Overview

This article delves into the history and significance of Cost-of-Living Adjustments (COLA) in Social Security, recognizing the vital role they play in protecting beneficiaries from the challenges posed by inflation. We understand that many individuals, especially seniors and those with disabilities, face rising living costs that can strain their budgets. Since their introduction in 1975, COLA has evolved to help maintain purchasing power, calculated based on the Consumer Price Index.

It's common to feel concerned about whether these adjustments are adequate in today’s economic climate. The ongoing debates surrounding COLA reflect the shared worries of many who depend on Social Security for their livelihoods. We’re here to help you navigate these complexities and understand how COLA impacts your financial well-being.

As we explore this important topic, remember that you are not alone in this journey. Together, we can advocate for fair adjustments that truly reflect the cost of living. Your voice matters, and understanding COLA is a step towards ensuring a more secure future.

Introduction

Understanding the evolution of Cost-of-Living Adjustments (COLA) in Social Security is essential for grasping how these changes impact the financial stability of millions. We recognize that as inflation continues to rise, the adjustments made to Social Security benefits serve as a crucial lifeline. These adjustments ensure that individuals can maintain their purchasing power amidst escalating costs.

However, it's common to feel uncertain about whether these adjustments truly reflect the unique financial challenges faced by seniors and individuals with disabilities. This article delves into the historical context, calculation methods, and ongoing debates surrounding COLA, revealing the complexities and implications of these vital adjustments.

We're here to help you navigate this important topic.

Define Cost-of-Living Adjustments (COLA) in Social Security

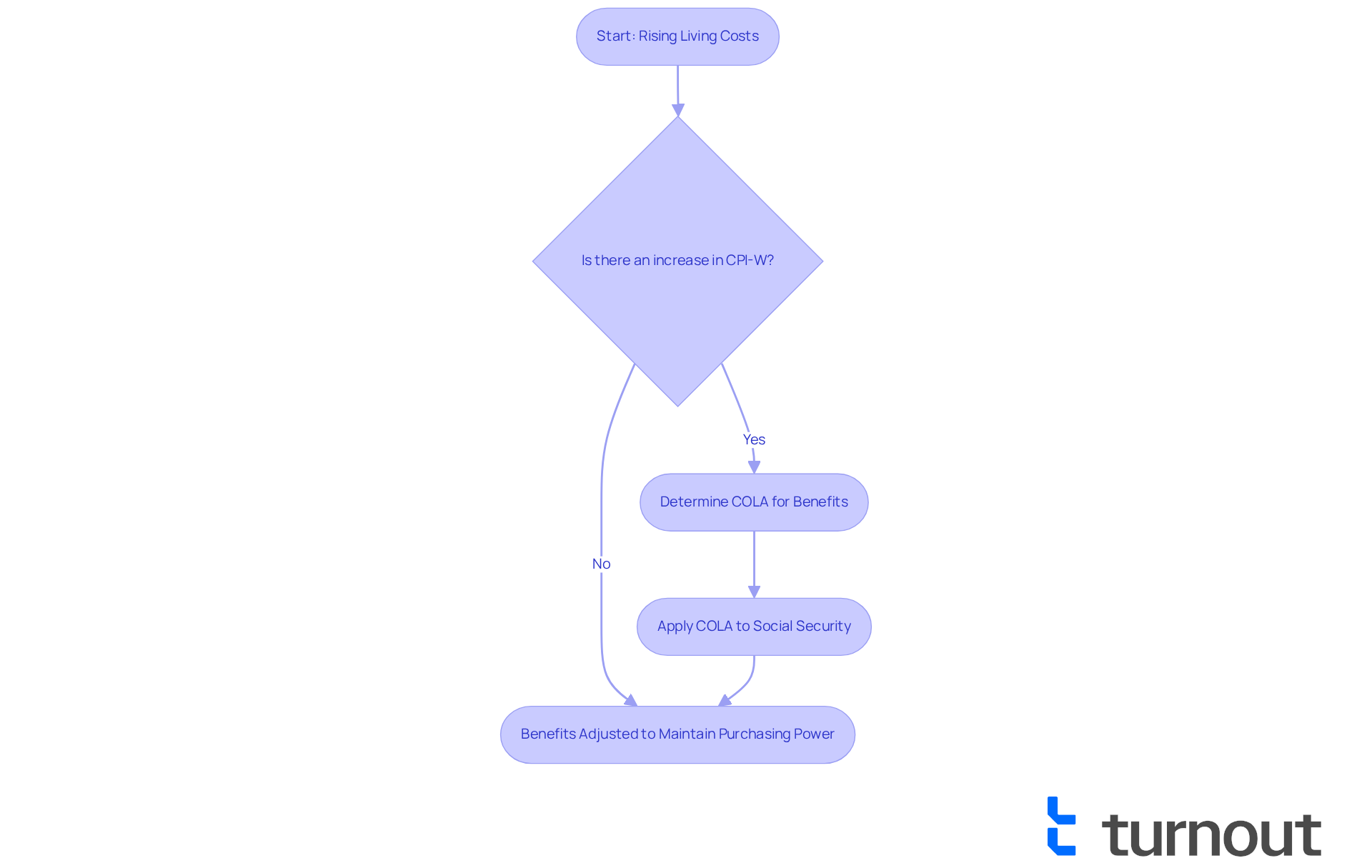

Cost-of-Living Adjustments (COLAs) represent the annual increases in Social Assistance benefits designed to help alleviate the burden of inflation. We understand that rising living costs can create significant stress. These adjustments are determined by the changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), ensuring that benefits keep pace with economic realities.

The primary goal of these adjustments is to protect your purchasing power, so you can maintain your quality of life despite increasing expenses. The history of social security COLA indicates that since 1975, COLAs have been automatically applied to Social Insurance benefits, providing a reliable way to adapt payments in response to economic shifts. You are not alone in this journey; we’re here to help you navigate these changes and ensure you receive the support you need.

Trace the Historical Development of COLA in Social Security

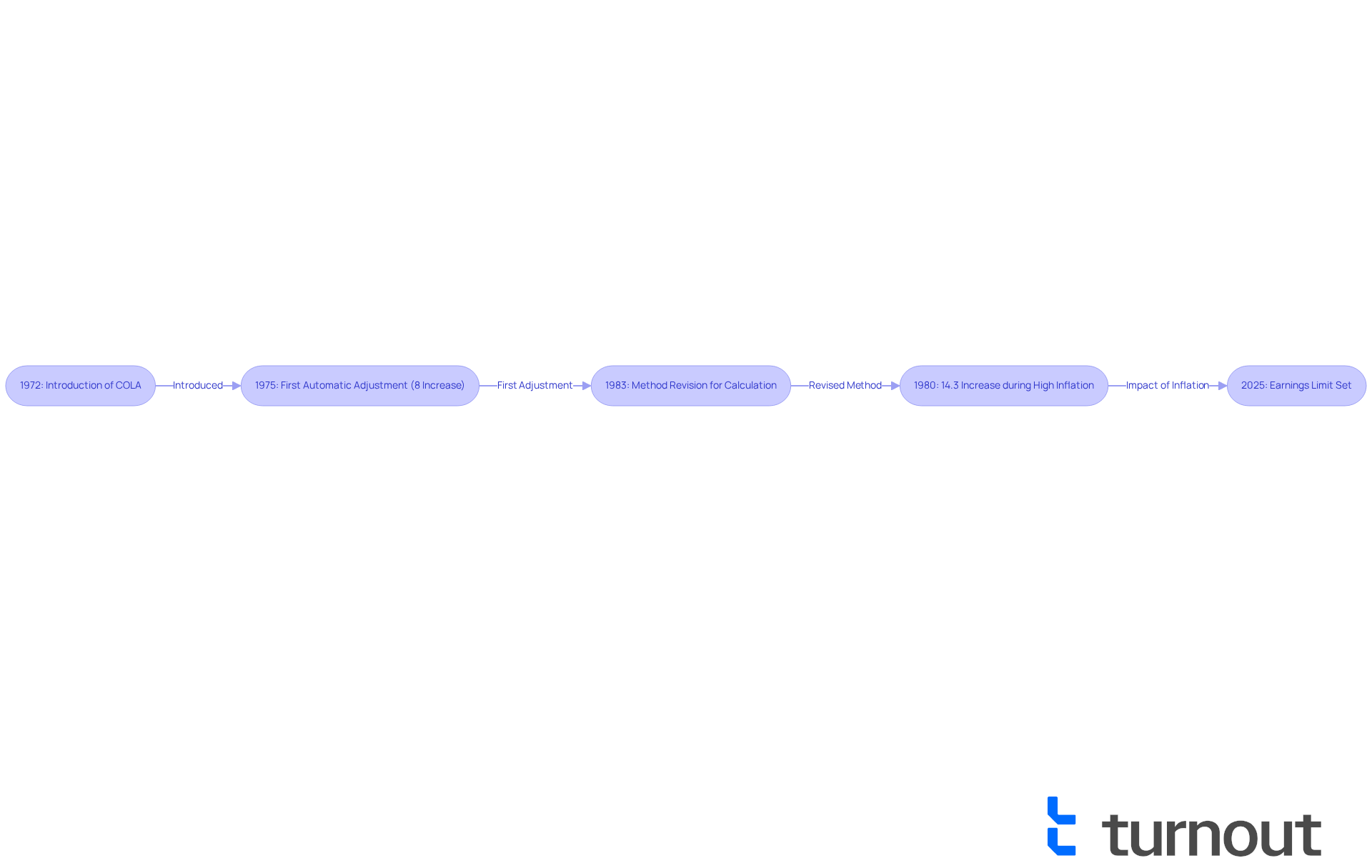

The introduction of Cost-of-Living Adjustments in the 1972 Social Security Amendments represents a pivotal moment in the history of social security cola, aimed at safeguarding beneficiaries against inflation. We understand that this can be a complex topic, and it’s important to recognize the changes that have occurred over time. The initial automatic cost-of-living adjustment was introduced in 1975, leading to an 8% rise in benefits. At first, these modifications were determined using the inflation rate from the second quarter of the prior year. However, this method was revised in 1983 to utilize the third quarter inflation rate, a practice that continues today.

Throughout the decades, cost-of-living modifications have fluctuated greatly, with notable surges during times of high inflation. For instance, the extraordinary 14.3% increase in 1980 was significant for many. In 2025, for those under full retirement age, the earnings limit is set at $23,400, with a deduction of $1 for every $2 earned over this limit. This can impact beneficiaries' financial planning, and we want you to be aware of how these adjustments may affect your situation.

Additionally, it’s crucial for beneficiaries to report any changes in their earnings or life circumstances to maintain eligibility for benefits. We recognize that grasping the history of social security cola is essential for understanding the ongoing debates about how cost-of-living adjustments reflect the inflationary pressures faced by beneficiaries, particularly as economic conditions evolve.

The recently created cost-of-living adjustment notice, which clarifies details for beneficiaries, further highlights the significance of remaining aware of these changes. Remember, you are not alone in this journey; we’re here to help you navigate these important adjustments.

Explain How COLA is Calculated and Its Impact on Benefits

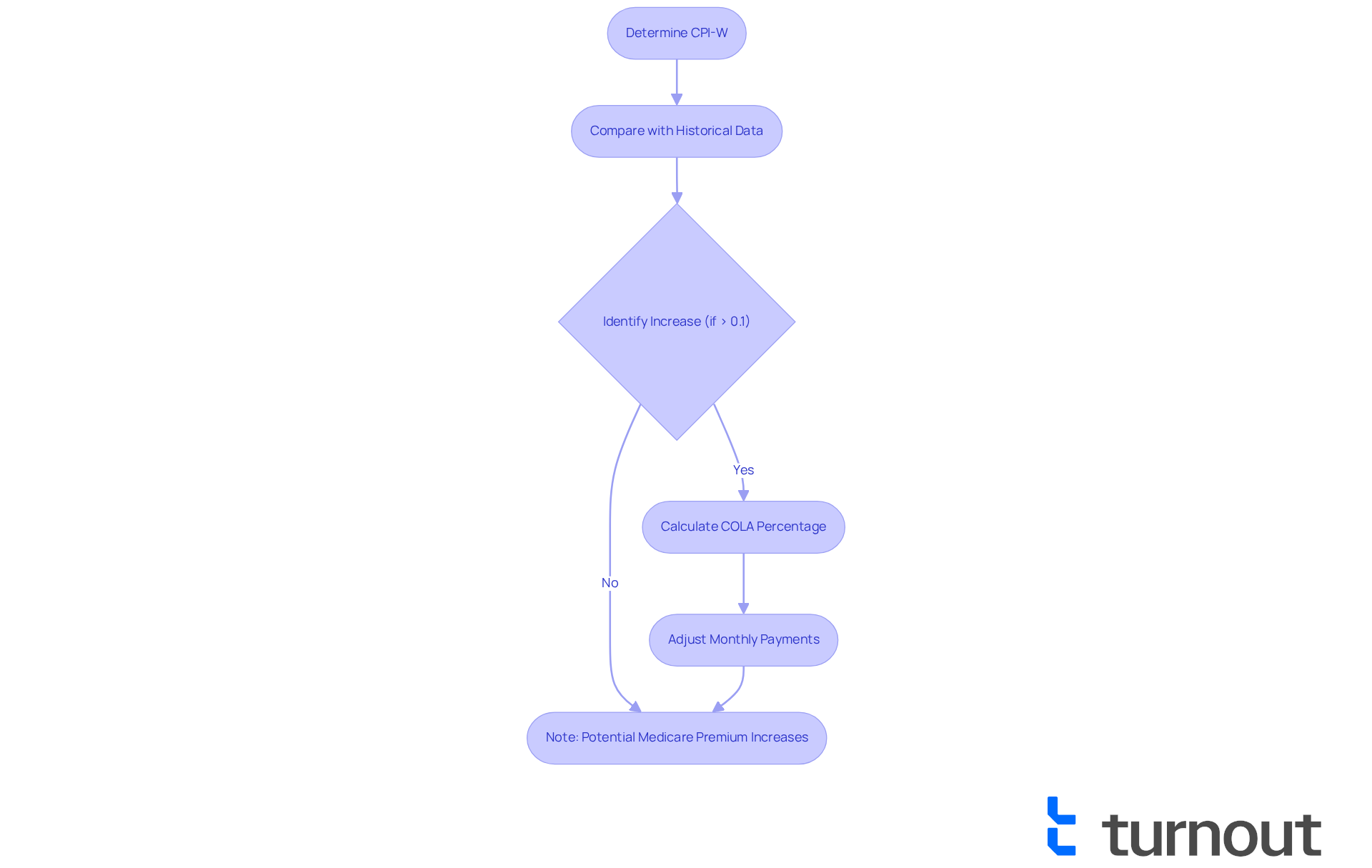

The Cost-of-Living Adjustment (COLA) is determined by comparing the average Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter of the current year with the history of social security cola from the previous year. We understand that many individuals rely on these adjustments for their financial stability. If the CPI-W indicates a rise of more than 0.1%, a cost-of-living adjustment is implemented, which is part of the history of social security cola. For 2025, the COLA is established at 2.5%, resulting in an increase in monthly payments for beneficiaries. This modification is vital for preserving the purchasing power of benefits, especially for seniors and individuals with disabilities who depend on these payments for essential living expenses, reflecting the history of social security cola.

For instance, a 2.5% rise on a monthly benefit of $1,800 leads to an extra $45 each month. This increase can greatly assist those who rely entirely on Social Security for their financial well-being. Economists highlight that modifications related to the history of social security cola are essential for maintaining quality of life in the face of rising expenses. One expert remarked, "This 2.5% cost-of-living increase is important for beneficiaries who rely on Social Security income."

It's important to note that this rise is the smallest in the last three years, underscoring its significance in the current economic climate. Moreover, beneficiaries should be aware that potential increases in Medicare premiums could offset some of the benefits from the cost-of-living adjustment. Real-life examples illustrate this: for a person receiving $2,000 per month in SSDI benefits, their payment could increase to $2,100 or more in 2025. This provides much-needed relief as living expenses continue to rise. Remember, you are not alone in this journey; we’re here to help you navigate these changes.

Discuss Controversies and Debates Surrounding COLA Adjustments

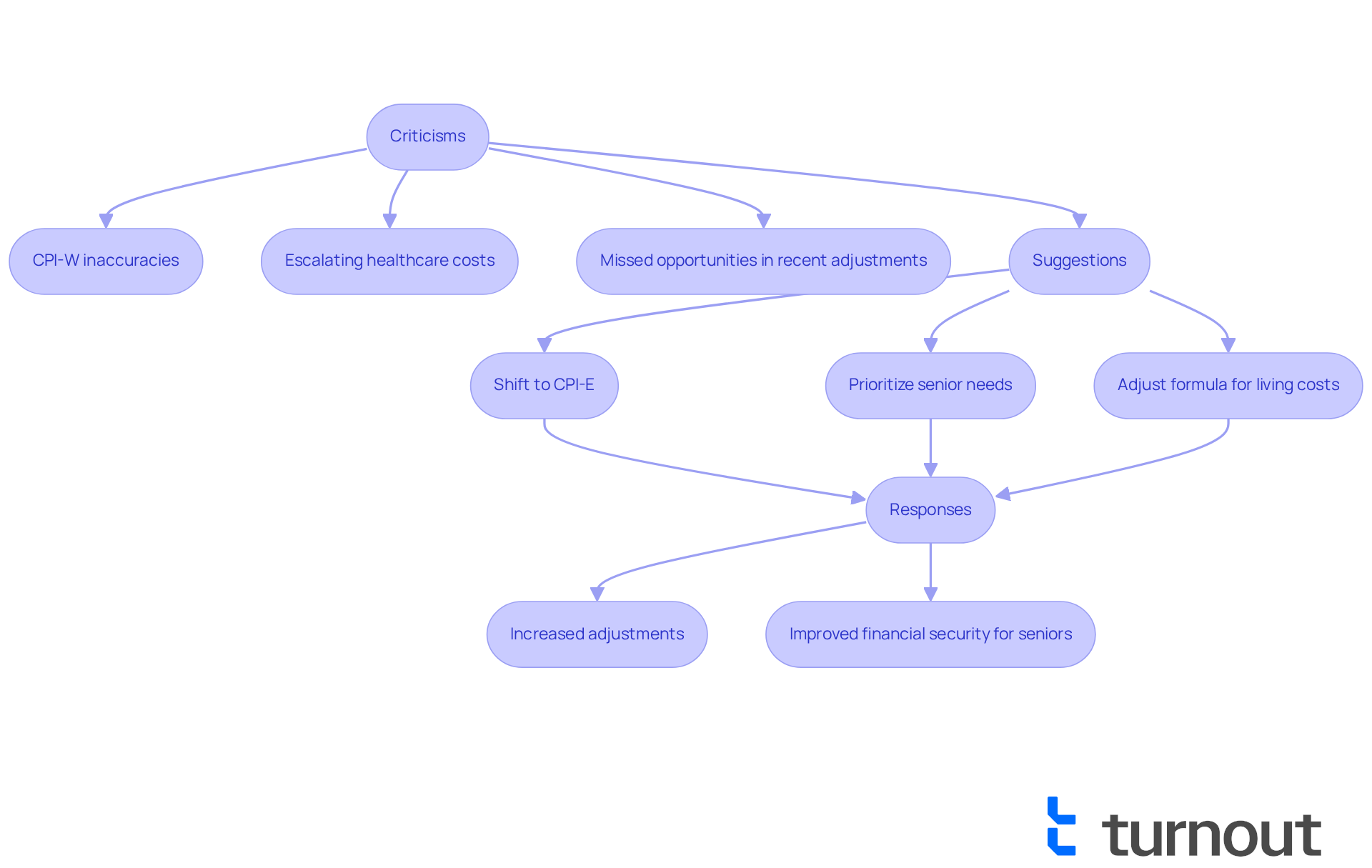

The execution of COLA modifications has ignited considerable discussion about the history of social security cola, and we understand that this topic is deeply important to many. Critics argue that the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) fails to accurately capture the spending patterns of seniors and individuals with disabilities, leading to adjustments that do not keep pace with their actual living costs. It's common to feel concerned about this, especially as healthcare expenses often escalate more rapidly than general inflation, posing a significant concern for many beneficiaries. For instance, from March 2021 to March 2022, the Senior Citizens League noted significant rises in essential expenses, such as home heating oil (79%) and gasoline (51%).

Suggestions to alter the formula for determining [cost-of-living adjustments in the history of social security cola](https://crr.bc.edu/social-securitys-cola-lets-not-mess-with-the-index) have surfaced. Supporters emphasize that any modifications must prioritize the needs of individuals who rely on [Social Security benefits](https://myturnout.com), reflecting the history of social security cola in their livelihood. The call for a shift to the Consumer Price Index for Elderly Consumers (CPI-E) is gaining traction, as many believe it aligns more closely with the history of social security cola and the financial realities faced by older Americans. Transitioning to the CPI-E is expected to raise the average cost-of-living adjustment by 0.2 percentage points, offering essential support for seniors. In fact, a significant majority of seniors have expressed concern that their retirement income will not cover essential expenses, highlighting the urgency of this issue. Furthermore, 67% of seniors depend on Social Security for more than half their income, emphasizing the critical need for sufficient cost-of-living increases.

The recent 2.5% cost-of-living increase for 2025 has faced criticism from senior advocacy organizations, who described it as a 'missed chance' to adequately assist retirees grappling with escalating expenses. This ongoing debate underscores the necessity for beneficiaries to remain informed about the history of social security cola and any potential legislative changes that could significantly impact future COLA adjustments. As advocates continue to push for reforms, the conversation around the adequacy of the CPI-W remains vital in ensuring that Social Security benefits truly meet the needs of those they are intended to support. Together, we can advocate for changes that will better serve our seniors and ensure their financial security.

Conclusion

Understanding the history and mechanics of Cost-of-Living Adjustments (COLA) in Social Security is crucial for beneficiaries navigating the complexities of financial stability. These adjustments act as a safeguard against inflation, helping individuals maintain their purchasing power as living costs rise. Since their introduction in 1975, COLAs have evolved, reflecting the economic realities faced by seniors and individuals with disabilities. It is clear that ongoing attention to these adjustments is essential.

Key insights from the article reveal the historical development of COLA, the methodology behind its calculation, and the ongoing debates surrounding its adequacy. The fluctuations in COLA rates, especially during periods of high inflation, highlight the importance of these adjustments for maintaining a standard of living. Moreover, discussions about the potential shift to the Consumer Price Index for Elderly Consumers (CPI-E) indicate a growing concern that current measures may not fully address the unique financial challenges faced by older Americans.

As the conversation about Social Security COLA adjustments continues, it's vital for beneficiaries to stay informed and engaged. We understand that advocating for changes that better reflect the realities of living costs can lead to more meaningful support for those who rely on these benefits. By grasping the history and implications of COLA, individuals can navigate their financial futures more effectively and contribute to discussions that shape the policies affecting their lives. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are Cost-of-Living Adjustments (COLA) in Social Security?

Cost-of-Living Adjustments (COLAs) are annual increases in Social Assistance benefits designed to help alleviate the burden of inflation and ensure that benefits keep pace with rising living costs.

How are COLAs determined?

COLAs are determined by changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which reflects economic realities and helps protect purchasing power.

What is the main goal of COLAs?

The primary goal of COLAs is to protect your purchasing power, allowing you to maintain your quality of life despite increasing expenses.

When did automatic COLAs begin for Social Security benefits?

Automatic COLAs have been applied to Social Insurance benefits since 1975, providing a reliable way to adjust payments in response to economic shifts.

How do COLAs help individuals?

COLAs help individuals by ensuring that their Social Assistance benefits increase in line with inflation, reducing the stress of rising living costs and supporting their financial stability.