Overview

This article is dedicated to guiding you through the process of using the Social Security Disability Insurance (SSDI) back pay calculator. We understand that navigating financial entitlements can be overwhelming, especially after being approved for disability benefits. That’s why it’s essential to:

- Accurately document your Established Onset Date and application date.

- Gather your medical and work history records, as it ensures precise calculations and maximizes your eligible retroactive payments.

Remember, you are not alone in this journey—we’re here to help you every step of the way.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that understanding financial entitlements, such as back pay, is crucial during this challenging time. Back pay represents the payments owed to you from the onset of your disability until your application is approved. Mastering the SSDI back pay calculator can provide you with valuable insights into your potential compensation, empowering you to make informed financial decisions.

However, it's common to feel uncertain with so many factors to consider, such as the established onset date and the mandatory waiting period. How can you ensure that you are maximizing your benefits and avoiding common pitfalls? Remember, you're not alone in this journey. We're here to help you navigate these complexities with compassion and understanding.

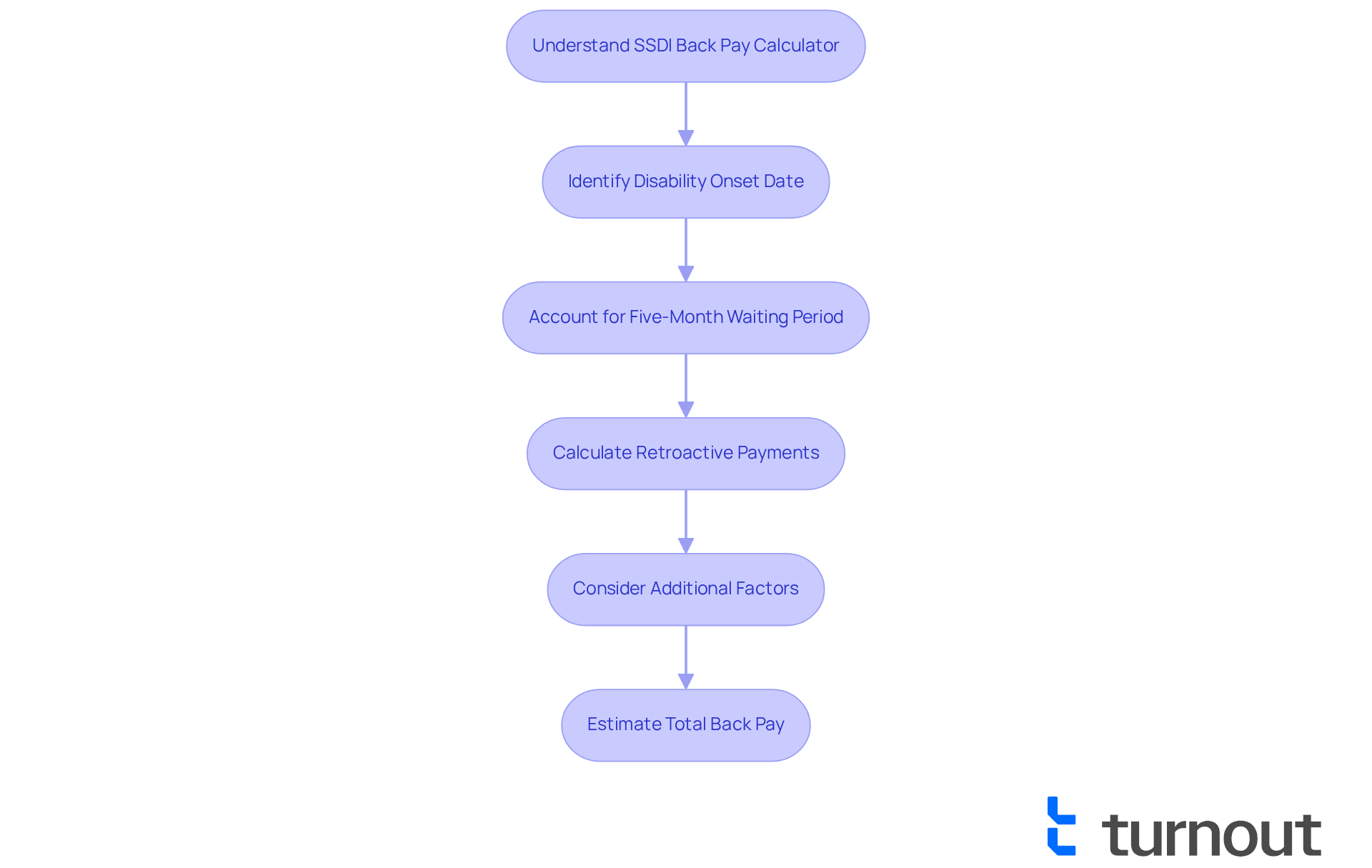

Understand the Purpose of the SSDI Back Pay Calculator

The social security disability back pay calculator is an essential tool for individuals looking to estimate their potential payments after being approved for Social Security Disability Insurance. Back pay represents the entitlements owed to claimants from the onset of their disability until their application is approved. By utilizing this calculator, you can gain a clearer understanding of your financial entitlements, empowering you to make informed decisions about your future.

This tool considers several important factors, such as the established onset date of your disability and the mandatory five-month waiting period set by the Social Security Administration (SSA). For instance, if you became impaired on January 1, 2023, and submitted your application for benefits on March 1, 2023, your retroactive payments would begin in July 2023, covering the months until approval.

It's important to note that over 3.2 million individuals are affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). This highlights the significance of using the social security disability back pay calculator in navigating the complexities of disability assistance. Financial experts emphasize that accurate calculations can help maximize the amount owed to you. For example, if you qualify for an average disability payment of $1,500 each month, you could potentially receive $10,500 in retroactive compensation for seven months of eligibility.

Real-world examples illustrate the calculator's practical application. One user reported receiving a lump sum payment retroactive to November 2024, while another noted a discrepancy in payments due to varying application dates. These experiences underscore the importance of understanding how past compensation is determined and the possibility for retroactive support, which can extend up to 12 months before the application date if it can be shown that the disability was present earlier.

Additionally, keeping thorough documentation of your medical conditions and treatment history is crucial for supporting your disability claim and proving your disability onset date. We understand that this process can be overwhelming, which is why utilizing trained nonlawyer advocates can be beneficial in navigating these complexities. Please remember that Turnout is not a law firm and does not provide legal advice.

In summary, the social security disability back pay calculator is an essential resource for accurately estimating your financial support. We're here to assist you in obtaining the complete assistance you deserve, ensuring there are no unforeseen surprises along the way.

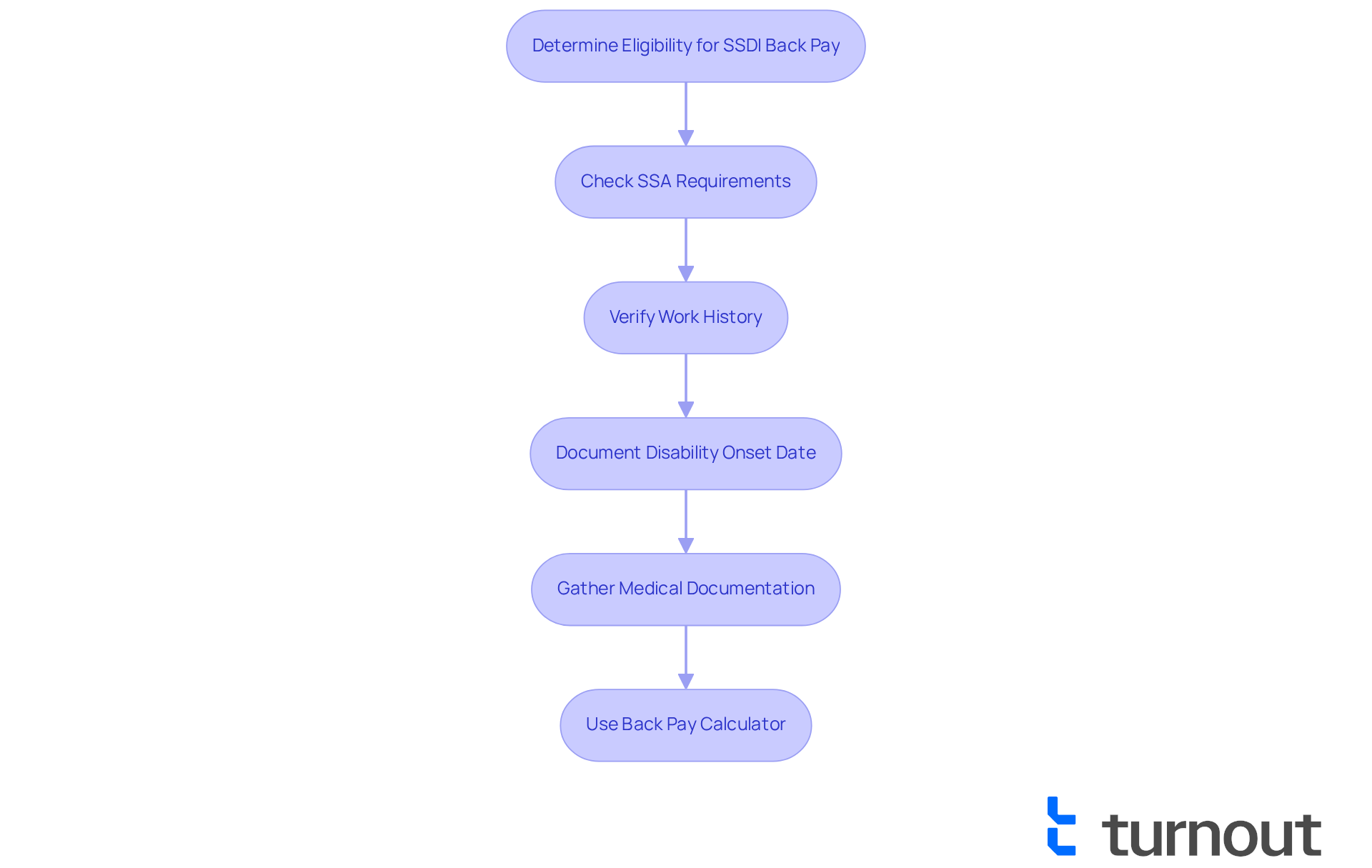

Determine Your Eligibility for SSDI Back Pay

To verify your eligibility for Social Security disability compensation, it's important to first ensure that you meet the Social Security Administration's (SSA) requirements for disability assistance. This usually involves having a work history that includes paying into Social Security for a certain duration. Your disability should be expected to last at least 12 months or result in death. A critical aspect of your application is the documented disability onset date (EOD), which indicates when your disability began. If your EOD is earlier than your application date, you may qualify for retroactive pay, which can be calculated using a social security disability back pay calculator. Gathering relevant medical documentation to support your claim is essential, as this evidence plays a crucial role in establishing your eligibility.

At Turnout, we provide access to tools and services designed to help you navigate the complexities of SSD claims. Our trained nonlawyer advocates are here to assist you throughout the process. It's important to note that Turnout is not a law firm and does not provide legal advice. Disability payments come with a required five-month waiting period, during which no retroactive payments are issued.

Real-life examples can highlight the importance of the EOD. For instance, if someone's EOD is April 1, 2024, and they request benefits on March 1, 2025, they could potentially use a social security disability back pay calculator to estimate the retroactive payments for the months leading up to their application, assuming all other eligibility criteria are met. Data show that a significant portion of disability applicants—often exceeding 60%—can use a social security disability back pay calculator to determine their eligibility for retroactive payments. This underscores the importance of understanding the application process and the necessity of having documented proof.

Experienced experts emphasize that having a clear and precise EOD can greatly impact the amount of compensation received. Therefore, careful record-keeping is vital throughout the application journey. Remember, you are not alone in this process; we’re here to help you every step of the way.

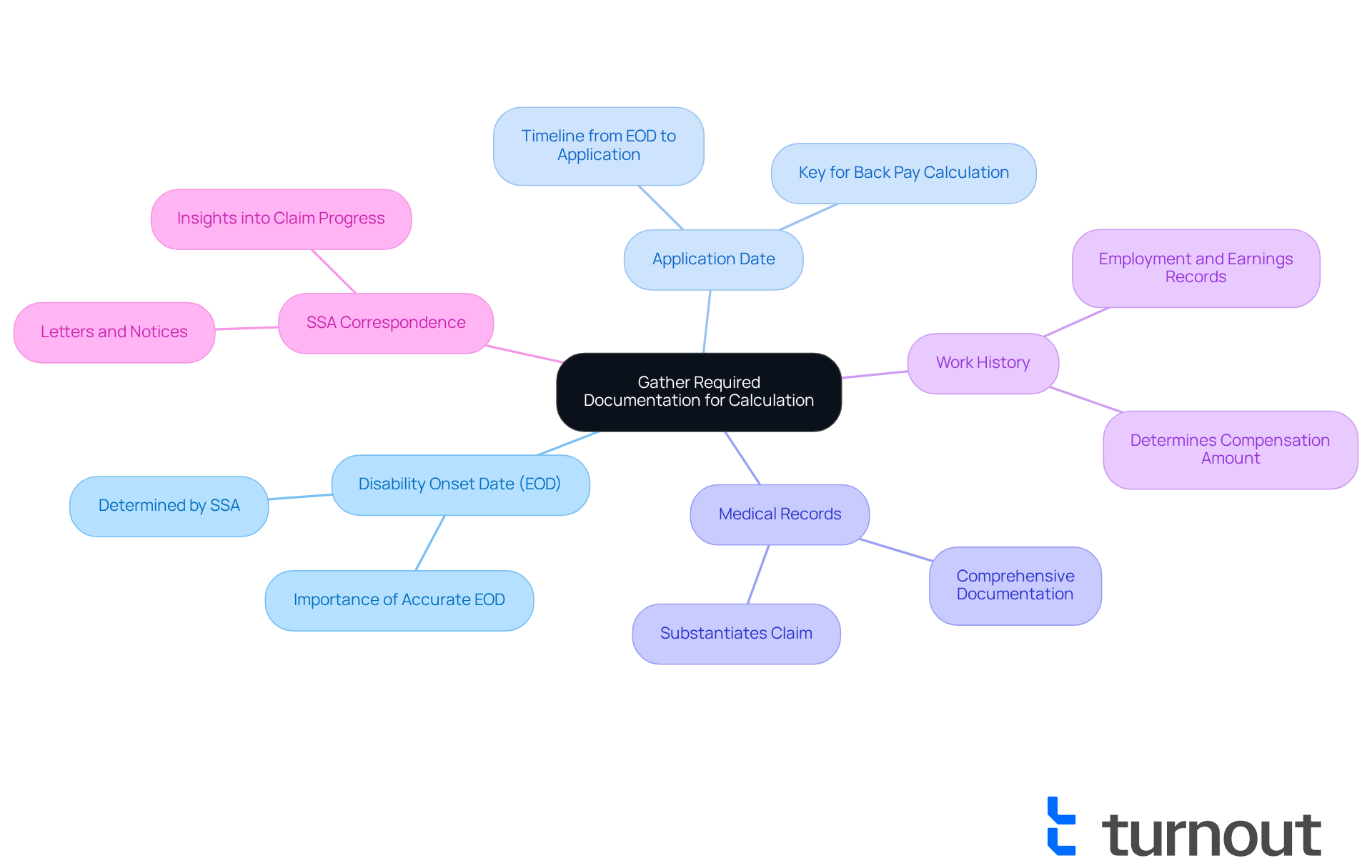

Gather Required Documentation for Calculation

Before using the social security disability back pay calculator, we understand how crucial it is to gather the necessary documentation for an accurate calculation. This includes:

- Disability Onset Date (EOD): This is the date recognized by the SSA as the beginning of your disability. Having accurate documentation of this date is vital, as it directly influences the calculation made by the social security disability back pay calculator.

- Application Date: The date you submitted your SSDI application is another key factor. Understanding the timeline from your EOD to your application date is essential for using a social security disability back pay calculator to determine the total months owed.

- Medical Records: Comprehensive documentation from healthcare providers detailing your condition and treatment history is necessary. These records substantiate your claim and are critical for using the social security disability back pay calculator to verify your disability status. It's common to feel overwhelmed by the process, and statistics indicate that issues with claim documentation can lead to delays or denials when utilizing a social security disability back pay calculator. This makes thorough medical records essential when utilizing a social security disability back pay calculator.

- Work History: Records that detail your employment and earnings are important for determining your compensation amount. The SSA utilizes this information to assess your eligibility and calculate the monthly payment you will receive using the social security disability back pay calculator.

- SSA Correspondence: Keep any letters or notices from the SSA regarding your application status or decisions. This correspondence can provide insights into your claim's progress and any additional information the SSA may require.

Furthermore, if you can demonstrate that your disability was present previously, you may be eligible for retroactive benefits, which can be assessed using a social security disability back pay calculator to determine compensation for as much as 12 months prior to your application date. Having these documents organized and readily available will streamline the calculation process with the social security disability back pay calculator, ensuring you have the necessary information to support your claim effectively.

We’re here to help you through this journey. Turnout's trained nonlawyer advocates can assist you in gathering all required documentation efficiently. For instance, individuals who meticulously gather their medical records often find that utilizing a social security disability back pay calculator leads to smoother processing of their claims, resulting in quicker approvals and back pay disbursements. Remember, you are not alone in this process.

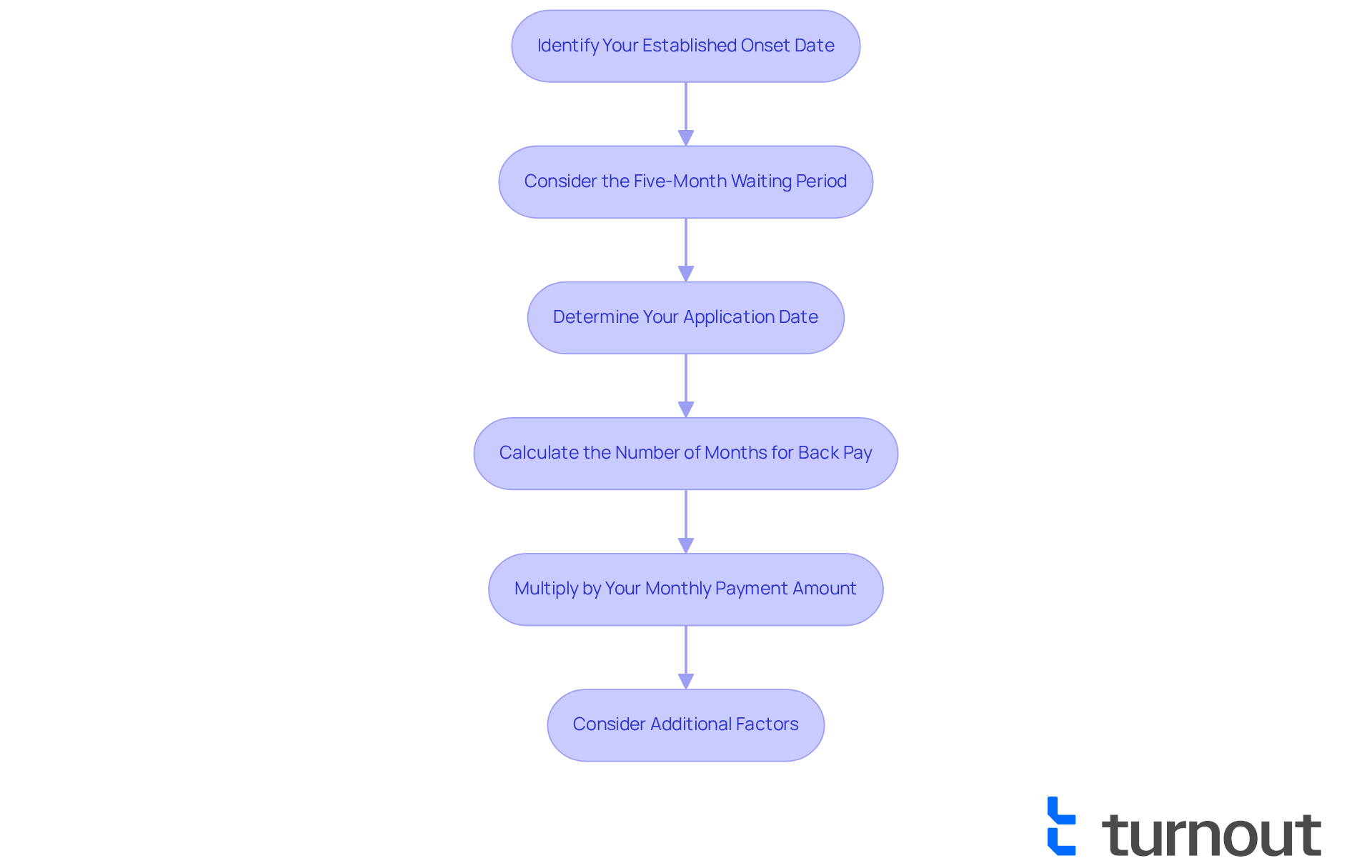

Follow the Step-by-Step Process to Use the Calculator

To effectively use the SSDI Back Pay Calculator, we invite you to follow these supportive steps:

- Identify Your Established Onset Date (EOD): This is the date the SSA determined your disability began. We understand that pinpointing this date can be challenging, but it’s crucial for your calculations.

- Consider the Five-Month Waiting Period: Disability payments begin five months following your EOD. For instance, if your EOD is January 1, 2025, your entitlements would commence on June 1, 2025. It’s common to feel anxious about this wait, but knowing the timeline can help ease your concerns.

- Determine Your Application Date: This is the date you submitted your SSDI application. Keeping track of this date is important for your calculations using the social security disability back pay calculator.

- Calculate the Number of Months for Back Pay: Count the months from the end of the waiting period until your application approval date. For instance, if your application was approved in December 2025, you would count from June to December, totaling 7 months. This step helps clarify what you might expect from the social security disability back pay calculator.

- Multiply by Your Monthly Payment Amount: Use the SSA's payment calculator to find your monthly payment amount. For instance, if your monthly payment is $1,200, multiply this by the 7 months determined earlier, resulting in an estimated reimbursement of $8,400. This calculation can provide you with a sense of what you may receive.

Additionally, you may qualify for retroactive benefits up to 12 months before your application date if you can prove your disability began earlier. It’s essential to keep comprehensive records of your medical conditions, treatment history, employment background, and work restrictions. These records can bolster your disability claim and assist in maximizing your retroactive compensation.

Turnout provides access to tools and services that assist you in navigating these complex processes. We want to ensure you understand the impact of the five-month waiting period and the importance of your established onset date. Please note that Turnout is not a law firm and does not provide legal representation; instead, we utilize trained nonlawyer advocates to support you. Generally, disability insurance payments are obtained within 60 days of authorization, so it is essential to prepare accordingly. Keep in mind that disability benefits retroactive payments can be regarded as taxable income, so seeking advice from a tax expert is recommended to handle your finances efficiently.

By following these steps and considering these additional factors, you can use a social security disability back pay calculator to accurately estimate the back pay you may be entitled to. Remember, you are not alone in this journey; we are here to help you every step of the way.

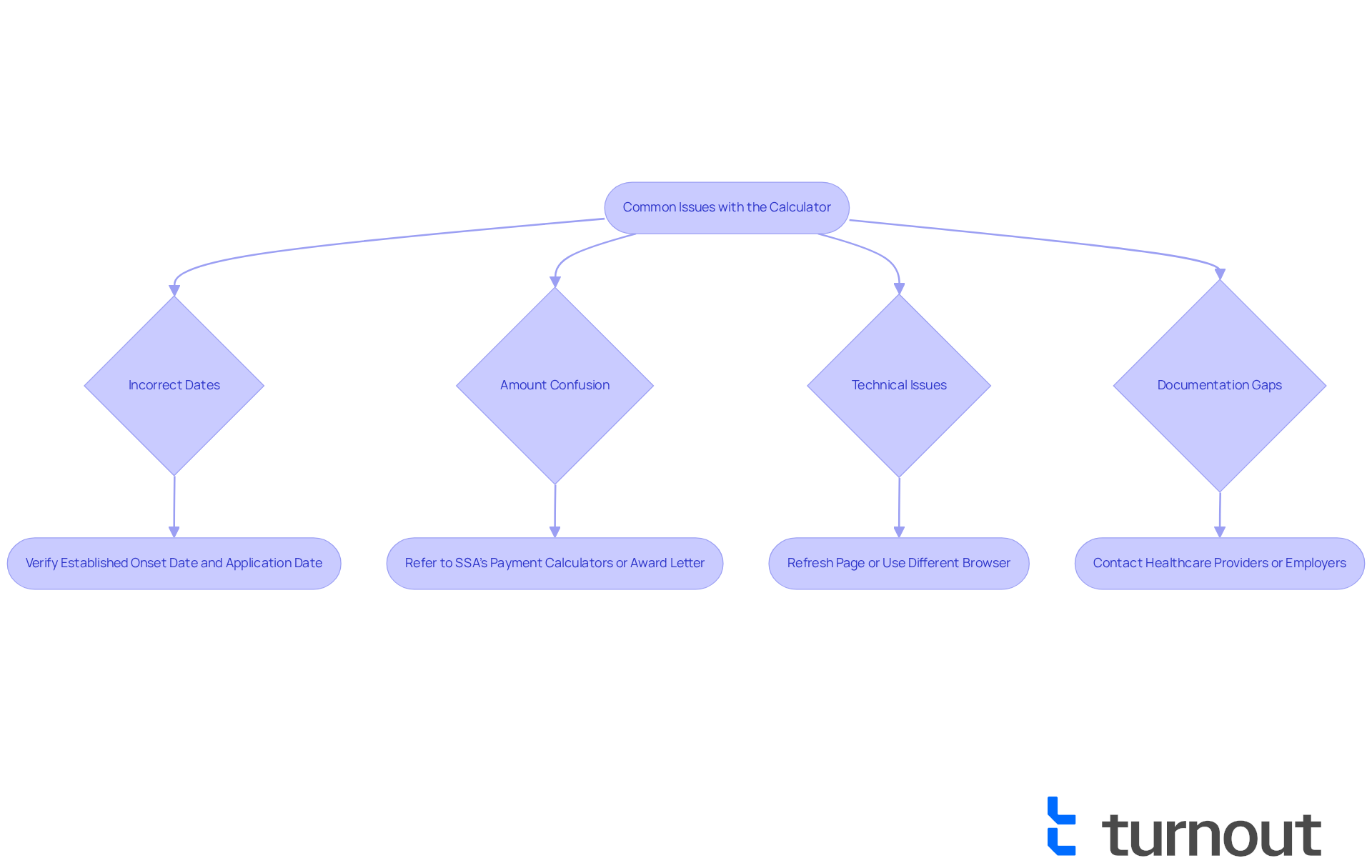

Troubleshoot Common Issues with the Calculator

While using the social security disability back pay calculator, we recognize that you may face several common issues. Here are some supportive solutions to help you troubleshoot:

- Incorrect Dates: It's crucial to ensure that you are using the correct Established Onset Date and Application Date. If you're uncertain, please verify your records, as errors can lead to substantial inconsistencies in your benefits.

- Amount Confusion: If you are unsure about your monthly payment amount, we encourage you to refer to the SSA's payment calculators or your award letter for precise figures. Misunderstandings in this area can lead to underestimating or overestimating your expected payments. It's important to note that mistakes in the VA's compensation calculator have been noted to cause monthly underpayments between approximately $133 and $4,200, highlighting the financial consequences of inaccuracies.

- Technical Issues: If the calculator is not functioning properly, try refreshing the page or using a different browser. If problems persist, reaching out to the SSA for assistance may be necessary, especially since recent outages on the Social Security website have lasted up to a day.

- Documentation Gaps: If you find yourself lacking certain documents, please contact your healthcare providers or previous employers to obtain the necessary records. Having thorough documentation is essential for accurate calculations, as omissions can hinder your ability to secure the benefits you deserve. As a disability advocate has noted, overcoming documentation gaps is crucial for a successful claim.

Additionally, it's important to understand that the Social Security Administration can award retroactive benefits for up to 12 months before your application date if you were eligible during that time. By being aware of these potential issues and their solutions, you can navigate the social security disability back pay calculator more effectively. Remember, we’re here to help you maximize your SSDI back pay and avoid common pitfalls. You are not alone in this journey.

Conclusion

Navigating the intricacies of the Social Security Disability Insurance (SSDI) back pay calculator can feel overwhelming. We understand that seeking disability benefits often comes with its own set of challenges. This tool is here to help you estimate your potential financial entitlements, empowering you to take charge of your financial future. By clarifying the compensation owed from the onset of your disability until your application approval, you can feel more secure in your journey.

In this guide, we have highlighted key aspects that are crucial to your success:

- Accurately determining the Established Onset Date (EOD) is vital, as is understanding the mandatory five-month waiting period.

- Gathering the necessary documentation to support your claims can make a significant difference.

- Real-world examples illustrate how careful record-keeping and awareness of eligibility criteria can positively impact the amount of back pay you receive.

- Troubleshooting common issues with the calculator ensures that you can maximize your potential benefits without unnecessary complications.

Ultimately, mastering the SSDI back pay calculator is about more than just crunching numbers; it's about ensuring you receive the financial support you deserve. By taking proactive steps—such as organizing your documentation, verifying important dates, and seeking assistance when needed—you can navigate this process more effectively. Remember, the journey may be challenging, but with the right tools and resources, securing the benefits owed is within your reach. You are not alone in this journey, and we’re here to help every step of the way.

Frequently Asked Questions

What is the purpose of the SSDI back pay calculator?

The SSDI back pay calculator is a tool that helps individuals estimate their potential payments after being approved for Social Security Disability Insurance (SSDI). It calculates back pay owed to claimants from the start of their disability until their application approval.

How does the SSDI back pay calculator determine the amount owed?

The calculator considers factors such as the established onset date of the disability and the mandatory five-month waiting period set by the Social Security Administration (SSA). For example, if someone became disabled on January 1, 2023, and applied for benefits on March 1, 2023, their retroactive payments would start in July 2023.

Who may be affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO)?

Over 3.2 million individuals are affected by the WEP and GPO, which can complicate the calculation of disability benefits and highlight the importance of using the SSDI back pay calculator.

Can I receive retroactive payments if my disability onset date is earlier than my application date?

Yes, if your documented disability onset date (EOD) is earlier than your application date, you may qualify for retroactive pay, which can be estimated using the SSDI back pay calculator.

What documentation is necessary for supporting my SSDI claim?

It is crucial to keep thorough documentation of your medical conditions and treatment history to support your disability claim and establish your disability onset date.

What is the required waiting period for SSDI payments?

There is a mandatory five-month waiting period during which no retroactive payments are issued.

How can I verify my eligibility for SSDI back pay?

To verify eligibility, you must meet SSA requirements, have a qualifying work history, and provide documented proof of your disability onset date. Gathering relevant medical documentation is essential for establishing your eligibility.

What role do trained nonlawyer advocates play in the SSDI process?

Trained nonlawyer advocates can assist individuals in navigating the complexities of SSDI claims, providing support throughout the application process. However, it is important to note that they do not provide legal advice.