Overview

Navigating Long-Term Disability Insurance (LTD) and Social Security Disability Insurance (SSDI) can feel overwhelming, especially when considering your financial future. It's important to understand that LTD differs from SSDI in several key areas, such as funding, eligibility, and benefit amounts. Often, LTD provides higher monthly payments and is typically offered through employers, while SSDI is a government program based on work credits.

We recognize that LTD can replace a significant portion of your income, providing a sense of security during challenging times. On the other hand, SSDI serves as a critical safety net for individuals who may not have employer-sponsored insurance. Understanding both options is essential for comprehensive financial planning in the event of a disability.

Remember, you are not alone in this journey. We’re here to help you make informed decisions that best suit your needs and circumstances. Take the time to explore both options, and don’t hesitate to reach out for support as you navigate this important aspect of your financial well-being.

Introduction

Navigating the financial landscape of disability support can feel overwhelming. We understand that evaluating the differences between Long-Term Disability Insurance (LTD) and Social Security Disability Insurance (SSDI) is no small task. Both serve as vital lifelines for individuals facing prolonged health challenges, yet they operate within distinct frameworks that can significantly affect your financial stability.

This article explores the nuances of these two systems, providing insights into eligibility requirements and benefit structures. As you consider your options, it’s common to wonder: how can you effectively balance the potential benefits of LTD with the safety net offered by SSDI? Our goal is to help you ensure comprehensive financial protection during times of need. Remember, you are not alone in this journey, and we’re here to help you find the right path forward.

Understanding Long-Term Disability Insurance and Social Security Disability Insurance

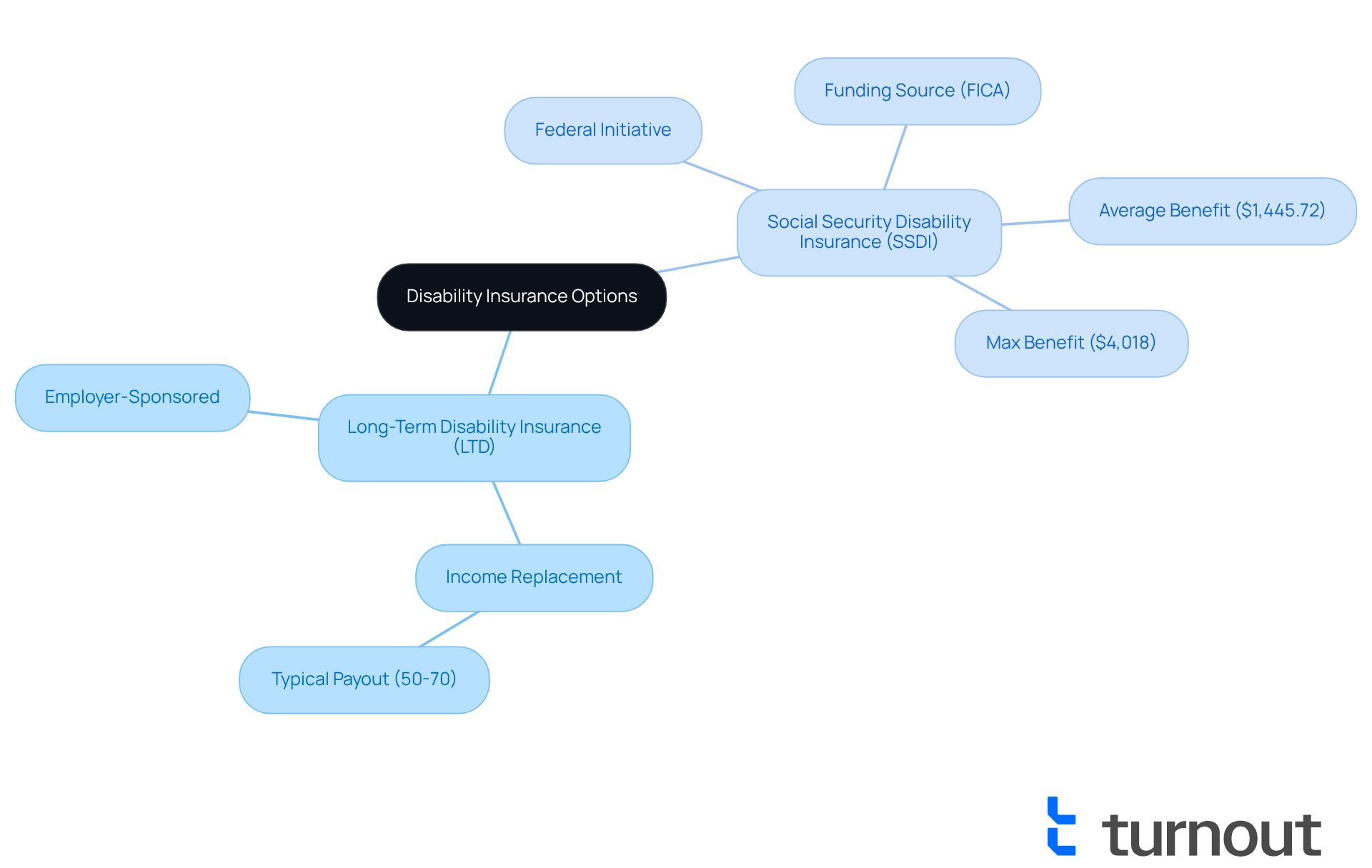

Long-Term Disability Insurance (LTD) and serve as a vital facing the challenges of prolonged illness or injury. Typically offered through employers, LTD policies replace a portion of your salary, usually between 50% and 70%, for a defined period or until retirement age, depending on the specific terms of the policy. We understand that can be overwhelming. In contrast, long term disability social security is a federal initiative designed to assist individuals with qualifying disabilities that impede their ability to work. Funded by payroll taxes under the Federal Insurance Contributions Act (FICA), rely on the accumulation of sufficient work credits based on your employment history. While LTD is a private insurance solution, the long term disability social security program is a government-sponsored initiative aimed at providing essential financial support for disabled workers.

is not a law firm and does not provide legal advice. However, it plays an important role in simplifying access to these benefits, offering tools and services that guide you through the complexities of SSD claims and . For instance, if you have contributed to Insurance, you may receive an average benefit of $1,445.72 per month in 2025, with a maximum benefit of $4,018 available for those with a strong earnings history. On the other hand, if you have LTD, your income replacement could be significantly higher, depending on your policy, leading to a more stable financial situation during recovery.

At Turnout, we employ trained nonlawyer advocates and IRS-licensed enrolled agents who are ready to support you in navigating these processes. Financial advisors stress the importance of understanding these differences. One advisor noted that while LTD can offer more substantial income replacement, long term disability social security provides a critical safety net for those without access to . As of 2025, only 43% of working Americans own any form of disability insurance, illustrating a significant gap in financial protection against disability-related income loss. This underscores the necessity for you to explore both options thoroughly to ensure comprehensive coverage in the event of a disability. With Turnout's guidance, you are not alone in this journey; we can help you effectively navigate these systems and access the financial support available to you.

Eligibility Requirements for Long-Term Disability and SSDI

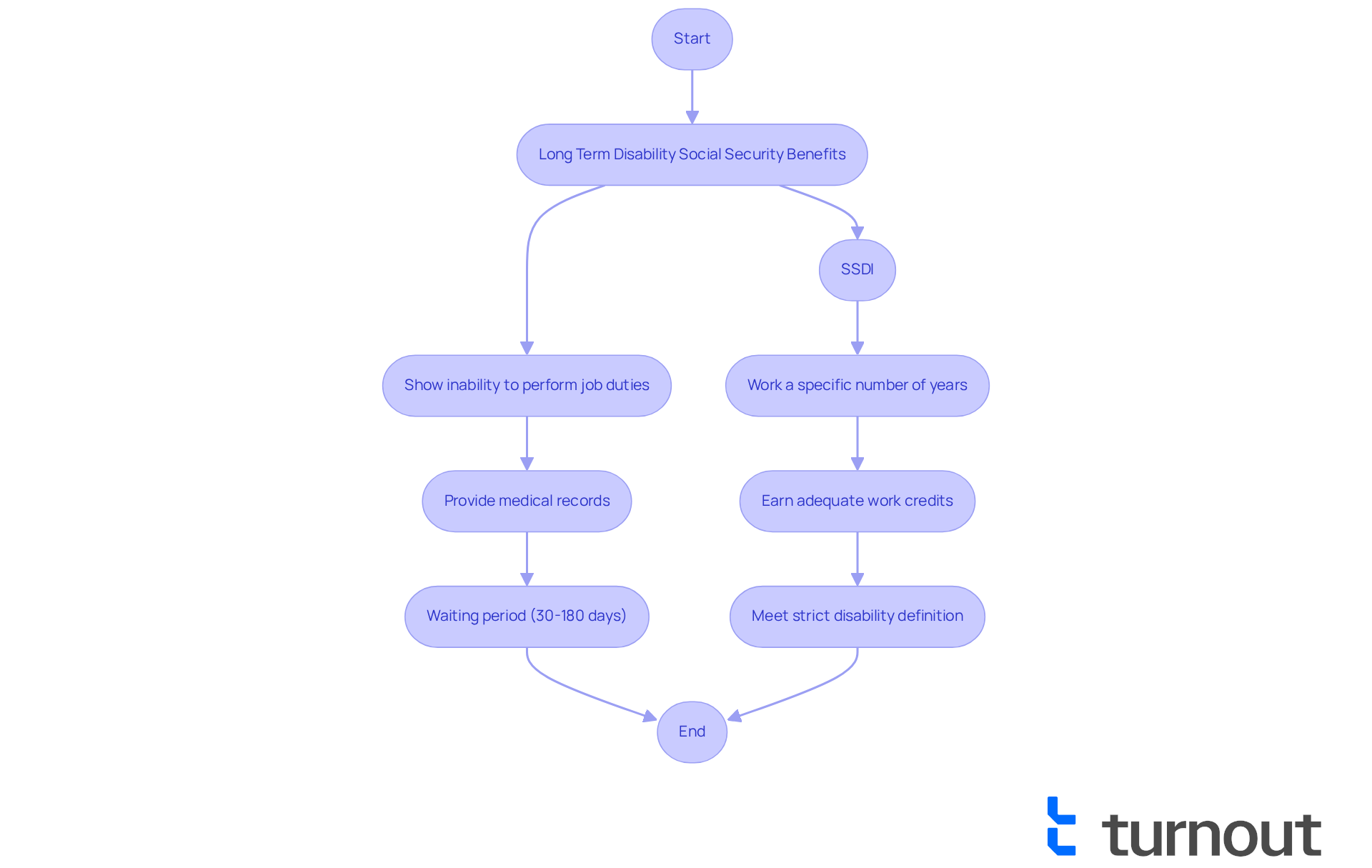

Navigating the world of and disability insurance can be overwhelming, and we understand that you're facing significant challenges. To qualify for , applicants typically need to show that they cannot perform their job duties due to a medical condition. This often requires and may involve a waiting period for assistance to begin, which usually spans from 30 to 180 days.

In contrast, eligibility for long term disability social security under requires that applicants have worked a specific number of years and earned adequate work credits based on their income. Additionally, applicants must meet Social Security's strict definition of long term disability social security, which requires that the condition be expected to last at least 12 months or lead to death. This difference in eligibility standards can greatly affect your access to long term disability social security benefits. Many may find it easier to qualify for long term disability social security than for the other program.

For instance, did you know that a young person starting their career today has about a 1 in 3 chance of before reaching full retirement age? This statistic highlights the importance of social security early on. Furthermore, according to the Social Security Administration, approximately , underscoring the challenges many applicants face.

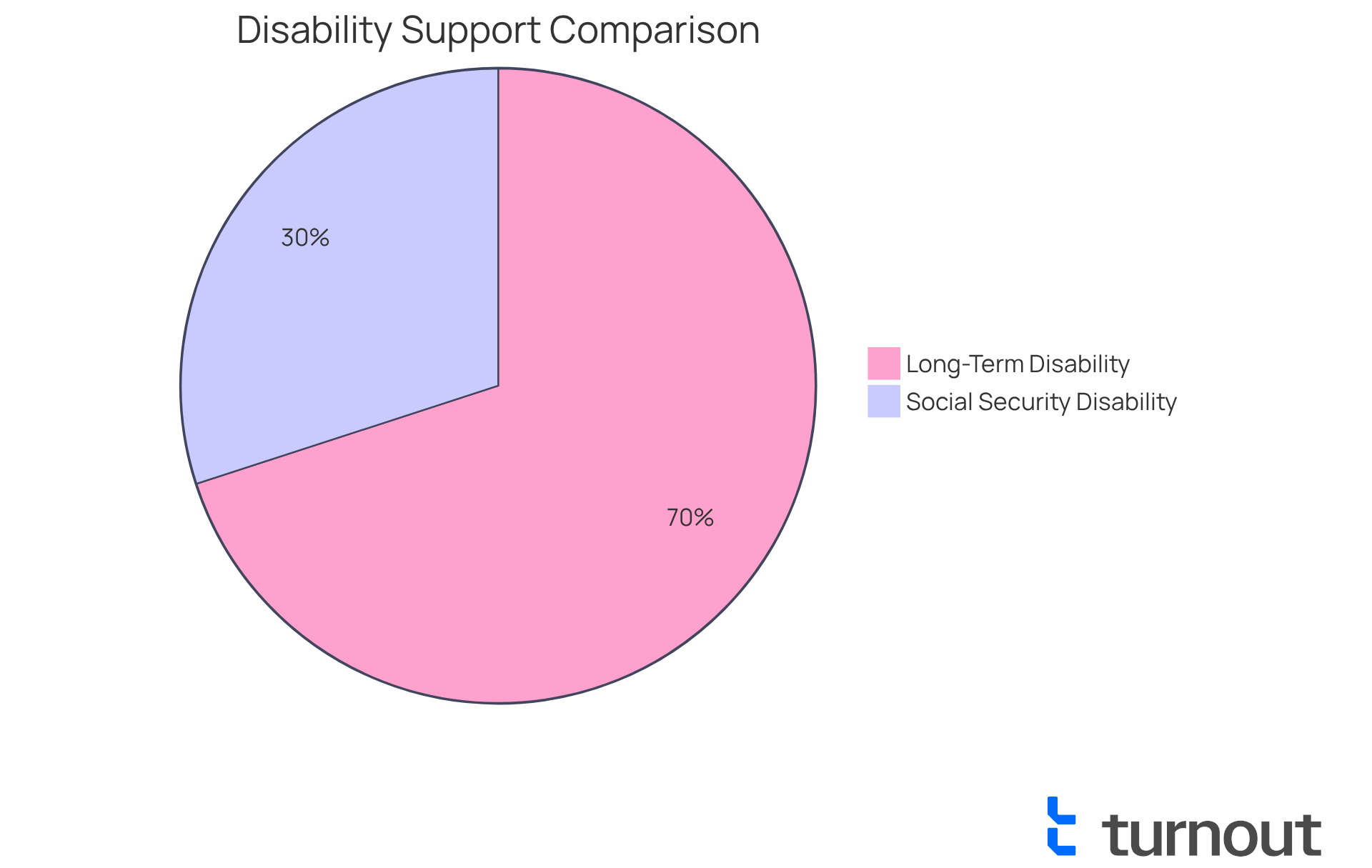

The average disability assistance for disabled workers is only $1,582 as of April 2025. This amount can create , especially considering that about 30% of Americans aged 35-65 will experience a disability lasting at least 90 days during their working careers. Grasping these distinctions is essential for managing the intricacies of long term disability social security assistance.

We're here to help. Turnout offers valuable tools and services to assist you in navigating these processes. Our trained nonlawyer advocates are ready to support you with SSD claims, and our IRS-licensed enrolled agents can help with . You are not alone in this journey; we ensure that you receive the support you need without the complexities of legal representation.

Comparing Benefits: Long-Term Disability vs. SSDI

(LTD) often provides greater monthly payments compared to coverage. Imagine having 60% to 80% of your after-tax income replaced during difficult times—LTD offers that substantial financial support when you need it most. In contrast, SSDI payments tend to be lower, with the projected to be around $1,580.

It's important to understand that while LTD payments can be arranged to cover specific periods—like two years, five years, or even until retirement—SSDI payments continue until you are no longer considered disabled or reach retirement age. This distinction is vital for anyone evaluating their long-term financial needs, as the duration and amount of support can significantly impact your quality of life during a disability.

the importance of recognizing these differences. Relying solely on long term disability social security may not provide adequate support for many individuals facing long-term disabilities. Remember, you might even , which can further influence your financial planning.

We understand that . . They provide tools and services to help you understand the complexities of SSD claims, utilizing to guide you through the process. It's essential to note that Turnout is not a law firm and does not affiliate with any law firm or government agency.

Additionally, Turnout offers assistance with , ensuring that you receive comprehensive support in facing financial challenges without the need for legal representation. You're not alone in this journey; we're here to help you every step of the way.

Interaction Between Long-Term Disability Benefits and SSDI

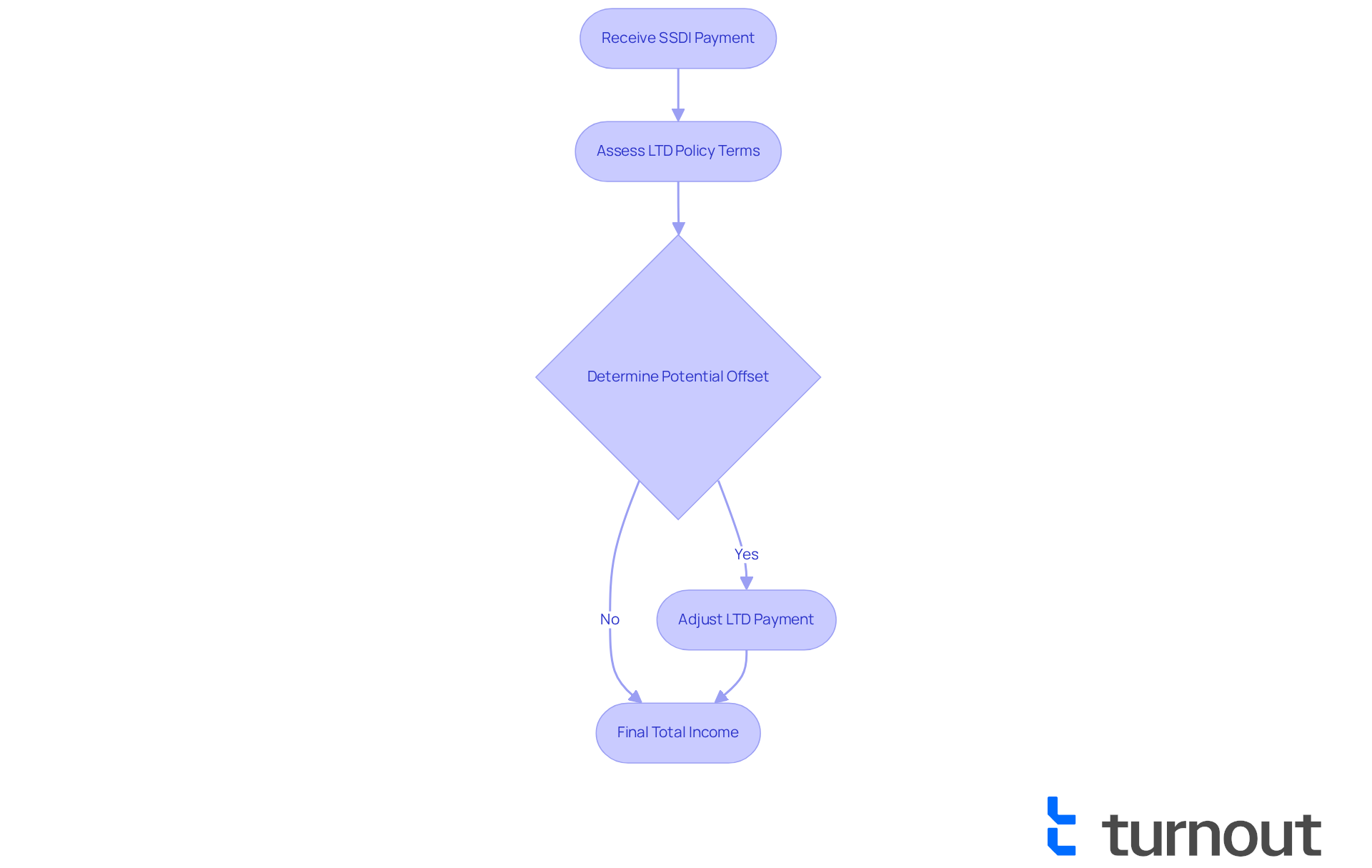

Navigating the intersection of (LTD) and can be challenging for those who qualify for both. We understand that a considerable amount of LTD policies require recipients to request disability payments to receive LTD disbursements. When , it often leads to a decrease in by the amount received from those payments. This can create uncertainty about total income. However, certain policies may allow a portion of disability support payments to be excluded from this offset calculation, allowing for greater financial flexibility.

is essential. These terms can significantly impact your . For instance, if your LTD policy pays $2,500 monthly and Social Security Disability Insurance grants $1,000, the LTD payment may be adjusted to $1,500. This adjustment ensures that the total benefits do not exceed the limits set by the LTD insurer.

Real-life examples illustrate these complexities. Many individuals have successfully managed both benefits, yet they frequently express uncertainty about how their payments from long term disability social security are influenced by SSDI. Financial advisors highlight the importance of reviewing policy details and understanding the implications of receiving both types of benefits. This knowledge can empower you to make informed decisions and navigate your financial landscape more effectively. Remember, we're here to help you through this journey.

Conclusion

Understanding the distinctions between Long-Term Disability Insurance (LTD) and Social Security Disability Insurance (SSDI) is crucial for anyone facing potential health-related work challenges. We understand that navigating these options can feel overwhelming. While both provide financial assistance during periods of disability, they operate under different frameworks and offer varying levels of support. LTD typically delivers higher monthly benefits and is often employer-sponsored, whereas SSDI is a government program with strict eligibility criteria based on work history and disability duration.

This article highlights several key points, including the significant differences in eligibility requirements, benefit amounts, and the interaction between these two forms of support. LTD policies may offer more substantial income replacement, while SSDI functions as a vital safety net, especially for those lacking access to employer-sponsored insurance. It's common to feel uncertain about how receiving SSDI can affect LTD payments, which is essential for effective financial planning and ensuring adequate coverage.

Ultimately, navigating the complexities of LTD and SSDI is essential for securing financial stability in the face of disability. You are not alone in this journey. Individuals are encouraged to explore both options thoroughly, leveraging available resources such as Turnout for guidance. Awareness of these differences not only empowers you to make informed decisions but also underscores the importance of proactive financial planning in safeguarding against unforeseen challenges.

Frequently Asked Questions

What is Long-Term Disability Insurance (LTD)?

Long-Term Disability Insurance (LTD) is typically offered through employers and replaces a portion of your salary, usually between 50% and 70%, for a defined period or until retirement age, depending on the specific terms of the policy.

How does Social Security Disability Insurance (SSDI) differ from LTD?

Social Security Disability Insurance (SSDI) is a federal initiative that assists individuals with qualifying disabilities that impede their ability to work. It is funded by payroll taxes under the Federal Insurance Contributions Act (FICA) and relies on the accumulation of sufficient work credits based on your employment history, unlike LTD, which is a private insurance solution.

What are the average benefits for Social Security Disability Insurance in 2025?

In 2025, individuals who have contributed to Social Security Disability Insurance may receive an average benefit of $1,445.72 per month, with a maximum benefit of $4,018 available for those with a strong earnings history.

What role does Turnout play in accessing these benefits?

Turnout simplifies access to Long-Term Disability Insurance and Social Security Disability Insurance benefits by offering tools and services that guide individuals through the complexities of SSD claims and tax debt relief.

What percentage of working Americans own disability insurance as of 2025?

As of 2025, only 43% of working Americans own any form of disability insurance, highlighting a significant gap in financial protection against disability-related income loss.

Why is it important to understand the differences between LTD and SSDI?

Understanding the differences is crucial because while LTD can offer more substantial income replacement, SSDI provides a critical safety net for those without access to employer-sponsored insurance, ensuring comprehensive coverage in the event of a disability.

What support does Turnout provide for navigating LTD and SSDI processes?

Turnout employs trained nonlawyer advocates and IRS-licensed enrolled agents who are ready to support individuals in navigating the processes related to Long-Term Disability Insurance and Social Security Disability Insurance.