Overview

The article highlights the history and significance of the Social Security Administration's Cost-of-Living Adjustments (COLA), particularly focusing on their impact on disabled beneficiaries. We understand that financial stability can be a concern for many, and the upcoming 2025 COLA increase of 2.5% plays a crucial role in maintaining the purchasing power of these individuals. This adjustment is essential for covering vital expenses such as healthcare and housing.

While it may not fully offset the rising costs due to inflation, it provides necessary support during challenging times. It’s common to feel overwhelmed by financial pressures, but know that this increase is a step towards alleviating some of those burdens. Remember, we’re here to help you navigate these changes and ensure you have the resources you need.

In summary, the 2025 COLA increase is a vital measure for disabled beneficiaries, offering essential assistance in maintaining their quality of life. You're not alone in this journey, and together we can work towards a more secure future.

Introduction

The financial landscape for disabled individuals in America is deeply intertwined with the Social Security Administration's Cost-of-Living Adjustment (COLA). We understand that as inflation continues to erode the purchasing power of fixed incomes, grasping the nuances of these adjustments becomes essential. This article explores the history and significance of SSA COLA, particularly its impact on disabled beneficiaries. Even modest increases can serve as a lifeline amid rising living costs. However, with the adjustment for 2025 set at only 2.5%, we must ask: will this increase truly alleviate the financial strain faced by millions? You are not alone in this journey, and together we can seek understanding and solutions.

Define SSA COLA: Understanding Cost-of-Living Adjustments

The Social Security Administration (SSA) Cost-of-Living Adjustment is a vital yearly increase in Social Security payments, thoughtfully designed to help combat the effects of inflation. This adjustment is determined by the fluctuations in the Consumer Price Index (CPI), which tracks the average change in prices paid by urban consumers for a basket of goods and services. The primary goal of the cost-of-living adjustment is to safeguard the purchasing power of Social Security and Supplemental Security Income (SSI) benefits. This allows recipients to maintain their standard of living, even as expenses rise.

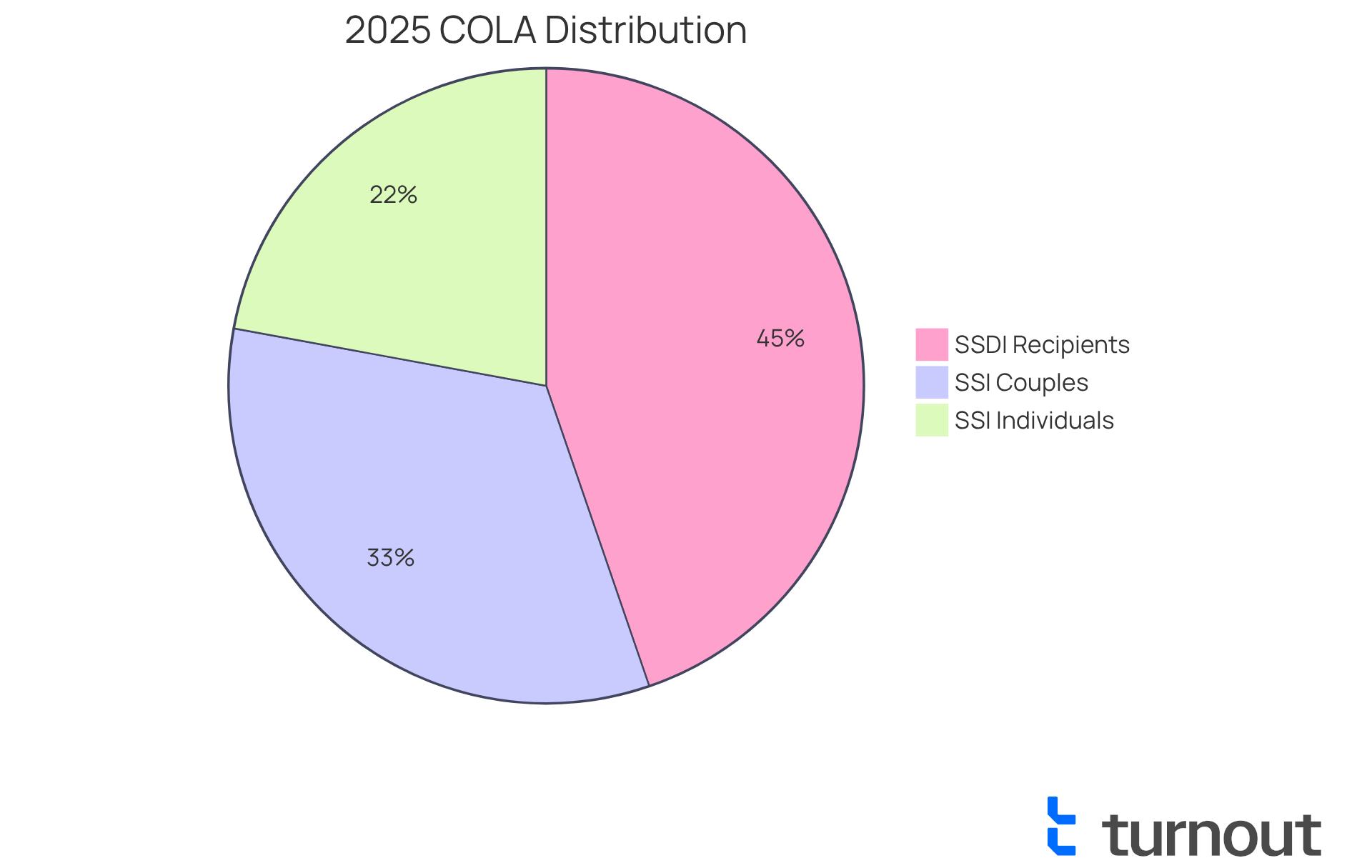

For 2025, the cost-of-living adjustment is set at 2.5%. This represents the smallest yearly increase since 2021 and will affect around 68 million beneficiaries. This rise translates to an average monthly enhancement of approximately $50, which is particularly significant for individuals with disabilities who often rely on these payments for their daily needs. For example, the average SSDI recipient will see their monthly payment increase to $1,957, while SSI recipients will receive a maximum of $967 for individuals and $1,450 for couples.

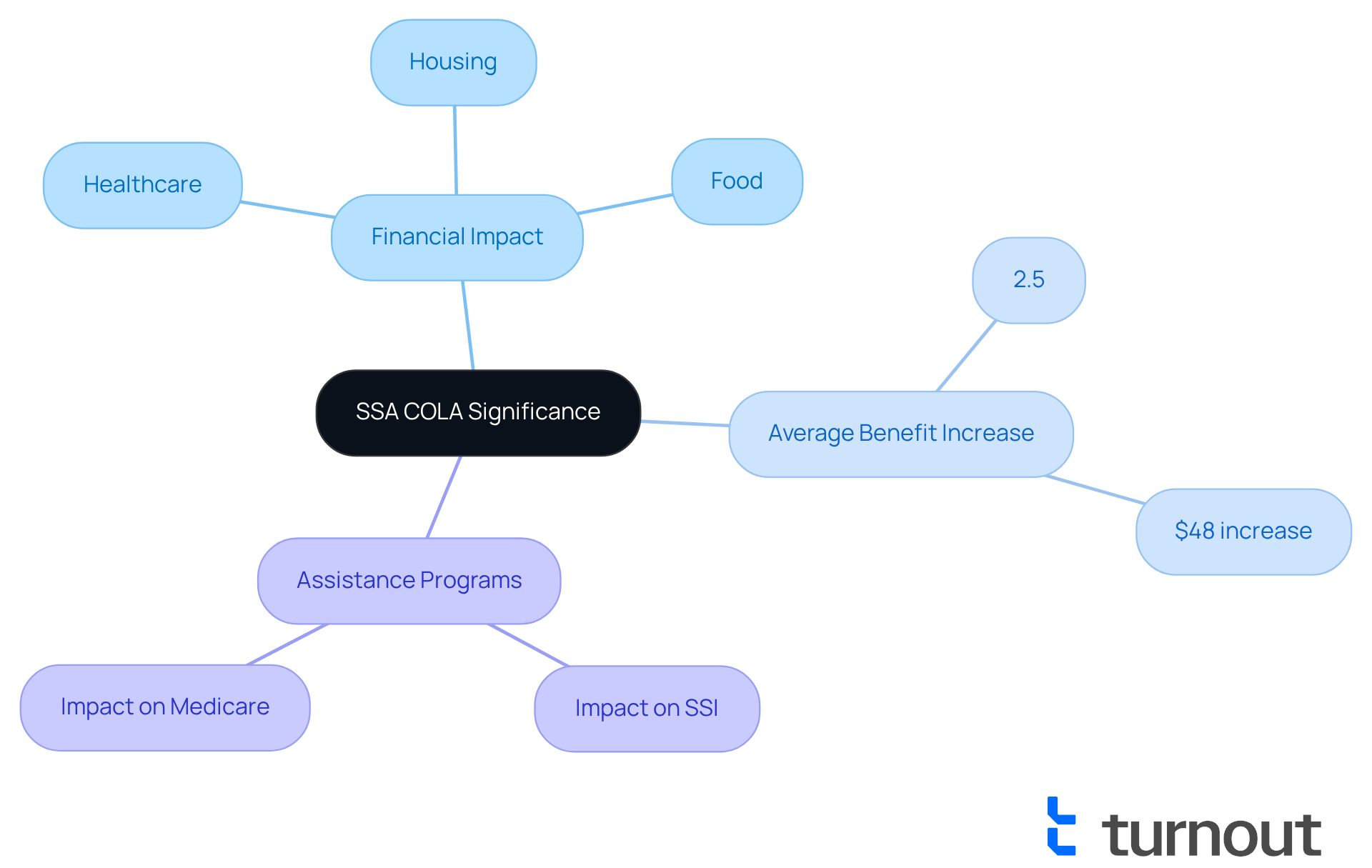

Real-world examples reveal how COLA adjustments impact Social Security recipients. Many individuals share that even small increases can alleviate financial pressures, especially given the rising cost of living. However, it’s important to acknowledge that these changes may not fully offset increases in expenses, such as healthcare costs. For instance, expected rises in Medicare Part B premiums could diminish the net benefit of the COLA for some recipients.

Economists emphasize the importance of cost-of-living adjustments for Social Security, noting that they are crucial for maintaining the financial stability of beneficiaries. As one economist pointed out, 'COLAs are essential for ensuring that Social Security payments keep pace with inflation, allowing recipients to meet their basic needs.' The 2025 cost-of-living increase serves as a reminder of the ongoing need for adjustments that reflect the economic realities faced by millions of Americans, particularly those with disabilities who depend on these supports for their well-being.

Trace the History of SSA COLA: Origins and Development

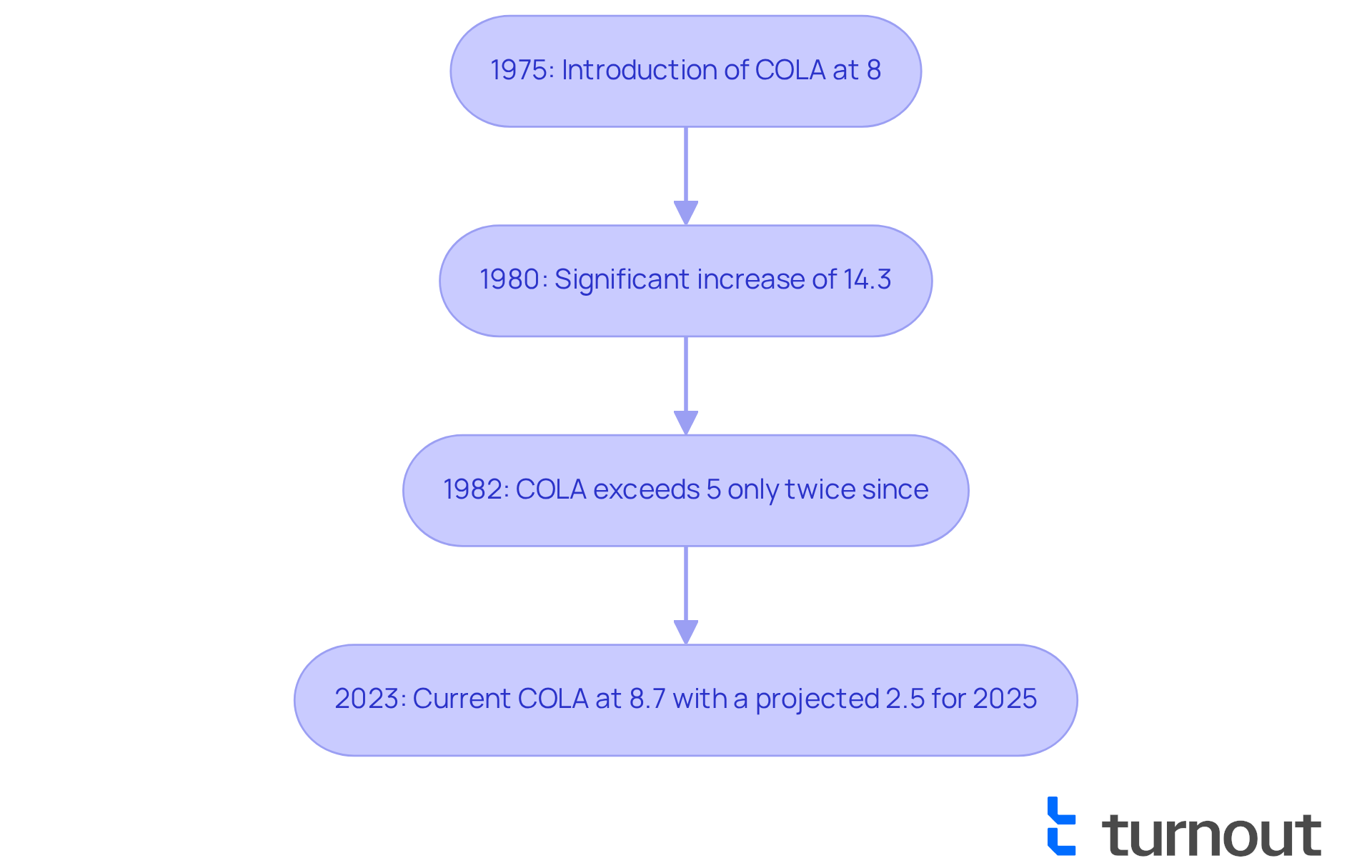

The concept of cost-of-living adjustments (COLAs) for Social Security payments emerged in 1975, responding to concerns that inflation was eroding the purchasing power of those on fixed incomes. The first COLA was set at 8%, marking a significant shift in how allowances were calculated. Previously, Congress had to enact specific laws for entitlement adjustments, which led to inconsistencies and uncertainty.

Now, COLAs are determined annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index captures the average price changes for a basket of goods and services that urban wage earners and clerical workers typically consume. This system ensures that benefits keep pace with inflation, providing a safety net for millions.

Over the years, the percentage increases have varied, with notable spikes. For instance, in 1980, there was a remarkable 14.3% increase due to soaring inflation rates. Since July 1982, however, the COLA has exceeded 5% only twice. The automatic nature of these adjustments means that recipients can rest assured their support reflects current economic conditions. Importantly, even in times of deflation, recipients do not experience a decrease in nominal benefits.

The introduction of automatic cost-of-living adjustments was a crucial reform aimed at ensuring regular and consistent benefit increases in line with inflation, reflecting the [SSA COLA history](https://aarp.org/social-security/cola-history). This change plays a vital role in safeguarding the financial stability of countless Americans who rely on Social Security benefits. As of 2023, the cost of living adjustment stands at 8.7%, with a projected estimate of 2.5% for 2025. We understand that navigating these changes can be challenging, but know that you are not alone in this journey. We're here to help you understand these adjustments and their implications for your financial well-being.

Examine the Significance of SSA COLA: Impact on Beneficiaries

The significance of the SSA cost-of-living adjustment is profound, especially for those disabled beneficiaries who depend on Social Security payments as their primary source of income. With a 2.5% COLA increase for 2025, this translates to an average monthly benefit rise of approximately $48, bringing the average monthly benefit to about $1,520 for disabled individuals. This adjustment is essential for covering necessary expenses like healthcare, housing, and food. We understand that without these modifications, beneficiaries may struggle as inflation continues to erode their purchasing power.

Moreover, cost-of-living adjustments impact income limits for various assistance programs, ensuring that recipients can access additional support when needed. For example, the Smith Family from Waco, TX, expressed their gratitude for the approval of their case, illustrating how these adjustments can provide crucial financial relief. Overall, the COLA is vital in safeguarding the financial stability of millions of Americans with disabilities. It helps them manage rising costs and maintain a stable quality of life. Remember, you are not alone in this journey—we’re here to help you navigate these changes.

Conclusion

The Social Security Administration's Cost-of-Living Adjustment (COLA) is essential in helping disabled beneficiaries maintain their purchasing power as inflation rises. With a projected 2.5% increase for 2025, these adjustments provide crucial financial support to millions who rely on Social Security and Supplemental Security Income. By connecting benefit increases to the Consumer Price Index, the SSA strives to protect the financial stability of individuals with disabilities who depend on these payments for their daily needs.

We understand that navigating financial challenges can be overwhelming. Throughout this article, we've highlighted the historical evolution of COLA, its significance for beneficiaries, and the real-life impact of these adjustments on everyday life. Since its inception in 1975, the automatic nature of COLA has ensured that beneficiaries receive consistent support that reflects economic realities. Even modest increases can alleviate financial stress, although rising healthcare costs remain a concern for many.

Ultimately, grasping the importance of the SSA COLA is vital for safeguarding the well-being of disabled individuals. As inflation continues to challenge financial stability, it's increasingly important for beneficiaries to stay informed about these adjustments and advocate for policies that meet their needs. Remember, you are not alone in this journey. By understanding how COLA affects your financial landscape, you can navigate your circumstances more effectively and seek additional support when necessary.

Frequently Asked Questions

What is the SSA Cost-of-Living Adjustment (COLA)?

The SSA Cost-of-Living Adjustment (COLA) is a yearly increase in Social Security payments designed to help combat the effects of inflation, determined by fluctuations in the Consumer Price Index (CPI).

How does COLA affect Social Security and SSI benefits?

COLA aims to safeguard the purchasing power of Social Security and Supplemental Security Income (SSI) benefits, allowing recipients to maintain their standard of living as expenses rise.

What is the COLA percentage for 2025?

The COLA for 2025 is set at 2.5%, which is the smallest yearly increase since 2021.

How many beneficiaries will be affected by the 2025 COLA?

Approximately 68 million beneficiaries will be affected by the 2025 COLA.

How much will the average monthly payment increase for Social Security recipients in 2025?

The average monthly payment will increase by approximately $50.

What will be the new monthly payment amounts for SSDI and SSI recipients in 2025?

The average SSDI recipient will see their monthly payment increase to $1,957, while SSI recipients will receive a maximum of $967 for individuals and $1,450 for couples.

How do COLA adjustments impact Social Security recipients in real life?

Many recipients report that even small increases can alleviate financial pressures, but these adjustments may not fully offset rising expenses, such as healthcare costs.

What potential issue could affect the net benefit of the COLA increase for recipients?

Expected rises in Medicare Part B premiums could diminish the net benefit of the COLA for some recipients.

Why are COLAs considered important by economists?

Economists emphasize that COLAs are crucial for maintaining the financial stability of beneficiaries, ensuring that Social Security payments keep pace with inflation and allowing recipients to meet their basic needs.