Overview

This article gently guides you through the minimum income requirements for filing taxes in 2025. We understand that navigating tax regulations can be overwhelming, especially when it comes to understanding specific thresholds based on your filing status and age. It's crucial to recognize these thresholds to ensure compliance and avoid any potential penalties.

If your income meets or exceeds the specified amounts, you are required to file. However, it's common to feel uncertain about your situation, particularly in special circumstances that may require you to file, regardless of your income level. Remember, you are not alone in this journey, and we're here to help you understand what you need to do.

Take a moment to reflect on your personal situation. Understanding these requirements can empower you to take the necessary steps with confidence. We encourage you to reach out for assistance if you have questions or need support. Your financial well-being is important, and being informed is the first step towards ensuring a smooth tax filing experience.

Introduction

Understanding the minimum income required to file taxes can feel overwhelming. It's common to struggle with the varying thresholds that depend on factors like age and filing status. This article is here to clarify these income requirements for the 2025 tax year, offering essential insights to help you navigate your tax obligations with greater confidence.

But what if you find yourself below these thresholds yet face unique circumstances that make filing necessary? We understand that these situations can be confusing. Exploring these nuances can reveal critical information that not only ensures compliance but also maximizes your potential benefits. Remember, you're not alone in this journey; we're here to help.

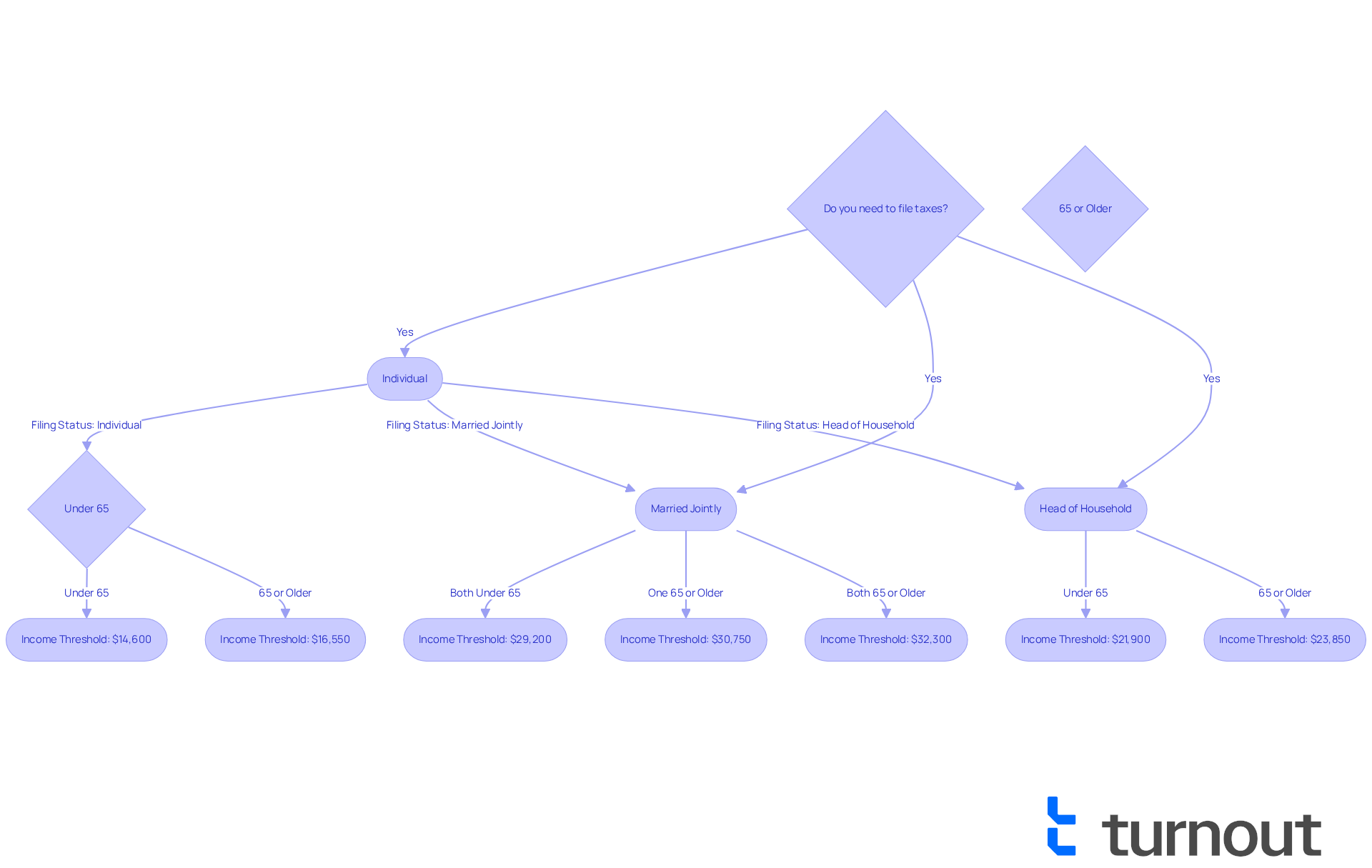

Define Minimum Income Requirements for Tax Filing

Understanding the can be a bit overwhelming, but we're here to help. These thresholds help identify the minimum income to file taxes based on your gross revenue. For the tax year 2025, these thresholds vary depending on your status and age. For instance, if you’re filing individually and are under 65, you’ll need to $14,600. If you’re 65 or older, that threshold increases to $16,550.

Married couples filing jointly have higher limits. If both partners are under 65, you need to submit if your combined earnings are at least $29,200. If one partner is 65 or older, the threshold rises to $30,750. Additionally, if you’re a married dependent under 65, you must file if your total earnings are $5 or greater, and your partner is filing separately and itemizing deductions.

For heads of household under 65, the requirement is to file if your total earnings reach at least $21,900. If you’re 65 or older, you’ll need to file if your earnings are at least $23,850. Grasping these thresholds, including the minimum income to file taxes, is crucial for and .

It’s common to feel uncertain about whether you need to file, especially if your earnings are low or if you have unique situations, like receiving advance payments of the Premium Tax Credit or having self-employment earnings of $400 or more. As Mark Steber, Senior Vice President and Chief Tax Officer for Jackson Hewitt, wisely points out, 'It’s better to be safe (and possibly get some cash back) than sorry.' This highlights the importance of knowing your , even when your earnings are below the minimum income to file taxes. Remember, you are not alone in this journey; understanding these details can make a significant difference.

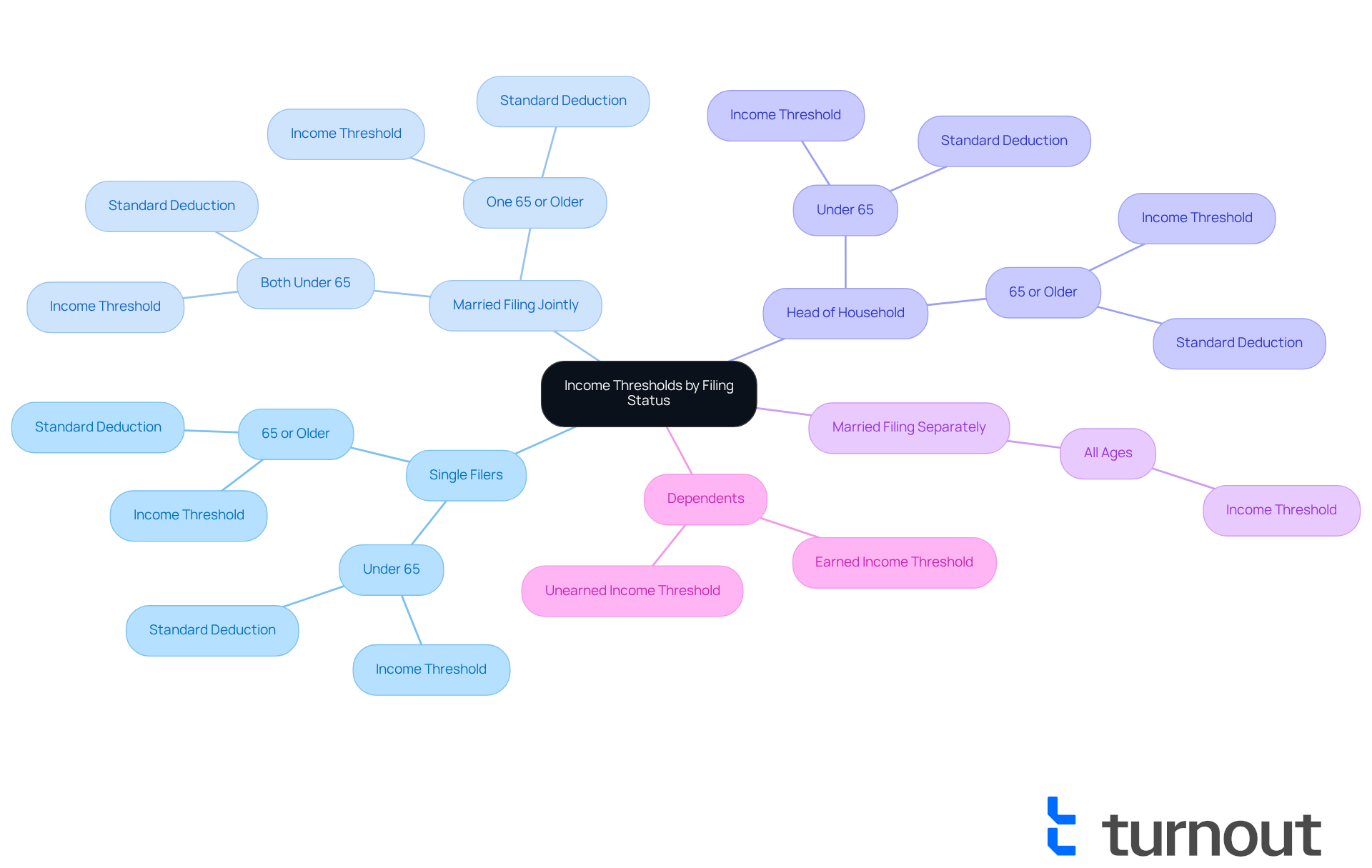

Examine Income Thresholds by Filing Status

Income thresholds, specifically the in 2025, can feel overwhelming, but understanding these requirements is essential for compliance with IRS regulations. Let’s break it down together:

- Single Filers: You must file if your gross income is $14,600 if you’re under 65, or $16,550 if you’re 65 or older. The standard deduction for single taxpayers is $15,000.

- Married : It’s necessary to submit if your combined gross earnings are $29,200 when both partners are under 65, or $30,750 if one partner is 65 or older. The standard deduction for married couples filing jointly rises to $30,000.

- Head of Household: You must submit a tax return if your total earnings reach $21,900 if you’re under 65, or $23,850 if you’re 65 or older. The standard deduction for heads of households is $22,500.

- Married Filing Separately: A return must be submitted if your gross earnings surpass $5, regardless of age.

Understanding your involves knowing the minimum income to file taxes. For instance, if you’re under 65 and make $14,500, you wouldn’t need to file. But if you earn $14,600, you must. We understand that navigating these financial criteria can be stressful, but adhering to them helps prevent possible fines for neglecting to submit when necessary. It also ensures that you can benefit from any qualifying tax deductions or reimbursements.

Additionally, if you have dependents, they are required to submit paperwork if their unearned earnings exceed $1,300 or earned revenue surpasses $14,600. This is an important consideration for families. Remember, you are not alone in this journey; we’re here to help you understand and meet your tax responsibilities.

Identify Special Situations Requiring Tax Filing

Certain special situations may require you to file a tax return, even if your income is below the . We understand that can be overwhelming, so it’s important to be aware of these circumstances:

- Owing special taxes, such as the alternative minimum tax or additional taxes on retirement accounts, means you need to file a return.

- If you receive , submitting a return is necessary to balance the amounts received.

- Earning net profits from self-employment of $400 or more prompts a reporting obligation, regardless of your overall earnings.

- Being eligible for , like the Earned Income Tax Credit (), requires , which can lead to significant refunds even for low-income earners.

- You may also want to submit a return to request the highest refundable credit of $1,000, even if you have no taxable earnings.

Understanding these situations is essential for ensuring compliance and maximizing your potential benefits. For instance, if you’re a single individual aged 25 to 65 with a taxable income of $7,900, you may not need to file a return because your income is less than the minimum income to file taxes, as the standard deduction exceeds your income. However, you could still qualify for the EITC, worth up to $600. This highlights the to access available credits and not missing out on financial assistance.

Moreover, it’s crucial to recognize that penalties for late submissions are significantly greater than those for failing to pay taxes on time. We’re here to help you navigate these complexities and ensure that you don’t miss any opportunities. Remember, you are not alone in this journey, and taking prompt action can make a difference.

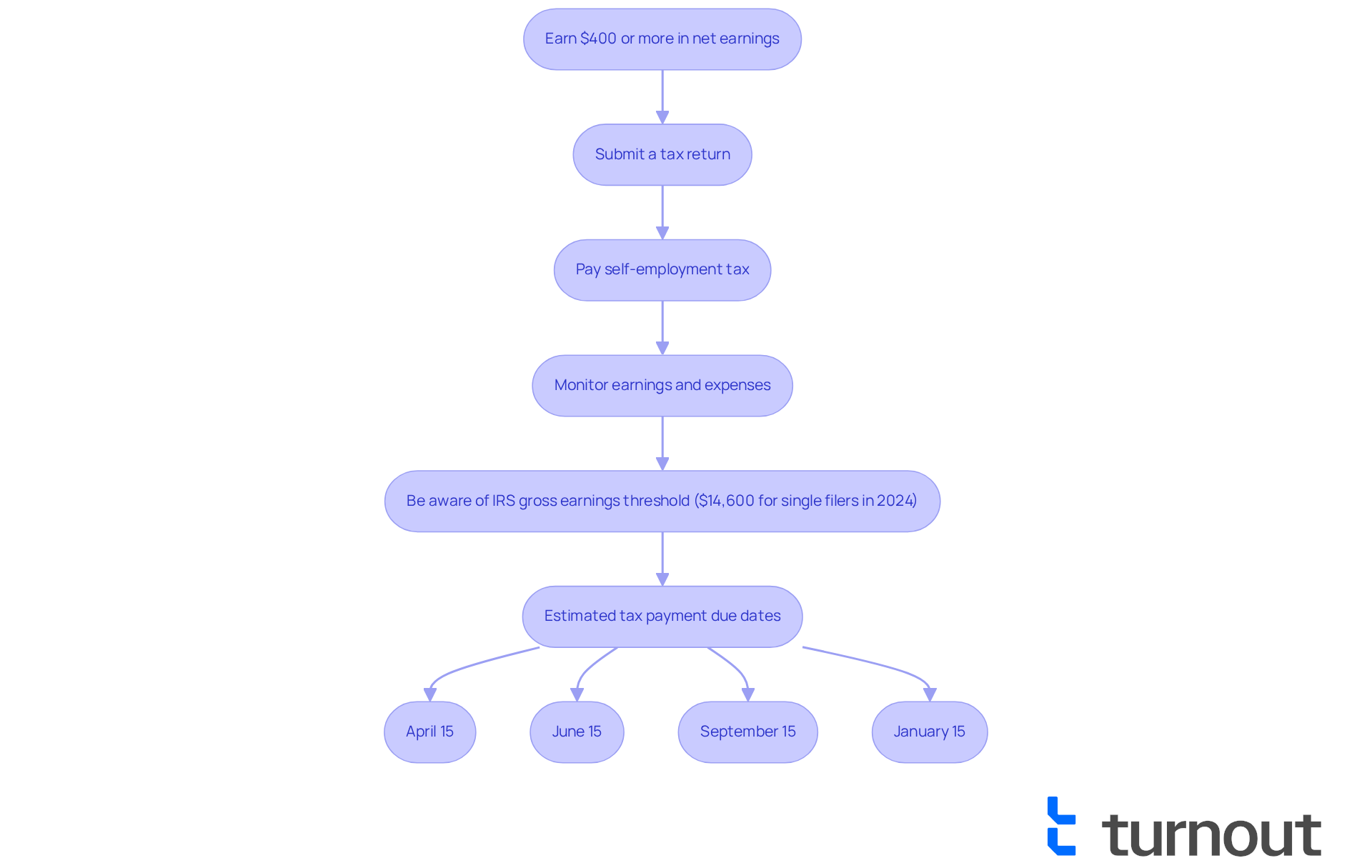

Analyze Self-Employment Income and Filing Obligations

Navigating self-employment earnings can feel overwhelming, but understanding your is essential. If you earn $400 or more in net earnings during the tax year, it's important to submit a tax return, regardless of your overall earnings. This requirement applies to freelance work, side jobs, or any business activities you engage in. Additionally, self-employed individuals must pay , which includes Social Security and Medicare taxes.

We understand that monitoring your earnings and expenses can be a challenge, especially for like rideshare driving or digital content creation. Staying informed about these obligations is crucial to avoid penalties and ensure you meet your . Remember, neglecting to disclose all earnings can lead to significant issues with tax compliance. It's vital to remain aware of filing requirements and due dates.

For your reference, the IRS has set the gross earnings threshold for single filers in 2024 at $14,600. If your earnings fall below the , you might not need to submit a federal tax return. Furthermore, estimated tax payments for self-employed individuals are due on April 15, June 15, September 15, and January 15 of the following year.

As Tom Conradt wisely points out, 'Filing taxes as a freelancer or gig worker doesn’t have to be overwhelming.' This highlights the importance of , like Schedule C (Form 1040), which is used to report income or loss from business activities. By staying organized and informed, you can navigate your tax obligations effectively. Remember, you are not alone in this journey, and we're here to help you succeed.

Conclusion

Understanding the minimum income required to file taxes is crucial for complying with IRS regulations and avoiding unnecessary penalties. We recognize that tax season can be overwhelming, and this article outlines the specific income thresholds for various filing statuses in 2025. It's essential to know when to file based on your earnings. By grasping these requirements, you can navigate your tax responsibilities more effectively and make informed decisions about your financial situation.

Key insights discussed here include the minimum income thresholds for:

- Single filers

- Married couples

- Heads of household

- Special cases that may require filing even with lower earnings

We also highlight the unique obligations faced by self-employed individuals, emphasizing the importance of vigilance in reporting income and understanding potential deductions and credits. These details are vital for maximizing benefits and preventing compliance issues.

Ultimately, being informed about tax filing requirements empowers you to take control of your financial well-being. It's important to stay updated on your obligations, even if your income falls below the minimum thresholds. Whether you are a freelancer, a dependent, or navigating unique financial circumstances, understanding these requirements can lead to significant savings and benefits. Taking proactive steps to ensure compliance will not only help you avoid penalties but may also unlock potential tax credits that can positively impact your financial situation. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What are the minimum income requirements for filing taxes in 2025 for individuals under 65?

Individuals under 65 must file taxes if their total earnings reach at least $14,600.

What is the filing threshold for individuals who are 65 or older in 2025?

If you are 65 or older, you need to file taxes if your total earnings are at least $16,550.

What are the minimum income requirements for married couples filing jointly in 2025 if both partners are under 65?

Married couples filing jointly must file if their combined earnings are at least $29,200.

What is the filing threshold for married couples filing jointly if one partner is 65 or older?

If one partner is 65 or older, the threshold increases to $30,750.

What are the filing requirements for a married dependent under 65?

A married dependent under 65 must file if their total earnings are $5 or greater and their partner is filing separately and itemizing deductions.

What is the minimum income requirement for heads of household under 65 in 2025?

Heads of household under 65 must file if their total earnings reach at least $21,900.

What is the filing threshold for heads of household who are 65 or older?

If you are 65 or older and filing as head of household, you need to file if your earnings are at least $23,850.

Why is it important to understand the minimum income thresholds for filing taxes?

Understanding these thresholds is crucial for knowing your reporting responsibilities and avoiding potential penalties for non-compliance.

What should you consider if your earnings are low or if you have unique tax situations?

If your earnings are low or you have unique situations, such as receiving advance payments of the Premium Tax Credit or self-employment earnings of $400 or more, it’s important to know your documentation requirements.

What advice does Mark Steber, Senior Vice President and Chief Tax Officer for Jackson Hewitt, give regarding filing taxes?

He advises that "it’s better to be safe (and possibly get some cash back) than sorry," emphasizing the importance of understanding your filing requirements.