Overview

Navigating Social Security long-term disability benefits can feel overwhelming. We understand that you may have concerns about eligibility requirements and the necessary documentation. Gathering the right paperwork is essential, as many applications face denial due to insufficient documentation. It’s important to know that you are not alone in this journey.

Thorough preparation is key. Accumulating health records and employment history can significantly enhance your chances of approval. We encourage you to seek assistance from advocates who can guide you through this process. Their support can make a real difference in your experience.

Remember, you deserve the best possible chance at receiving the benefits you need. Take the time to prepare, and don’t hesitate to reach out for help. Together, we can navigate this path more effectively.

Introduction

Navigating the complexities of Social Security long-term disability benefits can feel overwhelming. We understand that this journey is particularly challenging for those facing significant health issues. This guide serves as a comprehensive roadmap designed to help you understand:

- Eligibility requirements

- Application processes

- The essential documentation needed to secure the financial support that can make a crucial difference in your daily life

It's common to feel uncertain about the next steps, especially with the high denial rate for initial applications. So, what can you do to enhance your chances of approval? We’re here to provide you with the supportive information you need to ensure you receive the benefits you rightfully deserve.

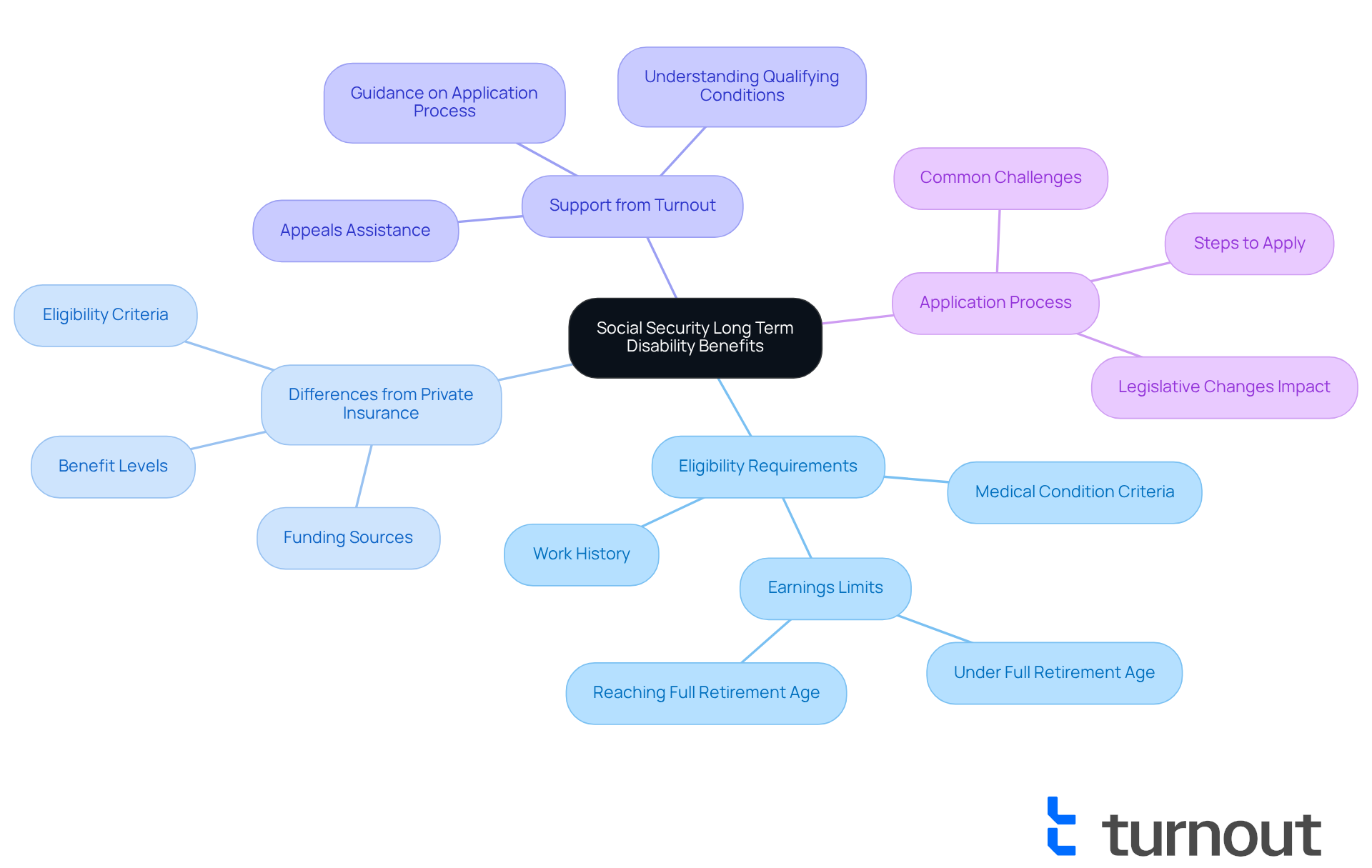

Understand Social Security Long Term Disability Benefits

Social Security long term disability is essential for individuals who are unable to work because of a medical condition that is anticipated to persist for at least one year or could result in death. These benefits are part of the social security long term disability program, which requires applicants to have a sufficient work history and contribute to Social Security through taxes. Understanding the differences between Social Security long term disability and private long-term disability coverage is essential. Social Security long term disability benefits are federally funded and determined by a person's earnings history, while private insurance plans may have different eligibility criteria and benefit levels.

Turnout provides vital support for individuals navigating the disability benefits application process. With the help of trained nonlawyer advocates, Turnout guides clients in understanding qualifying conditions and the potential for appeals, ensuring they feel informed and supported throughout. Many recipients express that these benefits are indispensable for covering essential living expenses, including housing and healthcare.

Familiarizing yourself with the SSDI application process and keeping up with legislative changes can significantly improve your chances of successfully navigating the system. Turnout's approach simplifies access to these benefits, making it easier for individuals with disabilities to obtain the financial support they deserve. Remember, you are not alone in this journey; we’re here to help you every step of the way.

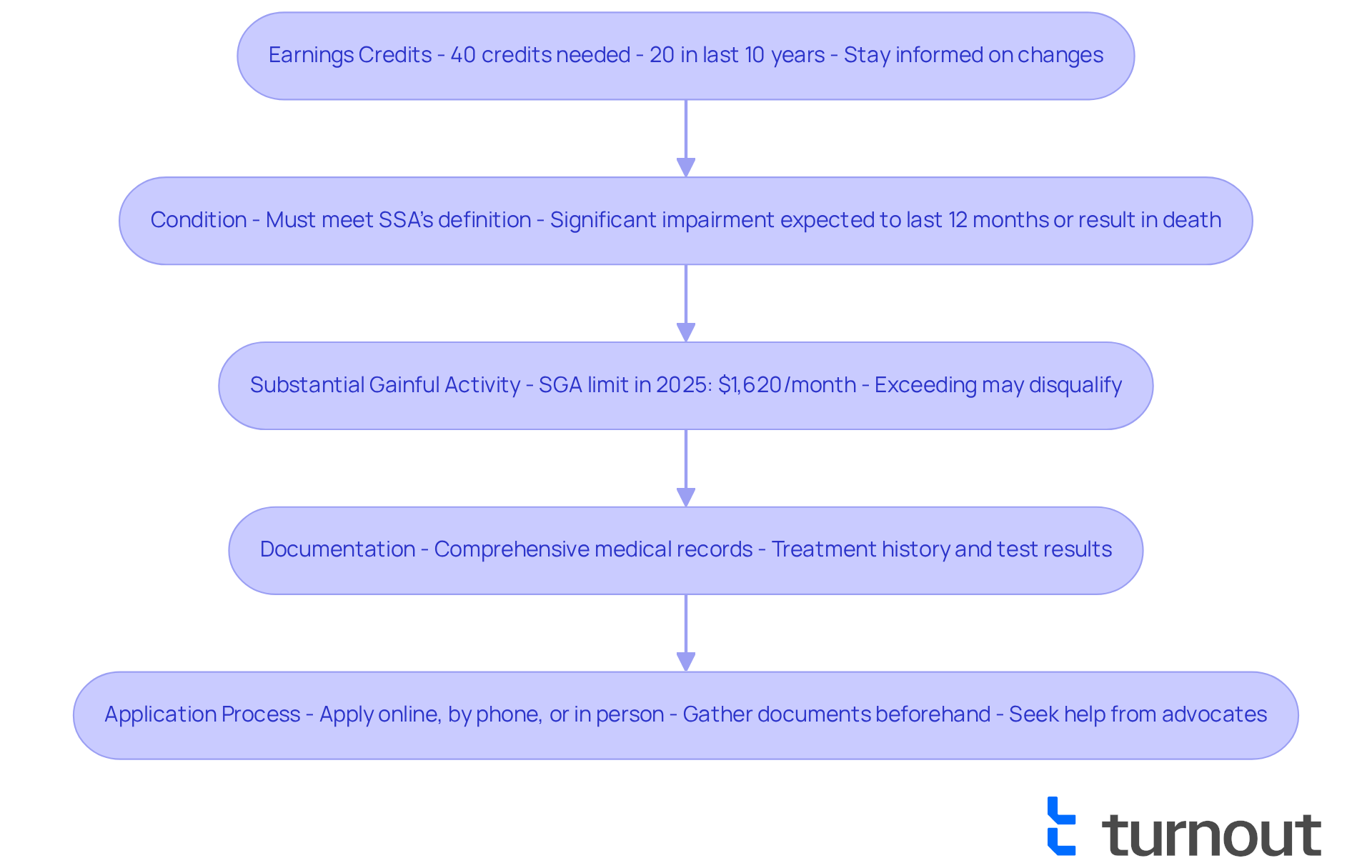

Determine Eligibility Requirements for Benefits

Understanding the key eligibility requirements is important to qualify for social security long term disability benefits, as they can feel overwhelming. We’re here to help you navigate this process with compassion and clarity.

- Earnings Credits: Generally, individuals need to accumulate 40 earnings credits, with at least 20 of those earned in the last 10 years before their disability begins. These credits are obtained by paying Social Security taxes on your earnings. As we approach 2025, keep an eye on potential adjustments to these requirements, as staying informed is crucial.

- Condition: It’s essential that the applicant has a health issue that meets the Social Security Administration's (SSA) definition of disability. This means the condition must significantly impede the ability to perform essential job functions and is expected to last at least 12 months or result in death.

- Substantial Gainful Activity (SGA): In 2025, the SGA limit is projected to be $1,620 per month (or $2,700 for individuals who are blind). If your earnings exceed this amount, you may not qualify as disabled under SSA rules, and we understand how disheartening that can be.

- Documentation: Comprehensive medical documentation is vital to support your claim. This includes medical records, treatment history, and relevant test results. Having this documentation ready is critical in demonstrating how your condition affects your ability to work.

- Application Process: Knowing how to apply is crucial. You can submit your application online, by phone, or in person at a nearby SSA office. We recommend gathering all necessary documents beforehand to make the process smoother. While Turnout is not a law firm and does not provide legal representation, they can connect you with trained nonlawyer advocates who can assist you in navigating the SSD claims process. In fact, claimants who had representation received benefits at a rate three times higher than those without, underscoring the importance of seeking help during this journey.

Real-life stories show that individuals who meet these work credit requirements often have a better chance of approval. Disability advocates stress the importance of thorough preparation and staying informed about the evolving landscape of SSDI eligibility, especially with the anticipated changes in 2025. By ensuring you meet these eligibility requirements, you can enhance your chances of a successful submission for social security long term disability. Remember, you are not alone in this journey; support is available to help you every step of the way.

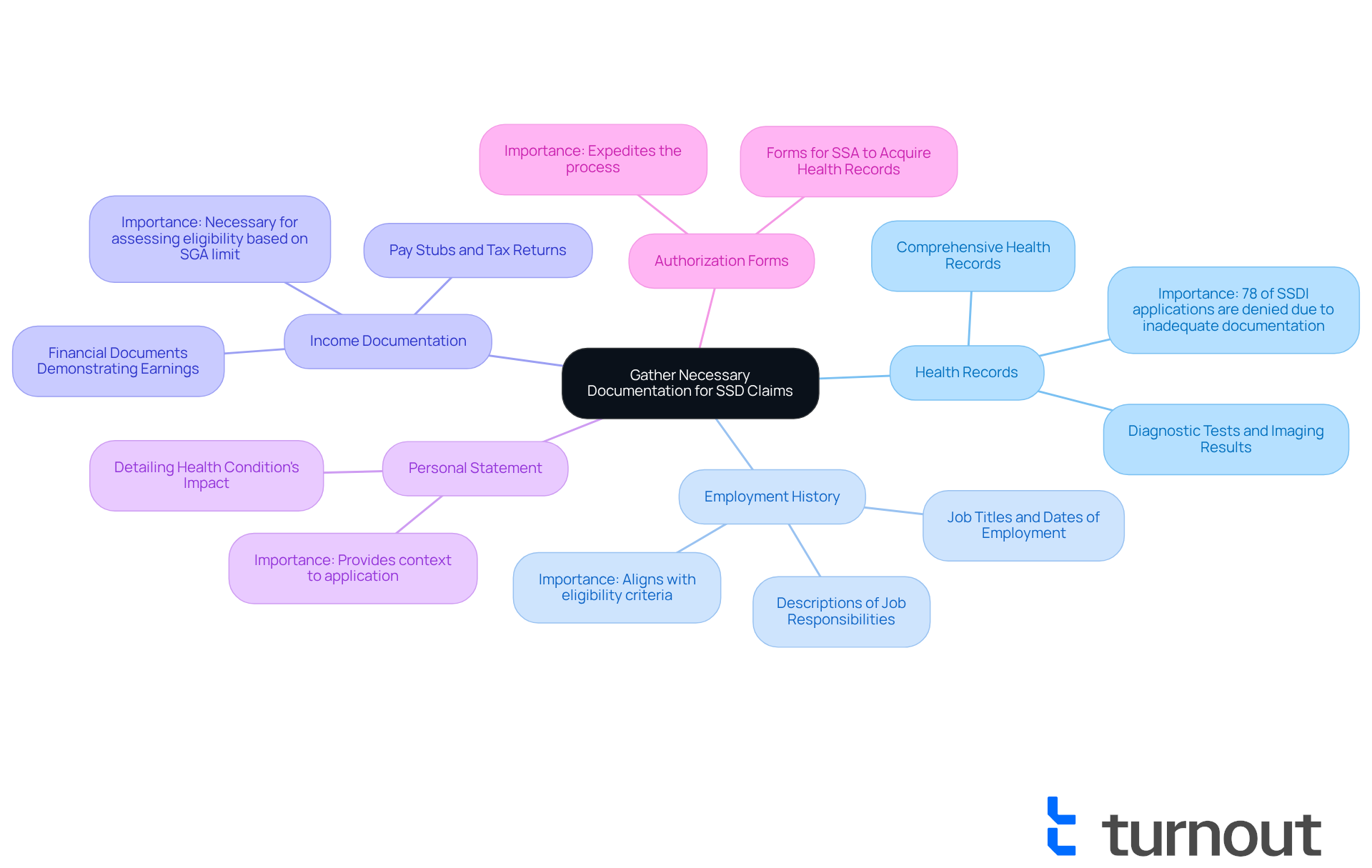

Gather Necessary Documentation

When applying for social security long term disability, we understand how crucial it is to gather the necessary documentation to support your claim. Turnout simplifies this process by providing tools and expert guidance, along with trained nonlawyer advocates, to help you navigate the complexities of SSD claims without the need for legal representation. It’s important to note that Turnout is not a law firm and does not provide legal advice. Here are the key documents you will need:

- Health Records: Acquire comprehensive health records from all healthcare providers who have cared for you regarding your condition. This includes notes from doctors, specialists, and therapists, as well as any diagnostic tests or imaging results. Robust health evidence is crucial for social security long term disability claims, as around 78% of SSDI applications are first denied, frequently because of inadequate documentation. Claimants must ensure that all relevant documentation is provided, as the SSA does not automatically gather medical records.

- Employment History: Prepare a detailed employment history that includes your job titles, dates of employment, and descriptions of your job responsibilities. This information aids in establishing your credit history and the nature of your previous employment. A well-documented employment history is vital, as it aligns with the eligibility criteria for social security long term disability and can significantly enhance your chances of approval.

- Income Documentation: Collect pay stubs, tax returns, and any other financial documents that demonstrate your earnings. This information is necessary to assess your eligibility for social security long term disability based on the Substantial Gainful Activity (SGA) limit, which is crucial for determining your benefits.

- Personal Statement: Write a personal statement detailing how your health condition affects your daily life and ability to work. This narrative can provide context to your application and help reviewers understand your situation better. Including personal insights can strengthen your case by illustrating the real-world impact of your condition.

- Authorization Forms: Complete any necessary authorization forms that permit the Social Security Administration (SSA) to acquire your health records directly from your healthcare providers. This can expedite the process and ensure that all relevant information is considered. It’s common for applicants to mistakenly think the SSA will automatically collect their health records, but it is crucial to follow up to guarantee completeness.

By collecting these documents beforehand, you can simplify the process and enhance your likelihood of a favorable result. Practical cases demonstrate that applicants who submit thorough health documentation and an extensive employment history greatly enhance their chances of acceptance, with certain conditions such as musculoskeletal disorders having an approval rate of around 40%. Additionally, it is common for claimants to overlook the average number of documents required for SSDI applications, which can include multiple medical records, work history details, and financial documentation. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security long term disability benefits can feel overwhelming, especially for those facing medical challenges that hinder their ability to work. We understand that this journey can be daunting, which is why it’s crucial to grasp the eligibility requirements, gather necessary documentation, and seek support throughout the application process. By breaking down these essential steps, you can feel more prepared to secure the financial assistance you need during these difficult times.

Key insights from this guide highlight the importance of:

- Accumulating earnings credits

- Having comprehensive medical documentation

- Providing personal statements that genuinely reflect the impact of health conditions on daily life

It's also beneficial to engage with trained nonlawyer advocates, as they can significantly enhance your chances of a successful claim. Many have found that seeking assistance during their application journey leads to higher approval rates.

Ultimately, remember: you are not alone in this process. With the right tools, support, and an understanding of the Social Security long term disability benefits framework, navigating the system can become a more manageable endeavor. Stay informed and proactive, ensuring that all requirements are met and that every vital piece of documentation is in place. Taking these steps can pave the way for a brighter future and the financial stability needed to overcome life's challenges.

Frequently Asked Questions

What are Social Security long term disability benefits?

Social Security long term disability benefits are designed for individuals who are unable to work due to a medical condition expected to last at least one year or could result in death.

Who is eligible for Social Security long term disability benefits?

Eligibility requires applicants to have a sufficient work history and have contributed to Social Security through taxes.

How do Social Security long term disability benefits differ from private long-term disability coverage?

Social Security long term disability benefits are federally funded and based on a person's earnings history, while private insurance plans may have different eligibility criteria and benefit levels.

How can Turnout assist individuals with the disability benefits application process?

Turnout provides support by helping clients understand qualifying conditions, guiding them through the application process, and assisting with potential appeals.

What do recipients of Social Security long term disability benefits typically use the funds for?

Many recipients use these benefits to cover essential living expenses, including housing and healthcare.

How can individuals improve their chances of successfully navigating the SSDI application process?

Familiarizing oneself with the SSDI application process and staying informed about legislative changes can significantly enhance the chances of success.

What role does Turnout play in simplifying access to disability benefits?

Turnout's approach simplifies the process, making it easier for individuals with disabilities to obtain the financial support they need.