Overview

Navigating the world of Social Security Disability Insurance (SSDI) can be challenging, especially when you're facing the emotional weight of a disability. The amount of SSDI benefits you may receive is influenced by several factors, including your work history, earnings, and the severity of your condition. Understanding these elements is crucial, as specific eligibility requirements and calculations ultimately determine the final benefit amount.

At the heart of SSDI benefits is the Average Indexed Monthly Earnings (AIME), which reflects your highest-earning years. We understand that this process can feel overwhelming, and it's common to have questions about how your employment status and potential delays in payment might impact your financial support.

Remember, you're not alone in this journey. There are resources available to help you navigate these complexities, and we're here to support you every step of the way. If you have concerns or need assistance, please reach out. Together, we can work towards ensuring you receive the benefits you deserve.

Introduction

Navigating the intricacies of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that eligibility criteria and benefit calculations change each year, adding to the confusion. This article aims to shed light on the essential factors that determine SSDI benefits. By providing clarity on how work history, income limits, and benefit calculations impact financial support for those facing disabilities, we hope to ease your concerns.

As you embark on this journey, you may find yourself asking:

- How can I ensure that I meet the eligibility requirements?

- What hidden factors might influence the amount of benefits I receive?

By exploring these themes, we empower you to take control of your SSDI journey. Remember, you are not alone in this process, and we are here to help you make informed decisions about your financial future.

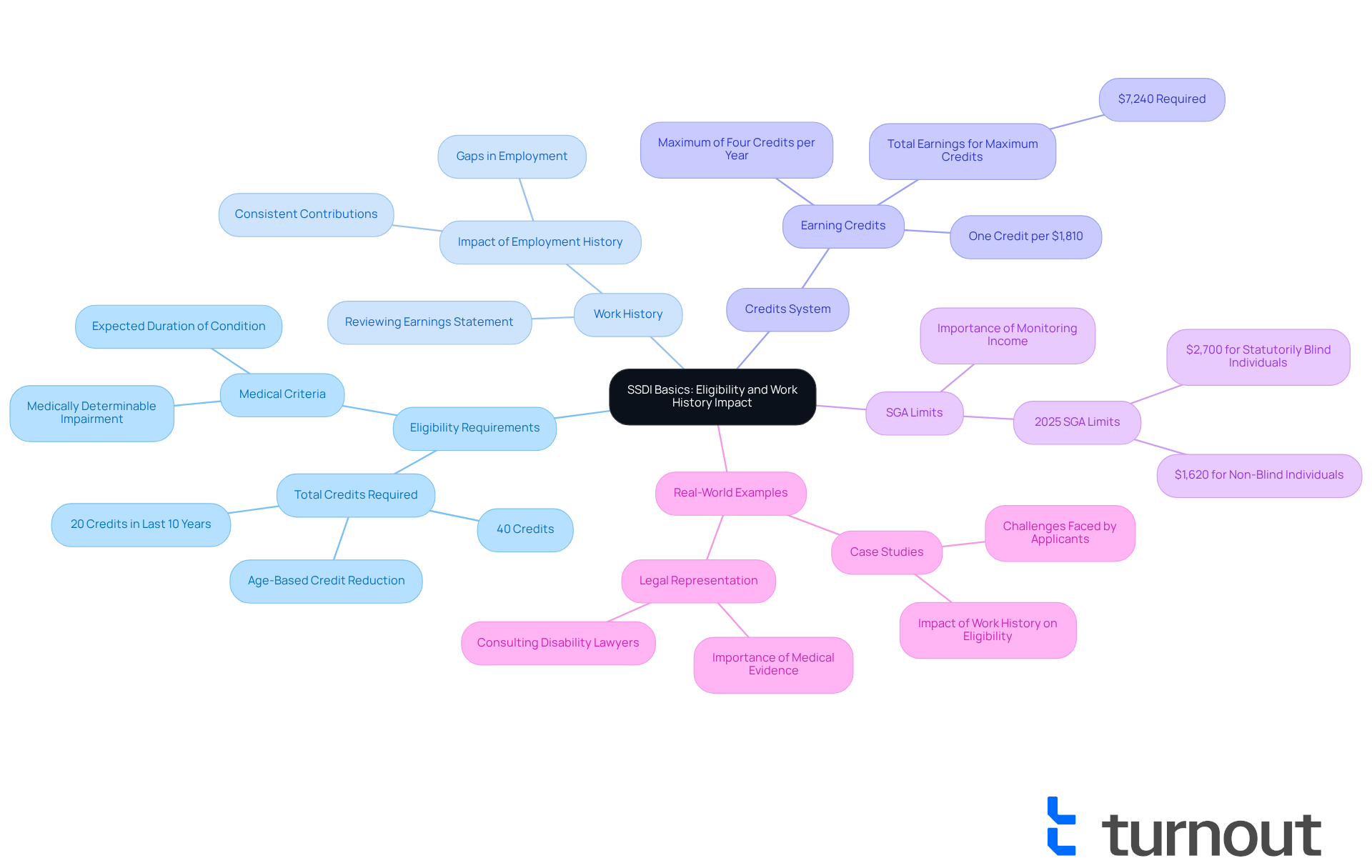

Clarify SSDI Basics: Eligibility and Work History Impact

Navigating the world of Insurance can feel overwhelming, but understanding the is the first step toward securing the support you need. To qualify, applicants must focus on their work history. In 2025, individuals earn one credit for every $1,810 in wages or self-employment income, with a maximum of four credits available each year. Generally, a total of 40 credits is required, with at least 20 earned in the decade preceding the onset of disability. However, if you are younger, you may qualify with fewer credits based on your age at the time of disability. This knowledge is crucial, as it directly influences the and the overall application process.

We understand that the (SSA) also evaluates the severity of your disability. It must prevent you from engaging in substantial gainful activity (SGA). For 2025, the SGA limit is set at $1,620 per month for non-blind individuals and $2,700 for statutorily blind individuals. If your earnings exceed these limits, your request for disability benefits may be denied. This highlights the importance of .

Real-world examples illustrate how your employment history impacts . Individuals who have consistently contributed to Social Security through their jobs are more likely to meet the required credit qualifications. Conversely, those with gaps in their employment history may face challenges in obtaining assistance. Thus, is essential to ensure you meet the revised work credit criteria for 2025. This verification can significantly influence your eligibility and the you may receive. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Explore Calculation Methods: How SSDI Benefits Are Determined

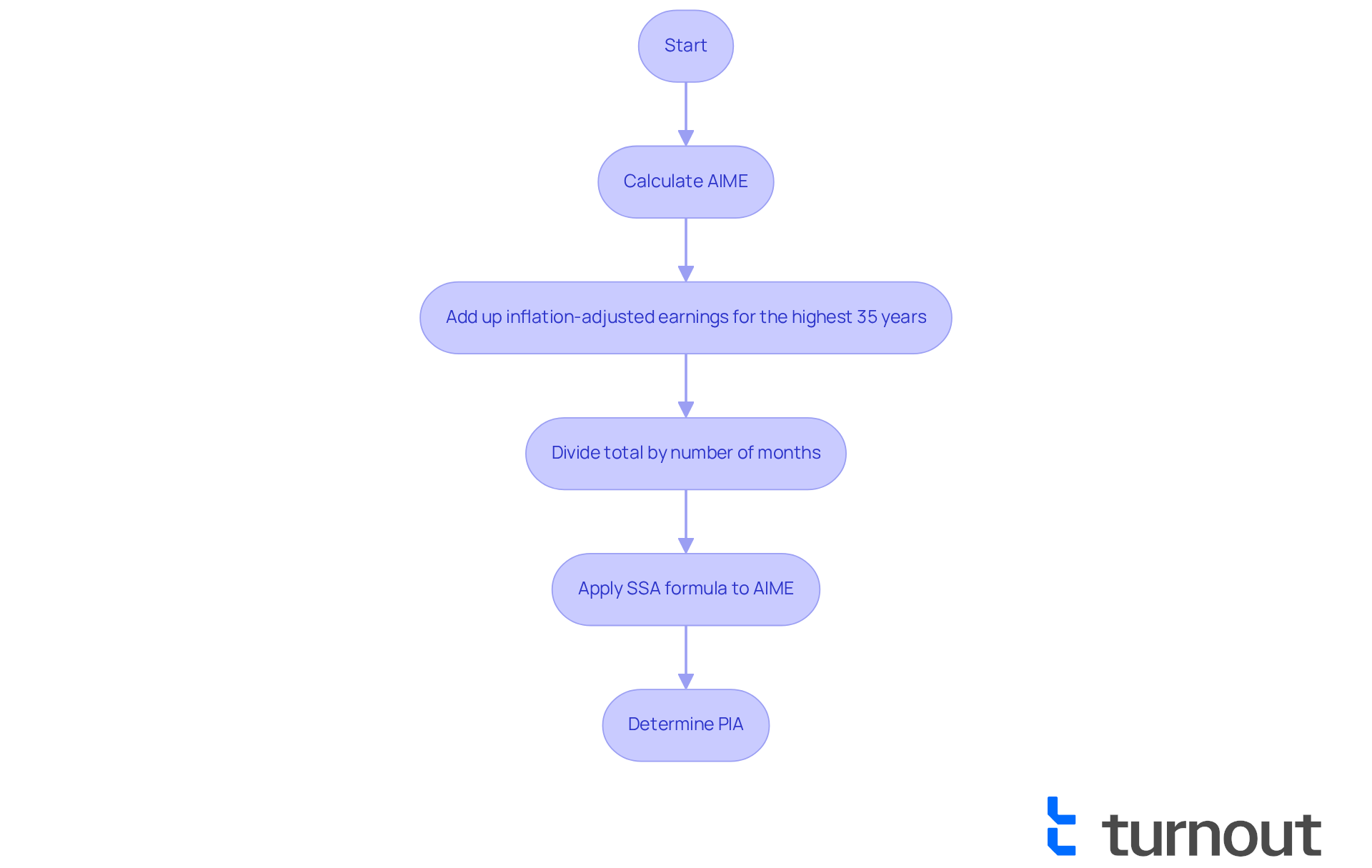

Navigating the world of can feel overwhelming. We understand that many individuals are concerned about their financial future, especially when it comes to understanding how these payments are calculated. Social Security disability payments are determined by your (AIME), which reflects your years of highest earnings. The Social Security Administration (SSA) uses a formula that considers up to 35 years of indexed earnings to calculate your (PIA). For 2025, the maximum SSDI payment is expected to be $4,018 per month, while the minimum will be $967.

To compute your AIME, the SSA adds up your inflation-adjusted earnings over your highest-earning years and divides this total by the number of months in those years. This calculation is crucial, as it directly impacts the amount of that you will receive. The SSA then applies a specific formula to the AIME to derive the PIA, which serves as the basis for your monthly payment amount.

For instance, if someone has a consistent earning record with high wages, their AIME could be significantly higher, resulting in a larger monthly payment. Conversely, an individual with irregular or lower earnings may see a smaller amount of support. Understanding these calculations can empower you to navigate the in your overall more effectively.

At Turnout, we're here to claims process. We offer tools and services, utilizing trained who can assist you without the need for legal representation. Remember, you are not alone in this journey, and we are dedicated to of the way. Please note that Turnout is not a law firm and does not provide legal advice.

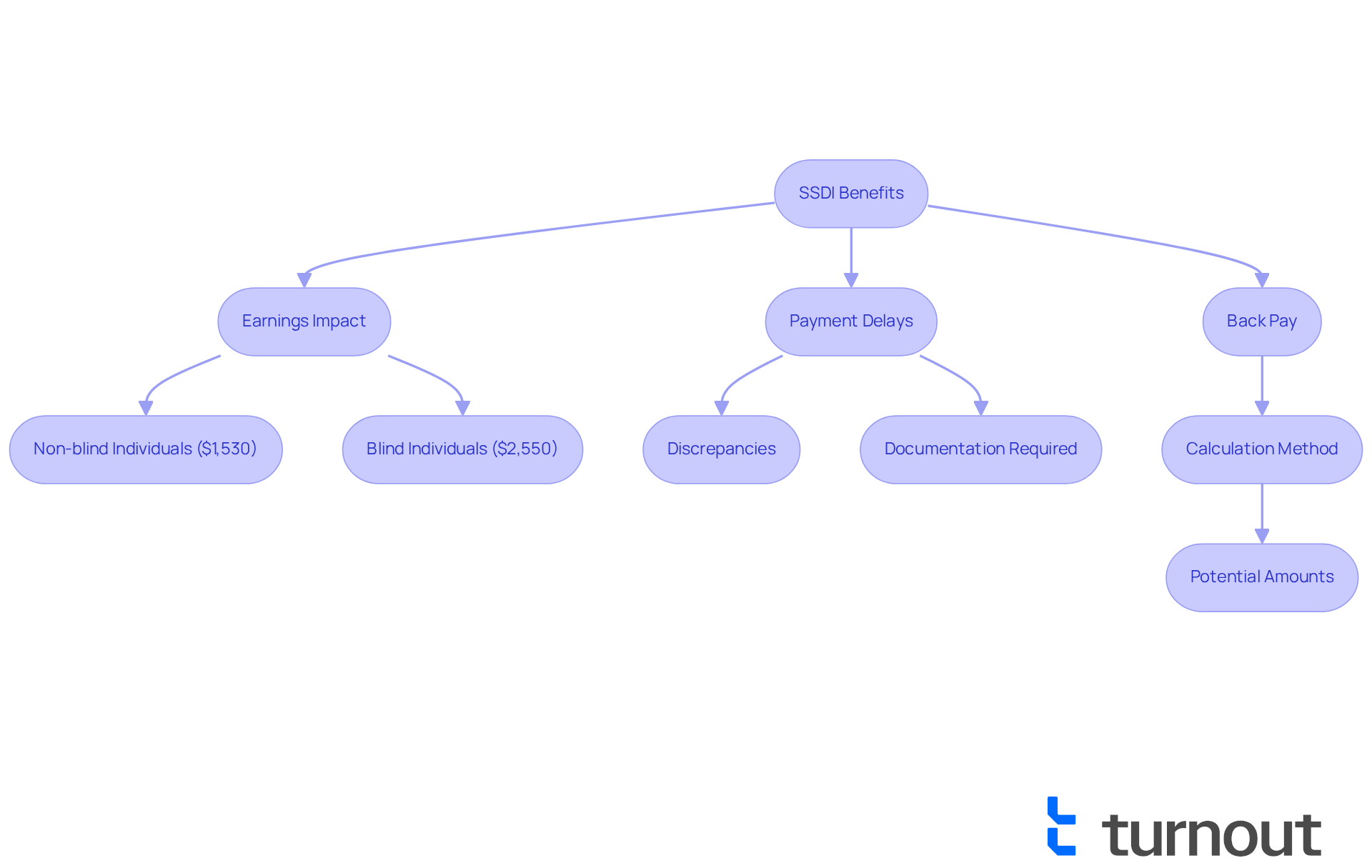

Understand Benefit Amounts: Reductions, Delays, and Back Pay

Once approved for SSDI, recipients may face several factors that can influence the amount of . We understand that can be a significant step, but if you earn above the Substantial Gainful Activity (SGA) limit, your assistance may be reduced. In 2025, the SGA limit is expected to increase to:

- $1,530 monthly for non-blind individuals

- $2,550 for blind individuals

This change allows recipients to earn more while still receiving support. However, it's important to note that the (SSA) may delay payments if there are discrepancies in your application or if additional documentation is required.

Understanding , as it relates to the compensation owed from the onset of your disability until your application is approved. In 2025, recipients can anticipate receiving up to 12 months of back pay, calculated from their established onset date. This can provide significant financial relief, especially for those who have been waiting for their assistance approval. For instance, if your monthly disability payment is $1,200, you could receive for an 8-month delay.

Being aware of these details can help you manage your expectations and plan accordingly. It's common to feel uncertain about how returning to work might affect the , as it can lead to changes in your financial assistance. By staying informed about these factors, you will be better equipped to navigate the SSDI system. Remember, you are not alone in this journey, and we are here to help you every step of the way.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is essential for anyone seeking financial support due to disability. We recognize that navigating this process can be overwhelming. The eligibility criteria, work history requirements, and benefit calculations are pivotal in determining the level of assistance one can receive. By grasping these fundamental aspects, individuals can navigate the SSDI process more effectively and secure the benefits they deserve.

This article delves into several key factors influencing SSDI benefits. We highlight the importance of:

- Work credits

- The calculation of Average Indexed Monthly Earnings (AIME)

- The potential impacts of returning to work

It's common to feel uncertain about how income aligns with the Substantial Gainful Activity (SGA) limits. Understanding how retroactive payments can provide crucial financial relief is equally important. Each of these insights contributes to a clearer picture of the SSDI landscape, empowering applicants to make informed decisions.

Ultimately, staying well-informed about the SSDI system is vital for those who may need to rely on it. By understanding eligibility requirements, calculation methods, and the implications of work on benefits, individuals can better prepare for their financial future. Remember, seeking support from knowledgeable resources can further enhance this journey. You are not alone in this process; we’re here to help you navigate these challenges with confidence.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a program that provides financial support to individuals who are unable to work due to a severe disability.

What are the eligibility requirements for SSDI?

To qualify for SSDI, applicants must focus on their work history and generally need a total of 40 work credits, with at least 20 earned in the decade preceding the onset of disability. Younger individuals may qualify with fewer credits based on their age at the time of disability.

How are work credits earned for SSDI eligibility?

In 2025, individuals earn one credit for every $1,810 in wages or self-employment income, with a maximum of four credits available each year.

What is the significance of the substantial gainful activity (SGA) limit?

The SGA limit is the maximum amount you can earn while applying for SSDI without affecting your eligibility. For 2025, the SGA limit is $1,620 per month for non-blind individuals and $2,700 for statutorily blind individuals. Exceeding these limits may result in a denial of disability benefits.

How does employment history affect SSDI eligibility?

Individuals who have consistently contributed to Social Security through their jobs are more likely to meet the required credit qualifications. Those with gaps in their employment history may face challenges in obtaining assistance.

Why is it important to check your Social Security earnings statement?

Examining your Social Security earnings statement is essential to ensure you meet the work credit criteria for 2025, as this verification can significantly influence your eligibility and the amount of SSDI benefits you may receive.