Overview

We understand that navigating tax season can be overwhelming, especially when it comes to filing your taxes. Failing to file, even when you owe nothing, can lead to penalties and complications with the IRS. It's common to feel anxious about the potential risks, including audits or identity theft. Did you know that penalties can start at $210 for late submissions? It's crucial to file on time to avoid these issues.

Moreover, by filing your taxes, you open the door to potential refunds and beneficial tax credits that you might miss out on otherwise. Maintaining a clear financial record is essential for your peace of mind. Remember, you are not alone in this journey; we're here to help you navigate these challenges with confidence. Take action today to ensure your financial well-being.

Introduction

Neglecting to file taxes, even when you owe nothing, can lead to unexpected and often severe consequences. We understand that many individuals mistakenly believe that if they have no tax liability, there is no need to file. However, this misconception can result in penalties, lost opportunities for refunds, and even complications with the IRS.

What happens when taxpayers choose to skip filing despite having no dues? It's common to feel uncertain about the implications, which can extend beyond mere fines. These concerns raise critical questions about your financial health and compliance that merit exploration.

You're not alone in this journey. Many face similar dilemmas, and it's essential to recognize the importance of filing, even when it seems unnecessary. By taking the time to understand the potential consequences, you can make informed decisions that protect your financial future. Remember, we're here to help you navigate this process with confidence.

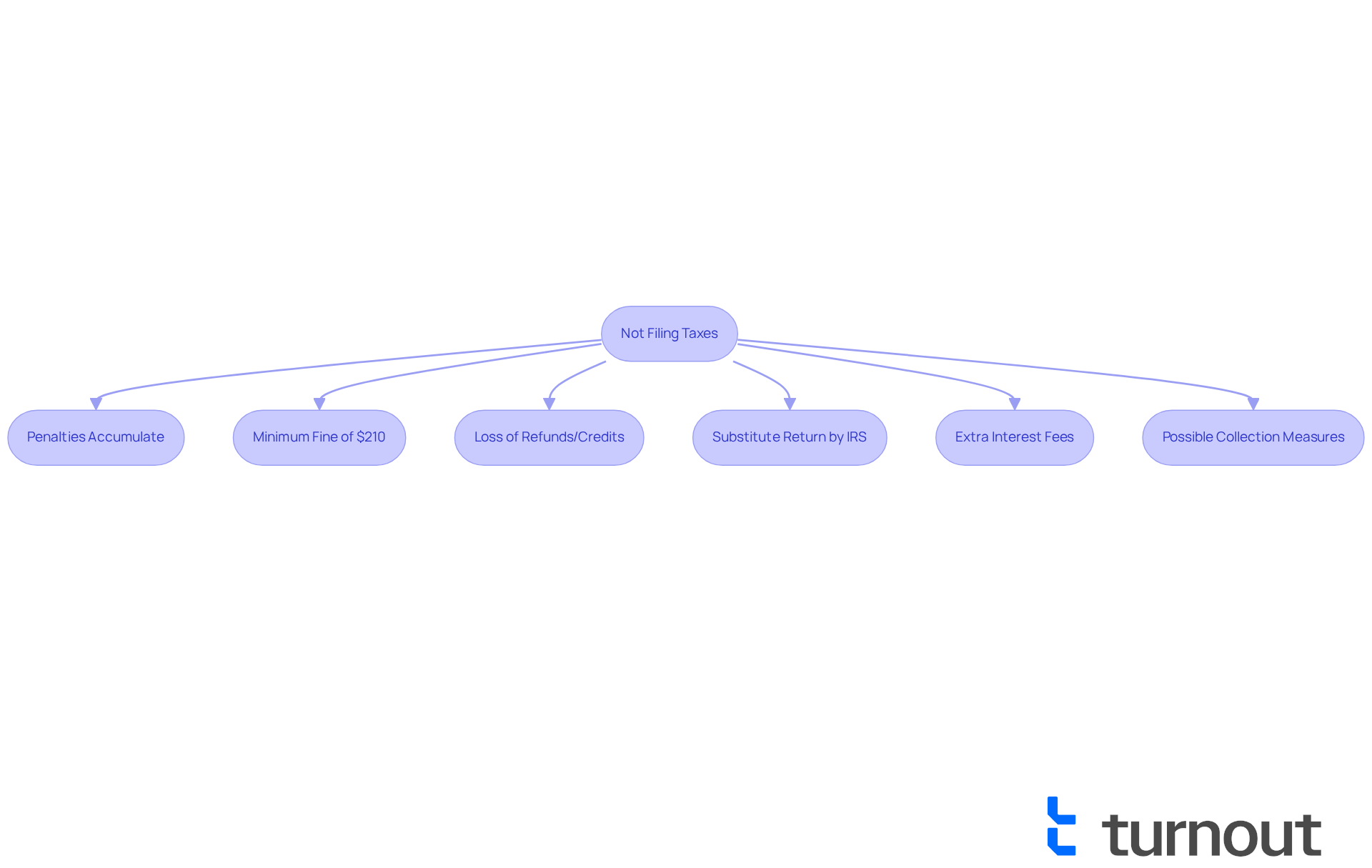

Define the Consequences of Not Filing Taxes

Neglecting to submit taxes can lead to , which raises the question of but don't owe anything. We understand that tax matters can be overwhelming, and the Internal Revenue Service (IRS) imposes , which can accumulate rapidly. Specifically, the penalty is 5% of the unpaid tax for each month the return is late, capping at 25%.

It's common to feel anxious about this, but it's important to understand what happens if you don't file your taxes but don't owe anything; a taxpayer may still encounter a minimum fine of $210 if the return is submitted more than 60 days overdue. This minimum penalty applies only if the return is filed late.

Additionally, individuals may forfeit that could have been claimed had they filed on time. We want to remind you that the on behalf of the taxpayer, which often overlooks available deductions or credits. This can lead to a higher tax liability than necessary, which can be frustrating.

Moreover, penalties can result in extra interest fees and possible collection measures. This highlights the significance of prompt submission, as the repercussions can go beyond simple penalties to . Remember, you are not alone in this journey, and .

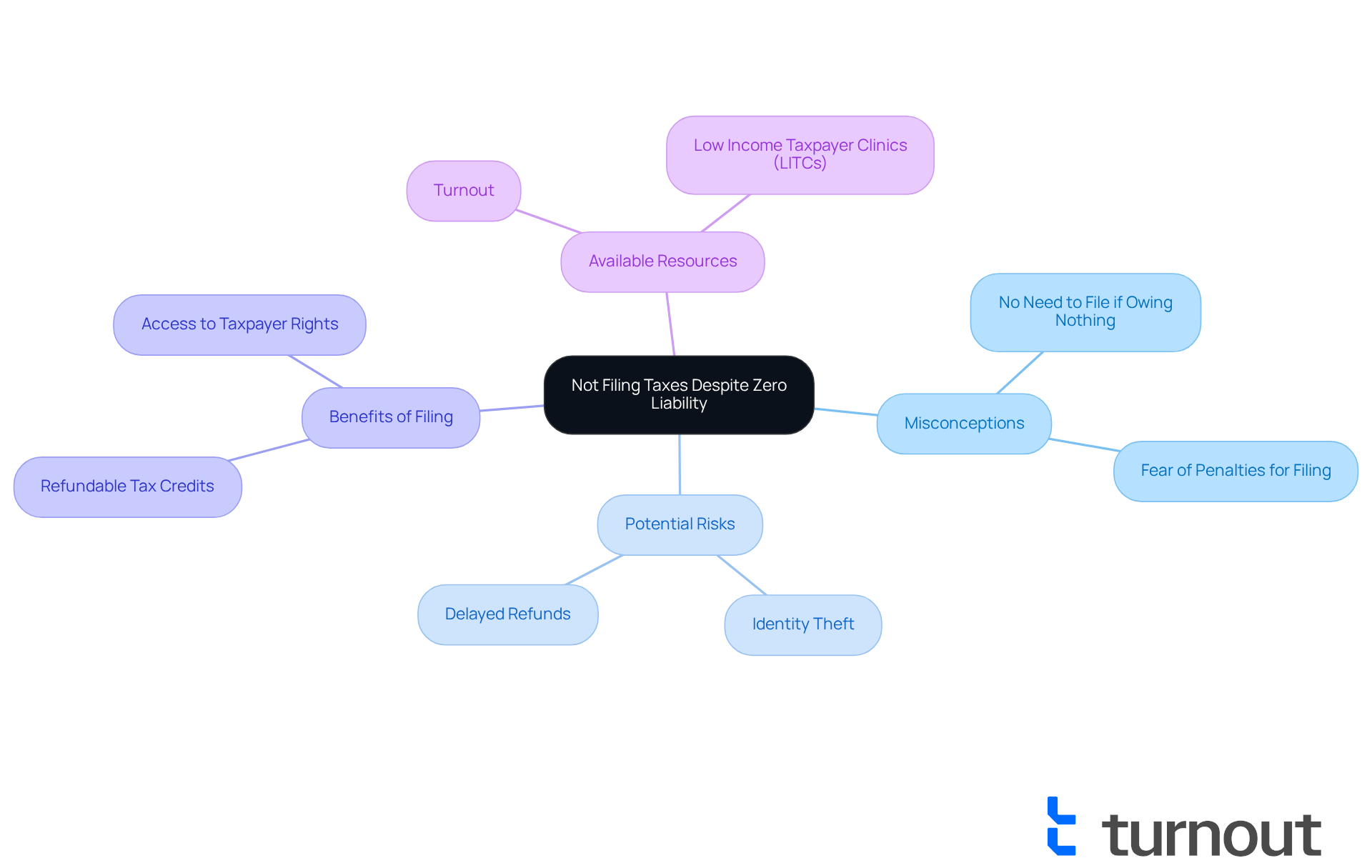

Explore Reasons for Not Filing Taxes Despite Zero Liability

Many individuals wonder , even when they have no obligation to do so. Often, this stems from misunderstandings about the process. It's a common belief regarding what happens if you don't file your taxes but don't owe anything, suggesting that there’s no need to file. This misconception results in a —31.4% in 2022—who do not submit their returns, leading to confusion about what happens if you don't file your taxes but don't owe anything. We understand that the complexity of the tax system can feel overwhelming, and many may not be aware of or refunds.

Additionally, some people mistakenly fear penalties for submitting a return when they are uncertain about what happens if you don't file your taxes but don't owe anything. This fear can create a cycle of avoidance that ultimately harms their financial situation. , where someone else may use their Social Security number to file a fraudulent return. This can delay legitimate refunds while the IRS investigates. It’s crucial to recognize the , even when it seems like there’s nothing owed.

As we approach 2025 and discussions about tax policy evolve, it is vital for citizens to understand their rights, including those outlined in the . Submitting returns on time can help prevent potential complications. offers access to tools and services designed to assist consumers in navigating these complexities, including help with (SSD) claims and .

It’s important to note that Turnout is not a law firm and does not provide legal advice. We work with trained nonlawyer advocates and IRS-licensed enrolled agents to support clients in their processes. Resources like Low Income Taxpayer Clinics (LITCs) can be invaluable for those facing challenges in the tax system, ensuring they receive the support they need to make informed decisions. Remember, you are not alone in this journey—we’re here to help.

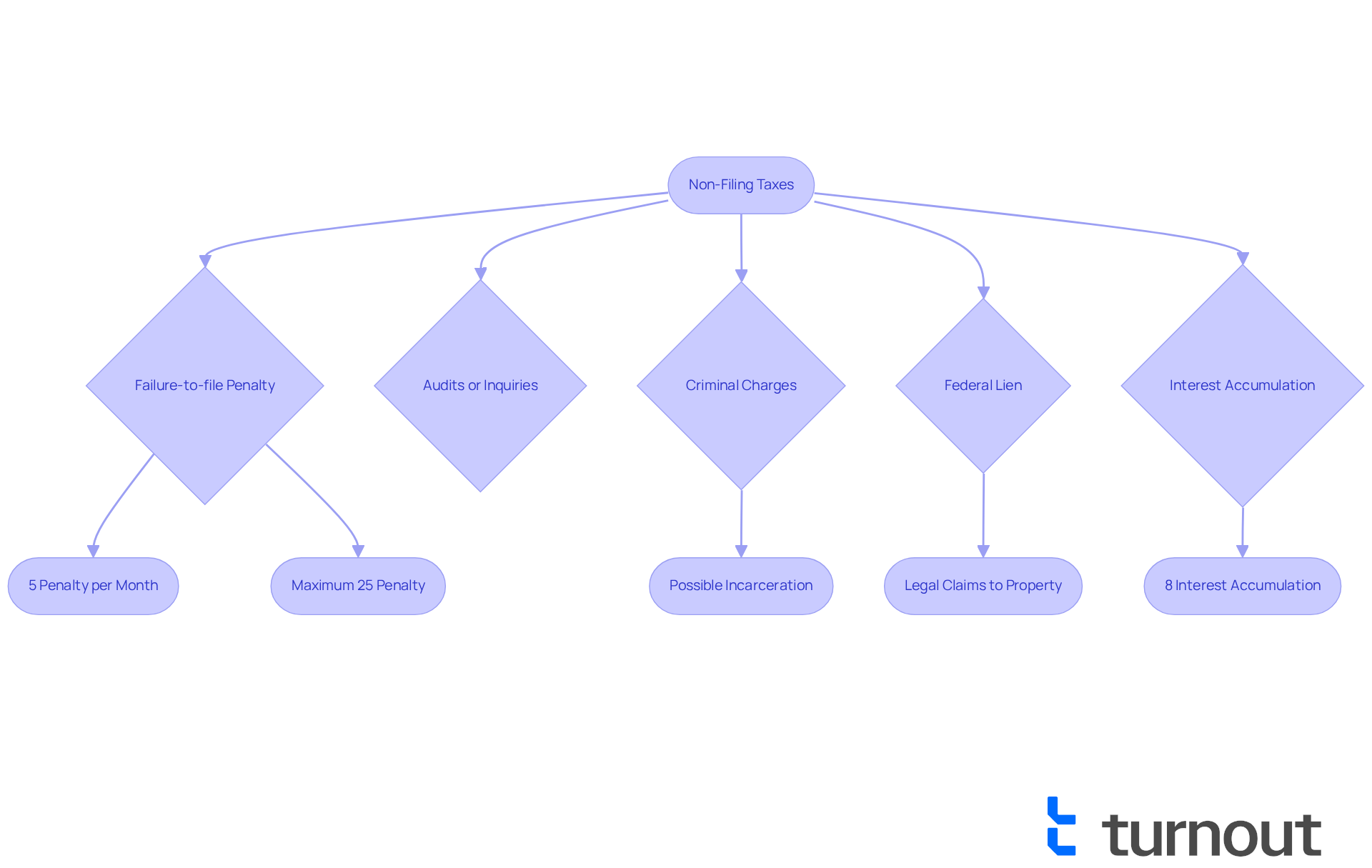

Outline Legal and Financial Risks of Non-Filing

We understand that can be daunting, and the legal and financial risks of not submitting required forms can be substantial. Even if you believe you do not owe fees, it's important to know , as you may still face a . This penalty starts at 5% of unpaid amounts for each month the return is overdue, reaching a maximum of 25%. Over time, this can significantly increase your total tax bill.

Moreover, neglecting to submit your forms can lead to audits or inquiries, which raises the question of what happens if you don't file your taxes but don't owe anything, especially if the . It's common to feel overwhelmed, but staying proactive can help you avoid these situations. Additionally, understanding what happens if you don't file your taxes but don't owe anything is important, as it can lead to and refunds that adversely affect your financial well-being.

In more severe cases, continuous non-filing can result in criminal charges for evasion of financial obligations. This typically involves deliberate efforts to avoid payments, which can lead to penalties that include . For instance, if amounts owed exceed $10,000 and no payment plan is established, the IRS may file a federal lien. This gives them legal rights to your property and allows actions such as freezing bank accounts or garnishing wages.

Furthermore, it's crucial to remember that begins accumulating at a yearly rate of 8% on April 15th, compounded daily. Understanding these consequences is vital for maintaining your and avoiding complications with the IRS.

You are not alone in this journey. Taxpayers can explore various options, such as applying for extensions and payment plans, which can help reduce some of the risks related to non-submission. We're here to help you navigate these challenges with confidence.

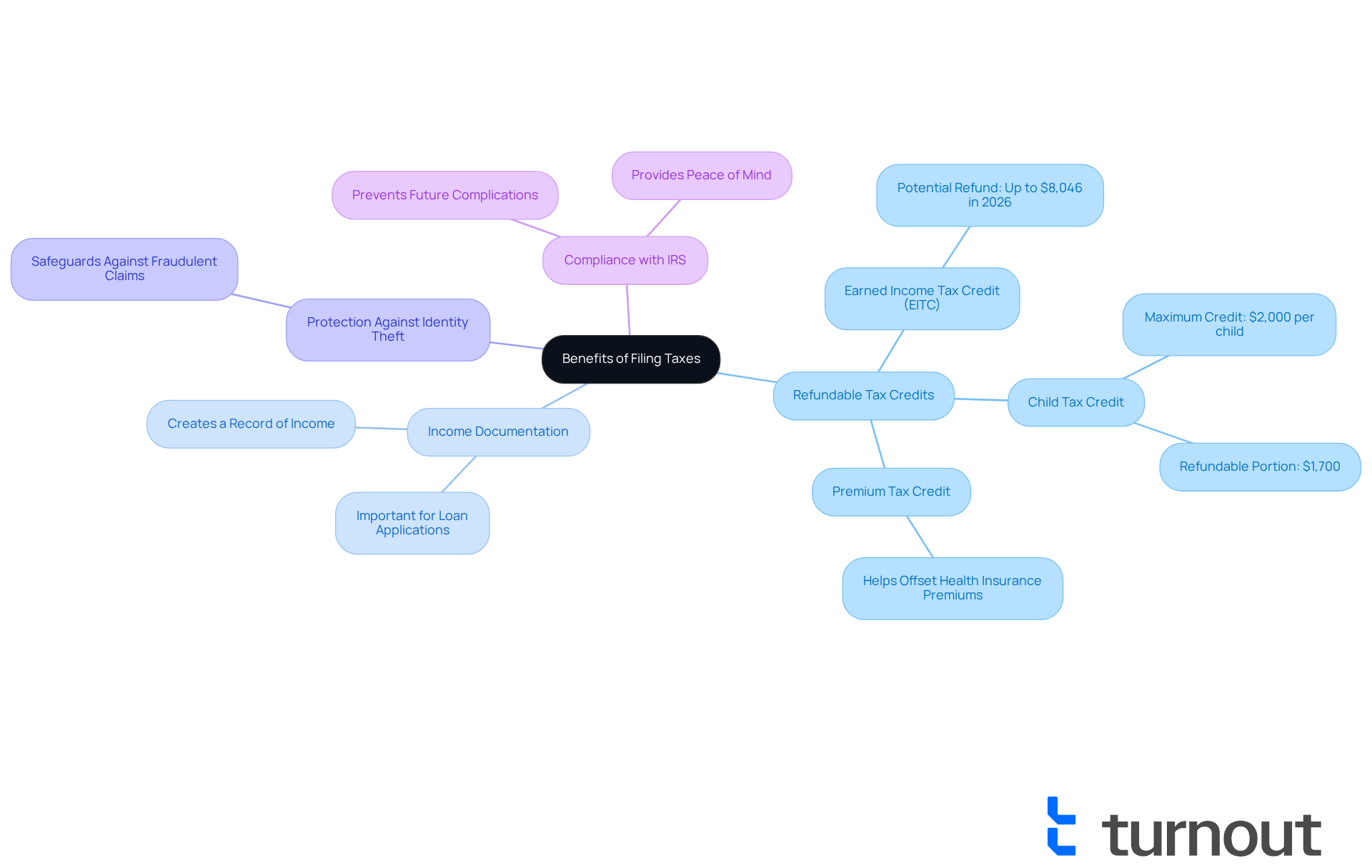

Discuss Benefits of Filing Taxes Regardless of Owed Amount

Filing taxes, even when you owe nothing, can open the door to numerous benefits, and . Have you considered that you might qualify for like the Earned Income Tax Credit (EITC)? This credit could lead to a cash refund of up to $8,046 in 2026, depending on your tax status and income. That's a significant financial opportunity for those who qualify.

Moreover, submitting a tax return creates an important record of your income. This documentation can be incredibly beneficial when you apply for loans or mortgages down the line. It also acts as a safeguard against identity theft, ensuring that no one else can fraudulently claim a refund in your name.

We understand that tax regulations can be overwhelming, but maintaining compliance helps prevent future complications with the IRS, providing peace of mind. By submitting your information, you not only protect your interests but also position yourself to , including:

- The child tax credit

- The premium tax credit

These credits can significantly enhance your overall financial well-being.

Neglecting to raises concerns about what happens if you don't file your taxes but don't owe anything, as it can mean missing out on valuable credits and potentially facing . It's essential to understand what happens if you don't file your taxes but don't owe anything, even when no taxes are due. Remember, you are not alone in this journey. Turnout is dedicated to simplifying this process for you, guiding you through the complexities of tax filing, and ensuring you can access the benefits you deserve, including assistance with and SSD claims.

Conclusion

Neglecting to file taxes, even when no amount is owed, can lead to a cascade of unintended consequences that many may not fully grasp. We understand that the importance of timely submission cannot be overstated. The penalties for non-filing can accumulate quickly, resulting in financial burdens that extend beyond mere fines. Understanding the ramifications of this decision is crucial for maintaining your financial health and ensuring compliance with tax regulations.

Throughout this article, we’ve highlighted the risks associated with non-filing, including:

- Potential penalties

- Loss of refunds or credits

- Exposure to identity theft

It's common to feel overwhelmed by misconceptions that lead many individuals to avoid filing altogether, often out of fear or misunderstanding. By recognizing the benefits of filing, such as eligibility for refundable tax credits and creating a documented income history, you can better navigate your financial landscape.

Ultimately, the message is clear: filing taxes, regardless of whether you owe anything, is an essential step in safeguarding your personal finances and accessing potential benefits. Taking action now not only helps prevent future complications with the IRS but also opens doors to financial opportunities that can enhance your overall well-being. Embracing the process of tax filing can lead to peace of mind and a more secure financial future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to significant penalties imposed by the IRS, which can accumulate rapidly. The penalty is 5% of the unpaid tax for each month the return is late, capping at 25%.

What happens if I don't file my taxes but don't owe anything?

Even if you don't owe taxes, you may still face a minimum penalty of $210 if your return is submitted more than 60 days overdue. This penalty applies only if the return is filed late.

Can I lose out on refunds or credits by not filing on time?

Yes, by not filing your taxes on time, you may forfeit potential refunds or credits that could have been claimed had you filed on time.

What does the IRS do if I don't file my taxes?

The IRS may submit a substitute return on your behalf, which often overlooks available deductions or credits, potentially leading to a higher tax liability than necessary.

Are there additional costs associated with not filing taxes?

Yes, penalties for not filing can result in extra interest fees and possible collection measures, impacting your overall financial well-being.

How can I avoid the consequences of not filing taxes?

The best way to avoid these consequences is to submit your tax return on time, even if you believe you do not owe any taxes.