Overview

If you're facing back taxes, it's important to approach the situation with care and understanding. We know that dealing with tax issues can be overwhelming, but you are not alone in this journey.

Start by gaining a clear understanding of your tax situation. Gather all necessary financial records, as this will help you navigate the next steps more effectively.

Next, reach out to tax authorities. It's common to feel apprehensive about contacting them, but they are there to help you find a resolution. Explore your payment options, including:

- Installment agreements

- Offers in compromise

These pathways can provide the relief you need to resolve your back taxes.

Remember, addressing back taxes promptly is crucial to avoid severe penalties. We're here to help you through this process, ensuring you have the support and information needed to move forward confidently.

Introduction

Navigating the complexities of back taxes can often feel like wandering through a maze of financial obligations and potential penalties. We understand that the stakes are high—ranging from wage garnishments to property liens. Addressing these unpaid dues is not just advisable; it is essential for your financial peace of mind. This guide offers a clear, step-by-step approach to resolving back taxes owed, empowering you to take control of your tax situation and explore viable payment options.

But what happens when the burden of unpaid taxes feels overwhelming? It’s common to feel lost in the maze of tax authorities and payment plans. How can you effectively find a resolution? We're here to help you navigate this journey with compassion and understanding.

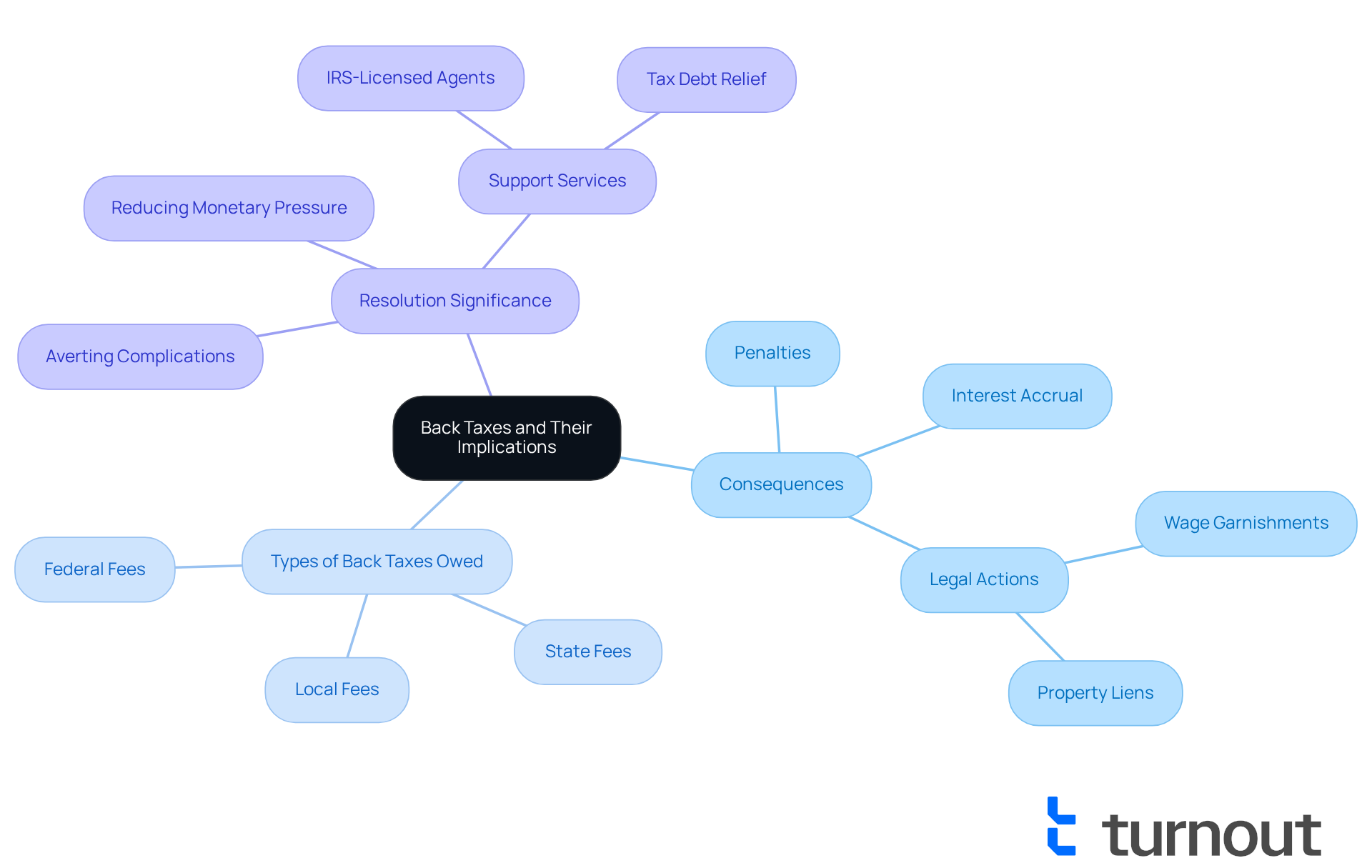

Understand Back Taxes and Their Implications

Unpaid dues are amounts that remain unsettled past their deadline. They can accumulate for various reasons, including financial hardship, lack of awareness, or mismanagement of finances. Understanding back taxes is essential because:

- Consequences: We understand that failing to address back taxes can lead to severe penalties, interest accrual, and even legal actions such as wage garnishments or property liens.

- Types of : It's common to feel overwhelmed by the different types of back taxes owed, which can include federal, state, and local fees, each with its own regulations and consequences.

- Resolution Significance: Tackling back taxes owed swiftly can avert additional complications and monetary pressure. It's essential to comprehend the consequences involved in this process.

At Turnout, we're here to help. We offer a variety of tools and services to assist individuals in managing these intricate monetary obligations, including support with . Our approach involves working with who are qualified to support you in resolving your tax issues. While we do not offer legal assistance, our services guarantee that you receive the essential support to handle your overdue payments efficiently. You are not alone in this journey.

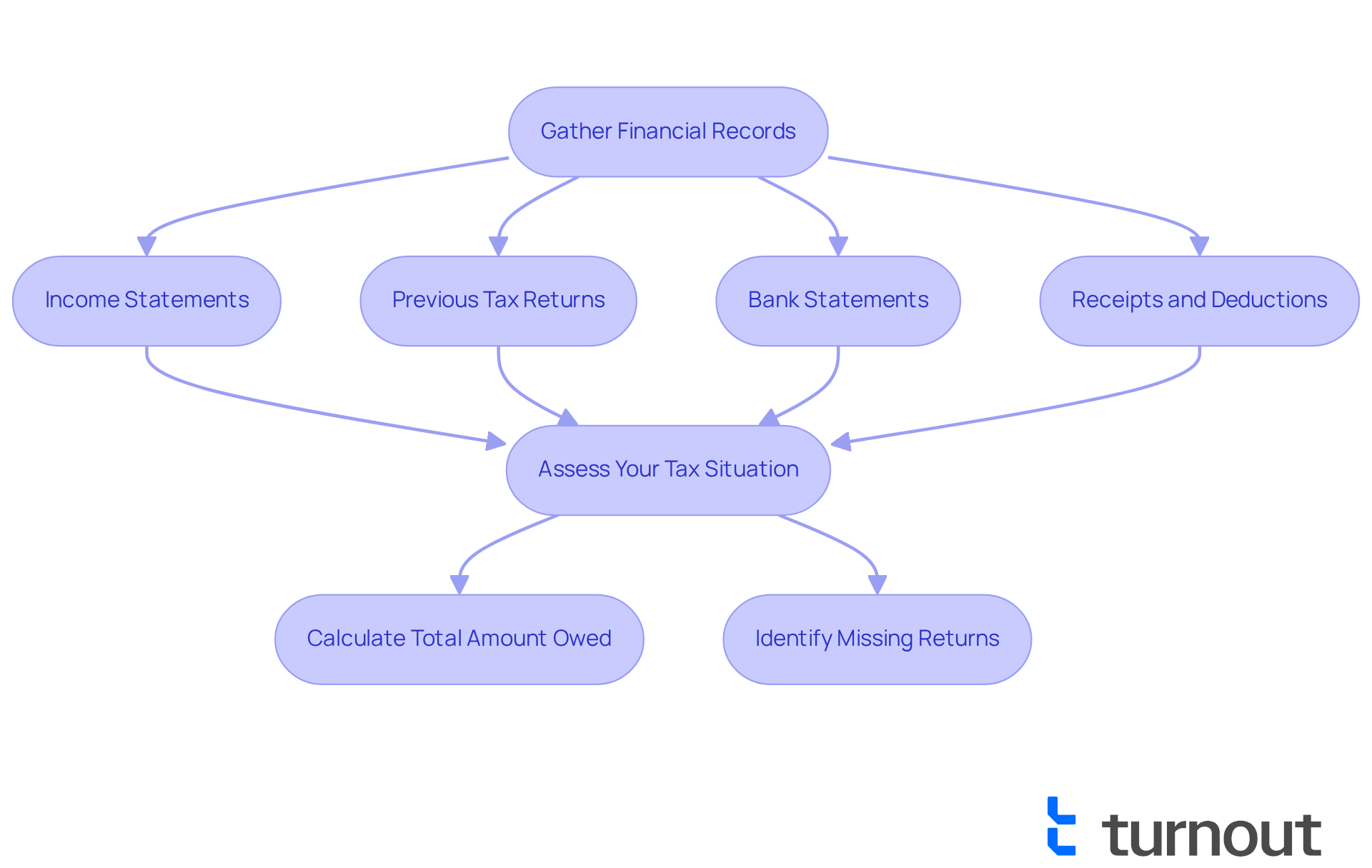

Gather Financial Records and Assess Your Tax Situation

To successfully address your outstanding obligations, it’s important to start by gathering all relevant . We understand that this can feel overwhelming, but taking it step by step can help ease your concerns. Here’s what you’ll need:

- Income Statements: Collect your W-2s, 1099s, and any other income documentation for the years in question. This will give you a clear picture of your earnings.

- Previous : Having copies of your past tax returns will help you understand what has been filed and identify anything that may be missing.

- Bank Statements: Examining your bank statements allows you to monitor your income and expenses, providing insight into your financial situation.

- Receipts and Deductions: Gather receipts for any deductible expenses, as these may help reduce your .

Once you have all your documents, take a moment to assess your overall . It’s common to feel uncertain, but we’re here to help:

- Calculate the total amount owed, including any penalties and interest. This will clarify your obligations related to .

- Identify any years for which you have not filed returns. Understanding this will significantly impact your resolution options.

Remember, you are not alone in this journey. Taking these steps can help you regain control and move towards resolution.

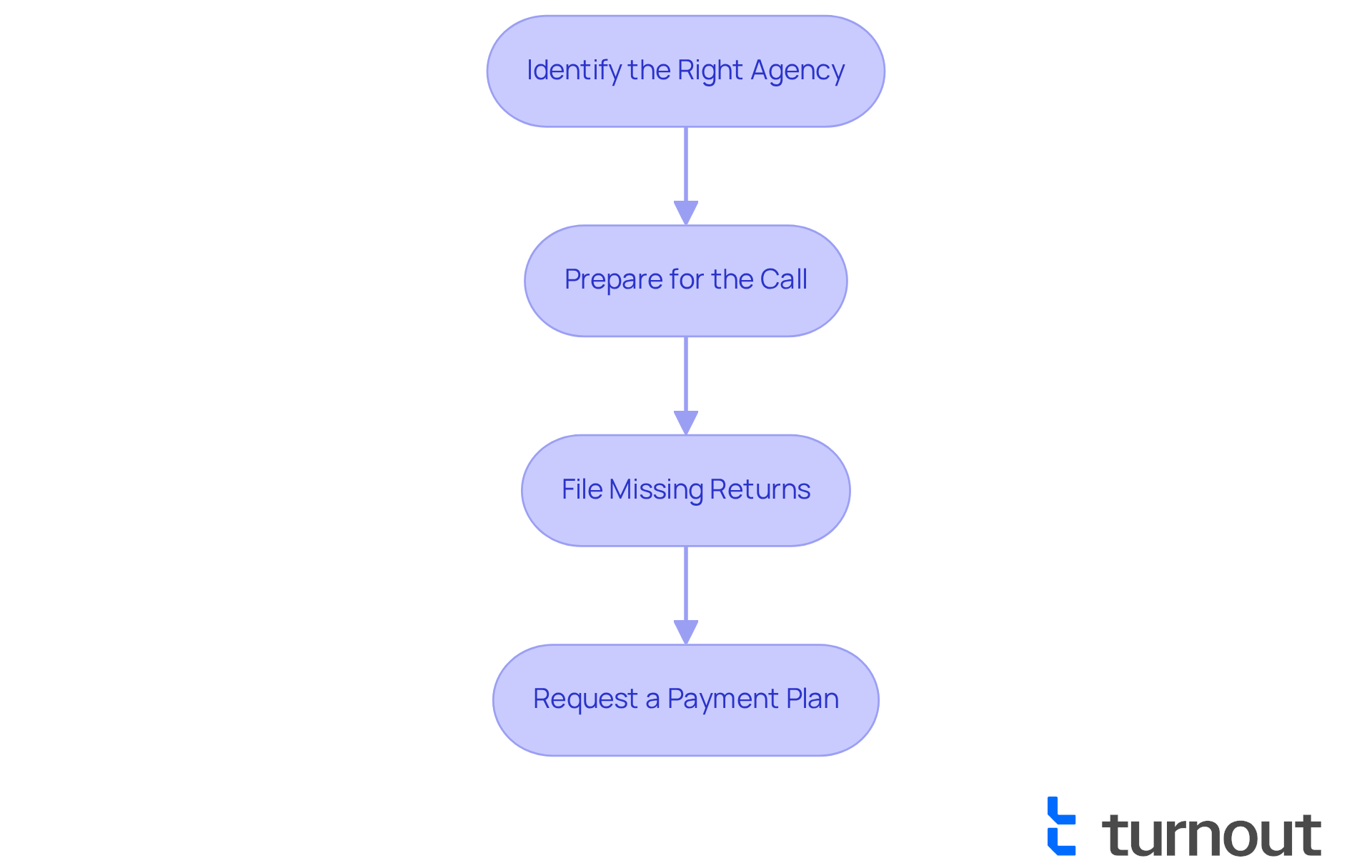

Contact Tax Authorities and File Necessary Returns

Once you have assessed your tax situation, we understand that the next step can feel overwhelming. It's important to reach out to the relevant tax authorities, and we're here to guide you through that process.

- Identify the Right Agency: You may need to contact the IRS for federal taxes or your state’s tax agency for state taxes. Knowing who to reach out to is the first step.

- Prepare for the Call: We encourage you to gather your monetary records and any relevant notices. This preparation will help you discuss your situation clearly and confidently.

- : If you have because you have not filed returns for certain years, it’s crucial to complete and submit them as soon as possible. Utilize the suitable forms for each tax year, which can be easily found on the IRS or local tax agency website.

- Request a : If paying the full amount owed, including back taxes owed, feels daunting, don’t hesitate to inquire about setting up a payment plan. Be honest about your financial situation; this openness will help you find a manageable solution.

Remember, you are not alone in this journey, and taking these steps can lead you toward relief and resolution.

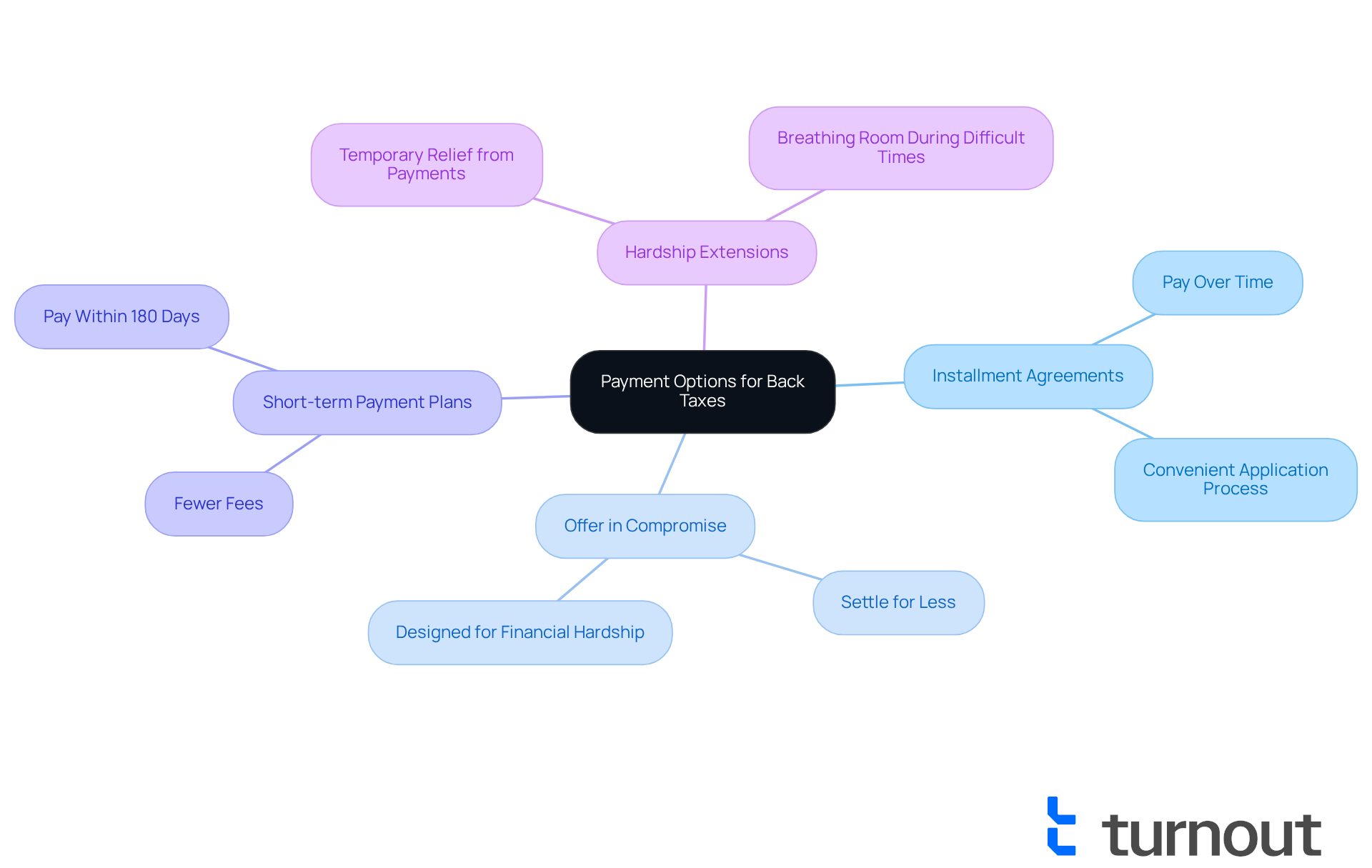

Explore Payment Options and Plans for Back Taxes

After reaching out to tax authorities and filing the necessary returns, you may feel overwhelmed by your options. We understand that managing tax debt can be challenging, but there are several pathways available to help you navigate this situation:

- : The IRS and many state agencies offer installment agreements that allow you to pay your tax debt over time. You can easily apply for these plans online or by phone, making it a convenient choice for many.

- Offer in Compromise: If you find yourself in a tough spot financially, this program may be a lifeline. It allows you to settle your back taxes owed for less than the full amount, specifically designed for those unable to pay their obligations due to economic hardships.

- s: If you can pay your tax debt within 180 days, consider a short-term payment plan, which often comes with fewer fees. This option can provide a quicker resolution to your tax concerns.

- Hardship Extensions: Experiencing significant financial difficulties? Inquire about hardship extensions that may offer temporary relief from payments, allowing you a bit of breathing room during tough times.

Remember, it’s crucial to keep all correspondence with tax authorities and document your payment agreements. This diligence can help you avoid future complications. You're not alone in this journey, and we're here to help you find the best path forward.

Conclusion

Addressing back taxes owed is a crucial step towards achieving financial stability and peace of mind. We understand that the implications of unpaid taxes can be overwhelming. By following a structured approach, you can effectively navigate the complexities of your tax obligations. Taking timely action can prevent severe penalties and legal issues, allowing you to regain control over your financial situation.

Key steps to consider include:

- Gathering essential financial records

- Assessing your tax situation

- Reaching out to the appropriate tax authorities

Each of these actions is significant in resolving back taxes, as they clarify what is owed and pave the way for potential payment plans or compromises. Exploring various payment options, such as installment agreements and hardship extensions, empowers you to manage your tax debts without the burden of overwhelming stress.

Ultimately, the journey to resolving back taxes is not one you must face alone. With the right resources and support, you can take actionable steps towards relief. Embracing this process not only alleviates immediate financial burdens but also fosters a more informed and proactive approach to your future tax responsibilities. Taking the first step today can truly lead to a brighter financial future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What are back taxes?

Back taxes are unpaid dues that remain unsettled past their deadline, which can accumulate due to financial hardship, lack of awareness, or mismanagement of finances.

Why is it important to understand back taxes?

Understanding back taxes is essential because failing to address them can lead to severe penalties, interest accrual, and legal actions such as wage garnishments or property liens.

What types of back taxes might someone owe?

Individuals may owe various types of back taxes, including federal, state, and local fees, each with its own regulations and consequences.

What are the consequences of not resolving back taxes?

Not addressing back taxes can result in severe penalties, accruing interest, and potential legal actions like wage garnishments or property liens.

How can one resolve back taxes?

Tackling back taxes swiftly is crucial to avoid additional complications and financial pressure. Understanding the resolution process and its consequences is important for effective management.

What services does Turnout offer for managing back taxes?

Turnout provides tools and services to assist individuals in managing their tax obligations, including support with tax debt relief, through IRS-licensed enrolled agents.

Does Turnout provide legal assistance for tax issues?

No, Turnout does not offer legal assistance, but they provide essential support to help individuals handle their overdue payments efficiently.