Overview

We understand that navigating tax forms can be daunting, especially when it comes to claiming the Additional Child Tax Credit (ACTC) for your eligible dependents. This article provides detailed, step-by-step instructions for completing Schedule 8812, ensuring you have the support you need.

Accurately filling out this form is crucial. By doing so, you can maximize your tax benefits. The ACTC can offer significant refunds for families, particularly those with lower incomes. We want to help you take full advantage of this opportunity.

It's common to face challenges during the filing process. This article also addresses common issues that taxpayers may encounter, providing reassurance and guidance. Remember, you're not alone in this journey. We’re here to help you every step of the way.

Introduction

Navigating the intricacies of tax forms can often feel like traversing a maze, especially when it comes to claiming credits for dependents. We understand that the Additional Child Tax Credit (ACTC) form, Schedule 8812, is not merely another piece of paperwork; it has the potential to significantly lighten a family's tax burden or even provide a much-needed refund. As families prepare for the 2025 tax year, the stakes are high, and the need for clarity is paramount.

How can you ensure that you are maximizing your benefits while avoiding common pitfalls along the way? We're here to help you through this journey.

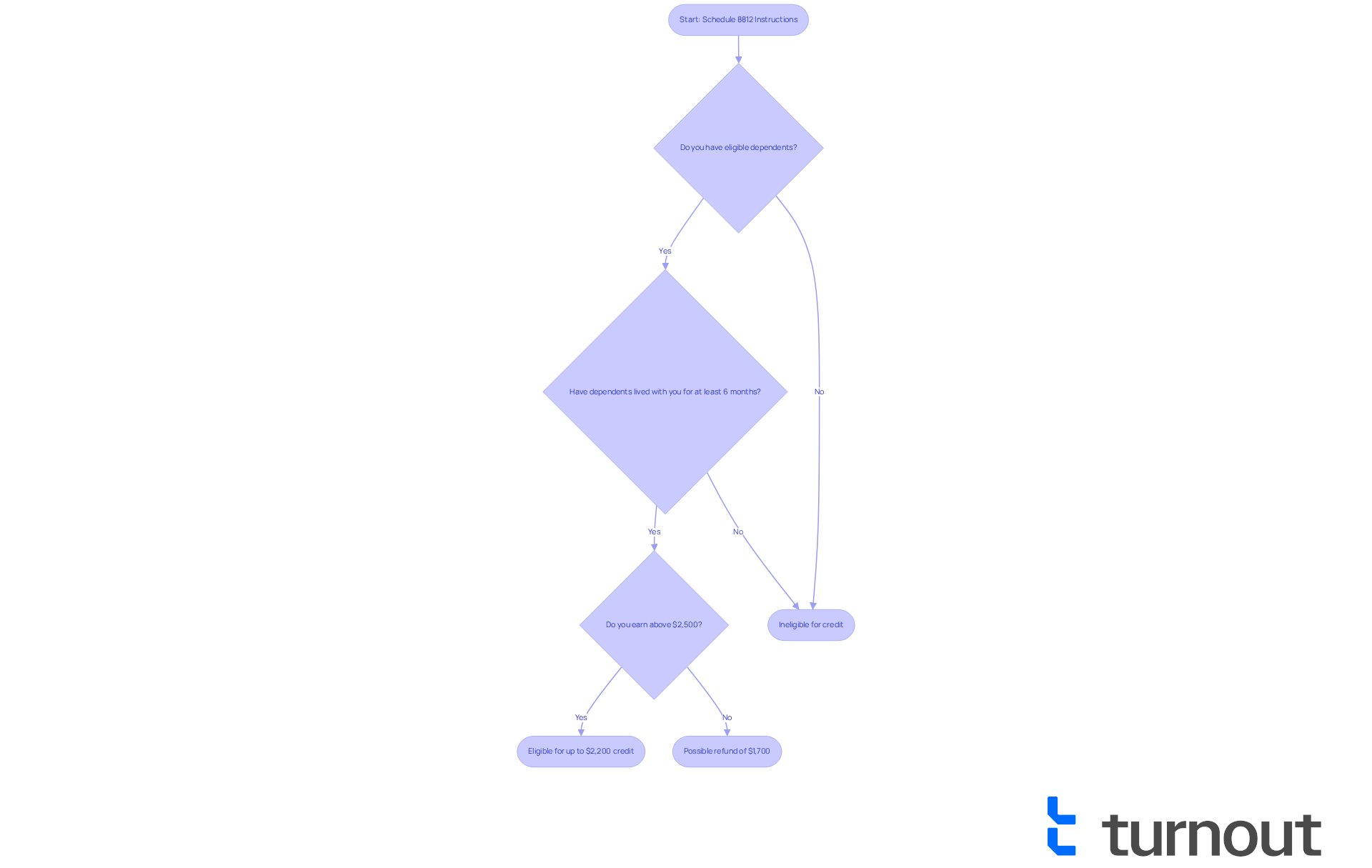

Understand Schedule 8812 and Its Importance for Child Tax Credits

The instructions for , also known as the Additional Dependent Tax Credit (ACTC) form, are essential for those who wish to claim tax credits for eligible dependents. This form plays a vital role in determining the amount of credit you can receive, which can significantly ease your tax burden or even lead to a refund. Understanding its purpose and the benefits it offers is the first step toward maximizing your tax advantages. For the 2025 tax year, the Dependent Tax Credit can be valued at up to $2,200 for each qualifying dependent, making it a crucial aspect of your tax return.

The ACTC is a refundable portion of the , meaning that eligible taxpayers can receive refunds even if their tax bill is reduced to zero. This aspect is especially beneficial for families with lower incomes, as they may receive up to $1,700 per eligible dependent as a refund. To qualify, children must have lived with the caregiver for at least six months during 2025. Families earning above the minimum threshold of $2,500 can begin to benefit from this credit. However, it's important to note that the credit phases out for higher earners—specifically, single filers earning over $200,000 and joint filers over $400,000.

Real-world experiences illustrate the impact of 8812. Many taxpayers have successfully navigated the complexities of this form to secure significant refunds, alleviating financial stress. Tax experts emphasize the importance of accurately completing Form 8812 to ensure families receive the maximum benefits possible. As one expert noted, "The extra tax credit for dependents is calculated at 15 percent for every dollar of earned income starting at $2,500," highlighting the necessity of reporting earned income accurately.

It's also crucial to be aware of the potential penalties for improper claims of the Child Tax Credit, which could lead to restrictions on future claims. In summary, understanding the instructions for Schedule 8812 and its role in claiming the is essential for maximizing your tax benefits and ensuring that families receive the financial support they deserve. Remember, you are not alone in this journey, and we're here to help you navigate these important tax matters.

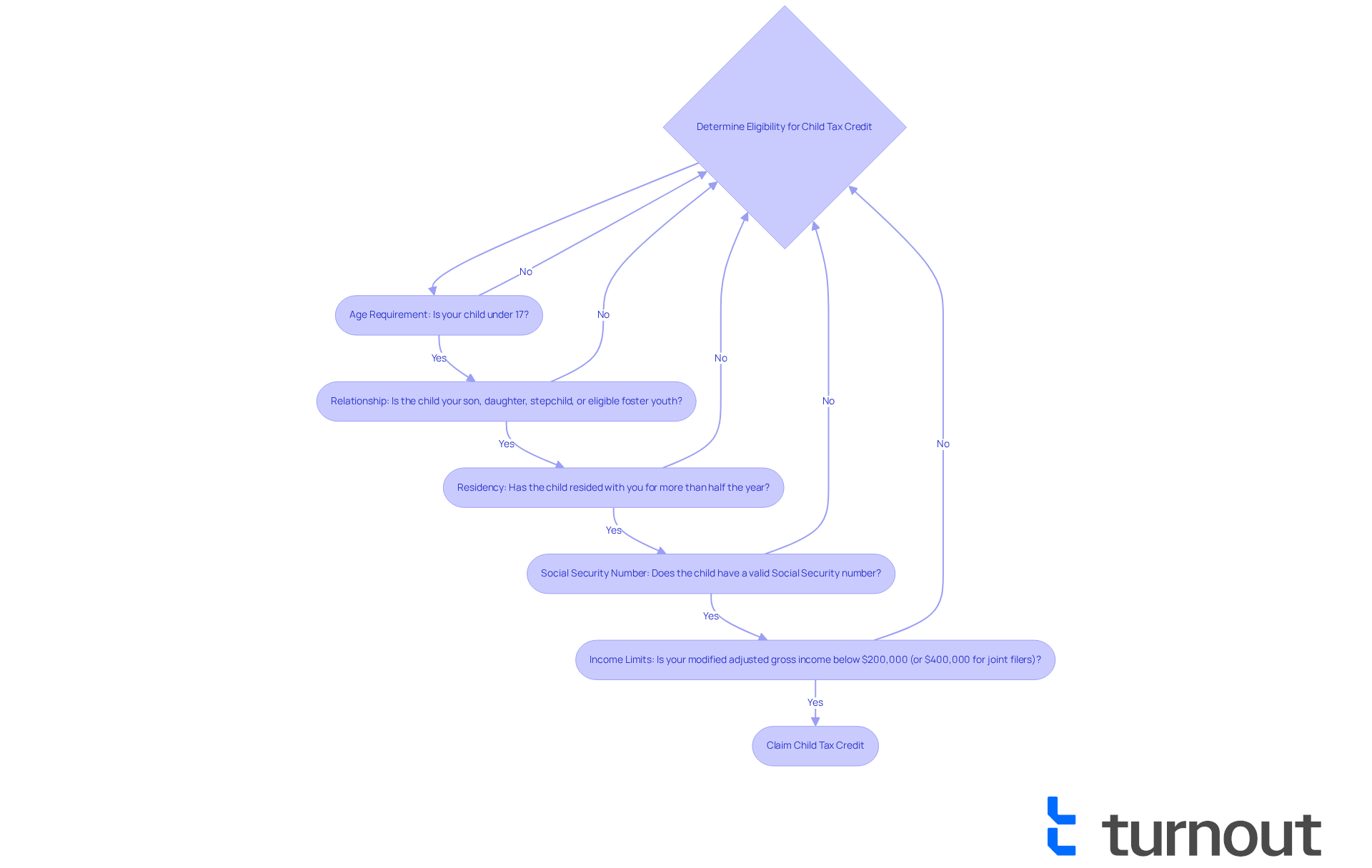

Determine Eligibility for the Child Tax Credit

We understand that navigating can be overwhelming, but we're here to help you qualify for the . To ensure you meet the , consider the following:

- Age Requirement: Your child must be under 17 at the end of the tax year.

- Relationship: The young person should be your son, daughter, stepchild, or eligible foster youth.

- Residency: It's important that the minor has .

- Social Security Number: Each qualifying child must have a .

- : Your modified adjusted gross income should be below certain thresholds—$400,000 for married couples filing jointly and $200,000 for other filers in 2025.

By verifying these criteria, you can confidently claim the Child Tax Credit and proceed with the to complete Form 8812. Remember, you are not alone in this journey, and we are here to support you every step of the way.

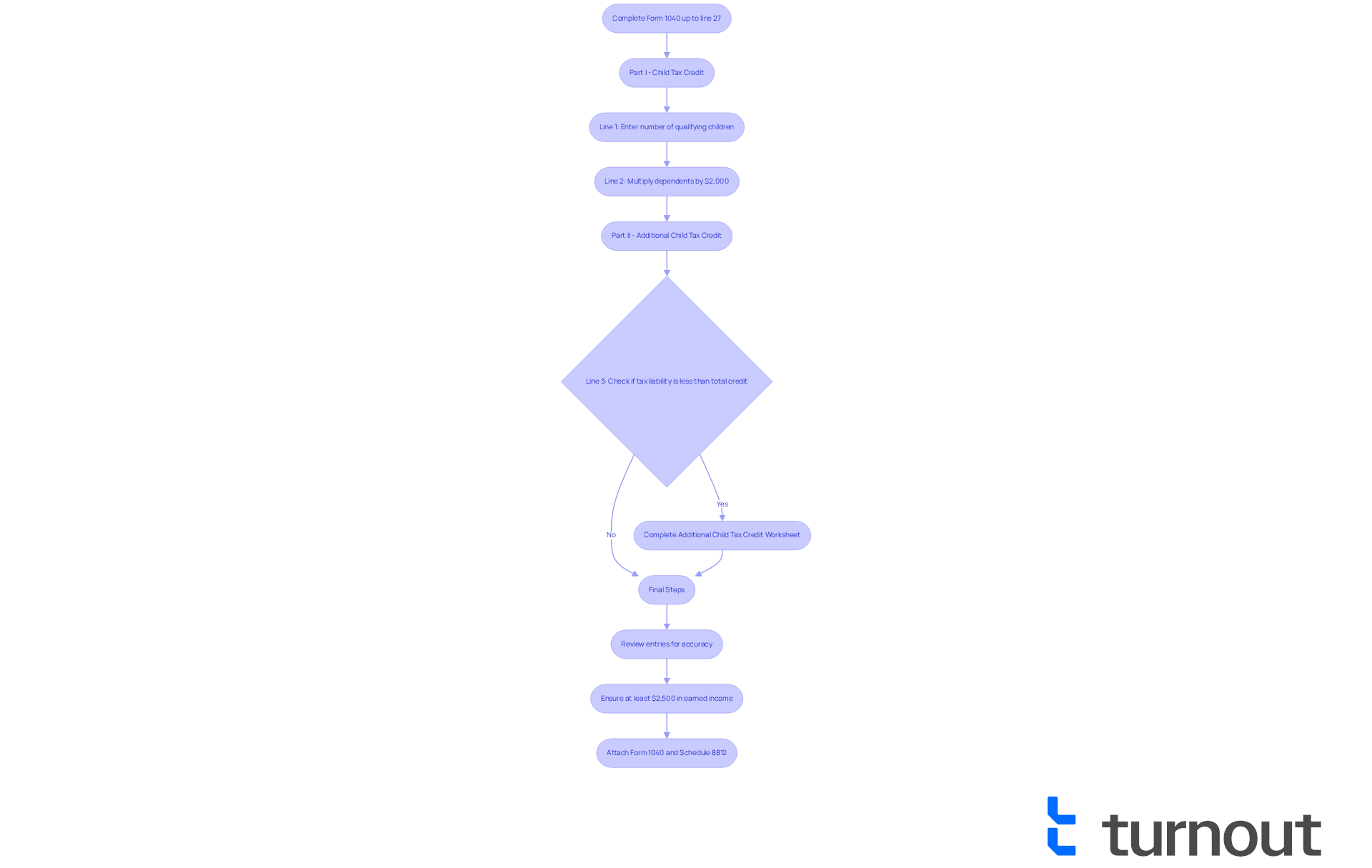

Complete Schedule 8812: Step-by-Step Instructions

To help you accurately complete , let's walk through these essential steps together:

-

Start with : Before diving into Schedule 8812, ensure you complete your Form 1040 up to line 27. This foundation is crucial.

-

Part I - Child Credit:

- Line 1: Enter the number of qualifying children you have.

- Line 2: Multiply the number of eligible dependents by $2,000 and enter the total. This can significantly impact your credits.

-

Part II - Additional :

- Line 3: If your tax liability falls short of the total credit calculated, you may qualify for the (ACTC), which can provide up to $1,700 per qualifying child.

- Be sure to complete the Additional Child Tax Credit Worksheet to determine the refundable amount.

-

Final Steps:

- Take a moment to review all entries for accuracy. Common mistakes, such as incorrect Numbers or overlooking qualifying children, can happen to anyone.

- Remember, you need at least $2,500 in earned income to qualify for the refundable portion of the ACTC for your 2024 tax returns.

- Finally, when filing, attach your Form 1040 along with the instructions schedule 8812.

By following the instructions schedule 8812 carefully, you can ensure that Form 8812 is completed correctly, helping you . We understand that is crucial, especially since the IRS cannot issue refunds for returns claiming the ACTC before mid-February 2025. If you ever feel overwhelmed, remember that can help you navigate these complexities and avoid common pitfalls. You're not alone in this journey, and we're here to help.

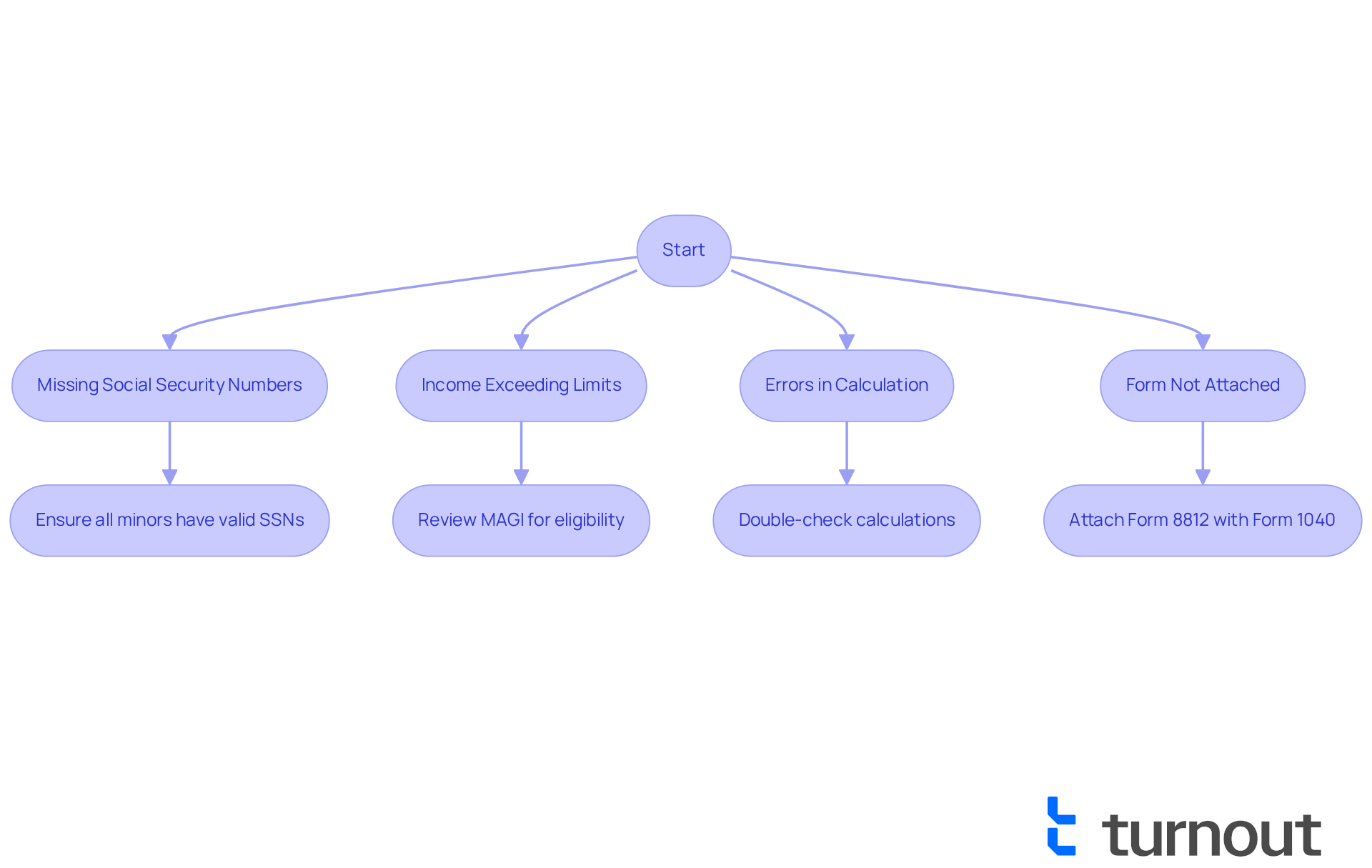

Troubleshoot Common Issues When Filing Schedule 8812

Filing instructions schedule 8812 can feel overwhelming, but you are not alone in this journey. Many taxpayers encounter common issues that can complicate the process. Here’s how to address them effectively:

- Missing : It's essential for all eligible minors to have valid [Social Security numbers](https://myturnout.com). If any are missing, the credit cannot be claimed. Please ensure you have the correct numbers for each individual listed.

- Income Exceeding Limits: If your modified adjusted gross income (MAGI) exceeds the established thresholds, you may not qualify for the full credit. Take a moment to carefully review your income to determine your eligibility.

- Errors in Calculation: Mistakes in calculating the number of eligible dependents or the corresponding credit amounts can lead to issues. We encourage you to double-check all calculations to ensure accuracy.

- Form Not Attached: Remember, must be included with your Form 1040 when submitting. Failing to include this form can delay your refund.

Approximately 37% of taxpayers qualify for the , yet many face challenges in claiming it. For instance, a single filer with two dependents and a MAGI of $150,000 can qualify for a credit of $4,400, but only if all criteria are met correctly.

of understanding the instructions . Antonio Del Cueto, a CPA, advises, "Finding an accountant to manage your bookkeeping and file taxes is a big decision." They recommend compiling accurate information about qualifying children, including their Social Security numbers and relationships, to avoid common pitfalls. By being proactive and aware of these potential issues, you can navigate the more smoothly and .

Additionally, it’s important to note that the maximum refundable amount of the Additional Child Tax Credit is capped at $1,700 for the 2025 tax year. Utilizing like IRS Free File Fillable Forms can also assist you in navigating the filing process effectively. Remember, we're here to help you every step of the way.

Conclusion

Understanding and accurately completing Schedule 8812 is essential for families eager to maximize their Child Tax Credit benefits. This form not only helps determine eligibility but also significantly impacts the financial relief families can receive. By following the detailed steps outlined in this guide, you can confidently navigate the complexities of claiming the Additional Child Tax Credit, ensuring you secure the maximum refund possible.

We recognize that navigating tax forms can be overwhelming. This article highlights key aspects of Schedule 8812, including:

- Eligibility requirements for dependents

- The importance of accurate income reporting

- Common pitfalls to avoid during the filing process

Families with children under 17, valid Social Security numbers, and income within specified thresholds can benefit greatly from this refundable tax credit. Moreover, understanding the calculation process and ensuring all necessary forms are attached to your tax return can prevent delays and complications.

Ultimately, the significance of Schedule 8812 extends beyond mere compliance; it represents an opportunity for families to alleviate financial burdens and enhance their economic stability. By being proactive in understanding the requirements and seeking assistance when needed, you can navigate this process effectively. Embracing the resources available, such as tax professionals and software, can make a substantial difference in ensuring you receive the support you deserve. Taking action now can lead to a more secure financial future, making the effort to complete Schedule 8812 truly worthwhile.

Frequently Asked Questions

What is Schedule 8812 and why is it important?

Schedule 8812, also known as the Additional Dependent Tax Credit (ACTC) form, is essential for claiming tax credits for eligible dependents. It determines the amount of credit you can receive, which can ease your tax burden or result in a refund.

How much can the Dependent Tax Credit be worth for the 2025 tax year?

For the 2025 tax year, the Dependent Tax Credit can be valued at up to $2,200 for each qualifying dependent.

What is the ACTC and who benefits from it?

The ACTC is a refundable portion of the Child Tax Credit, allowing eligible taxpayers to receive refunds even if their tax bill is reduced to zero. It is particularly beneficial for families with lower incomes, who may receive up to $1,700 per eligible dependent as a refund.

What are the residency requirements for dependents to qualify for the credit?

To qualify, children must have lived with the caregiver for at least six months during the tax year.

What income threshold must families meet to begin benefiting from this credit?

Families earning above the minimum threshold of $2,500 can begin to benefit from the credit.

Are there income limits for the Child Tax Credit?

Yes, the credit phases out for higher earners—specifically, single filers earning over $200,000 and joint filers over $400,000.

What is the significance of accurately completing Form 8812?

Accurately completing Form 8812 is crucial to ensure families receive the maximum benefits possible, as the extra tax credit for dependents is calculated at 15 percent for every dollar of earned income starting at $2,500.

What are the potential consequences of improper claims of the Child Tax Credit?

Improper claims of the Child Tax Credit could lead to penalties and restrictions on future claims.

How can taxpayers secure significant refunds through Schedule 8812?

Many taxpayers have successfully navigated the complexities of Schedule 8812 to secure significant refunds, alleviating financial stress, by ensuring accurate reporting of earned income and dependent information.