Overview

We understand that navigating tax obligations can be overwhelming. Failing to file your taxes can lead to significant financial penalties, interest accumulation, and even potential legal ramifications. This includes civil fines and, in serious cases, criminal charges for tax evasion. It's important to recognize that the IRS imposes penalties that can grow over time, which can add to your stress.

By addressing these concerns early, you can avoid severe implications. Filing your taxes is not just a legal obligation; it’s a step towards financial peace of mind. Remember, you are not alone in this journey. Many people face similar struggles, and there are resources available to help you through this process.

Taking action now can help you avoid these consequences. We're here to help you navigate your tax obligations and find the best path forward.

Introduction

Neglecting to file taxes can lead to significant consequences, impacting both your financial stability and legal standing. We understand that many individuals may feel overwhelmed by the complexities of the tax system, which can create a reluctance to submit returns. However, it’s important to recognize the repercussions of inaction. Failing to file can result in hefty penalties, interest accumulation, and even legal ramifications.

What happens when you choose to ignore your tax obligations?

How can you navigate the daunting path back to compliance?

We're here to help you understand and take the necessary steps forward.

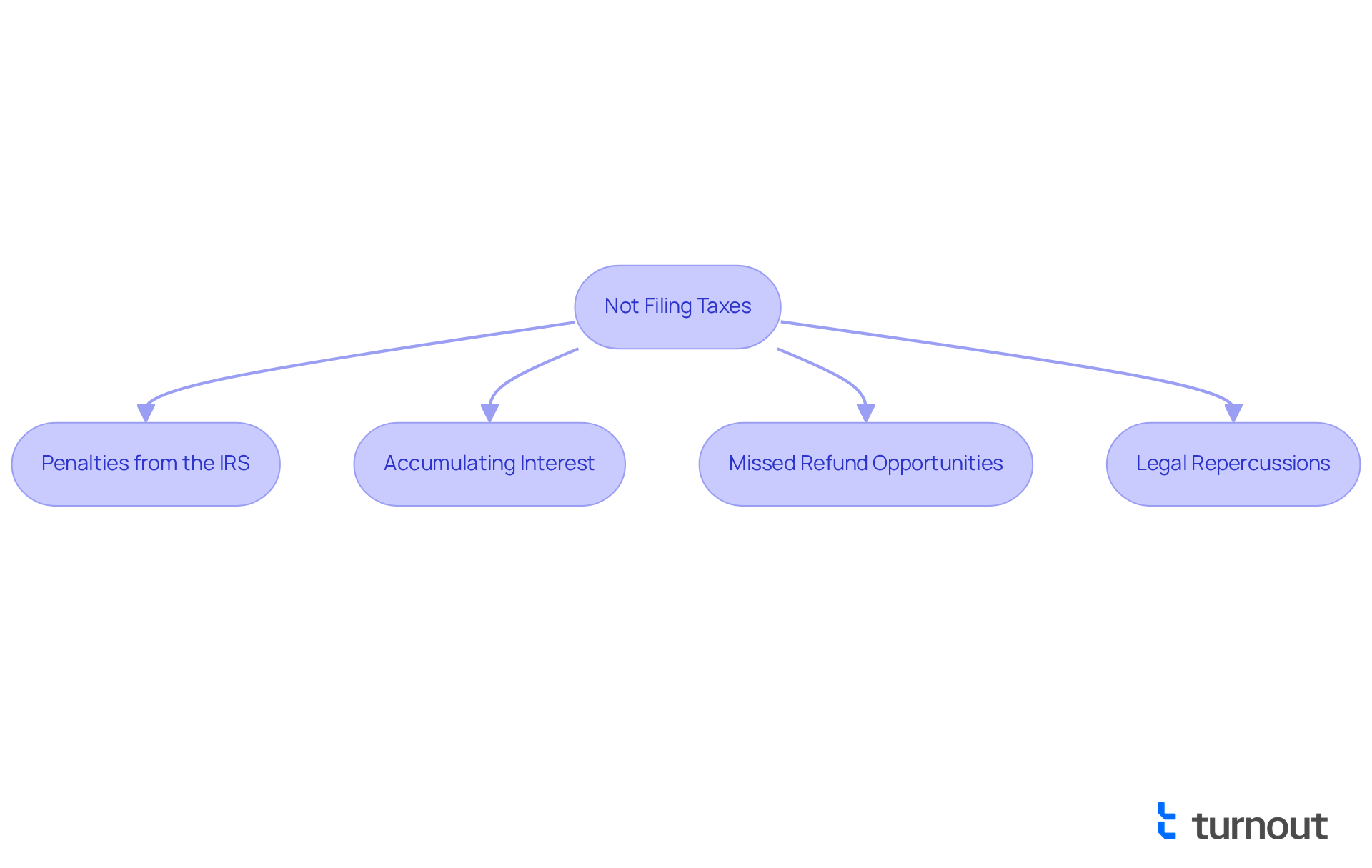

Define the Consequences of Not Filing Taxes

Not filing taxes can lead to a range of consequences, highlighting and how it impacts both your . We understand that it can be overwhelming, and many people may feel hesitant to file due to fear or confusion about the process. It's common to feel this way, but it's important to recognize what happens if you don't file your taxes, as neglecting to submit them can result in that can accumulate over time.

Moreover, it's important to understand what happens if you don't file your taxes, as you may miss out on that could help ease your financial strain. Understanding these consequences is essential. You are not alone in this journey, and . If you're feeling uncertain, consider reaching out for assistance to ensure you make informed decisions about your taxes.

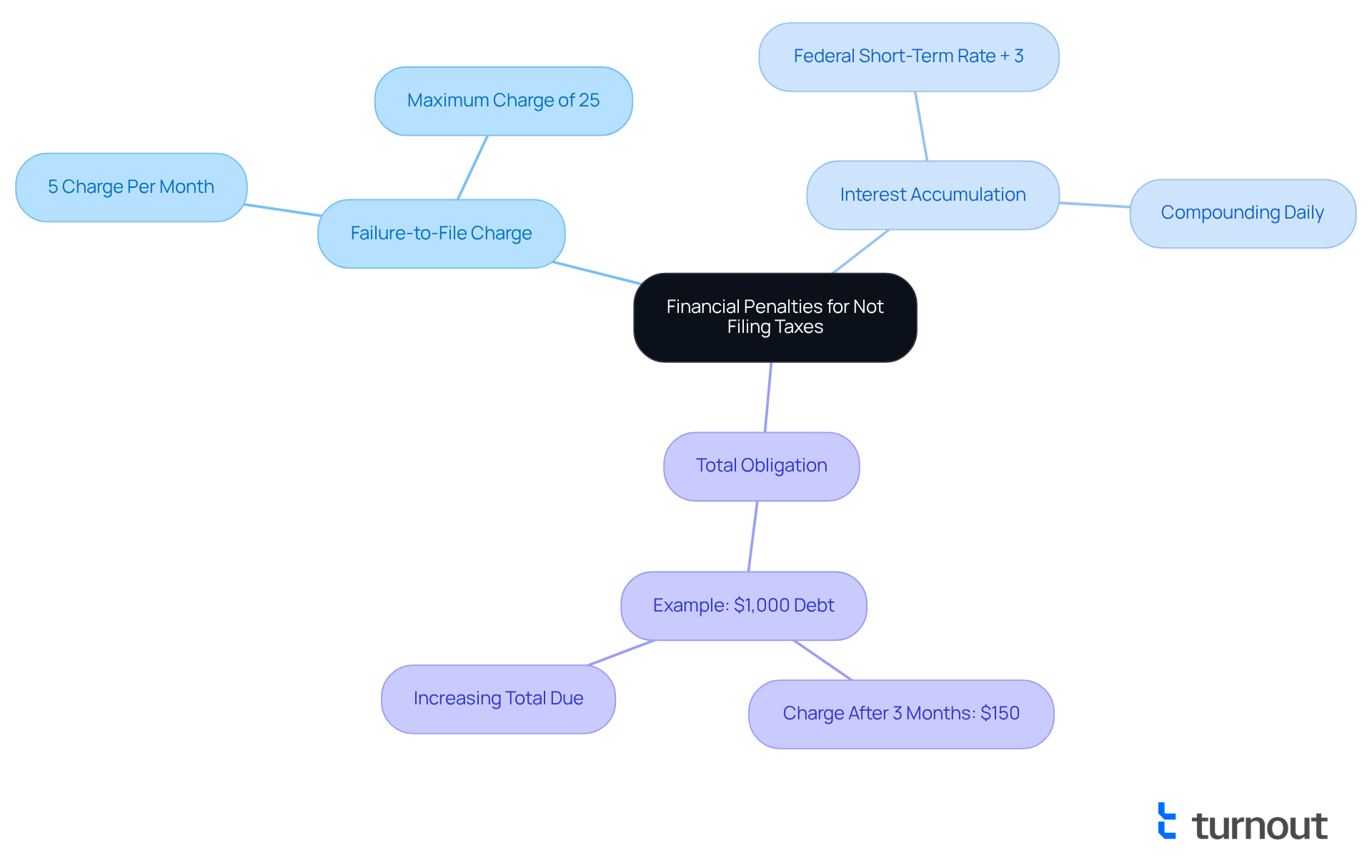

Explore Financial Penalties and Interest Accumulation

We understand that can lead to . The IRS typically enforces a of 5% of the unpaid tax for each month the return is late, leading to concerns about what happens if you don't file your taxes, up to a maximum of 25%. Additionally, interest accumulates on the unpaid balance, compounding daily at the federal short-term rate plus 3%. This means that what happens if you don't file your taxes is that the longer you delay in submitting, the more you will owe. It can lead to a that feels challenging to escape.

For instance, if you owe $1,000 in dues and submit three months past the deadline, you might face a charge of $150. Along with interest, this results in a total obligation that keeps increasing. It's common to feel anxious about these financial responsibilities, but remember, you're not alone in this journey. We're here to help you and find a way forward.

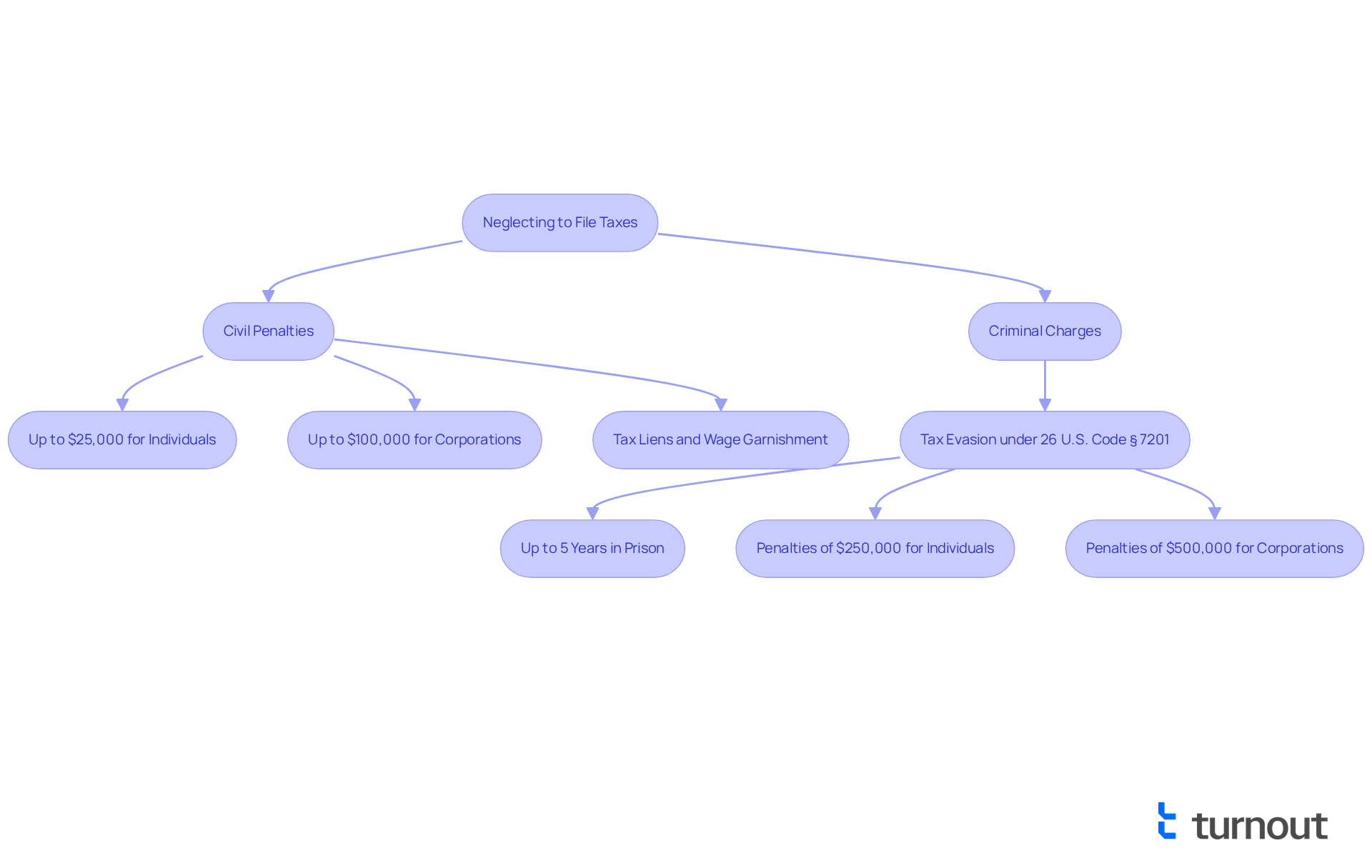

Examine Legal Ramifications and Criminal Charges

Neglecting to submit taxes can lead to , prompting concerns about , which can be overwhelming. We understand that the thought of facing civil fines or even criminal charges can be daunting. While most individuals encounter civil penalties for non-filing, it's important to recognize that may result in criminal charges for . Under 26 U.S. Code § 7201, those found guilty of tax evasion could face up to five years in prison and penalties that reach $250,000 for individuals and $500,000 for corporations.

Moreover, Title 26 USC § 7203 imposes penalties of up to $25,000 for individuals and $100,000 for companies for intentionally neglecting . The IRS can also initiate civil actions, such as imposing tax liens on property or , complicating your financial situation even further. We want to emphasize what happens if you don't file your taxes, as failing to submit your returns can result in that extend beyond .

It's important to note that you cannot be guilty of tax fraud if you genuinely believe you are not breaking the law, even if that belief may seem unreasonable. Maintaining good records is essential to demonstrate compliance and avoid appearing negligent during any investigations. If you find yourself navigating these complexities, remember that you're not alone in this journey. , like Timothy S. Hart, who specializes in innovative solutions for tax problems, can provide you with the valuable guidance you need. We're here to help you through this process.

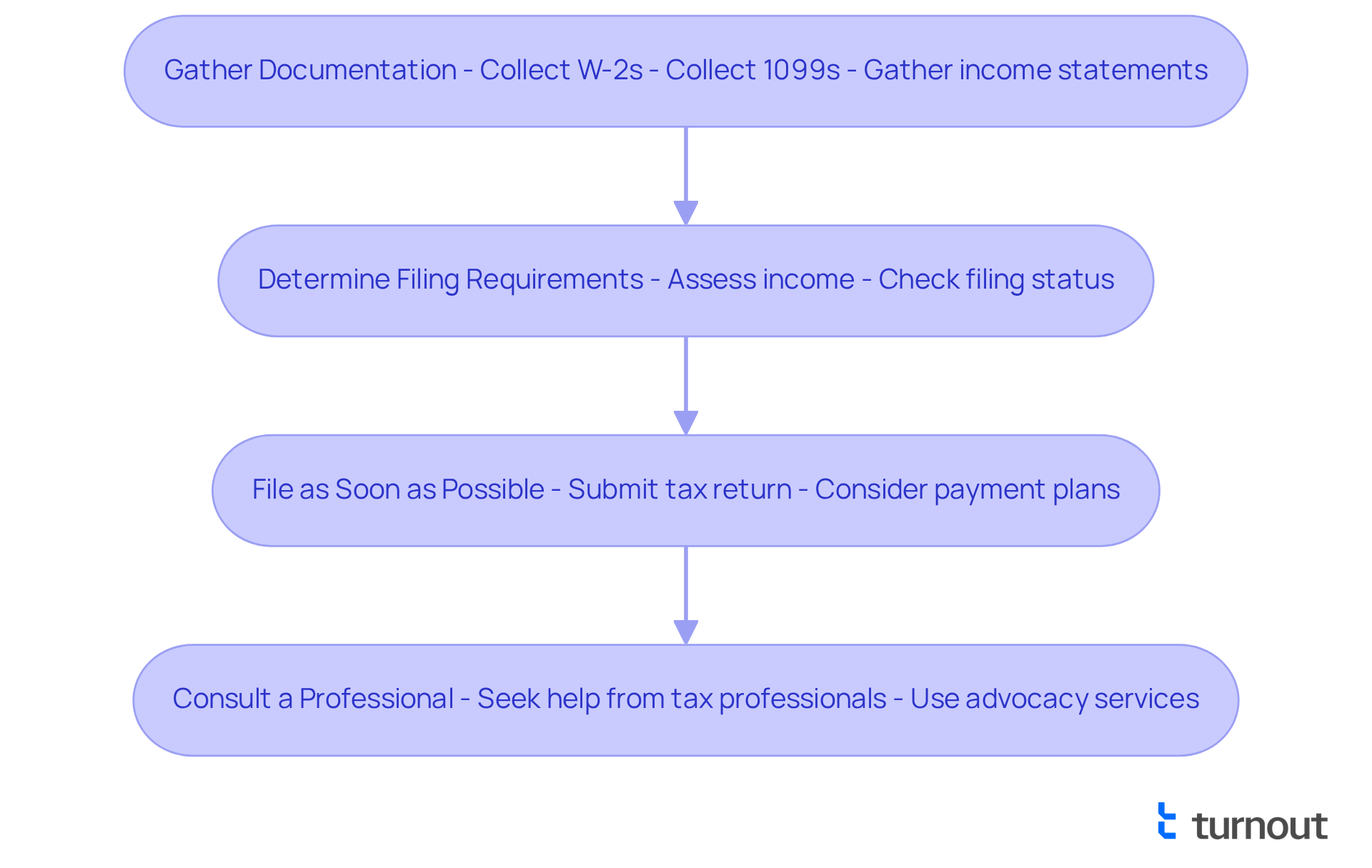

Outline Steps to Take If You Haven't Filed Taxes

If you haven't filed your taxes, we understand that what happens if you don't can be a stressful situation. It's crucial to take , such as . Here are some steps to consider:

- Gather Documentation: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine Filing Requirements: Assess whether you are required to file based on your income and filing status.

- File as Soon as Possible: Submit your tax return, even if you cannot pay the full amount owed. The IRS offers payment plans for those who need them.

- : If you're unsure about the process, consider seeking help from a tax professional or an , which can provide guidance tailored to your situation.

Taking these steps can help you regain control over what happens if you don't file your taxes. Remember, you are not alone in this journey, and we're here to help you avoid further complications.

Conclusion

Neglecting to file taxes can lead to significant repercussions that affect both your financial and legal standing. We understand that navigating tax obligations can be overwhelming, and recognizing the consequences of failing to meet these responsibilities is crucial for anyone looking to maintain their financial health and avoid legal troubles. By understanding the potential penalties, interest accumulation, and legal ramifications, you can take proactive steps to address your tax situation and mitigate the negative effects of non-filing.

This article outlines the various consequences of not filing taxes, including financial penalties imposed by the IRS, which can accumulate quickly and lead to a cycle of debt. It’s common to feel anxious about these penalties, but knowing the serious legal ramifications that may arise, such as civil fines and potential criminal charges for tax evasion, can empower you to take action. Additionally, we provide practical steps for those who have missed the filing deadline, emphasizing the importance of taking immediate action to minimize penalties and regain control over your tax situation.

Ultimately, the significance of filing taxes on time cannot be overstated. By understanding the potential consequences and taking the necessary steps to address any missed filings, you can protect yourself from escalating financial burdens and legal issues. Remember, you are not alone in this journey. Seeking assistance from tax professionals can provide valuable guidance and support, ensuring that you are equipped to navigate the complexities of your tax obligations effectively. Taking action now can pave the way for a more secure financial future.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to various penalties imposed by the IRS, which can accumulate over time and negatively impact your financial and legal standing.

How does failing to file taxes impact financial opportunities?

By not filing your taxes, you may miss out on valuable opportunities for refunds or credits that could alleviate financial strain.

Why might people hesitate to file their taxes?

Many people may feel overwhelmed, fearful, or confused about the tax filing process, which can lead to hesitation in submitting their taxes.

What should someone do if they feel uncertain about filing their taxes?

If you're feeling uncertain, it's advisable to reach out for assistance to ensure you make informed decisions about your taxes.