Overview

Navigating the process of setting up an IRS installment plan can feel overwhelming, but we're here to help. It involves verifying your eligibility, gathering necessary documents, and submitting an application through various methods—whether online, by phone, or by mail.

This article serves as your comprehensive guide, detailing the types of plans available, the eligibility criteria, and the benefits you can expect. We understand that addressing common issues can be daunting, but with the right support, you can successfully navigate this journey.

You're not alone in this; we’re here to guide you every step of the way.

Introduction

Navigating tax obligations can feel overwhelming, especially when faced with the prospect of a hefty bill that seems impossible to pay all at once. We understand that this can be a stressful situation. Fortunately, the IRS offers installment plans that allow you to manage your debts over time, making it easier to regain your financial stability. In this guide, we will walk you through the step-by-step process of setting up an IRS installment plan, highlighting essential requirements, potential benefits, and common pitfalls to avoid.

But what happens when unexpected challenges arise during this journey? It's common to feel uncertain in these moments. Understanding how to troubleshoot these issues can be the key to successfully managing your tax responsibilities. Remember, you are not alone in this journey; we’re here to help you every step of the way.

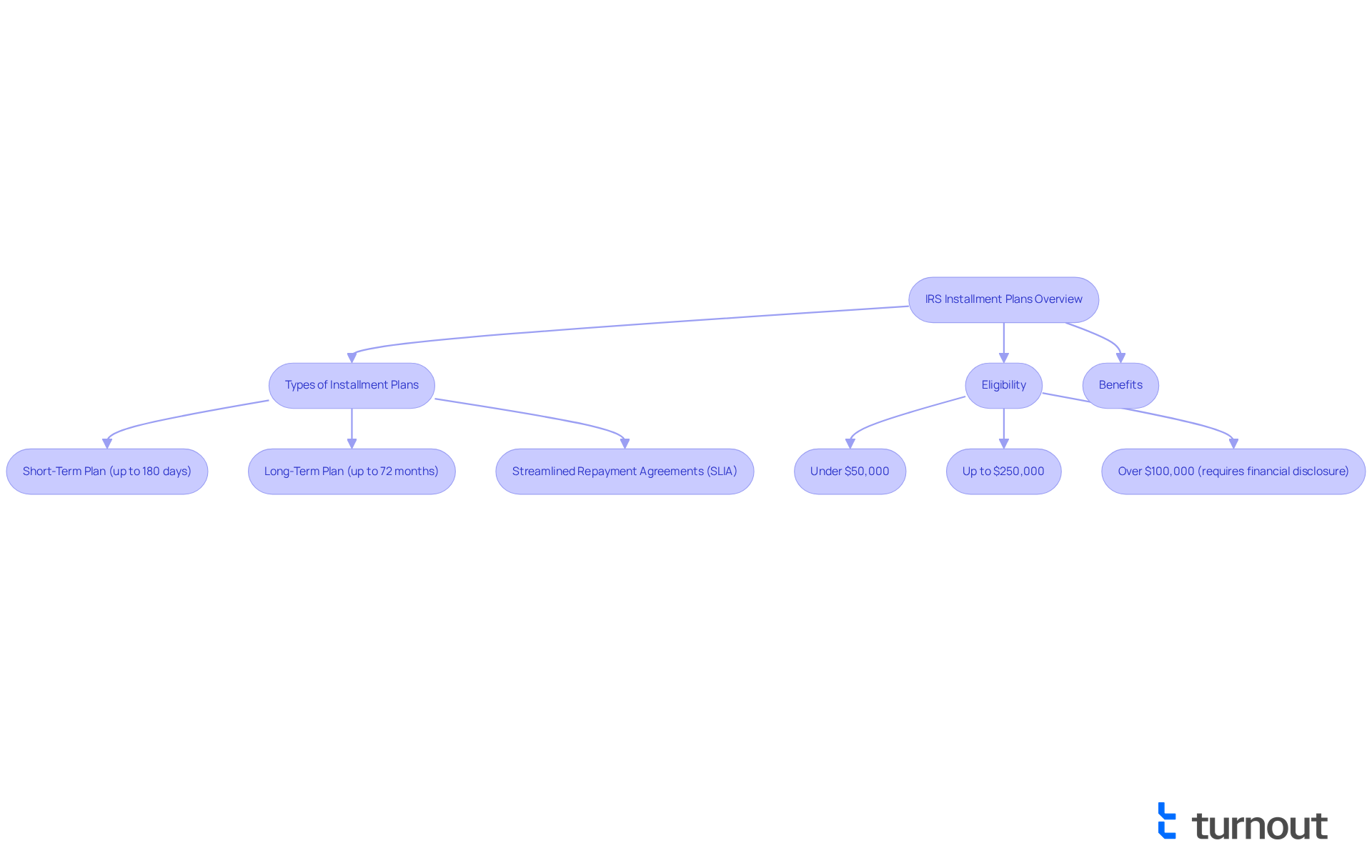

Understand IRS Installment Plans

An IRS repayment arrangement, often referred to as a financial schedule, enables taxpayers to set up an installment plan with the IRS to resolve their tax obligations over time rather than in a single payment. This option is particularly beneficial for those who may struggle to pay their full tax bill by the due date. Let’s explore some essential points to consider:

- Types of Installment Plans: The IRS provides various installment agreements, including short-term plans lasting up to 180 days and long-term plans that can extend to 72 months or more. Streamlined repayment agreements (SLIAs) are especially favored, making up nearly 70% of all IRS arrangements. These plans are designed to ease the process for taxpayers owing $50,000 or less.

- Eligibility: Most taxpayers can qualify for a payment arrangement, especially if their total balance, including tax, penalties, and interest, is under $50,000. For individuals with balances up to $250,000, establishing an arrangement has become more accessible, allowing for quicker approvals without the need for extensive financial disclosures. However, taxpayers who owe more than $100,000 will need to provide detailed financial information to the IRS to assess their ability to pay.

- Benefits: Setting up an installment plan with the IRS can protect taxpayers from more aggressive collection actions, like wage garnishments or bank levies. Additionally, making a partial payment by the deadline can help reduce interest fees and late charges, which currently stand at 7% annually, compounded daily, and 0.5% monthly. Remember, if your financial situation changes, you have the option to renegotiate your payment agreements.

Understanding these elements will empower you to navigate the process to set up an installment plan with the IRS more efficiently. You are not alone in this journey; we’re here to help you every step of the way.

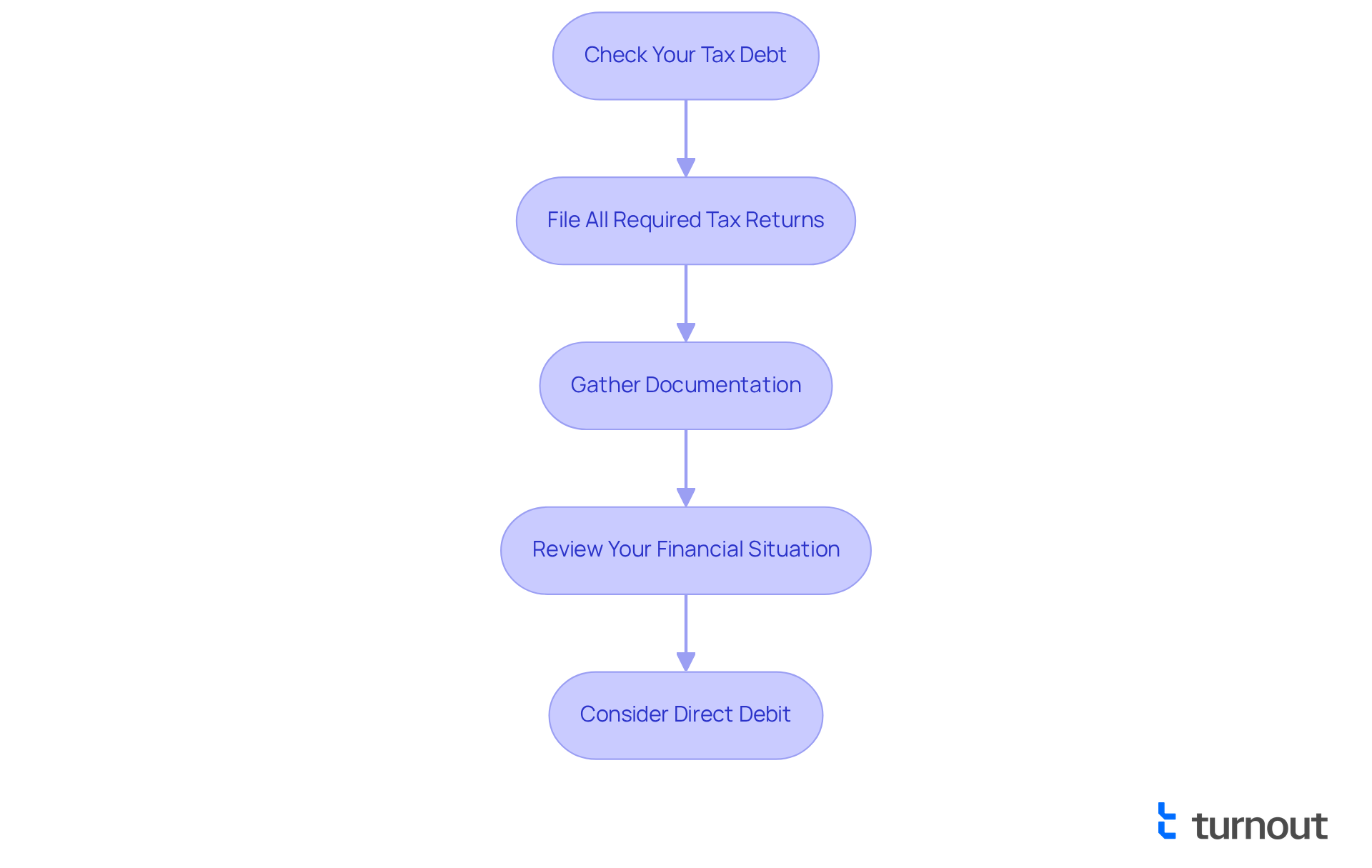

Determine Eligibility and Gather Required Documents

Before seeking to set up an installment plan with the IRS, it’s important to assess your eligibility and gather the necessary documents. We understand that this process can feel overwhelming, but following these steps can help ensure a smooth application experience:

- Check Your Tax Debt: Confirm that your total tax debt is less than $50,000. This includes assessed taxes, penalties, and interest. More than 90% of individual taxpayers with an outstanding balance qualify for payment arrangements under this threshold. Most individuals can set up an installment plan IRS by utilizing payment options via the Online Payment Agreement on IRS.gov.

- File All Required Tax Returns: Ensure that all necessary tax returns for previous years have been filed. It’s essential to be current on submitting your tax returns to qualify for a Simple Payment Arrangement. If there are unfiled returns, the IRS will not allow you to set up an installment plan IRS.

- Gather Documentation: Collect the following essential documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- A valid email address for communication.

- Financial details, including income, expenditures, and assets, if necessary for particular strategies.

- Review Your Financial Situation: Assess your monthly budget to determine how much you can afford to pay each month. Understanding your financial capacity will assist you in proposing a feasible arrangement. Remember, the late filing penalty is typically 5 percent per month on any unpaid balance, so timely filing is crucial.

Furthermore, consider setting up transactions through direct debit. This can streamline the process and help prevent missed payments. By ensuring you meet these eligibility criteria and have the necessary documents ready, you will simplify the application process and increase your chances of approval to set up an installment plan with the IRS. Please be aware that there may be setup charges linked to your arrangement, such as a $69 fee for long-term options applied online. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

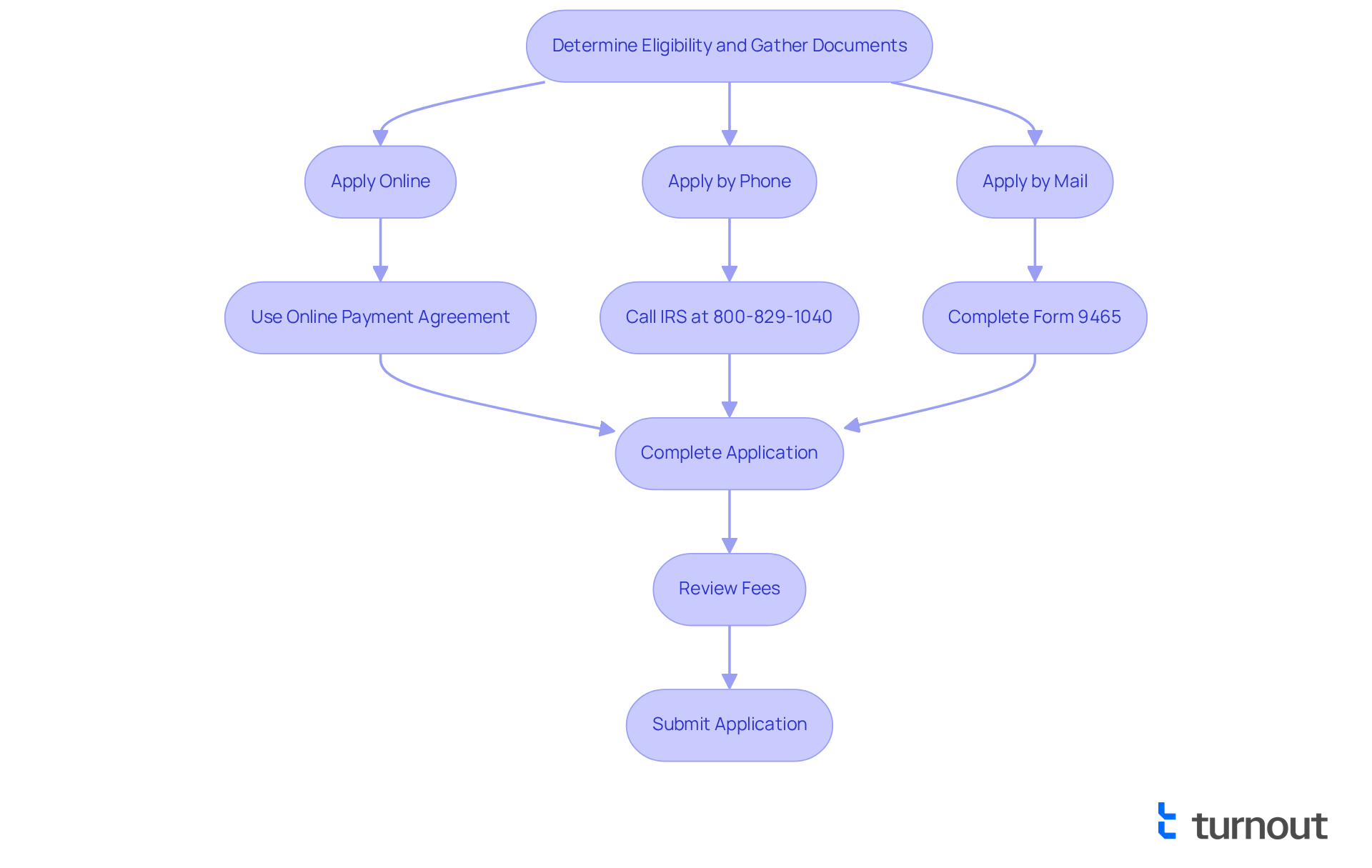

Apply for Your IRS Installment Plan

Once you have verified your eligibility and gathered the necessary documents, you're ready to set up an installment plan with the IRS by submitting your application. We understand that this process can feel overwhelming, but we're here to help you every step of the way. Here’s how to proceed:

-

Choose Your Application Method: You have several options to apply, whether online, by phone, or by mail:

- Online: Visit the IRS website and use the Online Payment Agreement (OPA) tool. Most taxpayers qualify for this method, which enables them to set up an installment plan IRS quickly without the hassle of paperwork. If you don’t already have one, you will need to create an IRS Online Account.

- By Phone: Call the IRS at 800-829-1040, and follow the prompts to apply for a repayment arrangement. It’s common to feel unsure about this step, but the representatives are there to assist you.

- By Mail: Complete Form 9465, Installment Agreement Request, to set up an installment plan IRS, and send it to the address specified in the form instructions. Make sure to double-check your information to avoid delays.

-

Complete the Application: Provide all required information accurately. If you choose to apply online, follow the prompts carefully to sidestep common mistakes that can slow down your application.

-

Review Fees: Be aware that setup charges may apply for certain types of financial arrangements. Understanding these costs upfront can help you budget accordingly and ease any worries you might have.

-

Submit Your Application: Ensure that you submit your application within the required timeframe to avoid penalties. Making at least a partial contribution by the deadline can help reduce interest charges and late fees, as highlighted by the IRS. We know that managing finances can be stressful, but taking this step can provide some relief.

After submitting, you will receive a confirmation from the IRS regarding your application status, allowing you to manage your tax obligations effectively. Remember, you are not alone in this journey, and support is available to help you navigate any challenges.

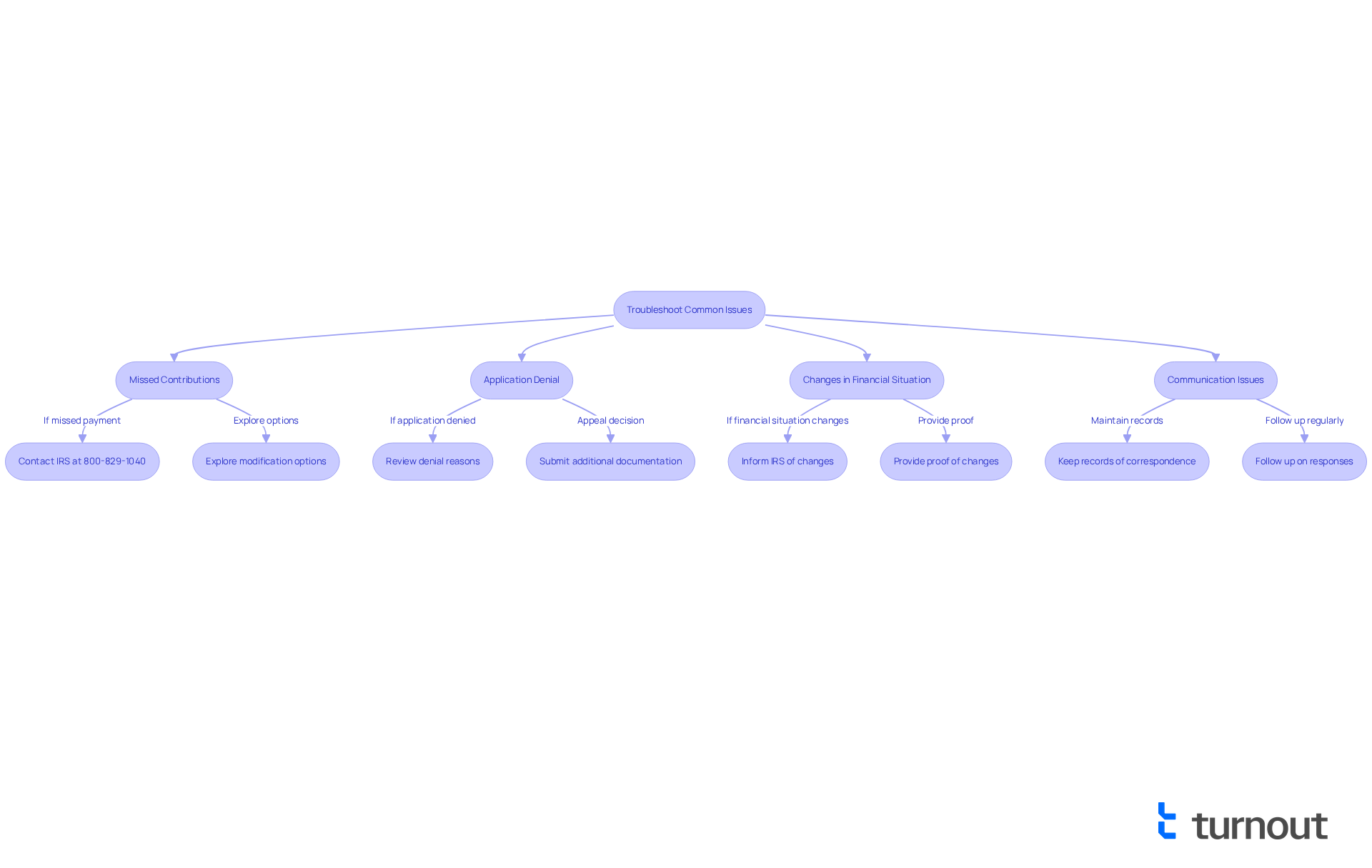

Troubleshoot Common Issues with Your Installment Plan

Even after you set up an installment plan with the IRS, you may encounter some common challenges. We understand that this can be stressful, but here’s how to troubleshoot effectively:

- Missed Contributions: If you miss a contribution, don’t hesitate to reach out to the IRS at 800-829-1040. They can help you explore your options. You might qualify for a modification of your financial arrangement or even a temporary postponement in collection, especially if your circumstances have changed. Additionally, consider setting up direct debit transactions to reduce the likelihood of missing payments.

- Application Denial: If your application is denied, take a moment to carefully review the reasons provided by the IRS. Common issues often stem from incomplete information or not meeting eligibility criteria. For those owing more than $50,000 or who do not qualify for a streamlined agreement, the IRS may ask for more detailed financial information. Remember, you can appeal the decision by submitting additional documentation that addresses their concerns.

- Changes in Financial Situation: If you experience a significant change in your financial situation, such as job loss or unexpected expenses, it’s important to inform the IRS as soon as possible. They may allow you to adjust your payment arrangement to better reflect your current ability to pay. Be prepared to provide proof of these changes when you reach out.

- Communication Issues: Keep thorough records of all correspondence with the IRS. They typically communicate through mail, sending a bill, letter, or notice detailing what you owe. If you experience delays in their responses, follow up regularly to ensure your concerns are addressed promptly.

By being proactive and prepared for these common issues, you can effectively set up an installment plan with the IRS and minimize the risk of further complications. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Setting up an IRS installment plan can be a crucial step for you if you're seeking to manage your tax obligations effectively. This guide has illuminated the path to establishing a payment arrangement, emphasizing that it is a viable option for those who cannot pay their full tax bill at once. By understanding the types of plans available, eligibility requirements, and the application process, you can take control of your financial responsibilities.

We’ve discussed various types of installment plans, such as:

- Short-term options

- Long-term options

- Streamlined agreements for those with smaller debts

It’s essential to verify your eligibility, gather necessary documents, and be aware of the potential fees associated with setting up a plan. Moreover, we’ve addressed common issues like missed payments or application denials, ensuring that you are better prepared to navigate the complexities of IRS interactions.

Ultimately, the ability to set up an installment plan with the IRS not only provides relief from immediate financial pressure but also safeguards against more aggressive collection actions. By taking proactive steps and staying informed about the process, you can manage your tax debts effectively. Embracing this opportunity can lead to greater financial stability and peace of mind. Remember, understanding and utilizing IRS installment plans is a significant step towards a more secure financial future, and you are not alone in this journey.

Frequently Asked Questions

What is an IRS installment plan?

An IRS installment plan, also known as a repayment arrangement, allows taxpayers to resolve their tax obligations over time through scheduled payments rather than a single payment.

What types of installment plans does the IRS offer?

The IRS offers various installment agreements, including short-term plans lasting up to 180 days and long-term plans that can extend to 72 months or more. Streamlined repayment agreements (SLIAs) are particularly popular, making up nearly 70% of all IRS arrangements.

Who is eligible for an IRS installment plan?

Most taxpayers can qualify for a payment arrangement if their total balance, including tax, penalties, and interest, is under $50,000. For those with balances up to $250,000, the process has become more accessible, allowing for quicker approvals. However, taxpayers who owe more than $100,000 must provide detailed financial information to the IRS.

What are the benefits of setting up an installment plan with the IRS?

Setting up an installment plan can protect taxpayers from aggressive collection actions, such as wage garnishments or bank levies. Additionally, making a partial payment by the deadline can help reduce interest fees and late charges.

What are the current interest rates and fees associated with IRS installment plans?

The current interest rate is 7% annually, compounded daily, and there is a late charge of 0.5% monthly.

Can taxpayers renegotiate their payment agreements if their financial situation changes?

Yes, if a taxpayer's financial situation changes, they have the option to renegotiate their payment agreements with the IRS.