

Conclusion

Understanding what a levy on property entails is vital for property owners. It serves as a legal mechanism through which governments enforce tax collection and recover unpaid debts. We understand that the implications of such levies can be severe, leading to the confiscation of assets, including bank accounts and real estate, if obligations are not met. Recognizing the gravity of this issue is crucial for safeguarding personal finances and maintaining ownership of valuable possessions.

Throughout this article, we've shared key insights regarding the nature of levies, their purpose, and the processes involved. The increase in property taxes and subsequent levies highlights the growing financial strain on homeowners, particularly in light of rising delinquency rates. Real-world examples emphasize the importance of understanding one’s rights and options when facing potential tax seizures. By actively engaging with tax authorities and exploring available relief options, property owners can mitigate the risks associated with tax delinquency.

Ultimately, being informed about the mechanics of property levies is essential for effective financial management. We encourage property owners to take proactive steps in addressing their tax responsibilities and seeking assistance when needed. By doing so, they can protect their assets and ensure their financial stability in an ever-changing economic landscape. Understanding the nuances of levies not only empowers individuals but also contributes to a more informed and resilient community. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is a levy?

A levy is a legal tool used by government officials to confiscate assets in order to fulfill a debt, often related to unpaid taxes.

How does a levy differ from a lien?

A lien is a claim against assets to secure payment, while a levy results in the actual confiscation of belongings, such as bank accounts, wages, or tangible items.

What can happen if a taxpayer does not respond to notices about unpaid debts?

If a taxpayer does not respond, it can lead to serious repercussions, including the initiation of a levy on their property.

What is the current trend in real estate tax delinquencies in the United States?

As of 2025, real estate tax delinquencies have increased to 5.1%, up from 4.5% in 2024, largely due to rising property taxes.

What has contributed to the rise in property taxes?

Property taxes have surged by 27% since 2019, placing additional financial strain on homeowners.

Can you provide an example of the impact of a levy?

An example includes a case where the Taxpayer Advocate Service intervened for a taxpayer facing an IRS seizure of their Social Security benefits, helping them maintain access to essential funds.

Why is it important to understand one’s rights regarding levies?

Understanding one's rights is crucial as it can provide potential relief from financial burdens and help individuals navigate the challenges associated with tax delinquencies.

What should landowners do to mitigate the risks associated with tax delinquency?

Proactive communication with tax officials can be essential in reducing the risks associated with tax delinquency.