Overview

This article serves as a comprehensive guide for filing Form 1040, recognizing that navigating tax forms can be daunting. We understand that many individuals may feel overwhelmed, and that’s why it’s crucial to grasp the form's purpose, gather the necessary documents, and follow step-by-step instructions for a successful submission. By doing so, you can alleviate some of the stress associated with this process.

To support you, we provide practical examples and expert advice, which highlight common pitfalls to avoid. It’s common to feel uncertain about what to include or how to proceed, but thorough preparation is key. This not only ensures compliance but also maximizes your potential tax benefits.

Remember, you are not alone in this journey. We’re here to help you every step of the way, ensuring that you feel confident and informed as you tackle your tax responsibilities.

Introduction

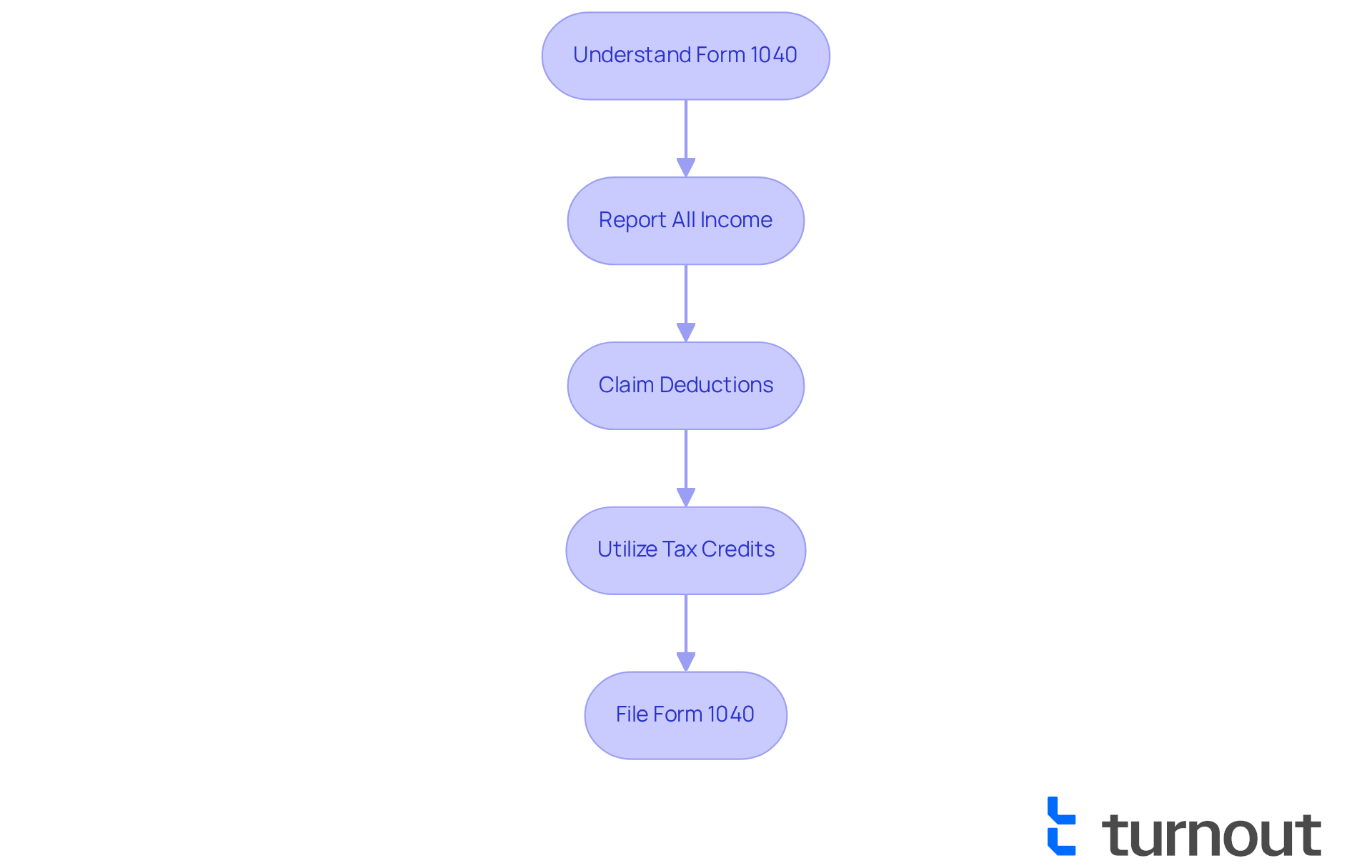

Navigating the complexities of tax season can often feel overwhelming. We understand that understanding the significance of Form 1040 is crucial. This essential document serves as a means for U.S. taxpayers to report their income and claim deductions, playing a vital role in maximizing potential refunds. With the stakes so high and the process fraught with potential pitfalls, it’s common to wonder: what are the key steps to ensure a smooth filing experience and avoid common mistakes? This guide is here to unravel the intricacies of Form 1040, providing valuable insights and step-by-step instructions to empower you on your journey to financial clarity. Remember, you are not alone in this journey; we're here to help.

Understand Form 1040: Purpose and Importance

The is the standard federal income tax document that is essential for U.S. taxpayers to report yearly income, claim deductions, and calculate tax obligations. This important document, known as the formulario 1040, serves as the primary means for individuals to share their financial information with the IRS. Understanding the purpose of the formulario 1040 is crucial. It not only ensures compliance with tax laws related to the formulario 1040 but also helps or minimize liabilities. In fact, over 90% of U.S. taxpayers submit the formulario 1040, which highlights its vital role in the tax system.

We understand that can be overwhelming. Practical instances show how taxpayers can enhance their refunds by using the appropriate tax document. For example:

- Individuals who accurately report all sources of income, including wages and investment earnings, often see significant returns.

- Utilizing available deductions and credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit, can further boost refund amounts.

Tax experts emphasize the in this process. One specialist observes that the formulario 1040 is the foundation of the American tax submission system, highlighting its critical role in ensuring that taxpayers receive the refunds they deserve. Recent modifications to the submission process, including improvements to the and the launch of mobile-friendly tax forms, have made it easier for taxpayers to manage their submissions and access essential information.

It's comforting to know that printed versions of the tax document are available at public courthouses or federal buildings for those who prefer physical copies. It's also essential to examine all documents for errors or missing details to ensure accurate tax submissions. By familiarizing yourself with the formulario 1040 and using the IRS Online Account for secure access to your tax details, you can approach the with confidence and understanding. Ultimately, this can lead to improved financial results. Remember, you are not alone in this journey, and we're here to help you every step of the way.

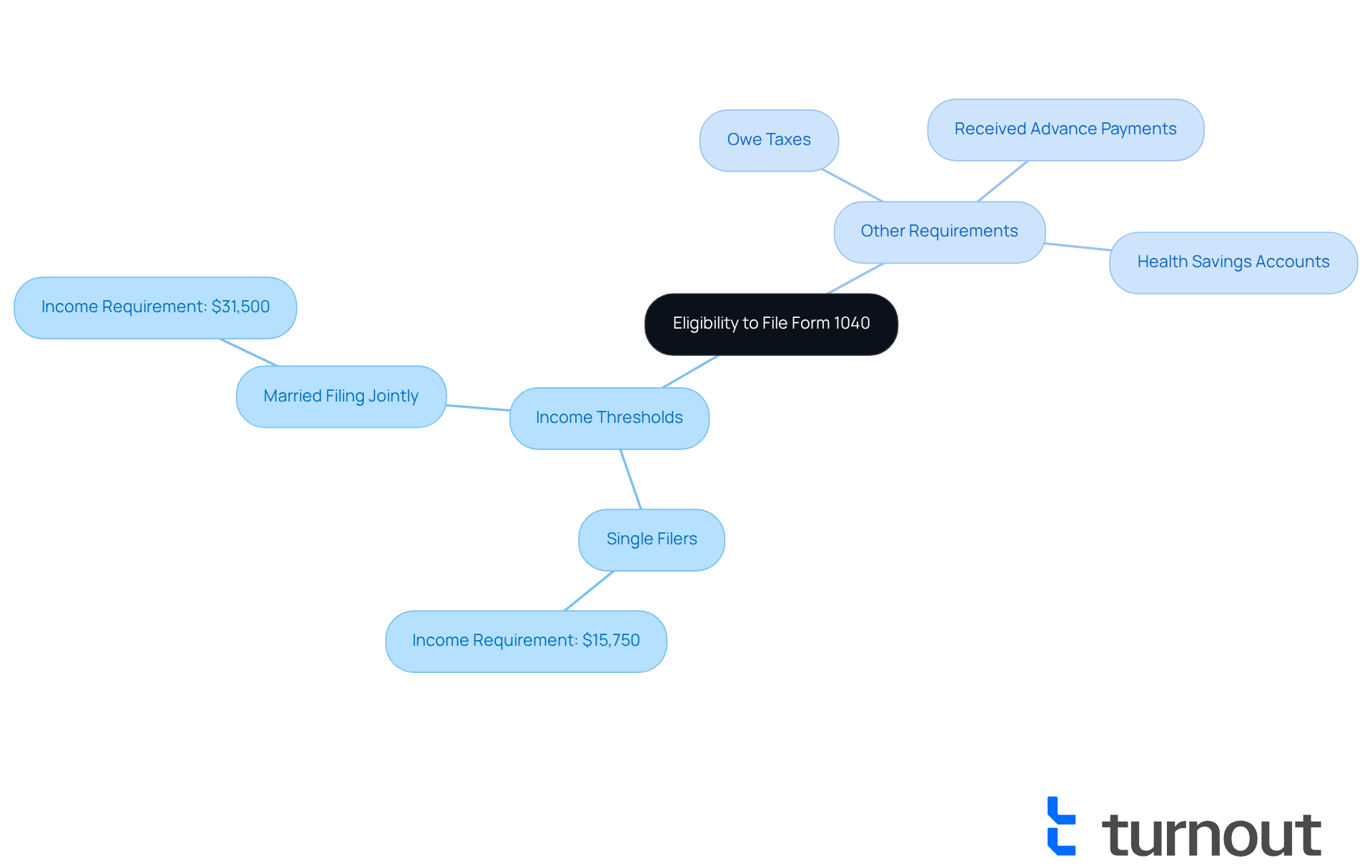

Determine Eligibility: Who Needs to File Form 1040?

We understand that navigating . Most U.S. citizens and residents earning above are mandated to file the . For the 2025 tax year, single filers under 65 must if their gross income reaches at least $15,750. Married couples filing jointly must complete their formulario 1040 if their combined income exceeds $31,500.

It's common to feel uncertain about whether you need to file. Additionally, individuals who owe specific levies, received , or had health savings accounts must also file. Not fulfilling these criteria may lead to penalties, such as interest on overdue payments and possible fines. For instance, individuals who do not submit their returns may encounter a failure-to-file fee, which can be 5% of the owed amounts for each month the return is delayed, up to a maximum of 25%.

and to avoid unnecessary financial repercussions. As noted by tax experts, staying informed about your tax obligations is crucial. In fact, statistics indicate that millions of U.S. citizens are required to file taxes based on their income levels. Remember, you are not alone in this journey, and we're here to help you navigate these requirements with confidence.

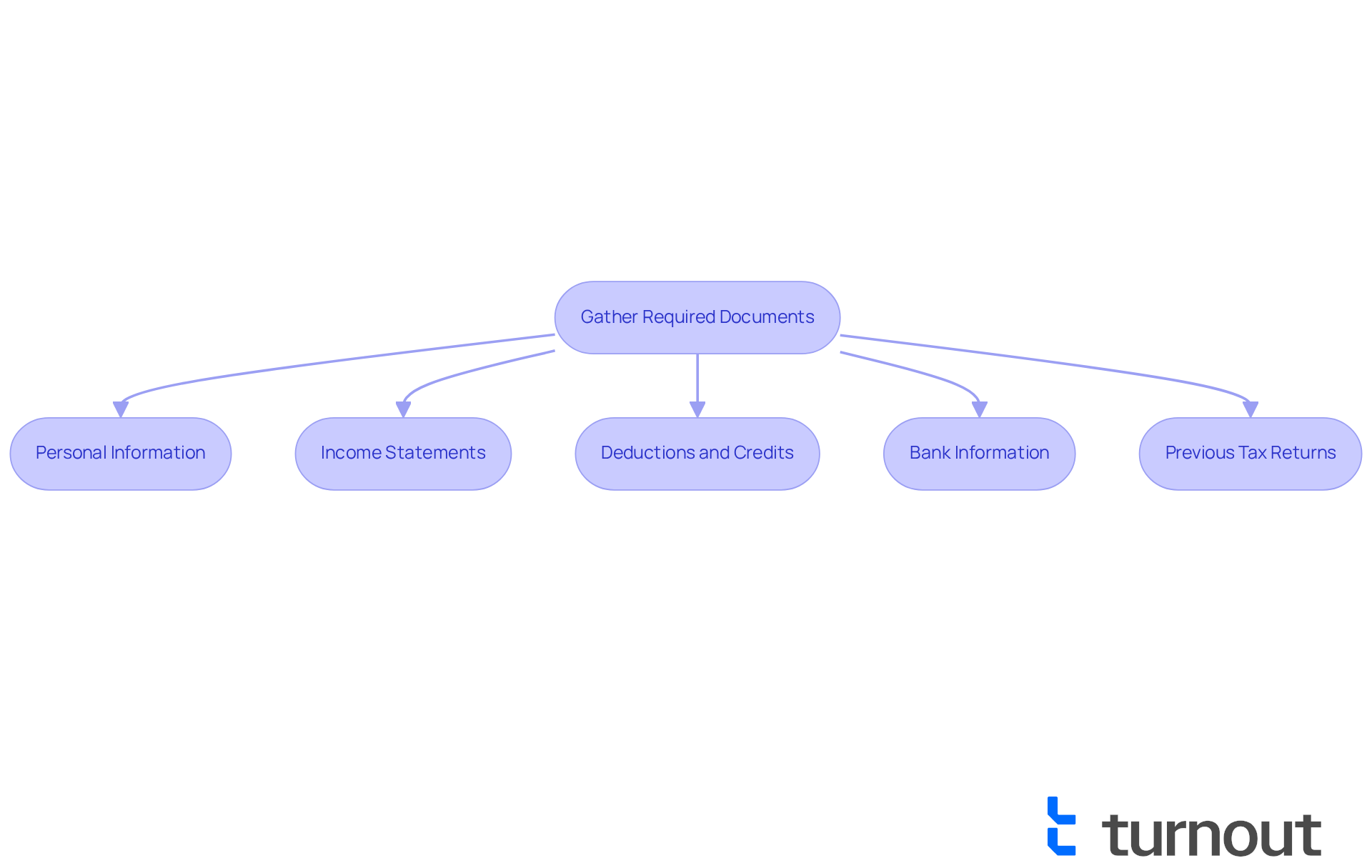

Gather Required Documents: Essential Information for Filing

Before you begin filling out the , we understand how important it is to gather the . Here’s a helpful checklist to guide you:

- Personal Information: Make sure you have Social Security numbers for yourself, your spouse, and any dependents.

- Income Statements: Collect W-2 forms from your employers, 1099 forms for freelance or contract work, and any other income documentation.

- Deductions and Credits: Keep . If you are a custodial parent releasing your right to claim a child, don’t forget to include Form 8332.

- Bank Information: Have your bank account and routing numbers ready for .

- Previous Tax Returns: A copy of in your current submission.

Arranging these documents not only simplifies the documentation process but also greatly decreases the chance of mistakes. It's common to feel overwhelmed, but remember that missing a W-2 form can lead to underreporting income, which may trigger audits or penalties. Tax advisors emphasize that . According to statistics, nearly 30% of tax returns are flagged for errors, often due to missing or incorrect information. As Kelly Wallace, a CPA, advises, "A good place to start when for the year is to grab last year’s tax return." By preparing in advance, you can avoid common pitfalls and ensure a smoother experience while completing the formulario 1040 during tax season. Keep in mind, the due date for submitting your tax document is April 15, 2025. You are not alone in this journey; we’re here to help you every step of the way.

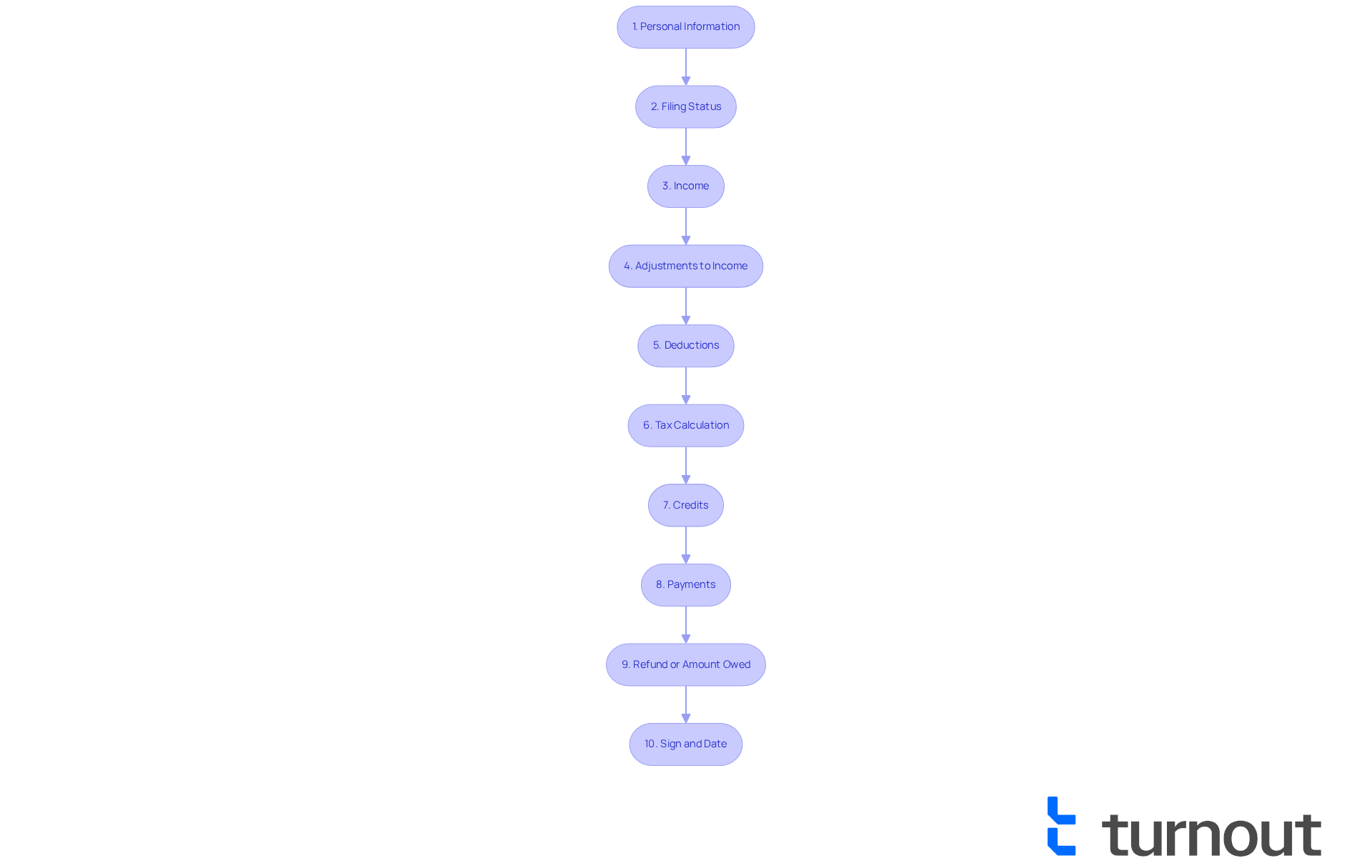

Complete Form 1040: Step-by-Step Instructions

To successfully complete Form 1040, we encourage you to follow these steps:

- Personal Information: Start by entering your name, address, and at the top of the form. This is your first step toward a smooth filing experience.

- : It’s important to select your filing status (e.g., single, married filing jointly) in the designated box. If you're unsure, the Interactive Tax Assistant on IRS.gov can help you determine the correct status.

- Income: Make sure to accurately report your total income from all sources, including wages, dividends, and any additional income. This helps you avoid any future complications.

- Adjustments to Income: Calculate your Adjusted Gross Income (AGI) by subtracting any adjustments, such as contributions to retirement accounts. This can significantly impact your tax situation.

- Deductions: Decide whether to take the standard deduction or to itemize your deductions, and enter the appropriate amount. This choice can lead to substantial savings.

- : Utilize the tax tables provided in the instructions to determine your tax liability based on your taxable income. We understand this can be a bit daunting, but it’s crucial for accuracy.

- Credits: Don’t forget to claim any for which you qualify, such as the Earned Income Tax Credit or Child Tax Credit. These credits can make a real difference.

- Payments: Report any taxes already paid through withholding or estimated contributions. Being thorough here will help you see the full picture.

- Refund or Amount Owed: Calculate whether you will receive a refund or owe additional taxes. Knowing this can help you plan ahead.

- Finally, ensure you sign and date the formulario 1040 before submitting it to the IRS. This is an important step that shouldn’t be overlooked.

We recognize that can occur when completing the tax document, such as missing or incorrect Social Security numbers, wrong filing status, and calculation mistakes. Tax professionals emphasize the importance of double-checking calculations to avoid these pitfalls. For instance, the IRS found nearly 2.5 million math errors on returns filed for the 2017 tax year, highlighting the need for diligence in this area. Moreover, the error rate for paper submissions is 21%, compared to under 1% for e-filed submissions, showcasing the advantages of electronic submissions.

On average, taxpayers spend several hours finishing their , but this can differ depending on personal circumstances and the complexity of their financial situations. Successful submissions often lead to prompt refunds, especially when taxpayers employ electronic methods, which greatly decrease error rates in comparison to paper submissions.

By following these steps and being aware of , you can enhance the accuracy of your tax submission and ensure a more seamless process. Remember, free tax preparation assistance is available for individuals earning $67,000 or less, providing valuable support. As a tax professional advises, " to avoid errors and delays in processing your return." .

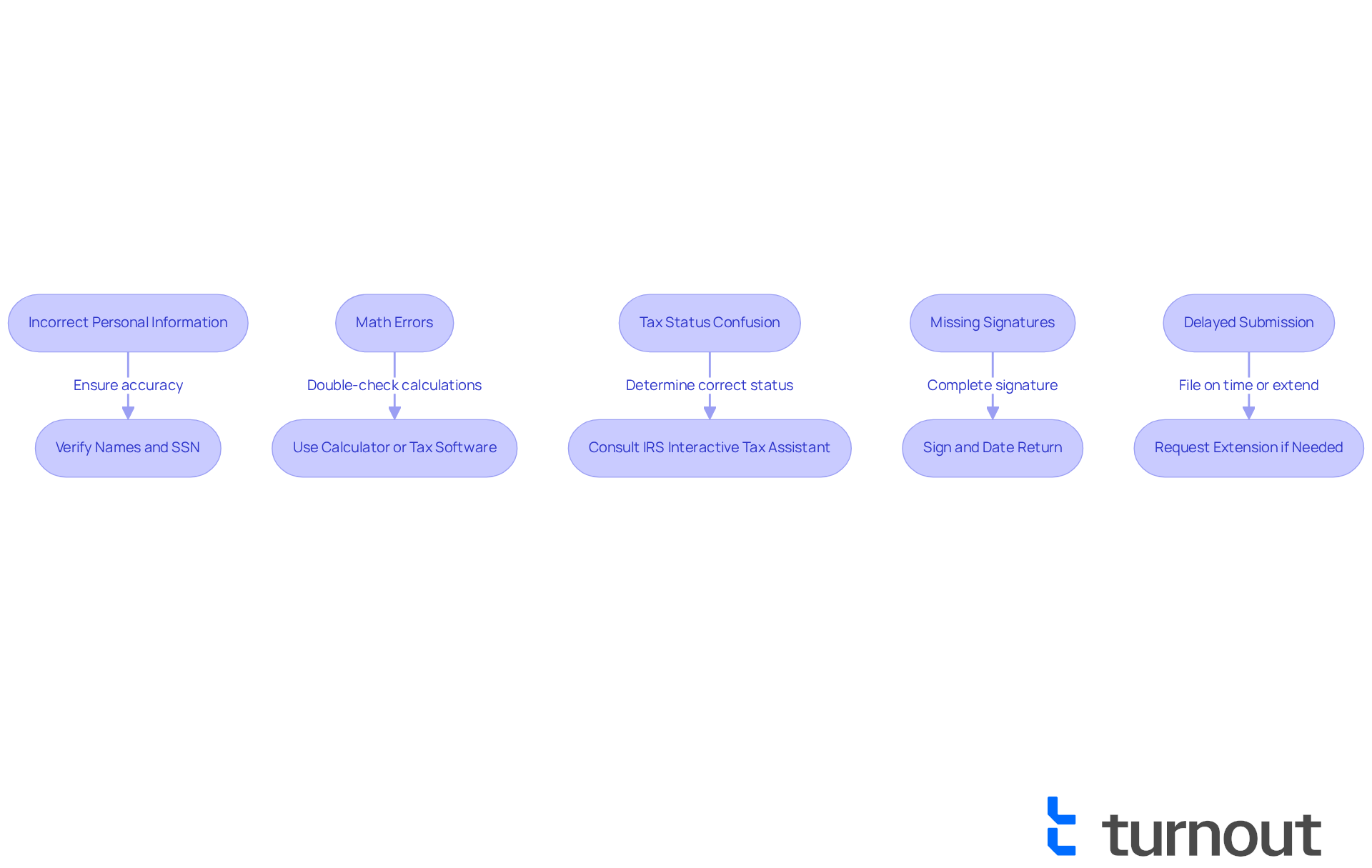

Troubleshoot Common Issues: Avoid Mistakes When Filing

When , we understand that it can be overwhelming. It's crucial to be aware of :

- Incorrect Personal Information: It's essential to ensure that names and Social Security numbers are accurate. Discrepancies can lead to processing delays, as the IRS requires that the name on the tax return matches exactly with the name on the Social Security card.

- Math Errors: Simple mathematical mistakes can lead to significant issues. We encourage you to utilize a calculator or tax software to verify all calculations. According to the IRS, made by taxpayers.

- Tax Status Confusion: Choosing the appropriate tax status is crucial, as it affects your tax rate and eligibility for specific credits. Many taxpayers erroneously select the incorrect status, which can complicate their submission process. The IRS's Interactive Tax Assistant can help clarify the correct status.

- Missing Signatures: Always remember to . An unsigned tax return is invalid and will be returned by the IRS, causing unnecessary delays. The IRS emphasizes that an unsigned return isn't valid.

- Delayed Submission: Be mindful of the deadline (April 15, 2025, for the 2024 tax year) to avoid penalties. It's common to feel rushed, but statistics show that a significant percentage of taxpayers file late and incur penalties. If you need more time, you can , but remember that tax payments are still due by the original deadline.

Real-world examples illustrate the importance of these precautions. For instance, one taxpayer adjusted their status after consulting tax software, which assisted them in avoiding complications and ensured smoother processing. Tax professionals emphasize that and using reliable tax software can significantly reduce errors.

By being vigilant about these common pitfalls, you can approach your tax filing, particularly the formulario 1040, with greater confidence and accuracy. Remember, we're here to help, and you are not alone in this journey.

Conclusion

Mastering the formulario 1040 is an essential skill for U.S. taxpayers. It serves as the cornerstone for accurately reporting income, claiming deductions, and ensuring compliance with tax laws. We understand that this process can seem daunting, but by grasping the significance of this form, you can not only meet your tax obligations but also optimize your potential refunds and minimize liabilities. With the right knowledge and preparation, navigating the complexities of the formulario 1040 becomes manageable and rewarding.

Throughout this article, we have highlighted key aspects of successfully filing the formulario 1040. From determining eligibility and gathering necessary documents to providing step-by-step instructions for completion and identifying common pitfalls to avoid, each element plays a crucial role in ensuring a smooth filing experience. Accuracy and organization are vital, and utilizing available resources, such as tax software and professional assistance, can enhance your overall process.

Ultimately, the journey of filing taxes does not have to be a solitary one. By taking proactive steps to understand and master the formulario 1040, you can empower yourself to achieve better financial outcomes. As the deadline approaches, it is vital to stay informed and prepared. Ensure that all necessary documents are in order and that common mistakes are avoided. Embrace this opportunity to take control of your financial future by mastering the filing process; the benefits of a well-prepared tax return can be significant.

Frequently Asked Questions

What is Form 1040 and why is it important?

Form 1040 is the standard federal income tax document used by U.S. taxpayers to report yearly income, claim deductions, and calculate tax obligations. It is essential for ensuring compliance with tax laws and helps maximize potential refunds or minimize liabilities.

Who is required to file Form 1040?

Most U.S. citizens and residents earning above specific income thresholds must file Form 1040. For the 2025 tax year, single filers under 65 must file if their gross income is at least $15,750, and married couples filing jointly must file if their combined income exceeds $31,500.

What are the consequences of not filing Form 1040 when required?

Failing to file Form 1040 when required can lead to penalties, including interest on overdue payments and potential fines. For example, individuals who do not submit their returns may incur a failure-to-file fee of 5% of the owed amounts for each month the return is delayed, up to a maximum of 25%.

How can taxpayers maximize their refunds using Form 1040?

Taxpayers can maximize their refunds by accurately reporting all sources of income and utilizing available deductions and credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit.

Are there resources available for those who prefer physical copies of Form 1040?

Yes, printed versions of Form 1040 are available at public courthouses or federal buildings for individuals who prefer physical copies.

What recent improvements have been made to the Form 1040 submission process?

Recent modifications include improvements to the IRS Online Account and the launch of mobile-friendly tax forms, making it easier for taxpayers to manage their submissions and access essential information.

How can taxpayers ensure accurate submissions of Form 1040?

Taxpayers should examine all documents for errors or missing details to ensure accurate tax submissions. Familiarizing themselves with Form 1040 and using the IRS Online Account for secure access to tax details can also help improve their financial results.